Best Home and Auto Insurance Bundles in 2026 (Top 10 Companies)

State Farm, USAA, and Progressive stand out as the best home and car insurance companies bundles. Discover how these companies excel in offering tailored coverage options and innovative features. This guide provides detailed insights to empower you in making informed decisions for optimal home and auto coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated February 2024

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Our Top 10 Best Companies: Best Home and Auto Insurance Bundles

| Company | Rank | See Pros/Cons | Multi-Policy Discount | Home and Auto Bundle Discount | Best for |

|---|---|---|---|---|---|

| #1 | State Farm | 15% | 20% | Bundling Policies | |

| #2 | USAA | 12% | 18% | Customer Service | |

| #3 | Progressive | 10% | 15% | Budgeting Tools | |

| #4 | Allstate | 18% | 22% | Customizable Policies | |

| #5 | Farmers | 15% | 20% | Local Agents | |

| #6 | Nationwide | 12% | 17% | Safe-Driving Discounts |

| #7 | Liberty Mutual | 20% | 25% | Usage Discount |

| #8 | Travelers | 15% | 20% | Online Convenience |

| #9 | American Family | 14% | 19% | Add-on Coverages | |

| #10 | Erie | 13% | 18% | 24/7 Support |

#1 – State Farm: Bundling Excellence

State Farm stands out as the leading choice for home and auto insurance bundles, offering tailored coverage options and innovative features that excel in meeting diverse customer profiles.Jeff Root Licensed Life Insurance Agent

Pros

- Bundling policies: State Farm offers a substantial 15% multi-policy discount and a 20% home and auto bundle discount, making it an excellent choice for customers looking to bundle their policies.

- Diverse coverage options: State Farm provides customizable policies, allowing customers to tailor coverage to their specific needs.

- Positive reputation: With a high average monthly rating for good drivers and a low complaint level, State Farm has a positive reputation in terms of customer satisfaction.

Cons

- Average monthly rates: While State Farm offers competitive rates, the average monthly rates for full coverage and minimum coverage are relatively higher compared to some other providers.

- Limited customer service mention: The guide doesn’t specifically highlight State Farm’s customer service, so there may be limited information available on this aspect.

Read more: State Farm Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Customer Service Supremacy

Pros

- Excellent customer service: USAA is recognized for its outstanding customer service, making it a top choice for those who prioritize exceptional support.

- Competitive rates: With an average monthly rate for good drivers at $62.75, USAA provides affordable options for home and auto insurance bundles.

- Military-focused benefits: USAA caters to the unique needs of military members and their families, offering specialized services and discounts.

Cons

- Membership limitation: USAA membership is limited to military personnel and their families, excluding the general public.

- Slightly lower bundle discounts: While still competitive, USAA’s bundle discounts are slightly lower compared to some other providers.

Read more: USAA Car Insurance Review

#3 – Progressive: Budgeting Tools and Diversity

Pros

- Budgeting tools: Progressive stands out for its budgeting tools, helping customers manage their insurance costs effectively.

- Low complaint level: With a low complaint level, Progressive demonstrates a commitment to customer satisfaction and dispute resolution.

- Varied discounts: Progressive offers diverse discounts, including safe-driving discounts, making it appealing for customers looking to save on premiums.

Cons

- Moderate bundle discounts: While Progressive provides bundle discounts, they are not as high as some other competitors in the market.

- Average monthly rates: The average monthly rates for good drivers are slightly higher compared to some other providers, which may affect budget-conscious customers.

Read more: Progressive Car Insurance Review

#4 – Allstate: Customization and High Bundle Discounts

Pros

- Customizable policies: Allstate stands out for offering customizable policies, allowing customers to tailor coverage to their specific needs.

- High bundle discounts: With an 18% multi-policy discount and a 22% home and auto bundle discount, Allstate provides significant savings for bundled policies.

- Nationwide presence: Allstate’s widespread network and availability make it convenient for customers across the country.

Cons

- Higher average monthly rates: Allstate’s average monthly rates for both full coverage and minimum coverage are on the higher side compared to some competitors.

- Mixed customer reviews: While Allstate has a high average monthly rating, the guide doesn’t provide information on its complaint level, making it challenging to assess overall customer satisfaction.

Read more: Allstate Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Local Touch and Generous Discounts

Pros

- Local agents: Farmers is recognized for its local agent presence, providing customers with a personal touch and localized support.

