Top California Auto Insurance Providers [2026]

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated March 2024

| California Statistic Summary | STATS |

|---|---|

| Road Miles | 225,531 |

| Registered Vehicles | 28,595,129 |

| State Population | 39,557,045 |

| Most Popular Vehicle | Honda Civic |

| Percentage of Uninsured Motorists | 15.2% Rank: 12 |

| Driving Deaths | Speeding: 1,070 Drunk Driving: 1,120 |

| Average Annual Premiums | Liability: $462.95 Collision: $364.56 Comprehensive: $99.29 |

| Cheapest Providers | USAA CIC United Financial Casualty |

It could happen anywhere.

Cruising along the Pacific Coast Highway. Sightseeing on State Road 120. Stuck in traffic on Route 60.

One minute, you’re behind the wheel, heading to your destination. And the next, you’re the victim of a fender bender, pulled over on the side of the road and lost in a haze of flashing lights. Suddenly you’re not going to work or to your house, you’re landed in the hospital facing sudden medical bills. It’s a harrowing thought, but one that should be kept in the back of your mind: you’re not invincible.

It could happen to anyone. And with over 26.7 million licensed drivers in the state, it could happen to you.

Without a doubt, having reliable car insurance in California is critical, especially given its distinction as a state with a high number of fatal crashes. You don’t want to be out hundreds of dollars by leaving something like this to chance.

What Golden State drivers need to know is that car insurance is about much more than meeting a legal requirement. It’s about knowing that in the face of the worst possible scenario, you have the assurance that you’re protected legally and financially.

Indeed, purchasing car insurance in Calfornia is an important decision. But beyond searching out the best rates, you’ll want to know:

- How the largest car insurance providers stack up financially.

- What risk factors could cost you more money.

- Whether your city or zip code of residence is known for higher rates.

And that’s just the beginning.

Thanks to this comprehensive and easy-to-follow guide, getting the scoop on California car insurance doesn’t have to be complicated. We’re breaking down all of the essentials you need to make the best decision about your coverage — and that includes state-specific laws, traffic fatality trends, and vehicle theft statistics. Not to mention the sort of coverage levels you’ll discover are actually available if you shop around.

You can start your journey into exploring the best rates by entering your ZIP code into our free car insurance comparison tool.

What do California car insurance coverage and rates tend to look like?

Given the state’s status as the most populous in the country, one thing is certain – the number of drivers hitting California’s roads isn‘t slowing down any time soon.

And whether you’re new to the state or you’re a familiar driver, most will agree that California’s roadways live up to their reputation for traffic headaches.

In fact, researchers with the Texas A&M Transportation Institute confirm this. According to the institute’s 2019 Urban Mobility Report, three of California’s largest urban areas — Los Angeles-Long Beach-Anaheim, San Francisco-Oakland, and San Diego — rank among the nation’s top 20 most congested.

Without a doubt — an ever-increasing population coupled with constant congestion makes for a good case to not only purchase the best car insurance coverage possible, but to also have a solid understanding of the sate’s minimum coverage requirements.

Read more: Wawanesa Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does California have minimum coverage requirements?

California state law is clear — residents with registered vehicles must meet these minimum car insurance coverage requirements:

| California Required Coverage | Amount |

|---|---|

| Bodily Injury Liability | $15,000 per person $30,000 per accident |

| Property Damage Liability | $5,000 |

To elaborate, this means drivers must have at least —

- $15,000 in bodily injury liability per person. This type of insurance covers the costs associated with another person’s injuries or death in an accident that you caused, up to the policy’s limits.

- $30,000 in bodily injury liability per accident.

- $5,000 in property damage liability per accident. This type of coverage addresses property that was damaged in an accident that you caused.

From here, drivers need to be aware of two key takeaways.

First, these are the state’s minimum requirements, meaning, you can always purchase additional coverage. Remember, your insurance will cover costs up to its limits.

That means if you cause an accident with damage exceeding those minimums – let’s say, property damage totaling more than $5,000 — your insurance will only go so far. The rest could come out of pocket.

Second, liability insurance is designed to compensate people other than the policyholder. In other words, if you cause an accident and your own vehicle is damaged, these coverage won’t address those costs. You do, however, have options:

- Comprehensive coverage. This kind of coverage addresses unpredictable, non-collision incidents like weather damage (sometimes referred to as “Acts of God”) vandalism, or hitting animals. Comprehensive coverage typically requires paying an initial deductible. Drivers who are leasing or financing cars are usually required to have comprehensive coverage.

- Collision coverage. This type of coverage addresses physical damage done to your own vehicle as a result of a collision. As is the case with comprehensive coverage, collision coverage typically requires an initial deductible and is often required of those leasing or financing their cars.

- Uninsured/underinsured motorists coverage (UM/UIM). This helps covers costs in crashes involving drivers who have no insurance or insufficient coverage. UM/UIM becomes even more compelling when you consider that, according to the Insurance Information Institute, California ranks 12th in the nation for uninsured drivers.

- Medical Payments or MedPay. This coverage pays medical expenses for you, as well as your passengers, when injured in a car accident.

Read more: Which states have the worst drivers?

California drivers also need to know that the state follows a “fault” system.

Under a fault system, drivers who are found to be at-fault in causing an accident are held financially responsible.

What are the forms of financial responsibility in California?

It’s simple — proof of financial responsibility is required on all cars in California, even if they’re parked on a roadway.

This is known as the California Compulsory Financial Responsibility Law. It requires that you not only keep proof of financial responsibility in your car at all times, but that you also present it when —

- It’s requested by law enforcement

- You’re renewing your vehicle registration

- You’ve been involved in an accident

The state’s Department of Motor Vehicles (DMV) reports that there are four forms of financial responsibility:

- A motor vehicle liability insurance policy

- A deposit of $35,000 with DMV

- A surety bond for $35,000. This bond must be obtained from a company licensed to do business in the state. To find a company, you can contact the California Department of Insurance.

- A DMV-issued self-insurance certificate.

Keep in mind that even though drivers have options that go beyond purchasing traditional car insurance, each presents a level of risk that could lead to high out-of-pocket costs.

Not complying with the state’s Financial Responsibility law can lead to fines, or having your vehicle impounded.

According to the AAA, a first offense of not complying can result in fines between $100 and $200, plus additional penalties. Subsequent offenses within three years can result in fines between $200 and $500, plus additional penalties.

Read more: AAA Texas County Mutual Insurance Company: Customer Ratings & Reviews

What would be California premiums shown as a percentage of income?

Two percent.

It’s how much of a typical driver’s income goes toward car insurance, according to a 2017 Department of Treasury study on affordability.

The National Association of Insurance Commissioners (NAIC) affirms this by revealing that drivers spent, on average, 2.29 percent of their income on car insurance 2014. That percentage is based upon an average disposable income of $40,726.23, and an average full coverage policy of $943.80.

Knowing that insurance costs and disposable incomes will vary by state, we took a closer look at numbers specific to California:

- As of 2014, the average California resident spent 2.16 percent of their income on car insurance. This was lower than the national average that year.

- The average cost of a full-coverage policy in California increased by 6.73 percent from 2012 to 2014.

- The average disposable income for California residents also increased by 3.59 percent in the same time period.

We also compared California to its neighboring states:

| State | 2014 Disposable Income | 2014 Full Coverage | Percentage of Income Toward Insurance |

|---|---|---|---|

| California | $43,978.00 | $951.75 | 2.16% |

| Arizona | $34,321.00 | $961.88 | 2.8% |

| Nevada | $36,477.00 | $1,083.42 | 2.97% |

| Oregon | $36,445.00 | $894.10 | 2.45% |

| Washington | $45,143.00 | $952.10 | 2.11% |

In addition to having the highest average disposable income, we can see that California residents are, for the most part, paying a lower percentage of their income toward their car insurance than those in neighboring states.

You can determine how much of your income is going toward car insurance by using our free CalculatorPro tool below:

