The Full Colorado Auto Insurance Guide [Providers + Coverage]

Learn the essentials of Colorado auto insurance and being a driver in the state. This comprehensive guide covers the best car insurance companies in Colorado, types of coverage for auto policies, state laws as well as road and highway statistics, and more.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated January 2024

| Colorado Statistics Summary | |

|---|---|

| Annual Road Miles | 88,740 Vehicle Miles Driven: 48,985 Million |

| Vehicles Registered in State | 4,632,430 |

| Population | 5,607,154 |

| Most Popular Vehicle | Subaru Outback |

| Uninsured Drivers | 13.3 Percent |

| Total Driving Fatalities | 2008-2017 Speeding: 230 DUI: 177 |

| Annual Premiums | Liability: $520.04 Collision: $287.00 Comprehensive: $174.61 |

| Cheapest Provider | Safeco Geico |

Do you love a good cheeseburger? If so, you have Colorado to thank for the cheeseburger. That isn’t the only thing Colorado has to offer.

Mountains.

Fishing.

Hiking.

Colorado’s leading industry is tourism, so it is no surprise it has a lot to offer its residents.

With all the beauty to take in and outdoor activities, who wants to spend time looking for cheap car insurance?

We are guessing you don’t want to and you came to the right place. Let us do the work for you so you can save your money and your time.

We will cover everything from the required coverages and cheapest companies to licensing laws and vehicle thefts. So sit back and get ready to find out everything you need to know about Colorado insurance.

Think you are ready to take the plunge and get some quotes? Go ahead and enter your zip code here to use our free comparison quote tool.

How to get Colorado car insurance coverage and rates

Finding the right insurance company for your needs can be difficult. We are going to help you find which auto insurance company could be a good fit for you, but we are also going to cover state laws.

If you are new to Colorado, you may not know the legal requirements that are necessary. So, let’s go ahead and cover exactly what coverage you have to obtain before driving in Colorado.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the state car culture like?

When most people think of Colorado, they think outdoorsy. When most people think of outdoorsy vehicles, they think Subaru.

So you guessed it, Subaru is the make of choice most Colorado residents pick for their vehicle. Out of the top ten vehicles of Colorado, Subaru makes half of them.

Another popular choice is a sport utility vehicle. Nine of those top 1o vehicles fall in the category of an SUV. It is no surprise with the mountainous terrain and snow in Colorado.

No matter what vehicle you choose, you will need to buy car insurance for it. How much do you need? We will answer that question and more.

What is Colorado minimum coverage?

Like most states, Colorado has a minimum requirement for the amount of insurance on your vehicle before you can legally drive on the roads.

| Colorado Minimum Coverage Requirements | |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $15,000 per accident |

| Uninsured/Underinsured Motorist Coverage* | $25,000 per person $50,000 per accident |

| Medical Payments (MedPay)* | $5000 |

You must carry the above limits, but please remember this is the minimum limit required for auto policies.

Minimum limits required by states are usually very low. While they may be cheaper upfront with your monthly premium insurance costs, if you were to get into an accident they may not be enough to cover the loss.

Kiplinger suggests a limit of “bodily injury coverage of at least $100,000 per person, and $300,000 per accident, and property damage coverage of $50,000, or a minimum of $300,000 on a single-limit policy.”

Liability limits are used when you get into an accident and you are the one at fault. Colorado is an at-fault state. This means that if you get into an accident, the person at fault files insurance. Their liability limits will pay for the person that is not at fault.

This is why having adequate coverage limits in your auto insurance policy is important. If you get into an accident and are found at fault, you are responsible for making sure the other party can get back on the road.

Colorado law requires insurance companies to offer $5,000 med-pay coverage to insureds. You must decline this coverage or it will automatically be added to your policy. Medpay is medical coverage, outside of health insurance, which can be used no matter who is at fault.

Are you required to have a form of financial responsibility?

You must be financially responsible if you were to get into an accident. Due to that responsibility, you must show proof of your security. In Colorado, that comes in the form of an auto insurance policy.

You must show proof of insurance any time a police officer requests or in the event of an accident. You will also have to show proof when registering your vehicle or reinstating your driver’s license.

Forms of financial responsibility can be an insurance card, binder (proof from the company), or electronic proof on your cellular device.

Colorado also offers police officers an online database called Colorado’s Motorist Insurance Identification Database (MIIDB). This system is updated daily from registrations and matches with insurance company information. This is helpful to prevent drivers from getting behind the wheel of an uninsured vehicle.

Failure to provide proof could result in a ticket or your car being confiscated.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What percentage of income are insurance premiums?

Insurance takes an average of 2.35 percent of an American’s income. How much are Colorado residents putting towards insurance?

| Colorado Car Insurance as a Percentage of Income | ||||

|---|---|---|---|---|

| Annual Full Coverage Average Premiums | Monthly Full Coverage Average Premiums | Annual Per Capita Disposable Personal Income | Monthly Per Capita Disposable Personal Income | Percentage of Income |

| $939.52 | $78.29 | $43,609.00 | $3,634.08 | 2.15 |

They are putting a little less at 2.15 percent. Over the years of 2012 – 2014, income has gone up and insurance has gone up as well, but the average percentage has stayed about the same.

What’s the core coverage?

There are three core components of an insurance policy – liability coverage, comprehensive, and collision insurance. When a driver chooses to have all three types of coverage, they have a full-coverage policy.

We discussed liability coverage in the required minimum limits, now let’s take a look at comprehensive and collision coverage.

Comprehensive and Collision covers your car. These coverages are usually based on a deductible. The higher the deductible is the lower the annual premium. So, if you have a $1,000 deductible, you pay the first $1,000 of the claim and the insurance company will pick up the remaining amount for a covered loss.

Below is a table of NAIC data showing average prices based on state minimum coverage.

| Type of Coverage | Average Annual Cost |

|---|---|

| Liability | $520.04 |

| Collision | $287 |

| Comprehensive | $174.61 |

| Full Coverage | $981.64 |

As mentioned above, full coverage auto insurance is the option to have all three coverages.

Is there an additional liability?

Loss ratio data is used to show how much a company earns in premiums and how much they pay out in claims. If a company makes $50,000 in premium and pays $25,000 in claims, the loss ratio is fifty percent.

Loss ratios too high could mean the company isn’t making money and could be in financial distress. If they are too low, this could mean the company doesn’t pay out very well in claims.

This table shows loss ratios for optional additional liability insurance you can purchase in Colorado.

| Type of Coverage | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (MedPay) | 85.64% | 82.53% | 77.44% |

| Uninsured/Underinsured Motorist Coverage | 96.63% | 96.81% | 95.82% |

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there any add-ons, endorsements, and riders?

There are many additional options you can add to your policy. Below is a list of commonly added coverages.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

It is important to relay information correctly to your insurance provider so they can assess your needs and make sure there is no gap in coverages.

Male vs. female auto insurance rates: What’s the difference?

