Best Auto Insurance for Luxury Cars in 2026 (Top 10 Companies)

Navigate the best car insurance companies for luxury cars such as Hartford, Travelers, and Safeco. This guide meticulously explores coverage rates and options, providing valuable insights tailored for high-end vehicle owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor of Nutrition & Kinesiology

Melissa Morris has a BS and MS in exercise science and a doctorate in educational leadership. She is an ACSM certified exercise physiologist and an ISSN certified sports nutritionist. She teaches nutrition and applied kinesiology at the University of Tampa. She has been featured on Yahoo, HuffPost, Eat This, Bulletproof, Vitacost, LIVESTRONG, Toast Fried, The Trusty Spotter, Best Comp...

Melissa Morris

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated March 2024

1,733 reviews

1,733 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 1,278 reviews

1,278 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviewsAssess the the best car insurance companies for luxury cars like The Hartford, Travelers, and Safeco. These companies offer competitive rates alongside 24/7 support, vanishing deductibles, and safe-driving discounts. This guide explores coverage types, company profiles, and cost-saving strategies for your ideal policy.

Whether you prioritize premium coverage or budget-friendly options, our data-driven exploration unveils insights tailored to your needs. From pristine driving records to the credit-conscious, discover which company, among Hartford, Travelers, and Safeco, offers the most advantageous rates for your unique profile, ensuring your luxury ride is protected without breaking the bank.

Our Top 10 Best Companies: Best Car Insurance for Luxury Cars

| Company | Rank | See Pros/Cons | Luxury Car Discount | Multi-Vehicle Discount | Best For |

|---|---|---|---|---|---|

| #1 | Hartford | Up To 15% | Up To 17% | 24/7 Support |

| #2 | Travelers | Up To 14% | Up To 16% | Vanishing Deductible |

| #3 | Safeco | Up To 12% | Up To 15% | Safe-Driving Discounts | |

| #4 | Farmers | Up To 10% | Up To 14% | Multi-Policy Discounts | |

| #5 | State Farm | Up To 11% | Up To 13% | Bundle Discounts | |

| #6 | Amica | Up To 13% | Up To 16% | Customizable Policies | |

| #7 | Progressive | Up To 12% | Up To 17% | Comprehensive Coverage | |

| #8 | Allstate | Up To 9% | Up To 12% | Local Agents | |

| #9 | Liberty Mutual | Up To 10% | Up To 15% | Policy Options |

| #10 | The General | Up To 8% | Up To 11% | Online Convenience |

Owning a luxury car brings not only the thrill of high-end driving but also heightened stakes and unique considerations. In this guide, we’ll explore the world of car insurance tailored for luxury vehicles, addressing the added costs and risks associated with these prized possessions. Discover the best coverage options for your luxury car.

#1 – Hartford: 24/7 Support

Hartford stands out as a top choice for luxury car insurance with its unwavering commitment to providing immediate and reliable support, showcasing a dedication to the safety and satisfaction of high-end vehicle owners.Dani Best Licensed Insurance Producer

Pros

- Up to 15% luxury car discount: Offers significant savings for high-end vehicle owners.

- Up to 17% multi-vehicle discount: An attractive option for those with multiple vehicles.

- 24/7 support: Ensures round-the-clock assistance for any insurance-related concerns.

Cons

- Limited information on customizable policies: No specific details provided on policies that can be tailored to individual needs.

- Limited details on vanishing deductible feature: Insufficient information on the extent of the vanishing deductible feature.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Vanishing Deductible

Pros

- Up to 14% luxury car discount: Competitive rates for insuring luxury vehicles.

- Up to 16% multi-vehicle discount: Caters to customers with more than one vehicle.

- Vanishing deductible feature: Offers the potential for deductible reduction over time.

Cons

- Limited details on customizable policies: No specific information on the extent of policies that can be customized.

- No specific information on 24/7 support services: Lack of clarity on round-the-clock support.

Read more: Travelers Auto Insurance Review

#3 – Safeco: Safe-Driving Discounts

Pros

- Up to 12% luxury car discount: Moderate but valuable discount for high-end vehicle owners.

- Up to 15% multi-vehicle discount: Savings for customers with more than one vehicle.

- Emphasis on safe-driving discounts: Appeals to those who prioritize safe driving habits.

Cons

- Limited information on 24/7 support: No specific information on continuous assistance or additional customer service features.

- No specific details on customizable policies: Lack of clarity on policies that can be tailored to individual needs.

