Best Life Insurance Companies in 2026 (Top 10 Companies)

The best life insurance companies, including Farmers, USAA, and Allstate, take the lead in providing comprehensive coverage. Discover the strengths of these top providers, explore various coverage options, and make well-informed decisions to ensure a financially secure future.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated February 2024

6,589 reviews

6,589 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

Life insurance is a crucial financial tool that provides financial security and peace of mind to individuals and their loved ones. With numerous life insurance companies in the market, it can be challenging to identify the best ones.

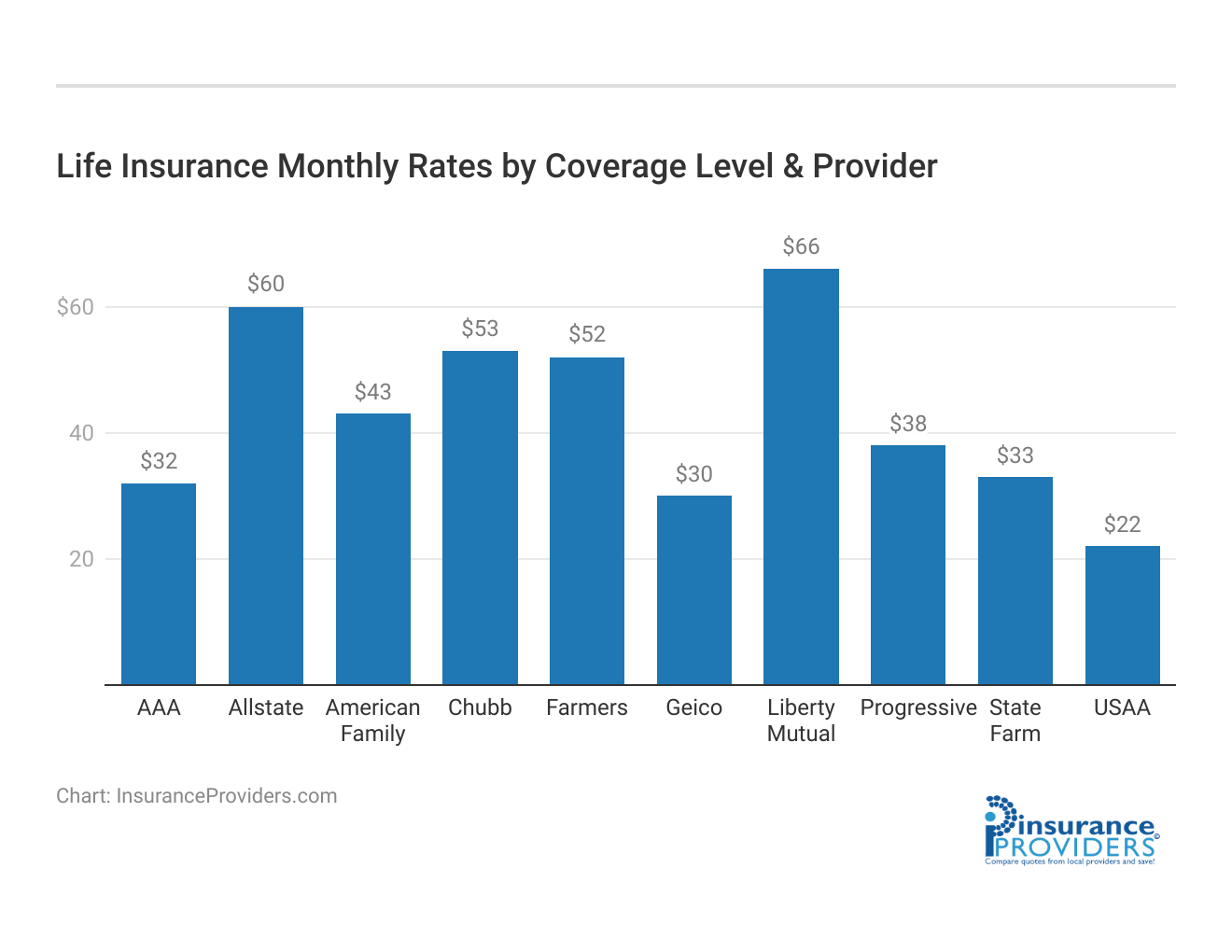

Our Top 10 Best Companies: Best Life Insurance Companies

| Company | Rank | See Pros/Cons | Maximum Multi-Policy Discount | Maximum Low-Mileage Discount | Best For |