Demographics play a role in how much you pay for insurance. As you can see below, rates for drivers can change depending on their gender as well as age. For some, it can be surprising to learn that married drivers can have slightly cheaper rates than their single peers.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,397.34 | $3,180.33 | $3,056.13 | $3,088.23 | $11,732.84 | $12,322.40 | $3,748.22 | $3,771.84 |

| American Family Mutual | $2,552.17 | $2,552.17 | $2,302.28 | $2,302.28 | $6,182.18 | $8,292.20 | $2,552.17 | $3,128.70 |

| Farmers Ins Exchange 2.0 | $3,095.55 | $3,068.12 | $2,804.12 | $3,023.70 | $11,703.79 | $11,788.62 | $3,401.12 | $3,436.88 |

| Geico Cas | $1,962.23 | $2,140.86 | $2,069.94 | $2,343.70 | $6,116.54 | $6,472.19 | $1,797.35 | $1,830.71 |

| Safeco Ins Co of America | $1,859.15 | $1,810.08 | $1,578.98 | $1,736.25 | $5,559.53 | $6,061.99 | $1,877.93 | $1,897.98 |

| AMCO Insurance | $2,490.00 | $2,536.58 | $2,226.47 | $2,354.68 | $6,292.06 | $8,057.66 | $2,863.59 | $3,094.73 |

| Progressive Direct | $2,593.20 | $2,426.75 | $2,250.01 | $2,245.05 | $8,765.26 | $9,802.10 | $2,926.11 | $2,846.92 |

| State Farm Mutual Auto | $2,048.74 | $2,048.74 | $1,842.60 | $1,842.60 | $5,901.90 | $7,471.21 | $2,293.13 | $2,717.20 |

| USAA CIC | $2,232.85 | $2,232.55 | $2,126.52 | $2,134.62 | $5,582.30 | $6,398.91 | $2,873.09 | $3,130.10 |

Read more:

- AMCO Insurance Company: Customer Ratings & Reviews

- American Road Insurance Company: Customer Ratings & Reviews

- Encompass Insurance Company of America Review

Age is a huge factor in determining your premium. Teen drivers can pay between $4000-$8000 more than someone older with more driving experience.

What are the best Colorado car insurance companies?

If you are required to have insurance, where are you going to get it?

Chances are if you can name one company, you can name ten more behind it. The choice of where to buy your insurance is tough.

You want to get the cheapest provider, but you also want to find a company that is great about paying claims and has helpful customer service representatives.

A lot goes into what makes a company a good fit for your needs. If you have a long commute, poor credit, or a not-so-great driving record, certain companies might be a better fit for you than others. Sometimes the cheapest car insurance isn’t the best policy for your needs. The good news is that you should be able to find affordable rates for a policy that has the coverage you want.

We are going to take a look at the biggest, the best, and the worst. First up, let’s dig in to find the companies with the best financial ratings.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the financial strength rating of the largest companies?

You definitely have a choice of financially sound companies in Colorado.

| Company | AM Best Rating |

|---|---|

| State Farm | A++ |

| USAA | A++ |

| Geico | A++ |

| Progressive | A+ |

| Allstate | A+ |

| American Family | A |

| Farmers | A |

| Liberty Mutual | A |

| Travelers | A++ |

| Nationwide | A+ |

All of the top ten largest companies have ratings of A or higher in financial ratings. AM Best is the widely-known credit agency that focuses on the insurance world.

Which companies have the best ratings?

You definitely want a financially sound insurance company in the event of an insurance claim, but you also want a company with great customer service.

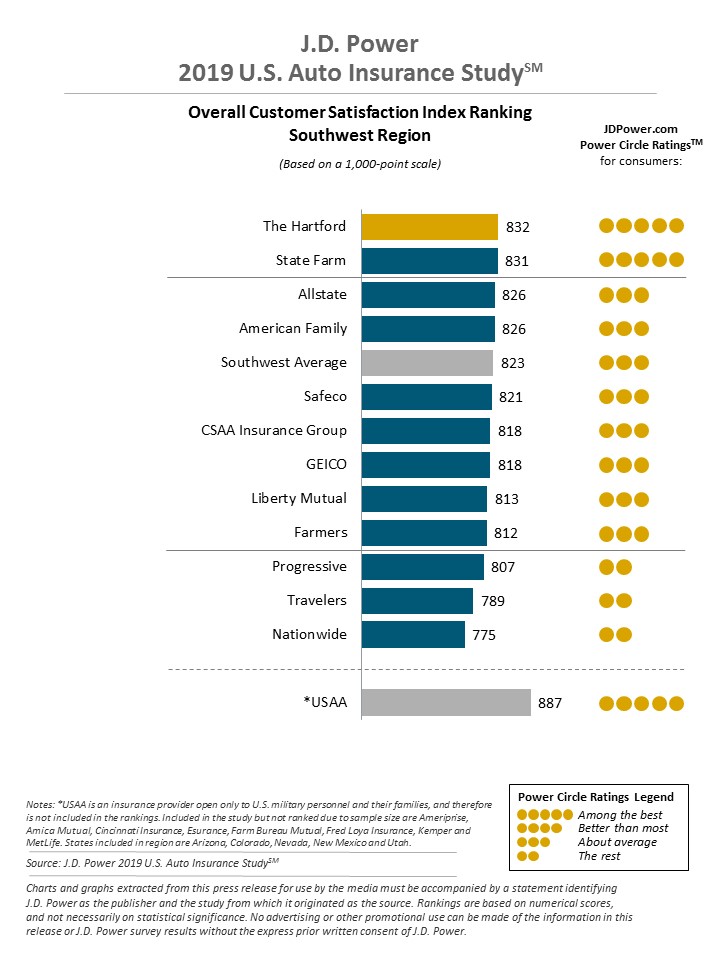

JD Power is an excellent resource for customers as they use customer reviews to rate companies.

The average for the Southwest region is 823 out of a 1000 score. Two companies, The Hartford and State Farm, are among the best.

Which companies have the most complaints in Colorado?

With all the good, there is sometimes a complaint. Larger companies will have more customers which makes them suspectable to more complaints. Because of this, we look at the complaint ratio to get a good look at the number of complaints.

| Company Name | Total Complaints | Confirmed Complaints | Complaint Ratio | Company Name | Total Complaints | Confirmed Complaints | Complaint Ratio |

|---|---|---|---|---|---|---|---|

| AIG | 0 | 0 | 0 | MetLife | 4 | 3 | 0.17 |

| Essentia | 0 | 0 | 0 | Nationwide Agribusiness | 6 | 3 | 0.18 |

| Farmers Alliance Mutual | 0 | 0 | 0 | 360 Insurance | 1 | 1 | 0.2 |

| Grange | 0 | 0 | 0 | Farmers | 53 | 18 | 0.2 |

| Great Northern | 1 | 0 | 0.08 | USAA | 32 | 11 | 0.2 |

| Country Preferred | 2 | 0 | 0.09 | Geico | 6 | 2 | 0.21 |

| Travelers Home and Marine | 2 | 0 | 0.12 | Liberty Mutual | 43 | 16 | 0.21 |

| Amica Mutual | 4 | 2 | 0.15 | State Farm | 174 | 62 | 0.21 |

| SECURA Supreme | 1 | 0 | 0.15 | Horace Mann | 1 | 0 | 0.22 |

Read more:

- Farmers Alliance Mutual Insurance Company Review

- Essentia Insurance Company: Customer Ratings & Reviews

Complaint data is provided by the National Association of Insurance Commissioners, NAIC.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the cheapest companies in Colorado?