#4 – Farmers: Multi-Policy Discounts

Pros

- Up to 10% luxury car discount: Provides savings for luxury vehicle owners.

- Up to 14% multi-vehicle discount: Suitable for customers with multiple vehicles.

- Emphasis on multi-policy discounts: Attractive option for bundling insurance coverage.

Cons

- Limited information on 24/7 support: No specific details on continuous assistance or additional customer service features.

- No specific details on customizable policies: Lack of clarity on policies that can be tailored to individual needs.

Read more: Farmers Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Bundle Discounts

Pros

- Up to 11% luxury car discount: Offers savings for luxury vehicle owners.

- Up to 13% multi-vehicle discount: Provides discounts for customers with more than one vehicle.

- Focus on bundle discounts: Appeals to those looking to combine multiple insurance policies.

Cons

- Limited information on 24/7 support: No specific information on continuous assistance or additional customer service features.

- No specific details on customizable policies: Lack of clarity on policies that can be tailored to individual needs.

Read more: State Farm Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Luxury Cars: Decoding Car Insurance Coverage Rates

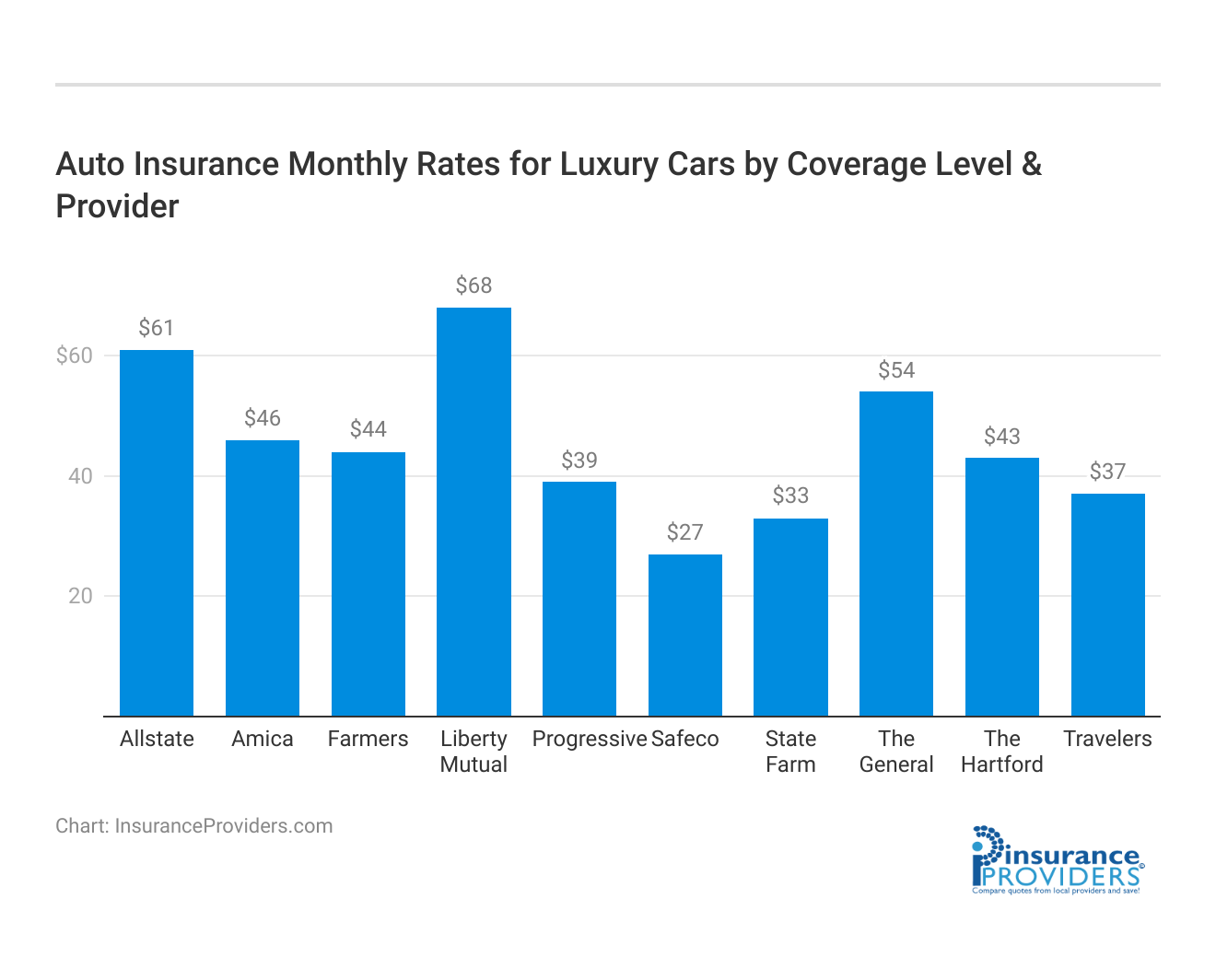

Embarking on the journey of insuring luxury cars requires a nuanced understanding of coverage rates, a critical factor that defines the protective embrace of insurance policies. As we explore the realm of luxury car insurance, the table below unveils the specific coverage rates offered by prominent insurance companies, differentiating between full coverage and minimum coverage options.

Average Monthly Auto Insurance Rates for Luxury Cars

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| Hartford | $113 | $43 |

| Travelers | $99 | $37 |

| Safeco | $71 | $27 |

| Farmers | $139 | $44 |

| State Farm | $86 | $33 |

| Amica | $151 | $46 |

| Progressive | $105 | $39 |

| Allstate | $160 | $61 |

| Liberty Mutual | $174 | $68 |

| The General | $232 | $54 |

This insight into the monthly rates not only empowers prospective policyholders in making informed decisions but also sheds light on the varying degrees of protection available for their high-end automotive investments.

The table meticulously dissects the average monthly car insurance rates for luxury cars across renowned insurance providers, offering a comprehensive view of the financial commitment associated with safeguarding high-value vehicles.

Notably, the figures for full coverage and minimum coverage present a spectrum of options, catering to the diverse preferences and risk appetites of luxury car owners.

Hartford emerges with an enticing $113 for full coverage, while Liberty Mutual extends a robust yet pricier option at $174. The disparity in rates reflects a delicate balance between comprehensive protection and budget considerations, urging consumers to weigh the offered coverage against their individual needs.

