Best Life Insurance Policies for Transgender People in 2026 (Top 10 Companies)

Prudential, AIG, and Security Benefit offer the best life insurance policies for transgender people, providing customized coverage, competitive rates, and excellent service. Understand the importance of life insurance for transgender individuals for peace of mind.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Michael Leotta

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated February 2024

163 reviews

163 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

163 reviews

163 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Life insurance is an important financial tool that provides protection and peace of mind to individuals and their loved ones. It ensures that financial obligations are met, even in the event of unforeseen circumstances such as illness, accidents, or death.

Our Top 10 Best Companies: Best Life Insurance Policies For Transgender People

| Company | Rank | See Pros/Cons | LGBTQ+ Inclusive Discount | Transgender Support Discount | Best For |

|---|---|---|---|---|---|

| #1 | Prudential | Up to 12% | Up to 15% | LGBTQ+ Discount | |

| #2 | AIG | Up to 15% | Up to 18% | LGBTQ+ Savings | |

| #3 | Security Benefit Life | Up to 10% | Up to 12% | Inclusive Security |

| #4 | MetLife | Up to 10% | Up to 12% | Diverse Advantage | |

| #5 | Guardian Life | Up to 12% | Up to 15% | Inclusive Guard | |

| #6 | Transamerica | Up to 10% | Up to 12% | LGBTQ+ Ease | |

| #7 | New York Life | Up to 15% | Up to 18% | Inclusive Support |

| #8 | MassMutual | Up to 12% | Up to 15% | Trans Savings | |

| #9 | Northwestern Mutual | Up to 10% | Up to 12% | Trans Secure | |

| #10 | State Farm | Up to 8% | Up to 10% | Trans Support |

However, obtaining appropriate life insurance can be challenging for transgender individuals due to various factors, including discrimination and bias in insurance policies.

In this article, we will explore the importance of life insurance for transgender people, the challenges they face in obtaining coverage, and the top life insurance policies available to them.

#1 – Prudential: LGBTQ+ Leader

Prudential stands out as a leader in LGBTQ+ inclusive life insurance, offering tailored coverage and a commitment to fostering an inclusive and supportive environment.Zach Fagiano Licensed Insurance Broker

Pros

- LGBTQ+ discount: Prudential offers an inclusive discount for the LGBTQ+ community, providing up to 12% savings.

- Transgender support discount: The company supports transgender individuals with a discount of up to 15%, showcasing commitment to diverse inclusion.

- Brand reputation: Prudential is a well-established and reputable insurance company, instilling confidence in customers.

- Customized solutions: Known for offering a range of insurance products, Prudential allows customers to tailor coverage to their specific needs.

- Financial stability: Prudential’s long-standing financial stability provides assurance that the company can fulfill its commitments.

Cons

- Limitation in discounts: While offering discounts, the maximum discount percentages may be considered modest compared to some competitors.

- Complex policy structure: The extensive range of insurance products may lead to a complex policy structure, potentially confusing customers.

Read more: The Prudential Insurance Company of America Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AIG: Inclusive Savings Champion

Pros

- LGBTQ+ savings: AIG provides a substantial discount of up to 15% for the LGBTQ+ community, promoting inclusivity.

- Transgender support discount: AIG’s commitment is evident through a significant up to 18% discount for transgender individuals.

- Competitive discounts: AIG’s discount rates are comparatively higher, attracting customers looking for substantial savings.

- Global presence: AIG’s extensive global presence may appeal to customers seeking an insurer with a broad reach.

- Innovative offerings: Known for innovation, AIG may provide cutting-edge insurance products and services.

Cons

- Premium costs: AIG’s innovative offerings and higher discount rates may lead to slightly higher premium costs.

- Customer service challenges: Some customers have reported challenges with AIG’s customer service, which could impact the overall experience.

Read more: AIG Assurance Company Review

#3 – Security Benefit Life: Security Through Inclusion

Pros

- Inclusive security: The company’s focus on “Inclusive Security” is reflected in discounts of up to 10%, catering to a diverse customer base.

- Stability and trust: Security Benefit Life’s emphasis on security may appeal to customers seeking a stable and trustworthy insurance provider.