Money is usually what gets you in the door at most insurance companies. Customer service and great claims keep you with the same company.

So who is the cheapest in Colorado? Let’s take a look.

| Cheapest Companies | Rate | Most Expensive Companies | Rate |

|---|---|---|---|

| USAA | $782.90 | American Hallmark | $4,408.66 |

| USAA Casualty | $807.74 | LM Insurance Corporation | $3,761.54 |

| Hartford Casualty | $819.44 | LM General | $3,397.64 |

| Progressive Direct | $845.84 | Metropolitan Casualty | $2,751.98 |

| National General Assurance | $863.50 | Metropolitan Property and Casualty | $2,733.37 |

| Owners | $866.89 | Pharmacists Mutual | $2,667.51 |

| Horace Mann | $898.52 | Electric | $2,276.12 |

| Nationwide Private Client | $904.90 | Safeway | $2,133.85 |

| The Cincinnati | $909.15 | Employers Mut Cas Co | $2,107.18 |

| Nationwide Mutual | $923.95 | Safeco Insurance Company of America | $1,979.75 |

| IDS Property Casualty | $925.55 | National Farmers Union Prop & Cas | $1,851.67 |

| Garrison Property and Casulty | $950.27 | Arizona Auto | $1,837.51 |

| CSAA General | $956.30 | 360 | $1,799.90 |

| Auto-Owners | $960.90 | Loya | $1,791.13 |

| Nationwide Agribusiness | $993.66 | Country Casualty | $1,727.11 |

| Farmers Insurance Exchange | $1,032.77 | Amica Mutual | $1,658.20 |

| United Fire & Casualty | $1,034.94 | American National General | $1,638.35 |

| Geico Casualty | $1,058.89 | Encompass Indemnity | $1,613.30 |

| Colorado Farm Bureau Mutual | $1,069.23 | Mendota | $1,600.02 |

| Grange Insurance Association | $1,080.59 | Allstate Fire and Casualty | $1,548.48 |

USAA is usually one of the cheapest companies a state has to offer. Keep in mind, USAA is a company for veterans, military personnel, or eligible family members.

Now, let’s dig into the factors that make up your insurance premium. Commuting, credit history, driving record, and coverage amounts are all things that can make or break that low insurance premium.

Read more:

- Safeco Insurance Company of America Review

- IDS Property Casualty Insurance Company: Customer Ratings & Reviews

- Mendota Insurance Company Review

What are the average commute rates by companies?

Do you travel for work? If you do, you will want to pay attention to this section.

Colorado residents spend an average of 23.7 minutes commuting to work, which is just a few minutes shorter than the average US worker’s commute of 25.5 minutes.

| Cost by Company with Different Annual Commutes | ||

|---|---|---|

| Group | Commute And Annual Mileage | Annual Average |

| Allstate | 10 miles commute. 6000 annual mileage. | $5,537.17 |

| Allstate | 25 miles commute. 12000 annual mileage. | $5,537.17 |

| Farmers | 10 miles commute. 6000 annual mileage. | $5,290.24 |

| Farmers | 25 miles commute. 12000 annual mileage. | $5,290.24 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,231.92 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,231.92 |

| American Family | 25 miles commute. 12000 annual mileage. | $3,812.93 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $3,739.47 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $3,739.47 |

| American Family | 10 miles commute. 6000 annual mileage. | $3,653.11 |

| USAA | 25 miles commute. 12000 annual mileage. | $3,433.70 |

| State Farm | 25 miles commute. 12000 annual mileage. | $3,351.22 |

| USAA | 10 miles commute. 6000 annual mileage. | $3,244.04 |

| State Farm | 10 miles commute. 6000 annual mileage. | $3,190.31 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,157.93 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,025.45 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $2,797.74 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $2,797.74 |

Not all companies rate higher for longer commutes. If you do have a commute, you might want to take a look at companies like Liberty Mutual, Nationwide, or others that do not have a higher rating for longer commutes.

What are the coverage level rates by companies?

If you have more auto insurance coverage the chances are high that you will be paying for your insurance than the guy with lower coverages. That may be true with most companies, but not all of them. Check out Nationwide insurance rates.

| Cost by Company with Different Coverage Levels | ||

|---|---|---|

| Group | Coverage_Type | Annual Average |

| Farmers | High | $6,013.62 |

| Allstate | High | $5,856.45 |

| Allstate | Medium | $5,518.14 |

| Allstate | Low | $5,236.91 |

| Farmers | Medium | $5,215.47 |

| Farmers | Low | $4,641.62 |

| Progressive | High | $4,535.53 |

| Progressive | Medium | $4,244.39 |

| Progressive | Low | $3,915.86 |

| American Family | High | $3,842.92 |

| American Family | Medium | $3,809.91 |

| Nationwide | Low | $3,748.13 |

| Nationwide | Medium | $3,740.53 |

| Nationwide | High | $3,729.76 |

| American Family | Low | $3,546.22 |

| State Farm | High | $3,487.06 |

| USAA | High | $3,486.28 |

| Geico | High | $3,454.92 |

| USAA | Medium | $3,338.66 |

| State Farm | Medium | $3,272.35 |

| USAA | Low | $3,191.66 |

| State Farm | Low | $3,052.89 |

| Geico | Medium | $3,034.95 |

| Liberty Mutual | High | $2,969.02 |

| Liberty Mutual | Medium | $2,787.15 |

| Geico | Low | $2,785.20 |

| Liberty Mutual | Low | $2,637.04 |

Nationwide’s lower coverage actually is more than the higher coverage. It is always great to take a look at all your options. They may surprise you with a lower rate or one that isn’t nearly as high as you thought it would be.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the credit history rates by companies?

Did you know your credit can affect your interest rates, homebuying opportunities, and car loans? It definitely does, but what some do not know is that it also affects your insurance rates.

