AAA Texas County Mutual Insurance Company: Customer Ratings & Reviews [2026]

Explore AAA Texas County Mutual Insurance Company, a County Mutual Association founded in 1949, committed to providing transparent and impartial information to help you make informed choices about your coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Updated April 2024

AAA Texas County Mutual Insurance Company was founded in 1949, emphasizing its commitment to transparency and informed decision-making. It outlines the comprehensive insurance types offered, including auto, homeowners, renters, motorcycle, and RV insurance, along with additional offerings like discounts for various circumstances.

Customer reviews highlight positive experiences, praising the company’s exceptional customer service and competitive rates. While minor concerns such as claims processing time and limited online account features are acknowledged, the overall conclusion recommends AAA Texas County Mutual Insurance Company as a reliable choice for those seeking trustworthy and diverse insurance coverage.

What You Should Know About AAA

In the vast landscape of insurance providers, AAA Texas County Mutual Insurance Company stands as a beacon of reliability, offering coverage solutions to individuals seeking protection for their vehicles.

Established in 1949, this County Mutual Association has been dedicated to providing transparent and impartial information, aiding individuals in making informed decisions about their insurance coverage. This article delves into an exploration of AAA Texas County Mutual Insurance Company, shedding light on its offerings, customer ratings, and expert opinions.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AAA Insurance Coverage Options

When it comes to insurance coverage, AAA Texas County Mutual Insurance Company understands the diverse needs of its policyholders. The company provides a range of coverage options across different insurance types, ensuring comprehensive protection for various aspects of life.

Auto Insurance Coverage

- Comprehensive Coverage: Comprehensive coverage protects against non-collision incidents, such as theft, vandalism, or natural disasters.

- Collision Coverage: Collision coverage covers damage to your vehicle resulting from collisions with other vehicles or objects.

- Liability Coverage: Liability coverage provides financial protection if you’re responsible for an accident, covering the costs of bodily injury and property damage.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when the at-fault party in an accident lacks sufficient insurance, ensuring you’re still covered.

- Personal Injury Protection: Personal Injury Protection takes care of medical expenses for you and your passengers, regardless of fault.

Read more: Top Texas Auto Insurance Providers

Homeowners Insurance Coverage

- Dwelling Coverage: Dwelling coverage protects the structure of your home, including the walls, roof, and attached structures.

- Personal Property Coverage: Personal Property Coverage ensures that your belongings inside your home are protected against covered perils.

- Liability Coverage: Liability coverage provides financial protection in case of accidents on your property, covering legal and medical costs.

- Additional Living Expenses Coverage: This coverage assists with temporary housing costs if you need to live elsewhere due to a covered event.

- Medical Payments Coverage: Medical Payments Coverage takes care of medical expenses for guests injured on your property.

Renters Insurance Coverage

- Personal Property Coverage: Protects your personal belongings inside your rented space against damage or theft.

- Liability Coverage: Liability coverage provides financial protection if you’re held responsible for damaging someone else’s property or causing injury.

- Additional Living Expenses Coverage: This coverage assists if you need temporary housing due to a covered event, providing peace of mind for renters.

Motorcycle Insurance Coverage

- Comprehensive Coverage: Comprehensive coverage protects against non-collision incidents, offering a broad spectrum of protection.

- Collision Coverage: Collision coverage steps in for accidents with other vehicles or objects.

- Liability Coverage: Liability coverage provides financial protection if you’re responsible for a motorcycle accident.

- Uninsured/Underinsured Motorist Coverage: Ensures coverage when involved with an insufficiently insured party.

- Personal Injury Protection: Takes care of medical expenses in case of injuries sustained in a motorcycle accident.

RV Insurance Coverage

- Comprehensive Coverage: Comprehensive coverage protects against non-collision incidents like fire, theft, or natural disasters.

- Collision Coverage: Collision coverage covers damage caused by collisions while driving your RV.

- Liability Coverage: Provides financial protection if you’re at fault in an accident involving your RV.

- Uninsured/Underinsured Motorist Coverage: Ensures coverage when the other party lacks sufficient insurance.

- Personal Injury Protection: Takes care of medical expenses for you and your passengers during RV journeys.

