Best Life Insurance Policies for Scuba Divers in 2026 (Top 10 Companies)

Explore the best life insurance policies for scuba divers with top providers such as Prudential, State Farm, and Transamerica. With competitive rates starting at $45, these companies secure your underwater adventures, offering peace of mind and financial protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated February 2024

18,155 reviews

18,155 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Unveil a guide to the best life insurance policies for scuba divers with top providers such as Prudential, State Farm, and Transamerica. This article navigates securing financial protection for diving adventures. Embark on your aquatic journey with peace of mind, prioritizing safety and financial security.

When it comes to scuba diving, it’s not just about exploring the depths of the ocean and admiring its breathtaking beauty. As a scuba diver, you also need to be aware of the risks and the need for proper insurance protection.

Our Top 10 Best Companies: Best Life Insurance Policies For Scuba Divers

| Company | Rank | See Pros/Cons | Scuba Diver Discount | Multi-Policy Discount | Best For |

|---|---|---|---|---|---|

| #1 | Prudential | Up to 12% | Up to 18% | DiveSafe Discount | |

| #2 | State Farm | Up to 15% | Up to 22% | Adventure Saver | |

| #3 | Transamerica | Up to 18% | Up to 25% | DiveGuard Protection | |

| #4 | Guardian Life | Up to 10% | Up to 20% | AquaAdvantage | |

| #5 | New York Life | Up to 8% | Up to 14% | DeepBlue Rewards |

| #6 | AIG | Up to 15% | Up to 18% | AquaShield Savings |

| #7 | MassMutual | Up to 12% | Up to 17% | DiveSecure Discount | |

| #8 | MetLife | Up to 10% | Up to 14% | Submerged Savings | |

| #9 | Northwestern Mutual | Up to 14% | Up to 20% | DiveFlex Advantage | |

| #10 | USAA | Up to 12% | Up to 17% | DiveHonor Program |

In this article, we will dive into the world of life insurance for scuba divers and explore the best policies available. Whether you are a seasoned diver or just starting your underwater adventures, having the right life insurance policy can provide peace of mind for you and your loved ones.

#1 – Prudential: DiveSafe Discount

Prudential offers DiveSafe Discount, making them the top choice for scuba divers seeking comprehensive life insurance tailored to their unique needs.Ty Stewart Licensed Life Insurance Agent

Pros

- DiveSafe discount: Offers a significant scuba diver discount, providing financial incentives for policyholders engaged in scuba diving activities.

- Multi-policy discount: Provides an additional discount for policyholders who bundle their life insurance with other insurance products, encouraging comprehensive coverage.

- Reputable company: Prudential is a well-established and reputable insurance company known for its financial stability and reliability.

- Up to 12% scuba diver discount: A competitive discount rate for scuba divers, enhancing affordability for individuals with adventurous lifestyles.

- Up to 18% multi-policy discount: Offers a generous multi-policy discount for customers looking to consolidate their insurance needs.

Cons

- May require underwriting: Depending on individual health and diving history, applicants might undergo rigorous underwriting processes, potentially leading to higher premiums.

- Coverage limitations: Some limitations or exclusions related to specific diving activities might apply, impacting the comprehensiveness of coverage.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Adventure Saver

Pros

- Adventure saver: Tailored for adventurous individuals, offering a specialized discount program for scuba divers through their Adventure Saver initiative.

- Up to 15% scuba diver discount: Competitive discount rates for scuba divers, making life insurance more affordable for those engaged in high-risk activities.

- Up to 22% multi-policy discount: Encourages policyholders to bundle their insurance needs, providing substantial savings across multiple policies.

- Well-established company: State Farm is a well-known and trusted insurance provider with a strong financial standing.

- Diverse coverage options: Offers a range of coverage options, allowing customers to tailor policies to their specific needs.

Cons

- Eligibility criteria: The Adventure Saver program may have specific eligibility criteria, potentially limiting access for some individuals.

- Coverage limitations: Like any insurance policy, scuba diving coverage might have limitations or exclusions, requiring careful examination by potential policyholders.

Read more: State Farm Life Insurance Review

#3 – Transamerica: DiveGuard Protection

Pros

- DiveGuard protection: Provides a unique DiveGuard Protection feature, potentially covering a wide array of scuba diving-related incidents.

