Cheap Life Insurance Policies in 2026 (Save With These 10 Companies!)

Uncover the cheap life insurance policies offered by leading companies such as USAA, AIG, and Prudential. These companies offer a variety of options, including term life, whole life, and universal life insurance, allowing customers to find a policy that suits their needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated March 2024

163 reviews

163 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

163 reviews

163 reviews 0 reviews

0 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews

In today’s world, life insurance has become an essential part of financial planning. It provides financial protection and peace of mind to individuals and their families. However, many people are concerned about the cost of life insurance policies and believe that they may not be able to afford them.

Our Top 10 Best Companies: Cheap Life Insurance Policies

| Company Logo | Rank | See Pros/Cons | Monthly Rates | Multi-Policy | Best For |

|---|---|---|---|---|---|

| #1 | USAA | $30 | Up to 5% | Military Affiliation | |

| #2 | AIG | $40 | Up to 3% | Guaranteed Issue | |

| #3 | Prudential | $35 | Up to 4% | Customizable Policies | |

| #4 | Banner Life | $25 | Up to 3% | Term Life Affordability | |

| #5 | Mutual of Omaha | $30 | Up to 4% | Whole Life Options | |

| #6 | Transamerica | $35 | Up to 3% | Accelerated Underwriting | |

| #7 | New York Life | $45 | Up to 4% | Dividend Payments | |

| #8 | Pacific Life | $40 | Up to 3% | Universal Life Flexibility |

| #9 | Guardian Life | $35 | Up to 4% | Living Benefits | |

| #10 | Lincoln Financial Group | $30 | Up to 3% | Conversion Options |

The good news is that there are affordable options available. In this article, we will explore various aspects of cheap life insurance policies and how to make the most out of them.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

