AAA Auto Insurance Review [2026]

Embark on the legacy of AAA Auto Insurance, a century-strong commitment to driver advocacy and safer roads, where renowned roadside assistance meets competitive rates and valuable membership benefits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Updated April 2024

The American Automobile Association (AAA) was established more than a century ago with the mission of advocating for driver and passenger rights, just laws, and safer vehicles. AAA was the first to offer roadside assistance, starting in 1915. Today, it is one of the most valuable benefits of a AAA membership.

Since that time, AAA has expanded to serve over 62 million members while offering beneficial membership benefits like its signature roadside assistance. Aside from offering a range of insurance and financial products and services, AAA has expanded its horizons to include travel-related services.

The AAA of today is made up of 30 clubs located across North America to serve its members. Keep reading to learn more about AAA auto insurance rates, coverage, and membership benefits.

What You Should Know About AAA

AAA is a private company with around 45,000 employees across the U.S. through its network of clubs and agents. It provides members with high-quality protection, service, and value through its full-service insurance agency — AAA Insurance.

AAA Insurance is a selection of insurance programs, services, and products for eligible members with the AAA brand. If you buy coverage from AAA, your policy may be underwritten by the following insurers:

- Auto Club Indemnity Company

- CSAA Insurance Group

- Auto Club of Southern California

As an AAA member, if you choose not to buy AAA auto insurance, a variety of A.M. Best-rated insurance providers are available through AAA for your home, car, and other insurance needs.

Member-based, exclusive discounts are also available, along with quick, nationwide claims service. Most of AAA’s partners offer qualified members discounted rates, and an AAA insurance agent can inform you of additional discounts that may result in even greater savings. Learn how much a AAA membership costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is AAA car insurance good?

Financially, AAA is a strong company that you can count on to pay insurance claims. It receives an A+ from A.M. Best which determines financial strength and the ability to pay out claims to existing policyholders.

However, in terms of customer service and satisfaction, AAA is lacking. While it receives an A+ from the BBB via The Auto Club Group and has a 100% business response, it scores lower among other rating programs.

AAA Customer Service

AAA sells solid and reliable auto insurance. However, its lower overall customer satisfaction ratings tell the real story. AAA customer service for insurance is not the highest compared to other insurance companies.

The J.D. Power U.S. Auto Insurance Study rates insurance providers and gives a score based on a 1,000-point scale. Because AAA auto insurance is delivered to its customers regionally through different clubs, it receives several different ratings.

Find AAA customer service scores for your region below:

- Texas. AAA (Automobile Club of Southern California) received a score of 835, lower than the region’s average of 844.

- Southwest. AAA (CSAA Insurance Group) received a score of 798, far below other major insurance companies and the regional average of 827.

- North Central. AAA (Automobile Club Group) received a score of 810, below the average of 838.

- Mid-Atlantic. AAA (CSAA Insurance Group) received a score of 832, slightly below the regional average of 839.

- Florida. AAA (Automobile Club Group) received a score of 849, above the regional average of 832.

- Central. AAA (Automobile Club of Southern California) received a score of 838, a little higher than the region’s average of 835.

- California. AAA (CSAA Insurance Group) received a score of 814, while AAA (Automobile Club of Southern California) received a score of 844. The region’s average was 820, making its combined score above average.

Overall, AAA comes slightly below average when you combine their regional scores. Read more about how the AAA auto insurance experience might go with our Auto Club Insurance Review. Find out if AAA is the same as Auto Club.

AAA Complaint Level

The National Association of Insurance Commissioners (NAIC) assigns a score to insurance companies based on the level and frequency of complaints, adjusted for company size. A score of 1.0 is average, and anything higher than this indicates more complaints filed.

AAA has a very high complaint level of 3.82, considering many large insurance companies have lower-than-average scores.

AAA Claims Handling

Where you live may influence how satisfied you are with your claims based on which subsidiary insurance company underwriters your policy.

For example, Automobile Club of Southern California had higher-than-average claims satisfaction, while Automobile Club Group and CSAA Insurance Group had lower-than-average claims satisfaction.