- Flexible coverage: The company’s commitment to inclusivity may extend to providing flexible coverage options to meet individual needs.

- Educational resources: Security Benefit Life may offer educational resources to help customers make informed decisions about their insurance coverage.

- Positive customer feedback: Positive customer feedback highlights satisfaction with Security Benefit Life’s services.

Cons

- Limited discount range: The discount range, while inclusive, may be perceived as less competitive compared to some other insurers.

- Limited global presence: Security Benefit Life may have a more limited global presence compared to larger competitors.

Read more: Security Benefit Life Insurance Company Review

#4 – MetLife: Diverse Advantage Innovator

Pros

- Diverse advantage: MetLife’s “Diverse Advantage” initiative, offering up to 10-12% discounts, demonstrates commitment to diversity and inclusion.

- Financial strength: MetLife’s strong financial standing provides assurance to policyholders about the company’s ability to meet its obligations.

- Variety of products: MetLife’s diverse product range allows customers to find insurance solutions that align with their unique needs.

- Customer support: Positive customer reviews suggest a strong customer support system, enhancing the overall customer experience.

- Community engagement: MetLife may engage in community initiatives, contributing to its positive brand image.

Cons

- Moderate discounts: The discount rates, while supportive, may not be as high as those offered by some competitors.

- Complex policy options: The variety of products could result in a potentially complex decision-making process for customers.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Guardian Life: Inclusive Guard Protector

Pros

- Inclusive guard: Guardian Life’s commitment to inclusivity is evident in its up to 12% discount, catering to the LGBTQ+ community.

- Transgender support discount: Offering up to 15% discount for transgender individuals further showcases Guardian Life’s dedication to diversity.

- Customizable policies: Guardian Life may provide customizable insurance policies to meet the specific needs of its diverse customer base.

- Customer satisfaction: Positive customer reviews highlight satisfaction with Guardian Life’s services and support.

- Longevity and stability: Guardian Life’s long history in the insurance industry may instill confidence in customers regarding the company’s stability.

Cons

- Limited discounts: While offering inclusive discounts, the rates may be considered moderate compared to some competitors.

- Smaller market share: Guardian Life’s market share may be smaller compared to larger insurance providers.

Read more: Guardian Life Insurance Company of America Review

#6 – Transamerica: LGBTQ+ Ease Specialist

Pros

- LGBTQ+ ease: Transamerica offers up to a 10% LGBTQ+ Inclusive Discount, providing a balance between savings and inclusivity.

- Transgender support discount: The company’s commitment to transgender support is evident with a discount of up to 12%.

- Simplicity and accessibility: Transamerica’s focus on LGBTQ+ Ease may attract customers looking for a straightforward and accessible insurance experience.

- Financial wellness resources: Transamerica may provide resources and tools to promote financial wellness among its policyholders.

- Online presence: The company’s strong online presence may offer convenient digital access for customers to manage their policies.

Cons

- Moderate discount rates: While inclusive, the discount rates may be perceived as moderate compared to some competitors.

- Limited global presence: Transamerica may have a more regional rather than a global presence.

Read more: Transamerica Life Insurance Company Review

#7 – New York Life: Supportive Inclusion Expert

Pros

- Inclusive support: New York Life offers substantial discounts of up to 15%, showcasing a commitment to inclusive support.

- Transgender support discount: The company provides an even higher discount of up to 18% for transgender individuals.

- Financial strength: New York Life’s long-standing financial stability provides assurance to policyholders about the company’s ability to meet its obligations.

- Comprehensive services: The company may offer a range of insurance and financial products, allowing customers to fulfill multiple needs in one place.

- Community engagement: Positive reviews highlight New York Life’s involvement in community initiatives, enhancing its reputation.

Cons

- Potential higher premiums: The comprehensive services and higher discount rates may lead to comparatively higher premium costs.

- Complex product offerings: The variety of services offered may result in a complex decision-making process for customers.

Read more: New York Life Insurance Company Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – MassMutual: Trans Savings Pioneer

Pros

- Trans savings: MassMutual caters specifically to the transgender community with discounts of up to 12%, demonstrating targeted support.

