Best Life Insurance Policies for My Spouse in 2026 (Top 10 Companies)

Northwestern Mutual, USAA, and State Farm stand out with the best life insurance policies for my spouses. Explore the personalized coverage options and benefits offered by these top-tier companies. This guide will delve into the specifics, empowering you to make informed decisions for your spouse's financial security.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor of Nutrition & Kinesiology

Melissa Morris has a BS and MS in exercise science and a doctorate in educational leadership. She is an ACSM certified exercise physiologist and an ISSN certified sports nutritionist. She teaches nutrition and applied kinesiology at the University of Tampa. She has been featured on Yahoo, HuffPost, Eat This, Bulletproof, Vitacost, LIVESTRONG, Toast Fried, The Trusty Spotter, Best Comp...

Melissa Morris

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated February 2024

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

The companies with the best life insurance policies for my spouses are Northwestern Mutual, USAA, and State Farm, they lead the way with competitive rates and personalized coverage options. This guide navigates through the intricacies of life insurance, emphasizing the significance of coverage, available policy types, and key decision factors.

Our Top 10 Best Companies: Best Life Insurance Policies for My Spouse

| Company | Rank | See Pros/Cons | Multi-Policy Discount | Healthy Lifestyle Discount | Best For |

|---|---|---|---|---|---|

| #1 | Northwestern Mutual | Up to 5% | Up to 10% | Financial Strength | |

| #2 | USAA | Up to 7% | Up to 15% | Long-Term Care | |

| #3 | State Farm | Up to 6% | Up to 12% | Dividend Payouts | |

| #4 | Prudential | Up to 8% | Up to 14% | Policy Variety | |

| #5 | New York Life | Up to 5% | Up to 13% | Policy Options |

| #6 | MassMutual | Up to 4% | Up to 11% | Active Lifestyle | |

| #7 | Transamerica | Up to 6% | Up to 12% | Employee Benefits | |

| #8 | Guardian Life | Up to 7% | Up to 11% | Global Presence | |

| #9 | AIG | Up to 5% | Up to 12% | Accelerated Underwriting |

| #10 | Nationwide | Up to 4% | Up to 14% | Business Succession |

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Importance of Life Insurance for Your Spouse

When it comes to financial planning, life insurance plays a vital role in providing peace of mind and financial security for your loved ones in the event of your passing. However, it is equally important to ensure that your spouse is adequately protected through a suitable life insurance policy.