To improve your experience when filing a claim, ensure you know all the details of your coverage between the auto insurance and roadside features. Some benefits may be limited depending on your policy and the location where you require service.

AAA Insurance Coverage Options

As one of the largest national insurers by market share, AAA provides all of the standard auto insurance coverages that the competition does, including the legally required minimums and more.

The standard insurance AAA offers includes:

- Bodily and property injury liability insurance. Covers costs for injuries, fatalities, or property damage caused by your negligence in an at-fault accident. Required by 48 states to legally drive.

- Comprehensive auto insurance. Covers damages as a result of events beyond your control, such as weather, hitting an animal while driving, theft, fire, and vandalism.

- Collision auto insurance. Covers repair costs for your vehicle after an accident or collision, regardless of who is at fault. Required when you’re financing or leasing a vehicle.

- Underinsured drivers/uninsured drivers (UM/UIM). Covers your injuries and property damage following a collision with a driver who has little or no insurance. Required in some no-fault insurance states.

- Personal injury protection insurance (PIP). Covers injuries and medical costs after an accident, including lost wages and other household costs while you recover. Often required in no-fault states.

- Medical payments coverage (MedPay). Covers injuries, doctor visits, hospital stays, surgery, X-rays, and other medical expenses after an accident.

Liability insurance is also the legal minimum required in most states and adequate for older vehicles that may not be worth investing in repairs. However, we recommend full coverage if your car is too valuable or would be hard to replace with just your savings.

To put things in perspective, carrying liability-only insurance can mean the equivalent of paying one-third of full coverage auto insurance in terms of price. Still, you have much less coverage and will have to pay out of pocket for damages to your own vehicle if you’re at fault.

Full coverage auto insurance combines liability-only, collision, and comprehensive coverage to guarantee that you’re protected no matter what happens on the road. If you live in a no-fault insurance state, full coverage will often include a combination of UM/UIM, PIP, and MedPay.

AAA Auto Insurance Extra Coverage Options

On top of the standard minimum and full coverage policies listed above, AAA offers additional options you can use to supplement your policy:

- Enhanced total loss replacement. After a collision, if your car is a total loss, AAA will pay to replace it with a brand-new vehicle.

- Gap insurance coverage. This covers the difference between what you owe on a loan or lease and the vehicle’s actual cash value in the event of a total loss.

- Enhanced exterior OEM coverage. AAA will purchase original exterior parts from the manufacturer for repairs Instead of using aftermarket components. Coverage excludes mechanical components and window glass.

- Rideshare endorsement. Extends your personal auto policy to cover yourself, your vehicle, and your passengers when you drive for a transportation network company (TNC) like Uber or Lyft. Not available in every state.

Expect your monthly rates to increase if you add any of these coverages to your policy — for example, rideshare insurance costs between 15%-20% of your annual rates.

What other benefits does AAA auto insurance offer?

AAA offers the following options, which you may qualify for depending on your specific auto insurance plan:

- Small-claim forgiveness. Available on all plans, a small claim— under $250 if you are at fault or under $750 for all other claims — won’t increase your rates.

- Claim forgiveness loyalty. Your rates won’t rise after an accident if you remain claim-free for five years.

- Claim forgiveness ultimate. A component of that Ultimate Plan that gives you an additional chance for claim forgiveness right away.

- Claim-free rewards. For going the entire policy term without filing a claim, you’ll receive cash back or a renewal credit worth 3% up to $50.

- Disappearing deductible. For each policy term you go without filing a claim, the comprehensive and collision deductibles on each vehicle are reduced by $50, up to $500.

These are just some of the extra coverages AAA Insurance offers to policyholders. AAA also sells home, renters, condo, business, boat, and life insurance where available.

It’s a good idea to remember this when considering your total insurance needs. For example, if you have an RV, it might make sense to get a AAA membership to save on auto and RV insurance. Speak with an agent to see what kind of benefits are available in your state.

Where is AAA auto insurance available?