Lower credit history can make it look like you have a hard time paying bills on time and you have a higher likelihood of filing a claim.

| Cost by Company with Different Credit History | ||

|---|---|---|

| Group | Credit History | Annual Average |

| Allstate | Poor | $7,066.00 |

| Farmers | Poor | $6,142.35 |

| Allstate | Fair | $5,439.82 |

| Farmers | Fair | $4,988.44 |

| USAA | Poor | $4,943.34 |

| American Family | Poor | $4,850.67 |

| Progressive | Poor | $4,819.49 |

| Farmers | Good | $4,739.93 |

| State Farm | Poor | $4,541.00 |

| Nationwide | Poor | $4,522.20 |

| Progressive | Fair | $4,108.11 |

| Allstate | Good | $4,105.68 |

| Liberty Mutual | Poor | $3,999.04 |

| Progressive | Good | $3,768.17 |

| Geico | Poor | $3,717.48 |

| Nationwide | Fair | $3,578.13 |

| American Family | Fair | $3,452.49 |

| Nationwide | Good | $3,118.09 |

| Geico | Fair | $3,091.66 |

| State Farm | Fair | $2,918.53 |

| American Family | Good | $2,895.90 |

| USAA | Fair | $2,816.63 |

| Geico | Good | $2,465.94 |

| Liberty Mutual | Fair | $2,446.38 |

| State Farm | Good | $2,352.76 |

| USAA | Good | $2,256.64 |

| Liberty Mutual | Good | $1,947.80 |

Let’s look at Allstate rates. The difference between good and poor credit can cost you almost $3000 a year.

Things happen and hardships occur. If your credit is less than desirable, look for a company like Geico that doesn’t rate as much on credit.

What are the driving record rates by companies?

Your driving record is probably the most obvious factor in getting your rate. All insurance companies request your driving record and take it into consideration.

Most drivers have seen those flashing blue lights in your rearview mirror. If you haven’t, good for you. Those tickets can be expensive. Court costs, fees, and possible attorney costs can put a dent in your wallet. But, how much is it going to cost you in insurance?

| Cost by Company with Different Driving Record | ||

|---|---|---|

| Allstate | With 1 DUI | $6,643.37 |

| Allstate | With 1 accident | $5,431.34 |

| Allstate | With 1 speeding violation | $5,350.87 |

| Allstate | Clean record | $4,723.09 |

| American Family | With 1 DUI | $5,122.27 |

| American Family | With 1 accident | $3,915.14 |

| American Family | With 1 speeding violation | $3,131.89 |

| American Family | Clean record | $2,762.77 |

| Farmers | With 1 accident | $5,743.39 |

| Farmers | With 1 DUI | $5,665.21 |

| Farmers | With 1 speeding violation | $5,283.78 |

| Farmers | Clean record | $4,468.57 |

| Geico | With 1 DUI | $3,928.75 |

| Geico | With 1 accident | $3,395.15 |

| Geico | With 1 speeding violation | $2,858.30 |

| Geico | Clean record | $2,184.55 |

| Group | Driving_Record | Annual Average |

| Liberty Mutual | With 1 DUI | $2,978.75 |

| Liberty Mutual | With 1 speeding violation | $2,891.61 |

| Liberty Mutual | With 1 accident | $2,869.91 |

| Liberty Mutual | Clean record | $2,450.68 |

| Nationwide | With 1 DUI | $4,991.57 |

| Nationwide | With 1 accident | $3,930.20 |

| Nationwide | With 1 speeding violation | $3,163.26 |

| Nationwide | Clean record | $2,872.86 |

| Progressive | With 1 accident | $5,115.10 |

| Progressive | With 1 speeding violation | $4,278.14 |

| Progressive | With 1 DUI | $3,869.05 |

| Progressive | Clean record | $3,665.41 |

| State Farm | With 1 accident | $3,532.80 |

| State Farm | With 1 DUI | $3,270.76 |

| State Farm | With 1 speeding violation | $3,270.76 |

| State Farm | Clean record | $3,008.73 |

| USAA | With 1 DUI | $5,192.84 |

| USAA | With 1 accident | $2,973.13 |

| USAA | With 1 speeding violation | $2,750.39 |

| USAA | Clean record | $2,439.12 |

A speeding ticket is usually a lesser increase while accidents and driving under the influence can heavily increase your rate.

What are the largest car insurance companies in Colorado?

State Farm is, by far, the largest company writing in Colorado. It is followed by USAA and Geico.

| Rank | Company Group | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| 1 | State Farm Group | $906,918 | 77.60% | 19.81% |

| 2 | USAA Group | $467,079 | 86.16% | 10.20% |

| 3 | Geico | $452,585 | 98.99% | 9.89% |

| 4 | Progressive Group | $440,274 | 69.82% | 9.62% |

| 5 | Allstate Insurance Group | $388,445 | 78.44% | 8.49% |

| 6 | American Family Insurance Group | $384,892 | 100.38% | 8.41% |

| 7 | Farmers Insurance Group | $330,473 | 63.89% | 7.22% |

| 8 | Liberty Mutual Group | $319,166 | 86.69% | 6.97% |

| 9 | Travelers Group | $129,187 | 91.67% | 2.82% |

| 10 | Nationwide Corp Group | $91,547 | 86.32% | 2.00% |

What is the number of insurers by state?

There are a total of 858 insurers available to Colorado residents.

| Domestic | Foreign | Total Number of Licensed Insurers |

| 10 | 848 | 858 |

Domestic carriers are formed within the state, while foreign carriers are formed under the laws of a different state.

Compare Insurance Providers Rates to Save Up to 75% Secured with SHA-256 Encryption

What are the Colorado laws?

You have got your insurance and you know what companies to look at for it. Next, the laws of the state to keep you a legal driver.

In this section, we are going to look at certain state laws, licensing laws, and rules of the road to keep drivers safe.

Laws can be as confusing as trying to pick an insurance provider. We will help you understand as we breakdown some different Colorado laws.

What are the car insurance laws?

State laws make a huge impact on insurance providers. They can determine how insurance policies are mandated to which companies will be responsible to pay out for a claim.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How state laws for insurance are determined

The General Assembly makes state laws pertaining to fraud, at-fault status, road safety, car seat laws, and laws of that nature.

In regards to insurance law, like filing forms and rates, the insurance carrier must file those before they use them in practice. The State Insurance Commissioner can step in if he or she sees rates as excessive.

How to get windshield coverage

As you are driving down the interstate, you hear the crack of a rock hitting your windshield. Soon, you see a giant crack going down your windshield. Does insurance cover your windshield? Well, that answer depends on your coverage.

Most companies have windshield coverage under comprehensive insurance. If you do not have comprehensive coverage, you will more than likely be the one responsible for replacing your windshield.

Colorado has no unique law concerning the use of aftermarket parts or certain repair shops.

How to get high-risk insurance

If you have been convicted of driving under the influence or driving without insurance, you may be required to file an SR-22 as a high-risk driver.

SR-22 is a filing, not an insurance policy. This means the insurance carrier must file an SR-22 with the state DMV office proving you have insurance. If you lapse or cancel your insurance, your insurance company will then notify DMV of your insurance status.

If you are unable to find insurance in a normal market, Colorado has an option for you. The Colorado Automobile Insurance Plan is a residual market for drivers with lengthy records and who are unable to find insurance elsewhere.

Please remember, this is not a low-cost plan. When you move outside a normal insurance market, you will pay a premium. This is the last resort to keep you legal while driving on the roads.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to get low-cost insurance

Currently, Colorado does not have any low-cost insurance plans. The best way to get the lowest rate is to shop your insurance and keep a clean driving record.