- LGBTQ+ inclusive discount: The company offers up to 12% for the LGBTQ+ community, aligning with its commitment to inclusivity.

- Financial planning services: MassMutual may provide financial planning services, assisting customers in making informed decisions.

- Customer satisfaction: Positive customer feedback suggests a strong customer service system, contributing to overall satisfaction.

- Stability and longevity: MassMutual’s long history in the industry may instill confidence in customers regarding the company’s stability.

Cons

- Moderate discount rates: While supportive, the discount rates may be perceived as moderate compared to some competitors.

- Limited global presence: MassMutual may have a more regional rather than a global presence.

#9 – Northwestern Mutual: Trans Secure Provider

Pros

- Trans secure: Northwestern Mutual focuses on the transgender community with discounts of up to 10%, offering a sense of security.

- LGBTQ+ inclusive discount: The company provides up to 12% for the LGBTQ+ community, aligning with its commitment to inclusivity.

- Customizable policies: Northwestern Mutual may offer customizable insurance policies to meet the specific needs of its diverse customer base.

- Financial strength: The company’s financial strength provides assurance to policyholders about its ability to fulfill commitments.

- Educational resources: Northwestern Mutual may offer educational resources to help customers make informed decisions about their insurance coverage.

Cons

- Moderate discount rates: While inclusive, the discount rates may be perceived as moderate compared to some competitors.

- Potentially higher premiums: The comprehensive services and higher discount rates may lead to comparatively higher premium costs.

Read more: The Northwestern Mutual Life Insurance Company Review

#10 – State Farm: Trans Support Leader

Pros

- Trans support: State Farm offers discounts of up to 8% for the transgender community, providing targeted support.

- LGBTQ+ inclusive discount: The company provides up to 10% for the LGBTQ+ community, aligning with its commitment to inclusivity.

- Wide network: State Farm’s extensive network of agents and offices may provide convenient access and personalized service.

- Financial strength: The company’s financial stability provides assurance to policyholders about its ability to meet its obligations.

- Diverse insurance products: State Farm offers a variety of insurance products, allowing customers to find solutions that align with their unique needs.

Cons

- Moderate discount rates: While inclusive, the discount rates may be perceived as moderate compared to some competitors.

- Variable customer service: Customer service experiences may vary based on the specific State Farm agent or office.

Read more: State Farm Life Insurance Review

Understanding the Importance of Life Insurance

Life insurance plays a crucial role in securing the financial future of individuals and their families. It acts as a safety net, providing financial support to cover expenses such as mortgage payments, education costs, and daily living expenses in case of the policyholder’s unexpected demise. Without adequate life insurance coverage, loved ones may be left struggling to cope with the financial burden, adding to the emotional distress they are already experiencing.

For transgender individuals, life insurance can be even more important. Transitioning is an important and often costly process, involving medical procedures, hormone therapy, and sometimes even surgery. Life insurance can help ensure that the financial resources needed for these procedures are available without placing an additional burden on family members.

Why Life Insurance is Essential

Life insurance provides a financial safety net for transgender individuals, helping to protect their loved ones against potential financial hardship in the event of their untimely passing. It can help cover funeral expenses, outstanding debts, medical bills, and provide financial support for dependents. Having life insurance is especially important for those who may not have a traditional support system in place.

Furthermore, life insurance can also act as an investment tool. Some policies offer cash value accumulation, allowing policyholders to borrow against the policy or even surrender it for a cash payout if needed. This can provide additional financial flexibility and options for transgender individuals as they navigate their unique circumstances.

In addition, life insurance can provide a sense of peace of mind. Knowing that loved ones will be taken care of financially can alleviate stress and anxiety, allowing individuals to focus on their personal growth and well-being. It can serve as a foundation for building a secure and stable future.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Misconceptions About Life Insurance

Despite the importance of life insurance, there are several common misconceptions that can deter transgender individuals from seeking coverage. One such misconception is that transgender people are automatically denied coverage or face higher premiums. While discrimination does exist within the insurance industry, many companies have taken steps to be more inclusive and provide coverage to transgender individuals.

