Best Auto Insurance for Drivers With a Suspended License in 2026 (Top 10 Companies)

Discover the best auto insurance for drivers with a suspended license with top providers like Progressive, Farmers, and Safeco. This article delves into their tailored solutions, competitive rates, and specialized coverage options, providing crucial insights for those seeking the best auto insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Chris Abrams

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated March 2024

3,072 reviews

3,072 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 1,278 reviews

1,278 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviewsIn this article, we explore the best auto insurance for drivers with a suspended license with companies like Progressive, Farmers, and Safeco. These companies offer specialized solutions that stand out in assessing the balanced rates and comprehensive support.

- Progressive, Farmers, and Safeco are among the top car insurance providers offering tailored solutions for drivers with suspended licenses.

- Specialized policies for suspended license holders consider unique risks like legal expenses and lack of license reinstatement.

- Defensive driving courses and maintaining a clean driving record can help lower premiums over time.

Most insurance companies view drivers with suspended licenses as high-risk individuals, which often leads to higher insurance rates or even denial of coverage. However, there are still options available for drivers in this situation.

Our Top 10 Best Companies: Best Auto Insurance for Drivers With a Suspended License

| Company | Rank | See Pros/Cons | Auto Insurance Discount | Additional Insurance Discount | Best For |

|---|---|---|---|---|---|

| #1 | Progressive | Up to 15% | Up to 10% | Flexible Coverage | |

| #2 | Farmers | Up to 20% | Up to 15% | Specialized Coverage | |

| #3 | Safeco | Up to 10% | Up to 15% | Offers SR-22 | |

| #4 | Bristol West | Up to 10% | Up to 12% | Non-Standard Policies | |

| #5 | Direct Auto | Up to 15% | Up to 10% | Minimum Coverage |

| #6 | Dairyland | Up to 20% | Up to 10% | Standard Coverage | |

| #7 | Infinity | Up to 10% | Up to 10% | Higher Premiums | |

| #8 | SafeAuto | Up to 10% | Up to 15% | Local Agents |

| #9 | Titan | Up to 10% | Up to 10% | Multi-Car Discounts | |

| #10 | National General | Up to 15% | Up to 10% | Financial Stability |

By understanding the unique challenges that come with having a suspended license and exploring the top car insurance providers that cater to this specific market, you can find the best car insurance for drivers in your situation and get back on the road legally and safely.

#1 – Progressive: Flexibility in Coverage

Progressive stands out for its flexibility in coverage, making it a top choice for drivers with suspended licenses.Zach Fagiano Licensed Insurance Broker

Pros

- Up to 15% discount offers significant savings.

- Up to 10% coverage accommodates diverse needs.

- Flexible coverage options cater to individual preferences.

Cons

- Rates may be higher for certain demographics.

- Complex pricing structure may confuse some customers.

Read more: Progressive Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Specialized Coverage Solutions

Pros

- Up to 20% discount provides substantial cost benefits.

- Up to 15% coverage ensures comprehensive protection.

- Specialized coverage options tailored to unique needs.

Cons

- Premiums might be comparatively higher.

- Availability may be limited in certain regions.

Read more: Farmers Auto Insurance Review

#3 – Safeco: SR-22 Support and Balanced Rates

Pros

- Up to 10% discount offers competitive rates.

- Up to 15% coverage accommodates various circumstances.

- Specialized SR-22 support for drivers in need.

Cons

- Limited coverage options compared to some competitors.

- Customer service may receive mixed reviews.

#4 – Bristol West: Non-Standard Policies

Pros

- Up to 10% discount provides decent savings.

- Up to 12% coverage suitable for non-standard policies.

- Options for drivers facing challenges with their records.

Cons

- Coverage may not be as comprehensive as other providers.

- Limited availability in certain regions.

Read more: Bristol West Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Direct Auto: Emphasis on Minimum Coverage

Pros

- Up to 15% discount caters to budget-conscious individuals.

- Up to 10% coverage is suitable for minimal insurance needs.

- Straightforward options for those seeking minimum coverage.

Cons

- Limited add-ons may not meet all customer preferences.

- Customer service reviews may vary.