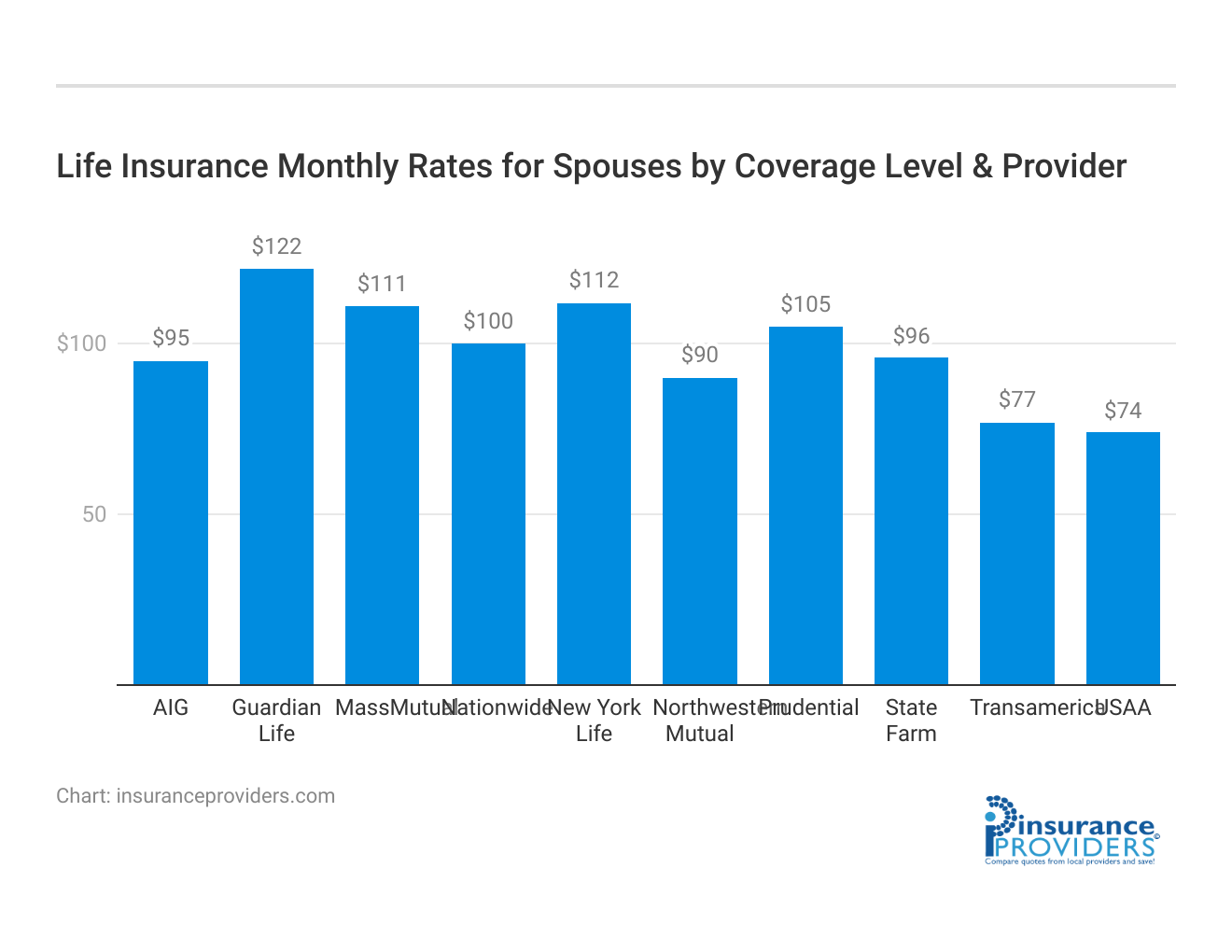

Average Monthly Life Insurance Rates for Spouses

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| Northwestern Mutual | $222 | $90 |

| USAA | $160 | $74 |

| State Farm | $180 | $96 |

| Prudential | $212 | $105 |

| New York Life | $232 | $112 |

| MassMutual | $220 | $111 |

| Transamerica | $150 | $77 |

| Guardian Life | $240 | $122 |

| AIG | $180 | $95 |

| Nationwide | $115 | $100 |

When examining the average monthly life insurance rates for spouses, noteworthy variations emerge. Northwestern Mutual, recognized for its personalized coverage, presents rates starting at $90 for minimum coverage and $222 for full coverage. USAA, with a focus on military personnel, offers competitive rates, starting at $74 for minimum coverage and $160 for full coverage.

State Farm, known for tailored options, provides rates beginning at $96 for minimum coverage and $180 for full coverage. Prudential, New York Life, MassMutual, Transamerica, Guardian Life, AIG, and Nationwide each bring their unique strengths to the table, showcasing diverse coverage rates to suit different preferences and financial plans.

Carefully evaluating these rates ensures you secure the most suitable life insurance for your spouse’s needs.

The Role of Life Insurance in Financial Planning

Life insurance acts as a safety net, providing a lump sum payment to the designated beneficiaries upon the policyholder’s death. This payout can help cover various expenses, including funeral costs, outstanding debts, mortgage payments, and future financial needs.

But life insurance is not just about financial security. It also provides emotional support during a difficult time. Losing a loved one is never easy, and the financial burden can only add to the emotional stress. With a life insurance policy in place, your spouse can have the peace of mind knowing that they will be taken care of financially, allowing them to focus on healing and rebuilding their life.