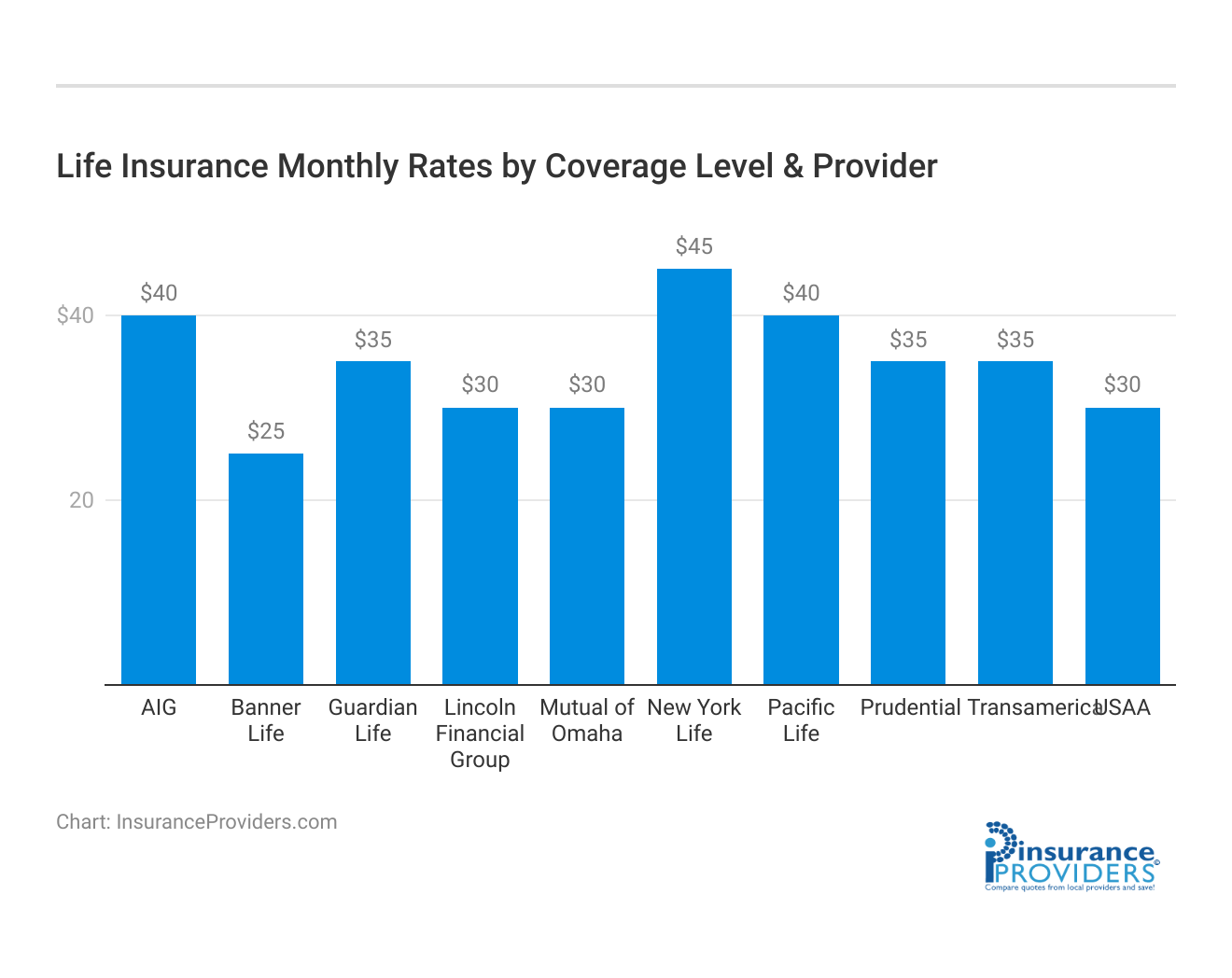

Navigating Life Insurance Rates: A Comparative Look

Understanding the coverage rates offered by different life insurance companies is crucial for making informed decisions. Each insurance provider has its own set of rates for both minimum and full coverage, reflecting diverse options available to consumers.

Average Monthly Life Insurance Policies

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| USAA | $30 | $150 |

| AIG | $40 | $180 |

| Prudential | $35 | $200 |

| Banner Life | $25 | $140 |

| Mutual of Omaha | $30 | $160 |

| Transamerica | $35 | $170 |

| New York Life | $45 | $220 |

| Pacific Life | $40 | $200 |

| Guardian Life | $35 | $240 |

| Lincoln Financial Group | $30 | $190 |

The minimum coverage rates vary, with companies like Banner Life offering a competitive $25 per month, making it an attractive choice for those looking for budget-friendly options. On the other end, New York Life sets a slightly higher bar at $45 per month for minimum coverage, emphasizing a broader range of services.

For those seeking comprehensive protection, the full coverage rates come into play. USAA stands out with a reasonable $150 per month, providing a balance between affordability and extensive coverage. On the higher end, Guardian Life offers a robust package at $240 per month, catering to individuals who prioritize comprehensive financial security.

Understanding Life Insurance

Before we delve into the world of cheap life insurance policies, let’s first understand what life insurance is all about. Life insurance is a contract between an individual and an insurance company. The individual pays regular premiums, and in return, the insurance company provides a lump sum payment, known as a death benefit, to the beneficiary upon the insured’s death. This financial protection ensures that your loved ones are taken care of even in your absence.

Life insurance serves as a safety net, protecting your family from the financial uncertainties that may arise after your demise. It provides monetary support to cover funeral expenses, outstanding debts, mortgage payments, and other financial obligations. Life insurance ensures that your loved ones can maintain their quality of life and financial stability even when you are no longer there to support them.

What is Life Insurance?

Life insurance is more than just a financial product; it is a promise of security and peace of mind. It is an agreement that allows you to protect your loved ones and provide for them even after you are gone. Life insurance policies come in various forms, such as term life insurance, whole life insurance, and universal life insurance, each offering different benefits and features tailored to meet your specific needs.

Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years. It is an affordable option for individuals who want temporary coverage to protect their loved ones during their working years. Whole life insurance, on the other hand, offers lifelong coverage and includes a cash value component that grows over time. This type of insurance provides both protection and an investment opportunity.

Universal life insurance combines the benefits of both term and whole life insurance. It offers flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their needs change. With universal life insurance, you have the freedom to customize your policy to fit your unique financial goals and circumstances.

Importance of Life Insurance

Life insurance holds great significance in safeguarding the future of your loved ones. It acts as a financial security blanket, giving you the peace of mind that comes with knowing that those who depend on you will be taken care of. Whether you are the primary breadwinner or a stay-at-home parent, life insurance provides a valuable safety net that can help your loved ones navigate through challenging times.

Life insurance can offer financial stability to your family by replacing lost income, covering educational expenses for your children, and ensuring that your spouse can maintain their standard of living. It can also help pay off outstanding debts, such as a mortgage or car loan, relieving your loved ones of financial burdens during an already difficult time.

Moreover, life insurance can provide funds to cover funeral and burial expenses, sparing your family from the added stress of financial strain while grieving. It allows them to focus on healing and honoring your memory without worrying about the cost of final arrangements.

