Accident Fund National Insurance Company Review (2026)

Accident Fund National Insurance Company stands as a dependable choice, offering personalized coverage for individuals and businesses, coupled with competitive rates and a commitment to customer satisfaction.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Accident Fund National Insurance Company stands as a trusted name in the insurance arena, offering a diverse array of coverage options to protect individuals and businesses alike. From workers’ compensation insurance ensuring employee well-being to commercial auto and general liability coverage shielding businesses from legal liabilities, Accident Fund covers it all.

Their customer-centric approach, commitment to personalized assistance, and innovative use of technology set them apart. With competitive rates, a low complaint level, and a range of discounts, Accident Fund makes insurance accessible and tailored to individual needs.

In a competitive landscape with renowned competitors, Accident Fund’s expertise, comprehensive policies, and emphasis on client satisfaction make them a stalwart partner in safeguarding futures.

Accident Fund National Insurance Company Insurance Coverage Options

Accident Fund National Insurance Company offers a comprehensive range of coverage options designed to address various insurance needs. Here are the coverage options they provide:

- Workers’ Compensation Insurance: Ensures financial protection for employees in case of work-related injuries or illnesses, covering medical expenses, rehabilitation, and lost wages.

- Commercial Auto Insurance: Protects businesses that rely on vehicles for their operations by providing coverage for accidents, damages, theft, and liability arising from the use of company vehicles.

- General Liability Insurance: Safeguards businesses from legal claims related to bodily injury, property damage, and advertising errors. This coverage is crucial for businesses interacting with the public.

- Business Income Insurance: Provides a safety net for businesses experiencing interruptions due to covered events. It helps cover ongoing expenses and ensures a consistent income stream during downtime.

These coverage options ensure that businesses and individuals alike have access to tailored protection, allowing them to navigate potential risks with confidence.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