With a commitment to meeting the varied needs of its policyholders, AAA Texas County Mutual Insurance Company offers a comprehensive array of coverage options, providing peace of mind and financial security in every aspect of life.

Read more: How much is a AAA membership?

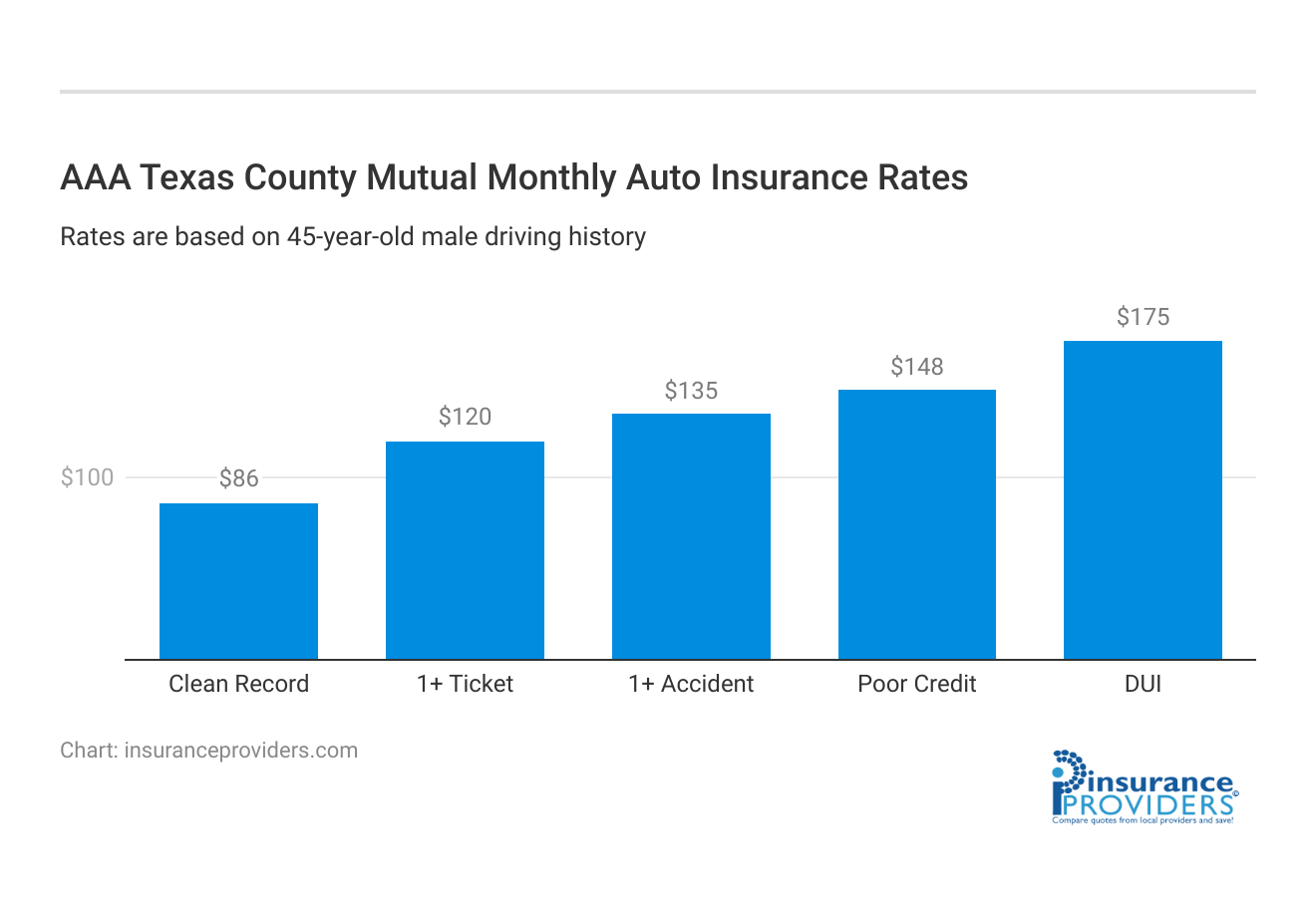

AAA Insurance Rates Breakdown

| Driver Profile | AAA | National Average |

|---|---|---|

| Clean Record | $86 | $119 |

| 1+ Ticket | $120 | $147 |

| 1+ Accident | $135 | $173 |

| DUI | $175 | $209 |

| Poor Credit | $148 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

AAA Discounts Available

Compare RatesStart Now →

"}” data-sheets-userformat=”{"2":4737,"3":{"1":0},"10":2,"12":0,"15":"Arial"}”>

| Discount | AAA Texas County Mutual |

|---|---|

| Anti Theft | 14% |

| Good Student | 20% |

| Low Mileage | 10% |

| Paperless | 7% |

| Safe Driver | 25% |

| Senior Driver | 13% |

AAA Texas County Mutual Insurance Company understands the importance of making insurance coverage not only comprehensive but also affordable. To enhance the value for its policyholders, the company offers a range of discounts tailored to various circumstances. Here’s a glimpse of the discounts available:

- AAA Discounts: Policyholders may benefit from various discounts offered by AAA, such as multi-policy discounts, safe driver discounts, and loyalty discounts.

- Good Driver Discounts: AAA Texas County Mutual Insurance Company offers incentives for policyholders with a clean driving record, encouraging and rewarding safe driving habits.

- Claims-Free Discounts: Policyholders who maintain a claims-free history may be eligible for discounts, promoting responsible and cautious driving.

- Multi-Policy Discounts: Combining multiple insurance policies under AAA Texas County Mutual Insurance Company may lead to significant cost savings, making it financially advantageous for customers.

- Safety Features Discounts: Installing safety features in your vehicle can earn you additional discounts, showcasing the company’s commitment to promoting safer driving practices.

- Educational Discounts: Students with good academic records may qualify for discounts, offering financial relief to families with young drivers.

- Home Security Discounts: Homeowners implementing security measures may be eligible for additional discounts on their homeowners or renters insurance policies.

These discounts reflect AAA Texas County Mutual Insurance Company’s dedication to providing not just quality coverage but also ensuring that policyholders can enjoy cost savings and added value.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How AAA Ranks Among Providers

