Cheapest Auto Insurance Companies in 2026 (Save With These 10 Companies!)

Consider the cheapest auto insurance companies like Progressive, USAA, and State Farm for their competitive rates and affordable options. With their accessibility and specialized savings programs, they provide reliable options for drivers looking to save money on their insurance premiums.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated February 2024

6,589 reviews

6,589 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsNavigate the cheapest auto insurance companies with the top providers like Progressive, USAA, and State Farm. Renowned for its military savings, diverse discount offerings, and commitment to customer satisfaction, USAA emerges as the top choice for affordability and reliability.

In today’s world, owning a vehicle has become a necessity for many people. Whether it’s for work, school, or leisure, having a car provides convenience and independence. However, along with the freedom comes certain responsibilities, such as obtaining auto insurance.

Our Top 10 Best Companies: Cheapest Auto Insurance Companies

| Company | Rank | See Pros/Cons | Monthly Rates | Multi-Policy | Best For |

|---|---|---|---|---|---|

| #1 | Progressive | $35 | Up to 10% | Online Convenience | |

| #2 | USAA | $26 | Up to 10% | Military Savings | |

| #3 | State Farm | $40 | Up to 17% | Many Discounts | |

| #4 | Allstate | $70 | Up to 25% | Add-on Coverages | |

| #5 | Nationwide | $60 | Up to 20% | Usage Discount |

| #6 | Farmers | $45 | Up to 15% | Local Agents | |

| #7 | Liberty Mutual | $75 | Up to 25% | Customizable Polices |

| #8 | Travelers | $38 | Up to 8% | Accident Forgiveness |

| #9 | American Family | $45 | Up to 20% | Student Savings | |

| #10 | Esurance | $70 | Up to 10% | Policy Options |

Auto insurance is a crucial aspect of vehicle ownership as it provides financial protection in case of accidents, theft, or other unexpected events. Understanding auto insurance and finding the cheapest auto insurance companies are essential steps to protect yourself and your vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