Why Your Spouse Needs a Life Insurance Policy

While your spouse may not be the primary breadwinner in the household, their absence can still have significant financial implications. A life insurance policy for your spouse can provide vital financial support during the adjustment period, helping to cover childcare costs, household expenses, or even allowing time for job retraining or education.

Furthermore, life insurance can also serve as an investment tool for your spouse’s future. Certain types of life insurance policies, such as whole life or universal life insurance, accumulate cash value over time. This cash value can be accessed by your spouse in the form of a loan or withdrawal, providing them with an additional source of funds for emergencies or retirement.

Additionally, a life insurance policy for your spouse can help bridge the income gap that may arise if they decide to take time off work to care for children or family members. This financial support can alleviate the stress of lost income and ensure that your spouse can continue to meet their financial obligations.

Moreover, having a life insurance policy for your spouse can also be a smart financial move in terms of estate planning. The death benefit received from the policy can help cover estate taxes, ensuring that your assets are preserved for future generations.

Lastly, it is worth noting that the cost of life insurance premiums is generally lower when individuals are younger and healthier. By securing a life insurance policy for your spouse early on, you can take advantage of lower premiums and potentially save money in the long run.

Types of Life Insurance Policies

Life insurance policies come in various forms, each with its own unique features and benefits. Understanding the different types of life insurance can help you choose the most suitable option for your spouse.

Term Life Insurance

Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years. It offers a death benefit if the insured passes away during the policy term. Term life insurance policies are typically affordable and straightforward, making them a popular choice for many individuals.

With term life insurance, you have the flexibility to choose the duration of coverage that aligns with your specific needs. For example, if you have young children and want to ensure their financial security until they become financially independent, a 20-year term policy might be the right choice for you.

Term life insurance also allows you to select the death benefit amount that best suits your family’s needs. This means you can tailor the policy to provide enough coverage to pay off outstanding debts, such as a mortgage or student loans, and provide for your family’s future expenses, such as education or living expenses.

Additionally, some term life insurance policies offer the option to convert to a permanent life insurance policy later on. This can be beneficial if your needs change over time and you decide you want lifelong coverage.

Whole Life Insurance

Whole life insurance offers lifelong coverage and builds cash value over time. This type of policy provides a death benefit to the beneficiaries and accumulates cash value that can be borrowed against or used for other purposes during the insured’s lifetime.

One of the key advantages of whole life insurance is that it guarantees a death benefit payout to your beneficiaries, regardless of when you pass away. This can provide peace of mind knowing that your loved ones will be financially protected no matter when the unfortunate event occurs.

In addition to the death benefit, whole life insurance also has a cash value component. As you continue to pay your premiums, a portion of the premium goes towards the cash value, which grows over time. This cash value can be accessed through policy loans or withdrawals, providing you with a source of funds for emergencies or other financial needs.

Moreover, whole life insurance policies often offer the option to receive dividends. These dividends can be used to increase the death benefit, accumulate more cash value, or reduce future premium payments.

Universal Life Insurance

Universal life insurance combines the benefits of both term life insurance and whole life insurance. It offers flexible premiums, death benefit options, and a cash value component. Universal life insurance policies often provide the opportunity for investment growth.

One of the key advantages of universal life insurance is its flexibility. Unlike term life insurance, universal life insurance allows you to adjust your premium payments and death benefit amount as your financial situation changes. This can be particularly useful if you experience significant life events, such as marriage, the birth of a child, or changes in income.

Universal life insurance also offers a cash value component, similar to whole life insurance. However, the cash value growth in universal life insurance policies is tied to the performance of investment options within the policy. This means that the cash value has the potential to grow at a higher rate than in a whole life insurance policy, depending on the performance of the investments.