- Bundle discounts: With a 15% multi-policy discount and a 20% home and auto bundle discount, Farmers offers attractive savings for customers bundling their policies.

- Diverse coverage options: Farmers provides a range of coverage options, allowing customers to choose the policies that best fit their needs.

Cons

- Average monthly rates: Farmers’ average monthly rates for both full coverage and minimum coverage are relatively higher compared to some competitors.

- Limited focus on specific features: The guide doesn’t highlight specific features or benefits that set Farmers apart, making it challenging to identify unique selling points.

Read more: Farmers Car Insurance Review

#6 – Nationwide: Safe-Driving Discounts and Nationwide Coverage

Pros

- Safe-driving discounts: Nationwide offers a 12% multi-policy discount and a 17% home and auto bundle discount, making it appealing for customers looking for safe-driving discounts.

- National presence: With a nationwide presence, Nationwide provides accessibility and coverage options to customers across the country.

- Budgeting tools: The guide mentions Nationwide’s focus on budgeting tools, helping customers manage their insurance costs effectively.

Cons

- Average monthly rates: Nationwide’s average monthly rates for both full coverage and minimum coverage are moderately higher compared to some competitors.

- Limited mention of unique features: The guide does not specifically highlight unique features or benefits that make Nationwide stand out in the market.

#7 – Liberty Mutual: Generous Bundle Discounts and Usage Benefits

Pros

- High bundle discounts: Liberty Mutual offers substantial bundle discounts, with a 20% multi-policy discount and a 25% home and auto bundle discount.

- Usage discount: Liberty Mutual stands out for its usage discount, providing additional savings for customers with specific usage patterns.

- National presence: With a nationwide presence, Liberty Mutual provides widespread coverage and accessibility.

Cons

- Higher average monthly rates: Liberty Mutual’s average monthly rates for both full coverage and minimum coverage are relatively higher compared to some competitors.

- Mixed customer reviews: While Liberty Mutual has a high average monthly rating, the guide doesn’t provide information on its complaint level, making it challenging to assess overall customer satisfaction.

Read more: Liberty Mutual Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Online Convenience and Nationwide Reach

Pros

- Online convenience: Travelers is recognized for its online convenience, making it easy for customers to manage their policies and access information.

- Bundle discounts: With a 15% multi-policy discount and a 20% home and auto bundle discount, Travelers provides attractive savings for customers bundling their policies.

- National presence: Travelers has a nationwide presence, offering coverage options to customers across the country.

Cons

- Average monthly rates: The guide does not provide specific information about Travelers’ average monthly rates, making it challenging to assess its affordability compared to competitors.

- Limited mention of unique features: The guide does not highlight specific features or benefits that set Travelers apart, making it challenging to identify unique selling points.

Read more: Travelers Car Insurance Review

#9 – American Family: Add-on Coverages and Personalization

Pros

- Add-on coverages: American Family offers a range of add-on coverages, allowing customers to customize their policies with additional protection.

- Bundle discounts: With a 14% multi-policy discount and a 19% home and auto bundle discount, American Family provides attractive savings for customers bundling their policies.

- National presence: American Family has a national presence, providing coverage options to customers across the country.

Cons

- Average monthly rates: The guide does not provide specific information about American Family’s average monthly rates, making it challenging to assess its affordability compared to competitors.

- Limited focus on specific features: The guide doesn’t highlight specific features or benefits that make American Family stand out, making it challenging to identify unique selling points.

Read more: American Family Car Insurance Review

#10 – Erie: 24/7 Support and Local Presence

Pros:

- 24/7 support: Erie is known for providing 24/7 support, ensuring that customers can access assistance whenever they need it.

- Bundle discounts: With a 13% multi-policy discount and an 18% home and auto bundle discount, Erie provides attractive savings for customers bundling their policies.

- Local presence: Erie has a local presence, offering personalized support and services through local agents.

Cons:

- Average monthly rates: The guide indicates that Erie has relatively lower average monthly rates for both full coverage and minimum coverage, but specific figures are not provided for comparison.

- Limited mention of unique features: The guide doesn’t highlight specific features or benefits that make Erie stand out, making it challenging to identify unique selling points.