Insurance providers are increasingly recognizing the importance of diversity and inclusion, and some have specific policies in place to cater to the unique needs of transgender individuals. By working with knowledgeable insurance agents and brokers who understand the intricacies of transgender life insurance, individuals can find suitable coverage that meets their specific requirements.

Another misconception is that life insurance is only for older individuals or those with dependents. In reality, life insurance can be beneficial for people of all ages, as it provides financial protection and peace of mind regardless of whether or not they have dependents. It is an investment in one’s own future and the well-being of loved ones.

Moreover, life insurance can also be a valuable tool for wealth creation and preservation. Certain policies offer the opportunity to accumulate cash value over time, which can be used for various purposes such as supplementing retirement income, funding education expenses, or even starting a business. This flexibility can be particularly advantageous for transgender individuals who may have unique financial goals and aspirations.

Additionally, life insurance can be used as a means of charitable giving. By naming a charitable organization as a beneficiary, individuals can leave a lasting legacy and support causes that are important to them. This can be a meaningful way for transgender individuals to contribute to their communities and make a positive impact beyond their lifetime.

Challenges Faced by Transgender People in Getting Life Insurance

Despite the importance of life insurance, transgender individuals often face unique challenges when seeking coverage. These challenges can include discrimination and bias in insurance policies, as well as the impact of medical transition on insurance eligibility and premiums.

Transgender individuals have long struggled to access affordable and inclusive life insurance coverage. The discrimination and bias they face in insurance policies have been significant barriers to obtaining the protection they need. In the past, many insurance companies categorized being transgender as a pre-existing condition or a risk factor, leading to denials of coverage or higher premiums.

Imagine the frustration and disappointment of transgender individuals who have worked hard to build a secure future for themselves and their loved ones, only to be met with rejection or exorbitant costs when seeking life insurance. This discrimination not only undermines their financial security but also sends a message that their lives and well-being are less valued.

Discrimination and Bias in Insurance Policies

Discrimination and bias in insurance policies have been significant barriers for transgender individuals seeking life insurance. However, it is important to acknowledge that progress has been made in recent years. Some insurance providers have recognized the need for change and have taken steps to adopt more inclusive policies.

These progressive insurance companies are striving to ensure that transgender individuals are treated fairly and offered coverage on the same terms as cisgender individuals. By eliminating discriminatory practices and biases, they are working towards a more equitable insurance landscape for all.

It is heartening to see these positive changes, but there is still much work to be done. Advocacy groups and transgender rights organizations continue to push for further reforms and increased awareness of the unique challenges faced by transgender individuals in accessing life insurance.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Medical Transition and Its Impact on Insurance

Medical transition, including hormone therapy and gender-affirming surgeries, can also impact insurance eligibility and premiums. While these procedures are essential for many transgender individuals to align their physical appearance with their gender identity, insurance providers may view them as high-risk or pre-existing conditions.

This perception can lead to increased premiums or even denial of coverage altogether. Transgender individuals find themselves caught in a frustrating catch-22 situation: they need medical transition to live authentically, but this very process can hinder their ability to obtain affordable life insurance.

It is crucial for transgender individuals to research insurance providers that understand and support their medical transition journey. Finding insurance companies that recognize the importance of gender-affirming care and do not penalize individuals for seeking such treatment is vital.

Furthermore, insurance providers should strive to educate their underwriters and agents about the medical realities of transgender individuals. By fostering a better understanding of gender identity and the necessity of medical transition, insurance companies can ensure fair and inclusive coverage for all.

Overall, the challenges faced by transgender individuals in obtaining life insurance are not only a matter of financial security but also reflect the broader societal issues of discrimination and bias. It is essential for insurance providers, policymakers, and society as a whole to work together to create a more inclusive and equitable landscape for transgender individuals seeking life insurance.