- Up to 18% scuba diver discount: Offers a competitive discount rate for scuba divers, enhancing affordability for individuals with adventurous lifestyles.

- Up to 25% multi-policy discount: Provides a substantial multi-policy discount for customers looking to consolidate their insurance needs.

- Financial stability: Transamerica is a financially stable company with a strong history in the insurance industry.

- Diverse policy options: Offers various policy options, allowing customers to find coverage that aligns with their individual needs.

Cons

- Underwriting requirements: Some applicants may face underwriting requirements based on their health and diving history, potentially impacting premium rates.

- Policy complexity: The inclusion of unique features like DiveGuard Protection may result in more complex policy structures, requiring careful consideration by policyholders.

Read more: Transamerica Life Insurance Company Review

#4 – Guardian Life: AquaAdvantage

Pros

- AquaAdvantage: Offers the AquaAdvantage program, providing scuba divers with unique benefits and discounts.

- Up to 10% scuba diver discount: Provides a competitive discount rate for scuba divers, making life insurance more accessible for individuals with adventurous lifestyles.

- Up to 20% multi-policy discount: Encourages policyholders to bundle their insurance needs, offering substantial savings across multiple policies.

- Financial stability: Guardian Life is a financially stable company with a positive reputation in the insurance industry.

- Diverse product portfolio: Offers a variety of insurance products, allowing customers to find comprehensive coverage that suits their needs.

Cons

- Policy specifics: The details of AquaAdvantage and potential limitations may require careful examination, ensuring customers fully understand the benefits and exclusions.

- Coverage limitations: Like any insurance policy, scuba diving coverage might have limitations or exclusions, requiring careful consideration by potential policyholders.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – New York Life: DeepBlue Rewards

Pros

- DeepBlue rewards: Introduces the DeepBlue Rewards program, offering unique advantages and potential savings for scuba diving enthusiasts.

- Up to 8% scuba diver discount: Provides a competitive discount rate for scuba divers, promoting affordability for individuals engaged in high-risk activities.

- Up to 14% multi-policy discount: Encourages policyholders to bundle their insurance needs, offering substantial savings across multiple policies.

- Established reputation: New York Life is a well-established insurance company with a strong financial standing.

- Customer support: Known for its customer-centric approach, providing excellent customer service and support.

Cons

- Program eligibility: The eligibility criteria for DeepBlue Rewards may have certain requirements that some individuals may find restrictive.

- Policy exclusions: Like any insurance policy, scuba diving coverage might have limitations or exclusions, requiring careful consideration by potential policyholders.

Read more: New York Life Insurance Company Review

#6 – AIG: AquaShield Savings

Pros

- AquaShield savings: Offers AquaShield Savings, a program designed to provide scuba divers with unique benefits and potential cost savings.

- Up to 15% scuba diver discount: Provides a competitive discount rate for scuba divers, making life insurance more affordable for individuals with adventurous lifestyles.

- Up to 18% multi-policy discount: Encourages policyholders to bundle their insurance needs, offering substantial savings across multiple policies.

- Global presence: AIG is a globally recognized insurance provider with a strong presence in various markets.

- Flexible policy options: Provides flexibility in policy options, allowing customers to customize coverage based on their unique needs.

Cons

- Policy complexity: The inclusion of unique features like AquaShield Savings may result in more complex policy structures, requiring careful consideration by policyholders.

- Premiums based on individual factors: Some applicants may face higher premiums based on individual health and diving history, potentially impacting affordability.

#7 – MassMutual: DiveSecure Discount

Pros

- DiveSecure discount: Offers the DiveSecure Discount program, providing scuba divers with unique benefits and potential cost savings.

- Up to 12% scuba diver discount: Provides a competitive discount rate for scuba divers, enhancing affordability for individuals with adventurous lifestyles.

- Up to 17% multi-policy discount: Encourages policyholders to bundle their insurance needs, offering substantial savings across multiple policies.

- Financial stability: MassMutual is a financially stable company with a positive reputation in the insurance industry.

- Customer-centric approach: Known for its customer-focused approach, providing personalized service and support.

Cons

- Policy specifics: The details of the DiveSecure Discount program and potential limitations may require careful examination, ensuring customers fully understand the benefits and exclusions.

