Best Auto Insurance for a New Car in 2026 (Top 10 Companies)

Uncover the best auto insurance companies for a new car with State Farm, USAA, and Progressive, offering rates for as low as $50/month. Their excellence lies in diverse options, military exclusivity, and innovative savings, ensuring your new car is safeguarded comprehensively.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated April 2024

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Find the best auto insurance companies for a new car such as State Farm, USAA, and Progressive. These companies cater to different customer profiles based on factors like credit score, mileage, coverage level, and driving record. In this article, we will explore the significance of auto insurance, the various coverage options, deductibles, premiums, and highlight some top providers for new cars.

When purchasing a new car, one of the most important considerations is securing the right auto insurance. Understanding auto insurance and the factors to consider when choosing the best policy for a new car can save you from potential financial burdens.

Introducing our curated list of the top 10 auto insurance providers, tailored specifically for new car owners. With benefits like vanishing deductibles, safe-driving discounts, and customizable policies, our selection offers the perfect coverage for your new vehicle. Explore the options to find the ideal match for your needs, whether you prioritize comprehensive coverage or online convenience.

Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Our Top 10 Best Companies: Best Auto Insurance for a New Car

| Company | Rank | Best for | New Car Discount | Safety Features Discount | See Pros/Cons |

|---|---|---|---|---|---|

| #1 | Vanishing Deductible | Up To 10% | Up To 15% | statefarm | |

| #2 | Safe-Driving Discounts | Up To 12% | Up To 20% | USAA | |

| #3 | Multi-Policy Discounts | Up To 8% | Up To 12% | Progressive | |

| #4 | Bundle Discounts | Up To 15% | Up To 18% | Allstate | |

| #5 | Customizable Policies | Up To 10% | Up To 14% | Nationwide |

| #6 | Comprehensive Coverage | Up To 7% | Up To 10% | Liberty Mutual |

| #7 | Local Agents | Up To 9% | Up To 13% | Farmers | |

| #8 | Policy Options | Up To 8% | Up To 11% | AAA |

| #9 | Online Convenience | Up To 6% | Up To 9% | Travelers |

| #10 | 24/7 Support | Up To 10% | Up To 15% | Esurance |

#1 – State Farm: Diverse Coverage Expert

Pros

- Extensive Network of Agents: State Farm has a large network of local agents, providing personalized service and assistance.

- StrongFinancial Stability: State Farm boasts excellent financial strength ratings, providing assurance that claims will be handled efficiently.

- Diverse Coverage Options: State Farm offers a wide range of insurance products beyond auto insurance, including home, life, and health insurance. Find more insights in our State Farm Auto Insurance Review.

Cons

- Higher-than-Average Rates for Certain Demographics: While State Farm offers competitive rates for many drivers, some individuals may find their premiums to be higher compared to other insurers.

- Limited Online Capabilities: State Farm’s online platform may not be as user-friendly or robust as some of its competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Military-Exclusive Advantage

Pros

- Exceptional Customer Service: USAA consistently receives high marks for its outstanding customer service and claims handling.

- Exclusive Membership: USAA serves military members, veterans, and their families, offering specialized products and services tailored to their unique needs. Analyze this provider in our USAA Auto Insurance Review.

- Competitive Rates and Discounts: USAA often provides competitive rates and offers various discounts, helping members save on their premiums.

Cons

- Limited Eligibility: Membership with USAA is restricted to military members, veterans, and their families, excluding the general public from accessing their services.

- Limited Branch Locations: USAA primarily operates online and through phone support, which may be inconvenient for individuals who prefer in-person interactions.

#3 – Progressive: Innovation in Savings

Pros

- Innovative Technology and Tools: Progressive offers advanced online tools and features, including the Snapshot program, which tracks driving habits to potentially lower premiums.

- Wide Range of Coverage Options: Progressive provides a comprehensive selection of coverage options, allowing customers to tailor their policies to their specific needs.

- Competitive Rates and Discounts: Progressive offers competitive rates and various discounts, such as multi-policy, multi-car, and safe driver discounts, helping customers save money. Explore our appraisal in the Progressive Auto Insurance Review.

Cons

- Mixed Customer Service Reviews: Some customers have reported issues with Progressive’s customer service, particularly regarding claims handling and responsiveness.