CalculatorPro

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

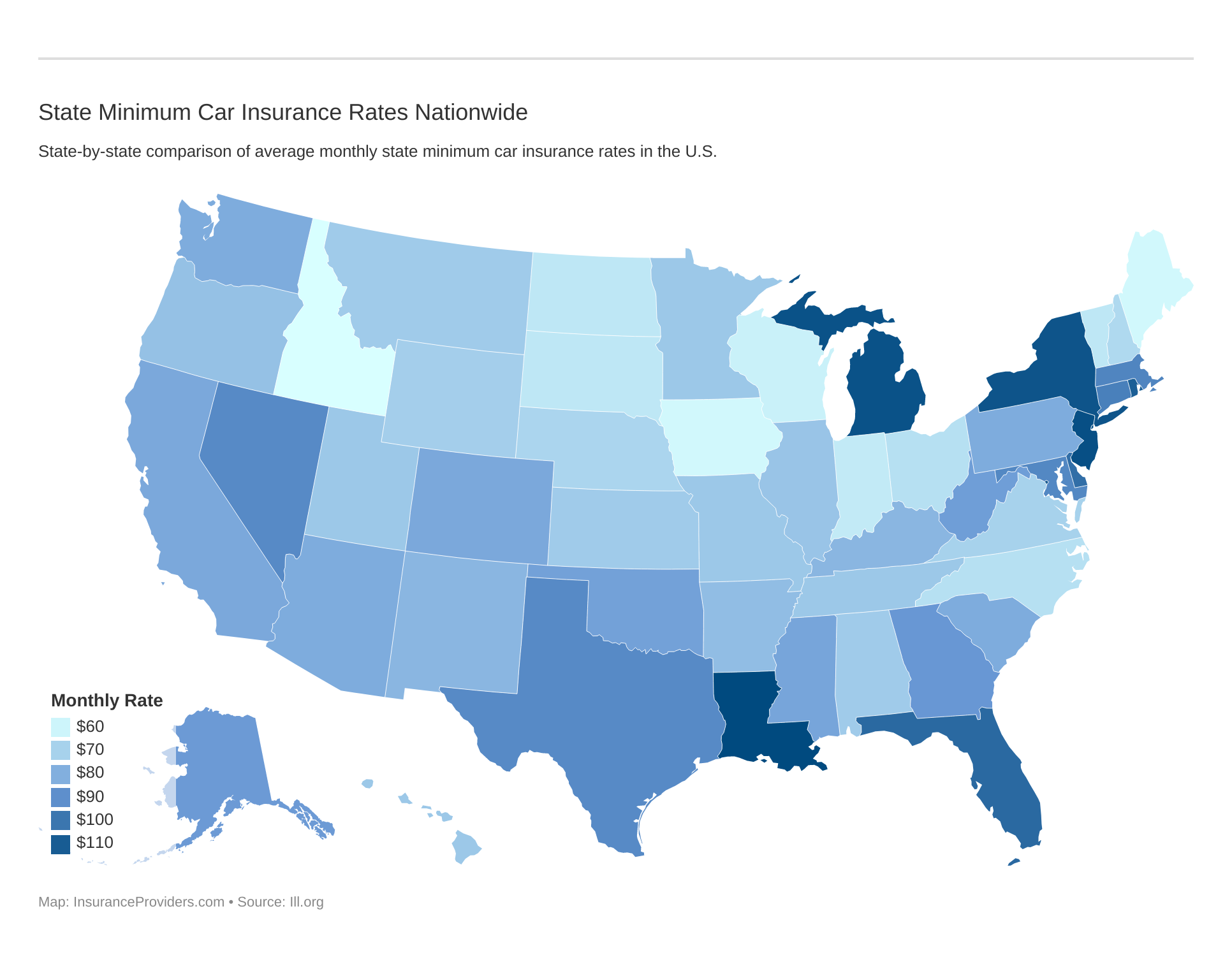

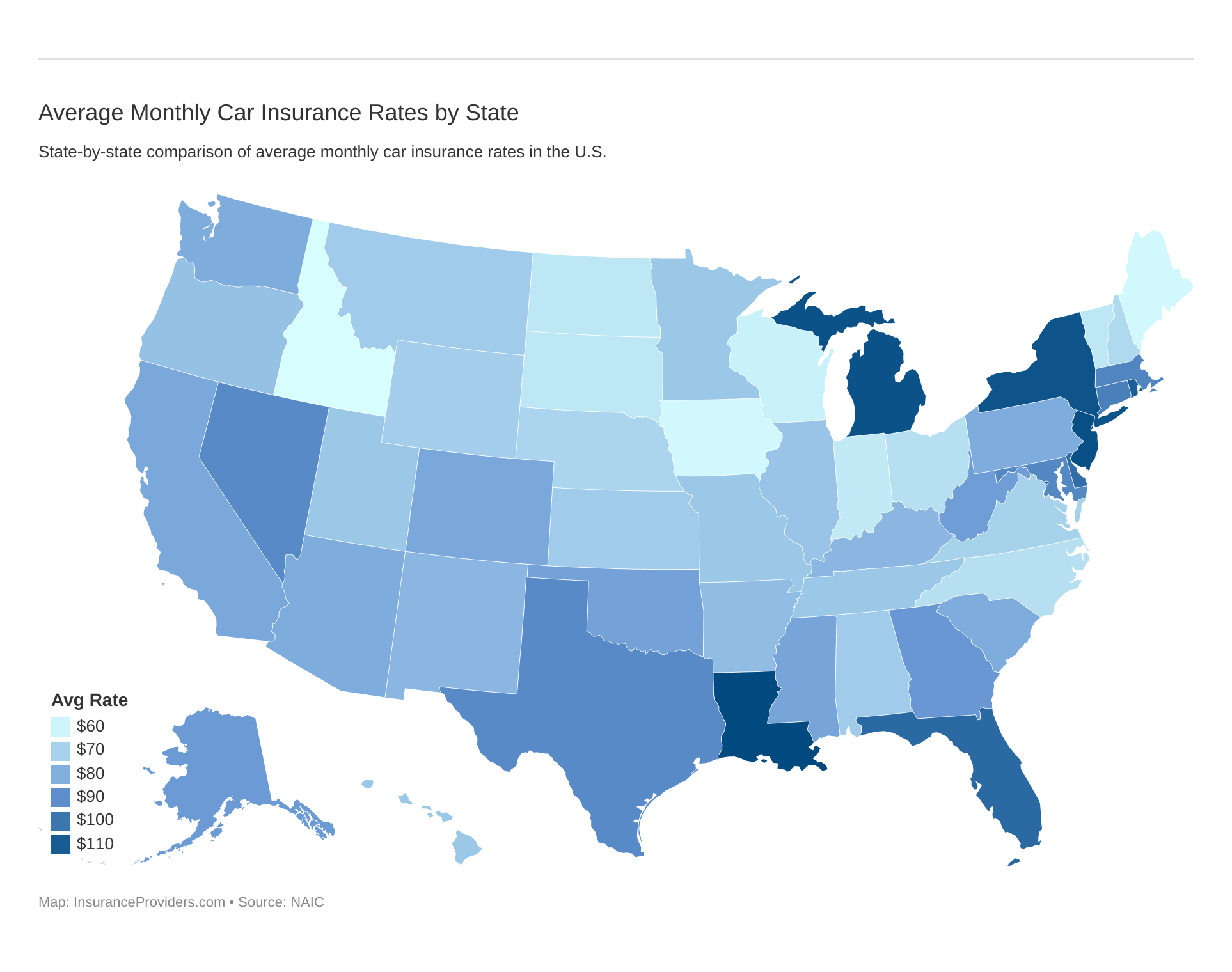

What are the average monthly car insurance rates in CA, including liability, collision, and comprehensive?

To get a better idea of how California’s core coverages compare to the rest of the nation, we examined state averages according to the NAIC, as of 2015:

| Coverage Type | Annual Costs |

|---|---|

| Liability | $489.66 |

| Collision | $396.55 |

| Comprehensive | $100.54 |

| Combined Total | $986.75 |

When comparing these averages to other states and Washington, D.C., we find that:

- In 2015, California’s average cost of collision coverage ($396.55) was the fifth highest in the nation, surpassed only by Washington, D.C., Lousiana, Michigan, and Rhode Island.

- California had the nation’s second-lowest average cost for comprehensive coverage in the nation ($100.54), higher only than Oregon.

- California ranked 26th in its average liability costs ($489.66) and 19th in full coverage costs (986.75).

Let’s take a look at the average monthly car insurance rates.

Is there any additional liability in California?

To better determine the financial health of California’s car insurers, we now look to the state’s loss ratio trends.

Investopedia defines loss ratio as a ratio of a company’s loss to gains. Loss ratios are given as a percentage, and they represent what an insurer is paying out in claims versus the money it’s bringing in through premiums.

This means that if an insurance company has a loss ratio that exceeds 100 percent, the company is paying out more in claims than they’re receiving through premiums. Experts say this could be an “indicator of financial distress,” and could lead to a company raising rates to make up for its losses.

On the flip side, if an insurer’s loss ratio is too low, this may be a sign that they are not paying out enough in claims.

In the end, a loss ratio between 60 and 70 percent is considered to be ideal.

Here’s a look at California’s loss ratio trends in Medical Payments and Uninsured/Underinsured motorists coverage:

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 69% | 62% | 60% |

| Uninsured/Underinsured Motorist (UM/UIM) | 60% | 58% | 69% |

The good news for California insurers is that as of 2015, the loss ratio in both of these categories fell into the safe range of 60 to 70 percent. In the case of Medical Payments, we see a steady decline in the loss ratio. In the case of UM/UIM, we see a slight dip from 2013 to 2014, but an 11 percent increase from 2014 to 2015.

Remember, Medical Payments and Uninsured/Underinsured motorist coverage are optional in the state of California. However, in the words of financial expert Clark Howard, these coverages can “step in to protect your wallet.” It is also worth reiterating that California ranks 12th in the nation in uninsured motorists. Bottom line,

In the face of a car accident, these additional coverages can serve as much-needed financial support and protection for you and your family.

Can you purchase add-ons, endorsements, and coverage for additional riders?

From the increasingly-popular usage-based insurance, and to additional coverage like GAP or Emergency Roadside Assistance. Here’s what California motorists need to know — they have plenty of options far beyond traditional car insurance coverage.

For the driver looking for additional levels of coverage, here’s a list of add-ons, endorsements, and riders to consider:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

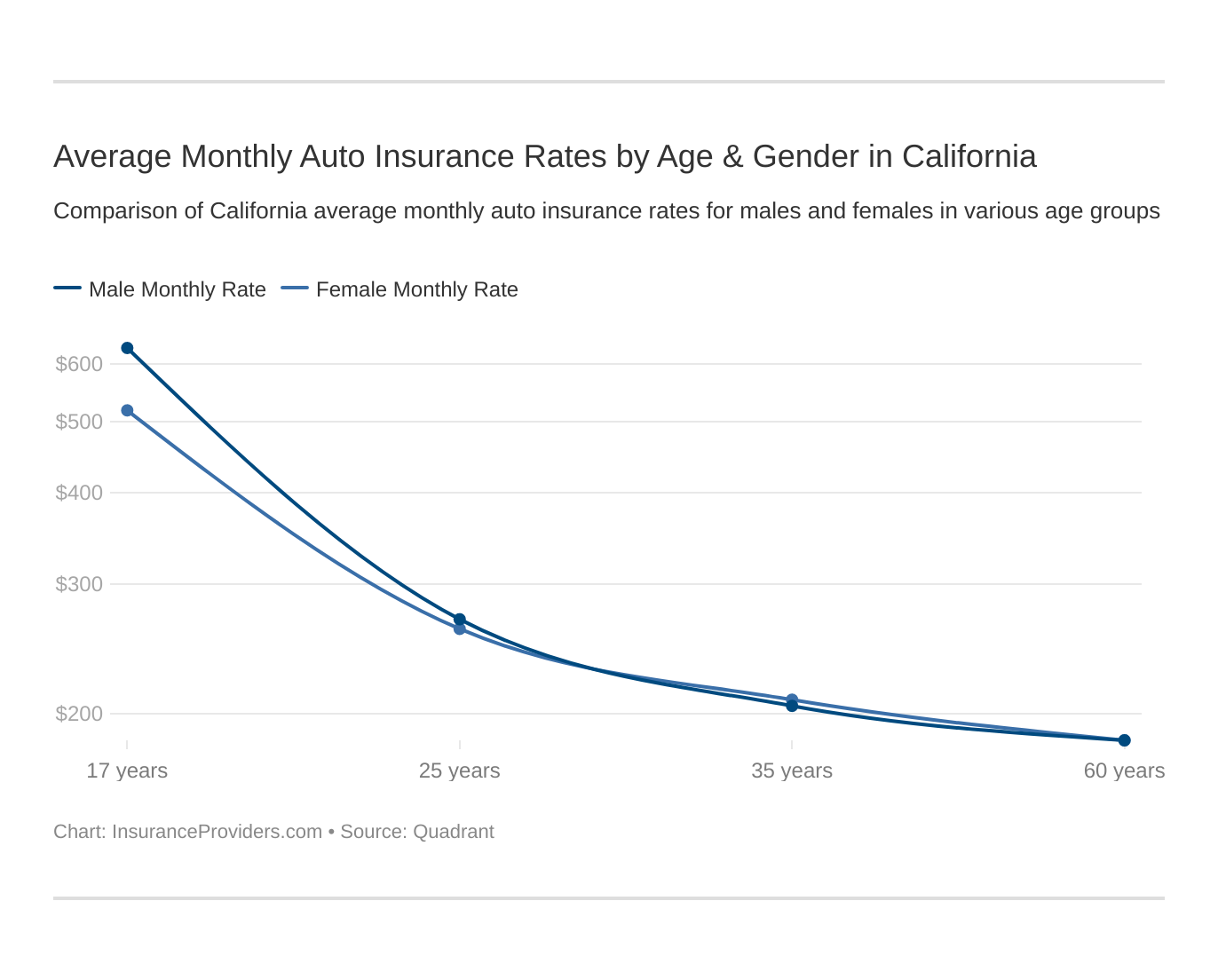

Are there California rates by gender, age, and marital status?

Where you live.

How old you are.

Whether you’re a man or a woman.

They’re all among common the factors insurance providers look to when assessing rates for motorists.

Age and gender will affect your car insurance. Younger drivers are often in a high risk class. See if the gender stereotype (males pay more) holds true in CA.

Experts say at the end of the day, what it all boils down to is risk. Where insurers see greater levels of risk, drivers will often pay a higher price.

For many car insurance companies, gender is a common risk factor that can lead to higher rates, as men have been statistically linked to higher rates of fatal car crashes. But in the state of California, that’s no longer the case.

As of January 1, 2019, insurers in the state are banned from using a driver’s gender as a factor in setting rates.

This is formally known as the Gender Non-Discrimination in Automobile Insurance Rating Regulation. According to state officials, the regulation “mandates that all automobile insurance companies operating in California file a revised class plan that eliminates the use of gender as a rating factor.”

Additionally, California’s Gender Recognition Act of 2017 allows drivers to use the term “binary” on their driver’s licenses.

That being said, we wanted to examine rates that shed more light on other factors that may still come into play with California motorists — that is, age and marital status.

To do so, we analyzed data purchased from Quadrant Information Services. What you see in the table below, and throughout this piece, represents the actual cost of car insurance coverage purchased by California residents.