Read more: Erie Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

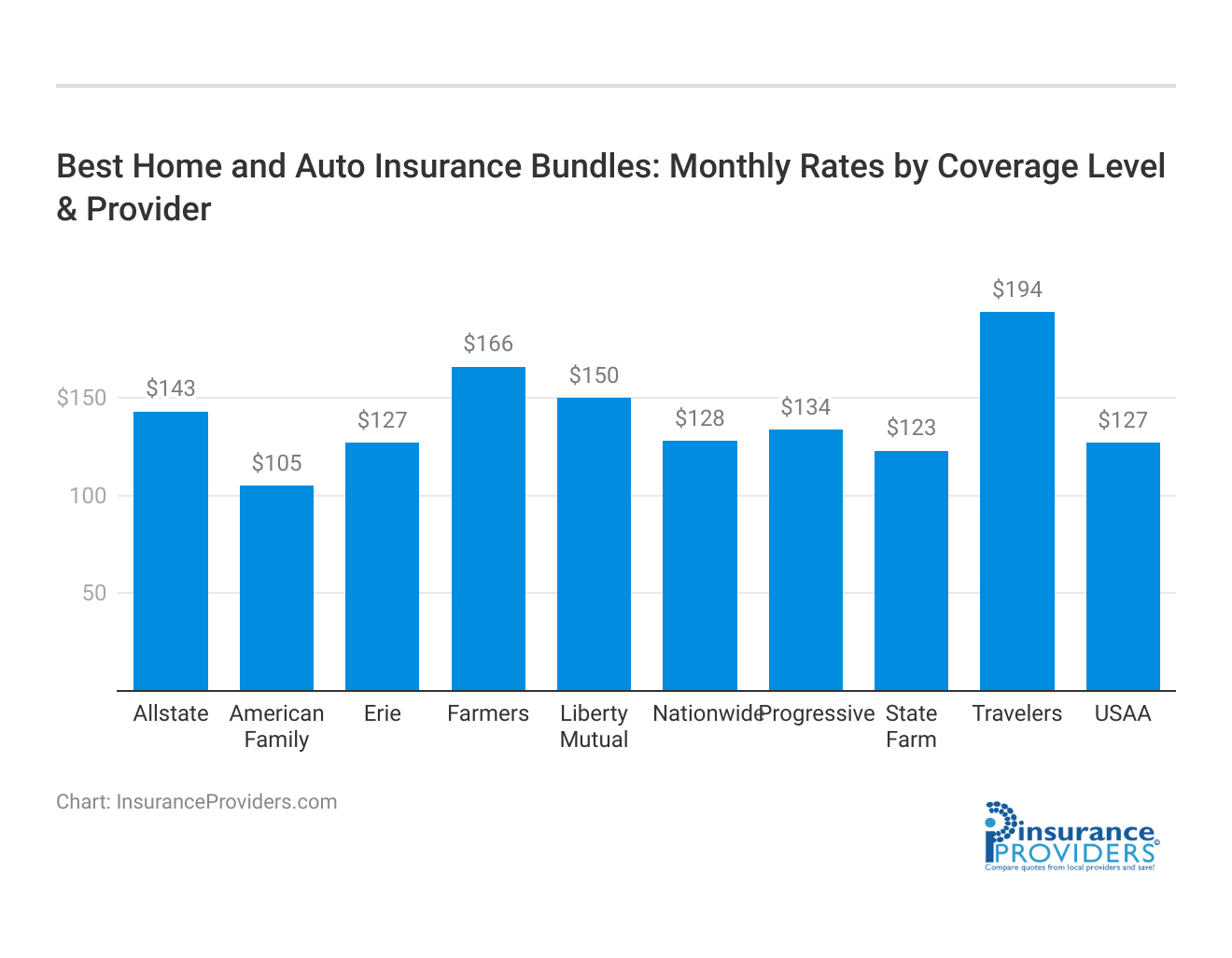

Understanding Top 10 Providers for Home and Auto Insurance Bundles

The top 10 providers for home and auto insurance bundles play a significant role in shaping the choices consumers make, and understanding the average monthly auto insurance rates further informs decision-making. Among the listed companies, State Farm emerges with competitive rates, offering full coverage at $86 and minimum coverage at $33 per month.