Is there an automobile insurance fraud in Colorado?

Insurance fraud is a serious crime in Colorado, as it is in most states.

Fraud can be classified into two different types, hard and soft. Hard fraud is knowingly fabricating an event to commit fraud. Soft fraud is exaggerating or fabricating details of a loss or claim that did actually happen.

Fraud can happen at any level. At the insured level filing the claim to the adjuster manipulating the details.

Filing a fraudulent claim in Colorado is a felony and can get you up to three years in prison and up to $100,000 in fines.

What’s considered a statute of limitations?

Statute of limitations is the set amount of time you have from when the loss occurred to when you can file the claim or seek damages.

| Colorado Statute of Limitations | |

|---|---|

| Property Damage | Bodily Injury |

| 3 years | 3 years |

You have three years to file a claim or sue for property damage or bodily injury. After the allowed time limit has expired, you can no longer file.

It is always best to file a claim as soon as possible. Once a loss has occurred, witnesses and evidence can decrease in accuracy over time.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the vehicle licensing laws?

If we keep your car legal on the roads with insurance, our next step is to keep you legal as a driver.

We are going to breakdown licensing laws next. When to renew, if you are new to the area, or a teen – we will have information for you all.

First up, the Real ID and what it is and if you have to get it.

What’s considered a Real ID?

In 2005, congress pass the Real ID Act. This act makes for stricter laws regarding the issuance of driver’s licenses so they can be used to fly commercial flights and enter federal buildings.

Colorado is compliant with these stricter laws and if you have a Real ID license, you can continue to fly on commercial airlines and use your license as identification to enter federal buildings.

What are the penalties for driving without insurance?

As we discussed earlier, you must have insurance to drive in Colorado.

Driving without insurance is very costly. Taking the chance of driving without coverage is a game no one should play. There are serious consequences for driving without insurance.

| Penalties for Driving Without Insurance | ||

|---|---|---|

| Penalty | First Offense | Second Offense |

| Fine | $500 minimum | $1,000 minimum |

| Points | Four | Four |

| License Suspension | Until you show proof of insurance to the DMV | Four months |

| Community Service | Possible up to 40 hours | Possible up to 40 hours |

Fines, community service, license suspension, and points on your record are all punishments if found guilty for driving without insurance.

Once you get insurance to get your license reinstated, you will face higher premiums with the possibility of SR-22 and reinstatement fees.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the teen driver laws?

Teen drivers are very costly to insure. Teens are inexperienced and not matured drivers.

Colorado helps ease teens into driving with a graduated licensing program.

| Graduated Licensing System for Teens | |||

|---|---|---|---|

| Restrictions | Learner's Permit | Restricted License | Unrestricted License |

| Age | 15 - if enrolled, attending, and participating in driver's ed 15 1/2 - if completed a four-hour driver-awareness course 16 - if none of above | If under 18, one year after obtaining learner's permit | 17 - if held restricted license 12 months 18 - otherwise |

| Passengers | Must be supervised by a licensed parent/guardian or their licensed adult appointee | First six months - no passengers under 21 Second six months - limit of one passenger under 21 (exceptions: siblings, family emergencies) | No restrictions |

| Hours | No restrictions | First year - no driving between midnight and 5 a.m. (exceptions: presence of a parent/guardian, driving to and from school activities or work, family emergency, being an emancipated teen) | No restrictions |

| Cell phone use | Forbidden | Forbidden | Forbidden if under 18 |

| Pre-requisites | If under 18, parent or guardian must sign an affidavit of liability | Completion of 50 hours supervised driving, 10 of which at night | If under 18, holding a restricted license for one year |

What’s the license renewal procedure for older drivers?

All Colorado drivers must renew their driver’s licenses every five years, no matter of age. All drivers must also have proof of vision at every renewal.

The difference between older drivers and younger is how you can renew. Older drivers, 66 years and older, can only renewal every other year by mail. You must go to your local DMV office in the years you can not mail.

What’s the procedure for new residents?

Welcome to Colorado!

According to the Colorado DMV, once you become a Colorado resident you have 30 days to get your new license and ninety days to register your vehicle.

In order to become a resident of Colorado you must fall into one of the below categories:

- Own or operate a business in Colorado

- You are gainfully employed in Colorado

- Live in Colorado for 90 consecutive days

You must bring your current out of state license to turn in when getting your new Colorado license. You must also show proof of residency and social security number.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the license renewal procedures?

All Colorado drivers must renew their licenses every five years. Each renewal also requires proof of a vision test.

If you are under the age of 66 years, you may renew online or mail for two consecutive renewal terms.

If your license has been suspended during a renewal term, you must also complete a written test.

What is considered a Negligent Operator Treatment System (NOTS)?

Colorado uses a points system when you receive driving violations. All drivers start with zero points.

| Age of Driver | Number of points for suspension during any time period | Number of points for suspension within 12 months | Number of points for suspension within 24 months |

|---|---|---|---|

| 17 & Under | 7 or more | 6 or more | N/A |

| 18-21 | 14 or more | 9 or more | 12 or more |

| 21 and over | N/A | 12 or more | 18 or more |

Below is a list of infractions along with their point value.

- Speeding (5-9 MPH over the limit): One point

- Failure to yield right-of-way: Three points

- Improper passing: Four points

- Failure to show proof of insurance: Four points

- Speeding (10-19 MPH over the limit): Four points

- Careless driving: Four points

- Speeding (20-39 MPH over the limit): Six points

- Reckless driving: Eight points

- Driving under the influence of drugs or alcohol: 12 points

- Speed contests: 12 points

- Evading an officer: 12 points

- Speeding (40+ MPH over the limit): 12 points

- Leaving an accident scene: 12 points

What are the rules of the road?

If you are new to Colorado, you may not know all the rules of the road. Even if you have lived in Colorado for a while, you still may not be aware of certain road laws.

We are going to take a look at speed limits, ridesharing, and more in this next section.

We are trying to save you money on your insurance, so we also want to avoid any unwanted fees and fines for tickets.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is Colorado at fault or no-fault state?

As we mentioned earlier. Colorado is an at-fault state. The party found at fault for the accident is held liable to pay for damages with their insurance coverage.

Colorado also follows modified comparative negligence. This means if you are found under 50 percent at fault, you are legally allowed to receive compensation. However, your compensation will be adjusted for the percentage you are found at fault.

What are the seat belt and car seat laws?

Any passengers in the front seat, 16 years and older, must use a safety restraint.

Passengers fifteen years and under also follow strict laws for safety belt and car seat usage. Child safety laws are a primary offense and you can be pulled over for this offense.

| Colorado Car Seat Requirements | ||

|---|---|---|

| Type of Car Seat Required | Age | Weight |

| Rear-Facing Child Safety Seat | Under one year old | Under 40 pounds if under one year old Under 20 pounds if over one year old |

| Forward Facing or Rear Facing Child Safety Seat | One to four years old | 20 - 40 pounds |

| Forward Facing Safety Seat, Booster Seat, or With Safety Belt-Positioning Device | Four to eight years old | Over 40 pounds |

| Seat Belt or Child Restraint System | Over eight years old | No weight restrictions when over eight years old |

What are the keep right and move over laws?