Life insurance is not just for individuals with dependents; it can also be an essential tool for business owners. It can help protect your business from financial setbacks in the event of your death, ensuring its continuity and providing funds to cover debts, pay employees, or facilitate the transfer of ownership.

In conclusion, life insurance is a vital component of a comprehensive financial plan. It offers a sense of security and peace of mind, knowing that your loved ones will be taken care of financially when you are no longer there. By understanding the different types of life insurance policies available and their benefits, you can make an informed decision that aligns with your goals and priorities.

Factors Influencing Life Insurance Costs

Life insurance premiums are determined by various factors. Understanding these factors can help you make informed choices and find a cheap life insurance policy that suits your needs and budget.

Age and Life Insurance

One of the most significant factors influencing life insurance costs is age. Younger individuals typically pay lower premiums compared to older ones. This is because younger individuals are considered less risky by insurance companies, as they are generally healthier and less likely to develop health complications.

For example, a 25-year-old individual may pay significantly less for a life insurance policy compared to a 55-year-old individual with the same coverage. This is because the younger individual has a longer life expectancy, reducing the likelihood of the insurance company having to pay out a claim in the near future.

Furthermore, age can also affect the type of life insurance policy available to you. Younger individuals often have more options, including term life insurance, which provides coverage for a specific period, such as 10 or 20 years. Older individuals may have limited options and may need to consider permanent life insurance, which provides coverage for the entire duration of their life.

Health and Life Insurance

Your health plays a crucial role in determining the cost of your life insurance policy. Insurance companies evaluate your medical history, current health status, and any pre-existing conditions before setting your premiums. Generally, individuals with good health habits and no significant health issues enjoy lower premiums.

During the underwriting process, insurance companies may require you to undergo a medical examination or provide medical records to assess your health. They may also consider factors such as your body mass index (BMI), blood pressure, cholesterol levels, and whether you smoke or engage in risky behaviors.

For instance, a non-smoker with a healthy BMI and no history of chronic illnesses may qualify for preferred rates, which are lower than standard rates. On the other hand, individuals with pre-existing conditions, such as diabetes or heart disease, may face higher premiums due to the increased risk of early mortality.

Occupation and Life Insurance

Believe it or not, your occupation can impact your life insurance costs. Individuals engaged in high-risk professions, such as pilots or skydiving instructors, may have higher premiums. This is because insurance companies consider high-risk occupations to be more prone to accidents or untimely deaths.

Insurance companies assess occupational risks based on statistical data and actuarial tables. They consider factors such as the physical demands of the job, exposure to hazardous materials or environments, and the likelihood of work-related accidents.

For example, a construction worker who operates heavy machinery at great heights may face higher premiums compared to an office worker in a low-risk environment. Similarly, a police officer or firefighter may also have higher premiums due to the inherent risks associated with their professions.

It’s important to note that some occupations may require specialized life insurance policies tailored to their specific needs. These policies may offer additional benefits or coverage options to address the unique risks associated with the profession.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Cheap Life Insurance Policies

When it comes to life insurance, there are various types of policies available in the market. Each type serves a specific purpose and comes with its own set of advantages and disadvantages. By understanding these types, you can make an informed decision about the most suitable and affordable policy for your needs.

Term Life Insurance

Term life insurance is one of the most popular and affordable life insurance options available. With term life insurance, you pay premiums for a specific term, usually ranging from 10 to 30 years. This type of policy provides coverage for a set period, and if you pass away during the term, the insurance company pays the death benefit to your beneficiaries.

One of the advantages of term life insurance is its affordability. Since it provides coverage for a limited period, the premiums are generally lower compared to other types of life insurance policies. This makes it an attractive option for individuals who want to ensure financial protection for their loved ones without breaking the bank.

However, it’s important to note that term life insurance does not provide any cash value. If you outlive the term, the policy expires and does not offer any financial benefits. Therefore, it’s crucial to carefully consider the term length and coverage amount to ensure that your loved ones are adequately protected.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime. Unlike term life insurance, which has a specific term, whole life insurance offers lifelong protection. This means that as long as you continue paying the premiums, your policy remains in force.

One of the key advantages of whole life insurance is that it builds cash value over time. This means that a portion of your premium payments goes towards accumulating cash value, which grows on a tax-deferred basis. The cash value can be accessed during your lifetime and can serve as a financial asset for the policyholder.