#6 – Dairyland: Standard Coverage and Generous Discounts

Pros

- Up to 20% discount provides significant savings.

- Up to 10% coverage for standard insurance needs.

- Generous discounts contribute to cost-effective policies.

Cons

- Limited availability in certain states.

- Options for additional coverage may be limited.

Read more: Dairyland Auto Insurance Review

#8 – Infinity: Trade-offs for Higher Premiums

Pros

- Up to 10% discount offers some savings.

- Up to 10% coverage provides standard protection.

- Higher premiums may translate to enhanced coverage.

Cons

- Rates may be less competitive for certain profiles.

- Limited options for specialized coverage.

Read more: Infinity Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – SafeAuto: Localized Service with Competitive Rates

Pros

- Up to 10% discount offers reasonable savings.

- Up to 15% coverage ensures comprehensive protection.

- Emphasis on local agents for personalized service.

Cons

- Limited coverage options compared to some competitors.

- Regional availability may be a constraint.

Read more: SafeAuto Insurance Review

#9 – Titan: Multi-Car Discounts and Balanced Rates

Pros

- Up to 10% discount provides reasonable savings.

- Up to 10% coverage suitable for various needs.

- Multi-car discounts for enhanced cost-effectiveness.

Cons

- Limited coverage options compared to competitors.

- Customer service reviews may vary.

Read more: Titan Auto Insurance Review

#10 – National General: Financial Stability and Competitive Rates

Pros

- Up to 15% discount offers significant savings.

- Up to 10% coverage for diverse insurance needs.

- Strong emphasis on financial stability and reliability.

Cons

- Limited availability in certain regions.

- Options for specialized coverage may be limited.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