Top Life Insurance Policies for Transgender Individuals

Fortunately, there are insurance companies that have recognized the importance of providing inclusive coverage for transgender individuals. When choosing a life insurance policy, it is essential to consider several factors, including coverage amount, premiums, and policy terms. Here are some top life insurance policies to consider:

Features to Look for in a Life Insurance Policy

When it comes to selecting a life insurance policy, transgender individuals have unique considerations. It’s crucial to find a policy that not only meets your financial needs but also acknowledges and respects your gender identity. Here are some key features to look for:

Gender-Neutral Underwriting: Look for companies that have adopted gender-neutral underwriting practices, treating transgender individuals the same as cisgender individuals. This ensures that you are not discriminated against based on your gender identity.

Competitive Premiums: Compare premiums from different insurance providers to ensure you are getting the best value for your coverage. Some providers offer lower premiums for transgender individuals who have completed their medical transition. It’s important to find a policy that provides affordable coverage while still meeting your specific needs.

Flexible Coverage Options: Choose a policy that meets your specific needs. Consider the coverage amount, policy term, and any additional riders or benefits that may be important to you. For example, if you have dependents or outstanding debts, you may want to opt for a higher coverage amount to ensure their financial security.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

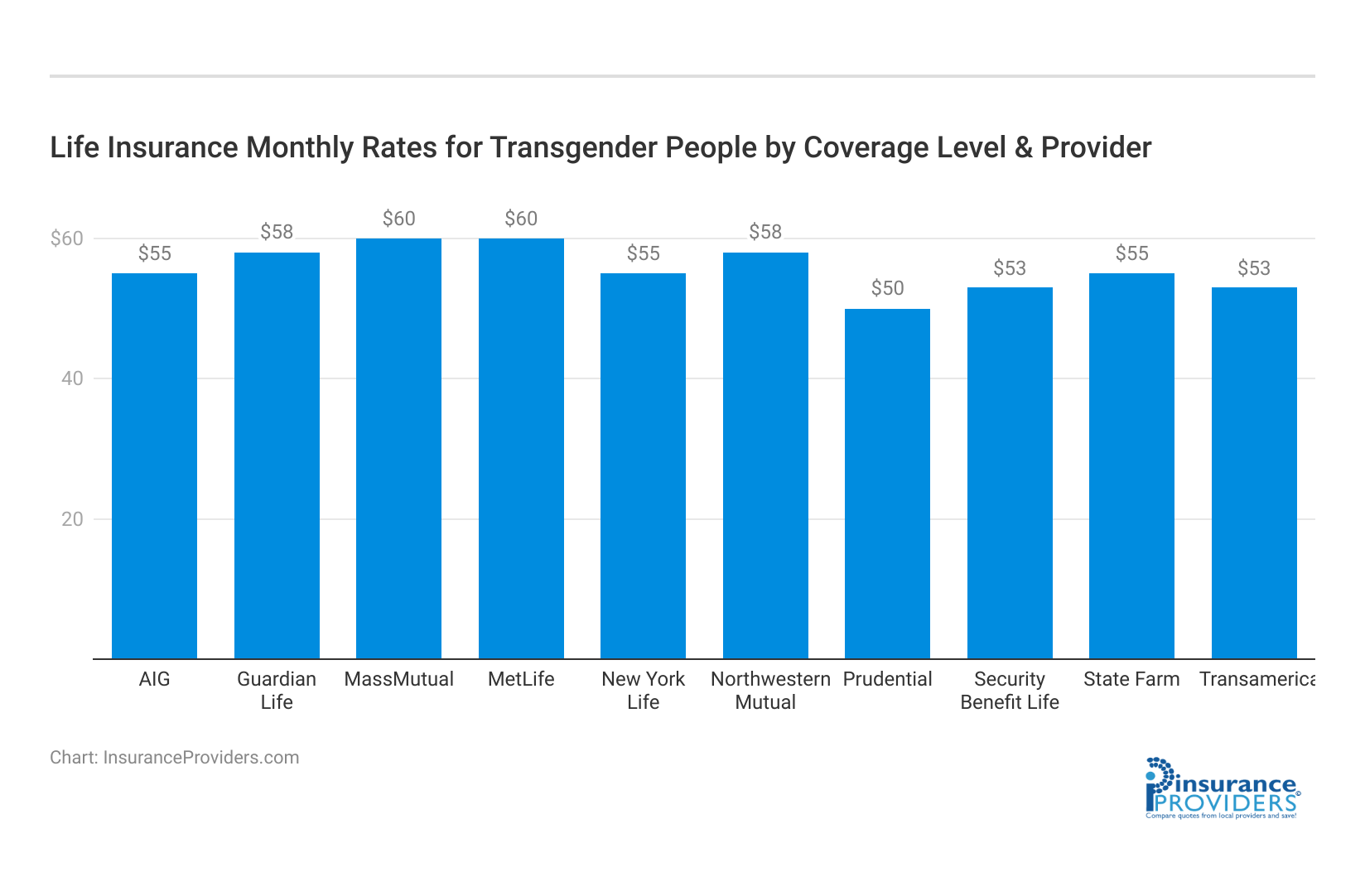

Comparing Different Insurance Providers

When comparing different insurance providers, it is crucial to consider their reputation, financial stability, and customer service. Look for insurers that have a track record of inclusive practices and positive feedback from transgender policyholders. Here are some additional factors to consider:

Reputation and Inclusive Practices: Research the insurance provider’s reputation and commitment to inclusivity. Look for companies that actively support and advocate for transgender rights and have policies in place to ensure fair and equal treatment for all policyholders.

Financial Stability: It is important to choose an insurance provider that is financially stable and has a strong track record of fulfilling their obligations to policyholders. Check their financial ratings and stability to ensure that they will be able to pay out claims when needed.

Customer Service: Consider the quality of customer service provided by the insurance provider. Look for companies that have a dedicated customer support team knowledgeable about transgender-specific concerns and who can assist you throughout the policy application and claims process.

Remember, finding the right life insurance policy is a personal decision that should be based on your individual needs and circumstances. It’s always a good idea to consult with an insurance broker or financial advisor who can provide expert guidance tailored to your specific situation. By taking the time to research and compare different insurance providers, you can find a policy that offers the coverage and support you deserve as a transgender individual.