While whole life insurance premiums are generally higher compared to term life insurance, the policy’s cash value can provide financial flexibility. The cash value can be used to cover premium payments, supplement retirement income, or even be borrowed against in case of emergencies.

Universal Life Insurance

Universal life insurance is another form of permanent life insurance that offers flexibility and competitive premiums. Like whole life insurance, universal life insurance provides coverage for your entire lifetime. However, it offers more flexibility when it comes to premium payments and death benefits.

With universal life insurance, policyholders have the ability to adjust their premiums and death benefits to match their changing financial circumstances. This means that if you experience a change in your income or financial goals, you can modify your policy accordingly. This flexibility can be particularly beneficial for individuals who anticipate fluctuations in their financial situation.

In addition to the flexibility it offers, universal life insurance also accumulates cash value over time. The cash value grows on a tax-deferred basis and can be utilized for various purposes. It can be used to cover premium payments, increase the death benefit, or even supplement retirement income.

When considering universal life insurance, it’s important to carefully review the policy’s terms and conditions. Understanding how the policy works and its potential risks and benefits will help you make an informed decision.

In conclusion, understanding the different types of cheap life insurance policies available in the market can help you choose the most suitable option for your needs. Whether it’s term life insurance, whole life insurance, or universal life insurance, each type has its own unique features and benefits. By considering your financial goals and circumstances, you can select a policy that provides the necessary coverage and peace of mind for you and your loved ones.

Tips to Get Cheap Life Insurance Policies

Now that we have explored the types of cheap life insurance policies let’s discuss some practical tips that can help you secure an affordable policy.

Maintaining a Healthy Lifestyle

Your lifestyle choices have a direct impact on your life insurance costs. Maintaining a healthy lifestyle, including regular exercise and a balanced diet, can significantly improve your overall health and reduce the risk of developing health conditions. By adopting a healthy lifestyle, you may qualify for lower premiums on your life insurance policy.

Avoiding High-Risk Activities

Engaging in high-risk activities, such as extreme sports or excessive alcohol consumption, can increase the cost of your life insurance policy. Insurance companies assess the risk associated with your lifestyle choices, and if you partake in dangerous activities, you may be considered a higher risk. By avoiding such activities, you can potentially secure a cheaper life insurance policy.

Choosing the Right Coverage Amount

When selecting a life insurance policy, it’s crucial to determine the appropriate coverage amount. Calculating your financial obligations, such as mortgage payments, outstanding debts, and future expenses like college tuition, will give you a clearer picture of the coverage you need. Opting for the right coverage amount ensures that you are not overpaying for your policy while providing sufficient protection for your loved ones.

In conclusion, everyone deserves the peace of mind that comes with having life insurance coverage. By understanding the various types of cheap life insurance policies available and the factors that influence their costs, you can make informed decisions and find a policy that fits your needs and budget. Remember, life insurance is not only about affordability, but also about providing financial security and protection for those who depend on you. Start exploring your options today and secure a cheap life insurance policy that offers you and your loved ones the peace of mind you deserve.

Frequently Asked Questions

What is the average cost of a cheap life insurance policy?

The average cost of a cheap life insurance policy can vary depending on several factors such as age, health condition, coverage amount, and term length. However, you can typically find affordable life insurance policies starting from as low as $10 to $20 per month.

What factors should I consider when looking for a cheap life insurance policy?

When searching for a cheap life insurance policy, it’s important to consider factors such as the coverage amount you need, the term length that suits your requirements, your age and health condition, the reputation and financial stability of the insurance company, and any additional riders or benefits you may require.

Can I get a cheap life insurance policy if I have pre-existing health conditions?

While having pre-existing health conditions can affect your life insurance premiums, it is still possible to find affordable options. Some insurance companies specialize in offering coverage to individuals with specific health conditions, and there are policies available that may not require a medical exam. Shopping around and comparing quotes from different insurers can help you find a cheap life insurance policy that suits your needs.

Are cheap life insurance policies reliable?

Yes, cheap life insurance policies can be reliable if you choose a reputable insurance company. It’s essential to research and select a company with a strong financial rating and a history of fulfilling their policy obligations. Reading reviews and seeking recommendations can also help you gauge the reliability of a particular insurance provider.

Can I convert a cheap term life insurance policy into a permanent policy later?

Many term life insurance policies offer the option to convert to a permanent policy at a later date. However, the availability and specific terms of conversion can vary between insurance companies and policies. It’s advisable to review the terms and conditions of your cheap term life insurance policy or consult with your insurance agent to understand the conversion options available to you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.