Best Auto Insurance for Rideshare Drivers in 2026 (Top 10 Companies)

State Farm, Progressive, and Allstate emerge as the best car insurance companies for rideshare drivers. Their competitive rates, extensive protection, and commitment to meeting the unique needs of rideshare drivers set them apart in the insurance landscape.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated February 2024

13,283 reviews

13,283 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsUnraveling the intricacies of the best car insurance companies for rideshare drivers such as State Farm, Progressive, and Allstate. Discover the ideal blend of competitive rates and comprehensive protection, tailored precisely to fuel your peace of mind on every ride.

Rideshare driving has become a popular way for many individuals to earn extra income or even make a full-time living. However, one of the most important considerations for rideshare drivers is obtaining the right auto insurance coverage.

Our Top 10 Best Companies: Best Car Insurance for Rideshare Drivers

| Company | Rank | See Pros/Cons | Rideshare Driver Discount | Multi-Vehicle Discount | Best For |

|---|---|---|---|---|---|

| #1 | State Farm | Up To 12% | Up To 15% | Customizable Policies | |

| #2 | Progressive | Up To 15% | Up To 17% | Comprehensive Coverage | |

| #3 | Allstate | Up To 14% | Up To 15% | Local Agents | |

| #4 | Liberty Mutual | Up To 10% | Up To 14% | Policy Options |

| #5 | Farmers | Up To 11% | Up To 13% | Online Convenience | |

| #6 | Esurance | Up To 13% | Up To 16% | 24/7 Support | |

| #7 | Nationwide | Up To 9% | Up To 12% | Vanishing Deductible |

| #8 | Travelers | Up To 10% | Up To 13% | Safe-Driving Discounts |

| #9 | American Family | Up To 11% | Up To 14% | Multi-Policy Discounts | |

| #10 | Safe Auto | Up To 18% | Up To 20% | Bundle Discounts |

In this article, we will explore everything you need to know about auto insurance for rideshare drivers, including why it is necessary and the top insurance providers in the market. We will also discuss how to compare different insurance policies and provide tips on choosing the best coverage for your needs.

#1 – State Farm: A Closer Look at Advantages and Disadvantages

State Farm, with its commitment to meeting the unique needs of rideshare drivers and providing comprehensive protection, emerges as a top choice in the auto insurance landscape.Zach Fagiano Licensed Insurance Broker

Pros

- Extensive network of agents for personalized service.

- Offers various discounts for policyholders.

Cons

- Rates may be higher compared to some competitors.

- Limited digital tools and mobile app features.

Read more: State Farm Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Evaluating Strengths and Weaknesses

Pros

- Innovative Snapshot program for potential discounts based on driving behavior.

- User-friendly website and mobile app for managing policies.

Cons

- Customer service quality can be inconsistent.

- Rates may increase significantly after filing a claim.

Read more: Progressive Auto Insurance Review

#3 – Allstate: Pros and Cons for Informed Decisions

Pros

- Offers multiple policy discounts for bundling home and auto insurance.

- Drivewise program rewards safe driving habits with discounts.

Cons

- Premiums may be higher than average.

- Some policyholders report difficulties in claims processing.

Read more: Allstate Auto Insurance Review

#4 – Liberty Mutual: Analyzing Benefits and Limitations

Pros

- Wide range of coverage options and add-ons.

- Multi-policy discounts for bundling auto, home, and other insurance products.

Cons

- Mixed customer reviews regarding claims handling.

- Rates may be higher for certain demographics or locations.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Delving Into the Positives and Negatives

Pros

- Customizable policies to fit individual needs.

- Offers various discounts for policyholders, including good student and multi-policy discounts.

Cons

- Premiums may be higher compared to some competitors.

- Limited availability in some regions.

Read more: Farmers Auto Insurance Review

#6 – Esurance: Exploring the Upsides and Downsides of Coverage

Pros

- Convenient online platform for purchasing and managing policies.

- Offers a variety of discounts, including multi-policy and paid-in-full discounts.

Cons

- Limited availability in certain states.

