21st Century Auto Insurance Review [2026]

Discover 21st Century Auto Insurance, a Farmers Insurance subsidiary catering to California residents with rates that may surpass averages, yet providing unique coverage options like customized equipment and antique auto insurance for a tailored and diverse insurance experience.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Chris Abrams

Updated April 2024

Ultimately, whether 21st Century is the right choice for you depends on your own personal needs and preferences. The company offers a variety of coverage options to meet different types of customers’ needs.

21st Century has an excellent reputation for providing reliable service and high-quality coverage. The company also ranks high in customer satisfaction reviews, making it an excellent option for those seeking affordable car insurance with a reputable provider.

What You Should Know About 21st Century Auto Insurance

21st Century Insurance was established in 1958 and is a subsidiary of Farmers Insurance. It offers auto insurance policies only to customers in California, with most of its business done online or over the phone. This makes 21st Century an ideal choice for those who don’t need a personal agent.

The provider also allows you to pay your premium monthly, so you don’t have to make one large payment at once. Customers can take advantage of auto insurance discounts like multi-car, good student, defensive driver, and anti-theft vehicle discounts.

If you’re shopping for car insurance and are considering 21st Century Insurance, this guide will provide you with the information to make an informed buying decision.

21st Century Insurance has received excellent ratings from a variety of sources. According to the National Association of Insurance Commissioners (NAIC), their financial strength rating is 3.35 out of 5, indicating appropriate financial resources and strong operating performance.

The Better Business Bureau has rated 21st Century Insurance with an A+ for customer service, trustworthiness, and transparency.

Moreover, A.M. Best gives them an A rating, which reflects their superior ability to meet ongoing insurance obligations. S&P Global Ratings has also assigned them a stellar A+ rating attesting to their financial liquidity and ability to pay claims effectively over time.

These impressive ratings demonstrate that 21st Century Insurance is a reliable organization committed to providing quality products and services. Its financial security, customer service excellence, transparency, and trustworthiness make them desirable for a small car insurance company.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

21st Century Insurance Financial Strength

21st Century Insurance is a Farmers Insurance Group subsidiary with total assets of $17.02 billion in 2019. The insurer does not rank among the top 25 auto insurance providers, but its parent company holds 4.16% of the market share for private passenger auto insurance.

This puts Farmers in seventh place overall, with over $10.5 billion in direct premiums written during 2019–behind State Farm (which had 16.14%), Geico, Progressive, Allstate, United, and Liberty Mutual, respectively. 21st Century’s total assets for 2017 amounted to about $25.4 million dollars.

Overall, 21st Century Insurance has solid ratings, with a secure foundation provided by its parent company. However, customers may have to weigh the benefits of going through Farmers against getting lower rates from another provider. Learn how to lower your auto insurance premiums.

21st Century Auto Insurance Coverage Options

When looking for auto insurance, it’s essential to know which coverage options are available and which are mandated by law. Most states require drivers to carry liability auto insurance to operate a vehicle.

Generally, this entails bodily injury and property damage liability insurance, but some states also require personal injury protection (PIP) insurance and uninsured or underinsured motorist coverage. Consider getting full coverage insurance if you’d like more protection. This isn’t one specific policy type but combines different coverage types, such as liability, collision, and comprehensive insurance.

Read our guide to compare the difference between comprehensive and collision auto insurance, or scroll down to learn about the most common auto insurance coverages offered by 21st Century:

Bodily Injury and Property Damage Liability

Bodily injury and property damage liability coverage pay for expenses associated with an accident you cause, including medical bills and vehicle repair costs. This coverage also covers damages to another person’s property.

For example, if you’re in an accident and the other driver’s car is damaged, this policy will pay for the repairs. It can also provide legal defense if there’s a lawsuit over the incident. This form of auto insurance is generally required by law.

Uninsured and Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage is designed to protect you in the event of an accident with someone who either doesn’t have insurance or doesn’t have enough insurance.

This type of auto insurance covers expenses related to medical bills, lost wages, and vehicle repairs if a driver hits you without sufficient coverage.

It also provides legal defense for any claims or lawsuits resulting from the accident. Although this form of coverage is not required by law in all states, it is highly recommended as protection against financial loss due to an uninsured driver.

Collision Coverage

Collision auto insurance helps to protect your vehicle if you collide with a stationary object or are in an accident with another car, regardless of who is at fault. This coverage pays for repairs needed to your vehicle after a collision up to the limits of your policy.