Average Monthly Auto Insurance Rates for Home and Auto Insurance Bundles

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| State Farm | $86 | $33 |

| USAA | $59 | $22 |

| Progressive | $105 | $39 |

| Allstate | $160 | $61 |

| Farmers | $139 | $44 |

| Nationwide | $115 | $44 |

| Liberty Mutual | $174 | $68 |

| Travelers | $99 | $37 |

| American Family | $117 | $44 |

| Erie | $58 | $22 |

USAA stands out as a cost-effective option, boasting the lowest rates at $59 for full coverage and $22 for minimum coverage. Progressive, another major player, positions itself with average rates of $105 for full coverage and $39 for minimum coverage. Comparatively, Allstate presents higher average monthly rates, charging $160 for full coverage and $61 for minimum coverage.

Farmers follow closely with rates of $139 for full coverage and $44 for minimum coverage. Nationwide and American Family provide mid-range options, with average monthly rates of $115 and $117 for full coverage, and $44 for minimum coverage in both cases. Liberty Mutual comes in with relatively higher rates, quoting $174 for full coverage and $68 for minimum coverage.

Travelers offer a more balanced approach with rates of $99 for full coverage and $37 for minimum coverage. Erie stands out as one of the most affordable choices, featuring rates of $58 for full coverage and $22 for minimum coverage.

Understanding the nuanced pricing strategies of these top providers is essential for consumers looking to strike a balance between cost and coverage when bundling their home and auto insurance policies. Each company’s rates provide a comprehensive overview of the financial considerations associated with these bundled insurance packages.

What is an Insurance Bundle?

An insurance bundle is a combination of two or more insurance policies provided by the same insurance company. Instead of having separate policies for each coverage, you consolidate them into one comprehensive policy. This allows for easier management and potential cost savings.

When you opt for an insurance bundle, you are essentially creating a customized package that meets your specific insurance needs. Whether you own a home and a car or have additional assets that require coverage, bundling allows you to tailor your policy to fit your unique circumstances.

Moreover, insurance bundles often come with additional coverage options that you may not have considered or been aware of. For example, some bundles include umbrella insurance, which provides extra liability protection beyond what your home or auto insurance policies offer.

Benefits of Bundling Home and Auto Insurance

There are numerous advantages to bundling your home and auto insurance policies. First and foremost, it simplifies your insurance life by consolidating both policies under one provider. This means you have a single point of contact for any questions or claims.

Additionally, bundling can often lead to significant cost savings. Insurance companies frequently offer discounts for bundling, allowing you to enjoy lower premiums compared to having separate policies from different providers.

When you bundle your home and auto insurance, you also benefit from the convenience of having a single bill to pay. Instead of keeping track of multiple due dates and payment amounts, you only need to remember one payment for your bundled policy.

Furthermore, bundling your home and auto insurance can provide you with added coverage options that may not be available with separate policies. For example, some insurance companies offer roadside assistance as part of their bundled policies, providing peace of mind when you’re on the road.

Top Home and Auto Insurance Bundles

Now that we understand the benefits of insurance bundles, let’s take a closer look at some of the top home and auto insurance bundles available in the market. Remember that the best bundle for you depends on your personal needs and preferences, so it’s essential to consider multiple options before making a decision.

Company A’s Insurance Bundle

Company A offers a comprehensive insurance bundle that includes home and auto coverage. Their bundle provides extensive protection for your property and vehicle, along with added benefits such as roadside assistance and rental car reimbursement.

When it comes to home insurance, Company A’s bundle covers not only the structure of your house but also your personal belongings, liability, and additional living expenses in case of a covered loss. For auto insurance, their bundle offers coverage for collision, comprehensive, liability, and uninsured/underinsured motorist, ensuring that you’re protected from various risks on the road.

With Company A’s bundle, you’ll enjoy the convenience of managing both policies under one roof while potentially saving money through their bundle discount. They also have a strong reputation for excellent customer service and claims handling, providing you with peace of mind knowing that you’re in good hands.

Company B’s Insurance Bundle

Company B offers a unique home and auto insurance bundle that focuses on customization. They understand that every customer’s needs are different, so they allow you to tailor your coverage to fit your specific requirements.

With Company B’s bundle, you have the flexibility to choose the coverage limits, deductibles, and add-ons that suit your situation best. Whether you need higher liability limits for your home or prefer a lower deductible for your auto, Company B gives you the freedom to customize your policy accordingly. This level of customization ensures that you only pay for the coverage you truly need, potentially resulting in lower premiums.

In addition to customization, Company B’s bundle also includes unique features such as identity theft protection and equipment breakdown coverage for your home. These additional coverages provide an extra layer of protection, giving you peace of mind against unexpected events.

