Best No Down Payment Auto Insurance in 2026 (Top 10 Companies)

Find the best no down payment car insurance companies like Progressive, USAA, and State Farm. This guide provides an insightful exploration of rates, discounts, and benefits offered by these leading companies, empowering you to make informed choices and economically secure your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ...

Laura Kuhl

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Michael Leotta

Updated February 2024

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Our Top 10 Best Companies: Best No Down Payment Auto Insurance

| Company | Rank | See Pros/Cons | Safe Driver Discount | AutoPay Discount | Best For |

|---|---|---|---|---|---|

| #1 | Progressive | Up to 10% | Up to 5% | Bundle Discounts | |

| #2 | USAA | Up to 15% | Up to 8% | Customer Service | |

| #3 | State Farm | Up to 8% | Up to 4% | Local Agents | |

| #4 | Allstate | Up to 12% | Up to 6% | Safe-Driving Discounts | |

| #5 | Nationwide | Up to 10% | Up to 5% | Multi-Policy Discounts |

| #6 | Liberty Mutual | Up to 15% | Up to 7% | Quick Claims |

| #7 | Esurance | Up to 10% | Up to 5% | Budgeting Tools | |

| #8 | Farmers | Up to 12% | Up to 6% | Student Savings | |

| #9 | American Family | Up to 8% | Up to 4% | Vanishing Deductibles | |

| #10 | Travelers | Up to 10% | Up to 5% | Policy Options |

#1 – Progressive: Pioneering Affordability and Customization

Progressive stands out as a leader in providing tailored and budget-friendly solutions, excelling in affordability and customization for various profiles.Ty Stewart Licensed Life Insurance Agent

Pros

- Bundle discounts: Progressive offers bundle discounts, making it an attractive option for customers looking to combine multiple insurance policies.

- Safe driver discount: With a safe driver discount of up to 10%, Progressive rewards good driving behavior, potentially lowering premiums.

- Budget-friendly options: Progressive provides tailored and budget-friendly solutions for various profiles, ensuring affordability for different customer needs.

Cons

- Average monthly rate: The average monthly rate for good drivers is $109.17, which might be on the higher side compared to some competitors.

- Complaint level: While the complaint level is low, individual experiences may vary, and it’s important to consider customer reviews and feedback.

Read more: Progressive Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Customer Service Excellence and Generous Discounts

Pros

- Customer service: USAA is recognized for its exceptional customer service, making it an ideal choice for customers who prioritize a positive service experience.

- High discounts: USAA offers substantial discounts, with up to 15% for safe drivers and up to 8% for AutoPay, potentially resulting in significant savings.

- Low complaint level: With a low complaint level, USAA demonstrates a commitment to customer satisfaction and efficient issue resolution.

Cons

- Limited eligibility: USAA membership is limited to military personnel and their families, excluding a significant portion of the general population.

- Average monthly rate: While the average monthly rate is relatively low at $62.75, eligibility restrictions may limit access for many potential customers.

Read more: USAA Car Insurance Review

#3 – State Farm: Trusted Local Connections and Personalized Service

Pros

- Local agents: State Farm is known for its extensive network of local agents, providing customers with personalized service and a convenient point of contact.

- Safe driver discount: With a safe driver discount of up to 8%, State Farm rewards good driving habits, potentially reducing insurance costs.

- Well-established reputation: State Farm’s long-standing reputation in the insurance industry adds a layer of trust and reliability for customers.

Cons

- Average monthly rate: The average monthly rate of $86 may be considered moderate, and potential customers may want to compare rates with other providers.

- AutoPay discount: While State Farm offers an AutoPay discount, it’s up to 4%, which may be lower than some competitors.

Read more: State Farm Car Insurance Review

#4 – Allstate: Holistic Coverage and Established Reputation

Pros

- Safe-driving discounts: Allstate offers up to 12% safe-driving discounts, encouraging and rewarding good driving habits.

- Comprehensive coverage: Allstate provides a range of coverage options, allowing customers to tailor their policies to meet specific needs.