Furthermore, universal life insurance policies often provide the opportunity to access the cash value through policy loans or withdrawals. This can be advantageous if you need funds for large expenses, such as a down payment on a home or funding a child’s education.

In conclusion, understanding the different types of life insurance policies can help you make an informed decision when choosing coverage for your spouse. Whether you opt for term life insurance, whole life insurance, or universal life insurance, each type offers its own set of advantages and can provide valuable financial protection for your loved ones.

Factors to Consider When Choosing a Life Insurance Policy for Your Spouse

When selecting a life insurance policy for your spouse, there are several factors to carefully consider to ensure the chosen policy meets their specific needs and circumstances.

Choosing the right life insurance policy for your spouse is an important decision that requires thoughtful consideration. It is crucial to take into account various factors that can significantly impact the coverage and benefits provided by the policy. By carefully evaluating these factors, you can make an informed decision that will provide financial security and peace of mind for your spouse and your family.

Age and Health Status

Your spouse’s age and health play a crucial role in determining their insurability and the cost of premiums. Generally, purchasing life insurance at a younger age and in good health can result in lower premiums. However, it is essential to consider any pre-existing medical conditions or potential health risks that may affect the coverage and cost of the policy. Consulting with a qualified insurance agent can help assess your spouse’s health status and determine the most suitable life insurance options available.

Additionally, as your spouse ages, their health needs may change. It is essential to choose a policy that provides flexibility and can be adjusted to meet their evolving health requirements. Regularly reviewing and updating the policy can ensure that it continues to provide adequate coverage as your spouse’s health situation changes over time.

Financial Obligations

Consider your spouse’s financial obligations, such as outstanding debts, mortgage payments, or children’s education expenses. An appropriate life insurance policy should provide sufficient coverage to address these obligations adequately. By carefully assessing your spouse’s financial situation, you can determine the amount of coverage needed to protect against any potential financial hardships that may arise in the event of their untimely passing.

Furthermore, it is crucial to consider the impact of inflation on your spouse’s financial obligations. As time goes on, the cost of living and expenses may increase. Therefore, it is advisable to choose a life insurance policy that takes into account future inflation rates and provides coverage that can keep up with the rising costs.

Future Plans and Goals

Take into account your spouse’s future plans and goals. If your spouse plans to retire, start a business, or contribute to a charity, the life insurance policy should consider these aspirations to offer the necessary financial support. By understanding your spouse’s long-term objectives, you can select a policy that provides the means to fulfill these goals even in the event of their unfortunate demise.

Additionally, it is essential to consider any potential changes in your spouse’s future plans. Circumstances may evolve, and new goals may emerge over time. Choosing a life insurance policy that allows for flexibility and can be adjusted to accommodate changing needs can provide peace of mind and ensure that your spouse’s future plans and aspirations are protected.

In conclusion, when selecting a life insurance policy for your spouse, it is crucial to consider their age, health status, financial obligations, and future plans. By taking these factors into account, you can make an informed decision that provides the necessary coverage and support for your spouse’s specific needs and circumstances. Remember to regularly review and update the policy as needed to ensure its continued relevance and effectiveness.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Life Insurance Policies for Spouses

Now that we have explored the importance of life insurance for your spouse and the factors to consider when choosing a policy, let’s review some of the top life insurance options available.

Review of the Best Term Life Insurance Policies

- Company A: This company offers competitive rates and flexible policy terms suitable for various needs.

- Company B: With a strong financial track record, this provider offers excellent customer service and customizable term life insurance policies.

These companies have consistently received positive reviews and are known for their reliability and customer satisfaction.

Review of the Best Whole Life Insurance Policies

- Company C: This company offers comprehensive whole life insurance policies with attractive cash value accumulation and potential dividend payments.

- Company D: Known for their long-standing presence in the market, Company D provides stable, reliable, and customizable whole life insurance options.

These top-rated companies have proven their commitment to policyholders and offer robust whole life insurance coverage.