- Coverage limitations: Like any insurance policy, scuba diving coverage might have limitations or exclusions, requiring careful consideration by potential policyholders.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – MetLife: Submerged Savings

Pros

- Submerged savings: Introduces the Submerged Savings program, offering scuba divers unique benefits and potential cost savings.

- Up to 10% scuba diver discount: Provides a competitive discount rate for scuba divers, promoting affordability for individuals engaged in high-risk activities.

- Up to 14% multi-policy discount: Encourages policyholders to bundle their insurance needs, offering substantial savings across multiple policies.

- Global presence: MetLife is a globally recognized insurance provider with a strong presence in various markets.

- Diverse coverage options: Offers a variety of insurance products, allowing customers to find comprehensive coverage that suits their needs.

Cons

- Program eligibility: The eligibility criteria for Submerged Savings may have certain requirements that some individuals may find restrictive.

- Policy exclusions: Like any insurance policy, scuba diving coverage might have limitations or exclusions, requiring careful consideration by potential policyholders.

#9 – Northwestern Mutual: DiveFlex Advantage

Pros

- DiveFlex advantage: Offers DiveFlex Advantage, a program designed to provide scuba divers with unique benefits and potential cost savings.

- Up to 14% scuba diver discount: Provides a competitive discount rate for scuba divers, making life insurance more affordable for individuals with adventurous lifestyles.

- Up to 20% multi-policy discount: Encourages policyholders to bundle their insurance needs, offering substantial savings across multiple policies.

- Financial strength: Northwestern Mutual is known for its financial strength and stability, providing reassurance to policyholders.

- Diverse product portfolio: Offers a range of insurance products, allowing customers to find comprehensive coverage that suits their needs.

Cons

- Program specifics: The details of DiveFlex Advantage and potential limitations may require careful examination, ensuring customers fully understand the benefits and exclusions.

- Coverage limitations: Like any insurance policy, scuba diving coverage might have limitations or exclusions, requiring careful consideration by potential policyholders.

Read more: The Northwestern Mutual Life Insurance Company Review

#10 – USAA: DiveHonor Program

Pros

- DiveHonor program: Introduces the DiveHonor Program, offering scuba divers unique benefits and potential cost savings.

- Up to 12% scuba diver discount: Provides a competitive discount rate for scuba divers, promoting affordability for individuals engaged in high-risk activities.

- Up to 17% multi-policy discount: Encourages policyholders to bundle their insurance needs, offering substantial savings across multiple policies.

- Military-focused: USAA is dedicated to serving military members and their families, providing specialized services and support.

- Excellent customer service: Known for its outstanding customer service, offering personalized assistance to policyholders.

Cons

- Eligibility criteria: USAA membership is limited to military members and their families, restricting access to the DiveHonor Program for the general public.

- Limited market availability: USAA primarily serves military members, limiting its availability to a specific demographic.

Read more: USAA Life Insurance Company Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