- Well-known brand: Allstate is a widely recognized and reputable insurance brand, instilling trust in its customers.

Cons

- Higher average monthly rate: The average monthly rate for good drivers is $160, which might be relatively higher compared to some competitors.

- Complaint level: It’s important to consider that, despite the low complaint level, individual experiences may vary.

Read more: Allstate Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Savings Through Bundling and Diverse Coverage Choices

Pros

- Multi-policy discounts: Nationwide offers up to 10% multi-policy discounts, encouraging customers to bundle their insurance policies for potential savings.

- Variety of coverage options: Nationwide provides a range of coverage options, allowing customers to customize their policies based on their specific needs.

- Established presence: Nationwide has a well-established presence, contributing to a sense of reliability and stability.

Cons

- Average monthly rate: The average monthly rate of $115 may be a factor for customers seeking lower premiums.

- AutoPay discount: While Nationwide offers an AutoPay discount, it’s up to 5%, which might be lower than some competitors.

#6 – Liberty Mutual: Efficiency in Claims Processing and Generous Discounts

Pros

- Quick claims processing: Liberty Mutual is recognized for its quick claims processing, ensuring a streamlined and efficient experience for customers.

- High safe driver discount: With up to 15% safe driver discount, Liberty Mutual provides substantial incentives for maintaining a good driving record.

- AutoPay discount: Liberty Mutual offers an AutoPay discount of up to 7%, potentially resulting in additional savings for customers.

Cons

- Higher average monthly rate: The average monthly rate for good drivers is $174, which may be considered on the higher side.

- Limited information: The content provides limited details about other aspects of Liberty Mutual’s offerings, and customers may need to explore further.

Read more: Liberty Mutual Car Insurance Review

#7 – Esurance: Tech-Savvy Budgeting and Safe Driving Rewards

Pros

- Budgeting tools: Esurance offers budgeting tools, providing customers with resources to manage their insurance expenses effectively.

- Safe driver discount: With up to 10% safe driver discount, Esurance encourages and rewards safe driving habits.

- Competitive autoPay discount: Esurance provides an AutoPay discount of up to 5%, contributing to potential cost savings.

Cons

- Average monthly rate: The average monthly rate of $114 may be a consideration for customers looking for more affordable options.

- Limited physical presence: Esurance operates primarily online, which may be a drawback for customers who prefer face-to-face interactions.

Read more: Esurance Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Personalized Support, Student Savings, and Varied Discounts

Pros

- Student savings: Farmers offers student savings, making it a potentially attractive option for families with student drivers.

- Varied discounts: With up to 12% safe-driving discounts and up to 6% AutoPay discounts, Farmers provides multiple avenues for potential savings.

- Local agents: Farmers utilizes local agents, providing customers with personalized service and local support.

Cons

- Average monthly rate: The average monthly rate for good drivers is $139, which might be relatively higher compared to some competitors.

- Complaint level: While the content mentions discounts and features, individual experiences with Farmers may vary.

Read more: Farmers Car Insurance Review

#9 – American Family: Innovative Vanishing Deductibles and Customizable Coverage

Pros

- Vanishing deductibles: American Family offers vanishing deductibles, rewarding customers for safe driving by reducing their deductibles over time.

- Safe driver discount: With up to 8% safe driver discount, American Family incentivizes and recognizes good driving habits.

- Varied coverage options: American Family provides a range of coverage options, allowing customers to customize their policies.

Cons

- Average monthly rate: The average monthly rate for good drivers is $117, and customers may want to compare rates with other providers.

- Limited information: The content provides limited details about other aspects of American Family’s offerings.

Read more: American Family Car Insurance Review

#10 – Travelers: Flexibility in Policy Options and Reputation for Choices

Pros

- Policy options: Travelers offers a variety of policy options, allowing customers to choose coverage that suits their specific needs.

- AutoPay discount: With an AutoPay discount of up to 5%, Travelers provides an avenue for potential cost savings.

- Reputation for policy flexibility: Travelers is known for offering flexible policy options, catering to the diverse needs of its customers.