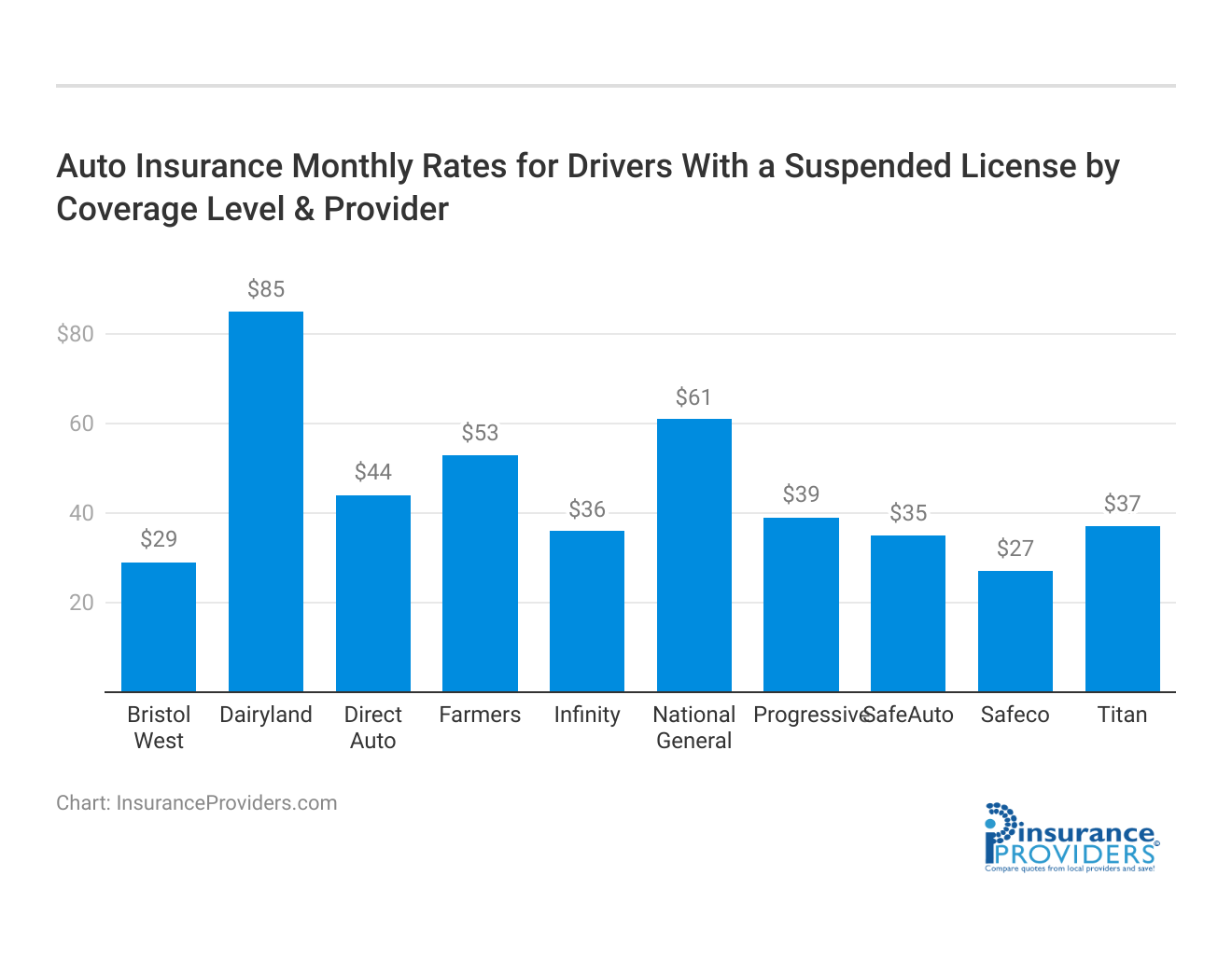

Drivers With a Suspended License: Unveiling Coverage Rates

The table provides a detailed overview of the average monthly auto insurance rates tailored for drivers with a suspended license. This distinct category demands a nuanced understanding of coverage rates, both for Minimum Coverage and Full Coverage, as drivers with suspended licenses often face unique circumstances that influence insurance premiums.

Average Monthly Auto Insurance Rates for Drivers With a Suspended License

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Progressive | $39 | $105 |

| Farmers | $53 | $139 |

| Safeco | $27 | $71 |

| Bristol West | $29 | $77 |

| Direct Auto | $44 | $115 |

| Dairyland | $85 | $237 |

| Infinity | $36 | $111 |

| SafeAuto | $35 | $93 |

| Titan | $37 | $97 |

| National General | $61 | $161 |

Examining the specific coverage rates, Safeco emerges as the most affordable option for Minimum Coverage, charging a mere $27 per month, followed closely by Bristol West at $29. Conversely, Dairyland presents the highest Minimum Coverage rate at $85.

Transitioning to Full Coverage, Safeco maintains its cost-effectiveness with a rate of $71, while Dairyland remains the priciest choice at $237 per month.

Notably, Progressive and Infinity offer competitive Full Coverage rates at $105 and $111, respectively. These rates underscore the impact of a suspended license on insurance costs, emphasizing the need for individuals in this category to carefully assess and compare options.

While affordability is a key consideration, it is equally important to evaluate coverage adequacy and other pertinent factors to make well-informed decisions when selecting auto insurance for drivers with suspended licenses.

Read more: Can you negotiate your Auto Insurance rates?

Understanding Car Insurance for Suspended License Holders

Driving with a suspended license can happen for various reasons, including DUI convictions, multiple traffic violations, or failure to pay fines. Regardless of the reason, insurance companies view this as a high-risk behavior, which can make it challenging for drivers to secure insurance coverage at an affordable rate.

However, it’s important to note that insurance companies do offer specialized policies designed specifically for drivers with suspended licenses. These policies take into account the specific risks associated with driving in this situation and provide coverage tailored to the needs of these drivers.

Why is Special Insurance Needed for Suspended Licenses?

When drivers have their licenses suspended, it often indicates a pattern of risky behavior or a lack of responsibility behind the wheel. Insurance companies take this into account when assessing the risk of providing coverage to drivers in this situation.

Special insurance for suspended licenses is needed because it provides coverage for the specific risks associated with drivers who have had their licenses suspended. This may include coverage for legal expenses, fines, or additional repercussions if you are caught driving without a valid license.

One of the main reasons insurance companies require special policies for suspended license holders is the increased likelihood of accidents. Drivers with suspended licenses have already demonstrated a disregard for traffic laws, and this behavior puts them at a higher risk of being involved in accidents. These specialized policies offer higher coverage limits to protect both the driver and other parties involved in case of an accident.

