Top Auto Insurance Provider for Single Moms in 2026 (Top 10 Companies)

Progressive, USAA, and State Farm emerge as top car insurance provider for single moms. Discover tailored coverage options and competitive rates from these industry leaders. This guide provides insights for securing reliable and affordable car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated February 2024

6,589 reviews

6,589 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 0 reviews

0 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

0 reviews

0 reviewsDiscover the top car insurance provider for single moms such as Progressive, USAA, and State Farm, offering tailored rates and safety-centric savings. Progressive stands out with monthly premiums and average deductible, making it a budget-friendly choice for single moms seeking a balance between cost and coverage.

Are you a single mom looking for auto insurance? You’re not alone, and the good news is that there are options regarding car insurance for single moms. There was a total of 17.4 million children who were being raised by single mothers in the United States alone. About 45 percent of these families live below the poverty level.

Our Top 10 Best Companies: Top Auto Insurance Provider for Single Moms

| Company | Rank | See Pros/Cons | Single Parent Discount | Safe Driving Discount | Best for |

|---|---|---|---|---|---|

| #1 | Progressive | Up To 10% | Up To 15% | Vanishing Deductible | |

| #2 | USAA | Up To 12% | Up To 20% | Safe-Driving Discounts | |

| #3 | State Farm | Up To 15% | Up To 17% | Multi-Policy Discounts | |

| #4 | Allstate | Up To 10% | Up To 18% | Bundle Discounts | |

| #5 | Nationwide | Up To 10% | Up To 15% | Customizable Policies |

| #6 | Liberty Mutual | Up To 8% | Up To 14% | Comprehensive Coverage |

| #7 | Farmers | Up To 9% | Up To 16% | Local Agents | |

| #8 | AAA | Up To 8% | Up To 11% | Policy Options |

| #9 | Travelers | Up To 7% | Up To 12% | Online Convenience |

| #10 | Esurance | Up To 10% | Up To 13% | 24/7 Support |

Other statistics involving single moms indicate the struggles they face daily in making ends meet. For this reason, it is more important than ever for single mothers to find affordable utilities, and housing, and seek out the best commercial auto insurance coverage and what you need to know.

This extends itself to various facets of life that need protecting. When looking for car insurance, there are some things you will want to keep in mind to find the best policy. And you will want that policy at the best price because chances are money is tight.

The good news is, that there are plenty of options and ways to look up the information you’ll need to make an informed decision. Use our free comparison tool to find the insurer that is right for you.

#1 – Progressive – Vanishing Deductible and Tailored Discounts

Progressive, with its tailored coverage options and safety-centric approach, stands out as a top choice for single moms seeking reliable and comprehensive auto insurance.Jeff Root Licensed Life Insurance Agent

Pros

- Vanishing deductible: Progressive offers a unique feature where the deductible decreases for safe drivers over time.

- Single parent discount: Up to 10% discount specifically designed to cater to the needs of single parents.

- Safe driving discount: Up to 15% discount for maintaining a safe driving record.

Cons

- Limited single parent discount: While Progressive offers a discount, it may be lower compared to some competitors.

- Varied rates: Premiums may vary depending on individual factors, potentially leading to higher rates for some customers.

Read more: Progressive Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA – Safety-Centric Savings:

Pros

- Safe-driving discounts: Up to 20% discount for safe driving, encouraging and rewarding responsible behavior.

- Generous single parent discount: Up to 12% discount tailored to single parents.

- Military-focused: USAA is known for its commitment to serving military members and their families.

Cons

- Eligibility restrictions: USAA membership is limited to military personnel and their families, excluding a broader customer base.

- Limited local agents: While USAA provides excellent online service, the availability of local agents may be limited.

Read more: USAA Auto Insurance Review

#3 – State Farm – Multi-Policy Affordability:

Pros

- Multi-policy discounts: Up to 15% discount for bundling auto insurance with other policies.

- Safe driving discount: Up to 17% discount for maintaining a safe driving record.

- Extensive agent network: State Farm boasts a large network of local agents for personalized assistance.

Cons

- Average single parent discount: While offered, the single parent discount may not be as high as some competitors.

- Potentially higher rates: Some customers may find State Farm’s rates to be on the higher side compared to other providers.

Read more: State Farm Auto Insurance Review

#4 – Allstate – Bundle Benefits and Safe Driving Rewards:

Pros

- Bundle discounts: Allstate offers significant savings with bundle discounts when combining auto insurance with other policies.

- Generous safe driving discount: Up to 18% discount for maintaining a safe driving record.

- Wide range of policy options: Allstate provides flexibility with various policy options to meet individual needs.