AAA Auto insurance is available in all 50 states, but the underwriter will vary based on your region and ZIP code. For example, Auto Club Indemnity underwrites AAA policies in Texas, while Auto Club of Southern California underwrites policies in California, Kentucky, Maine, and more.

However, even if AAA is in your state, you may not have a AAA club in your city, and you will not be able to buy AAA car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AAA Auto Insurance: The Bottom Line

AAA insurance is a membership-based option connecting clients with insurance companies. AAA auto policies are underwritten by different subsidiaries depending on where you live. So, it’s important to research which company you’re working with and to compare quotes from multiple local insurers.

You must be a AAA member to buy insurance, but you’ll get numerous perks, including free roadside assistance, travel insurance, and discounts at nationwide businesses.

Unfortunately, despite competitive rates, AAA customer service is below average regarding claims satisfaction. To best understand how your experience with AAA auto insurance would be, check the specific ratings of your region or club. Then, read the customer comments to get a sense of how it handles questions and claims processing, specifically for auto accidents.

To see how AAA auto insurance compares to companies in your area, use our free comparison tool below. We’ll give you quotes from local insurers so you can find the best car insurance near you.

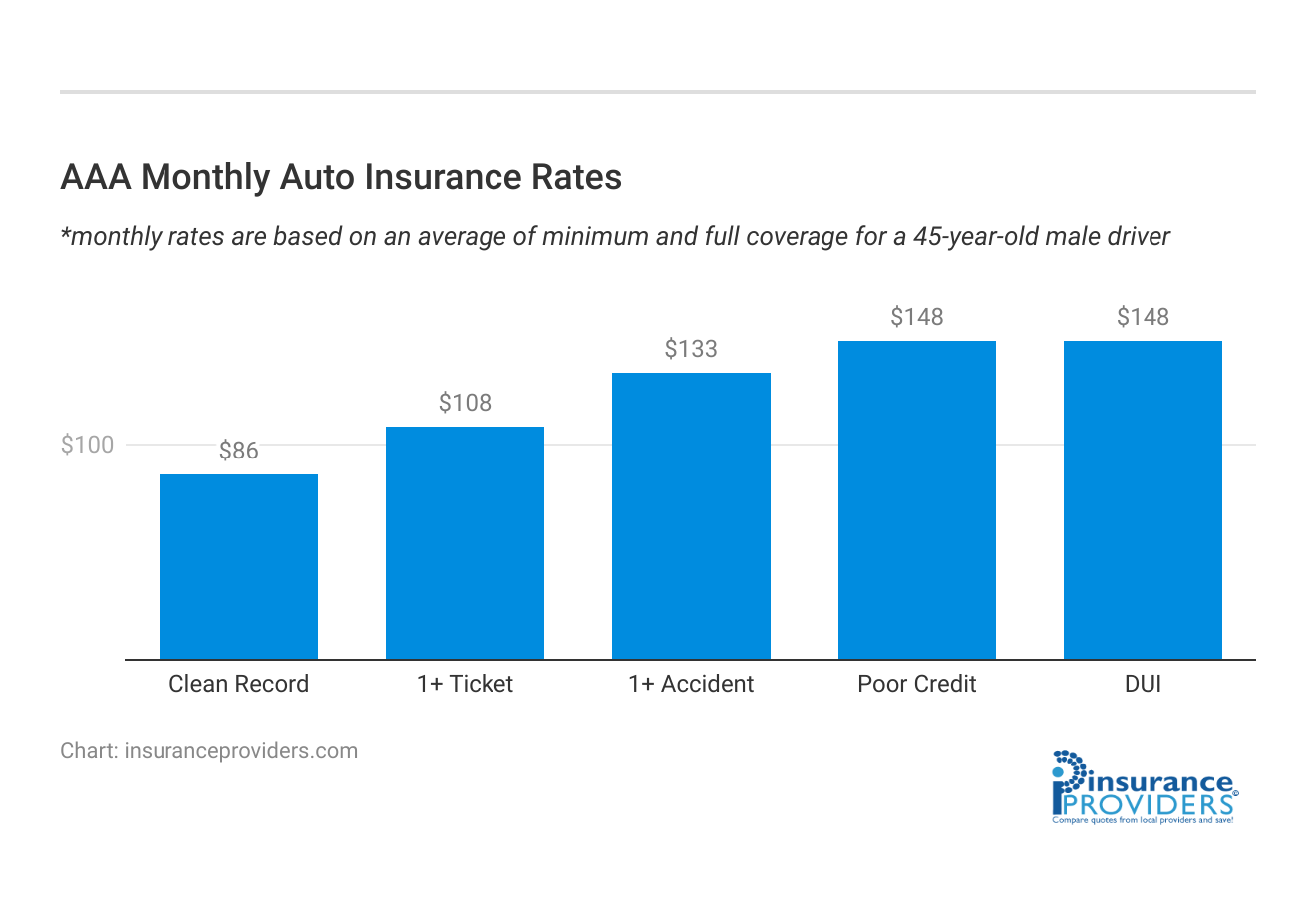

AAA Insurance Rates Breakdown

| Driver Profile | AAA | National Average |

|---|---|---|

| Clean Record | $86 | $119 |

| 1+ Ticket | $108 | $147 |

| 1+ Accident | $133 | $173 |

| DUI | $148 | $209 |

| Poor Credit | $148 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

If you want to buy auto insurance through AAA, you must become a member first.

AAA membership costs vary by where you live and the membership package you choose. Benefits increase with your membership level, which also increases your annual costs.

Compare AAA membership fees below:

- AAA Classic costs $70/year.

- AAA Plus costs $106/year.

- AAA Premier costs $131/ year.

Once you’re a member, you will purchase the actual auto insurance through one of the many regional AAA Auto Clubs. AAA car insurance underwriters and coverage options vary by state, so compare multiple quotes from companies near you to see what’s available.