- Limited Availability of Local Agents: Progressive primarily operates online, which may be a drawback for individuals who prefer face-to-face interactions with agents.

#4 – Allstate: Comprehensive Protection Provider

Pros

- Extensive Coverage Options: Allstate offers a wide range of coverage options and add-on policies, allowing customers to customize their insurance plans to meet their specific needs.

- Strong Financial Stability: Allstate boasts excellent financial strength ratings, providing policyholders with confidence that their claims will be paid promptly. Summary provided in our Allstate Auto Insurance Review.

- User-Friendly Mobile App: Allstate’s mobile app offers convenient features such as digital ID cards, roadside assistance, and claims tracking, enhancing the customer experience.

Cons

- Higher-than-Average Premiums: Allstate’s rates may be higher compared to some other insurers, particularly for drivers with certain demographics or driving histories.

- Mixed Customer Service Reviews: While many customers praise Allstate’s customer service, some have reported issues with claims processing and communication.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Tailored Policies for Everyone

Pros

- Tailored Policies: Nationwide offers customized policies to meet individual needs, providing flexibility in coverage options.

- Nationwide Network: With a widespread network of agents and service providers, Nationwide ensures accessibility and convenience for policyholders.

- Strong Financial Stability: Nationwide boasts a solid financial standing, providing reassurance that claims will be handled promptly and efficiently. Learn more in our Nationwide Mutual Insurance Company Review.

Cons

- Limited Discount Options: Some customers may find that Nationwide’s discount offerings are not as extensive as those of other insurers.

- Average Customer Service: While Nationwide provides adequate customer service, it may not always excel in responsiveness or satisfaction compared to other companies.

#6 – Liberty Mutual: Holistic Coverage Provider

Pros

- Holistic Coverage: Liberty Mutual offers comprehensive coverage options, including additional features such as roadside assistance and rental car reimbursement.

- Multi-Policy Discounts: Policyholders can benefit from significant discounts by bundling multiple insurance policies with Liberty Mutual.

- Strong Claims Handling: Liberty Mutual is known for its efficient claims processing and prompt settlement of claims, ensuring a smooth experience for policyholders.

Cons

- Higher Premiums: Some customers may find that Liberty Mutual’s premiums are slightly higher compared to other insurers, particularly for certain coverage options. Insights detailed in our Liberty Auto Insurance Review.

- Limited Availability: Liberty Mutual may not be available in all regions or states, limiting options for potential policyholders in certain areas.

#7 – Farmers: Local Touch, National Reach

Pros

- Local Touch: Farmers provides personalized service through its network of local agents, offering a personal touch and tailored recommendations.

- National Reach: Despite its local focus, Farmers operates nationally, providing coverage options to a wide range of customers across the country.

- Discounts and Rewards: Farmers offers various discounts and rewards programs, allowing policyholders to save money on their premiums.

Cons

- Mixed Customer Service Reviews: While Farmers generally provides good customer service, some customers may encounter inconsistencies or dissatisfaction in their interactions.

- Limited Digital Experience: Farmers’ online platform and digital tools may not be as robust or user-friendly as those offered by some other insurers, potentially hindering convenience for tech-savvy customers. Insights available in our Farmers Auto Insurance Review.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA: Trusted Roadside Assistance Provider

Pros

- Trusted Roadside Assistance: AAA is renowned for its reliable roadside assistance services, providing peace of mind to policyholders in case of emergencies.

- Member Benefits: AAA members enjoy exclusive benefits and discounts on various services beyond insurance, enhancing overall value and customer satisfaction. Details in our appraisal in the AAA Auto Insurance Review.

- Strong Reputation: AAA has a longstanding reputation for reliability and trustworthiness, making it a preferred choice for many consumers seeking insurance coverage.

Cons

- Membership Requirements: To access AAA’s insurance products, individuals must be members of AAA, which may involve additional fees and eligibility criteria.

- Limited Availability: AAA insurance may not be available in all regions or states, limiting options for potential policyholders outside of AAA’s service areas.

#9 – Travelers: Convenience at Your Fingertips

Pros

- Convenience: Travelers offers convenient online tools and resources for policy management, making it easy for customers to access their accounts and make changes as needed.