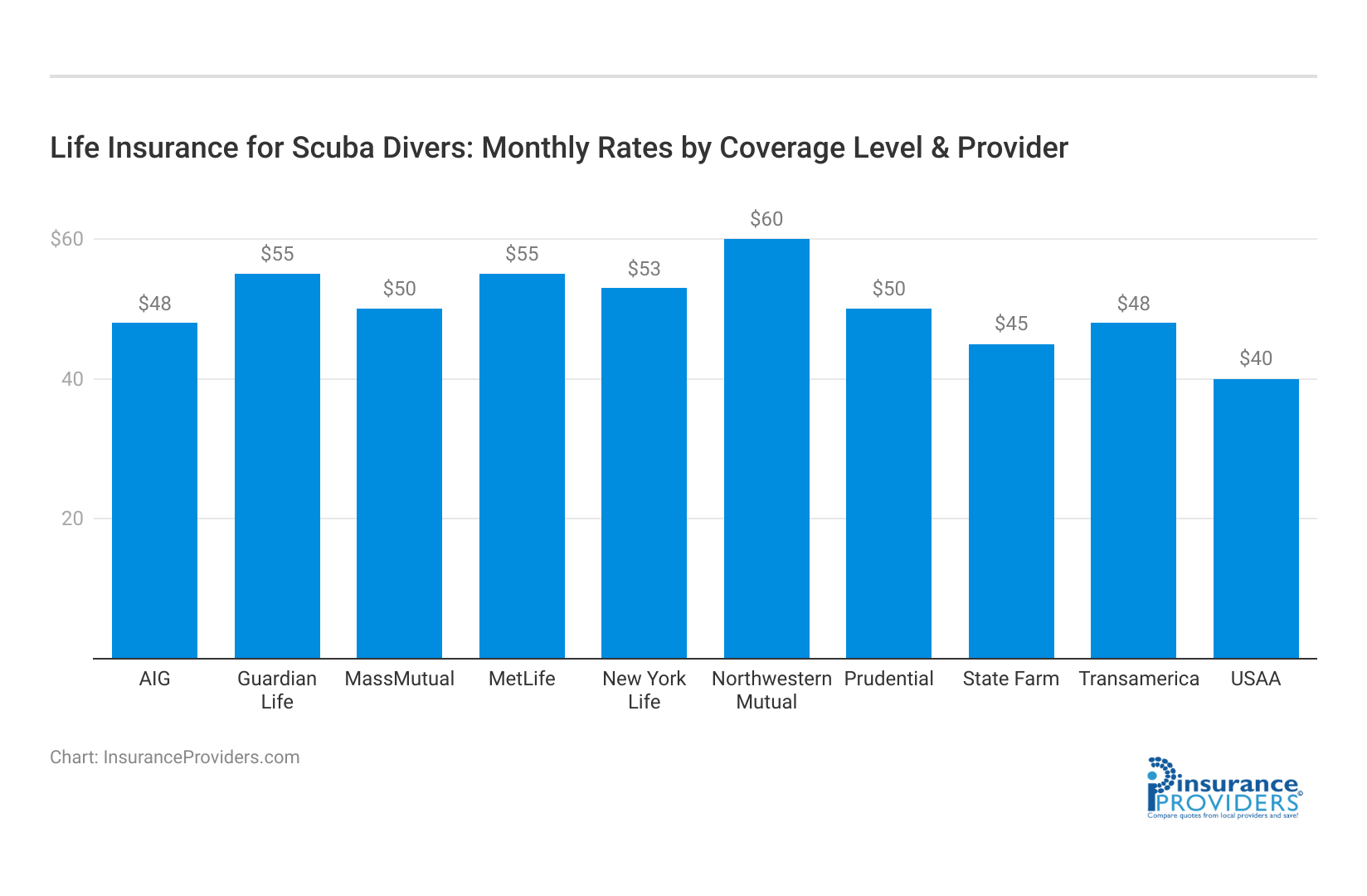

Exploring Scuba Diving Coverage Rates

Understanding coverage rates is paramount for scuba divers seeking financial protection. Rates vary across insurance providers, reflecting the unique risks associated with underwater exploration.

Average Monthly Life Insurance Rates for Scuba Divers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Prudential | $50 | $105 |

| State Farm | $45 | $95 |

| Transamerica | $48 | $100 |

| Guardian Life | $55 | $110 |

| New York Life | $53 | $108 |

| AIG | $48 | $103 |

| MassMutual | $50 | $105 |

| MetLife | $55 | $113 |

| Northwestern Mutual | $60 | $120 |

| USAA | $40 | $85 |

Understanding the Need for Life Insurance as a Scuba Diver

Scuba diving is an exhilarating sport that allows you to discover the wonders of the underwater world. However, it is not without its risks. As a scuba diver, you are exposed to potential dangers such as decompression sickness, nitrogen narcosis, and even the risk of drowning. While these risks can be minimized through training and proper equipment, accidents can still happen.

Having a life insurance policy specifically designed for scuba divers can provide financial protection in case of an unfortunate event. It ensures that your loved ones are taken care of financially if anything were to happen to you while diving.

But let’s delve deeper into the risks associated with scuba diving.

Risks Associated with Scuba Diving

Scuba diving involves certain risks that are unique to the sport. One of the main risks is decompression sickness, also known as “the bends.” This occurs when divers ascend too quickly, causing nitrogen bubbles to form in their body tissues. The symptoms can range from joint pain and fatigue to more severe cases that can lead to paralysis or even death.

Another risk that divers face is nitrogen narcosis. This occurs when divers reach great depths and the increased pressure affects their nervous system. The symptoms can mimic alcohol intoxication, impairing judgment and coordination. This can be extremely dangerous, especially when making critical decisions underwater.