|---|---|---|---|---|---|

| #1 | Farmers | Up to 15% | Up to 20% | Local Agents | |

| #2 | USAA | Up to 25% | Up to 30% | Military Savings | |

| #3 | Allstate | Up to 15% | Up to 30% | Add-on Coverages | |

| #4 | Progressive | Up to 15% | Up to 20% | Online Convenience | |

| #5 | Chubb | Up to 29% | Up to 15% | Policy Options | |

| #6 | American Family | Up to 17% | Up to 30% | Student Savings | |

| #7 | State Farm | Up to 35% | Up to 30% | Many Discounts | |

| #8 | Liberty Mutual | Up to 15% | Up to 20% | Customizable Polices |

| #9 | Geico | Up to 25% | Up to 35% | Cheap Rates | |

| #10 | AAA | Up to 25% | Up to 30% | Local Agents |

In this article, we will discuss the top life insurance companies and the factors you should consider when choosing one.

#1 – Farmers Insurance: Local Agents

Farmers Insurance stands out as a top choice, offering competitive rates, comprehensive coverage, and exceptional customer support for a secure financial future.Zach Fagiano Licensed Insurance Broker

Pros

- Up to 15% multi-policy discount: Significant discount for policyholders bundling multiple insurance policies.

- Up to 20% low-mileage discount: Savings for those with limited vehicle usage.

- Local agents: Access to personalized service and assistance through a network of local agents.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: Farmers Auto Insurance Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Military Savings

Pros

- Up to 25% multi-policy discount: Competitive discount for bundling insurance needs.

- Up to 30% low-mileage discount: Significant savings for members with limited vehicle usage.

- Military savings: Tailored benefits for military members and their families.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Low-mileage discount rates may differ for different policyholders.

Read more: USAA Life Insurance Company Review

#3 – Allstate: Add-on Coverages

Pros

- Up to 15% multi-policy discount: Savings for policyholders bundling various insurance policies.

- Up to 30% low-mileage discount: Substantial discounts for those with limited vehicle usage.

- Add-on coverages: Extensive options for additional coverage.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Low-mileage discount rates may differ for different policyholders.

Read more: Allstate Insurance Company Review

#4 – Progressive: Online Convenience

Pros

- Up to 15% multi-policy discount: Competitive savings for bundling policies.

- Up to 20% low-mileage discount: Significant discounts for limited vehicle usage.

- Online convenience: User-friendly online platform enhances policy management.

Cons

- Varied multi-policy discount: The percentage may vary based on specific policies.

- Varied low-mileage discount: Low-mileage discount rates may differ for different policyholders.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Chubb: Policy Options

Pros

- Up to 29% multi-policy discount: Substantial savings for bundling insurance needs.

- Up to 15% low-mileage discount: Discount rates may differ for different policyholders.

- Policy options: Extensive choices for tailored coverage.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Low-mileage discount rates may differ for different policyholders.

Read more: Chubb Auto Insurance Review

#6 – American Family: Student Savings

Pros

- Up to 17% multi-policy discount: Savings for policyholders bundling multiple insurance policies.

- Up to 30% low-mileage discount: Significant discounts for those with limited vehicle usage.

- Student savings: Tailored benefits for students and young policyholders.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: American Family Insurance Company Review

#7 – State Farm: Many Discounts

Pros

- Up to 35% multi-policy discount: Competitive discount for bundling insurance needs.

- Up to 30% low-mileage discount: Significant savings for policyholders with limited vehicle usage.

- Many discounts: Diverse options for additional savings.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Low-mileage discount rates may differ for different policyholders.

Read more: State Farm Life Insurance Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Customizable Policies

Pros

- Up to 15% multi-policy discount: Savings for policyholders bundling various insurance policies.