It’s important to remember that online quotes only serve as generalizations and that your actual costs may vary. The best way to figure out how much it will cost you is to get a precise, personalized auto insurance quote. Learn more about where to find the best auto insurance rates.

AAA Auto Insurance Rates by State

Numerous elements frequently impact insurance costs, and AAA will use the following to determine your monthly rates:

- Age

- Driving record, including any tickets

- Personal consumer credit rating

- History of claims

- Gender

- ZIP code

- Annual mileage

- Marital status

- Type of vehicle insured

Not all states allow insurance companies to use gender or credit score when determining rates. Your state insurance laws also determine how much coverage you must carry, which will impact your rates.

Compare AAA minimum auto insurance vs. full coverage rates below.

How much is AAA minimum coverage car insurance?

A liability-only or minimum car insurance policy gives you the protection necessary to be able to drive legally, even though each state has different minimum coverage requirements.

Liability-only insurance is available from AAA at reasonable prices. To get an idea of how much the minimum auto insurance coverage recommended by AAA might cost you, see the table below:

Average Monthly Minimum Coverage Rates for the Top Auto Insurance Companies

| Insurance Company | Average Minimum Coverage Rates |

|---|---|

| Allstate | $50 |

| American Family | $48 |

| Farmers | $56 |

| Geico | $24 |

| Liberty Mutual | $64 |

| Nationwide | $49 |

| Progressive | $40 |

| State Farm | $34 |

| Travelers | $39 |

| Average | $45 |

AAA’s average minimum coverage rates are quite cheap, coming in at $38 monthly for 30-year-old drivers.

Minimum insurance is less expensive than a full coverage policy because it doesn’t cover your car or medical costs. Therefore, we advise full coverage, including collision and comprehensive, unless your car is old or has lost value.

How much is an AAA full coverage car insurance policy?

A full coverage policy that includes liability, collision, and comprehensive coverages offers the best protection for you and your vehicle overall. Full coverage insurance is more expensive than minimum coverage, but it provides more security.