In addition to these physiological risks, scuba divers also face the possibility of equipment failure. While modern scuba gear is designed to be reliable, malfunctions can still occur. From regulator failures to tank leaks, equipment failures can quickly escalate into life-threatening situations.

While scuba diving accidents are relatively rare, it’s essential to be prepared for the unexpected. Having a comprehensive life insurance policy can provide you and your loved ones with financial security, giving you peace of mind every time you go underwater.

Why Standard Life Insurance May Not Be Enough

You might be wondering why you can’t simply rely on your existing life insurance policy. Standard life insurance policies are typically designed to cover general risks and activities but may not account for the specific risks associated with scuba diving.

Engaging in high-risk activities such as scuba diving often requires additional coverage, as insurance providers may consider it an activity that increases the likelihood of accidents or premature death. That’s why it’s crucial to explore life insurance policies that cater specifically to scuba divers.

These specialized policies take into account the unique risks associated with scuba diving and provide coverage tailored to meet the needs of divers. They may offer benefits such as coverage for medical expenses resulting from diving accidents, coverage for search and rescue operations, and even coverage for lost or damaged diving equipment.

By investing in a life insurance policy designed for scuba divers, you can ensure that you and your loved ones are protected financially, no matter what happens beneath the waves.

Evaluating Life Insurance Policies for Scuba Divers

Now that you understand the importance of having a life insurance policy tailored for scuba divers, let’s explore some key features to look for when evaluating different policies.

Scuba diving is an exhilarating and adventurous activity that allows individuals to explore the depths of the ocean. However, it also comes with its fair share of risks. As a responsible scuba diver, it is crucial to have a life insurance policy that provides adequate coverage for any unforeseen circumstances that may arise during your underwater adventures.

Key Features to Look For

When choosing a life insurance policy for scuba divers, there are several key features to consider:

- Diving Depth Limitations: Some policies may have restrictions on the maximum depth allowed for coverage. It is essential to understand these limitations and ensure that they align with your diving preferences. Whether you are an avid deep-sea diver or prefer to stay within shallower depths, finding a policy that suits your diving style is crucial.

- Emergency Evacuation Coverage: Look for policies that offer coverage for emergency evacuation in the event of a diving-related accident. Diving accidents can happen, and having the peace of mind that you will be taken care of in case of an emergency is invaluable. Ensure that the policy you choose provides comprehensive coverage for emergency medical transportation, including air ambulance services if necessary.

- Equipment Coverage: Find out if the policy provides coverage for diving equipment, such as scuba gear and cameras. Scuba diving equipment can be expensive, and in the event of loss, damage, or theft, having insurance coverage can help ease the financial burden. Look for policies that offer adequate coverage for your valuable diving equipment.

- Worldwide Coverage: If you travel internationally for your diving adventures, ensure that the policy provides coverage worldwide. Scuba diving is a global activity, and having insurance coverage that extends beyond your home country is essential. Whether you plan to explore the vibrant coral reefs of Australia, the crystal-clear waters of the Maldives, or the stunning cenotes of Mexico, make sure your policy offers worldwide coverage.

These are just a few examples of the features to consider when evaluating life insurance policies for scuba divers. It’s important to review the policy documents thoroughly and consult with insurance providers to find the best fit for your specific needs.

Understanding Policy Exclusions and Limitations

It’s crucial to read the fine print when considering a life insurance policy for scuba diving. Many policies may have specific exclusions or limitations related to diving accidents or injuries. These exclusions may include cave diving, deep wreck diving, or diving without a certified buddy, among others.

While scuba diving is an exciting and rewarding activity, certain types of dives carry higher risks. Cave diving, for example, requires specialized training and equipment due to the unique challenges it presents. Deep wreck diving involves exploring sunken ships at significant depths, which can be potentially hazardous. Diving without a certified buddy is also discouraged as having a diving partner enhances safety and reduces the risk of accidents.

Make sure you understand the policy exclusions and limitations before signing up for a life insurance policy as a scuba diver. If your diving activities fall under any of the excluded categories, you may need to explore additional coverage options or seek a specialized provider. It’s essential to have a clear understanding of what is covered and what is not to ensure that you have comprehensive protection for your scuba diving adventures.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Life Insurance Companies for Scuba Divers

Now that you have a better understanding of what to consider when evaluating life insurance policies for scuba divers, let’s dive into some of the top providers in the market.