This comprehensive breakdown of coverage rates not only serves as a valuable resource for those navigating the luxury car insurance landscape but also underscores the importance of aligning insurance choices with the unique characteristics of high-end vehicular assets.

Understanding Car Insurance for Luxury Cars

Before we dive into the specifics, let’s first understand what luxury car insurance is all about. Luxury car insurance is a specialized form of coverage designed specifically for high-end vehicles. It provides protection against common risks such as accidents, theft, and damage, while also taking into account the unique factors that come with owning a luxury car.

When it comes to luxury car insurance, it’s important to have a comprehensive understanding of what this type of coverage entails. Luxury car insurance offers more than just the basic protection found in standard car insurance policies. It goes above and beyond to ensure that high-value vehicles are adequately covered in case of any unforeseen events.

What is luxury car insurance?

Luxury car insurance is a type of car insurance that offers comprehensive coverage for high-value vehicles. It includes protection against not only the usual risks but also factors such as high repair costs, specialized parts, and depreciation. This type of insurance ensures that luxury car owners are adequately covered if anything happens to their prized possessions.

When you invest in a luxury car, you’re not just purchasing a mode of transportation, but a symbol of prestige and luxury. Luxury car insurance recognizes the unique value and significance of these vehicles, providing coverage that is tailored to their specific needs. Whether it’s a sleek sports car or a luxurious sedan, luxury car insurance is designed to protect your investment and give you peace of mind.

Why is luxury car insurance different?

Luxury car insurance differs from standard car insurance in a few key ways. Firstly, luxury car insurance takes into account the higher value of the vehicle, which means higher coverage limits and more comprehensive protection. This ensures that in the event of an accident or theft, you’re not left with a significant financial burden.

Additionally, luxury car insurance providers often have specialized repair networks and access to OEM (Original Equipment Manufacturer) parts. This means that if your luxury car requires repairs after an accident, you can rest assured that it will be taken care of by professionals who are experienced in handling high-end vehicles.

The use of OEM parts also ensures that your car maintains its original quality and performance. Furthermore, luxury car insurance understands the unique depreciation factors associated with high-end vehicles. Luxury cars tend to depreciate at a slower rate compared to standard vehicles. Luxury car insurance takes this into account and provides coverage that considers the potential loss in value over time.

Overall, luxury car insurance offers a level of protection and service that goes beyond what is typically provided by standard car insurance policies. It acknowledges the specialized needs of luxury car owners and aims to provide the utmost peace of mind when it comes to protecting their valuable assets.

