Accredited Surety and Casualty Company, Inc. Review (2026)

Accredited Surety and Casualty Company, Inc. excels in providing diverse insurance coverage options tailored to various needs, backed by a strong A.M. Best rating and a commitment to customer satisfaction.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Accredited Surety and Casualty Company, Inc. shines as a trusted partner, offering a diverse array of coverage options tailored to various needs. With an excellent A.M. Best rating, this company stands as a beacon of reliability, safeguarding homes, vehicles, businesses, and loved ones from life’s uncertainties.

Their offerings cater comprehensively to individual and business requirements. With competitive rates and a commitment to customer satisfaction, Accredited Surety and Casualty Company, Inc. is not only a financial safeguard but also a source of peace of mind in a world of uncertainties.

Accredited Surety and Casualty Company, Inc. Insurance Coverage Options

Accredited Surety and Casualty Company, Inc. provides a diverse range of coverage options designed to meet the unique needs of individuals, families, and businesses. Whether you’re looking to protect your home, vehicle, business, or loved ones, the company offers comprehensive solutions:

- Home Insurance: Tailored policies to safeguard your property, belongings, and liabilities against unexpected events such as theft, fire, and natural disasters.

- Auto Insurance: Comprehensive coverage for your vehicles, including protection against accidents, collisions, theft, and liability issues.

- Business Insurance: Specialized policies that address the challenges businesses face, offering protection for property, liability, and other business-related risks.

- Life Insurance: Various life insurance policies designed to provide financial security and support to your loved ones in times of need.

- Legal Protection: Surety bonds and legal liability coverage to streamline legal processes and ease the complexities of the legal system.

With a commitment to tailoring coverage to individual needs, Accredited Surety and Casualty Company, Inc. ensures that you have the protection you need in every aspect of life.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