AAA car insurance rates for full coverage are cheaper than average but still more expensive than some of its competitors:

Average Monthly Full Coverage Rates for the Top 10 Auto Insurance Companies

| Insurance Company | Average Full Coverage Rates |

|---|---|

| Allstate | $166 |

| American Family | $116 |

| Farmers | $140 |

| Geico | $82 |

| Liberty Mutual | $177 |

| Nationwide | $120 |

| Progressive | $109 |

| State Farm | $91 |

| Travelers | $107 |

| USAA | $63 |

| Average | $123 |

A 30-year-old driver can expect to pay around $92 monthly for a full coverage AAA auto insurance policy. State Farm monthly rates are around the same price, but Geico is the cheapest overall for full coverage.

Drivers may choose not to carry full coverage if their car is old or has a low value, and AAA provides a variety of extra insurance plans to meet the needs of almost every driver.

AAA Auto Insurance Rates by Age

The price for a AAA full coverage auto insurance policy becomes much less expensive throughout the middle-aged driver demographic, as it does with most major national insurance companies.

Teens and young drivers under 25 pay the most for car insurance, but AAA offers teen insurance rates at $200 less than the national average. If you’re a young driver or plan on adding a teen to your insurance policy, compare AAA auto insurance rates by age below.

AAA Auto Insurance Rates for Teen Drivers

Due to their lack of experience and predisposition for distracted driving, insurance companies view teen drivers as high-risk. Male teenagers pay the highest rates, but as soon as they reach their early 20s, rates begin to decline.

See the table below to see how much the top insurers typically charge teen drivers:

Average Monthly Full Coverage Teenage Auto Insurance Rates by Gender

| Insurance Company | 16-Year-Old Male With a Clean Record | 16-Year-Old Female With a Clean Record | 18-Year-Old Male with a Clean Record | 18-Year-Old Female with a Clean Record |

|---|---|---|---|---|

| Allstate | $637.83 | $608.25 | $518.58 | $448.42 |

| American Family | $480.08 | $390.17 | $390.33 | $287.67 |

| Farmers | $741.75 | $777.50 | $603.17 | $573.25 |

| Geico | $311.92 | $297.75 | $253.58 | $219.58 |

| Liberty Mutual | $778.25 | $716 | $632.75 | $527.92 |

| Nationwide | $476.17 | $410.50 | $387.17 | $302.67 |

| Progressive | $813.83 | $801.42 | $661.75 | $590.83 |

| State Farm | $349.25 | $310.83 | $284 | $229.17 |

| Travelers | $896.83 | $708.83 | $729.17 | $522.58 |

| National Average | $609.58 | $557.92 | $495.58 | $411.33 |

Teen drivers fare much better with AAA than other companies, with an average rate of around $450/month. It’s still a lot of money, so see if you can add a teen driver to an existing policy at a reduced cost.

AAA Auto Insurance Rates for Young Adult Drivers

Drivers in their early twenties continue to pay higher rates than other age groups. The good news is your rates will drop as you approach 25 if you maintain a spotless driving record and don’t report any accidents.

This table compares young adult insurance rates from AAA and other national insurers:

Average Monthly Auto Insurance Rates by Age and by Company

| Companies | 25-Year-Old Female | 25-Year-Old Male | 17-Year-Old Female | 17-Year-Old Male |

|---|---|---|---|---|

| Allstate | $219.51 | $220.97 | $678.65 | $733.87 |

| Farmers | $172.13 | $179.75 | $810.38 | $773.12 |

| Geico | $108.35 | $111.96 | $259.76 | $385.52 |

| Liberty Mutual | $279.38 | $296.29 | $544.95 | $882.56 |

| Nationwide | $170.12 | $216.52 | $304.87 | $452.46 |

| Progressive | $192.71 | $187.71 | $527.40 | $587.72 |

| State Farm | $181.32 | $192.87 | $497.40 | $641.39 |

| Travelers | $247.44 | $255.98 | $558.84 | $664.92 |

| USAA | $162.66 | $179.06 | $520.49 | $617.89 |

Young adult drivers pay about $350 per month for AAA full coverage, which is close to 50% less than Travelers auto insurance for drivers their age and 25% less than the national average.

AAA Auto Insurance Rates for Adult Drivers

Since they have extra driving experience and are involved in fewer accidents than teens and young adults, adult drivers in their 30s and 40s typically pay lower rates.