It can also cover the cost of a rental car while yours is being repaired. In some states, this type of auto insurance may be required by law if you have taken out a loan or lease on your vehicle.

Comprehensive Coverage

Comprehensive coverage is designed to provide financial protection if your vehicle is damaged by something other than a collision.

This includes theft, vandalism, fire, floods, storms, and hail. It also covers broken glass and damage caused by animals or falling objects. Depending on your policy limits and deductibles, this type of auto insurance can be used to pay for repairs or replace stolen items.

In addition to covering repair costs for damages resulting from events outside of an accident, comprehensive coverage may also cover medical expenses for you and any passengers in the car at the time of an incident.

Additional Auto Insurance Options From 21st Century

Along with the standard coverage options, you can receive complimentary roadside assistance and filing of SR-22 forms. 21st Century also provides a range of optional car insurance options, such as:

Roadside Assistance

21st Century offers an optional roadside assistance package to help drivers in various emergencies. Roadside assistance includes towing services, flat tire repair, battery jump-start, key lockout service, fuel delivery, and more.

Customers who purchase this option also receive discounts on rental cars and hotel stays while their vehicle undergoes repairs. This service protects all kinds of personal vehicles, so you can always be sure you’re covered if something goes wrong on the road.

Antique Auto Insurance

Antique auto insurance from 21st Century is designed to protect classic and antique vehicles from the risks of everyday driving. This specialized coverage provides a range of benefits tailored specifically to vintage automobiles, including:

- Agreed value coverage: 21st Century offers agreed-value insurance on classic cars, ensuring that the policyholder will receive full payment for their vehicle if it’s stolen or totaled.

- Replacement parts coverage: If any components of an antique car are damaged or destroyed, 21st Century can provide replacement parts so that repairs can be completed quickly and affordably.

- Dedicated customer service: The company employs experienced agents who specialize in antique car insurance and are available to assist policyholders with questions and claims processing.

If you have an antique auto, compare 21st Century insurance quotes against the best classic car insurance companies to find the best provider for you.

Rental Reimbursement

Rental reimbursement is an optional add-on to car insurance policies that covers the cost of a rental car while a customer’s vehicle is being repaired after a covered incident. This coverage allows customers to maintain mobility and helps minimize disruptions caused by auto repairs.

Policyholders who select the rental reimbursement option from 21st Century are protected from having to pay out of pocket for rental cars if their own vehicle needs to be repaired due to a covered incident.

The company offers generous limits on this coverage, so insured individuals can rent vehicles without worrying about exceeding their policy limit. Additionally, 21st Century offers additional discounts on rental cars for policyholders who choose this optional coverage.

SR-22 Insurance

SR-22 auto insurance isn’t an actual policy, but many states mandate this coverage for drivers who have committed serious traffic violations or other offenses that require them to prove financial responsibility.

An SR-22 is required if you have been convicted of a DUI/DWI offense, serious moving violation, or your driver’s license has been revoked or suspended. This form proves that you maintain enough coverage to legally drive in your state.

21st Century offers SR-22 coverage that meets the California legal requirements to keep local customers on the road after a violation.

The process of obtaining an SR-22 policy from 21st Century is simple. Policyholders can easily file the necessary paperwork online, making it easier than ever to comply with legal mandates without waiting in line at the DMV.

Additionally, customers are provided with comprehensive coverage when they purchase an SR-22 policy from 21st Century, ensuring that they’re protected financially if they’re involved in an accident while their policy is in effect.

Finally, 21st Century SR-22 insurance is highly affordable and offers discounts for customers who maintain a clean driving record. By providing cost-effective solutions to individuals facing legal requirements, the company helps them remain compliant and avoid further penalties or license suspensions.

Waiver of Collision Deductible

21st Century offers a waiver of collision deductible, an optional add-on to auto insurance policies that eliminates the out-of-pocket expense associated with repairing damage caused by an accident.

This coverage allows policyholders to keep their deductibles even if they’re involved in an at-fault accident, making it easier for them to pay for repairs without breaking the bank.

It helps individuals avoid significant financial losses from accidents and any potential legal issues or other complications that might arise due to a lack of funds for repairs. Furthermore, this option is highly affordable and can be added easily when purchasing a policy.

Lastly, 21st Century works with experienced auto repair shops to ensure that customers receive the highest-quality repairs promptly. With this optional add-on, drivers can rest assured that they’re receiving maximum peace of mind during the repair process.

Customized Equipment Coverage

For drivers who have invested in extra or special equipment for their vehicles, 21st Century offers a coverage option that helps protect these investments.