- Customizable Policies: Travelers provides flexible coverage options, allowing customers to tailor their policies to meet their specific needs and budget.

- Strong Financial Strength: With a solid financial rating, Travelers demonstrates stability and reliability in handling claims and meeting policy obligations. Summary provided in our Travelers Auto Insurance Review.

Cons

- Average Customer Service: While Travelers offers decent customer service, some customers may find that their interactions with representatives are not always exceptional or highly responsive.

- Limited Discounts: Travelers’ discount offerings may be more limited compared to some other insurers, potentially resulting in fewer opportunities for policyholders to save on premiums.

#10 – Esurance: 24/7 Support and Modern Solutions

Pros

- 24/7 Support: Esurance offers round-the-clock customer support, providing assistance to policyholders whenever they need it.

- Modern Solutions: Esurance leverages technology to offer a streamlined digital experience, including online quotes, policy management, and claims filing.

- Competitive Rates: Esurance is known for its competitive rates, making it an attractive option for cost-conscious consumers seeking affordable insurance coverage. Explore our appraisal in the Esurance Auto Insurance Review.

Cons

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Coverage Rates for New Car Insurance

When it comes to insuring your new car, understanding the specific coverage rates is crucial in making an informed decision. Different insurance providers offer varying rates for both full coverage and minimum coverage options.