This includes high-risk drivers (who often pay some of the highest premiums), as well as those purchasing minimum coverage.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate Northbrook Indemnity | $2,921.24 | $2,923.87 | $2,126.03 | $2,148.03 | $8,098.88 | $10,188.73 | $3,742.44 | $4,115.50 |

| Farmers Ins Exchange | $2,715.31 | $2,715.31 | $2,451.83 | $2,451.83 | $8,667.08 | $14,189.14 | $3,218.46 | $3,585.17 |

| Geico General | $1,786.81 | $1,787.80 | $1,680.52 | $1,680.52 | $5,433.56 | $5,529.48 | $2,566.22 | $2,624.98 |

| SAFECO Ins Co of America | $2,303.99 | $2,177.93 | $2,145.20 | $2,077.01 | $5,014.43 | $5,348.46 | $2,593.72 | $2,620.60 |

| AMCO Insurance | $3,272.83 | $3,124.42 | $2,863.68 | $2,699.52 | $8,318.27 | $9,186.72 | $3,904.76 | $3,858.43 |

| United Financial Casualty | $1,785.37 | $1,837.82 | $1,518.62 | $1,802.64 | $4,767.78 | $5,748.65 | $2,576.92 | $2,771.33 |

| State Farm Mutual Auto | $3,310.18 | $3,310.18 | $2,957.44 | $2,957.44 | $6,089.50 | $7,555.39 | $3,663.92 | $3,777.69 |

| Travelers Commercial Ins Co. | $2,497.45 | $2,417.86 | $2,206.26 | $2,182.92 | $5,165.60 | $5,906.73 | $3,249.64 | $3,179.78 |

| USAA CIC | $1,929.46 | $1,827.74 | $1,882.10 | $1,889.89 | $4,404.58 | $4,428.83 | $2,670.51 | $2,523.86 |

Read more: AMCO Insurance Company: Customer Ratings & Reviews

What these figures reveal is that married drivers are generally paying lower rates than single drivers. When we break the figures down by age, 60-year-olds have the lowest premiums. The lowest premium in this group falls to 60-year-old females insured with United Financial, at an average rate of $1,518.62.

What should come as no surprise? Seventeen-year-old drivers are paying the highest rates in this group. The highest premiums can be seen with 17-year-old men insured with Farmers Insurance Exchange, at an astounding average rate of $14,189.14.

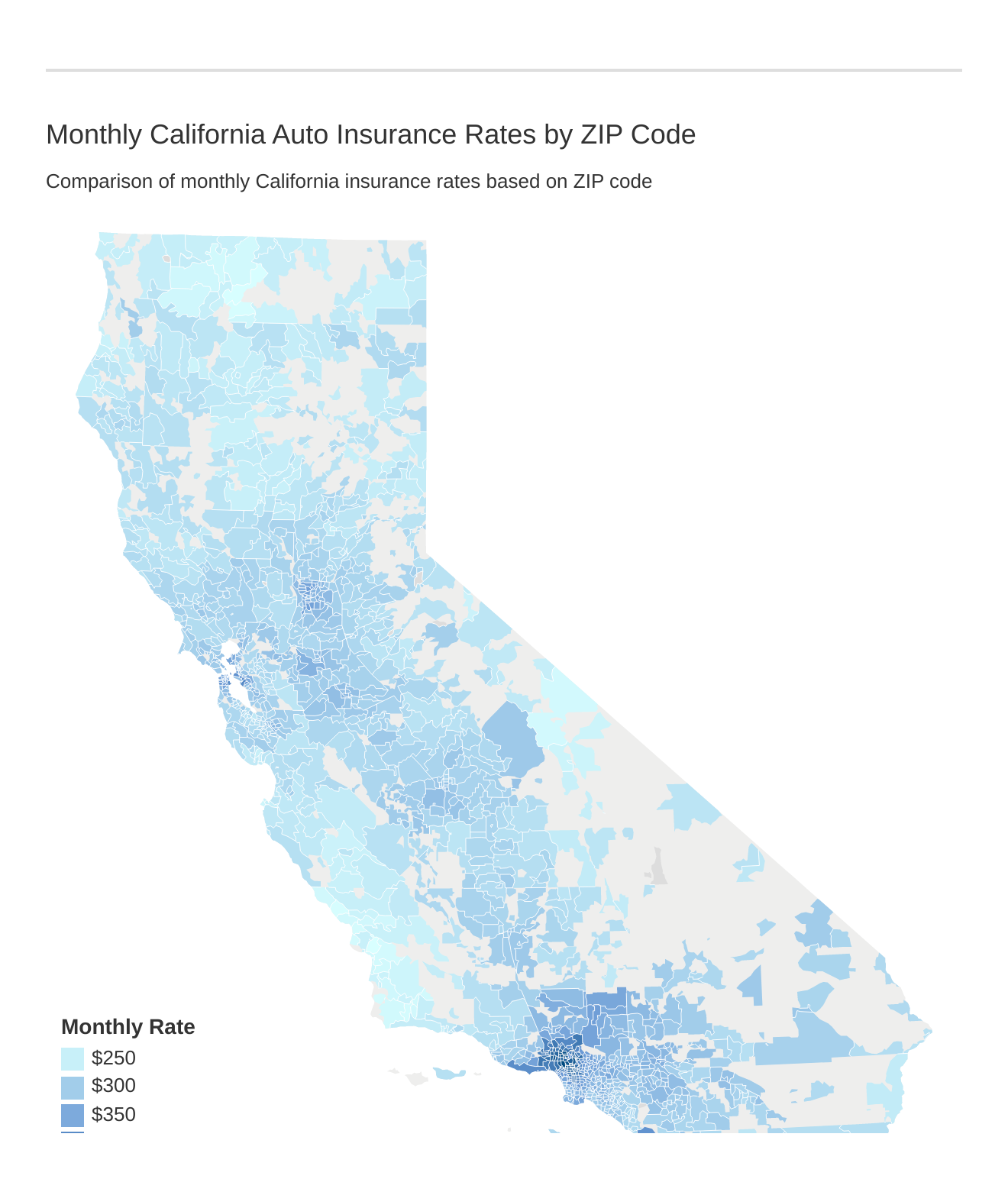

What are the cheapest California rates by ZIP code?

To the average car insurance provider, ZIP codes do much more than reveal where their customers live. They reveal important data — namely, crime and car accident rates.

Let’s take a closer look at how ZIP codes affect car insurance in California.

Experts report that some providers are looking beyond how much car-related crime —like break-ins, thefts, and vandalism — is taking place where you live. Some are also looking to measure trends in costs tied to car repair, and medical litigation.

Many advocates argue that the use of ZIP codes as a rate-setting factor is discriminatory, particularly toward those living in lower-income areas. So much so, a Consumer Federation of America Study found that drivers living in lower socioeconomic areas were paying significantly higher rates than their counterparts in different ZIP codes.

Our research shows that the zip code with the highest overall average rate of $6,324.83 is none other than the famed 90210, which includes Los Angeles, Beverly Hills, and West Hollywood.

Among the highest rates included in this ZIP code are $8,000+ average annual premiums with Allstate Northbrook and Farmers Insurance Exchange. (For more information, read our “Allstate Northbrook Indemnity Company Review“).

Conversely, the ZIP code with the lowest overall average rate is 93401 at $2,731.32. This zip code includes the cities of San Luis Obispo, Avila Beach, and Edna. The lowest premium listed in this zip code is with United Financial Casualty at $2,177.96.

What are the cheapest California rates by city?

Once more, Beverly Hills tops our list of communities with the highest average rates, at $6,188.41.

Among the state’s top ten cities with the highest average rates are:

- Beverly Hills, with an average rate of $6,188.41

- Van Nuys, $5,897.84

- West Hollywood, $5,844.28

- Tarzana, $5,798.46

- North Hollywood, $5,769.36

- Encino, $5,744.64

- Valley Village, $5,718.12

- Panorama City, $5,701.66

- Studio City, $5,649.18

- Reseda, $5,593.76

As for the state’s ten cities with the lowest rates, they are:

- Weed, with an average rate of $2,752.73

- Cambria, $2,774.88

- Mount Shasta, $2,777.88

- Buellton, $2,807.43

- Morro Bay, $2,807.96

- Los Osos, $2,821.16

- Lompoc, $2,823.96

- Arroyo Grande, $2,824.43

- Pismo Beach, $2,829.93

- Grover Beach, $2,834.19

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are some of the best car insurance companies in California?

Finding the best car insurance provider isn’t just about rates.

It involves knowing that trusted organizations like A.M. Best have assessed the provider to be financially stable.

It involves knowing that consumers are satisfied with the company’s overall performance.

It also involves knowing that an insurer can resolve customer complaints in a quick and competent matter.

Without a doubt, having a fuller picture of all of these factors will aid any California driver in determining which provider will truly suit their needs. It’s why we’re spending the next few moments taking a closer look at all of these topics — and much more.

Can we look into the financial ratings for the largest companies in California?

Anyone who’s ever been a student knows one thing for sure — grades tell an important story.

After all, whether a student gets an A or an F on a class project says a lot — about how well they know the topic, and whether they’ve truly mastered it.

The same can be said for car insurance companies.

For years, A.M. Best has provided financial insight into more than 3,5000 companies worldwide through the use of its Financial Strength Ratings (FSR) system. By assigning companies ratings ranging from an A++ to a D, consumers are told a story of how financially stable experts consider any given company.

Here’s a look at the A.M. Best’s FSRs for California’s largest car insurance providers:

| Insurance Provider | Rating |

|---|---|

| State Farm Group | A++ |

| Farmers Insurance Group | A |

| Geico | A++ |

| Allstate Insurance Group | A+ |

| Auto Club Enterprises Insurance Group | A- |

| Mercury Gen Group | a- (Long Term ICR) |

| CSAA Insurance Group | A |

| USAA Group | A++ |

| Progressive Group | A+ |

| Liberty Mutual Group | A |

We can see that three major insurers in California have garnered A.M. Best’s top A++ rating, also known as “Superior” — Geico, State Farm, and USAA. Not too far behind are Progressive and Allstate, both earning an A+.

Although A.M. Best did not provide an FSR for Mercury Gen Group, it does provide something called a Long-Term Issuer Credit Rating (ICR).

In short, an ICR represents an opinion of a company’s ability to meet its ongoing senior financial obligations. Mercury Gen Group’s ICR of an “a-” represents “an excellent ability to meet their senior financial obligations”

What are some of the California companies with the best ratings?

California drivers who want greater insight into customer satisfaction can turn to J. D. Power. Known for years of surveying consumers and analyzing their feedback, J.D. Power digs deeper into whether drivers are truly happy with their insurance provider.

Now let’s see who is the cheapest car insurance company in California.

Through its 2019 U.S. Auto Insurance Study, auto-insurance companies are ranked by region and measured in five areas (in order of importance):

- Interaction

- Policy offerings

- Price

- Billing process and policy information

- Claims

J.D. Power additionally assigns “Power Circle Ratings” to each insurer. They are:

- Five out of Five Circles, also known as “Among the Best”

- Four out of Five Circles/“Better than Most”

- Three out of Five Circles/“About Average”

- Two out of Five Circles/“The Rest”

Here’s a look at how insurers fared in the study’s California region. We placed them in order of their customer satisfaction index rating, from highest to lowest:

| Insurance Provder | Customer Satisfaction Index Rating (out of 1,000) | JDPower.com Power Circle Ratings |

|---|---|---|

| Esurance | 847 | 5/5 |

| Auto Club of Southern California | 834 | 4/5 |

| Ameriprise | 830 | 4/5 |

| Wawanesa | 828 | 4/5 |

| Geico | 825 | 4/5 |

| State Farm | 824 | 4/5 |

| Safeco | 822 | 3/5 |

| The Hartford | 821 | 3/5 |

| Progressive | 821 | 3/5 |

| California Average | 817 | 3/5 |

| CSAA | 809 | 3/5 |

| Allstate | 808 | 3/5 |

| Liberty Mutual | 808 | 3/5 |

| Farmers | 805 | 3/5 |

| Mercury | 805 | 3/5 |

| Nationwide | 780 | 2/5 |

| Kemper | 778 | 2/5 |

| USAA* *provider not included in rankings | 844 | 5/5 |

In reviewing these results, a clear front-runner can be seen in the Overall Customer Satisfaction Index Rating. Esurance tops this list with 847 out of 1,000 points. Additionally, with the company’s five-circle (“Among the Best”) Power Circle Rating, we know that Esurance has scored in the top ten percent of their study.