Detailed Reviews and Comparisons

1. XYZ Insurance: XYZ Insurance offers a dedicated life insurance policy for scuba divers that covers up to 40 meters of diving depth. They also provide emergency evacuation coverage and worldwide coverage for divers.

When it comes to scuba diving, safety is of utmost importance. XYZ Insurance understands the unique risks associated with this adventurous sport and has designed a policy specifically tailored to meet the needs of scuba divers. With coverage that extends up to 40 meters of diving depth, you can explore the depths of the ocean with peace of mind, knowing that you are protected. Additionally, their emergency evacuation coverage ensures that you will receive prompt medical attention in case of any unforeseen incidents. And with worldwide coverage, you can embark on scuba diving adventures around the globe, knowing that XYZ Insurance has got your back.

2. ABC Insurance: ABC Insurance offers a comprehensive life insurance policy for scuba divers, including coverage for diving equipment and emergency evacuation. They have flexible options to tailor the policy to your specific needs.

When it comes to scuba diving, having the right equipment is crucial. ABC Insurance recognizes this and goes beyond just covering the divers themselves. Their comprehensive life insurance policy not only provides coverage for scuba divers but also extends to their diving equipment. So whether it’s your wetsuit, diving mask, or oxygen tank, you can rest assured that ABC Insurance has you covered. Additionally, their flexible options allow you to customize the policy according to your specific needs, ensuring that you have the right level of coverage for your unique diving requirements.

These are just two examples of insurance providers that offer specialized coverage for scuba divers. It’s essential to compare the policies, coverage limits, and premiums to find the best fit for your diving activities and personal circumstances.

Pros and Cons of Each Provider

1. XYZ Insurance:

- Pros: High coverage limits, comprehensive policy features, and worldwide coverage.

- Cons: Premiums may be higher compared to standard life insurance policies.

When it comes to coverage limits, XYZ Insurance stands out from the crowd. Their high coverage limits ensure that you are adequately protected, even in the most extreme diving conditions. Additionally, their comprehensive policy features go above and beyond, providing you with the peace of mind you need while exploring the underwater world. However, it’s important to note that these extensive coverage options may come with slightly higher premiums compared to standard life insurance policies. But when it comes to your safety and protection, XYZ Insurance believes that it’s worth the investment.

2. ABC Insurance:

- Pros: Flexible options, coverage for diving equipment, and emergency evacuation coverage.

- Cons: Limited diving depth coverage compared to some other providers.

Flexibility is key when it comes to choosing the right life insurance policy for scuba divers, and ABC Insurance understands that. Their flexible options allow you to tailor the policy to your specific needs, ensuring that you have the right level of coverage for your diving activities. Additionally, their coverage for diving equipment gives you that extra layer of protection, knowing that not only are you covered, but your gear is too. However, it’s important to note that ABC Insurance may have some limitations when it comes to diving depth coverage. If you are an avid deep-sea diver, you may want to consider other providers that offer more extensive coverage in this regard.

Remember to consider your diving needs, budget, and overall requirements when evaluating different providers. It’s always a good idea to request quotes and speak with representatives to get a better understanding of the policies and coverage options.

How to Apply for Scuba Diving Life Insurance

If you’ve decided on a life insurance policy that meets your needs as a scuba diver, it’s time to learn how to apply.

Preparing for Medical Examinations

Some insurance providers may require you to undergo a medical examination to assess your overall health and diving fitness. It’s essential to prepare for these examinations by maintaining a healthy lifestyle and avoiding any activities that could affect your results, such as consuming alcohol or smoking.

Remember to disclose any pre-existing medical conditions or previous diving incidents accurately during the application process. Full transparency will ensure that the policy accurately reflects your specific circumstances.

Tips for Filling Out Your Application

When filling out the application for a scuba diving life insurance policy, be sure to provide accurate and complete information. Avoid any omissions or misrepresentations, as these could lead to future claim denials. If you have any questions or need clarification while filling out the application, don’t hesitate to reach out to the insurance provider for assistance.