- Some policyholders report higher rates compared to competitors.

Read more: Esurance Auto Insurance Review

#7 – Nationwide: Examining Advantages and Challenges

Pros

- Offers a wide range of coverage options and add-ons.

- Discounts available for safe driving, bundling, and loyalty.

Cons

- Some policyholders report higher premiums compared to competitors.

- Limited availability in certain regions.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Understanding the Good and the Not-So-Good

Pros

- Strong financial stability and reputation.

- Offers a variety of discounts for policyholders.

Cons

- Limited availability in certain states.

- Some policyholders report higher rates compared to competitors.

Read more: Travelers Auto Insurance Review

#9 – American Family: Reviewing Strengths and Weaknesses

Pros

- Offers a variety of coverage options and discounts.

- Excellent customer service and claims handling.

Cons

- Limited availability in certain regions.

- Rates may be higher compared to some competitors.

Read more: American Family Insurance Company Review

#10 – Safe Auto: Weighing the Pros and Cons for Protection

Pros

- Specializes in providing affordable coverage options for drivers with less-than-perfect driving records.

- Offers convenient online policy management.

Cons

- Limited coverage options compared to larger insurance companies.

- Higher rates for drivers with clean driving records.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

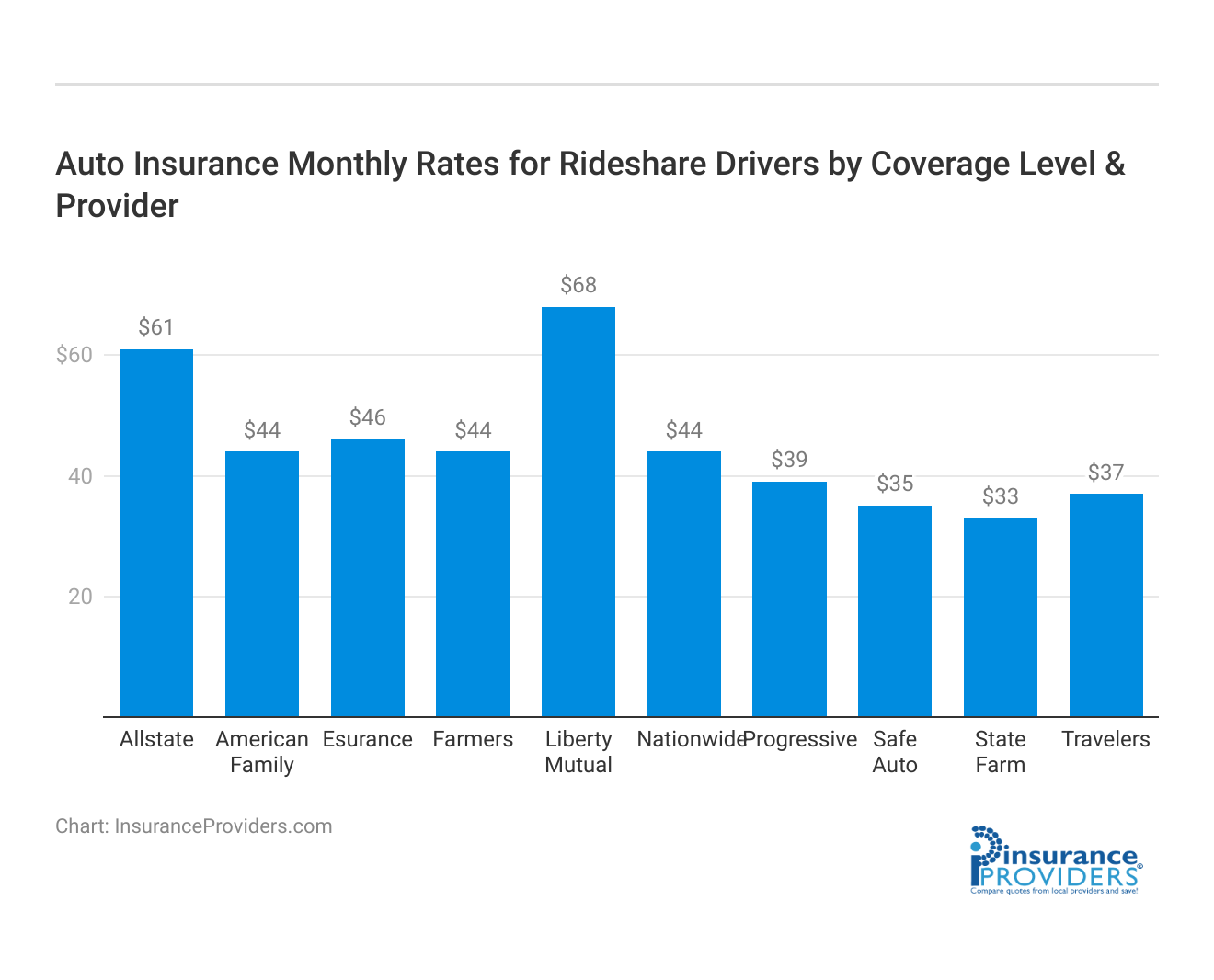

Rideshare Insurance Coverage Rates: Finding the Right Balance

Rideshare drivers need to strike a balance between comprehensive coverage and budget-friendly options. Let’s dive into the average monthly auto insurance rates for both full and minimum coverage, providing insights into some of the prominent insurance providers in the market.

Average Monthly Auto Insurance Rates for Rideshare Drivers

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| State Farm | $86 | $33 |

| Progressive | $105 | $39 |

| Allstate | $160 | $61 |

| Liberty Mutual | $174 | $68 |

| Farmers | $139 | $44 |

| Esurance | $114 | $46 |

| Nationwide | $115 | $44 |

| Travelers | $99 | $37 |

| American Family | $117 | $44 |

| Safe Auto | $93 | $35 |

When opting for full coverage, which includes comprehensive, collision, and liability insurance, State Farm emerges as a cost-effective choice with a monthly rate of $86. On the other end, Liberty Mutual offers a slightly higher but still competitive rate of $174 for those seeking extensive protection.