- Up to 20% low-mileage discount: Substantial discounts for those with limited vehicle usage.

- Customizable policies: Tailored coverage options.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: Liberty Mutual Insurance Company Review

#9 – Geico: Cheap Rates

Pros

- Up to 25% multi-policy discount: Competitive savings for bundling policies.

- Up to 35% low-mileage discount: Significant discounts for limited vehicle usage.

- Cheap rates: Cost-effective premium options.

Cons

- Varied multi-policy discount: The percentage may vary based on specific policies.

- Varied low-mileage discount: Low-mileage discount rates may differ for different policyholders.

Read more: Geico Choice Insurance Company Review

#10 – AAA Insurance: Local Agents

Pros

- Up to 25% multi-policy discount: Significant savings for policyholders bundling multiple insurance policies.

- Up to 30% low-mileage discount: Savings for those with limited vehicle usage.

- Local agents: Access to personalized service and assistance through a network of local agents.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: AAA Life Insurance Review

Understanding Life Insurance

Before diving into the topic of the best life insurance companies, it is essential to have a clear understanding of what life insurance is. Simply put, life insurance is a contract between an individual and an insurance company. The individual pays regular premiums, and in return, the insurer promises to provide a sum of money, known as the death benefit, to the beneficiaries named in the policy upon the insured individual’s death.

However, life insurance is more than just a financial agreement. It serves as a powerful tool to protect your loved ones and secure their future. By having a life insurance policy in place, you can have peace of mind knowing that your family will be taken care of financially even if you are no longer there to provide for them.

What is Life Insurance?

Life insurance serves as a financial safety net for your loved ones in the event of your untimely demise. It can help cover funeral expenses, pay off outstanding debts, replace lost income, and support the financial future of your family.

Imagine this scenario: you are the primary breadwinner of your family, and your sudden death leaves your spouse and children in a state of financial uncertainty. Without life insurance, they may struggle to pay for basic living expenses, mortgage payments, or even your children’s education. However, with the right life insurance policy, your family can have the financial resources they need to maintain their standard of living and achieve their long-term goals.

Importance of Life Insurance

Life insurance is especially crucial if you have dependents who rely on your income. It offers financial protection to ensure that your loved ones can maintain their standard of living even if you are no longer here to provide for them.

Furthermore, life insurance can also be a valuable tool for estate planning. It can help cover estate taxes and other expenses that may arise upon your death, allowing your family to inherit your assets without the burden of financial obligations.

Additionally, life insurance can provide a sense of stability and security for your family during a difficult time. Losing a loved one is emotionally challenging, and the last thing your family should worry about is their financial well-being. With life insurance, they can focus on grieving and healing without the added stress of financial instability.

It is important to note that life insurance needs vary from person to person. Factors such as age, marital status, number of dependents, and financial goals all play a role in determining the type and amount of coverage that is suitable for you. Consulting with a financial advisor or insurance professional can help you assess your needs and find the right life insurance policy that aligns with your unique circumstances.

Factors to Consider When Choosing a Life Insurance Company

When searching for the best life insurance company, it is essential to evaluate various factors to make an informed decision. Making the right choice can provide you and your loved ones with financial security and peace of mind in the event of an unforeseen circumstance.

One of the most critical factors to consider is the financial stability of the insurance company. You want to ensure that the company has a strong financial standing and has the ability to fulfill its obligations when the time comes to pay out claims. A financially stable company will have a solid track record of meeting its financial commitments and will be better equipped to handle any unexpected challenges that may arise.

Another important consideration is the coverage options offered by different life insurance companies. Each person’s needs and circumstances are unique, so it is crucial to find a policy that suits your specific requirements. You may choose from various types of life insurance policies, such as term life insurance, whole life insurance, or universal life insurance. It is essential to evaluate the features of each policy, including the duration of the policy, premium payments, and flexibility in adjusting coverage. This will help you select the policy that provides the right level of protection for you and your family.