Cons

- Moderate single parent discount: The single parent discount is offered but may not be as high as some competitors.

- Potentially higher rates: Rates may vary, and some customers may find Allstate’s premiums comparatively higher.

Read more: Allstate Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide – Tailored Policies for Personalized Coverage:

Pros

- Customizable policies: Nationwide stands out with policies that can be tailored to individual preferences and needs.

- Single parent discount: Up to 10% discount catering specifically to single parents.

- Safe driving discount: Up to 15% discount for maintaining a safe driving record.

Cons

- Limited local agents: Nationwide’s local agent network may be less extensive than some competitors.

- Varied rates: Premiums may differ based on individual factors, potentially leading to higher rates for some customers.

#6 – Liberty Mutual – Comprehensive Coverage Options:

Pros

- Comprehensive coverage: Liberty Mutual offers a range of coverage options to ensure comprehensive protection.

- Moderate single parent discount: Up to 8% discount for single parents.

- Safe driving discount: Up to 14% discount for maintaining a safe driving record.

Cons

- Limited single parent discount: The single parent discount may be lower compared to some competitors.

- Varied customer service: Customer experiences with Liberty Mutual’s service may vary.

Read more: Liberty Auto Insurance Review

#7 – Farmers – Localized Support and Savings:

Pros

- Local agents: Farmers emphasizes personalized service with a network of local agents.

- Safe driving discount: Up to 16% discount for maintaining a safe driving record.

- Moderate single parent discount: Farmers offers a single parent discount for added savings.

Cons

- Average single parent discount: The discount for single parents may not be as high as offered by some competitors.

- Potentially higher rates: Premiums may vary, and some customers may find Farmers’ rates relatively higher.

Read more: Farmers Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA – Policy Options and Roadside Assistance:

Pros

- Policy options: AAA provides various policy options to meet diverse coverage needs.

- Safe driving discount: Up to 11% discount for maintaining a safe driving record.

- Extensive network: AAA offers a vast network of service providers and resources for added support.

Cons

- Limited single parent discount: The single parent discount may not be as high as some competitors.

- Membership requirements: AAA membership is required for insurance eligibility, limiting accessibility.

Read more: AAA Auto Insurance Review

#9 – Travelers – Convenience With Online Management:

Pros

- Online convenience: Travelers offers the convenience of managing policies and obtaining quotes online.

- Safe driving discount: Up to 12% discount for maintaining a safe driving record.

- Multiple coverage options: Travelers provides a range of coverage options, allowing customers to tailor policies to their specific needs.d.

Cons

- Limited single parent discount: The single parent discount may be lower compared to some competitors.

- Varied customer service: Customer experiences with Travelers’ service may vary.

Read more: Travelers Auto Insurance Review

#10 – Esurance – Support Around the Clock:

Pros

- 24/7 Support: Esurance provides around-the-clock support for customer inquiries and assistance.

- Single parent discount: Up to 10% discount tailored to the needs of single parents.

- User-friendly technology: Esurance leverages technology for a seamless and user-friendly online experience, making it easy for customers to manage their policies.

Cons

- Limited single parent discount: The discount for single parents may be lower compared to some competitors.

- Varied rates: Premiums may differ based on individual factors, potentially leading to higher rates for some customers.

Read more: Esurance Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are some important components to consider?