Navigating the Application Process

Applying for life insurance can be an overwhelming process, but with the right preparation, it can be manageable. Here are some tips to help transgender individuals navigate the application process:

Tips for a Successful Application

Gather All Necessary Documentation: Prepare any required documentation, such as medical records, legal documents, and proof of identity.

Work with an Experienced Insurance Broker: An insurance broker with experience in working with transgender clients can provide valuable guidance and help navigate the application process.

Disclose Information Transparently: Be open and transparent about your medical history, including any gender-affirming procedures or treatments you have undergone.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dealing with Potential Rejections

While progress has been made, there may still be instances where transgender individuals face rejection or limited coverage options. If you encounter such a situation, it is essential to seek guidance from LGBTQ+ advocacy organizations or insurance professionals who can help you explore alternative options and advocate for your rights.

Legal Rights of Transgender People in Life Insurance

Transgender individuals are entitled to the same legal rights and protections as cisgender individuals when it comes to insurance coverage. Many countries have anti-discrimination laws that protect individuals from being denied coverage or charged higher premiums based on their gender identity. Understanding these rights is crucial in ensuring fair and equal access to life insurance.

Understanding Anti-Discrimination Laws

Anti-discrimination laws vary from country to country, but in general, they protect transgender individuals from being discriminated against by insurance providers. These laws prohibit insurers from denying coverage, charging higher premiums, or imposing exclusionary policies based solely on gender identity. If you believe your rights have been violated, it is essential to consult with legal professionals or LGBTQ+ advocacy organizations for guidance.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Advocacy Groups and Resources for Support

There are numerous advocacy groups and resources available to support transgender individuals in navigating the insurance landscape. These organizations provide valuable information, support, and guidance on life insurance options for transgender individuals. Some notable resources include transgender-specific LGBTQ+ advocacy groups, community centers, and online forums where individuals can share their experiences and seek advice.

In conclusion, life insurance is an important financial tool for transgender individuals, providing protection and peace of mind for themselves and their loved ones. While the challenges faced by transgender individuals in obtaining life insurance are significant, progress is being made as more insurance providers adopt inclusive policies. By understanding the importance of life insurance, researching available options, and seeking support from advocacy groups and professionals, transgender individuals can secure the best life insurance policies that meet their specific needs and provide the financial security they deserve.

