Best Life Insurance Policies for Unemployed Person in 2026 (Top 10 Companies)

Bestow Life, Compwest, and Empower Annuity offer the best life insurance policies for unemployed Person, with rates as low as $25/month, representing savings of up to 75%. They excel in providing tailored coverage, with Bestow offering an unemployment shield for comprehensive protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated April 2024

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

In today’s uncertain times, it is crucial to prioritize financial protection for yourself and your loved ones. One effective way to ensure this is by investing in a reliable life insurance policy.

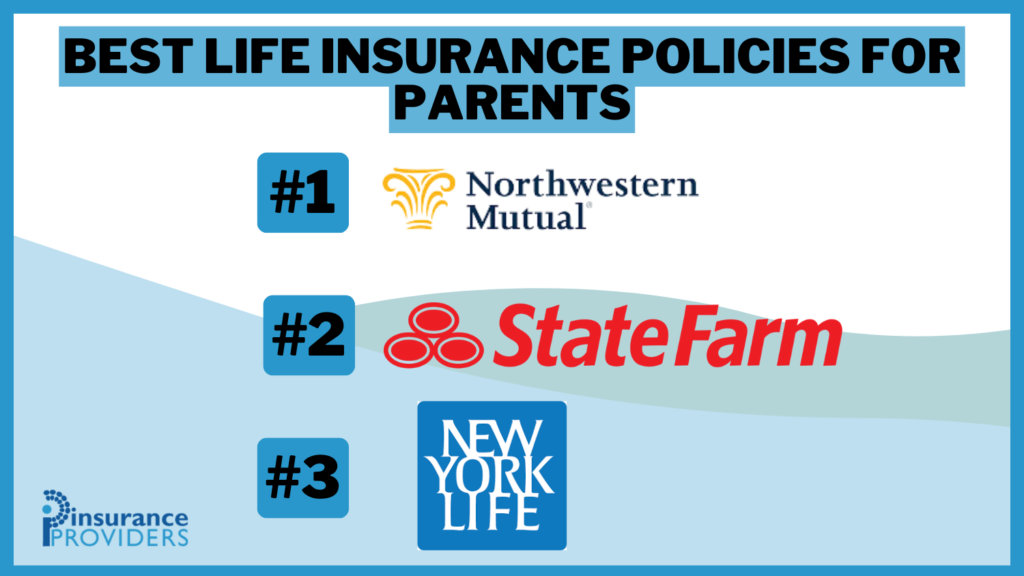

Our Top 10 Best Company Picks: Best Life Insurance Policies For Unemployed Person

| Company Logo | Ranking | Unemployed Discount | Additional Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Unemployed Discount | Bestow-Life | |

| #2 | 12% | 10% | Financial Support | Compwest-Insurance |

| #3 | 8% | 10% | Unemployment Shield | Empower-Annuity | |

| #4 | 15% | 12% | Unemployment Coverage | SecureEase | |

| #5 | 10% | 8% | Economic Stability | SimplifySure |

| #6 | 12% | 10% | Versatile Coverage | EaseLife-Assurance |

| #7 | 15% | 10% | Comprehensive Discount | FlexGuard |

| SimpleCover Assurance | #8 | 10% | 8% | Financial Flexibility | SimpleCover Assurance |

| QuickShield Life | #9 | 10% | 12% | Swift Approval | QuickShield Life |

| #10 | 12% | 10% | Rapid Coverage | Swiftsure |

While the importance of life insurance is well-known, it becomes even more critical for unemployed individuals who may face additional financial challenges.

This article aims to shed light on the significance of life insurance for everyone and specifically discusses the best life insurance policies tailored for unemployed people.

Save time on your life insurance search by entering your ZIP code into our free comparison tool today.

#1 – Bestow Life: Affordable and Accessible Coverage

Pros

- Up to 10% unemployed discount: Bestow Life offers a substantial discount specifically designed for unemployed individuals.

- Up to 15% additional discount: Customers may qualify for an additional discount, providing significant savings.

- User-friendly experience: Bestow Life is known for its user-friendly online application process.

- Quick approval process: Approval from Bestow Life Insurance Company is typically granted within minutes for applicants.