Factors to Consider When Choosing Luxury Car Insurance

When it comes to selecting the best car insurance for your luxury car, several factors need to be taken into consideration. Here are some of the key factors you should keep in mind:

First and foremost, it is crucial to consider the coverage options available. Luxury car insurance policies should offer comprehensive coverage, including protection against accidents, theft, vandalism, and natural disasters. With the high value of luxury cars, it is essential to have coverage that can adequately compensate for any damages or losses that may occur.

Furthermore, it is important to look for policies that cover specialized items such as customizations, high-value accessories, and diminishing value. Luxury cars often come with unique features and modifications, and having coverage for these additions ensures that you are fully protected in case of any damages or theft.

Another factor to consider is the level of customer service provided by the insurance provider. Having excellent customer service is vital when dealing with luxury car insurance. Look for insurance providers that have a reputation for providing prompt, efficient, and courteous service. This will ensure that you are well taken care of in case of any issues or claims.

It is essential to have a reliable point of contact who can assist you throughout the insurance process and address any concerns you may have. In addition to customer service, the claim settlement ratio is an essential factor to consider when choosing an insurance provider.

The claim settlement ratio indicates the percentage of claims that the company settles successfully. A higher claim settlement ratio indicates better reliability and a quicker claims process. When it comes to luxury car insurance, you want an insurance provider that can efficiently handle claims and provide a seamless experience in case of any unfortunate incidents.

Lastly, consider the reputation and financial stability of the insurance company. It is crucial to choose an insurance provider that has a strong financial standing and a solid reputation in the industry. This ensures that they have the financial resources to fulfill their obligations and provide the necessary coverage for your luxury car.

Overall, when selecting luxury car insurance, it is important to consider the coverage options, customer service, claim settlement ratio, and the reputation of the insurance provider. Taking these factors into account will help you make an informed decision and choose the best insurance policy for your valuable luxury car.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Car Insurance Providers for Luxury Cars

Now that you know what to consider when choosing luxury car insurance, let’s take a look at some of the top car insurance providers that cater specifically to luxury cars:

Company Profiles and Ratings

When it comes to insuring your luxury car, it’s important to choose a reliable and reputable insurance provider. Company profiles and ratings provide valuable insights into the performance and reputation of insurance providers. These profiles typically include information about the company’s history, financial stability, customer satisfaction ratings, and claims handling process.

Before making a decision, take the time to research and compare the profiles of different luxury car insurance companies. Look for providers that have a strong track record of providing excellent customer service and prompt claims settlement. It’s also a good idea to read customer reviews and testimonials to get a sense of other policyholders’ experiences with the company.

Comparison of Coverage and Prices

When it comes to luxury car insurance, it’s not just about finding the cheapest policy, but also ensuring that you have adequate coverage. Luxury cars often come with a higher price tag and require specialized repairs, so it’s important to choose a policy that offers comprehensive coverage.

When comparing the coverage options and prices offered by different insurance providers, consider the specific needs of your luxury car. Look for policies that offer a balance between comprehensive coverage and affordable premiums. This may include coverage for damage caused by accidents, theft, vandalism, natural disasters, and even coverage for accessories and modifications.

It’s also worth considering any additional benefits or perks that may be offered by the insurance provider. Some companies may offer services such as roadside assistance, concierge services, or even coverage for rental cars while your luxury car is being repaired.

Remember, it’s not just about the price, but also the value you receive in terms of coverage. While it’s important to find a policy that fits within your budget, compromising on coverage could leave you financially vulnerable in the event of an accident or theft.

By taking the time to research and compare the coverage options, prices, and additional benefits offered by different luxury car insurance providers, you can make an informed decision and find the best deal for your prized possession.

Tips to Reduce Luxury Car Insurance Costs

While luxury car insurance may seem expensive, there are ways to reduce your premium costs without compromising on coverage. Here are a few tips to help you lower your luxury car insurance costs:

Bundling Insurance Policies

Consider bundling your luxury car insurance with your other insurance policies, such as homeowner’s or renter’s insurance. Many insurance providers offer discounted rates for customers who bundle multiple policies, potentially saving you a significant amount of money.

Bundling insurance policies not only helps you save money, but it also simplifies your insurance management. With all your policies under one provider, you have a single point of contact for any questions or claims. Additionally, bundling can provide you with a comprehensive coverage package that includes benefits like extended liability protection and roadside assistance.

Safe Driving Discounts

Safe driving discounts are a common way to save on luxury car insurance. Maintaining a clean driving record and completing defensive driving courses can often lead to lower premiums and additional discounts.