Colorado law is pretty standard when it comes to moving over laws. If you see flashing lights, whether, from police or tow truck, you must vacate the closest lane if possible. If vacating the lane is not possible, you must slow your speed.

You must also follow keep right laws. In Colorado, you must keep right unless you are passing a slower vehicle or if returning to the right line is unsafe or due to traffic.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the average speed limit?

Most, if not all, roads should have posted speed limit signs. Here is a list of speed limits in Colorado. Please remember these are subject to change, especially if you are in a construction zone.

| Speed Limits | |

|---|---|

| Type of Roadway | Speed Limit |

| Rural Interstates | 75 mph |

| Urban Interstates | 65 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 65 mph |

How does ridesharing work?

Ridesharing has become a popular side hustle. With companies like Uber and Lyft, drivers have the flexibility to work when they can.

If you are interested in becoming a ridesharing driver, you will want to check with your current auto insurance provider to verify coverage.

The following companies offer ridesharing coverage in Colorado.

- Farmers

- USAA

- Geico

- Allstate

- Safeco

- State Farm

- MetLife

- American Family

Is there an automation on the road?

Cars are becoming more autonomous than ever before. First, they started with adaptive speed control, and then cars began parking themselves and having steering assistance. Now, cars can even drive themselves without human interaction to maneuver them.

Data found that 94 percent of accidents are due to human error. Researchers are hoping that with autonomous vehicles, accidents and fatalities will be dramatically lowered.

Colorado allows autonomous vehicles to be used as long as they follow state laws and regulations.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the safety laws?

Safety is a huge part of why we have insurance and state laws. Every state wants to keep their drivers safe on roadways.

We are going to take a look at two major safety hazards on all roadways which are, distracted driving and driving under the influence.

What are the DUI laws?

There are two levels of driving under the influence in Colorado.

- Driving Under the Influence (DUI) – When a driver’s blood alcohol content 0.08 percent or higher.

- Driving While Ability Impaired (DWAI) – When a driver’s blood alcohol content 0.05 percent to 0.07 percent.

Driving under the influence can be deadly. It can also be very costly. Not only on your record and with regards to insurance but also the fines and fees.

| Penalties for a DUI | ||||

|---|---|---|---|---|

| Penalty Type | First Driving While Ability Impaired (DWAI) | First Driving Under the Influence (DUI) | Second DUI or DWAI | Third and Subsequent DUIs and DWAIs |

| Revoked License | Eight points on license | Nine months | One year | Two years |

| Imprisonment | Two days to 180 days | Five days to one year | 10 days to one year | 60 days to one year |

| Fine | $200-$500 | $600-$1000 | $600-$1500 | $600-$1500 |

| Community Service | 24 to 48 hours | 24 to 48 hours | 48 to 120 hours | 48 to 120 hours |

What are the marijuana-impaired Driving Laws

While marijuana is legal for recreational use in Colorado, you can not drive while under the influence of marijuana. Drivers using marijuana and driving will face the same penalties as drivers under the influence of alcohol.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the distracted driving laws?

Texting is banned for all drivers. Drivers under the age of 18 are not allowed to use a wireless device while driving.

| Cellphone and Texting Restrictions | |

|---|---|

| Hand-held ban | No |

| Young drivers all cellphone ban | Under 18 years old |

| Texting ban | All drivers |

| Enforcement | Primary |

| Penalties for Illegal Handheld Use While Driving | ||

|---|---|---|

| Class of Driver | First Offense | Second and Subsequent Offenses |

| Minor Drivers (all cellphone use) | Class A traffic infraction One point on license $50 fine | One point on license $100 fine |

| Adult Drivers (text messaging) | Class 2 misdemeanor traffic offense Four points on license $300 fine | Bodily injury or proximate cause of death to another, class 1 misdemeanor Four points on license $1000 fine and/or up to one year imprisonment |

Cell phones have become a huge source of distraction while driving. Looking away from the road for a second can have catastrophic consequences.

What’s driving in Colorado like?

In our last section, we are going to look at driving in Colorado. We are going to cover a lot of statistics in regard to roadway fatalities in Colorado.

We want to keep drivers informed about where and when most accidents and thefts occur to keep you and your loved ones safe.

First, we are going to look at theft.

Is there a vehicle theft in Colorado?

Ever park your car and go into a store to come out and find your car no longer parked where you left it?

I have never had that feeling, but I can only imagine the sinking feeling one must get.

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Honda Civic | 1997 | 1,380 |

| Honda Accord | 1997 | 1,167 |

| Ford Pickup (Full Size) | 2005 | 595 |

| Jeep Cherokee/Grand Cherokee | 1999 | 594 |

| Chevrolet Pickup (Full Size) | 2000 | 450 |

| Dodge Pickup (Full Size) | 2001 | 308 |

| Subaru Legacy | 1996 | 215 |

| Acura Integra | 1994 | 208 |

| Toyota Camry | 1989 | 203 |

| Toyota Corolla | 2014 | 170 |

Honda Civic was top of the list with 1997 models being the most popular.

We talked earlier about your city and zip code making a difference in your premium. One thing companies look at is the crime rate in your city and zip code. Below is a chart showing a six-year trend in the top 10 worst cities in Colorado for car theft.

| Cities with the Worst Vehicle Theft | |

|---|---|

| City | Number of Thefts |

| Denver | 3,487 |

| Colorado Springs | 1,928 |

| Aurora | 1,000 |

| Lakewood | 623 |

| Pueblo | 528 |

| Thornton | 352 |

| Westminster | 322 |

| Arvada | 197 |

| Greeley | 186 |

| Commerce City | 183 |

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of road fatalities in Colorado?

Road fatalities happen even with the safest of drivers. We are going to look at National Highway Safety Administration data on when, where, and who of traffic fatalities in Colorado.

What’s the most fatal highway in Colorado?

The US-160 in Colorado is the most fatal highway in Colorado. It crosses the state east to west and has seen 111 fatalities in the last 10 years.

What’s the percentage of fatal crashes by weather condition and light condition?

Most drivers think dark, rainy nights would be the time more accidents and fatalities would happen, right?

While most fatalities are in the “unknown” category, it is important to see that more fatalities are noted during normal, daylight hours as opposed to dark and poor weather conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 38 | 11 | 16 | 1 | 0 | 66 |

| Rain | 8 | 1 | 4 | 0 | 0 | 13 |

| Snow/Sleet | 10 | 1 | 2 | 0 | 0 | 13 |

| Other | 3 | 0 | 0 | 1 | 0 | 4 |

| Unknown | 254 | 104 | 125 | 21 | 0 | 504 |

| TOTAL | 313 | 117 | 147 | 23 | 0 | 600 |

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of fatalities (all crashes) by county?