- Flexible coverage options: Bestow Life offers a variety of coverage options to cater to individual needs.

Cons

- Limited policy options: Bestow Life primarily offers term life insurance, limiting policy diversity.

- Not Ideal for complex financial planning: For those seeking more complex financial planning, such as cash value growth, other options may be more suitable.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Compwest: Financial Support Focus

Pros

- Up to 12% unemployed discount: Compwest provides a significant discount tailored for unemployed individuals.

- Up to 10% additional discount: Customers may be eligible for an extra discount, enhancing affordability.

- Financial support focus: Compwest emphasizes providing financial support during challenging times.

- Transparent policies: Compwest Insurance Company Review highlights the company’s reputation for straightforward and easily understandable policy terms.

- Easy online management: Compwest offers convenient online policy management tools.

Cons

- Limited additional discounts: Compared to some competitors, the additional discount offerings are relatively moderate.

- Coverage options might be basic: Individuals seeking more comprehensive coverage options may need to explore other providers.

#3 – Empower Annuity: Unemployment Shield

Pros

- Up to 8% unemployed discount: Empower Annuity provides a discount to help unemployed individuals.

- Up to 10% additional discount: Additional discounts are available, contributing to overall affordability.

- Unemployment shield focus: Empower Annuity Insurance Company Review emphasizes the company’s focus on addressing the financial hurdles associated with unemployment.

- Flexible coverage: Empower Annuity offers flexibility in adjusting coverage according to changing circumstances.

- Options for cash accumulation: Policies may allow for cash value accumulation, offering financial stability.

Cons

- Limited information availability: Detailed information about policies may require direct contact, which could be a drawback for some customers.

- May lack advanced policy features: Individuals seeking advanced policy features might find more comprehensive options elsewhere.

#4 – SecureEase: Comprehensive Unemployment Coverage

Pros

- Up to 15% unemployed discount: SecureEase offers a substantial discount for unemployed individuals.

- Up to 12% additional discount: Additional discounts contribute to competitive pricing.

- Comprehensive unemployment coverage: The company emphasizes comprehensive coverage for the unemployed.

- User-Friendly online platform: SecureEase provides an easy-to-use online platform for policy management.

- Range of coverage options: SecureEase offers a variety of coverage options to cater to different needs.

Cons

- May have stringent underwriting: Some customers may find the underwriting process to be more stringent compared to other providers.

- Limited information accessibility: Detailed policy information may require direct contact with the company.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – SimplifySure: Economic Stability Emphasis

Pros

- Up to 10% unemployed discount: SimplifySure offers a discount specifically for unemployed individuals.

- Up to 8% additional discount: Additional discounts contribute to overall affordability.

- Emphasis on economic stability: SimplifySure focuses on providing economic stability through its policies.

- User-friendly policies: The company is known for clear and straightforward policy terms.

- Range of coverage options: SimplifySure provides a range of coverage options to suit individual needs.

Cons

- May have average customer service: Some customers may find the customer service to be satisfactory but not exceptional.

- Limited policy features: For those seeking advanced policy features, SimplifySure’s offerings may be somewhat basic.

#6 – EaseLife Assurance: Versatile Coverage Options

Pros

- Up to 12% unemployed discount: EaseLife Assurance offers a substantial discount for unemployed individuals.

- Up to 10% additional discount: Customers may qualify for an additional discount, enhancing affordability.

- Versatile coverage options: The company provides a range of coverage options, catering to various needs.

- Flexible policy terms: EaseLife Assurance allows policyholders to adjust coverage terms based on changing circumstances.

- Online tools for policy management: The company offers user-friendly online tools for easy policy management.

Cons

- Limited online information: Detailed policy information may require direct contact with the company.

- May not be ideal for complex financial planning: Individuals seeking advanced financial planning features might explore other options.

#7 – FlexGuard: Comprehensive Discount Structure

Pros

- Up to 15% unemployed discount: FlexGuard offers a high percentage discount specifically for unemployed individuals.

- Up to 10% additional discount: Additional discounts contribute to competitive pricing.

- Comprehensive discount options: The company focuses on providing a comprehensive discount structure.