Companies that didn’t fare quite as well include Nationwide and Kemper. The two providers are the only ones on this list scoring in the 700-point range and with a two-circle (“The Rest”) Power Circle Rating.

Finally, it’s also worth clarifying USAA’s status on this list. Even though the insurer is part of the study, it is not ranked. This is because USAA is only open to U.S. military personnel and their families, and therefore, is not included in J.D. Power’s overall rankings.

Read more:

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are some companies with the most complaints in California?

As we move from customer satisfaction to complaints, we gain even greater insight into how California providers are relating to drivers.

Thanks to a 2018 Consumer Complaint Study published by California’s Department of Insurance, we are able to track complaint data for the state’s largest insurers between 2015 and 2017:

| Insurance Provider | 2017 | 2016 | 2015 |

|---|---|---|---|

| State Farm Mut Auto Ins Co | 77 | 119 | 204 |

| Farmers Ins Exch | 39 | 32 | 40 |

| Geico Gen Ins Co | 32 | 44 | 92 |

| Allstate Northbrook Ind Co | 61 | 50 | 38 |

| Mercury Ins Co | 38 | 42 | 44 |

| CSAA Ins Exch | 64 | 55 | 63 |

| USAA Cas Ins Co | 8 | 14 | 25 |

| Progressive Select Ins Co | 26 | 10 | 15 |

| Liberty Mut Fire Ins Co | 38 | 55 | 28 |

We can immediately see that the company fielding the highest number of complaints is State Farm, which at one point had numbers in the triple digits. Though the numbers are highest for the provider, we do see a downward trend — with the number of complaints dropping significantly from 204 in 2015 to 77 in 2017.

As of 2017, the provider with the lowest number of complaints was USAA, registering only eight complaints in 2017.

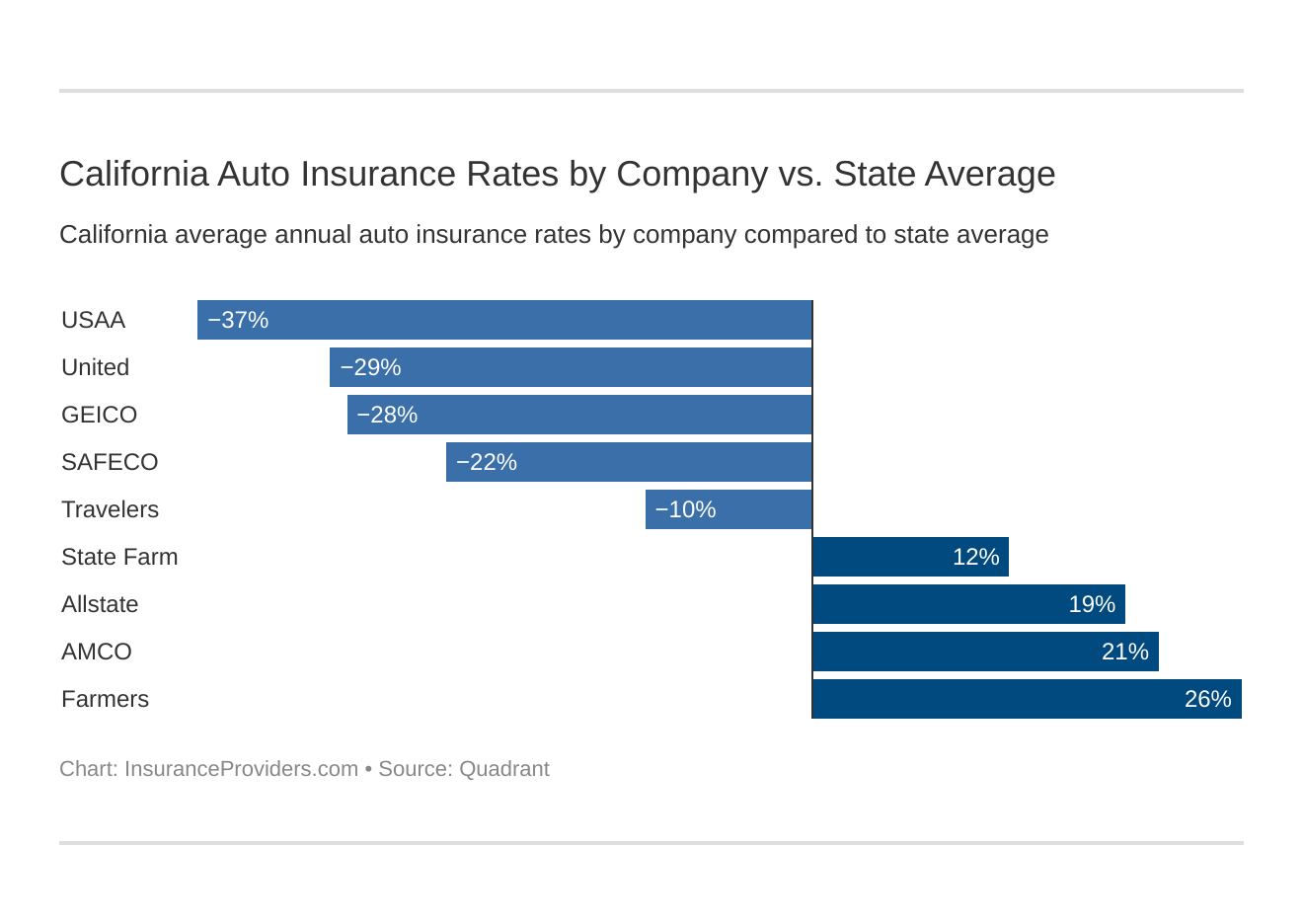

What are the cheapest companies in California?

To get a better idea of who’s offering the best rates, we broke down the average premiums among California’s largest auto insurers:

| Insurance Provider | Average Rate | Compared to State Average (higher or lower) | Compared to StateAverage (% higher or lower) |

|---|---|---|---|

| Allstate Northbrook Indemnity | $4,533.09 | + $843.47 | + 18.61% |

| Farmers Ins Exchange | $4,999.27 | + $1,309.64 | + 26.20% |

| Geico General | $2,886.24 | - $803.38 | - 27.84% |

| SAFECO Ins Co of America | $3,035.17 | - $654.45 | - 21.56% |

| AMCO Insurance | $4,653.58 | + $963.96 | + 20.71% |

| United Financial Casualty | $2,851.14 | - $838.48 | - 29.41% |

| State Farm Mutual Auto | $4,202.72 | + $513.10 | + 12.21% |

| Travelers Commercial Ins Co. | $3,350.78 | - $338.84 | - 10.11% |

| USAA CIC | $2,694.62 | - $995.00 | - 36.93% |

According to this data, Farmers has the highest average rate at $4,999.27. This rate represents a $1,309.64 increase above the overall average rate.

Of these insurers, only three providers have average rates that fall into the $2,000 range — Geico, United Financial and USAA. Of the three, USAA has the lowest average rate. At $2,694.62, this is a $995.00 decrease under the overall average.

Read more: Cheapest California Auto Insurance Providers

What about California rates by commute?

To the Insurance Information Institute, the logic is simple —

The more miles you put on your car,the more likely you are to get into an accident.

It’s why some insurers will charge drivers higher rates for a longer commute. This is important when you consider that as of 2014, the U.S. Department of Transportation’s Federal Highway Administration estimated that the average licensed California resident drove 13,414 miles annually.

Some states have banned discrimination based on your credit score when it comes to auto insurance rates, and this is one of those States.

We reviewed our data to see whether California drivers with longer commutes were paying higher rates:

| Insurance Provider | 10-Mile Commute/ 6,000 Miles Annually | 25-Mile Commute/ 12,000 Miles Annually |

|---|---|---|

| Allstate | $4,086.25 | $4,979.93 |

| Farmers | $4,535.69 | $5,462.84 |

| Geico | $2,621.93 | $3,150.55 |

| Liberty Mutual | $2,786.10 | $3,284.23 |

| Nationwide | $4,108.79 | $5,198.37 |

| Progressive | $2,587.19 | $3,115.09 |

| State Farm | $4,049.89 | $4,355.54 |

| Travelers | $3,014.07 | $3,687.49 |

| USAA | $2,482.96 | $2,906.28 |

Bottom line — every single insurance provider on this list charges drivers higher rates for a longer commute.

- The company with the smallest difference in commute rates is Progressive, at $305.65.

- The company with the largest difference in commute rates is Nationwide, at $1,089.58.

For the California drivers who don’t put a lot of miles on their vehicle, here’s some good news — you may have discounts coming your way.

- A number of large insurers offer low-mileage discounts, typically geared toward those who drive less than 7,500 miles annually.

- Additionally, through pay-per-mile insurance, drivers are charged according to the number of miles they drive. This typically consists of a monthly base rate, as well as a per-mile rate.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Can we look at California rates by coverage level?

It goes without saying — as drivers choose to purchase higher levels of coverage for their vehicles, their premiums will increase.

With this in mind, we took a closer look at what California drivers are paying for low, medium, and high coverage:

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $4,287.09 | $4,572.72 | $4,739.46 |

| Farmers | $4,651.83 | $5,038.58 | $5,307.39 |

| Geico | $2,612.92 | $2,918.49 | $3,127.30 |

| Liberty Mutual | $2,824.01 | $3,061.95 | $3,219.54 |

| Nationwide | $4,179.52 | $4,734.55 | $5,046.66 |

| Progressive | $2,555.04 | $2,936.65 | $3,061.73 |

| State Farm | $3,793.44 | $4,273.41 | $4,541.30 |

| Travelers | $2,924.52 | $3,440.36 | $3,687.46 |

| USAA | $2,445.05 | $2,746.50 | $2,892.32 |

Our analysis revealed that each insurer on this list progressively charges more when going from low, to medium, and to high coverage.

However, no matter what level of coverage California drivers are getting, one insurance provider is charging the highest rates across the board, and another is charging the lowest rates across the board:

- The provider charging the highest average rates across the board is Famers, ranging from $4,651.83 for low coverage and $5,307.39 for high coverage.

- The provider charging the lowest average rates across the board is USAA, ranging from $2,445.05 for low coverage and $2,892.32 for high coverage.