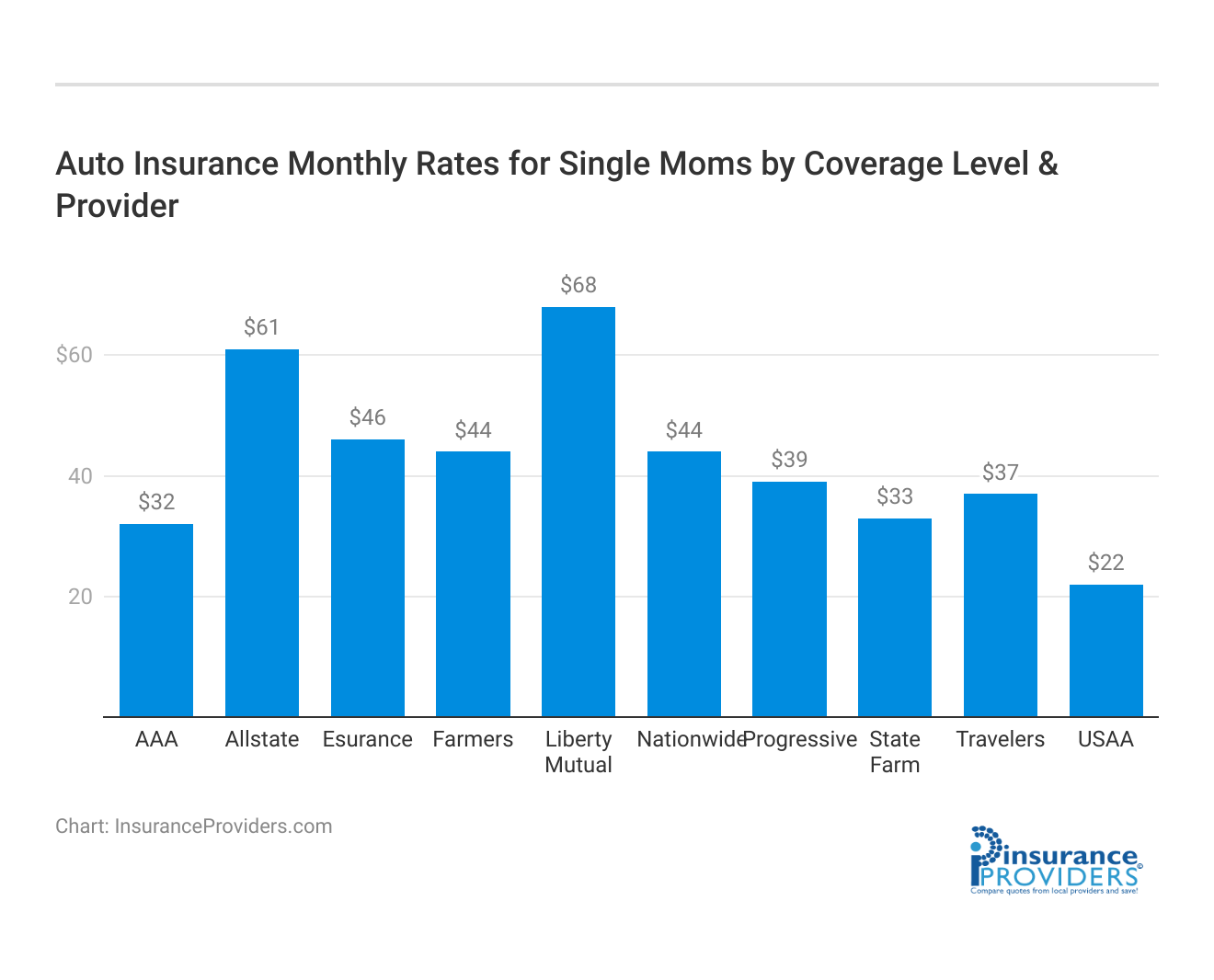

For single moms managing a myriad of responsibilities, securing affordable auto insurance is essential. In the table below, we’ve condensed monthly premiums and average deductibles from leading providers, providing a quick reference for those seeking a balance between cost and coverage.

Average Monthly Auto Insurance Rates for Single Moms

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| Progressive | $105 | $39 |

| USAA | $59 | $22 |

| State Farm | $86 | $33 |

| Allstate | $160 | $61 |

| Nationwide | $115 | $44 |

| Liberty Mutual | $174 | $68 |

| Farmers | $139 | $44 |

| AAA | $86 | $32 |

| Travelers | $99 | $37 |

| Esurance | $114 | $46 |

Progressive, for instance, offers a monthly premium of $105 with a $39 average deductible, making it a noteworthy option for budget-conscious single moms.

Understanding the specifics of each provider enables single moms to make informed decisions aligned with their budget and coverage needs. USAA stands out with a monthly premium of $59 and an average deductible of $22, showcasing affordability coupled with reliable coverage.

By comparing rates and considering additional benefits, you can tailor your auto insurance to provide necessary protection without compromising financial stability. Beyond the numbers, explore discounts and benefits tailored to single moms. State Farm, with an $86 monthly premium and $33 average deductible, offers a balance between cost and comprehensive coverage.

Selecting an insurance plan that aligns with your unique circumstances ensures not only financial stability but also peace of mind. The table serves as a practical guide, allowing you to navigate the insurance landscape and find a solution that fits your needs.

What coverage concerns exist as a single mother?

For many drivers, the question will be “What are the most popular cars in the United States?”, and whether their car fits in that category. But single moms will have more specific concerns that other people do not think about, such as the safety and care of their children that they may have in the car every day.

You should make sure that smaller children have adequate child safety seats or car seats that conform to your state laws.

You should look into making sure that you have enough coverage to cover all children that you have as passengers at all times. As a single parent, there are a lot of things to consider, with child safety being a top priority.