For those on a tighter budget, minimum coverage might be the preferred choice. Safe Auto stands out with a budget-friendly rate of $35 per month, offering a basic level of coverage. Progressive provides a middle-ground option at $39 per month, ensuring that drivers get essential coverage without breaking the bank.

Understanding Auto Insurance for Rideshare Drivers

Rideshare insurance is a specific type of auto insurance that is designed to provide coverage for individuals who work for rideshare companies like Uber or Lyft. Traditional personal auto insurance policies often exclude coverage for commercial activities, which means that if you are involved in an accident while driving for a rideshare company, your personal auto insurance policy may not cover the damages.

Rideshare insurance fills this gap by providing coverage during three distinct periods:

- Period 1 – When the rideshare app is on and the driver is waiting for a ride request.

- Period 2 – When the driver has accepted a ride request and is en route to pick up the passenger(s).

- Period 3 – When the passenger(s) are in the car and the driver is taking them to their destination.

During these periods, the rideshare insurance policy will provide coverage for both the driver and the passengers in the vehicle. It is important to note that rideshare insurance is typically offered as an optional add-on to your personal auto insurance policy or as a separate policy altogether.

Read more: What are the Lyft vehicle requirements?

What is Rideshare Insurance?

Rideshare insurance is a specialized insurance policy that covers drivers who use their personal vehicles to transport passengers for a fee. It provides financial protection in case of accidents or other incidents that may occur while driving for a rideshare company.

In addition to the coverage provided in traditional auto insurance policies, rideshare insurance also includes coverage for period 1, which is not typically covered under personal auto insurance. This is important because most personal auto insurance policies have a “business use exclusion,” which means they do not cover accidents that occur while the driver is working for a rideshare company.

Rideshare insurance offers peace of mind by providing comprehensive coverage during all stages of rideshare activities. Whether you are waiting for a ride request, en route to pick up passengers, or driving them to their destination, rideshare insurance ensures that you are protected financially in case of any unexpected events on the road.