Furthermore, insurance companies understand that drivers with suspended licenses may face challenges in reinstating their licenses. Therefore, these policies often include provisions that allow for coverage even if the driver’s license is not currently valid. This can provide a sense of security for drivers who are actively working towards reinstating their licenses but still need to drive in the meantime.

Legal Implications of Driving With a Suspended License

Driving with a suspended license is illegal, and the consequences can vary depending on the state you reside in and the reason for the suspension. It can lead to fines, license revocation, or even jail time.

In addition to the legal implications, driving with a suspended license can also have a significant impact on your insurance rates. If you are caught driving without a valid license, insurance companies may view you as an even higher risk, leading to increased premiums or denial of coverage altogether. (For more information, read our “Where can i get auto insurance without a license?“).

It’s important to note that the legal consequences of driving with a suspended license can extend beyond fines and penalties. Having a record of driving with a suspended license can have long-term effects on your driving record and may make it more difficult to reinstate your license in the future. It can also result in a tarnished driving history, which can affect your ability to secure affordable insurance coverage even after your license is reinstated.

Furthermore, driving with a suspended license can have personal and professional consequences. If you rely on driving for your job, such as being a delivery driver or a rideshare driver, having a suspended license can lead to loss of income and potential job termination (read our “Best Auto Insurance for Rideshare Drivers” for more information). It can also impact your personal life, as it may limit your ability to travel or fulfill family and social obligations.

Given these potential consequences, it is crucial for drivers with suspended licenses to understand the importance of obtaining specialized insurance coverage. While it may come at a higher cost, having the right insurance policy can provide the necessary protection and peace of mind while working towards reinstating your license.

Factors Insurance Companies Consider for Suspended License Holders

When determining the insurance rates for drivers with suspended licenses, insurance companies consider various factors to assess the level of risk associated with providing coverage.

Having a suspended license can make it challenging to find affordable car insurance. However, understanding the factors that insurance companies consider can help you navigate this process more effectively.

Driving Record and Suspension Reasons

Insurance companies will closely examine your driving record and the reasons behind your license suspension. Multiple traffic violations or a history of reckless driving can indicate a higher risk and may result in higher insurance rates.

It’s important to be honest and transparent with insurance companies about your driving history and the reasons for your license suspension. Being forthright can help insurance companies determine the appropriate coverage options for you.

Moreover, insurance companies may also consider the specific details of your license suspension. For example, if your license was suspended due to a DUI conviction, insurance companies may view you as a higher risk compared to someone with a suspended license due to unpaid tickets.

Risk Assessment by Insurance Companies

Insurance companies will assess the level of risk you pose as a driver with a suspended license. They will consider factors such as your age, driving experience, and the length of your license suspension.

If you are a younger driver with limited experience and a suspended license, insurance companies may perceive you as a higher risk. On the other hand, if you have a long history of safe driving before the suspension, insurance companies may be more lenient in their assessment.

Additionally, insurance companies may review your credit history to determine your financial responsibility and ability to make premium payments on time. A poor credit score can further increase your insurance rates as it is often seen as an indicator of higher risk.

Furthermore, insurance companies may take into account any efforts you have made to improve your driving skills or attend defensive driving courses during your license suspension. These proactive steps can demonstrate your commitment to becoming a safer driver and potentially lower your insurance rates.

It’s worth noting that each insurance company may have its own criteria and weightage for assessing risk, so it can be beneficial to shop around and compare quotes from multiple insurers.

While having a suspended license may initially make it difficult to find affordable car insurance, understanding the factors that insurance companies consider can help you navigate this process and potentially find suitable coverage at a reasonable price.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Lower Your Insurance Rates With a Suspended License

While drivers with suspended licenses may face higher insurance rates, there are steps you can take to potentially lower your premiums.

Tips for Negotiating Insurance Rates

One way to lower your insurance rates is to negotiate with insurance companies. Some providers may be willing to offer discounts or lower rates if you can demonstrate that you are taking steps to improve your driving behavior or if you complete defensive driving courses.

Additionally, shopping around and comparing quotes from multiple insurance providers can help you find the most competitive rates available.