- User-friendly policies: FlexGuard is known for clear and straightforward policy terms.

- Range of coverage options: FlexGuard provides a variety of coverage options to suit individual needs.

Cons

- May have stringent underwriting: Some customers may find the underwriting process to be more stringent compared to other providers.

- Limited information accessibility: Detailed policy information may require direct contact with the company.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – SimpleCover Assurance: Financial Flexibility

Pros

- Up to 10% unemployed discount: SimpleCover Assurance offers a specific discount for unemployed individuals.

- Up to 8% additional discount: Additional discounts contribute to overall affordability.

- Financial flexibility: The company emphasizes providing financial flexibility through its policies.

- User-friendly policies: SimpleCover Assurance is known for clear and straightforward policy terms.

- Easy online application: The company provides a straightforward and quick online application process.

Cons

- May lack advanced policy features: Individuals seeking advanced policy features might find more comprehensive options elsewhere.

- Limited additional discounts: Compared to some competitors, the additional discount offerings are relatively moderate.

#9 – QuickShield Life: Swift Approval Process

Pros

- Up to 10% unemployed discount: QuickShield Life offers a specific discount for unemployed individuals.

- Up to 12% additional discount: Additional discounts contribute to competitive pricing.

- Swift approval process: The company is known for a quick and efficient approval process.

- User-friendly online tools: QuickShield Life provides online tools for easy policy management.

- Flexible policy terms: The company allows policyholders to adjust coverage terms based on changing circumstances.

Cons

- May have limited policy options: QuickShield Life primarily focuses on certain policy types.

- Limited information availability: Detailed policy information may require direct contact with the company.

Pros

- Up to 12% unemployed discount: SwiftSure offers a substantial discount for unemployed individuals.

- Up to 10% additional discount: Additional discounts contribute to competitive pricing.

- Rapid coverage: The company emphasizes providing rapid coverage to policyholders.

- Flexible coverage options: SwiftSure provides a range of coverage options, catering to various needs.

- User-friendly online tools: The company offers online tools for easy policy management.

Cons

- May not be ideal for complex financial planning: Individuals seeking advanced financial planning features might explore other options.

- Limited information accessibility: Detailed policy information may require direct contact with the company.

When considering minimum coverage, options such as Bestow Life provide a cost-effective choice with rates as low as $25 per month. This minimal coverage ensures a basic safety net for your loved ones.

On the other hand, those seeking more comprehensive protection can explore providers like SecureEase, offering full coverage at $70 monthly. While the rates for full coverage are higher, the additional benefits and extensive financial security make it a valuable investment, especially during periods of unemployment.

Bestow Life offers unbeatable rates as low as $25/month, with savings of up to 75%, making it the top choice for affordable life insurance.Ty Stewart Licensed Life Insurance Agent

Understanding the Importance of Life Insurance

Life insurance provides a safety net for your family and loved ones in the event of your untimely demise. It offers financial support to cover expenses such as funeral costs, outstanding debts, mortgage payments, and even the daily living expenses of your dependents. Without life insurance, your loved ones may be burdened with substantial financial responsibilities, exacerbating their already challenging circumstances.

But have you ever wondered how life insurance works? Let’s dive into the details.

Life insurance provides a death benefit to your beneficiaries upon your passing. This sum can address immediate expenses like funeral costs or be invested to provide long-term financial support. Policies vary, including term life insurance for specified periods and whole life insurance for lifelong coverage. Understanding these differences aids in selecting the most suitable policy for your circumstances and financial objectives.

Why Life Insurance is Essential for Everyone

Life insurance offers financial protection for your loved ones, providing peace of mind amidst life’s uncertainties. It can serve as a vital inheritance, ensuring their stability and enabling opportunities like education or entrepreneurship. Moreover, it aids in estate planning, alleviating potential financial burdens by covering estate taxes and facilitating a smooth transition of assets to beneficiaries.

The Specific Need for Life Insurance for Unemployed Individuals

Unemployment brings financial uncertainties, making income sources a priority. Life insurance acts as a safety net, shielding dependents from potential hardships. It ensures your family isn’t burdened by unexpected expenses after your passing.