Review of the Best Universal Life Insurance Policies

- Company E: This company is renowned for its flexible universal life insurance policies and investment opportunities.

- Company F: With a strong emphasis on customer service and plan customization, Company F offers competitive universal life insurance solutions.

These companies provide flexible and comprehensive coverage options that align with different individuals’ financial goals.

Case Studies: Best Life Insurance Policies for My Spouse

Case Study 1: Northwestern Mutual- Personalized Protection for Families

Mr. and Mrs. Johnson, a young couple with two children, were seeking a life insurance policy that would provide comprehensive coverage tailored to their family’s needs. Northwestern Mutual stood out for its personalized approach.

Offering a range of coverage options, Northwestern Mutual ensured that the Johnsons could protect their family’s financial future with a policy starting at $90 for minimum coverage and $222 for full coverage. The couple appreciated the flexibility to adjust the policy as their family grew, making Northwestern Mutual their top choice.

Case Study 2: USAA- Military-Focused Coverage With Member Benefits

Sergeant Rodriguez, a military service member, was looking for life insurance that not only offered robust coverage but also catered to his unique needs. USAA, known for its military-focused approach, provided coverage starting at $74 for minimum coverage and $160 for full coverage.

The additional benefits and member-centric approach resonated with Sgt. Rodriguez, assuring him that his family would be well-supported. USAA’s commitment to serving the military community made it the ideal choice for Sgt. Rodriguez’s life insurance needs.

Case Study 3: State Farm- Coverage Tailored to Your Needs

The Davis family, a couple in their mid-40s, sought a life insurance policy that could adapt to their changing financial circumstances. State Farm’s reputation for tailoring coverage to individual needs made it an appealing choice. With rates starting at $96 for minimum coverage and $180 for full coverage, the Davis family found the flexibility they desired.

State Farm’s commitment to understanding their evolving needs and adjusting the policy accordingly made it the perfect fit for the Davis family’s long-term financial planning.

In Conclusion

Securing the best life insurance policy for your spouse is an important step in protecting your family’s financial future. Understanding the significance of life insurance for your spouse, considering the different types of policies available, as well as the essential factors to evaluate, can help you make an informed decision. By reviewing the top life insurance policies for spouses and selecting one that matches your spouse’s needs, you can ensure their financial well-being and provide peace of mind for both of you.

Frequently Asked Questions

What are the factors to consider when choosing a life insurance policy for my spouse?

When choosing a life insurance policy for your spouse, it is important to consider factors such as their age, health condition, financial needs, and the amount of coverage required.

What types of life insurance policies are available for spouses?

There are generally two types of life insurance policies available for spouses: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance offers lifelong coverage.

How much life insurance coverage should I consider for my spouse?

The amount of life insurance coverage you should consider for your spouse depends on factors such as their income, debts, future financial obligations, and long-term financial goals. It is advisable to assess their needs and consult with a financial advisor or insurance agent to determine an appropriate coverage amount.

Can I add my spouse as a beneficiary to my own life insurance policy?

Yes, you can add your spouse as a beneficiary to your own life insurance policy. This ensures that in the event of your death, your spouse will receive the designated benefits. It is recommended to review and update your beneficiaries periodically to ensure they reflect your current wishes.

What is the difference between whole life insurance and term life insurance for spouses?

The main difference between whole life insurance and term life insurance for spouses is the duration of coverage. Whole life insurance provides lifelong coverage, while term life insurance offers coverage for a specific term, such as 10, 20, or 30 years. Whole life insurance also has a cash value component, which term life insurance lacks.

Can I purchase life insurance for my spouse without their knowledge?

No, it is generally not recommended to purchase life insurance for your spouse without their knowledge. Life insurance involves important financial decisions and requires the consent and involvement of the insured individual. It is best to have open and transparent communication about the need for life insurance and involve your spouse in the decision-making process.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.