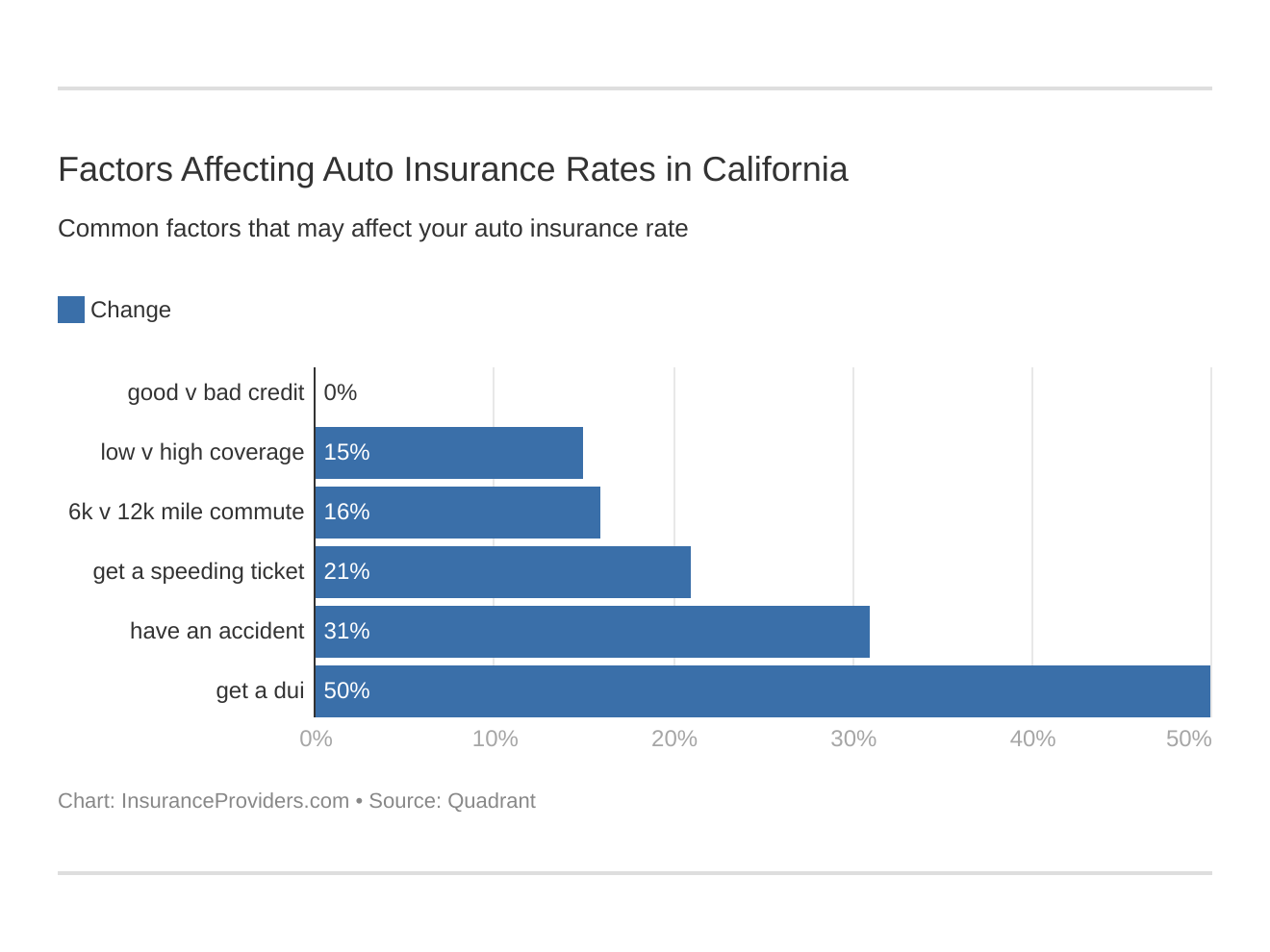

What are some California rates by credit history?

They’re three digits than can change the course of your buying power with banks, lenders, and other financial institutions —

Your credit score.

When it comes to car insurance, the state of your credit is impactful, as it points to how financially responsible you are. The Insurance Information Institute reports that most states allow the use of credit-based insurance scores (also called “insurance scoring”) as a determining factor for rates. However, that is not the case in the Golden State. That’s because,

In the state of California, using credit-based scoring is prohibited under Proposition 103.

California also joins Massachusetts in Hawaii in prohibiting auto insurers from using credit scoring to set rates. However, some lawmakers are pursuing legislation in the hopes of making this a reality in all 50 states.

Can we also look at California Rates by driving record?

Speeding tickets.

Car accidents.

DUIs.

For the California driver wondering whether their record can impact their car insurance premiums, the answer is yes.

In fact, as stated in the video below, insurers “try to predict your future by looking at your past.” It’s why they’ll often look to the last three to five years of your driving record to predict your risk level.

We took a look at what the state’s largest providers are charging drivers with various infractions:

| Insurance Provider | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Accident |

|---|---|---|---|---|

| Allstate | $2,728.84 | $3,582.21 | $7,223.45 | $4,597.86 |

| Farmers | $3,697.25 | $4,998.06 | $6,268.29 | $5,033.47 |

| Geico | $2,018.18 | $2,503.62 | $3,908.23 | $3,114.92 |

| Liberty Mutual | $2,634.50 | $2,791.65 | $3,185.41 | $3,529.11 |

| Nationwide | $3,246.63 | $4,162.31 | $7,043.06 | $4,162.31 |

| Progressive | $1,865.51 | $2,687.54 | $3,680.03 | $3,171.49 |

| State Farm | $2,998.34 | $3,480.06 | $6,756.08 | $3,576.40 |

| Travelers | $2,234.04 | $3,290.14 | $4,234.85 | $3,644.10 |

| USAA | $1,790.02 | $1,960.95 | $4,363.10 | $2,664.41 |

Generally speaking, most insurers charge higher rates as drivers progress from a clean record, to one speeding violation, to one accident, and to one DUI conviction. However, there are some exceptions:

- Nationwide charges the same average rate to drivers with one speeding violation and one accident

- Liberty drivers with one accident are paying more than drivers with a DUI.

Also of note:

- Drivers with a clean record are paying the least with Progressive and USAA, at rates of $1,865.51 and $1,790.02, respectively.

- Drivers with one DUI are paying the highest rates with Allstate and Nationwide, with averages exceeding $7,000.

Knowing that your rates can skyrocket after an infraction will, without a doubt, encourage safer driving habits. For many providers, this will be an incentive for savings.

Several insurers offer discounts for being claim-free over a set period of time. Others, like Liberty Mutual, even offer accident forgiveness.

California drivers should also know that they can request a copy of their driving records. By clicking this link and setting up an account, they can receive the following information:

- Convictions for three, seven, or 10 years

- Departmental actions

- Accidents on a person’s driver record

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

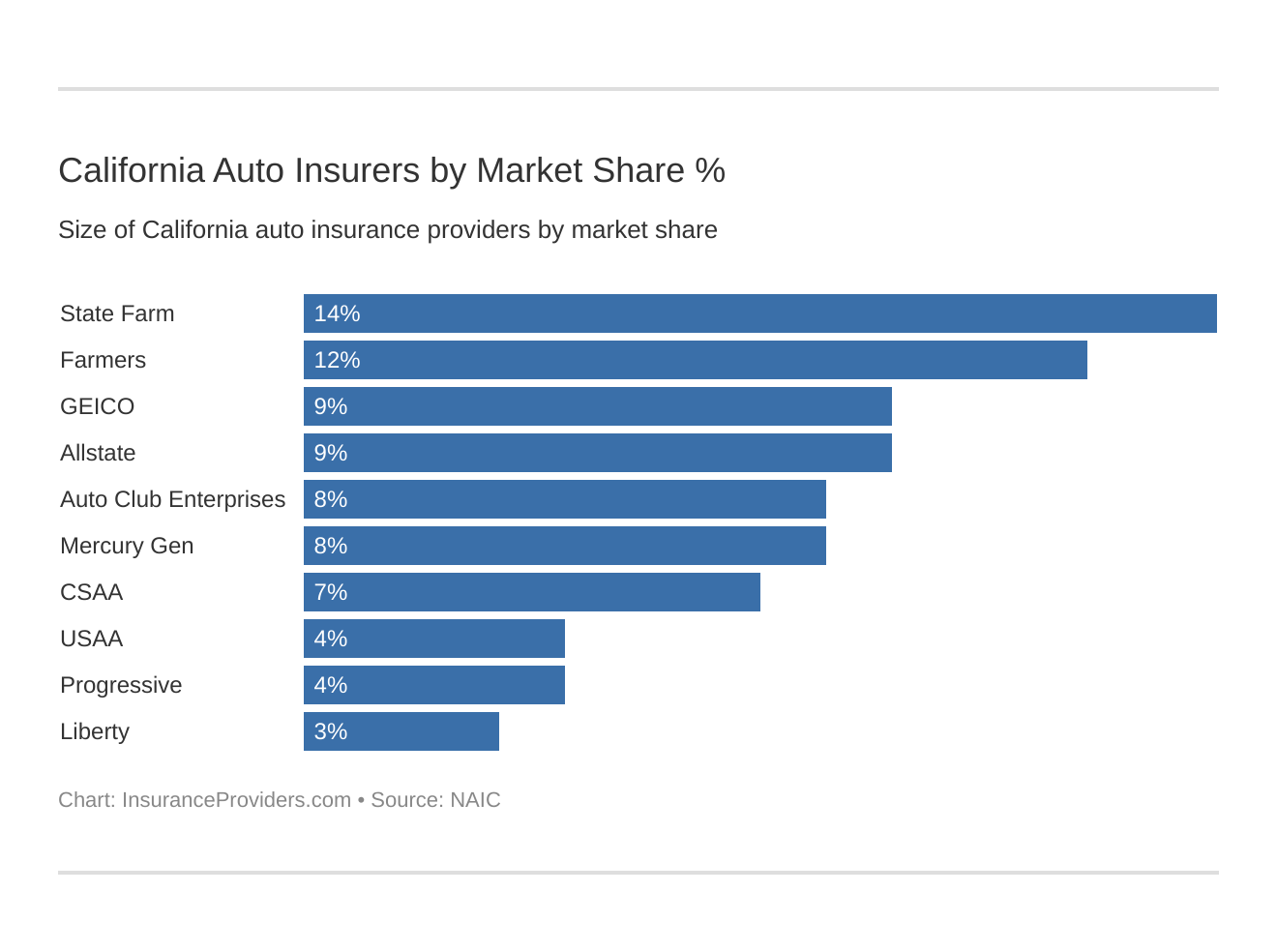

What are some of the largest car insurance companies in California?

Knowing an insurance provider’s market share will help drivers gain a better understanding of how well it’s performing as a business.

Who are the largest car insurance companies in CA?

A market share is a number that’s given as a percentage, and it illustrates a company’s portion of sales within the market it operates. In other words,

A company’s market share is a marker of its size in the market. The larger the market share, the more prominent the company.

To see which insurers in California have the largest market shares, we turned to the NAIC:

| Insurance Provider | Direct Premiums Written | Market Share |

|---|---|---|

| Allstate Insurance Group | $2,446,564 | 8.97% |

| Auto Club Enterprises Insurance Group | $2,312,230 | 8.48% |

| CSAA Insurance Group | $1,950,257 | 7.15% |

| Farmers Insurance Group | $3,158,814 | 11.59% |

| Geico | $2,502,854 | 9.18% |

| Liberty Mutual Group | $929,058 | 3.41% |

| Mercury Gen Group | $2,095,531 | 7.69% |

| Progressive Group | $1,147,186 | 4.21% |

| State Farm Group | $3,910,351 | 14.34% |

| USAA Group | $1,218,792 | 4.47% |

The NAIC reveals that in the state of California, the car insurance provider with the largest market share is State Farm, at a 14.34 percent share and $3,910,351 in direct premiums.

State Farm’s share of the market is 2.75 percent higher than the second provider on the list, which is Farmers Insurance Group at 11.59 percent.

What are the number of insurers in California?

When it comes to the number of insurers in California, drivers have options — 770, to be exact.

That’s because our research shows that there are99 domestic insurance providers and 671 foreign insurance providers in the state.

To elaborate, a domestic insurer has been formed under the laws of the state of California.

A foreign insurer has been formed under the laws of states, districts, territories, or commonwealths other than California.

Are there California-specific laws?

Without a doubt, the laws that govern drivers in any state can often seem overwhelming and complicated.

However, not having an understanding of those laws can lead to significant consequences — many which can negatively impact your driving record.