Vehicle insurance quotes are generally similar and do not differ significantly between people in their 30s to mid-50s. As a result, if you ever need to file a claim, choosing the right auto insurance company for lifetime needs depends heavily on customer service and claims satisfaction.

AAA Auto Insurance Rates for Senior Drivers

Insurance providers view motorists in their 60s as higher risk due to age-related issues like slower reflexes, vision loss, or other health issues. Due to these issues, they are more likely to have a collision, which increases the cost of their auto insurance by necessitating a payout to their insurance company.

Use this table to compare senior auto insurance rates across companies:

Average Monthly Full Coverage Senior Auto Insurance Rates by Gender

| Insurance Company | 60-Year-Old Male With a Clean Record | 60-Year-Old Female With a Clean Record | 65-Year-Old Male With a Clean Record | 65-Year-Old Female With a Clean Record |

|---|---|---|---|---|

| Allstate | $153.92 | $149.75 | $156.50 | $158.33 |

| American Family | $99.17 | $97.92 | $107.58 | $106.33 |

| Farmers | $122.83 | $115.25 | $130.08 | $130.67 |

| Geico | $74.33 | $72.67 | $78.42 | $78.17 |

| Liberty Mutual | $157.50 | $146.50 | $168.50 | $165.92 |

| Nationwide | $104.42 | $99.08 | $112.25 | $110.58 |

| Progressive | $95.25 | $92.08 | $102.83 | $109.33 |

| State Farm | $76 | $76 | $84.17 | $84.17 |

| Travelers | $88.75 | $87.67 | $95.42 | $94.17 |

| National Average | $108 | $104.08 | $115.08 | $115.25 |

Senior drivers insured with AAA auto can anticipate paying about $84 monthly for full coverage car insurance and $32 for liability-only. These rates will rise as drivers enter their 70s and 80s.

Senior Defensive Driving Discount is, however, available to senior drivers. RoadWise from AAA is senior defensive driving program that improves driving habits by helping seniors adapt to the age-related physical changes that impact their driving.

The driver improvement courses provided by AAA can be taken in person, online, or both ways.

AAA Auto Insurance Rates by Driver History

Along with your age and ZIP code, driver history will have the biggest impact on your rates. Insurance companies use your driving record to assess your level of risk, as high-risk drivers are more likely to file claims.

Things like speeding tickets, auto accidents, DUI/DWI charges, and other moving violations will increase your risk as a driver. Fortunately, AAA offers affordable auto insurance for high-risk drivers, especially those with DUIs.

Compare AAA car insurance rates by driving history below to see how much your rates go up after a speeding ticket, accident, or DUI.

AAA Auto Insurance Rates After a Speeding Ticket

Receiving a moving violation shows insurance companies that you drive dangerously, so your auto insurance rates will increase. Because your insurance company verifies your driving history at each policy renewal, you’ll recognize higher rates if you renew with a traffic violation, especially speeding or reckless driving.

But this is another area where AAA shines. Drivers with AAA may pay around 25% more monthly than a driver with a clean record, yet 40% less than the national average for a driver with a ticket.

See how AAA compares to other insurance companies after a speeding ticket:

Average Monthly Auto Insurance Rates with One Speeding Ticket

| Company | Average Rates with Clean Record | Average Rates with 1 Speeding Violation |

|---|---|---|

| Allstate | $318.33 | $373.63 |

| American Family | $224.47 | $252.15 |

| Farmers | $288.38 | $339.92 |

| Geico | $178.83 | $220.45 |

| Liberty Mutual | $397.86 | $475.11 |

| Nationwide | $228.85 | $259.47 |

| Progressive | $282.76 | $333.52 |

| State Farm | $235.10 | $265.50 |

| Travelers | $287.31 | $355.07 |

| USAA | $161.14 | $182.77 |

Only Geico and State Farm offer lower auto insurance rates after a ticket than AAA.

AAA Auto Insurance Rates After an Auto Accident

AAA drivers can expect to pay about 20% less than the national average after an accident, though rates will almost certainly increase.