Cons

- Average monthly rate: The average monthly rate for good drivers is $99, but customers should consider the overall value in terms of coverage and features.

- Limited information: The content provides limited details about certain features and customer satisfaction aspects.

Read more: Travelers Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Top 10 Companies for No Down Payment Auto Insurance

Understanding the landscape of no down payment auto insurance is essential for individuals seeking affordable coverage without the burden of an initial payment. The top 10 companies offering this option present varying rates for both full and minimum coverage, catering to the diverse needs of consumers.

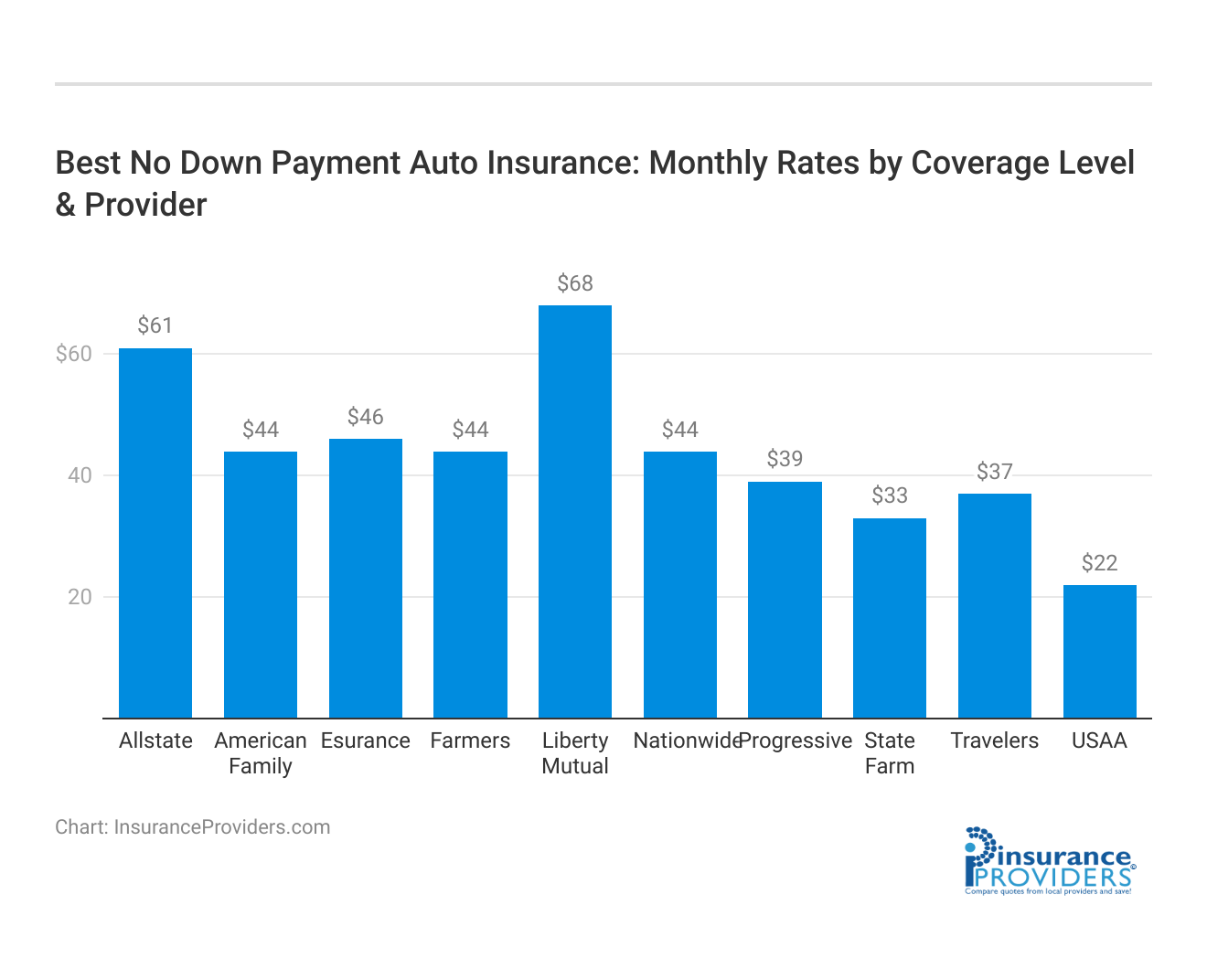

Average Monthly Auto Insurance Rates With No Down Payment

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| Progressive | $105 | $39 |