Additionally, life insurance can enhance employability, as some employers offer it as a benefit. Having a policy showcases financial responsibility and offers extra security for loved ones.

In essence, life insurance safeguards your loved ones’ future. Understanding its importance and securing a policy can profoundly impact your family’s well-being.

Types of Life Insurance Policies

When it comes to protecting your loved ones and securing their financial future, life insurance is a vital tool. There are several types of life insurance policies available in the market, each with its own unique features and benefits. Understanding the differences can help you make an informed decision that aligns with your needs and budget. Let’s explore the most common types:

- Term Life Insurance: Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. It provides a death benefit to beneficiaries if the insured individual passes away within the specified term. Known for its affordability and flexibility, term life insurance is an excellent choice for those seeking temporary coverage, especially during financially challenging times.

- Whole Life Insurance: In contrast to term life insurance, whole life insurance provides coverage for the insured individual’s entire life. It not only offers a death benefit but also accumulates cash value over time, making it a long-term investment option. With lifelong coverage and flexible usage of cash value, whole life insurance provides peace of mind and financial security for the insured and their loved ones.

- Universal Life Insurance: Universal life insurance combines a death benefit with a savings component, offering flexibility in premium payments and death benefits to adapt to changing circumstances. This type of policy is particularly beneficial for unemployed individuals, providing the ability to modify coverage and accumulate cash value over time, offering financial stability during uncertain times.

Choosing the right life insurance policy involves assessing your needs, budget, and long-term goals. Whether you opt for term life insurance for temporary coverage, whole life insurance for lifelong protection and investment, or universal life insurance for flexibility and cash accumulation, consulting with a licensed insurance professional can help you navigate the options and make the best decision for you and your family’s financial future.

Read more: Personal Financial Planning and Your Life Insurance Policy

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Life Insurance Policies for Unemployed Persons

When choosing a life insurance policy as an unemployed person, it’s essential to consider policy details, benefits, and cost comparisons. Let’s explore some of the top options:

Policy Details and Benefits

- Life insurance policies vary. Look for crucial aspects such as coverage amount, policy terms, flexibility, and additional benefits like accelerated death benefits or optional riders. Choose a policy that aligns with your needs and provides comprehensive protection for your loved ones.

- Coverage amount is vital, considering financial obligations like mortgage payments or dependent support. Opt for sufficient coverage to safeguard your family’s financial security.

- Policy terms range from specific periods to lifetime coverage. Choose a term length that suits your future plans.

- Flexibility is key. Seek policies that allow adjustments and explore optional riders for enhanced protection.

Cost Comparison

- Thoroughly compare premiums among insurance providers. Consider overall value, benefits, and coverage amounts. Choose a policy that balances affordability and comprehensive protection.

Average Monthly Life Insurance Rates for Unemployed Person

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Bestow Life | $25 | $50 |

| Compwest | $30 | $60 |

| Empower Annuity | $28 | $55 |

| SecureEase | $35 | $70 |

| SimplifySure | $32 | $65 |

| EaseLife Assurance | $30 | $60 |

| FlexGuard | $34 | $68 |

| SimpleCover Assurance | $29 | $58 |

| QuickShield Life | $33 | $66 |

| SwiftSure | $31 | $62 |

Choosing the right life insurance policy as an unemployed individual requires careful consideration. Understand policy details, benefits, and affordability to select a policy that provides adequate coverage and peace of mind.

Factors to Consider When Choosing a Life Insurance Policy

Several factors should be considered when selecting a life insurance policy as an unemployed person. Understanding policy terms and conditions, premium costs, and coverage amounts will enable you to make an informed decision that suits your unique needs. Let’s delve into these factors:

- Policy Terms and Conditions: Thoroughly read and understand the terms and conditions of each policy option. Pay close attention to details such as coverage length, renewal options, exclusions, and any limitations that may affect your specific situation. Awareness of these factors ensures that you choose a policy that provides adequate coverage for your loved ones.

- Premium Costs: Premiums play a crucial role in selecting a life insurance policy. Consider your budget and determine how much you can allocate towards premiums each month. Keep in mind that while lower premiums may be appealing, they may come with limitations in coverage or benefit amounts. Strike a balance between affordability and comprehensive coverage.