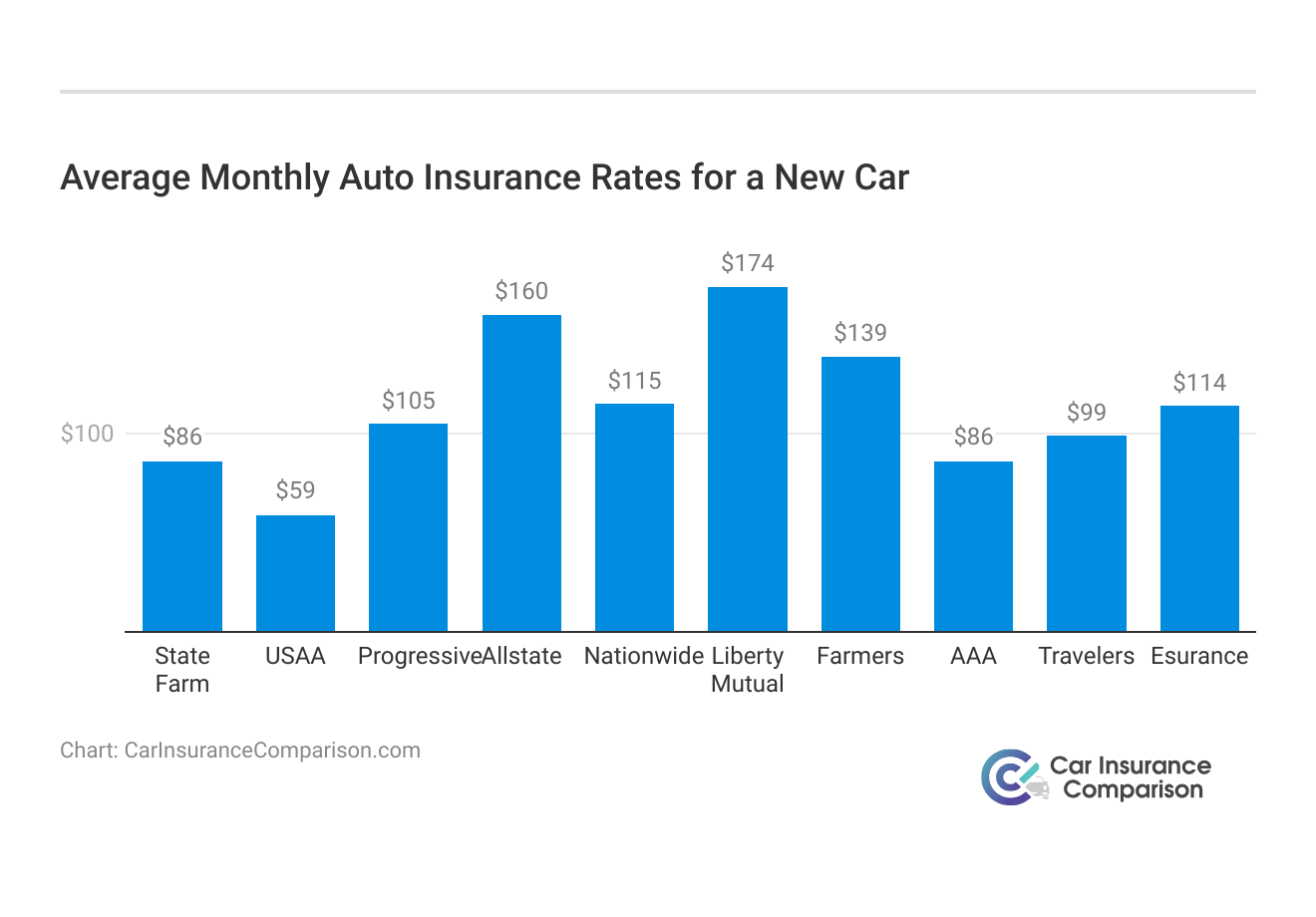

Average Monthly Auto Insurance Rates for a New Car

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| State Farm | $86 | $33 |

| USAA | $59 | $22 |

| Progressive | $105 | $39 |

| Allstate | $160 | $61 |

| Nationwide | $115 | $44 |

| Liberty Mutual | $174 | $68 |

| Farmers | $139 | $44 |

| AAA | $86 | $32 |

| Travelers | $99 | $37 |

| Esurance | $114 | $46 |

State Farm, known for its diverse coverage options, offers full coverage at an average monthly rate of $86. If you’re considering USAA, a military-exclusive advantage, their full coverage comes at a competitive rate of $59 per month. Progressive, with its innovative savings approach, provides full coverage at an average monthly rate of $105.

For those looking for more budget-friendly options, exploring minimum coverage rates is essential. USAA stands out with a minimum coverage rate of $22 per month, offering a cost-effective solution without compromising essential protection. State Farm and AAA both provide minimum coverage at $33 and $32 per month, respectively.

Understanding Auto Insurance

Why is Auto Insurance Important for a New Car?

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors to Consider When Choosing Auto Insurance for a New Car

State Farm leads with a Vanishing Deductible feature for a new car, providing a unique advantage for policyholders looking to lower their deductible over time.Jeff Root Licensed Life Insurance Agent

- Coverage Options: The passage discusses evaluating coverage options provided by insurance companies. It suggests looking for policies that include comprehensive coverage, collision coverage, and liability coverage, meeting or exceeding state minimum requirements. Comprehensive coverage protects against non-collision damages like theft or vandalism, collision coverage covers damages from accidents, and liability coverage protects financially in case of causing an accident. Additionally, it recommends considering extras like roadside assistance for breakdowns and rental car reimbursement for accidents.

- Deductibles: The passage emphasizes the importance of considering deductibles when choosing insurance coverage. It explains that deductibles are the amount one must pay out of pocket before insurance coverage begins. It suggests that policies with higher deductibles typically have lower premiums, while lower deductibles lead to higher premiums. It advises individuals to assess their financial situation and choose a deductible that matches their budget and risk tolerance. It also suggests that if one has enough savings to cover a higher deductible, it could be beneficial in reducing premium costs over time.

- Premiums: The passage discusses premiums in auto insurance, which are regular payments to maintain coverage. It suggests comparing premiums from different providers to balance cost and coverage, considering factors like driving record, age, location, and vehicle type. Insurers assess these factors to gauge the driver’s risk level. A clean driving record may qualify for lower premiums, while certain vehicles may be more expensive to insure due to repair costs or theft risk. It advises discussing with multiple providers to find competitive rates tailored to individual circumstances. It emphasizes the importance of adequate coverage, not just the cheapest premium, in case of accidents.

Top Auto Insurance Providers for New Cars

When it comes to insuring your new car, you want to make sure you choose the best insurance provider that offers comprehensive coverage and excellent customer service. With numerous options available in the market, it can be challenging to identify the right company for your needs. However, there are three reputable companies that stand out for their excellent auto insurance coverage and customer satisfaction.