| USAA | $59 | $22 |

| State Farm | $86 | $33 |

| Allstate | $160 | $61 |

| Nationwide | $115 | $44 |

| Liberty Mutual | $174 | $68 |

| Esurance | $114 | $46 |

| Farmers | $139 | $44 |

| American Family | $117 | $44 |

| Travelers | $99 | $37 |

Progressive, for instance, stands out with a reasonable $105 monthly rate for full coverage and $39 for minimum coverage, making it an attractive choice for those looking to balance cost and comprehensive protection.

On the other end of the spectrum, Liberty Mutual commands a higher price of $174 for full coverage and $68 for minimum coverage, positioning itself as a provider for those willing to invest more for extensive coverage. USAA emerges as a standout option, not only for its competitive rates but also for its commitment to serving military members and their families.

With a remarkably low $59 for full coverage and $22 for minimum coverage, USAA provides an appealing option for those eligible for its membership. Allstate, despite having a higher monthly rate of $160 for full coverage and $61 for minimum coverage, may attract customers with its strong brand reputation and extensive coverage options.

Nationwide offers a middle-ground option with a $115 monthly rate for full coverage and $44 for minimum coverage, appealing to those seeking balance between cost and coverage. Travelers provides a budget-friendly alternative with a $99 monthly rate for full coverage and $37 for minimum coverage, making it an attractive choice for cost-conscious consumers.

The nuanced analysis of these top 10 companies, including their specific rates, reveals a diverse landscape where individuals can find the right balance between cost, coverage, and reputation when seeking no down payment auto insurance.

What is No Down Payment Auto Insurance?

No Down Payment Auto Insurance, as the name suggests, enables you to get insured without having to pay a lump sum upfront as a down payment. Typically, traditional auto insurance policies require a down payment, which can range from a few hundred to thousands of dollars. No Down Payment Auto Insurance eliminates this financial burden, allowing you to get coverage without any upfront costs.

Imagine the relief of not having to worry about coming up with a large sum of money before you can even begin to protect your vehicle. No Down Payment Auto Insurance opens up the opportunity for individuals who may not have the immediate funds to make a down payment but still need reliable coverage. This option provides a more accessible path to obtaining auto insurance, making it easier for people to comply with legal requirements and ensure their peace of mind on the road.

How Does No Down Payment Auto Insurance Work?

With No Down Payment Auto Insurance, instead of paying a lump sum upfront, you pay for your insurance on a monthly basis. This means that the total cost of your premium is divided into equal installments that you pay each month. The amount of your monthly premium will depend on various factors such as your driving record, the type of vehicle you own, and your location.

When you opt for No Down Payment Auto Insurance, you have the flexibility to manage your budget more effectively. By spreading out the cost of your premium over several months, you can allocate your funds towards other essential expenses while still maintaining the coverage you need. This payment structure allows you to have greater control over your finances and avoid the strain of a large upfront payment.

Furthermore, No Down Payment Auto Insurance can be a convenient option for those who prefer a more predictable payment schedule. With fixed monthly installments, you can plan your budget more accurately, knowing exactly how much you need to allocate for your insurance premium. This stability can provide a sense of financial security, allowing you to confidently manage your expenses and maintain your coverage without any surprises.

Benefits of No Down Payment Auto Insurance

When it comes to auto insurance, one option that has gained popularity in recent years is No Down Payment Auto Insurance. This type of insurance offers numerous benefits that can make it an attractive choice for many drivers. Let’s take a closer look at some of the advantages:

Immediate Coverage

One of the significant advantages of No Down Payment Auto Insurance is that you can receive immediate coverage for your vehicle. Instead of waiting to save up for a down payment, you can get insured right away and hit the road with peace of mind.