Some single moms also take other people’s children with them to various sporting events or school activities. You need to remember that you are liable for bodily injury of all your passengers if you are at fault in a car accident.

Your general policy may cover your children based on the mandatory state requirements, but make sure you have enough coverage to cover an accident involving other kids as well.

Similar to other insurance, insurance for single moms provides that peace of mind we all seek. Extra coverage would avoid the risk of legal action that might be taken against you if you were to have an accident for which you are responsible.

What are no-fault states?

It is important to remember that, though the fault is usually based on the police report involving who is to blame for an accident, not every state is a “fault state.”

A fault state is one that makes the decision on whose insurance will pay for an accident based on fault, but according to the Insurance Information Institute there are many states which do not observe this criterion for insurance payouts.

Insurance laws are legislated at the state level so it is important to know the insurance laws in your state and how they may apply to you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What does “no-fault” really mean?

If you live in a no-fault state, you’ll likely have to have personal injury protection and you will pay for your collisions and accidents no matter whose fault it is. This no-fault law removes the threat of level problems between automobile owners since both parties will pay for their repairs and injuries. As a result, it would benefit you research the best personal injury protection (PIP) insurance coverage, and what you need to know.

However, it does not recuse you from being sued for damages or injuries sustained in your car if there are other children in your vehicle at the time.

For this reason, it is important to estimate the risk based on the number of passengers you typically carry in your vehicle with you and multiply by the estimated damage or injury that could be involved in an accident.

This information should dictate how much coverage you need if you regularly carry other children or your own in your car with you.

Remember that frequency is a risk factor.

The more you take people in the car with you, the higher the risk becomes. So check your state requirements then use your best judgment to decide how much coverage you need to feel secure.

What else should you consider other than cost?

One of the things you should remember when shopping around for auto insurance is that cost is not everything.

While you have to stay within your means and income to make your budget, you should always weigh the risk with the amount you will be paying your premiums and make your decision based on that.

You don’t want to end up overpaying for service when it comes to your auto insurance policy, but you also don’t want to miss out on the state requirement or coverage that will protect you the most. That being said, the cost is not the most important factor in choosing insurance. The main thing is to make sure that you have sufficient coverage for your vehicle so that every situation is covered including:

- Accident

- Theft

- Collision. Check out more about top collision auto insurance coverage and what you need to know.

Realistically, you can only afford what your budget allows, so talk to your representative when comparing insurance and tell them your situation.

They will be able to locate the best coverage for you based on your personal needs and budget restrictions, factoring in your need for transportation as important.

Are you a good driver?

This is one question that insurance companies will ask you. If you are a good driver with a clean driving record (no major traffic violations, including accidents for around three years), you may be eligible for a safe driver discount.

You won’t want to be untruthful here though, because they’ll be able to check your driving history. If you find yourself asking, “How long does an accident stay on your record?”, that could be a tell-tale sign that you might end up with higher rates.

Safe driver discounts can also often be obtained if you can show other proof of safe driving efforts. One way you can prove your commitment to safe driving is to take a defensive driving course.

Getting a safe driving discount may save you a lot of money when you take out a new insurance policy. Many people who are carrying car insurance do not even realize that they are eligible for such discounts.

Ask your insurance representative for information regarding these types of discounts when you are shopping online for car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there employee status discounts?

Some insurance companies offer special discounts for certain types of jobs or careers. For example, companies such as Geico Insurance Company and State Farm Home Insurance both offer various discounts for government employees (check out our State Farm Home Insurance review to learn more).

Read more: best home insurance policy

In fact, Geico founder, Leo Goodwin, started his insurance company for the sole purpose of serving the needs of federal government employees.

Goodwin thought government employees had a higher-than-normal risk due to some of the things that they had to do as a part of their jobs, so he created his insurance to cover these needs.

With time, Geico Insurance has become an insurance company that allows many other types of employees with jobs besides government-based jobs to apply. They even offer insurance for self-employed persons now.

But they still offer some discounts for federal employee status, and you may also qualify for similar discounts with other companies like State Farm and others, who have a preference for government employees.

What about a good student discount?

There are other discounts that single moms may want to apply for that may help you make your budget each month.

Are you a student currently enrolled in a technical college or university? If so, you may qualify for a good student discount.

Many people have never even heard of this discount.

If you do your research beforehand and do your homework, you can end up saving yourself hundreds of dollars per year in car insurance premiums.

What are some factors that affect your rates?

Do auto insurance companies do background checks? In a way, they do. Remember when shopping for auto insurance that certain factors affect your rates. Some of the most important ones are listed below.