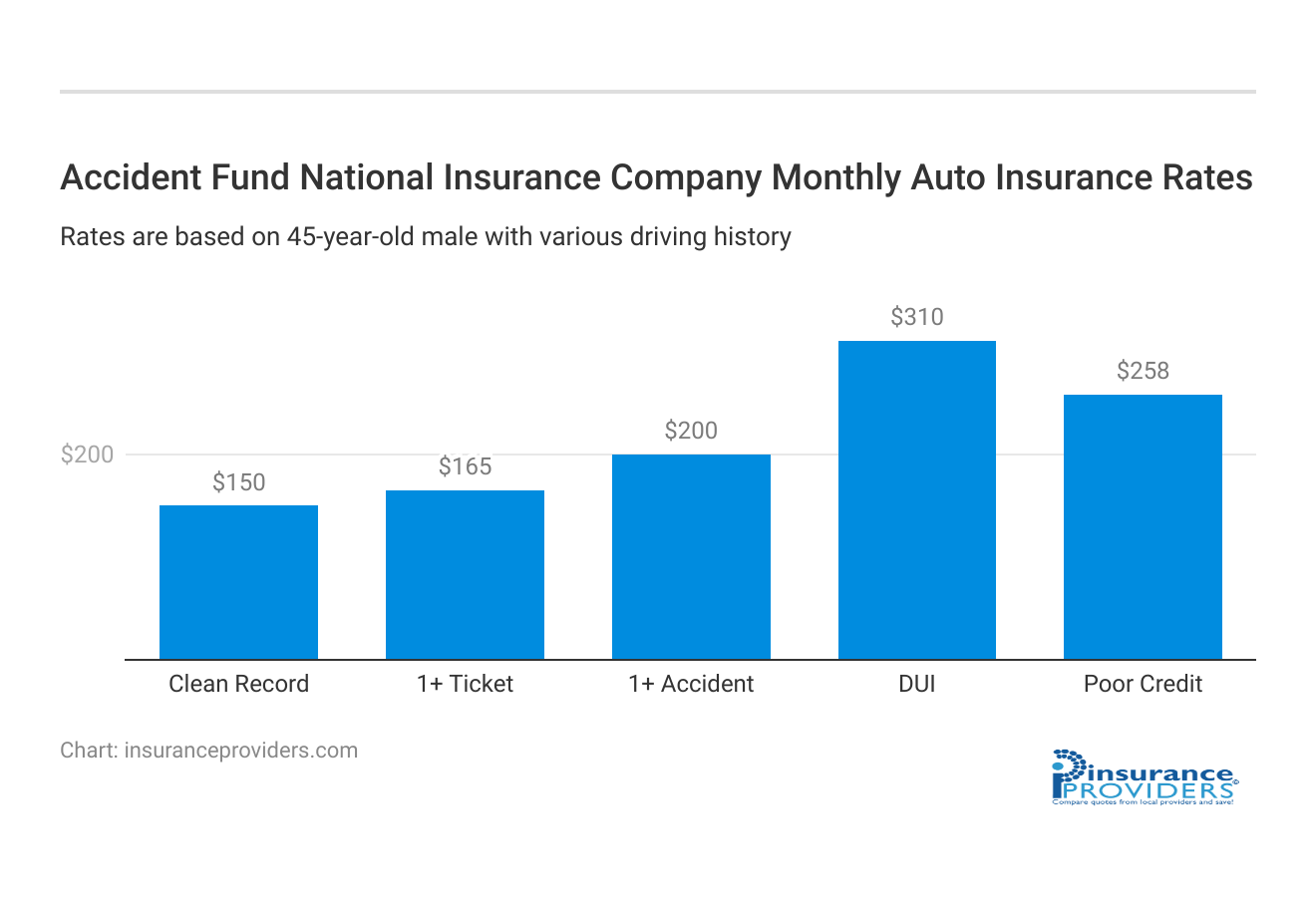

Accident Fund National Insurance Company Insurance Rates Breakdown

| Driver Profile | Accident Fund National Insurance Company | National Average |

|---|---|---|

| Clean Record | $150 | $119 |

| 1+ Ticket | $165 | $147 |

| 1+ Accident | $200 | $173 |

| DUI | $310 | $209 |

| Poor Credit | $258 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Accident Fund National Insurance Company Discounts Available

| Discount | Accident Fund National Insurance Company |

|---|---|

| Anti Theft | 8% |

| Good Student | 22% |

| Low Mileage | 18% |

| Paperless | 10% |

| Safe Driver | 20% |

| Senior Driver | 10% |

Accident Fund National Insurance Company offers a range of discounts that can help clients save on their insurance premiums. These discounts are designed to reward safe behavior, responsible practices, and certain affiliations. Here are the discounts provided by the company:

- Safe Driver Discount: Rewards policyholders with a clean driving record and a history of safe driving habits.

- Multi-Policy Discount: Provides savings to clients who bundle multiple insurance policies, such as auto and home insurance, with Accident Fund.

- Safety Features Discount: Offers discounts for vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and anti-theft systems.

- Group Affiliation Discount: Extends discounts to members of specific organizations, affiliations, or employee groups that have a partnership with Accident Fund.

- Paid-in-Full Discount: Grants a discount to clients who choose to pay their annual premium upfront in a single payment.

- Loyalty Discount: Rewards long-term clients who have maintained their policies with Accident Fund over time.

These discounts can help clients reduce their insurance costs while still enjoying comprehensive coverage and peace of mind.

Read more: Accident Fund Insurance Company of America Review

How Accident Fund National Insurance Company Ranks Among Providers

While each competitor has its own strengths and focus areas, understanding the competitive landscape can help clients make informed decisions. Here are some of Accident Fund’s main competitors:

- Travelers: Travelers is a well-established insurance company offering a wide range of insurance products, including auto, home, and business insurance. They are known for their strong financial stability and a variety of coverage options.

- The Hartford: The Hartford is a respected name in the insurance industry, providing specialized coverage for businesses, individuals, and groups. They are recognized for their comprehensive business insurance solutions.

- Liberty Mutual: Liberty Mutual offers a diverse portfolio of insurance products, including auto, home, and commercial insurance. They are known for their customer-centric approach and customizable coverage options.