Importance of Defensive Driving Courses

Completing defensive driving courses can not only improve your driving skills but also demonstrate to insurance companies that you are taking proactive measures to become a safer driver. Many insurance companies offer discounts to drivers who have completed these courses, which can help lower your insurance rates.

Case Studies: Empowering Drivers With Suspended Licenses

Case Study 1: Progressive’s Personalized Resolution

Meet Sarah, a driver facing the complexities of a suspended license. Progressive stepped in with a tailored approach, offering flexible coverage that met Sarah’s unique needs. With a 15% discount and personalized attention, Progressive not only assisted in navigating the challenges but also provided a roadmap towards reinstating Sarah’s driving privileges.

Case Study 2: Farmers’ Specialized Support

John found himself grappling with a suspended license, unsure of where to turn. Farmers entered the scene with specialized coverage solutions, offering a generous 20% discount to alleviate financial burdens. The company’s commitment to understanding the specific challenges of drivers like John ensured a smooth and supportive experience during a challenging period.

Case Study 3: Safeco’s SR-22 Assistance

Facing a suspended license, Emily sought an insurer that could cater to her SR-22 needs. Safeco not only provided competitive rates with a 10% discount but also demonstrated expertise in handling SR-22 requirements. Emily’s journey with Safeco showcased the company’s commitment to supporting drivers with unique circumstances, making the road to reinstatement more manageable.

Reinstating Your License and Insurance

Reinstating your license is crucial if you want to legally drive again. Once your license is reinstated, you can then work on securing car insurance coverage.

Steps to Reinstating Your License

Reinstating your license typically involves fulfilling certain requirements, such as paying any outstanding fines, completing any necessary classes or programs, and providing proof of insurance to the Department of Motor Vehicles (DMV). It’s important to follow the specific procedures outlined by your state’s DMV to ensure a smooth reinstatement process.

How Reinstatement Affects Your Insurance Rates

Reinstating your license can have a positive impact on your insurance rates. Insurance companies often view a reinstated license as an indication of responsible driving behavior, which can result in lower premiums.

However, it’s important to note that the specific impact on your insurance rates will depend on various factors, including your driving record, the length of your license suspension, and the insurance provider you choose.

By understanding the unique challenges associated with having a suspended license and exploring the best car insurance providers for drivers in this situation, you can find coverage that meets your needs and budget. Taking steps to improve your driving behavior and successfully reinstating your license can also help lower your insurance rates over time.

Remember to compare quotes from multiple providers and consider completing defensive driving courses to potentially secure the most affordable rates available. With the right insurance coverage in place, you can get back on the road legally and safely, ensuring peace of mind for yourself and other drivers on the road.

Frequently Asked Questions

What factors influence insurance rates for drivers with a suspended license?

Insurance rates are influenced by various factors, including the specific policies of insurance providers. Key factors include credit score, mileage, coverage level, and the driver’s record.

Why do insurance companies hesitate to provide coverage for drivers with a suspended license?

Insurance companies consider drivers with a suspended license to be high-risk customers. They are more likely to have previous traffic violations or accidents, which increases the likelihood of filing claims.

What factors can affect the cost of car insurance for drivers with a suspended license?

Several factors can influence the cost of car insurance for drivers with a suspended license. These include the reason for the license suspension, the duration of the suspension, the driver’s previous driving record, and the insurance company’s policies.

Are there any specialized insurance companies that cater to drivers with a suspended license?

Yes, there are insurance companies that specialize in providing coverage for drivers with a suspended license. These companies understand the unique circumstances of these drivers and may offer more flexible options.

What steps can I take to improve my chances of finding affordable car insurance with a suspended license?

To increase your chances of finding affordable car insurance with a suspended license, you can consider taking defensive driving courses, maintaining a clean driving record after the suspension is lifted, comparing quotes from different insurance providers, and seeking assistance from insurance brokers who have experience with high-risk drivers.

Will my car insurance rates decrease after my license suspension is lifted?

While there is no guarantee, your car insurance rates may decrease after your license suspension is lifted if you maintain a clean driving record. Insurance companies typically consider recent driving history when determining premiums, so a good record can lead to lower rates over time.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.