Why is Rideshare Insurance Necessary?

Rideshare insurance is necessary because personal auto insurance policies are not designed to cover commercial activities. Using your personal vehicle for rideshare purposes without the appropriate insurance coverage can leave you financially vulnerable in case of an accident. Without rideshare insurance, you may be personally responsible for all damages, medical expenses, and legal fees that arise from accidents that occur during rideshare activities.

Furthermore, if your personal auto insurance company discovers that you have been using your vehicle for rideshare purposes without the appropriate coverage, they may deny any claims you make or even cancel your policy altogether. This can have serious consequences and leave you without any insurance coverage when you need it the most.

Rideshare insurance provides a necessary layer of protection for rideshare drivers. It ensures that you are fully covered in case of an accident or other incidents that may occur while you are working for a rideshare company. With rideshare insurance, you can have peace of mind knowing that you are financially protected and can continue to earn income through ridesharing without worrying about potential risks.

By having rideshare insurance, you can have peace of mind knowing that you are properly covered in case of an accident or other incidents that may occur while you are working for a rideshare company. It is always better to be prepared and have the necessary insurance coverage than to face the consequences of being uninsured in a challenging situation.

Top Auto Insurance Providers for Rideshare Drivers

When it comes to choosing the best auto insurance for rideshare drivers, there are several top providers in the market that offer rideshare-specific coverage. Let’s take a closer look at three of the most popular options:

Geico Rideshare Insurance

Geico is a well-known insurance company that offers rideshare insurance coverage to drivers who use their personal vehicles for rideshare purposes. Their policy covers all three periods of rideshare activity, which includes when the driver is offline, waiting for a ride request, and transporting a passenger. Geico’s rideshare insurance provides liability coverage for bodily injury and property damage, ensuring that both the driver and their passengers are protected in case of an accident.

In addition to the essential coverage, Geico also offers optional coverages such as collision coverage and comprehensive coverage. Collision coverage helps pay for damages to the driver’s vehicle if they are involved in a collision, while comprehensive coverage provides protection against non-collision incidents such as theft, vandalism, and natural disasters.

Geico’s rideshare insurance is a popular choice among rideshare drivers due to its comprehensive coverage options and competitive pricing. With Geico, drivers can have peace of mind knowing that they are adequately protected while on the road.

State Farm Rideshare Insurance

State Farm is another reputable insurance provider that offers rideshare insurance to drivers in select states. Their rideshare insurance policy provides coverage for rideshare activities, ensuring that drivers are protected during all phases of their rideshare journey.

Similar to Geico, State Farm’s rideshare insurance includes liability coverage for bodily injury and property damage. This coverage is crucial as it protects both the driver and their passengers in the event of an accident. State Farm also offers optional coverages such as comprehensive and collision coverage, allowing drivers to customize their insurance policy according to their needs.

State Farm’s rideshare insurance is known for its excellent customer service and personalized approach. Their agents work closely with rideshare drivers to understand their unique insurance requirements and provide tailored coverage options. With State Farm, rideshare drivers can feel confident that they have the necessary protection while on the road.

Allstate Rideshare Insurance

Allstate is a trusted insurance company that offers rideshare insurance coverage specifically designed to meet the needs of rideshare drivers. Their rideshare insurance extends the driver’s personal auto insurance policy during the periods when the rideshare app is on but a passenger hasn’t been accepted yet.

This additional coverage provided by Allstate ensures that rideshare drivers are protected even when they are waiting for a ride request. It fills the gap between personal auto insurance and the commercial coverage provided by the rideshare company. Allstate also offers additional coverage options for drivers who want extra protection, such as collision coverage and comprehensive coverage.

Allstate’s rideshare insurance is known for its flexibility and affordability. By extending the driver’s personal auto insurance policy, Allstate provides a cost-effective solution for rideshare drivers who want comprehensive coverage without breaking the bank.