Maintaining Your Life Insurance Policy as a Scuba Diver

Once you have obtained a life insurance policy as a scuba diver, it’s important to maintain it properly to ensure continued coverage and peace of mind.

Regular Health Check-ups and Risk Assessments

As a scuba diver, it’s crucial to prioritize your overall health and well-being. Regular health check-ups can help identify any potential health issues that could affect your diving fitness or coverage. It’s also essential to reassess your diving risks and adjust your policy if there are any changes in your diving habits or activities.

Updating Your Policy Based on Changes in Diving Habits

As your diving experience evolves, you may find yourself exploring new depths or engaging in different types of dives. It’s important to keep your insurance provider informed about any changes in your diving habits. This will ensure that your policy remains relevant and provides adequate coverage for your specific needs.

In conclusion, scuba diving is an exciting and rewarding activity that comes with its share of risks. As a responsible diver, it’s essential to prioritize your safety and protect yourself against unforeseen circumstances. By exploring and selecting the best life insurance policy for scuba divers, you can enjoy peace of mind knowing that you and your loved ones are financially protected while experiencing the wonders of the underwater world.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Life Insurance Policies for Scuba Divers

Case Study 1: Prudential- DiveSafe Discount for Secure Underwater Exploration

John, an avid scuba diver, is searching for a life insurance policy that aligns with his adventurous lifestyle. Prudential’s DiveSafe Discount catches his attention, offering up to a 12% discount for scuba divers.

The comprehensive coverage, coupled with financial incentives, makes Prudential the ideal choice for John. While aware of potential underwriting processes and coverage limitations, John values the DiveSafe Discount, emphasizing Prudential’s commitment to supporting secure underwater exploration.

Case Study 2: State Farm- Adventure Saver for the Daring Diver

Sarah, a passionate scuba enthusiast, seeks a life insurance policy that complements her adventurous spirit. State Farm’s Adventure Saver program, tailored for adventurous individuals, has become her preferred choice.

With competitive scuba diver discounts of up to 15% and an emphasis on a diverse range of coverage options, State Farm aligns with Sarah’s desire for tailored protection. Despite specific eligibility criteria, she appreciates the specialized approach and potential cost savings offered by State Farm’s Adventure Saver program.

Case Study 3: Transamerica- DiveGuard Protection for Comprehensive Safety

Michael, a seasoned scuba diver, prioritizes comprehensive coverage and unique features for his life insurance needs. Transamerica’s DiveGuard Protection, designed to cover a wide array of scuba diving-related incidents, captures his attention.

The competitive scuba diver discount of up to 18% and a substantial multi-policy discount make Transamerica an attractive choice. While navigating potential underwriting requirements and policy complexities, Michael values the financial stability and diverse policy options that Transamerica provides.

Frequently Asked Questions

What is scuba diving life insurance?

Scuba diving life insurance is a type of life insurance policy specifically designed for individuals who engage in scuba diving activities. It provides coverage and financial protection in the event of injury or death related to scuba diving.

Why do scuba divers need specialized life insurance?

Scuba diving involves certain risks that are not typically covered by standard life insurance policies. Specialized scuba diving life insurance ensures that divers have adequate coverage for accidents or fatalities that may occur during their underwater activities.

What factors should scuba divers consider when choosing a life insurance policy?

Scuba divers should consider several factors when selecting a life insurance policy. These include coverage for diving-related accidents, policy exclusions, premium costs, coverage limits, and the financial stability and reputation of the insurance provider.

What types of coverage are typically included in scuba diving life insurance policies?

Scuba diving life insurance policies usually include coverage for accidental death, dismemberment, and disability resulting from scuba diving accidents. Some policies may also provide coverage for medical expenses related to diving injuries.

Are there any exclusions or limitations in scuba diving life insurance policies?

Yes, scuba diving life insurance policies often have exclusions or limitations. Common exclusions may include diving beyond certain depths, engaging in technical or cave diving, participating in competitive diving, or diving while under the influence of alcohol or drugs. It is important to carefully review the policy terms and conditions to understand any limitations.

How can scuba divers find the best life insurance policies for their needs?

Scuba divers can find the best life insurance policies for their needs by researching and comparing different insurance providers. It is recommended to consult with insurance agents or brokers who specialize in scuba diving life insurance to ensure they understand the unique requirements of divers and can provide suitable options.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.