- Coverage Amount: The coverage amount should be sufficient to support your loved ones in maintaining their current lifestyle. Consider factors such as outstanding debts, mortgage payments, children’s education, and daily living expenses. Evaluating your dependents’ financial needs will help you determine the appropriate coverage amount.

How Unemployment Affects Life Insurance

Unemployment can impact various aspects of your life, including your life insurance policy. It is essential to understand the potential effects to make informed decisions. Here are a few key areas to consider:

Impact on Premiums

If unemployment impacts your premium payments, reach out to your insurer for assistance; many offer flexible or temporary relief options to help policyholders facing financial challenges, emphasizing open communication to prevent policy cancellation.

Eligibility for Coverage

While being unemployed doesn’t automatically disqualify you from obtaining life insurance, it can impact the underwriting process. Insurers assess risk based on factors such as income, employment history, and financial stability. You may need to provide additional documentation or demonstrate alternative sources of income to secure coverage.

Bestow Life offers unparalleled financial security for unemployed individuals, ensuring peace of mind and protection for their loved ones.Dani Best Licensed Insurance Producer

To secure the best life insurance policy while unemployed, understand policy options, consider personal circumstances, and prioritize your loved ones’ financial security with comprehensive coverage that fits your budget, emphasizing the importance of protecting your family’s future during unemployment.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Securing Life Insurance for Unemployed Individuals

In today’s uncertain job market, life insurance serves as a vital lifeline for individuals facing unemployment. Let’s dive into three compelling case studies showcasing how life insurance provides financial security during times of job loss.

- Case Study #1 – Financial Safety Net: Sarah, a 35-year-old graphic designer, lost her job due to downsizing. Concerned about her family’s financial security, she opts for an affordable term life insurance plan to cover living expenses, mortgage, and children’s education.

- Case Study #2 – Legacy Planning: Mark, a 42-year-old sales manager, buys whole life insurance to support his elderly parents financially in case of his passing. The policy ensures lifelong coverage and cash value accumulation, securing their future.

- Case Study #3 – Future Security: Freelance writer Emily, 28, realizes the importance of financial security and invests in simplified issue term life insurance. Despite being single with no dependents, she ensures her funeral expenses are covered and leaves a small inheritance for her siblings.

Bestow Life offers affordable and flexible coverage tailored for unemployed individuals, ensuring financial security when it's needed most.Zach Fagiano Licensed Insurance Broker

These case studies vividly illustrate the crucial role life insurance plays in protecting individuals and their families during unemployment. Whether it’s covering living expenses, supporting loved ones, or planning for the future, life insurance offers peace of mind and stability in uncertain times.

Frequently Asked Questions

What is life insurance?

Life insurance is a contract between an individual and an insurance company. In exchange for regular premium payments, the insurance company provides a lump-sum payment, known as a death benefit, to the designated beneficiaries upon the insured person’s death.

Why is life insurance important for unemployed individuals?

Life insurance is important for unemployed individuals as it provides financial protection for their loved ones in the event of their death. It can help cover funeral expenses, outstanding debts, and provide income replacement for dependents.

Can unemployed persons get life insurance?

Yes, unemployed persons can generally get life insurance. While employment status may affect the type and cost of coverage available, there are options specifically designed for unemployed individuals, such as simplified issue or guaranteed issue policies.

What are the best life insurance policies for unemployed persons?

The best life insurance policies for unemployed persons may vary depending on individual circumstances. However, some options to consider include term life insurance, whole life insurance, or final expense insurance. It is recommended to compare quotes from multiple insurance providers to find the most suitable policy.

What factors should unemployed individuals consider when choosing a life insurance policy?

Unemployed individuals should consider factors such as the coverage amount needed, the duration of coverage required, affordability, and any specific features or riders that may be beneficial. It is also important to review the terms and conditions, exclusions, and the financial stability of the insurance company.

Can unemployed individuals afford life insurance?

Affordability of life insurance for unemployed individuals can vary depending on their financial situation. However, there are policies available at different price points, and unemployed individuals can explore options such as term life insurance, which generally offers lower premiums compared to permanent policies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.