Imagine this scenario: You’ve just purchased a new car, and you’re excited to take it for a spin. However, traditional auto insurance policies require a down payment before activating the coverage. This means you have to wait until you have enough money saved up to get insured. With No Down Payment Auto Insurance, you don’t have to wait. You can simply contact your insurance provider, sign up for a policy, and start driving without any delays.

Whether you need coverage for a new car or you’re switching insurance providers, the ability to get immediate coverage can be a huge relief. It allows you to protect your vehicle and yourself from any potential accidents or damages right from the start.

Financial Flexibility

No Down Payment Auto Insurance offers financial flexibility, especially for individuals who may not have a significant amount of savings to allocate towards a down payment. By opting for this type of insurance, you can manage your monthly budget more effectively and allocate your funds towards other essential expenses.

Let’s face it, saving up for a down payment can be challenging, especially if you’re already dealing with other financial obligations. Traditional auto insurance policies require a lump sum payment upfront, which can put a strain on your finances. However, with No Down Payment Auto Insurance, you don’t have to worry about that burden.

By eliminating the need for a down payment, you have more control over your finances. You can use the money that would have gone towards a down payment to pay off other debts, invest in your future, or simply save it for a rainy day. This financial flexibility can provide you with peace of mind and help you achieve your financial goals.

Ideal for Budget-Conscious Drivers

If you are a budget-conscious driver who wants to save money, No Down Payment Auto Insurance may be the ideal choice for you. By eliminating the need for a down payment, you can allocate your funds towards other financial obligations or build up your savings.

Many people are looking for ways to cut costs and save money. With No Down Payment Auto Insurance, you can do just that. Instead of paying a large sum upfront, you can spread out your insurance payments over time. This allows you to have more control over your monthly budget and avoid any financial strain.

Moreover, having extra money in your pocket can be beneficial in various ways. It can help you cover unexpected expenses, invest in your future, or simply enjoy a higher quality of life. By choosing No Down Payment Auto Insurance, you can prioritize your financial well-being without compromising on the coverage you need for your vehicle.

Overall, No Down Payment Auto Insurance offers immediate coverage, financial flexibility, and is ideal for budget-conscious drivers. So, if you’re looking for a convenient and cost-effective way to protect your vehicle, this type of insurance might be the perfect fit for you.

Comparing No Down Payment Auto Insurance Providers

Factors to Consider When Choosing a Provider

When selecting a No Down Payment Auto Insurance provider, it’s essential to consider a few factors to ensure you make the right choice. One crucial factor is the reputation of the provider. Look for reviews and ratings from other customers to gauge their level of customer satisfaction and reliability.

Furthermore, it is important to consider the financial stability of the insurance provider. You want to choose a company that has a strong financial standing and a solid track record of fulfilling their obligations to policyholders. This will give you peace of mind knowing that your claims will be handled efficiently and effectively.

Additionally, consider the coverage options offered and whether they meet your specific needs. Some providers may offer additional benefits such as roadside assistance or rental car coverage, which can be valuable in case of emergencies. It is also worth considering the deductible amount and how it will affect your premiums. A lower deductible may result in higher monthly payments, while a higher deductible could save you money in the long run if you are a safe driver.

Moreover, take into account the level of customer service provided by the insurance company. A provider that offers excellent customer service can make a significant difference in your overall experience. Look for a company that is responsive, helpful, and willing to assist you promptly with any questions or concerns you may have.

Top No Down Payment Auto Insurance Providers

There are several reputable No Down Payment Auto Insurance providers in the market. Some of the top providers include XYZ Insurance, ABC Insurance, and DEF Insurance. These providers are known for their competitive rates, excellent customer service, and hassle-free claims process.