While financial stability and coverage options are vital, excellent customer service is also crucial when dealing with life insurance companies. Look for a company that provides responsive and helpful customer support. A company with excellent customer service will ensure a smooth experience during policy issuance, claim filing, and other interactions. They will be available to answer any questions or concerns you may have, making the entire process more manageable and less stressful.

In addition to customer service, it is essential to consider the claim settlement ratio of an insurance company. The claim settlement ratio indicates the percentage of claims settled by a company. A higher claim settlement ratio is an indicator of the company’s efficiency in processing and settling claims. It demonstrates their commitment to providing timely assistance to policyholders and their beneficiaries during challenging times. Considering companies with a good track record in this area will give you added confidence that your claims will be handled promptly and fairly.

Choosing the right life insurance company is a crucial decision that requires careful consideration. By evaluating factors such as financial stability, coverage options, customer service, and claim settlement ratio, you can make an informed choice that aligns with your needs and provides you with the peace of mind you deserve.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Life Insurance Companies in the Market

When it comes to choosing a life insurance company, there are several factors to consider. It’s important to find a provider that offers reliable coverage, has a strong financial foundation, and provides exceptional customer service. Let’s explore some of the top life insurance companies in the market:

Company A

Company A has established itself as a reliable life insurance provider with a strong financial foundation. They have been in the industry for several years and have built a solid reputation for their commitment to their policyholders. Offering a wide range of coverage options, they ensure that individuals and families can find a policy that suits their specific needs.

One of the key strengths of Company A is their exceptional customer service. Their dedicated team of professionals is always ready to assist policyholders with any questions or concerns they may have. Whether it’s helping them understand their policy terms or guiding them through the claims process, Company A’s customer service team goes above and beyond to provide support.

In addition to their reliable coverage and exceptional customer service, Company A also boasts a high claim settlement ratio. This means that policyholders can trust that their claims will be handled efficiently and fairly, providing them with the financial support they need during difficult times.

Company B

If you’re looking for customizable policies, Company B is an excellent choice. They understand that everyone’s insurance needs are unique, and they offer flexible coverage options to cater to these individual requirements. Whether you’re a young professional just starting a family or a retiree looking to secure your legacy, Company B has policy features that can be tailored to your specific situation.

Similar to Company A, Company B also places great emphasis on customer service. They believe that building strong relationships with their policyholders is essential, and they strive to provide personalized assistance every step of the way. From the initial policy purchase to the claims process, their customer service team is dedicated to ensuring a smooth and hassle-free experience for their policyholders.

Company B’s claim settlement ratio is also noteworthy. This means that policyholders can have peace of mind knowing that their claims will be processed efficiently and fairly, providing them with the financial protection they need when it matters most.

Company C

With a long-standing presence in the life insurance market, Company C has earned a reputation for reliability and trustworthiness. They have been serving individuals and families for many years, offering a diverse portfolio of policies to meet various needs.

One of the key strengths of Company C is their attractive coverage options. They understand that different individuals have different priorities when it comes to life insurance, and they strive to provide policies that align with these preferences. Whether you’re looking for comprehensive coverage or a more specific policy, Company C has options that can cater to your requirements.

Company C’s strong financial backbone is another reason why they are considered one of the top life insurance companies in the market. With a solid financial foundation, they are well-equipped to honor their policy commitments and provide the necessary financial support to their policyholders when it’s needed the most.

Lastly, Company C’s customer service team is well-regarded for their professionalism and dedication. They understand that navigating the world of life insurance can be overwhelming, and they are committed to guiding their policyholders through the process. Whether it’s answering policy-related questions or assisting with claims, their customer service team is always ready to provide support and ensure a positive experience.

When considering life insurance companies, it’s important to evaluate factors such as coverage options, financial stability, and customer service. Companies like A, B, and C have proven themselves in these areas, making them top choices for individuals and families seeking reliable life insurance coverage.

Detailed Reviews of Top Life Insurance Companies

Review of Company A

When it comes to life insurance, Company A has established itself as a leader in the industry. With a commitment to providing comprehensive coverage options, they ensure that policyholders have the protection they need. Their policies not only offer affordability but also flexibility, allowing individuals to customize their coverage to suit their specific needs.