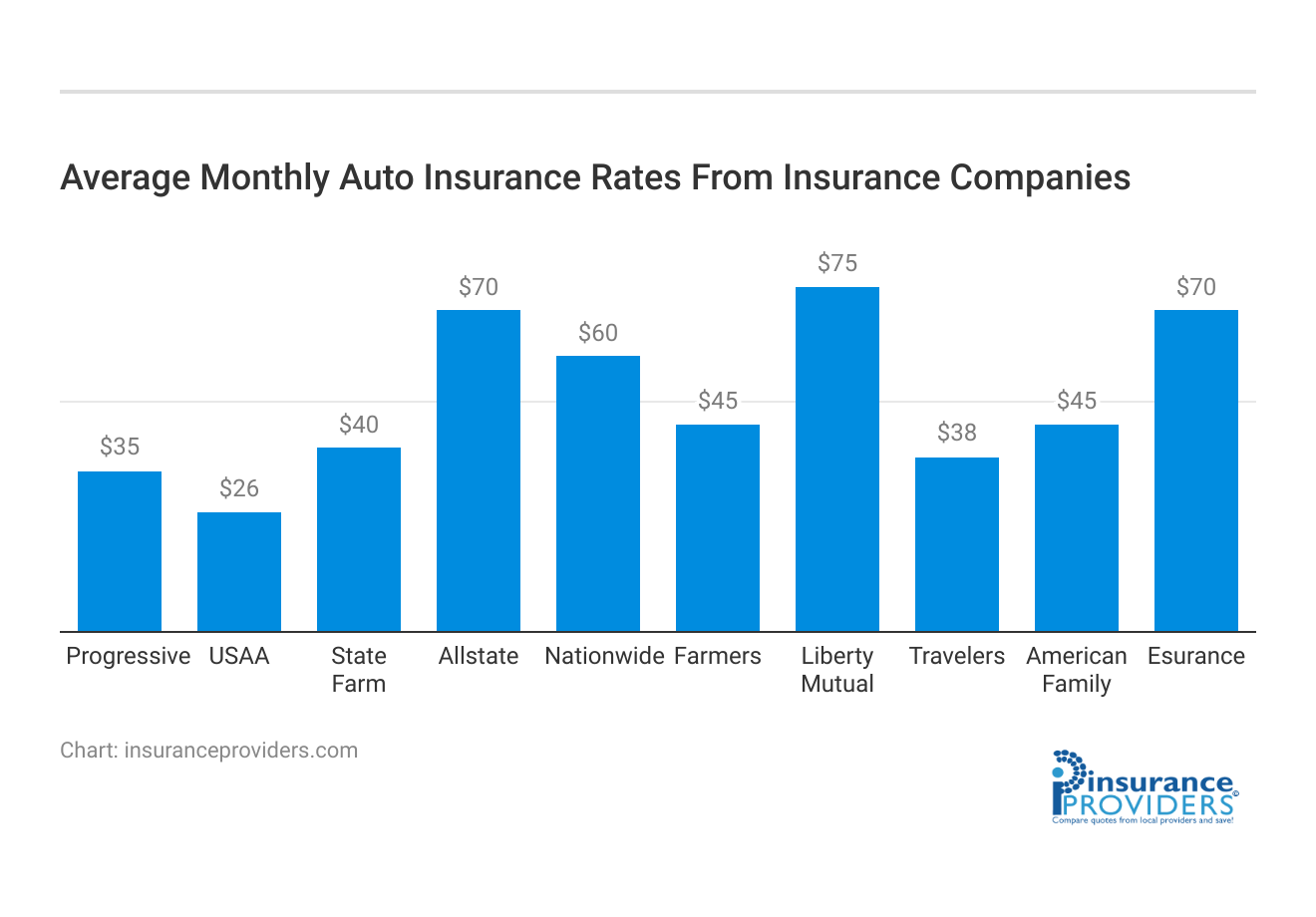

Comparing Coverage Rates: Finding the Right Balance

When it comes to auto insurance, striking the right balance between coverage and cost is crucial. Let’s take a closer look at the monthly rates for both minimum and full coverage from various insurance companies. Keep in mind that these rates can vary based on factors such as location, driving history, and the type of coverage you choose.

Average Monthly Auto Insurance Rates From Insurance Companies

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Progressive | $35 | $90 |

| USAA | $26 | $65 |

| State Farm | $40 | $110 |

| Allstate | $70 | $180 |

| Nationwide | $60 | $150 |

| Farmers | $45 | $120 |

| Liberty Mutual | $75 | $190 |

| Travelers | $38 | $100 |

| American Family | $45 | $115 |

| Esurance | $70 | $180 |

Starting with minimum coverage, USAA stands out with a low monthly rate of $26, providing affordable basic protection. Progressive and Travelers follow closely, offering rates at $35 and $38, respectively. On the other end of the spectrum, Liberty Mutual comes in with a higher minimum coverage rate of $75.

When opting for full coverage, USAA continues to lead the pack with a competitive monthly rate of $65. Progressive and Travelers maintain their affordability, with rates of $90 and $100, respectively. However, Liberty Mutual remains on the higher side, with a monthly full coverage rate of $190.

Understanding Auto Insurance

Auto insurance is a contract between an individual and an insurance company that provides coverage for potential financial losses resulting from accidents or other incidents involving their vehicle. It serves as a safeguard against the high costs of property damage, medical expenses, legal liabilities, and more. Auto insurance policies typically come in various forms, including liability coverage, collision coverage, comprehensive coverage, and personal injury protection.

What is Auto Insurance?

Auto insurance is a legal requirement in most states, ensuring that drivers have coverage for potential damages or injuries resulting from accidents they may cause. Without auto insurance, you may be personally liable for the costs associated with accidents, leading to severe financial hardship.

But let’s dive deeper into the world of auto insurance. Did you know that auto insurance coverage can vary depending on the state you live in? Each state has its own minimum requirements for auto insurance, which means that the coverage you need in one state may not be sufficient in another. It’s essential to familiarize yourself with the specific requirements of your state to ensure that you have adequate coverage.

Furthermore, auto insurance can also provide coverage for non-accident-related incidents. For example, some policies offer protection against theft, vandalism, or natural disasters. This additional coverage can provide peace of mind, knowing that your vehicle is protected from various risks beyond just accidents.

Why is Auto Insurance Important?

Auto insurance is crucial for several reasons. First and foremost, it provides financial protection. Accidents can happen at any time and result in significant expenses. Medical bills, property repair costs, and legal fees can quickly add up, causing financial strain. By having auto insurance, you transfer the potential financial burden to the insurance company, ensuring that you are not financially devastated in the event of an accident.

But did you know that auto insurance can also offer benefits beyond just financial protection? Some insurance policies provide roadside assistance services, such as towing, fuel delivery, or even locksmith services. These additional perks can be incredibly helpful in unexpected situations, providing you with the support you need when you’re stranded on the side of the road.

Secondly, auto insurance provides legal protection. Driving without insurance is against the law in most states. If you are caught without insurance, you may face fines, license suspension, or even jail time. It’s vital to have adequate insurance coverage to comply with the law and avoid unnecessary legal consequences.

Moreover, auto insurance can also offer coverage for uninsured or underinsured motorists. This means that if you are involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to pay for the damages, your own insurance policy can help cover the costs. This protection ensures that you are not left to bear the financial burden caused by someone else’s negligence.