By spending the next few sections focusing on important state laws, we’re helping you become a more informed driver who will remain on the right side of the law.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are California car insurance laws?

Car insurance is big business in California. So much so, state officials report that California is the largest insurance market in the U.S., and the fourth-largest in the world.

When it comes to the state’s car insurance standards and practices, here’s what drivers need to know — they are highly regulated by state statutes and policies.

How are California state laws for insurance determined?

Calfornia’s Department of Insurance enforces the insurance laws of the state and exercises authority over how insurance companies and licensees conduct business. This includes requiring prior approvals of property and casualty rates for personal auto insurance.

In fact, according to the CDI site, employees “… annually processes more than 8,000 rate applications, issue approximately 190,000 licenses (new and renewals) and perform hundreds of financial reviews and examinations of insurers doing business in California.”

Is there windshield coverage in California?

To have a cracked windshield or rear window in the state of California is more than just a safety matter — it’s also a legal matter.

That’s because according to state law, it is “unlawful to operate any motor vehicle upon a highway when the windshield or rear window is in such a defective condition as to impair the driver’s vision either to the front or rear.”

This means that if an officer finds your windshield fails to comply with this code, you must fix in within 48 hours. Even further,

The officer could decide to arrest the driver, and give them notice to appear in court with evidence that the windshield or rear window has been fixed and conforms to code.

Drivers will want to check with their provider to see whether their comprehensive coverage covers windshield replacement or repair.

We checked in with CarWinshields.info and found that in California, drivers can choose where the repair work is done, and are entitled to an estimate. Aftermarket parts may be used in the repair, but only if they are equal in kind, quality, safety, fit and performance of OEM (original equipment manufacturer) parts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is there high-risk insurance in California?

California drivers who are considered high-risk may find it challenging to find providers willing to insure them.

The Insurance Information Institute shares that those who may be categorized as high-risk drivers include:

- Drivers with a poor driving record (multiple traffic violations and citations, DUI/DWI convictions)

- Drivers with no insurance, or a bad record of insurance (lapsed coverage or missed payments)

Those who are considered high-risk may also be required to have an SR-22 filed with their insurance. According to the Shouse California Law Group,

An SR-22 is a certificate an insurer files with the DMV to confirm that you meet the state’s minimum requirements for liability coverage.

SR-22’s are usually mandated by the courts, and can be required for:

- Reinstating your driving privilege following a DUI

- Being involved in an accident when you were uninsured

- Reinstating your driving privilege after it was revoked or suspended by the DMV, as a result of being declared a negligent operator (in other words, getting too many points on your record in a set period of time)

High-risk drivers who are unable to acquire traditional insurance coverage have a resource in California’s assigned-risk insurance pool. The California Automobile Assigned Risk Plan (CAARP) serves as a last resort to drivers who have “in good faith” sought out insurance in the voluntary market but have had no success.

To learn more about CAARP, click here or contact:

California Automobile Assigned Risk Plan

1111 Broadway, Suite 1670 Oakland, CA 94607

Monday – Friday 8:00 – 4:00 PT

Phone: (800) 622-0954 / Fax: (415) 421-4013 / Email: caarp@aipso.com

Can you get low-cost insurance in California?

Liability coverage at affordable rates – that’s the focus of California’s Low-Cost Auto (CLCA) Insurance Program, which was established in 1999 to help income-eligible drivers purchase car insurance.

Keep in mind, that under the state’s low-cost insurance program, the minimum liability coverage limits are lower than the state’s minimum coverage requirements. These limits, however, are legal for those who qualify:

| Low-Cost Plan Coverage | California Minimum Requirements |

|---|---|

| Up to $10,000 for injury/death to one person Up to $20,000 for injury/death per accident Up to $3,000 for property damage | $15,000 for injury/death to one person $30,000 for injury/death per accident $5,000 for property damage |

To be clear, that’s

- Up to $10,000 per person in case of bodily injury or death

- Up to $20,000 per accident in case of bodily injury or death

- Up to $3,000 for property damage

The CLCA program also offers drivers the option of purchasing Uninsured Motorist-Bodily Injury and Medical Payments coverage.

Under the Uninsured Motorist-Bodily Injury Optional Coverage, drivers will receive:

- Up to $10,000 per person (for you or your passengers injured)

- Up to $20,000 per accident

Under the Medical Payments Optional Coverage, costs at up to $1,000 per person injured would be provided.

Drivers interested in comprehensive or collision coverage can purchase them through the agent who assists them.

In order to qualify for CLCA, drivers must:

- Have a valid California driver’s license

- Meet income eligibility requirements

- Own a car valued at $25,000 or less

- Be at least 16-years-old

- Have a good driving record

For additional information on eligibility, documentation requirements, and how to apply, visit the CLCA website.

Is there such a thing as automobile insurance fraud in California?

Insurance fraud is a crime that costs insurers as much as $30 billion annually. In the state of California, the Department of Insurance has designated an entire division of over 275 staffers to “…protect the public and prevent economic loss through the detection, investigation, and arrest of insurance fraud offenders.”

California officials define fraud as an occurrence in which someone knowingly lies to get a benefit or advantage they’re otherwise not entitled to. It can also be defined as someone who knowingly denies a benefit to someone who should not be denied.

Under California law, insurance fraud can be prosecuted when:

- The suspect had the intent to defraud.

- An act of fraud is completed. This includes written or oral statements made to an insurer with the intent to misrepresent.

- An act and intent must come together. Both must occur to be considered a crime.

- Officials also state that “actual loss is not needed as long as the suspect has committed an act and had the intent to commit the crime. No money necessarily has to be lost by a victim.”

The state’s Fraud Division regularly investigates auto collision and property damage cases that involve hit and runs, organized rings, sudden stops, phantom vehicle fraud, arson, inflated damages, embezzlement, faked damages, and more.

To report suspected cases of fraud, contact a regional office or:

California Department of Insurance, Fraud Division

2400 Del Paso Road, Suite 250

Sacramento, CA 95834

fraud@insurance.ca.gov

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the statute of limitations in California?

Should any California driver end up in a car accident, the law limits the amount of time in which they can pursue legal action. This is referred to as a statute of limitations, and can be defined as the maximum amount of time one can decide to initiate legal action following an accident.

In terms of personal injury and property damage claims in California, here’s what drivers need to know —

- The statute of limitations is two years for personal injury claims, and

- Three years for property damage claims

What are the California’s state-specific laws?

In the state of California, it’s good news for good drivers.

That’s because state law mandates that those who qualify as good drivers are entitled to a 20 percent discount.

According to Consumer Watchdog, drivers must meet the following qualifications:

- You’ve been licensed to drive a car for at least three years

- You haven’t had more than one point violation over the last three years

- You haven’t been at fault in an accident in the last three years that have resulted in death or injury

- You haven’t been convicted of DUIs, drugs, or alcohol in the last seven years.

To learn more about this discount, read the code here.

Compare Insurance Providers Rates to Save Up to 75% Secured with SHA-256 Encryption

What are the vehicle licensing laws in California?

Simply put — California has more licensed drivers than any other in the nation.

But whether you’re a new resident, a teenage driver, or a long-time resident — sticking to the state’s laws will be key in ensuring you can retain the right to drive in the Golden State.

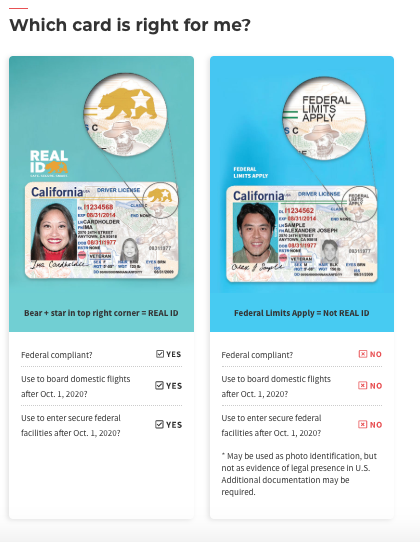

– Real ID in California

The Department of Homeland Security reports that nearly every U.S. state and territory is compliant with the federal REAL ID Act — including California.

The REAL ID Act was passed in 2005, and establishes a minimum set of security standards for state-issued licenses. Here’s what is essential for all drivers to know —

Drivers who don’t have compliant REAL ID licenses by October 1, 2020 (or an acceptable alternative ID) will not be able to get through most airport security checkpoints.

https://youtu.be/C7S2VEc4l94

In the state of California, a driver’s license that meets the requirements set forth by the REAL ID Act is marked with a gold bear and star. Here’s a photographic example as seen on the state’s Department of Motor Vehicles REAL ID site:

Under the REAL ID Act, drivers must provide specific pieces of documentation and proof that establish their identities – this includes an identity document (such as a birth certificate or passport), proof of your social security number (such as your social security card or a W-2 form), and proof of your residency (such as home utility bills, a tax return, or insurance documents).

To view a full list of eligible documents, click here. To learn more about getting a REAL ID, click here.

https://youtu.be/trAxYk7Xduo

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there penalties for driving without insurance in California?

It’s simple — as long as California drivers are getting behind the wheel, they must always carry proof of insurance.

Not doing so can result in the following consequences:

- First offense. Fines will range from $100-$200, plus penalty assessments.

- Second offense. A second offense within three years can result in fines ranging from $200-$500, plus penalty assessments.

In either case, the courts may order the impoundment of your vehicle.

It should also be noted that the state of California will suspend your vehicle registration under these circumstances:

- The Department of Motor Vehicles is notified that your insurance policy has been canceled, and a replacement policy hasn’t been submitted within 45 days

- Your insurance information hasn’t been submitted to the DMV within 30 days of it being issued.

- Your vehicle registration has been obtained by providing false evidence of insurance.

What are the California teen driver laws?

The statistics are compelling. According to the state’s Office of California Traffic Safety,

Teen driver fatalities increased 12.3 percent from 2015 to 2016.

Numbers like this are why the state requires teen drivers to comply with its graduated licensing laws. Under this system, teens are given the space to gradually gain more experience as competent and confident drivers.

To earn a permit, teens must:

- Be at least 15½ years old.

- Complete the proper Driver License & ID Card application

- Have their parent or guardian sign the application.

- Pass the knowledge test.

Drivers who are between 15½–17½ years old will need to provide proof that they:

- Completed driver education OR are enrolled and participating in an approved integrated driver education/driver training program (Certificate of Enrollment in an Integrated [Classroom] Driver Education and Driver Training Program)

Young drivers should also note that their permits are not valid until they begin driver training. Instructors will need to sign their permits to validate them.

Under the provisional permit, teens cannot drive alone at any time. They must be accompanied by a licensed California driver who is a parent or guardian, driving instructor, spouse, or adult over the age of 25.

To earn a Minors’ Drivers License (or Provisional License), teens must:

- Be at least 16

- Prove that they’ve completed both driver education and driver training.

- Have a California instruction permit (or from another state) for at least six months

- Provide documentation certifying that you have completed 50 hours of supervised driving practice (10 hours must be night driving)

- Pay a nonrefundable application fee

- Pass each of the required knowledge tests

- Pass the driving test, within three tries

Teens with a provisional license may drive alone as long as they don’t have any collisions or violations on their records. During the first year, they cannot drive between 11 p.m. and 5 a.m., and can’t drive with passengers under 20 years old, unless accompanied by a California-licensed parent or guardian, driving instructor, or driver over 25.

Once drivers turn 18, their licenses no longer become provisional.

To learn more about state laws dictating driving for teens, click here.

Are there any older driver license renewal procedures in California?

Experts agree — as drivers age so does the likelihood of vision and hearing impairments. But it doesn’t stop there.

The Insurance Institute for Highway Safety reports that older drivers have some of the highest rates of vehicle fatalities among all age groups.