This table shows how much rates increase after an auto accident compared to a clean record:

Average Monthly Auto Insurance Rates for Drivers with One Accident

| Company | Average Rates with Clean Record | Average Rates with 1 Accident |

|---|---|---|

| Allstate | $318.33 | $415.64 |

| American Family | $224.47 | $310.23 |

| Farmers | $288.38 | $376.56 |

| Geico | $178.83 | $266.06 |

| Liberty Mutual | $397.86 | $517.07 |

| Nationwide | $228.85 | $283.08 |

| Progressive | $282.76 | $398.09 |

| State Farm | $235.10 | $283 |

| Travelers | $287.31 | $357.48 |

| USAA | $161.14 | $209.69 |

AAA policyholders pay around $50 more per month after an accident. Geico, State Farm, Nationwide, and Travelers tend to offer lower prices to this demographic, but AAA is still competitive.

AAA Auto Insurance Rates After a DUI

Because insurance companies take DUI offenses seriously, you can anticipate paying much higher auto insurance rates if you renew with a DUI on your record.

Compare AAA car insurance rates after a DUI to other top companies:

Average Monthly Auto Insurance Rates with One DUI

| Company | Average Monthly Rates with Clean Record | Average Monthly Rates with 1 DUI |

|---|---|---|

| Allstate | $318.33 | $521.73 |

| American Family | $224.47 | $360.85 |

| Farmers | $288.38 | $393.23 |

| Geico | $178.83 | $406.32 |

| Liberty Mutual | $397.86 | $634.46 |

| Nationwide | $228.85 | $378.60 |

| Progressive | $282.76 | $330.80 |

| State Farm | $235.10 | $303.07 |

| Travelers | $287.31 | $478.45 |

| USAA | $161.14 | $292.17 |

A 45-year-old with a DUI can expect to pay around $150/month, or almost 20% less than the national average for minimum liability auto coverage.

As an alternative, State Farm DUI rates are $112, almost 50% cheaper than the U.S. average. Progressive also offers cheaper rates at $140.

However, AAA is cheaper than Geico, Nationwide, and most other top insurers in the country and is consistently one of the least expensive options for DUI auto insurance.

AAA Discounts Available

| Discount | AAA Auto Insurance |

|---|---|

| Anti Theft | 12% |

| Good Student | 18% |

| Low Mileage | 8% |

| Paperless | 6% |

| Safe Driver | 22% |

| Senior Driver | 11% |

Membership benefits and auto insurance discounts are the biggest perks of being an AAA member.

AAA offers policyholders the following participatory, household/driver, and vehicle discounts. Eligibility and availability will vary by state.

AAA Participatory Discounts

Participation discounts are based on your lifestyle as a driver and how you choose to buy car insurance, whether it’s online or through an agent.

These are the participatory discounts you might be eligible for from AAA:

- AAA membership discounts. This discount honors your loyalty to AAA by rewarding you for your length of membership.

- Paperless. Save money by receiving your documents electronically (a condition of the AAA Essential plan).

- Advanced purchase policy. When you buy your policy a predetermined number of days before coverage starts, you can be eligible for a discount.

- Pay in full, upfront. Pay the entire premium within seven days of the policy’s start date to receive a discount.

- Auto-pay electronic funds transfer discount. Enroll in an automatic payment (EFT) plan when starting a new policy or renewing an existing one.

- AAA safety inspection. This discount is given to authorized automobiles that have successfully passed a AAA Safety Inspection.

- Defensive driver. Receive a discount on your insurance premium when you successfully complete an approved defensive driving course.

- Good student. Students who maintain a B (3.0 GPA) or better grade point average earn a discount.

- Student away from home. Students living at least 100 miles away from home without a vehicle earn a discount.

- Teen driver training. Teens can save between 4%-5% on auto insurance by taking a AAA-approved driver training course.

- Occupation discount. Based on your attained education and occupation.

AAA also offers a usage-based insurance (UBI) program — AAADrive — that uses telematics to track your driving habits with your smartphone and improve your driving skills. Safe drivers receive a discount at their policy renewal.

