Post

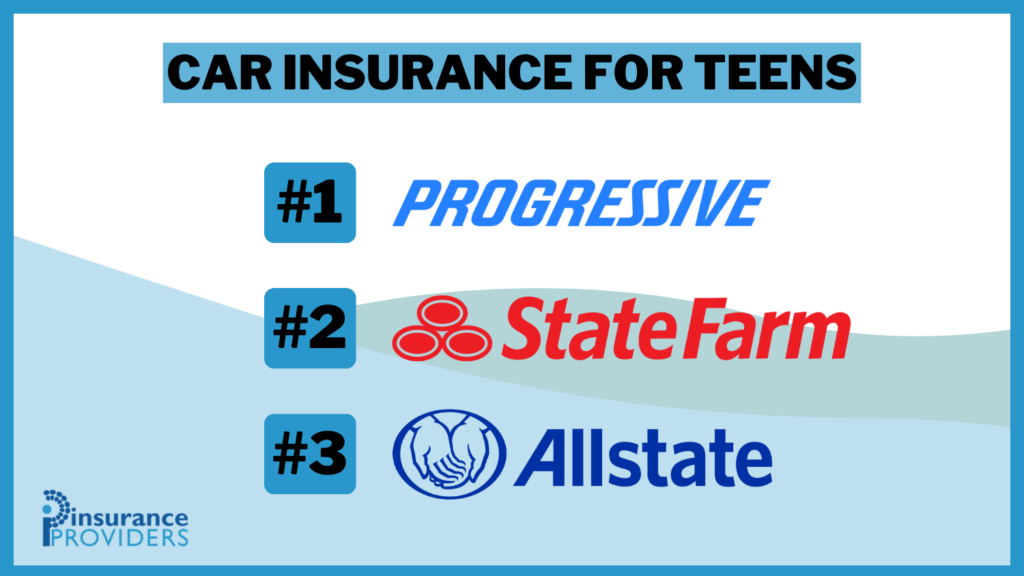

PostTop Auto Insurance Providers for Teens in 2025 (Top 10 Companies)

Explore top car insurance companies for teens, including Progressive, State Farm, and Allstate. This overview highlights rates, coverage choices, and discounts, with Progressive standing out for cost-effectiveness and innovative safe driving initiatives. What is the cheapest way to get auto insurance for a teenager? Shopping around and comparing multiple companies before you buy is the...

Explore top car insurance companies for teens, including Pro...