Customized and additional equipment coverage from 21st Century covers items added to a vehicle that are not typically included in the manufacturer’s standard plan. These may include a custom paint job, upgraded rims, tires, audio systems, or other non-standard additions.

21st Century’s customized and additional equipment coverage ensures that policyholders can recover the cost of any damage done to these extras due to an accident or covered incident. This makes it easier for customers to keep their cars looking great without paying out of pocket for costly replacements.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

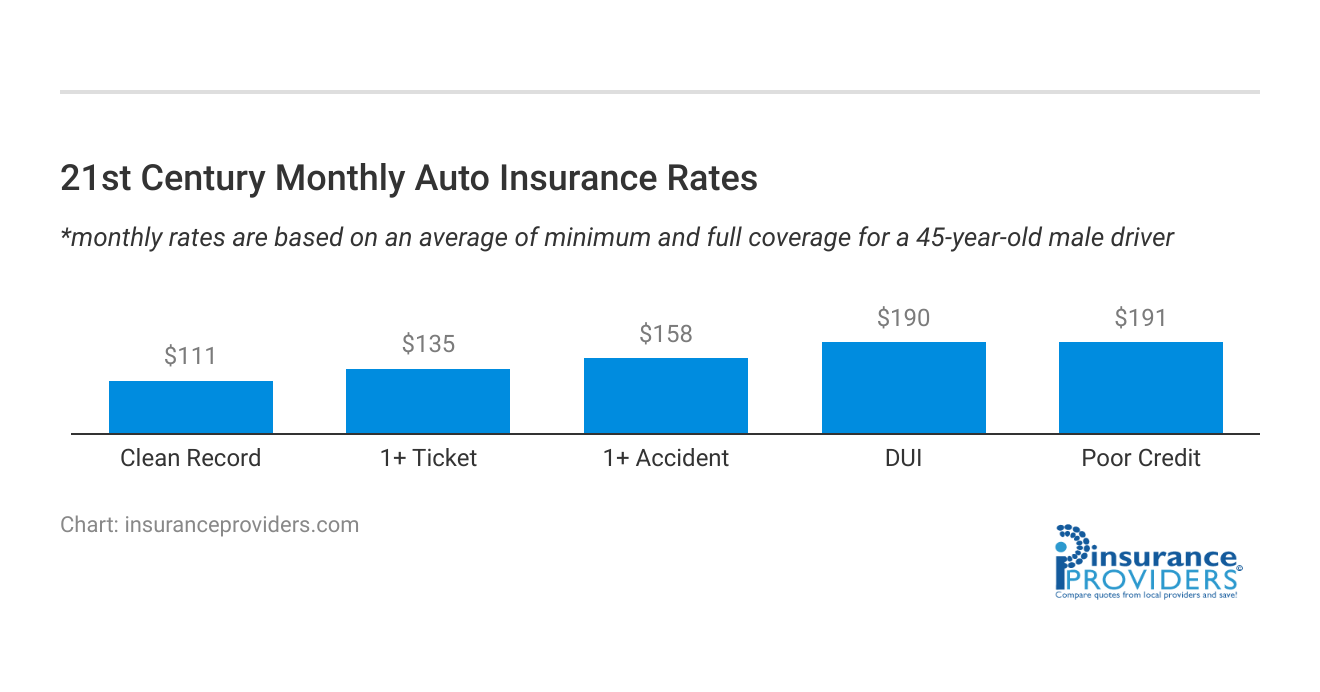

21st Century Auto Insurance Rates Breakdown

| Driver Profile | 21st Century | National Average |

|---|---|---|

| Clean Record | $111 | $119 |

| 1+ Ticket | $135 | $147 |

| 1+ Accident | $158 | $173 |

| DUI | $190 | $209 |

| Poor Credit | $191 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

According to our data, 21st Century’s auto insurance quotes are more expensive than those of other companies. However, it is important to remember that the most affordable quotes are not the only best choice.

When deciding which policy meets your needs, you should consider other factors such as financial stability and complaint ratios. 21st Century may calculate variables differently than other insurers, resulting in higher rates for certain factors like driving history, age, and location. Learn more about what affects the average cost of auto insurance.

To get an accurate estimate of your car insurance rates from 21st Century, you should obtain a personalized quote.