Here is a listing of traffic fatalities in all counties in Colorado.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 33 | 32 | 44 | 60 | 64 |

| Alamosa | 2 | 3 | 4 | 5 | 2 |

| Arapahoe | 21 | 30 | 37 | 46 | 45 |

| Archuleta | 2 | 4 | 3 | 3 | 1 |

| Baca | 2 | 0 | 2 | 0 | 8 |

| Bent | 3 | 1 | 1 | 0 | 2 |

| Boulder | 12 | 16 | 19 | 24 | 31 |

| Chaffee | 1 | 2 | 3 | 4 | 4 |

| Cheyenne | 2 | 3 | 0 | 0 | 0 |

| Clear Creek | 8 | 0 | 4 | 3 | 2 |

| Conejos | 1 | 1 | 2 | 0 | 2 |

| Costilla | 0 | 3 | 2 | 4 | 2 |

| Crowley | 1 | 0 | 0 | 0 | 1 |

| Custer | 0 | 2 | 0 | 1 | 1 |

| Delta | 10 | 3 | 0 | 3 | 6 |

| Denver | 40 | 42 | 52 | 54 | 49 |

| Dolores | 2 | 0 | 1 | 2 | 0 |

| Douglas | 12 | 17 | 13 | 24 | 19 |

| Eagle | 4 | 11 | 7 | 5 | 4 |

| El Paso | 63 | 53 | 48 | 48 | 77 |

| Elbert | 3 | 1 | 3 | 2 | 5 |

| Fremont | 8 | 7 | 9 | 10 | 9 |

| Garfield | 7 | 8 | 8 | 10 | 21 |

| Gilpin | 1 | 1 | 5 | 1 | 0 |

| Grand | 1 | 3 | 4 | 1 | 5 |

| Gunnison | 4 | 3 | 9 | 2 | 2 |

| Hinsdale | 0 | 0 | 1 | 0 | 0 |

| Huerfano | 1 | 3 | 2 | 4 | 2 |

| Jackson | 0 | 0 | 1 | 1 | 2 |

| Jefferson | 43 | 42 | 55 | 48 | 41 |

| Kiowa | 1 | 0 | 0 | 1 | 1 |

| Kit Carson | 5 | 3 | 1 | 4 | 4 |

| La Plata | 12 | 5 | 7 | 10 | 11 |

| Lake | 0 | 0 | 1 | 2 | 1 |

| Larimer | 20 | 24 | 33 | 44 | 36 |

| Las Animas | 9 | 2 | 1 | 8 | 3 |

| Lincoln | 8 | 4 | 4 | 1 | 2 |

| Logan | 6 | 5 | 6 | 8 | 4 |

| Mesa | 19 | 13 | 20 | 17 | 16 |

| Mineral | 0 | 0 | 1 | 2 | 1 |

| Moffat | 0 | 2 | 4 | 6 | 0 |

| Montezuma | 9 | 5 | 3 | 4 | 4 |

| Montrose | 4 | 6 | 7 | 3 | 9 |

| Morgan | 6 | 6 | 7 | 3 | 13 |

| Otero | 5 | 2 | 8 | 3 | 0 |

| Ouray | 0 | 2 | 3 | 2 | 1 |

| Park | 6 | 7 | 3 | 8 | 3 |

| Phillips | 1 | 1 | 1 | 0 | 0 |

| Pitkin | 2 | 2 | 0 | 1 | 1 |

| Prowers | 1 | 5 | 4 | 2 | 0 |

| Pueblo | 14 | 19 | 12 | 20 | 34 |

| Rio Blanco | 0 | 1 | 1 | 2 | 2 |

| Rio Grande | 4 | 2 | 5 | 2 | 1 |

| Routt | 4 | 0 | 4 | 5 | 5 |

| Saguache | 2 | 1 | 1 | 6 | 4 |

| San Juan | 1 | 2 | 0 | 1 | 0 |

| San Miguel | 2 | 6 | 1 | 3 | 1 |

| Sedgwick | 3 | 2 | 1 | 0 | 2 |

| Summit | 1 | 3 | 3 | 8 | 4 |

| Teller | 5 | 2 | 5 | 3 | 4 |

| Washington | 4 | 4 | 2 | 1 | 2 |

| Weld | 35 | 55 | 55 | 55 | 66 |

| Yuma | 2 | 4 | 3 | 4 | 3 |

Take a look at the top 10 counties for the most fatalities.

| Counties with the Most Traffic Fatalities | |||||

|---|---|---|---|---|---|

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

| El Paso County | 63 | 53 | 48 | 48 | 77 |

| Weld County | 35 | 55 | 55 | 55 | 66 |

| Adams County | 33 | 32 | 44 | 60 | 64 |

| Denver County | 40 | 42 | 52 | 54 | 49 |

| Arapahoe County | 21 | 30 | 37 | 46 | 45 |

| Jefferson County | 43 | 42 | 55 | 48 | 41 |

| Larimer County | 20 | 24 | 33 | 44 | 36 |

| Pueblo County | 14 | 19 | 12 | 20 | 34 |

| Boulder County | 12 | 16 | 19 | 24 | 31 |

| Garfield County | 7 | 8 | 8 | 10 | 21 |

– Traffic Fatalities

More fatalities occur on urban roads than on rural.

| Type of Roadway | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 296 | 252 | 247 | 227 | 233 | 244 | 228 | 260 | 266 | 277 |

| Urban | 252 | 213 | 203 | 220 | 241 | 238 | 260 | 285 | 342 | 369 |

What’s the number of fatalities by person type?

The number of fatalities with pedestrians and motorcyclists are on the rise, but passengers of vehicles remain the highest number of fatalities.

| Person Type | Vehicles Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 141 | 176 | 163 | 187 | 199 |

| – | Light Truck - Pickup | 77 | 56 | 77 | 66 | 78 |

| – | Light Truck - Utility | 85 | 70 | 85 | 85 | 104 |

| – | Light Truck - Van | 14 | 6 | 21 | 24 | 27 |

| – | Light Truck - Other | 0 | 0 | 1 | 0 | 2 |

| – | Large Truck | 11 | 10 | 13 | 18 | 26 |

| – | Bus | 0 | 0 | 0 | 1 | 1 |

| – | Total Occupants | 331 | 319 | 364 | 383 | 437 |

| Motorcyclists | Motorcycle | 87 | 94 | 106 | 125 | 103 |

| Nonoccupants | Pedestrian | 50 | 63 | 59 | 79 | 92 |

| – | Bicyclist and Other Cyclist | 12 | 10 | 13 | 16 | 16 |

| – | Other/Unknown Nonoccupants | 2 | 2 | 5 | 5 | 0 |

| – | Total Nonoccupants | 64 | 75 | 77 | 100 | 108 |

| Occupants, Motorcyclists, and Nonoccupants | Total Traffic-Related Fatalities | 482 | 488 | 547 | 608 | 648 |

What’s the number of fatalities by crash type?