Lastly, auto insurance can provide peace of mind. Knowing that you have insurance coverage can alleviate stress and worry, allowing you to focus on the road ahead. It offers a sense of security, knowing that you are protected in case of unforeseen circumstances.

In conclusion, auto insurance is not just a legal requirement; it is an essential financial and legal safeguard. It provides protection against potential financial losses, ensures compliance with the law, and offers additional benefits such as roadside assistance and coverage for uninsured motorists. By understanding auto insurance and choosing the right coverage, you can drive with confidence, knowing that you are prepared for whatever comes your way.

Factors That Influence Auto Insurance Rates

When it comes to auto insurance, several factors can significantly impact the premiums you pay. Understanding these factors can help you find the cheapest auto insurance companies and secure the best rates.

Age and Driving Experience

One of the primary factors influencing auto insurance rates is age. Young and inexperienced drivers generally have higher insurance premiums due to their higher risk of accidents. As drivers gain more experience and maintain a clean driving record, their insurance rates tend to decrease over time.

Vehicle Make and Model

The make and model of your vehicle also play a pivotal role in determining your auto insurance rates. High-end or luxury vehicles typically require more expensive repairs, making them pricier to insure. On the other hand, older or less valuable vehicles may have lower insurance rates due to their lower replacement costs.

Driving Record and Claims History

Your driving record and claims history are significant factors in determining your auto insurance rates. Drivers with a history of traffic violations, accidents, or insurance claims pose a higher risk to insurance companies and are therefore charged higher premiums. Maintaining a clean driving record can help you secure lower insurance rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top 10 Cheapest Auto Insurance Companies

Now that we understand the essential aspects of auto insurance, let’s explore the top ten cheapest auto insurance companies in the market today. Remember, it’s crucial to find a balance between affordability and reliable coverage when choosing an auto insurance company. Below are three companies that offer competitive rates:

Company 1 Overview and Rates

Company 1 is known for its exceptional customer service and affordable rates. With a wide range of coverage options and discounts available, they cater to drivers of all ages and backgrounds. Whether you’re a new driver or have a clean driving record, Company 1 has policies tailored to your needs. They understand that every driver is unique and strive to provide personalized insurance solutions.

In addition to their competitive rates, Company 1 also offers additional benefits such as roadside assistance, which can be a lifesaver in case of emergencies. Their commitment to customer satisfaction is evident in their prompt claim handling process, ensuring that you receive the support you need when you need it the most.

Company 2 Overview and Rates

Company 2 prides itself on providing quality coverage at affordable prices. They understand that auto insurance is a significant expense for many individuals and have designed their policies to be budget-friendly without compromising on coverage. With various discounts and rewards programs, they help policyholders save money while enjoying comprehensive protection.

One of the standout features of Company 2 is their user-friendly online platforms. Managing your policy and making claims has never been easier. With just a few clicks, you can access your policy information, make changes, and file claims hassle-free. This convenience is especially beneficial for busy individuals who prefer managing their insurance needs online.

Company 3 Overview and Rates

Company 3 has established a reputation for offering reliable coverage at the lowest rates in the market. They understand that affordability is a top priority for many drivers and have made it their mission to provide the most cost-effective auto insurance policies. With their strong financial stability and long-standing experience, you can trust Company 3 to protect you on the road without breaking the bank.

What sets Company 3 apart is their commitment to customer satisfaction. They take the time to understand your unique needs and offer personalized insurance solutions that fit your budget. Their dedicated customer service team is always available to answer your questions and provide guidance throughout the insurance process.

Furthermore, Company 3’s reputation for reliability extends to their claims handling process. They understand that accidents can be stressful, and their efficient claim handling ensures that you receive the support you need promptly. With Company 3, you can have peace of mind knowing that you’re in good hands.

How to Get the Best Rates with Cheap Auto Insurance Companies

Securing the best rates with cheap auto insurance companies requires some effort and research. Here are a few tips to help you find the most competitive rates:

When it comes to auto insurance, finding the best rates is a top priority for many drivers. After all, who doesn’t want to save money while still getting the coverage they need? To ensure you get the best rates possible, there are a few key factors to consider.

Tips for Comparing Auto Insurance Quotes

When comparing auto insurance quotes, it’s essential to gather multiple quotes from different companies. This allows you to compare coverage options, deductibles, and premiums. Remember to evaluate the overall value rather than solely focusing on the lowest price.

It’s crucial to consider coverage limits and customer reviews to ensure you find a reputable and reliable insurance provider. While price is an important factor, it’s equally important to choose a company that will be there for you when you need them the most.

By gathering quotes from multiple companies, you can get a comprehensive view of the options available to you. This will enable you to make an informed decision based on your specific needs and budget.