When it comes to luxury car insurance, insurance providers often reward safe driving habits. By consistently following traffic rules, avoiding accidents, and practicing defensive driving techniques, you demonstrate to insurers that you are a responsible driver. This can result in lower premiums and additional discounts, ultimately reducing your luxury car insurance costs.

Furthermore, defensive driving courses not only help you save money but also enhance your driving skills. These courses provide valuable knowledge on how to anticipate and react to potential hazards on the road, making you a safer driver. In some cases, completing a defensive driving course can even lead to the removal of certain traffic violations from your driving record, further improving your insurance rates.

Case Studies: How the Three Winning Companies Helped Luxury Car Owners

Case Study 1: A Nighttime Assistance Miracle With Hartford

One stormy night, John, a proud owner of a luxury car, found himself stranded on a desolate road due to a flat tire. Despite the late hour, he called Hartford’s 24/7 support for assistance.

To his amazement, a roadside assistance team promptly arrived, not only changing the tire but also ensuring John’s safety. This immediate and reliable support showcased Hartford’s commitment to providing round-the-clock assistance to luxury car owners.

Case Study 2: Travelers’ Deductible Magic in Action

Emily, the owner of a high-end sports car insured with Travelers, experienced an unfortunate minor collision. Concerned about the potential impact on her insurance deductible, she reached out to Travelers. The vanishing deductible feature came into play, gradually reducing Emily’s deductible over time without any claims.

This unique aspect of Travelers’ coverage provided her with financial relief and highlighted the insurer’s commitment to rewarding safe driving habits.

Case Study 3: Safeco’s Safety Rewards Program

Alex, a luxury SUV owner insured with Safeco, was committed to safe driving practices. Safeco’s emphasis on safe-driving discounts proved to be a boon for Alex.

As he consistently demonstrated responsible driving habits, his insurance premiums decreased, reflecting Safeco’s recognition of and rewards for maintaining a safe driving record. This case study underscores Safeco’s dedication to encouraging and rewarding safe behavior among luxury car owners.

Frequently Asked Questions

What factors should I consider when looking for the best car insurance for luxury cars?

When looking for the best car insurance for luxury cars, there are several factors to consider. These include the coverage options provided by the insurance company, the reputation and financial stability of the insurer, the cost of the insurance premiums, and any additional benefits or discounts offered specifically for luxury car owners.

What types of coverage should I look for when insuring a luxury car?

When insuring a luxury car, it is important to look for comprehensive coverage, collision coverage, and liability coverage. Comprehensive coverage protects against non-collision damages such as theft or natural disasters, collision coverage covers damages from accidents, and liability coverage protects against any damage or injuries caused to others.

Are there any insurance companies that specialize in providing coverage for luxury cars?

Yes, there are insurance companies that specialize in providing coverage for luxury cars. These companies understand the unique needs and risks associated with luxury vehicles and can offer tailored coverage options. It is recommended to research and compare different insurance providers to find the one that best suits your needs.

Do luxury cars have higher insurance premiums compared to regular cars?

Generally, luxury cars have higher insurance premiums compared to regular cars. This is because luxury cars tend to have higher values and repair costs. Additionally, luxury cars may be more attractive to thieves, increasing the risk of theft. However, insurance premiums can vary depending on several factors including the model of the luxury car, the driver’s age and driving history, and the location of the insured vehicle.

Are there any discounts available for luxury car owners when purchasing car insurance?

Yes, some insurance companies offer discounts specifically for luxury car owners. These discounts can vary but may include features such as multi-car discounts, safe driver discounts, or discounts for installing anti-theft devices in the luxury vehicle. It is advisable to inquire with different insurance providers to determine the discounts available for luxury car owners.

What should I do if my luxury car is involved in an accident?

If your luxury car is involved in an accident, there are a few steps you should take. First, ensure the safety of all individuals involved and seek medical attention if necessary. Then, contact your insurance company to report the accident and initiate the claims process. It is important to provide accurate and detailed information about the accident to your insurance company. They will guide you through the necessary steps to assess the damages and arrange for repairs.

How can I lower the costs of luxury car insurance?

To lower luxury car insurance costs, consider bundling policies, maintaining a clean driving record to qualify for safe-driving discounts, and exploring available discounts with different insurers. Additionally, opting for higher deductibles and reviewing coverage needs regularly can contribute to cost savings.

How do vanishing deductibles work in luxury car insurance policies?

Vanishing deductibles, as offered by some insurers, provide the opportunity for the deductible amount to decrease over time if no claims are made. This feature can be advantageous for luxury car owners, gradually reducing the financial responsibility in the event of a claim-free period.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.