One aspect that sets Company A apart from its competitors is their superior customer service. Their dedicated team goes above and beyond to assist policyholders, answering any questions and addressing concerns promptly. Customers have praised the company for their responsiveness and willingness to provide support during difficult times.

Another area where Company A excels is in their claim settlement process. Policyholders have reported prompt and hassle-free settlements, providing them with the financial security they need when it matters the most. This reliability and efficiency have earned Company A a stellar reputation in the industry.

Review of Company B

When it comes to innovation and personalized service, Company B stands out among its competitors. They have gained attention for their forward-thinking policies and their commitment to tailoring coverage to meet individual needs. This personalized approach ensures that policyholders receive the exact protection they require, without paying for unnecessary coverage.

Customers have praised Company B for their responsive customer service team. Whether it’s answering questions or assisting with policy adjustments, the team at Company B is known for their dedication and professionalism. Their commitment to providing exceptional service has earned them a loyal customer base.

In addition to their personalized approach and excellent customer service, Company B has a reputation for an efficient claim settlement process. Policyholders have reported quick and hassle-free settlements, allowing them to access the financial support they need during challenging times. This commitment to efficiency sets Company B apart from other life insurance providers.

Review of Company C

Company C has consistently received positive feedback from customers for their wide range of coverage options and competitive premiums. They understand that every individual’s insurance needs are unique, and they have designed their policies accordingly. From term life insurance to whole life insurance, Company C offers comprehensive coverage options to cater to various requirements.

One factor that has contributed to Company C’s positive reputation is their strong financial stability. Policyholders can rest assured knowing that the company is financially secure and will honor their commitments. This stability provides peace of mind and reassurance that their loved ones will be taken care of in the event of an unforeseen circumstance.

Moreover, Company C’s high claim settlement ratio has further enhanced its reputation. Policyholders have reported timely and efficient settlements, ensuring that they receive the financial support they need when it matters the most. This reliability and commitment to customer satisfaction have made Company C a trusted choice for life insurance.

Conclusion

Choosing the right life insurance company is an important decision that requires careful consideration. Consider the financial stability, coverage options, customer service, and claim settlement ratio of each company when making your choice. By taking the time to evaluate these factors, you can find a life insurance company that meets your needs and provides the best financial protection for you and your loved ones.

Frequently Asked Questions

What factors should I consider when choosing a life insurance company?

When choosing a life insurance company, it is important to consider factors such as the company’s financial stability, customer reviews and ratings, coverage options, policy features, and premium costs. These factors will help you determine the reliability and suitability of a life insurance company for your needs.

How can I determine the financial stability of a life insurance company?

You can determine the financial stability of a life insurance company by checking its ratings from independent rating agencies such as A.M. Best, Standard & Poor’s, and Moody’s. These agencies assess the financial strength and claims-paying ability of insurance companies, providing valuable insights into their stability and reliability.

What types of life insurance coverage options are typically offered by the best companies?

The best life insurance companies typically offer a range of coverage options, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each type of coverage has its own features and benefits, allowing individuals to choose the one that best fits their needs and financial goals.

How do I compare premium costs among different life insurance companies?

To compare premium costs among different life insurance companies, you can obtain quotes from multiple insurers. Provide the same information and coverage details when requesting quotes to ensure accurate comparisons. Additionally, consider the value provided by each company in terms of coverage options, customer service, and financial stability, rather than solely focusing on the premium cost.

What are some reliable sources for customer reviews and ratings of life insurance companies?

There are several reliable sources for customer reviews and ratings of life insurance companies. Websites such as J.D. Power, Consumer Reports, and the Better Business Bureau (BBB) provide valuable insights into customer experiences, satisfaction levels, and complaint records. These sources can help you gauge the reputation and reliability of different life insurance companies.

Can I switch my life insurance company if I am not satisfied with my current one?

Yes, you can switch your life insurance company if you are not satisfied with your current one. However, it is important to carefully evaluate your options and consider any potential implications, such as policy cancellation fees or the loss of certain policy features. It is recommended to consult with a licensed insurance professional before making a decision to switch companies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.