Case Studies in LGBTQ+ Inclusive Insurance: Learning From Industry Leaders

Case Study 1: Prudential – LGBTQ+ Leader

Emily, a 30-year-old transgender professional, recently got married and is considering life insurance. Prudential’s LGBTQ+ discount of up to 12% caught her attention, and she decided to explore their offerings.

The seamless application process and the personalized approach to LGBTQ+ inclusion made her feel seen and valued. Emily appreciated the tailored coverage options and the financial benefits of Prudential’s LGBTQ+ discount, providing her with a sense of security as she builds a life with her spouse.

Case Study 2: AIG – Inclusive Savings Champion

Alex, a 35-year-old non-binary entrepreneur, is on the lookout for life insurance that aligns with their values. AIG’s reputation as an inclusive savings champion drew Alex to explore their options. The up to 15% LGBTQ+ savings not only appealed to their financial sensibilities but also reflected AIG’s commitment to supporting the LGBTQ+ community.

The straightforward application process and competitive rates solidified Alex’s choice, showcasing how AIG’s inclusive policies resonate with those seeking financial security.

Case Study 3: Security Benefit Life – Security Through Inclusion

Taylor, a 40-year-old genderqueer individual, prioritizes security when it comes to life insurance. Considering Security Benefit Life’s emphasis on inclusive security, Taylor decided to opt for their coverage.

The up to 10% LGBTQ+ discount and 12% transgender support played a crucial role in Taylor’s decision, providing not just financial protection but also a sense of belonging. Taylor appreciated the company’s commitment to creating a secure environment for individuals across the gender spectrum, reinforcing the importance of inclusive security in insurance.

Frequently Asked Questions

What are the factors to consider when choosing a life insurance policy for transgender individuals?

When choosing a life insurance policy for transgender people, it is important to consider factors such as the coverage amount, premium affordability, policy exclusions related to gender transition, and the insurer’s track record of LGBTQ+ inclusivity.

Are transgender individuals eligible for life insurance policies?

Yes, transgender individuals are generally eligible for life insurance policies. Insurance companies cannot discriminate based on gender identity when offering coverage. However, specific policy terms and conditions may vary among insurers.

What is the impact of gender transition on life insurance premiums?

The impact of gender transition on life insurance premiums can vary depending on the insurer and policy. Some insurers may adjust premiums based on the individual’s current gender identity, while others may consider factors such as medical history and hormone therapy. It is advisable to compare quotes from multiple insurers to find the most affordable option.

Do life insurance policies cover gender-affirming surgeries or treatments?

Life insurance policies typically do not cover gender-affirming surgeries or treatments. However, some policies may include coverage for complications arising from these procedures. It is important to review the policy terms and conditions or consult with an insurance professional to understand the extent of coverage.

Can transgender individuals disclose their gender identity during the life insurance application process?

Yes, transgender individuals have the option to disclose their gender identity during the life insurance application process. However, it is not mandatory to disclose this information. It is advisable to review the insurer’s policies regarding gender disclosure and consult with an insurance professional for guidance.

What are the key features to look for in a life insurance policy for transgender individuals?

Key features to look for include gender-neutral underwriting, competitive premiums, flexible coverage options, and a commitment to LGBTQ+ inclusivity by the insurance provider.

How can transgender individuals navigate the life insurance application process successfully?

To navigate the application process, transgender individuals should gather necessary documentation, work with experienced insurance brokers, and disclose relevant information transparently.

What legal rights do transgender people have in relation to life insurance?

Transgender individuals have the same legal rights and protections as cisgender individuals. Anti-discrimination laws in many countries prohibit insurers from denying coverage or charging higher premiums based on gender identity.

What challenges do transgender people face in getting life insurance?

Challenges include discrimination and bias in insurance policies, as well as the impact of medical transition on insurance eligibility and premiums.

Which insurance companies are known for providing inclusive life insurance coverage for transgender individuals?

Prudential, AIG, Security Benefit Life, and others are recognized for their inclusive policies. It is essential to compare offerings and choose a company with a strong commitment to LGBTQ+ inclusivity.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.