21st Century Auto Insurance Discounts Available

| Discount | 21st Century |

|---|---|

| Anti Theft | 8% |

| Good Student | 15% |

| Low Mileage | 16% |

| Paperless | 8% |

| Safe Driver | 15% |

| Senior Driver | 20% |

At 21st Century Auto Insurance, we believe in providing our customers with not only excellent coverage but also opportunities to save. Take advantage of our exclusive discounts to enhance your insurance experience.

- Multi-Car Discount: Insure more than one vehicle with 21st Century and enjoy additional savings on your premiums.

- Good Student Discount: Students who maintain good grades may qualify for a special discount on their auto insurance.

- Defensive Driver Discount: Complete a recognized defensive driving course, and we’ll reward your commitment to safe driving with a discount on your coverage.

- Anti-Theft Vehicle Discount: Equip your vehicle with anti-theft devices, and we’ll offer you a discount on your comprehensive coverage.

- Customized Equipment Discount: If you’ve invested in special equipment for your vehicle, such as custom paint jobs, upgraded rims, or unique audio systems, we offer a discount to help protect these investments. (For more information, read our “Will auto insurance pay for paint jobs?“).

- Rental Reimbursement Discount: Opt for rental reimbursement coverage, and not only will you have peace of mind during repairs, but you’ll also enjoy discounts on rental cars.

- SR-22 Insurance Discount: If you require SR-22 insurance, 21st Century offers affordable options with additional discounts for maintaining a clean driving record.

- Waiver of Collision Deductible: Choose the waiver of collision deductible option to eliminate out-of-pocket expenses for repairs after an at-fault accident.

- Roadside Assistance Discount: Sign up for our optional roadside assistance package and enjoy discounts on towing services, flat tire repair, battery jump-starts, and more.

- Antique Auto Insurance Discount: Safeguard your classic or antique vehicle with our specialized coverage and benefit from exclusive discounts.

Explore these discounts and tailor your auto insurance coverage to meet your specific needs while enjoying significant savings. At 21st Century, it’s not just about insurance; it’s about providing value and protection for our valued customers.

How 21st Century Auto Insurance Ranks Among Providers

21st Century Auto Insurance among other providers based on positive ratings and reviews from various sources. Here’s a summary of the information related to rankings:

- Financial Strength Ratings: A.M. Best gives 21st Century Insurance an A rating, indicating superior ability to meet ongoing insurance obligations. Also, S&P Global Ratings assigns them a stellar A+ rating, attesting to their financial liquidity and ability to pay claims effectively over time.

- Better Business Bureau (BBB) Rating: The Better Business Bureau has rated 21st Century Insurance with an A+ for customer service, trustworthiness, and transparency.

- National Association of Insurance Commissioners (NAIC): The NAIC provides a financial strength rating of 3.35 out of 5, indicating appropriate financial resources and strong operating performance.

While the provided information highlights positive ratings and financial strength, it doesn’t directly compare 21st Century Auto Insurance to other providers in terms of rankings. If you’re looking for a specific comparison with other providers, you may need to explore additional sources or reviews that explicitly compare different auto insurance companies.

Frequently Asked Questions

Who is 21st Century auto insurance suitable for?

21st Century Auto Insurance is suitable for California residents who prefer online or phone interactions and do not require a personal agent. It is an ideal choice for those looking for affordable coverage with the option to pay premiums monthly.

What coverage options does 21st Century Auto Insurance offer?

21st Century offers standard coverage options, including Bodily Injury and Property Damage Liability, Uninsured and Underinsured Motorist Coverage, Collision Coverage, and Comprehensive Coverage. Additionally, they provide optional coverages like Roadside Assistance, Antique Auto Insurance, Rental Reimbursement, Waiver of Collision Deductible, and Customized Equipment Coverage.

What are the financial strength ratings of 21st Century Auto Insurance?

21st Century Insurance has received positive ratings, including an A+ from the Better Business Bureau, an A rating from A.M. Best, and an A+ from S&P Global Ratings. These ratings reflect the company’s financial strength, trustworthiness, and ability to meet insurance obligations.

How does 21st Century Auto Insurance cater to antique car owners?

21st Century provides Antique Auto Insurance tailored to protect classic and antique vehicles. This coverage includes benefits such as agreed value coverage, spare parts coverage, and coverage for restoration and customization expenses.

What discounts are available with 21st Century Auto Insurance?

21st Century offers various discounts, including multi-car, good student, defensive driver, and anti-theft vehicle discounts. Customers can also benefit from discounts on rental cars and hotel stays with the Roadside Assistance package. Exploring these discounts allows policyholders to customize their coverage while enjoying significant savings.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.