#1 – State Farm

State Farm is a prominent auto insurance provider with a long-standing reputation for reliability and extensive coverage options. Known for its personalized service, State Farm offers a wide range of policies tailored to meet the diverse needs of its customers. With a network of local agents across the country, State Farm provides personalized assistance and support to policyholders. While it may not always offer the lowest rates, State Farm’s strong financial stability and excellent customer service make it a top choice for many drivers seeking dependable coverage.

#2 – USAA

USAA stands out as a leading insurance provider dedicated to serving military members, veterans, and their families. With a commitment to exceptional customer service and competitive rates, USAA offers a variety of coverage options tailored to meet the unique needs of military personnel. Policyholders often praise USAA for its attentive service and efficient claims process. While membership is limited to military-affiliated individuals, those who qualify benefit from the company’s specialized offerings and commitment to serving the military community.

#3 – Progressive

Progressive is renowned for its innovative approach to auto insurance, offering a range of cutting-edge features and digital tools to simplify the insurance process for customers. With offerings like the Name Your Price® tool and Snapshot® program, Progressive empowers policyholders to customize their coverage and potentially save on premiums based on their driving habits. The company’s user-friendly website and mobile app make it easy for customers to manage their policies and file claims. While some customers may find cheaper rates elsewhere, Progressive’s focus on innovation and customer experience sets it apart in the insurance industry.

Start saving on your auto insurance by entering your ZIP code and comparing quotes.

How to Compare Auto Insurance Quotes

Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Best Auto Insurance for a New Car

In the realm of auto insurance, individual experiences play a pivotal role in shaping perceptions and decisions. Through three distinct case studies, we delve into the unique journeys of John, Emily, and Sarah, each navigating the world of auto insurance with different providers.

- Case Study #1 – John’s State Farm Experience: John opted for State Farm for his SUV, enjoying comprehensive coverage and a lease gap insurance discount. Prompt claims processing minimized disruptions after a minor collision.

- Case Study #2 – Emily’s USAA Security: Emily relied on USAA for specialized coverage tailored to military needs. USAA’s roadside assistance proved invaluable during a cross-country move.

-

From State Farm’s comprehensive coverage to USAA’s military-exclusive advantages and Progressive’s tailored service, these case studies illuminate the diverse needs and preferences of consumers in safeguarding their vehicles and peace of mind.

Securing the Best Auto Insurance for Your New Car

Frequently Asked Questions

What factors should I consider when choosing the best auto insurance for my new car?

Consider factors such as coverage options, deductibles, premiums, customer reviews, and the financial stability of the insurance company to make an informed decision.

Start saving on your auto insurance by entering your ZIP code and comparing quotes.

What types of coverage are essential for a new car insurance policy?

Comprehensive coverage, collision coverage, liability coverage, and uninsured/underinsured motorist coverage are crucial for protecting your new car against various risks.

How can I find the most affordable auto insurance for my new car?

Compare quotes from multiple insurance providers, maintain a good driving record, opt for higher deductibles, and consider bundling your auto insurance with other policies to lower premiums.

Why is it important to consider the financial stability of an insurance company when purchasing auto insurance for a new car?

Ensuring the financial stability of the insurance company ensures they have the resources to pay claims promptly, especially in the event of major accidents or disasters.

Should I opt for additional coverage options for my new car?

Additional coverage options such as gap insurance, new car replacement coverage, and roadside assistance can provide extra protection and support tailored specifically for new cars.

What benefits does comprehensive coverage offer for my new car?

Comprehensive coverage protects your vehicle from non-collision incidents such as theft, vandalism, fire, and natural disasters, providing peace of mind for your investment.

Start saving on your auto insurance by entering your ZIP code and comparing quotes.

How does uninsured/underinsured motorist coverage protect my new car?

This coverage ensures you’re financially protected if you’re involved in an accident with a driver who either has no insurance or insufficient coverage to pay for damages to your vehicle.

Are there any discounts available for insuring a new car?

Some insurance companies offer discounts for safety features installed in new cars, good driving records, bundling policies, and completing defensive driving courses.

Can I adjust my coverage levels as my new car ages?

Yes, you can adjust your coverage levels as your new car ages. However, it’s essential to reassess your coverage periodically to ensure you have adequate protection.

Is it necessary to inform my insurance company if I make modifications to my new car?

Yes, it’s crucial to inform your insurance company about any modifications made to your new car, as they can impact your coverage and premiums.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.