- Make and model of your car – The make and model of your car will influence your premiums. That is because newer cars cost more to replace or repair. Sports cars are also more expensive to insure than other models.

- Level of risk/number of passengers – The level of risk is a factor that your insurance company will take into account when deciding your premium. If you have had previous accidents or traffic violations or drive a long way each day to work, you will pay more than someone with a perfect driving record who works near home.

- Distance from work and total mileage – As mentioned above, the distance that you drive from your house to your place of employment is important and will affect your premiums. You may be eligible for a low-mileage discount if you only drive a short distance to work or work at home.

- Driving record – Your driving record is the most important factor in your premium calculation. Insurance companies decide your rates based primarily on this factor.

- Discount eligibility – Ask your insurance representative if you are eligible for some of the discounts we mentioned in this post.

- Credit rating – Believe it or not, your credit rating does affect your insurance premiums. One of the risk factors in insuring you is your ability to keep your policy current. If you have paid your bills on time before, you are seen as a lesser risk.

If you are a single mom, you have many concerns, but the most important is the safety of your children.

Make sure they are safe and that your financial situation is secure by carrying adequate insurance and keeping your driving record in good shape. You can talk to your insurance provider about cutting extra costs that aren’t necessary, and to discover if there are discounts available.

Another thing that you can do is comparison shop. Compare car insurance rates today right here and see how much you could save on auto insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Top Auto Insurance Provider for Single Moms

Case Study 1: Sarah’s Story

Sarah, a single mom of two kids, wanted affordable auto insurance with comprehensive coverage. She found XYZ Insurance Company, known for great customer service and competitive rates. Sarah was impressed by their easy online application and personalized help. XYZ Insurance Company gave her a custom policy within her budget, meeting her family’s needs.

Case Study 2: Jennifer’s Experience

Jennifer, a single mom with a teenage driver, faced the challenge of finding an auto insurance provider that offered competitive rates for young drivers. After extensive research, she discovered ABC Auto Insurance, which specialized in providing affordable coverage for families with teen drivers.

ABC Auto Insurance offered Jennifer a range of options, including discounts for good grades and safe driving habits. Jennifer was able to secure a policy that not only met her budget but also provided her teenage driver with the necessary coverage.

Case Study 3: Emily’s Journey

Emily, a single mom who frequently traveled for work, needed an auto insurance provider that offered flexible policies to accommodate her changing schedule. She came across PQR Insurance Company, which had a reputation for providing customizable coverage options. PQR Insurance Company offered Emily a policy that allowed her to adjust her coverage and deductibles based on her travel plans.

With their 24/7 customer service and easy-to-use mobile app, Emily felt confident and secure knowing that her auto insurance needs were met, no matter where her work took her.

Case Study 4: Maria’s Success Story

Maria, a single mom on a tight budget, was searching for an auto insurance provider that offered affordable rates without compromising on coverage. She found DEF Insurance Company, which specialized in providing budget-friendly options for single parents.

DEF Insurance Company offered Maria a policy that fit within her financial constraints while still providing the necessary coverage for her and her child. Maria appreciated the transparent pricing and exceptional customer service provided by DEF Insurance Company.

Frequently Asked Questions

What factors should single moms consider when choosing an auto insurance provider?

When choosing an auto insurance provider as a single mom, it’s important to consider several factors. These may include affordability, coverage options, customer service, discounts, financial stability of the company, and any specific needs you may have as a single mom.

Which auto insurance provider offers affordable rates for single moms?

Several auto insurance providers offer competitive rates for single moms. It’s recommended to obtain quotes from multiple companies to compare rates and find the most affordable option for your specific circumstances. Some providers known for offering competitive rates include GEICO, Progressive, State Farm, and Allstate.

Are there any auto insurance providers that offer discounts or special programs for single moms?

Yes, some auto insurance providers offer discounts or special programs for single moms. For example, GEICO offers a “Single Parent” discount that provides additional savings. Additionally, some companies may offer discounts for being a member of certain organizations or for having a good driving record.

What auto insurance providers have good customer service for single moms?

When considering customer service, it’s important to choose an auto insurance provider with a strong reputation for excellent customer service. Some providers known for their customer service include USAA (for military families), Amica, State Farm, and Progressive. Reading customer reviews and checking ratings from independent sources can also help gauge the quality of customer service.

Are there any auto insurance providers that offer specific coverage options for single moms?

While auto insurance coverage options are generally similar across providers, it’s important to review policy details to ensure they meet your specific needs as a single mom. Some providers may offer additional coverage options that could be beneficial, such as rental car coverage, roadside assistance, or coverage for car seats and other child-related equipment.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.