Here is a look at the last five years in the type of crash with a fatality. Total fatalities have risen over 150 in the last five years.

| Colorado Fatalities by Crash Type | |||||

|---|---|---|---|---|---|

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

| Total Fatalities (All Crashes)* | 482 | 488 | 547 | 608 | 648 |

| - (1) Single Vehicle | 284 | 273 | 305 | 344 | 335 |

| - (2) Involving a Large Truck | 56 | 63 | 64 | 86 | 87 |

| - (3) Involving Speeding | 151 | 168 | 217 | 211 | 230 |

| - (4) Involving a Rollover | 197 | 166 | 195 | 212 | 228 |

| - (5) Involving a Roadway Departure | 287 | 285 | 304 | 295 | 330 |

| - (6) Involving an Intersection (or Intersection Related) | 118 | 127 | 153 | 200 | 190 |

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Five-year trend for the top 10 counties

| Counties with the Most Traffic Fatalities | |||||

|---|---|---|---|---|---|

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

| El Paso County | 63 | 53 | 48 | 48 | 77 |

| Weld County | 35 | 55 | 55 | 55 | 66 |

| Adams County | 33 | 32 | 44 | 60 | 64 |

| Denver County | 40 | 42 | 52 | 54 | 49 |

| Arapahoe County | 21 | 30 | 37 | 46 | 45 |

| Jefferson County | 43 | 42 | 55 | 48 | 41 |

| Larimer County | 20 | 24 | 33 | 44 | 36 |

| Pueblo County | 14 | 19 | 12 | 20 | 34 |

| Boulder County | 12 | 16 | 19 | 24 | 31 |

| Garfield County | 7 | 8 | 8 | 10 | 21 |

What’s the number of fatalities involving speeding by county?

Take a look at the top ten counties for speed-related deaths.

| Colorado Fatalities Involving Speeding by County | ||||

|---|---|---|---|---|

| County Name | 2015 | 2016 | 2017 | Three-Year Total |

| El Paso County | 15 | 22 | 29 | 66 |

| Denver County | 28 | 22 | 15 | 65 |

| Jefferson County | 22 | 20 | 18 | 60 |

| Weld County | 25 | 11 | 20 | 56 |

| Adams County | 17 | 19 | 20 | 56 |

| Arapahoe County | 17 | 19 | 17 | 53 |

| Larimer County | 9 | 15 | 16 | 40 |

| Pueblo County | 4 | 4 | 16 | 24 |

| Garfield County | 5 | 6 | 10 | 21 |

| Douglas County | 4 | 8 | 8 | 20 |

What’s the number of fatalities in crashes involving an alcohol-impaired driver?

Many counties have seen a steady rise in the number of alcohol-related deaths.

| Colorado Traffic Fatalities Involving an Alcohol-Impaired Driver (BAC 0.08 percent or greater) | ||||

|---|---|---|---|---|

| County Name | 2015 | 2016 | 2017 | Three-Year Total |

| El Paso County | 17 | 20 | 24 | 61 |

| Denver County | 15 | 18 | 20 | 53 |

| Weld County | 19 | 13 | 13 | 45 |

| Adams County | 11 | 15 | 18 | 44 |

| Jefferson County | 19 | 9 | 13 | 41 |

| Arapahoe County | 12 | 13 | 13 | 38 |

| Larimer County | 8 | 12 | 11 | 31 |

| Pueblo County | 3 | 3 | 10 | 16 |

| Garfield County | 3 | 7 | 5 | 15 |

| Boulder County | 5 | 3 | 4 | 12 |

| Douglas County | 4 | 5 | 3 | 12 |

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the teen drinking and driving laws?

Colorado ranks high, at number seven, for underage DUI arrests.

| DUI Statistics for Under 18 | ||

|---|---|---|

| Number of Arrests | Arrests per One Million People | Rank Nationally |

| 217 | 172.03 | 7 |

What’s the average EMS response time?

In the event of an accident, you want to know that emergency medical teams can get to you quickly and get you to a hospital even faster.

| Location of Incident | Time of Crash to EMS Notification | Notification to Arrival | Arrival at Scene to Hospital Arrival | Time of Crash to Time of Hospital Arrival |

|---|---|---|---|---|

| Rural | 7.33 | 12.01 | 36.68 | 48.96 |

| Urban | 1.33 | 5.09 | 22.23 | 28.16 |

In urban areas, EMS can get to a scene of an accident and all necessary parties to a hospital in under 30 minutes. You are looking at under 50 minutes if you have an accident in a rural area.

What’s transportation like in Colorado?

Now let’s take a look at car ownership, commuting, and traffic.

All graphs are from DataUSA. Colorado is shown in orange while the United States average is shown in gray.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the percentage of car ownership?

Like most Americans, most Colorado families own two cars.

What’s the average commute time?

The average Colorado resident commutes 24 minutes to work which is close to the US average of 25.5 minutes.

– Commuter Transportation

A large majority of Colorado residents drive to work alone.

Is there a traffic congestion in Colorado?

No one likes sitting in traffic. If you have to commute to work every day, you will want to add some extra time to your driving time if you work in the below areas.

| City | Hours Spent in Traffic | Peak (Time in Traffic) | Daytime (Time in Traffic) | Overall (Time in Traffic) |

|---|---|---|---|---|

| Denver | 36 | 13% | 7% | 8% |

| Boulder | 24 | 13% | 10% | 10% |

| Greeley | 12 | 7% | 7% | 6% |

| Colorado Springs | 15 | 8% | 6% | 7% |

| Pueblo | 7 | 5% | 4% | 4% |

In 2018, traffic stats on INRIX show Denver as the 19th most congested city in the United States.

We hope this information has helped you and you are well on your way to buying the cheapest insurance. Don’t forget you can get started here by entering your zip code in our free comparison tool.

Frequently Asked Questions

What are the minimum auto insurance requirements in Colorado?

In Colorado, the minimum auto insurance requirements include liability coverage of at least $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $15,000 per accident for property damage.

Is it mandatory to have uninsured/underinsured motorist coverage in Colorado?

While uninsured/underinsured motorist coverage is not mandatory in Colorado, insurance companies are required to offer this coverage. It provides protection in case you are involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

What factors should I consider when choosing an auto insurance policy in Colorado?

When choosing an auto insurance policy in Colorado, consider factors such as coverage limits, deductibles, premiums, customer service, discounts, and the financial stability of the insurance company. It’s important to find a policy that meets your needs and fits within your budget.

How does my credit score affect my auto insurance premiums in Colorado?

In Colorado, insurance companies are allowed to consider credit scores when determining auto insurance premiums. A lower credit score may result in higher premiums, as it is often seen as an indicator of risk. It’s important to maintain a good credit score to potentially secure lower insurance rates.

Are there any discounts available to help reduce auto insurance costs in Colorado?

Yes, there are various discounts available in Colorado to help reduce auto insurance costs. These may include discounts for safe driving records, completion of defensive driving courses, bundling multiple policies with the same insurer, installing anti-theft devices in your vehicle, and maintaining good grades if you’re a student.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.