Usage-based insurance isn’t available in every state, and AAA requires drivers to track at least 1,000 miles annually or a total of 25 trips to earn the AAADrive discount. Compare AAA to other auto insurance companies for people who don’t drive often to see if UBI works for you.

AAA Household and Driver Discounts

These discounts are based on your policy, including the number of drivers and vehicles you insure:

- Multi-vehicle. Save when you insure more than one vehicle with AAA.

- New young motorist. Earn a discount when you add a driver under 20 to an existing policy.

- Continuity discount. AAA rewards a discount to drivers when they switch to AAA and have no lapse in coverage while insured with their prior carrier.

- Multi-product (bundle discount). Buy home, condo, renters, or life insurance from AAA to bundle with your auto insurance policy.

AAA Vehicle Discounts

AAA also offers insurance discounts unique to the kind of vehicle you insure.

Consider the type of car you have to the discounts you can earn below:

- Vehicle safety. Autos with specific factory-installed safety features earn an additional discount.

- Anti-theft discount. Install GPS trackers or other anti-theft devices to get this discount.

- New vehicle. Customers are rewarded with a lower new vehicle premium.

Although AAA offers some of the lowest rates, the company also offers many discounts to give policyholders even more chances to save money on car insurance.

Your policy, vehicle, and personal traits are just a few variables that affect your discount eligibility. To learn about the discounts you qualify for, speak with a sales representative from AAA Insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How else can you save on AAA auto insurance rates?

Even though AAA currently offers rates that are lower than the industry average, there are other ways to lower your insurance costs, and there are ways for policyholders to get additional discounts to help their bottom line.

Even though many things like your age or the state you live in are outside of your control, there are still some general factors you can control to lower your auto insurance rates:

- Raise the deductible. The higher your deductible, which is the amount you must pay out of pocket before insurance coverage kicks in, the cheaper your car insurance will be. However, don’t increase it to more than you can afford to pay out of pocket.

- Get a car with lower insurance and driving costs. Consider purchasing a low-value or easily repairable vehicle if you want to save money on your AAA auto insurance because insurers typically charge less for these types of vehicles.

- Practice safe driving habits. Your auto insurance provider will pay attention if you drive defensively, don’t get into accidents, and don’t get any tickets and reward you with lower rates.

- Drop unnecessary coverage. If your older car has depreciated to the point where you no longer require collision and comprehensive insurance, you may choose to carry liability-only insurance.

- Compare insurance quotes online. Your chance of saving money is always increased by comparison shopping. List all the major auto insurance companies discounts, then use that information to your advantage when you call an agent.

Make sure any insurance agent or company representative knows you’re shopping around for coverage. This can encourage them to offer you a better deal, as you might become a lifelong customer.

Frequently Asked Questions

Is AAA auto insurance available in all 50 states?

Yes, AAA auto insurance is available in all 50 states. However, the underwriter may vary based on your region and ZIP code. It’s important to research which company underwrites AAA policies in your area and compare quotes from multiple local insurers.

What does AAA auto insurance cover?

AAA provides standard auto insurance coverages, including liability insurance, which is the legal minimum required in most states. Additionally, AAA offers full coverage, combining liability, collision, and comprehensive coverage

How does AAA customer service and satisfaction compare to other insurance companies?

While AAA is financially strong and receives an A+ from A.M. Best, its customer service ratings are slightly below average. According to the J.D. Power U.S. Auto Insurance Study, AAA comes slightly below average when regional scores are combined.

What discounts does AAA offer on auto insurance?

AAA provides various discounts for its auto insurance policyholders. These include participatory discounts based on lifestyle and how you choose to buy insurance, household and driver discounts, and vehicle discounts.

How does AAA auto insurance rates vary by age and driving history?

AAA auto insurance rates vary based on factors such as age and driving history. Generally, rates become less expensive for middle-aged drivers, with teens and young adults paying higher premiums. Rates may also be impacted by factors like speeding tickets, accidents, or DUI offenses.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.