XYZ Insurance, for example, has been in the insurance industry for over 30 years and has built a strong reputation for providing reliable coverage at affordable rates. They offer a range of coverage options to suit different needs and budgets. With their user-friendly website and dedicated customer support team, XYZ Insurance ensures a seamless experience for their policyholders.

ABC Insurance, on the other hand, stands out for its extensive network of repair shops and preferred providers. This means that in the event of an accident, you can easily find a trusted repair shop that works directly with ABC Insurance, saving you time and effort. Their claims process is streamlined, allowing you to get back on the road quickly.

DEF Insurance prides itself on its personalized approach to insurance. They understand that every driver is unique, and their policies are tailored to meet individual needs. Whether you are a young driver, a senior citizen, or have a less-than-perfect driving record, DEF Insurance can find a policy that suits you. Their knowledgeable agents are available to guide you through the process and answer any questions you may have.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Qualify for No Down Payment Auto Insurance

No Down Payment Auto Insurance can be a great option for those looking to get insured without having to pay a large upfront cost. However, qualifying for this type of insurance may require meeting certain eligibility criteria set by the insurance provider. These criteria are put in place to ensure that the insured individual is a responsible driver and poses a lower risk to the insurance company.

Eligibility Criteria

When it comes to qualifying for No Down Payment Auto Insurance, there are a few key factors that insurance providers typically consider. Firstly, having a clean driving record is often a requirement. This means that you should have a history of safe driving, free from any major accidents or traffic violations. Insurance providers see individuals with a clean driving record as less likely to file claims, which can result in lower premiums.

In addition to a clean driving record, maintaining a certain credit score may also be a requirement. Insurance companies use credit scores as a way to assess an individual’s financial responsibility. A higher credit score indicates that you are more likely to make your insurance payments on time, reducing the risk for the insurance provider.

Furthermore, some insurance providers may ask for proof of continuous coverage for a specific period. This means that you need to demonstrate that you have had auto insurance in place without any gaps in coverage. Continuous coverage is seen as a sign of responsibility and commitment to maintaining insurance, which can make you a more attractive candidate for No Down Payment Auto Insurance.

It’s important to note that the specific eligibility criteria may vary from one insurance provider to another. Therefore, it’s crucial to familiarize yourself with the requirements of different providers to find one that suits your circumstances.

Tips to Increase Your Chances of Qualification

If you are concerned about meeting the eligibility criteria for No Down Payment Auto Insurance, there are a few steps you can take to increase your chances of qualification. Firstly, maintaining a good driving record is essential. This means obeying traffic rules, practicing defensive driving techniques, and avoiding accidents or traffic violations. By demonstrating your commitment to safe driving, you can showcase yourself as a responsible individual to insurance providers.

In addition to maintaining a clean driving record, it’s also important to focus on improving your credit score. This can be done by paying bills on time, reducing outstanding debts, and keeping credit card balances low. Taking these steps to improve your credit score not only benefits your overall financial health but also increases your chances of qualifying for No Down Payment Auto Insurance.

Lastly, maintaining continuous coverage without any gaps is crucial. This means renewing your auto insurance policy before it expires and ensuring that there are no lapses in coverage. By doing so, you demonstrate your responsibility as a driver and your commitment to maintaining insurance, which can make you a more desirable candidate for No Down Payment Auto Insurance.

By following these tips and taking the necessary steps to meet the eligibility criteria, you can increase your chances of qualifying for No Down Payment Auto Insurance. Remember to research different insurance providers and their specific requirements to find the best fit for your needs. With the right approach and a little effort, you can secure the auto insurance coverage you need without having to make a large upfront payment.

Potential Drawbacks of No Down Payment Auto Insurance

Higher Monthly Premiums

While No Down Payment Auto Insurance offers the advantage of not requiring an upfront payment, it does come with higher monthly premiums. Since the total cost of your premium is divided into installments without a down payment, each monthly payment will be larger compared to a traditional insurance policy. Take this into consideration when budgeting your monthly expenses.