Discounts and Savings Opportunities

Most auto insurance companies offer various discounts and saving opportunities that can significantly lower your premiums. These discounts are designed to reward safe driving habits, loyalty to the company, and other factors that reduce the risk of accidents or claims.

Common discounts include good student discounts, safe driving discounts, multi-policy discounts, and more. Good student discounts are often available to young drivers who maintain a certain grade point average. Safe driving discounts are typically given to those with a clean driving record and no recent accidents or traffic violations.

Multi-policy discounts are another way to save money on auto insurance. If you have multiple insurance policies with the same company, such as home and auto insurance, you may qualify for a discount on both policies.

Always inquire about available discounts and take advantage of them to secure the best rates. Insurance companies want to retain customers, so they are often willing to offer discounts to keep you satisfied.

Remember, getting the best rates with cheap auto insurance companies requires some effort on your part. By comparing quotes, considering coverage options, and taking advantage of discounts, you can find the most competitive rates and save money on your auto insurance premiums.

Pros and Cons of Cheap Auto Insurance

While cheap auto insurance can provide significant cost savings, it’s important to weigh the pros and cons before making a decision.

When it comes to auto insurance, finding the right policy at an affordable price is a top priority for many drivers. Cheap auto insurance offers the potential for substantial cost savings, allowing you to allocate your funds towards other essential expenses or savings. With the rising costs of living and the increasing financial demands of everyday life, finding ways to save money is always a welcome opportunity.

One of the primary benefits of cheap auto insurance is that it allows you to fulfill legal requirements without breaking the bank. In many countries, having auto insurance is mandatory, and failing to have proper coverage can result in hefty fines or even the suspension of your driver’s license. Cheap auto insurance ensures that you meet these legal obligations without putting a strain on your budget.

Benefits of Cheap Auto Insurance

However, it’s important to consider the potential drawbacks of cheap auto insurance before making a decision. One of the main concerns with cheap insurance policies is the possibility of limited coverage. While getting a lower premium may seem appealing, it’s crucial to ensure that the coverage adequately protects you and your vehicle in case of an accident or other incidents.

Cheap insurance policies may have higher deductibles, lower liability limits, or minimal coverage options, which could leave you financially vulnerable in certain situations. For example, if you’re involved in a major accident and your cheap insurance policy has a high deductible, you may find yourself responsible for a significant portion of the repair costs out of pocket.

Moreover, cheap auto insurance policies may not offer the same level of customer service and support as more expensive options. When you need to file a claim or seek assistance, you want to be confident that your insurance company will be responsive and helpful. With cheap auto insurance, there is a possibility of encountering delays or difficulties in getting the support you need.

Potential Drawbacks of Cheap Auto Insurance

It’s also important to consider the long-term implications of choosing cheap auto insurance. While it may save you money in the short term, it could end up costing you more in the event of an accident or other unforeseen circumstances. By opting for a cheap policy with limited coverage, you may find yourself having to pay for repairs or medical expenses that could have been covered by a more comprehensive insurance plan.

In conclusion, obtaining auto insurance is a critical step for vehicle owners. By understanding auto insurance and the factors that influence prices, you can find the cheapest auto insurance companies and secure the best rates. Compare quotes, consider potential discounts, and evaluate the coverage provided to make an informed decision. Remember, while cost savings are important, finding a balance between affordability and reliable coverage is key. Protect yourself, your vehicle, and your financial well-being by choosing the right auto insurance policy from a reputable and affordable insurance company.

Frequently Asked Questions

What factors affect the cost of auto insurance?

The cost of auto insurance can be influenced by various factors such as the driver’s age, driving record, location, type of vehicle, coverage limits, and deductibles.

How can I find the cheapest auto insurance companies?

To find the cheapest auto insurance companies, you can start by obtaining quotes from multiple insurers and comparing their rates. Additionally, you can consider factors such as customer reviews, financial stability, and the range of coverage options offered by each company.

Are there any discounts available to lower auto insurance costs?

Yes, many auto insurance companies offer discounts that can help lower insurance costs. These discounts may include safe driver discounts, multi-policy discounts, good student discounts, and discounts for installing safety features in your vehicle.

What should I consider when choosing an auto insurance company?

When choosing an auto insurance company, it is important to consider factors such as the company’s financial stability, customer service reputation, coverage options, discounts offered, and the ease of filing claims.

Can I switch my auto insurance company mid-policy?

Yes, you can switch your auto insurance company mid-policy. However, it is important to review the terms and conditions of your current policy to understand any potential penalties or fees for cancelling early. Additionally, it is crucial to have a new policy in place before cancelling the old one to ensure continuous coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.