- Nationwide: Nationwide is a prominent insurance provider known for its extensive network and variety of insurance solutions. They offer personal and business insurance, along with unique coverage options like pet insurance.

- Progressive: Progressive is recognized for its innovative approach to auto insurance, offering tools like usage-based insurance and online quote comparisons. They focus on providing a seamless digital experience for customers.

- State Farm: State Farm is one of the largest insurers in the United States, offering a wide range of insurance products and financial services. They are known for their personalized customer service and local agent network.

- Allstate: Allstate provides a variety of insurance options, including auto, home, and life insurance. They emphasize features like accident forgiveness and customizable coverage bundles.

- AIG: AIG is a global insurance company offering a broad spectrum of insurance solutions, including property, casualty, and specialty lines. They cater to both individual and corporate clients.

These competitors, along with others in the industry, contribute to a dynamic and competitive insurance market. Each company brings its own strengths and offerings to the table, making it essential for customers to evaluate their options carefully based on their specific needs and priorities.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Accident Fund National Insurance Company Claims Process

Ease of Filing a Claim

Accident Fund National Insurance Company offers multiple convenient channels for filing insurance claims, ensuring flexibility for policyholders. You can file a claim through their user-friendly online portal, over the phone with their dedicated customer support team, or even through their mobile app.

This accessibility makes it easy for policyholders to initiate the claims process in a way that suits their preferences and needs.

Average Claim Processing Time

Timely claim processing is crucial for policyholders, and Accident Fund National Insurance Company understands this. They have a reputation for efficient claim processing, striving to settle claims promptly. While specific processing times may vary depending on the nature of the claim, customers generally experience relatively quick turnarounds, providing peace of mind during stressful situations.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance, especially when it comes to claim resolutions and payouts. Accident Fund National Insurance Company has garnered positive feedback from its policyholders for their fair and transparent claim resolutions.

Customers appreciate the company’s commitment to addressing their needs promptly and fairly, making it a reliable choice for insurance coverage.

Accident Fund National Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Accident Fund National Insurance Company offers a feature-rich mobile app that enhances the overall insurance experience. The app provides policyholders with convenient access to their policies, allowing them to view coverage details, make payments, and even initiate the claims process right from their smartphones.

Additionally, the app offers useful tools like digital ID cards and accident guides, making it a valuable resource for policyholders on the go.

Online Account Management Capabilities

Managing your insurance policy has never been easier thanks to Accident Fund’s robust online account management capabilities. Policyholders can log in to their accounts through the company’s website to access and update their policy information, track claims, and view billing statements.

This online portal simplifies the administrative aspects of insurance, giving customers more control and flexibility.

Digital Tools and Resources

Accident Fund National Insurance Company provides a range of digital tools and resources to support their policyholders. These resources include informative articles, educational materials, and calculators to help customers make informed insurance decisions.

Additionally, the company’s website offers a user-friendly interface that makes it easy to navigate and find relevant information, ensuring that policyholders have access to the resources they need to understand and manage their insurance coverage effectively.

Frequently Asked Questions

Does Accident Fund National Insurance Company solely cater to businesses or also offer insurance solutions for individuals?

Accident Fund provides insurance solutions for both businesses and individuals, offering coverage such as workers’ compensation, auto, and liability insurance.

What sets Accident Fund apart from its competitors in the insurance landscape?

Accident Fund stands out due to its tailored coverage options, expert support, and embrace of technology for streamlined processes, distinguishing itself within the insurance market.

Are there opportunities to save on insurance premiums with Accident Fund?

Yes, Accident Fund provides various discounts, including safe driver, multi-policy, and safety features discounts, allowing clients to reduce their premiums while maintaining comprehensive coverage.

Can Accident Fund assist businesses during interruptions or disruptions?

Absolutely, Accident Fund offers Business Income Insurance, which provides coverage for interruptions due to covered events, ensuring continuous income for businesses facing downtime.

How efficient is Accident Fund in handling insurance claims?

Accident Fund excels in claims processing, offering a seamless process and timely assistance to ensure clients receive the necessary support when filing claims.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.