Choosing the right auto insurance for rideshare drivers is essential to ensure adequate protection on the road. Geico, State Farm, and Allstate are three of the top providers that offer rideshare-specific coverage. Each of these companies has its unique features and coverage options, allowing rideshare drivers to select the policy that best suits their needs and budget.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Rideshare Insurance Policies

When comparing different rideshare insurance policies, it is important to consider various factors:

Coverage Options

One of the most important factors to consider is the coverage options included in the rideshare insurance policy. Make sure the policy covers all three periods of rideshare activity and includes liability coverage for bodily injury and property damage. Additionally, consider any optional coverages that may be available, such as comprehensive and collision coverage.

When it comes to coverage options, it’s crucial to understand the specific terms and conditions of each policy. Some insurance providers may offer additional benefits, such as roadside assistance or rental car reimbursement, which can be valuable in case of an accident or breakdown. By carefully reviewing the coverage options, you can ensure that you have the necessary protection in any situation that may arise during your rideshare activities. (For more information, read our “Is it possible to have a rideshare car rental?“).

Pricing Comparison

Price is another important factor when comparing rideshare insurance policies. It is important to obtain quotes from multiple insurance providers and compare the prices along with the coverage offered. Keep in mind that the cheapest option may not always provide the best coverage, so it is essential to strike a balance between affordability and adequate coverage.

When considering pricing, it’s important to look beyond the initial premium. Some insurance policies may have lower upfront costs but higher deductibles or limitations on coverage. On the other hand, a slightly higher premium may come with lower deductibles and broader coverage. By carefully analyzing the pricing structure of different policies, you can determine which one offers the best value for your specific needs.

Customer Reviews and Ratings

Customer reviews and ratings can provide valuable insights into the level of customer satisfaction with a particular insurance provider. Take the time to research and read reviews from other rideshare drivers to understand their experiences with different insurance companies. This can help you make a more informed decision when choosing an insurance provider.

When reading customer reviews, pay attention to the overall satisfaction level, claims handling process, and customer service quality. Positive reviews that highlight prompt and fair claim settlements can give you peace of mind, knowing that you’ll be well taken care of in case of an accident. Conversely, negative reviews that mention difficulties in filing claims or unresponsive customer support should raise red flags and prompt further investigation.

Additionally, consider reaching out to fellow rideshare drivers in online communities or forums to gather more information about their experiences with specific insurance providers. This firsthand feedback can provide valuable insights and help you make a more confident decision.

How to Choose the Best Rideshare Insurance

Choosing the best rideshare insurance for your needs requires careful consideration. Here are some tips to help you make an informed decision:

Assessing Your Needs

Start by assessing your specific needs as a rideshare driver. Consider the level of coverage you feel comfortable with, any optional coverages you may require, and your budgetary constraints. Understanding your needs will help you narrow down your options and choose the best policy.

For example, if you live in an area with a high crime rate, you may want to consider a rideshare insurance policy that offers comprehensive coverage to protect against theft or vandalism. On the other hand, if you primarily drive during the day in a low-risk area, you may be able to opt for a policy with lower coverage limits to save on premiums.

Additionally, think about the type of vehicle you drive for rideshare purposes. If you have a newer and more expensive car, you may want to consider a policy that offers replacement cost coverage to ensure that you can replace your vehicle with a similar model in case of a total loss. However, if you have an older car with a lower market value, you may be comfortable with a policy that offers actual cash value coverage.

Evaluating Insurance Providers

Research and evaluate different insurance providers that offer rideshare insurance. Look for providers with a good reputation, positive customer reviews, and a strong financial standing. Additionally, consider the coverage options and pricing offered by each provider.

It’s important to choose an insurance provider that specializes in rideshare insurance and understands the unique needs of rideshare drivers. They should have experience working with drivers from companies like Uber and Lyft, and be knowledgeable about the specific coverage requirements for rideshare drivers in your area.

Furthermore, consider the level of customer service provided by each insurance provider. Are they responsive and helpful when answering your questions? Do they have a dedicated claims department to handle any potential claims efficiently? These factors can make a significant difference in your overall experience as a policyholder.