As a result, the state of California has specific license renewal procedures in place for older drivers. According to the IIHS:

- Older drivers in California must renew their licenses every five years

- However, mail or online renewal is not permitted for drivers over the age of 70. Renewal must take place in person.

- Finally, when renewing, drivers over 70 will need to take a vision test.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there procedures for new California residents?

New to California? The Department of Motor Vehicles asks that new residents must get a driver’s license within ten days. Residency is established by:

- Voting in a California election

- Paying resident tuition

- Filing for a homeowner’s property tax exemption, or any other benefit not typically available to non-California residents.

Residents who are over 18 and are applying for a driver’s license for the first time must:

- Complete an application

- Visit a DMV office

- Provide your social security number

- Verify your identity

- Provide your true full name

- Present your acceptable residency document if you have never had a California DL or California identification (ID) card

- Pay a nonrefundable application fee

- Give a fingerprint scan.

- Pass a vision exam and all knowledge tests

- Have your photograph taken

- Pass the knowledge test(s)

- Provide documentation in compliance with REAL ID requirements

To review the complete list of rules and requirements, click here.

What are the license renewal procedures in California?

California licenses must be renewed every five years. Renewal can be done by mail as long as the license is not probationary and if in the last two years, drivers:

- Have had no violation of specified traffic laws

- Don’t have a point count more than one

- Haven’t refused to submit to a chemical test

- Have no license suspensions

Drivers can also renew online by visiting this site. However, keep in mind that you may not renew online if you wish to update or change your name, address, or gender. You also cannot apply for a REAL ID for the first time online.

What is the California Negligent Operator Treatment System (NOTS)?

In the state of California, traffic violations, convictions, and collisions can have a lasting impact on your driving record — to the tune of 36 months or longer.

This is where the state’s Negligent Operator Treatment System (NOTS) comes in. Some examples of what drivers can earn points for include:

- Speeding (one point)

- Unsafe vehicle (one point)

- Condition of brakes (one point)

- Hit and Run (two points)

- DUI (two points)

As drivers progressively earn points against their record, they may be deemed a “negligent operator” if they reach the following thresholds:

- Four points in 12 months

- Six points in 24 months

- Eight points in 36 months

To learn more about the state’s Negligent Operator Program, click here.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the the rules of the road in California?

They’re all questions you could be asking.

- What is the maximum speed limit?

- When should my children be in car seats?

- Should I be keeping right, or moving over?

Indeed, the rules of the road are important in any state, and California is no exception. From speed limits to car seats, and to ridesharing — we’re breaking them down below:

Is California a fault or no-fault state?

As a reminder, California is considered a “fault” state. In other words, drivers who are considered to be at fault in causing an accident will be held financially responsible. Without a doubt, this underscores the importance of having car insurance, as to not shoulder these financial burdens on your own.

According to Nolo.com, California law allows those who have suffered injury as a driver, a passenger, or a pedestrian to pursue the following legal actions in order to get compensation for what’s been lost:

- Filing a claim under your own insurance policy.

- Pursuing a third-party claim through the at-fault driver’s insurance

- Filing a personal injury lawsuit against the at-fault driver.

What are California’s seat belt and car seat laws?

At the end of the day, experts say the effectiveness of seat belt use is all in the numbers. Case in point —

A National Highway Traffic Safety Administration study found that between 1960 and 2012, seat belts saved 329,715 lives.

California drivers need to be aware that state law requires that anyone 16 and older must wear a seat belt, regardless of where they’re sitting in the car.

When it comes to children and car seats:

- California law requires children under the age of two, less than 40 inches tall, and less than 40 pounds to be in a rear-facing car seat

- Children under 8 years old and under 4’9” tall must be in a car or booster seat

- Children between the ages of 8-15 years of age or those who are over 57 inches tall may use an adult seat belt.

- All children under 7 years of age who are under 57 inches in height must be in the back seat.

- Failing to comply with these laws can result in a $100 fine, for a first offense.

Finally, riding in the cargo area of a pickup truck is generally not permitted, but there are some exceptions. According to the IIHS, that includes:

- A passenger restrained by a federally approved restraint system

- A farmer-owned vehicle used exclusively within farming land

- Participation in a parade (going no more than 8 miles per hour)

- Emergency situations

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are California’s move over and keep right laws?

It’s a law that officers say was designed to protect lives.

However, some worry California’s “Move Over Law” is one that too many drivers neglect, ultimately putting people in harm’s way.

The state’s Move Over Law is simple —

As drivers encounter stationary emergency response vehicles with flashing lights, they must slow down and, if possible, vacate to the lane closest to them. This includes tow trucks, Caltrans vehicles with amber warning lights, and waste service vehicles.

Ultimately, by moving over, officers and other workers are protected from being struck as they conduct official business.

As for the state’s Keep Right Law, drivers are asked to keep right if they’re driving slower than the average speed of traffic around them.

Maximum Speed Limits in California

Here’s a look at the state’s maximum speed limits:

| Road Type | Rural Interstates | Urban Interstates | Other Limited Access Roads | Other Roads |

|---|---|---|---|---|

| Maximum Posted Speed Limit (mph) | 70 Trucks: 55 | 65 Trucks: 55 | 70 Trucks: 55 | 65 Trucks: 55 |

Drivers should also note that the speed limit on city streets is typically 35 miles per hour. Residential areas and areas near schools typically have a 25 mph speed limit.

Are there ridesharing insurance options in California?

Research continues to prove the obvious — ridesharing is on the rise.

In fact, a Pew Research Center study shows that

Thirty-six percent of all U.S. adults have used a ridesharing service like Uber or Lyft. This is compares to just 15 percent of those surveyed in 2015.

As more are turning to ridesharing as a source of income, they’re learning that not all car insurers will cover their needs. That’s because ridesharing drivers are using their cars for business, and not personal use.

However, according to the popular “The Rideshare Guy” blog, California is rideshare’s largest state, and therefore provides a number of options. This includes Allstate, Esurance, USAA, Geico, State Farm, Mercury, AAA, and MetLife.

For more details, click here.

Automation on the Road in California

Under California’s vehicle code, the Department of Motor Vehicles governs both the testing and public use of autonomous vehicles in the state. In fact, manufacturers can apply for:

- Testing permits (requires a driver)

- Driverless testing permits

- Deployment (public use) permits

For companies seeking to test autonomous vehicles in California, know that there are strict financial guidelines. According to the Insurance Institute for Highway Safety,

Companies testing autonomous vehicles in California are required to have a minimum of $5,000,000 in liability insurance in place.

What are California safety laws broken down?

They’re dangerous acts that can result in car accidents, collisions, and even the loss of life.

Yet in spite of these consequences, many California drivers lack a true understanding of the laws that prohibit DUIs and distracted driving.

Through a careful examination of both topics, Golden State motorists will not only encourage better driving habits, but they can also save lives.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there California DUI laws?

The Foundation for Advancing Alcohol Responsibility reports that in 2017, 1,120 deaths occurred in California as a result of alcohol-impaired driving.

Statistics show that the state also had an alcohol-impaired driving fatality rate of 2.8 per 100,000 population — lower the national average of 3.4 per 100,000.

This leads us to take a closer look at the state’s DUI laws:

| California DUI Laws | Details |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.15-0.2; 0.2+ |

| 1st Offense - Imprisonment | 96 hours to 6 months, including 48 continuous hours |

| 1st Offense - Fine | $390-$1000 |

| 1st Offense - ALS or Revocation | 4 months |

| 2nd Offense - Imprisonment | 96 hours to 6 months, including 48 continuous hours |

| 2nd Offense - Fine | $390-$1000 |

| 2nd Offense - DL Revocation | 1 year if offense in 10 years of previous |

| 3rd Offense - Imprisonment | 120 days to 1 year, including 48 continuous hours |

Are there any marijuana-impaired driving laws in California?

Even though the use of marijuana is legal in California, driving under its influence is not. To be clear:

Under the state’s vehicle code, driving under the influence of any drug is illegal.

This offense is better known as DUI of marijuana, and it carries nearly identical consequences to driving under the influence of alcohol.

California’s Office of Traffic Safety makes the following warnings regarding the effects of marijuana while driving:

- Slower reaction times and the ability to make decisions

- Impaired judgment, and memory

- Lessened attentiveness, perception of time, and speed

Officials go on to warn that “the effect of marijuana is strongest during the first 30 minutes after consumption. People who drive immediately after using marijuana may increase their risk of getting into a crash by 25 to 35 percent.”

What are the laws for distracted driving in California?

To the California drivers tempted to pick up their cell phones while commuting, know this — the state has a complete ban on the use of all hand-held devices while driving.

Drivers also need to know that this is considered a primary offense, meaning, officers can pull you over strictly for being on your phone.

California law only permits drivers to use phones while driving if it’s in hands-free mode. Some other points to remember:

- Drivers under 18 cannot drive a car while using a cell phone, or any other wireless communications device

- All drivers are banned from using a cell phone to write, send, or read texts while driving

- School bus drivers may not use cell phones.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What does it mean to be driving safely in California?

They’re the kind of statistics that cause all drivers to pay attention.

For instance, where the FBI is reporting the highest number of vehicle thefts in the state.

Or, which California counties are seeing the most traffic fatalities.

And, which cities are most prone to traffic slowdowns.

As we wrap up our California car insurance guide, we’re taking a closer look at the safety stats and trends that matter the most.

Is there vehicle theft in California?

Vehicle theft is a crime that experts say cost drivers $6 billion in 2017.

As for the California cities with the highest amount of car theft, the FBI reports the following cities as the top 10:

- Los Angeles, 19,193 car thefts

- San Jose, 8,068

- Oakland, 5,495

- San Diego, 5,135

- San Francisco, 4,834

- Fresno, 2,789

- Bakersfield, 2,777

- Long Beach, 2,729

- Sacramento, 2,718

- San Bernardino, 2,277

Finally, here’s a list of the top 10 most stolen cars in the state:

| Make/Model | Rank | Vehicle Year | Theft |

|---|---|---|---|

| Honda Accord | 1 | 1996 | 28,345 |

| Honda Civic | 2 | 1998 | 28,045 |

| Chevrolet Pickup (Full Size) | 3 | 2006 | 6,048 |

| Toyota Camry | 4 | 1991 | 5,345 |

| Ford Pickup (Full Size) | 5 | 2006 | 4,504 |

| Acura Integra | 6 | 1994 | 4,273 |

| Toyota Corolla | 7 | 2014 | 3,339 |

| Nissan Sentra | 8 | 1997 | 2,555 |

| Nissan Altima | 9 | 1997 | 2,281 |

| Honda CR-V | 10 | 1999 | 2,033 |

Read more: What are the most stolen cars in America?

What are road fatalities like in California?

To gain more insight into fatal crashes in the state, we turn to data provided by the experts, including the National Highway Traffic Safety Administration.

It’s in our analysis California drivers can learn more about where and how often these crashes are occurring.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the most fatal highway in California?

It is estimated that over 30,000 people are killed in road crashes in the United States each year. When it comes to highway fatalities in the California, Interstate 40 has garnered the distinction as being the most dangerous in the state. In fact, according to Geotab,

I-40 averages 11 fatal crashes annually, and ranks third nationally in its fatal crash rate.

Are there any fatal crashes by weather or light conditions?

Rain or snow, dusk or dawn.

When examining fatal crashes taking place at various times of day and weather conditions, we see that most occur during normal daylight hours:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 1,286 | 883 | 779 | 136 | 5 | 3,089 |

| Rain | 51 | 58 | 54 | 6 | 0 | 169 |

| Snow/Sleet | 4 | 0 | 4 | 1 | 0 | 9 |

| Other | 10 | 7 | 17 | 0 | 0 | 34 |

| Unknown | 0 | 2 | 1 | 0 | 0 | 3 |

| TOTAL | 1,351 | 950 | 855 | 143 | 5 | 3,304 |

What are California fatalities grouped by county?