AAA Texas County Mutual Insurance Company ranks among other providers refer to recent industry reports, customer reviews, and ratings from reputable sources such as:

- A.M. Best: A.M. Best provides credit ratings and financial data for insurance companies, offering insights into their financial strength and stability.

- J.D. Power: J.D. Power conducts customer satisfaction surveys, which can provide valuable insights into the experiences of policyholders with various insurance companies.

- Consumer Reports: Consumer Reports evaluates insurance providers based on customer satisfaction, claims satisfaction, and other factors.

- Insurance Review Websites: Websites like Insure.com, NerdWallet, and The Zebra often provide rankings and reviews based on customer feedback and expert evaluations.

- State Insurance Departments: Your state’s insurance department may offer information on customer complaints and regulatory actions against insurance companies.

When assessing rankings, it’s important to consider the specific factors that matter most to you, such as customer service, claims processing, coverage options, and pricing.

Customer Review

AAA Texas County Mutual Insurance Company has been a reliable insurance provider for my home and auto needs. The positive aspects, including diverse coverage options, competitive pricing, and responsive customer service, outweigh any minor concerns.

Policyholder recommend AAA Texas County Mutual to individuals seeking a trustworthy insurance partner, understanding that experiences may vary based on individual needs and circumstances.

Frequently Asked Questions

How can I compare quotes from multiple insurance providers?

To compare quotes from many different insurance providers, enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances you have to save on your coverage.

Can I trust the reviews and ratings provided for AAA Texas County Mutual Insurance Company?

Yes, their goal is to be an objective, third-party resource for everything auto insurance related.

What factors should I consider when evaluating AAA Texas County Mutual Insurance Company’s rates?

When evaluating rates, consider factors such as the average monthly rate for good drivers, A.M. Best rating, and complaint levels. These factors can help you assess the pros and cons of AAA Texas County Mutual Insurance.

How do I access the AAA Insurance Rates Breakdown?

The AAA Insurance Rates Breakdown, including monthly rates for different coverage types and discounts available, can be found on our website. It provides a detailed overview of the costs associated with AAA insurance coverage.