Understanding Policy Terms

Before making a final decision, carefully review and understand the terms and conditions of the rideshare insurance policy. Pay attention to any exclusions, deductibles, and limitations that may apply. Ensure that the policy meets your specific needs and provides the level of coverage you require.

For instance, some rideshare insurance policies may have a deductible specifically for rideshare-related accidents. This means that if you get into an accident while driving for a rideshare company, you will be responsible for paying a certain amount out of pocket before the insurance coverage kicks in. Make sure you are comfortable with the deductible amount and that it aligns with your budget.

Additionally, take note of any limitations on coverage for personal use of your vehicle. Some policies may only provide coverage while you are actively engaged in rideshare activities, leaving you without coverage during personal use. If you plan to use your vehicle for personal errands or other non-rideshare purposes, ensure that the policy provides adequate coverage.

By following these steps and conducting thorough research, you can choose the best auto insurance for rideshare drivers and ensure that you are adequately covered while working for a rideshare company. Remember, rideshare insurance is essential for protecting yourself, your passengers, and your finances in case of an accident or other incidents that may occur while on the road.

Case Studies: Navigating Real-World Challenges With Top Rideshare Insurance Providers

Case Study 1: John’s Comprehensive Coverage With State Farm

John, a rideshare driver in a bustling urban area, values comprehensive coverage to safeguard his vehicle and passengers. With State Farm’s auto insurance, John enjoys a monthly rate of $86 for full coverage, including comprehensive, collision, and liability insurance.

This comprehensive protection ensures that John can navigate the city streets with confidence, knowing that State Farm has him covered in case of any unforeseen accidents or incidents.

Case Study 2: Maria’s Budget-Friendly Option With Progressive

Maria, a part-time rideshare driver looking to save on expenses, opts for Progressive’s rideshare insurance policy. With a competitive monthly rate of $39 for minimum coverage, Maria gets essential protection without breaking the bank.

Progressive’s policy offers a balance between affordability and coverage, allowing Maria to earn extra income while driving with peace of mind, knowing that she has reliable insurance coverage from a trusted provider.

Case Study 3: David’s Flexible Coverage With Allstate

David, a rideshare driver with a fluctuating schedule, values flexibility in his insurance coverage. With Allstate’s rideshare insurance, David benefits from coverage extensions during periods when the rideshare app is active but no passenger has been accepted yet.

Allstate’s policy fills the gap between personal auto insurance and commercial coverage, providing David with the flexibility he needs to adapt to changing ride requests and maximize his earnings as a rideshare driver.

Frequently Asked Questions

What is rideshare insurance?

Rideshare insurance is a type of auto insurance coverage specifically designed for drivers who work for ridesharing companies like Uber or Lyft. It provides additional coverage that is not typically included in personal auto insurance policies.

Why do rideshare drivers need special insurance?

Rideshare drivers need special insurance because personal auto insurance policies usually exclude coverage for commercial activities. Since driving for a ridesharing company involves transporting passengers for a fee, it is considered a commercial activity and requires additional coverage.

What does rideshare insurance cover?

Rideshare insurance typically covers three periods: when the driver is offline, waiting for a ride request, and when the driver is on the way to pick up a passenger or has a passenger in the car. It provides liability coverage, collision coverage, and comprehensive coverage during these periods.

Is rideshare insurance mandatory?

Rideshare insurance is not mandatory in all states, but it is highly recommended for rideshare drivers. Without proper insurance coverage, drivers may face gaps in coverage and potential denial of claims if an accident occurs while they are driving for a ridesharing company.

Can rideshare drivers use their personal auto insurance?

Personal auto insurance policies typically do not cover accidents or incidents that occur while driving for a ridesharing company. Therefore, relying solely on personal auto insurance may leave rideshare drivers without proper coverage in case of an accident or damage to their vehicle.

Where can I find the best auto insurance for rideshare drivers?

To find the best auto insurance for rideshare drivers, it is recommended to compare quotes from different insurance providers that offer specific rideshare insurance policies. Online insurance comparison websites or contacting insurance agents specializing in rideshare insurance can help in finding the most suitable coverage for individual needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.