Limited Availability

Another drawback of No Down Payment Auto Insurance is that it may have limited availability. Not all insurance providers offer this option, and availability may vary depending on your location. Therefore, it’s crucial to research and compare different providers to find one that offers this type of insurance in your area.

In conclusion, No Down Payment Auto Insurance provides a practical and flexible solution for individuals who are unable to pay a down payment upfront. By understanding how it works, weighing its benefits against potential drawbacks, and comparing different providers, you can make an informed decision and find the best No Down Payment Auto Insurance that suits your needs and budget. Remember to consider your eligibility, qualifications, and financial circumstances before selecting a provider. With the right No Down Payment Auto Insurance, you can hit the road without worrying about the financial burden of a down payment.

Case Studies: Navigating No Down Payment Auto Insurance Realities

Case Study 1: Rachel’s Immediate Coverage Needs

Rachel, a recent college graduate, landed a job in a new city and needed a car for her daily commute. With limited savings, the prospect of a down payment for auto insurance seemed daunting. However, Rachel discovered No Down Payment Auto Insurance. Rachel needed immediate coverage to start her new job but couldn’t afford a substantial upfront payment.

Traditional insurance policies were financially burdensome for her as a young professional. Rachel opted for No Down Payment Auto Insurance, providing her with immediate coverage without the need for a significant upfront payment. This allowed her to hit the road promptly, ensuring she met her work obligations and giving her peace of mind on her daily commute.

No Down Payment Auto Insurance became a lifeline for Rachel, offering the financial flexibility she needed during this transitional period. It allowed her to allocate funds toward settling into her new city without compromising on essential coverage for her vehicle.

Case Study 2: James’ Financial Flexibility Journey

James, a single parent, faced financial challenges after unexpected medical expenses. Needing a reliable vehicle for family transportation, he explored insurance options that wouldn’t strain his already tight budget. James struggled to save for a traditional insurance down payment due to unforeseen medical costs.

He needed a solution that allowed him to manage his monthly budget effectively while ensuring his family’s safety on the road. No Down Payment Auto Insurance provided James with the financial flexibility he needed.

By spreading the cost of his premium over monthly installments, he could maintain coverage for his family without the burden of a hefty upfront payment. James successfully navigated through challenging times, thanks to the flexibility offered by No Down Payment Auto Insurance.

This allowed him to prioritize his family’s well-being while managing his monthly expenses more efficiently.

Case Study 3: Sarah’s Budget-Conscious Approach

Sarah, a recent graduate with student loans, started her career with a tight budget. As a budget-conscious individual, she sought ways to cut costs without compromising on essential services, including auto insurance. Sarah was on the lookout for cost-effective options that aligned with her budget-conscious approach.

Traditional insurance policies with substantial down payments were financially impractical for her at this stage in her life. No Down Payment Auto Insurance became the ideal choice for Sarah. By eliminating the need for a down payment, she could allocate her funds towards student loan payments and daily living expenses, while still obtaining the necessary coverage for her vehicle.

Sarah’s decision to opt for No Down Payment Auto Insurance allowed her to strike a balance between financial responsibility and essential coverage. This cost-effective solution empowered her to manage her budget efficiently during the early stages of her career.

Frequently Asked Questions

What is No Down Payment Auto Insurance?

No Down Payment Auto Insurance allows you to get insured without an upfront payment, eliminating the traditional down payment requirement.

How does No Down Payment Auto Insurance work?

You pay for No Down Payment Auto Insurance on a monthly basis, spreading the total premium cost into equal installments based on factors like your driving record and vehicle type.

What are the benefits of No Down Payment Auto Insurance?

Benefits include immediate coverage, financial flexibility, and suitability for budget-conscious drivers, offering a cost-effective solution without a large upfront payment.

How do I qualify for No Down Payment Auto Insurance?

Qualification may require a clean driving record, a certain credit score, and proof of continuous coverage. Improving your driving record and credit score can enhance eligibility.

What are the potential drawbacks of No Down Payment Auto Insurance?

Drawbacks include higher monthly premiums and limited availability. It’s important to consider these factors and compare providers to make an informed decision.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.