Best Auto Insurance for a Leased Vehicle in 2026 (Top 10 Companies)

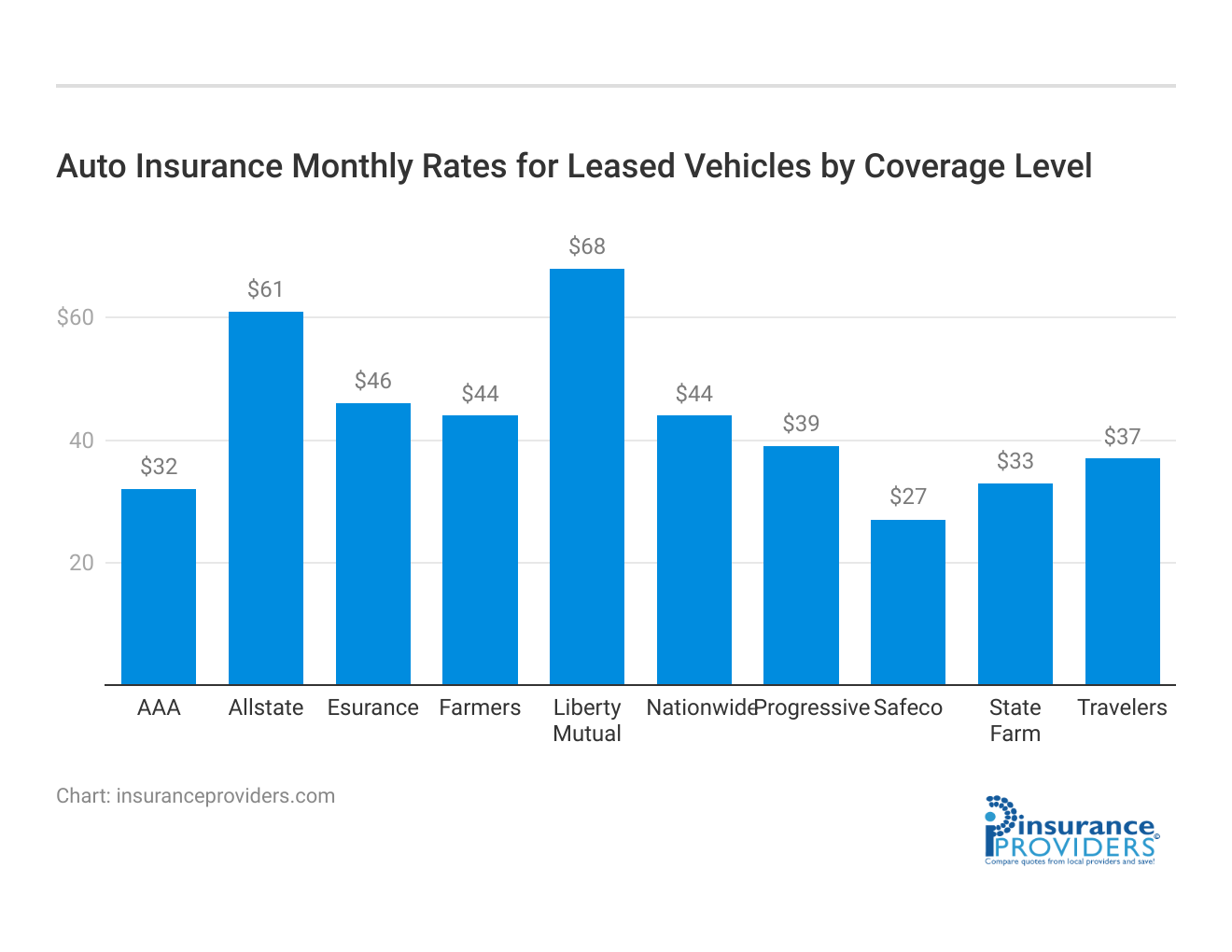

State Farm, Progressive, and Allstate stand out as the best auto insurance companies for a leased vehicle, offering competitive rates as low as $50 per month. With comprehensive coverage options, user-friendly platforms, and innovative programs, these insurers prioritize customer satisfaction

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated April 2024

hide

13,283 reviews

13,283 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe top picks for the best auto insurance companies for a leased vehicle are State Farm, Progressive, and Allstate. Factors like credit score, mileage, coverage level, and driving record significantly affect insurance rates, and these three providers offer tailored solutions for diverse needs.

Our Top 10 Best Companies: Best Auto Insurance for a Leased Vehicle

| Company | Rank | Best for | Lease Gap Insurance Discount | New Car Replacement Discount | See Pros/Cons |

|---|---|---|---|---|---|

| #1 | Comprehensive Coverage | Up To 10% | Up To 15% | Statefarm | |

| #2 | Local Agents | Up To 8% | Up To 12% | Progressive | |

| #3 | Policy Options | Up To 12% | Up To 18% | Allstate | |

| #4 | Online Convenience | Up To 10% | Up To 14% | Nationwide |

| #5 | 24/7 Support | Up To 9% | Up To 13% | Liberty Mutual |

| #6 | Vanishing Deductible | Up To 7% | Up To 10% | Farmers | |

| #7 | Safe-Driving Discounts | Up To 8% | Up To 11% | AAA |

| #8 | Multi-Policy Discounts | Up To 6% | Up To 9% | Travelers |

| #9 | Bundle Discounts | Up To 9% | Up To 12% | Esurance | |

| #10 | Customizable Policies | Up To 8% | Up To 11% | Safeco | |

Frequently Asked Questions

What is auto insurance for leased vehicles, and why is it important?

Auto insurance for leased vehicles is coverage designed specifically for vehicles under a lease agreement. It’s crucial to protect both the driver and the leasing company from potential financial losses in case of accidents, damage, or theft.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

What factors affect the cost of auto insurance for leased cars?

Factors such as the driver’s age, driving record, the type of vehicle being leased, and the coverage options selected can all affect the cost of auto insurance for leased cars.

Who insures a leased car?

Typically, the lessee is responsible for obtaining auto insurance for a leased car. However, the leasing company may have specific requirements and may be listed as an additional insured party on the policy.

What does leased car insurance coverage typically include?

Leased car insurance coverage typically includes liability coverage, which pays for injuries or damages caused by the leased vehicle, as well as comprehensive and collision coverage, which cover damages to the leased vehicle itself.

How can I find the best auto insurance for leased cars?

To find the best auto insurance for leased cars, consider factors such as coverage options, cost, customer service reputation, and any discounts available for leased vehicles.

Are there any discounts available for auto insurance for leased vehicles?

Yes, many insurance providers offer discounts for leased vehicles, such as bundling policies, safe driving discounts, and discounts for certain safety features on the leased vehicle.

How can I get cheap auto insurance for leased cars?

To get cheap auto insurance for leased cars, compare quotes from multiple insurance providers, consider higher deductibles, explore available discounts, and maintain a clean driving record.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

What is the cheapest insurance for leased cars?

The cheapest insurance for leased cars will vary depending on factors such as the driver’s profile, the type of vehicle, and the coverage options selected. It’s essential to compare quotes from different providers to find the most affordable option.

Can I get lease car insurance quotes online?

Yes, many insurance providers offer the option to get lease car insurance quotes online. You can typically obtain quotes by visiting the insurance company’s website or using online comparison tools.

What should I do if I’m involved in an accident with my leased car?

If you’re involved in an accident with your leased car, it’s essential to report the incident to your insurance provider and the leasing company as soon as possible. Follow their instructions for filing a claim and obtaining repairs for the vehicle.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.