Company C’s Insurance Bundle

Company C is renowned for its competitive pricing and generous discounts. Their home and auto insurance bundle offers comprehensive coverage at a highly affordable rate.

When you choose Company C’s bundle, you can enjoy not only the convenience of having both policies under one provider but also significant savings on your premiums. Their bundle discounts make them an attractive choice for budget-conscious homeowners and drivers. Additionally, Company C offers various discounts such as multi-policy discounts, safe driver discounts, and home security discounts, further reducing your insurance costs.

Despite their affordable rates, Company C doesn’t compromise on coverage. Their bundle includes all the essential protections for your home and auto, ensuring that you’re adequately covered against common risks. From fire and theft to accidents and natural disasters, Company C’s bundle provides the necessary safeguards to protect your property and vehicle.

How to Choose the Right Insurance Bundle for You

Now that we’ve explored some of the top insurance bundles, let’s discuss how to choose the right one for you. It’s crucial to assess your insurance needs, compare bundle offers, and consider customer reviews and ratings.

Assessing Your Insurance Needs

Start by evaluating your specific insurance needs. Consider factors such as the value of your home and assets, your driving habits, and any unique coverage requirements you may have. This assessment will help you determine the types and amount of coverage you need.

For example, if you live in an area prone to natural disasters, such as hurricanes or earthquakes, you may want to prioritize comprehensive coverage that includes protection for these events. On the other hand, if you rarely drive and mainly use public transportation, you may not need as much auto insurance coverage.

Additionally, think about your personal circumstances. Are you the sole breadwinner of your family? Do you have dependents who rely on you financially? These factors can influence the amount of life insurance coverage you should consider.

Once you have a clear understanding of your insurance needs, you can proceed with comparing bundle offers.

Comparing Insurance Bundle Offers

Shop around and compare bundle offers from different insurance companies. Pay attention to the coverages, deductibles, limits, and any additional benefits offered in each policy.

For example, some insurance bundles may offer a lower premium but have higher deductibles, while others may provide more comprehensive coverage at a slightly higher cost. It’s important to carefully review the details of each bundle to ensure it aligns with your specific needs and budget.

It’s also important to consider the reputation of the insurance company. Look for customer reviews and ratings to gain insights into their customer service, claims process, and overall satisfaction. This information can help you make an informed decision.

Furthermore, consider reaching out to insurance agents or brokers who can provide personalized assistance in comparing bundle offers. They can help explain the intricacies of each policy and guide you towards the best option for your unique circumstances.

Reading Customer Reviews and Ratings

Customer reviews and ratings provide valuable insights into an insurance company’s performance and reliability. Read reviews from both current and past customers to get a comprehensive understanding of their strengths and any potential drawbacks.

Look for feedback on the company’s claims handling efficiency, customer service responsiveness, and how satisfied customers are with their overall experience. Taking the time to research and read reviews will help you choose a reputable insurance company that meets your expectations.

Additionally, consider seeking recommendations from friends, family, or colleagues who have had positive experiences with their insurance providers. Personal referrals can often provide valuable insights and help you narrow down your options.

Remember, choosing the right insurance bundle is an important decision that can have a significant impact on your financial security and peace of mind. By carefully assessing your insurance needs, comparing bundle offers, and considering customer reviews and ratings, you can make an informed choice that best suits your individual circumstances.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save Money With Insurance Bundles

In addition to the convenience of bundling your home and auto insurance, it can also lead to substantial cost savings. Here are a few ways to maximize your savings:

When it comes to managing your finances, finding ways to save money is always a top priority. One area where you can potentially save a significant amount is through insurance bundles. By combining your home and auto insurance policies, you not only streamline your coverage but also open the door to various cost-saving opportunities.

Bundle Discounts and Promotions

Insurance companies often provide discounts or promotions for bundling multiple policies with them. Take advantage of these incentives to lower your premiums and save money.

Imagine this scenario: you’re shopping around for insurance quotes and stumble upon a company that offers a bundle discount for combining your home and auto insurance. This discount can range from 10% to 25% off your premiums, depending on the insurer. By bundling your policies, you not only simplify your insurance management but also enjoy a significant reduction in costs.