In evaluating fatalities by county, we see the following five emerge with the highest numbers in 2017:

- Los Angeles County, 658 fatalities

- Riverside County, 294

- San Bernardino County, 271

- San Diego County, 231

- Kern County, 182

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Alameda | 86 | 83 | 90 | 79 | 99 |

| Alpine | 1 | 1 | 1 | 7 | 4 |

| Amador | 5 | 7 | 8 | 14 | 12 |

| Butte | 21 | 24 | 33 | 36 | 38 |

| Calaveras | 7 | 8 | 11 | 9 | 20 |

| Colusa | 9 | 7 | 5 | 5 | 10 |

| Contra Costa | 50 | 44 | 76 | 81 | 63 |

| Del Norte | 12 | 8 | 15 | 8 | 6 |

| El Dorado | 26 | 23 | 26 | 19 | 26 |

| Fresno | 119 | 117 | 102 | 150 | 156 |

| Glenn | 5 | 12 | 6 | 11 | 9 |

| Humboldt | 28 | 33 | 28 | 21 | 39 |

| Imperial | 28 | 46 | 28 | 34 | 23 |

| Inyo | 3 | 0 | 6 | 7 | 11 |

| Kern | 131 | 111 | 138 | 149 | 182 |

| Kings | 16 | 12 | 35 | 30 | 25 |

| Lake | 22 | 7 | 17 | 15 | 17 |

| Lassen | 9 | 5 | 9 | 10 | 8 |

| Los Angeles | 625 | 639 | 651 | 837 | 658 |

| Madera | 21 | 32 | 29 | 39 | 26 |

| Marin | 14 | 10 | 8 | 12 | 12 |

| Mariposa | 3 | 5 | 3 | 5 | 7 |

| Mendocino | 14 | 19 | 10 | 25 | 30 |

| Merced | 48 | 37 | 54 | 72 | 70 |

| Modoc | 3 | 3 | 3 | 1 | 0 |

| Mono | 1 | 5 | 6 | 1 | 5 |

| Monterey | 33 | 32 | 49 | 55 | 51 |

| Napa | 16 | 6 | 15 | 12 | 14 |

| Nevada | 15 | 5 | 13 | 12 | 16 |

| Orange | 186 | 173 | 183 | 204 | 178 |

| Placer | 21 | 13 | 21 | 40 | 29 |

| Plumas | 3 | 6 | 5 | 10 | 6 |

| Riverside | 228 | 246 | 242 | 297 | 294 |

| Sacramento | 123 | 114 | 139 | 169 | 172 |

| San Benito | 7 | 9 | 9 | 11 | 9 |

| San Bernardino | 262 | 285 | 260 | 273 | 271 |

| San Diego | 198 | 233 | 246 | 243 | 231 |

| San Fransicso | 35 | 33 | 38 | 36 | 25 |

| San Joaquin | 93 | 83 | 98 | 119 | 116 |

| San Luis Obispo | 28 | 32 | 34 | 32 | 34 |

| San Mateo | 57 | 25 | 33 | 52 | 33 |

| Santa Barbara | 31 | 23 | 35 | 34 | 39 |

| Santa Clara | 95 | 106 | 133 | 114 | 105 |

| Santa Cruz | 14 | 20 | 19 | 20 | 19 |

| Shasta | 24 | 22 | 40 | 26 | 29 |

| Sierra | 2 | 0 | 1 | 1 | 3 |

| Siskiyou | 6 | 9 | 12 | 11 | 14 |

| Solano | 39 | 49 | 45 | 37 | 31 |

| Sonoma | 30 | 40 | 46 | 45 | 35 |

| Stanislaus | 54 | 62 | 49 | 79 | 74 |

| Sutter | 14 | 11 | 17 | 8 | 23 |

| Tehama | 11 | 14 | 19 | 18 | 13 |

| Trinity | 4 | 8 | 5 | 8 | 5 |

| Tulare | 54 | 60 | 75 | 80 | 85 |

| Tuolumne | 13 | 11 | 17 | 11 | 14 |

| Ventura | 66 | 46 | 56 | 57 | 47 |

| Yolo | 21 | 19 | 26 | 36 | 20 |

| Yuba | 17 | 9 | 9 | 10 | 11 |

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the California traffic fatalities?

We compared the number of traffic fatalities on rural and urban roads and found that in California, fatalities are happening more frequently on urban roads.

| Traffic Fatalities | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total | 3,107 | 3,102 | 3,387 | 3,837 | 3,602 |

| Rural | 1,201 | 1,170 | 1,404 | 1,593 | 1,404 |

| Urban | 1,906 | 1,931 | 1,982 | 2,244 | 2,195 |

What are the California fatalities by person type?

Statistics reveal that between 2013 to 2017, there were higher numbers of fatalities among car passengers in Calfornia. The next-highest number of fatalities can be seen among pedestrians.

| Pasenger Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 1,098 | 1,066 | 1,170 | 1,357 | 1,269 |

| Light Truck - Pickup | 239 | 209 | 294 | 278 | 279 |

| Light Truck - Utility | 241 | 271 | 288 | 307 | 336 |

| Light Truck - Van | 67 | 79 | 88 | 88 | 84 |

| Light Truck - Other | 12 | 6 | 9 | 6 | 6 |

| Large Truck | 38 | 33 | 32 | 48 | 53 |

| Bus | 11 | 17 | 1 | 20 | 3 |

| Other/Unknown Occupants | 20 | 26 | 14 | 18 | 19 |

| Total Occupants | 1,726 | 1,707 | 1,896 | 2,122 | 2,049 |

| Total Motorcyclists | 463 | 522 | 494 | 576 | 529 |

| Pedestrian | 734 | 709 | 819 | 933 | 858 |

| Bicyclist and Other Cyclist | 147 | 129 | 136 | 155 | 124 |

| Other/Unknown Nonoccupants | 37 | 35 | 42 | 51 | 42 |

| Total Nonoccupants | 918 | 873 | 997 | 1,139 | 1,024 |

| Total | 3,107 | 3,102 | 3,387 | 3,837 | 3,602 |

What are the California fatalities by crash type?

Between 2013 to 2017, the greatest number of fatalities occurred in single-vehicle crashes, followed by roadway departures. However, in both of these categories, we see a decrease in fatalities from 2016 to 2017.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 3,107 | 3,102 | 3,387 | 3,837 | 3,602 |

| Single Vehicle | 1,922 | 1,861 | 1,987 | 2,273 | 2,067 |

| Involving a Large Truck | 259 | 301 | 305 | 354 | 361 |

| Involving Speeding | 992 | 995 | 1,032 | 1,151 | 1,070 |

| Involving a Rollover | 697 | 696 | 770 | 800 | 796 |

| Involving a Roadway Departure | 1,442 | 1,374 | 1,530 | 1,754 | 1,588 |

| Involving an Intersection (or Intersection Related) | 797 | 811 | 881 | 1,024 | 927 |

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What have the five-year fatality trends been for California’s top-10 counties?

When comparing the 10 largest counties in the state, Los Angeles County has the highest number of fatalities in 2017. In 2017, Los Angeles County saw more than two times the number of fatalities of Riverside County, which held the number two spot.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Los Angeles | 625 | 639 | 651 | 837 | 658 |

| Riverside | 228 | 246 | 242 | 297 | 294 |

| San Bernardino | 262 | 285 | 260 | 273 | 271 |

| San Diego | 198 | 233 | 246 | 243 | 231 |

| Kern | 131 | 111 | 138 | 149 | 182 |

| Orange | 186 | 173 | 183 | 204 | 178 |

| Sacramento | 123 | 114 | 139 | 169 | 172 |

| Fresno | 119 | 117 | 102 | 150 | 156 |

| San Joaquin | 93 | 83 | 98 | 119 | 116 |

| Santa Clara | 95 | 106 | 133 | 114 | 105 |

| Top Ten Counties | 2,060 | 2,107 | 2,192 | 2,555 | 2,363 |

| All Other Counties | 1,047 | 995 | 1,195 | 1,282 | 1,239 |

| All Counties | 3,107 | 3,102 | 3,387 | 3,837 | 3,602 |

What are the California fatalities involving speeding by county?

Our analysis reveals that the California counties with the highest numbers of fatalities in 2017 were:

- Los Angeles County, 214 fatalities

- San Bernardino County, 88

- Riverside County, 84

- San Diego County, 78

- Orange County, 60

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Alameda | 33 | 24 | 37 | 25 | 32 |

| Alpine | 1 | 1 | 0 | 6 | 1 |

| Amador | 0 | 1 | 0 | 2 | 0 |

| Butte | 6 | 11 | 13 | 4 | 15 |

| Calaveras | 2 | 2 | 1 | 3 | 4 |

| Colusa | 1 | 1 | 2 | 2 | 2 |

| Contra Costa | 16 | 13 | 26 | 36 | 17 |

| Del Norte | 4 | 2 | 2 | 5 | 1 |

| El Dorado | 5 | 8 | 6 | 9 | 13 |

| Fresno | 26 | 24 | 22 | 44 | 51 |

| Glenn | 1 | 1 | 2 | 3 | 2 |

| Humboldt | 7 | 9 | 8 | 6 | 8 |

| Imperial | 8 | 11 | 9 | 3 | 7 |

| Inyo | 1 | 0 | 1 | 0 | 2 |

| Kern | 32 | 27 | 40 | 49 | 45 |

| Kings | 3 | 3 | 11 | 5 | 6 |

| Lake | 6 | 0 | 6 | 4 | 3 |

| Lassen | 3 | 1 | 5 | 1 | 1 |

| Los Angeles | 245 | 240 | 231 | 308 | 214 |

| Madera | 5 | 7 | 8 | 10 | 4 |

| Marin | 5 | 3 | 1 | 3 | 6 |

| Mariposa | 0 | 2 | 0 | 0 | 1 |

| Mendocino | 5 | 5 | 3 | 3 | 9 |

| Merced | 12 | 9 | 16 | 14 | 16 |

| Modoc | 1 | 0 | 0 | 0 | 0 |

| Mono | 0 | 2 | 0 | 0 | 0 |

| Monterey | 3 | 7 | 4 | 9 | 11 |

| Napa | 7 | 2 | 2 | 3 | 1 |

| Nevada | 7 | 3 | 5 | 4 | 4 |

| Orange | 62 | 56 | 51 | 53 | 60 |

| Placer | 6 | 3 | 2 | 11 | 10 |

| Plumas | 2 | 2 | 2 | 4 | 1 |

| Riverside | 66 | 93 | 87 | 95 | 84 |

| Sacramento | 40 | 35 | 42 | 56 | 53 |

| San Benito | 3 | 5 | 0 | 2 | 2 |

| San Bernardino | 92 | 90 | 82 | 72 | 88 |

| San Diego | 67 | 71 | 75 | 76 | 78 |

| San Francisco | 11 | 8 | 10 | 12 | 5 |

| San Joaquin | 36 | 26 | 34 | 36 | 35 |

| San Luis Obispo | 8 | 11 | 7 | 8 | 13 |

| San Mateo | 17 | 5 | 12 | 16 | 11 |

| San Barbara | 11 | 6 | 10 | 14 | 18 |

| San Clara | 28 | 32 | 39 | 33 | 29 |

| Santa Cruz | 7 | 11 | 5 | 4 | 7 |

| Shasta | 6 | 6 | 19 | 4 | 6 |

| Sierra | 1 | 0 | 0 | 0 | 3 |

| Siskiyou | 1 | 2 | 2 | 2 | 4 |

| Solano | 15 | 22 | 23 | 14 | 6 |