When obtaining quotes, inquire about any bundle discounts available and compare them across different insurance providers. This way, you can ensure you’re getting the best possible rate. Don’t be afraid to negotiate with insurers and ask for additional discounts or promotions. After all, saving money is the ultimate goal.

Long-term Savings With Bundles

Another benefit of insurance bundles is long-term savings. By sticking with one insurance provider over time, you may be eligible for loyalty discounts or other cost-saving opportunities.

Think of it as a loyalty program for insurance. The longer you stay with a particular insurer and maintain your bundled policies, the more you can potentially save. Insurance companies appreciate long-term customers and often reward their loyalty with discounts or additional perks. These perks can include reduced deductibles, accident forgiveness, or even coverage enhancements at no extra cost.

Consider choosing an insurance company that offers attractive long-term benefits to maximize your savings potential. However, always re-evaluate your insurance needs and compare quotes periodically to ensure you’re still getting the best value. Insurance rates can change over time, and what was once the best deal may no longer be the case.

Remember, bundling your insurance policies not only saves you money but also provides peace of mind. With a comprehensive coverage plan in place, you can rest easy knowing that your home and auto are protected. So, take the time to explore your options, compare quotes, and find the best insurance bundle that suits your needs and budget.

Case Studies: Unveiling Home and Auto Insurance Bundles

Case Study 1: Tailored Excellence in Bundling

Emily, a homeowner and frequent driver, sought a comprehensive insurance solution. With a good credit score and a clean driving record, she aimed to bundle her home and auto insurance for added convenience. State Farm presented Emily with a tailored bundle, providing competitive rates and a seamless policy management interface.

The comprehensive coverage options aligned with Emily’s specific needs, offering a one-stop solution for her insurance requirements. Emily experienced the convenience of managing both policies under one roof, and State Farm’s bundling excellence translated into a hassle-free insurance experience.

Case Study 2: Elevating Customer Service in Bundles

James, a military veteran, valued exceptional customer service and sought an insurance bundle that reflected his commitment to service. With a focus on cost-effectiveness, he explored options tailored to his unique requirements.

USAA, known for its military-focused benefits, provided James with a bundled package that not only met his cost-effectiveness criteria but also exceeded expectations in customer service. The package showcased special considerations for military members.

James found peace of mind in USAA’s commitment to customer service, reinforcing the value of bundling with a provider that understands and respects his military background.

Case Study 3: Personalized Budgeting and Diversity

Sarah, a budget-conscious individual, sought an insurance bundle that allowed for personalized coverage and budget flexibility. She valued diversity in coverage options to ensure her unique needs were met. Progressive’s bundle for Sarah incorporated budgeting tools, allowing her to customize coverage while staying within her financial parameters.

The diverse range of offerings provided her with the flexibility to choose the options that suited her lifestyle. Sarah enjoyed the budgeting flexibility and diverse coverage options, showcasing how Progressive’s approach to bundling aligns with the needs of those seeking a personalized insurance solution.

Conclusion

Choosing the best home and auto insurance bundle requires careful consideration of your insurance needs, comparing offers, and understanding the potential cost savings. Take the time to assess your requirements, explore different bundles, and read customer reviews before making a decision.

By bundling your home and auto insurance policies, you can simplify your insurance management while potentially enjoying cost savings. Remember to regularly review and reassess your insurance needs to ensure you’re always adequately protected at the best possible price.

Frequently Asked Questions

Can I customize my home and auto insurance bundle?

Yes, many insurance companies offer flexibility. You can choose coverage limits, deductibles, and add-ons tailored to your specific needs.

What happens if I want to change or cancel my insurance bundle?

To make changes, contact your insurance provider. Keep in mind that alterations may affect the overall cost and coverage of your policies. Review the terms and conditions of your bundle agreement and consult with your insurance company for guidance.

Is bundling always cheaper?

While bundling often leads to cost savings, it’s not guaranteed to be cheaper for everyone. The final cost depends on factors such as your location, driving record, and coverage needs. To ensure the best financial decision, compare quotes and evaluate each bundle offer carefully.

How do I choose the right insurance bundle for me?

To make the right choice, assess your insurance needs, compare bundle offers from different companies, read customer reviews, and seek recommendations from friends, family, or insurance agents.

How can I save money with insurance bundles?

Maximize savings by taking advantage of bundle discounts and promotions offered by insurance companies. Additionally, consider the potential for long-term savings by staying with one provider and qualifying for loyalty discounts.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.