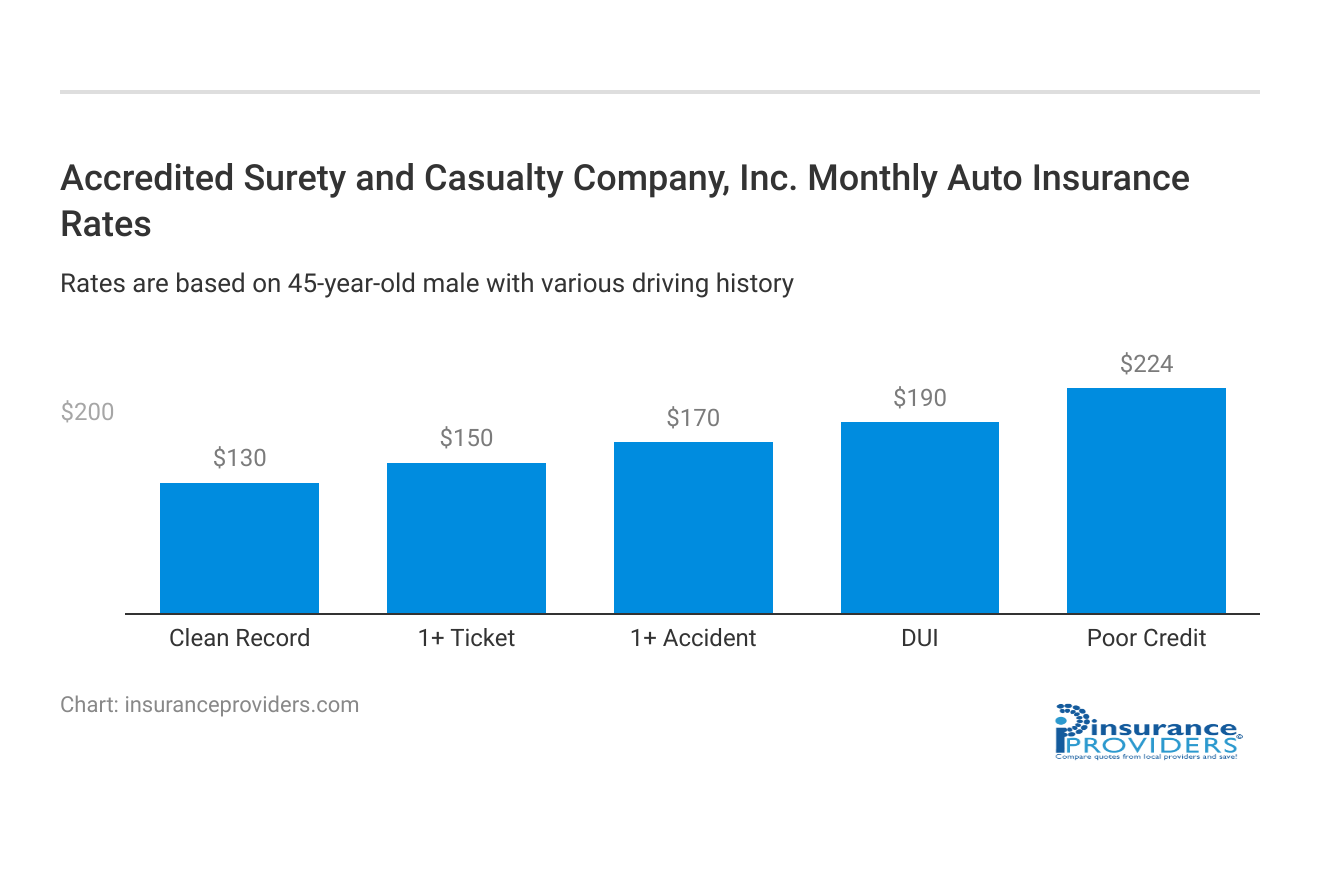

Accredited Surety and Casualty Company, Inc. Insurance Rates Breakdown

| Driver Profile | Accredited Surety and Casualty Company, Inc. | National Average |

|---|---|---|

| Clean Record | $130 | $119 |

| 1+ Ticket | $150 | $147 |

| 1+ Accident | $170 | $173 |

| DUI | $190 | $209 |

| Poor Credit | $224 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Accredited Surety and Casualty Company, Inc. Discounts Available

| Discount | Accredited Surety and Casualty Company, Inc. |

|---|---|

| Anti Theft | 8% |

| Good Student | 10% |

| Low Mileage | 10% |

| Paperless | 5% |

| Safe Driver | 15% |

| Senior Driver | 8% |

Accredited Surety and Casualty Company, Inc. values its customers and strives to make insurance more affordable without compromising on quality coverage. The company offers a range of discounts to help policyholders save on their premiums:

- Safe Driver Discounts: Rewarding policyholders with clean driving records and a history of responsible driving behavior.

- Multi-Policy Discounts: Offering savings when bundling multiple insurance policies, such as combining auto and home insurance.

- Good Student Discounts: Extending reduced rates to student drivers who demonstrate academic excellence.

- Safe Home Discounts: Providing savings to homeowners who have implemented safety features like alarm systems, fire detectors, and more.

- Loyalty Discounts: Recognizing and appreciating long-term customers by offering discounts based on their history with the company.

- Group Affiliation Discounts: Offering special rates to members of certain groups or organizations.

- Pay-in-Full Discounts: Encouraging policyholders to pay their premiums upfront for added savings.

- Automatic Payment Discounts: Providing discounts for policyholders who choose automatic payment options.

- Paperless Billing Discounts: Incentivizing environmentally friendly practices by offering discounts to those who opt for paperless billing.

Accredited Surety and Casualty Company, Inc. believes in making insurance accessible and rewarding for its customers through these valuable discounts.

How Accredited Surety and Casualty Company, Inc. Ranks Among Providers

Accredited Surety and Casualty Company, Inc. operates in a competitive landscape alongside several prominent insurance providers. These competitors offer a range of insurance products and services, aiming to cater to the diverse needs of consumers.

- Global Assurance Corporation: Another strong player in the insurance industry, Global Assurance Corporation is known for its innovative coverage solutions and competitive pricing. They provide various types of insurance, including specialized policies for unique risks, which can make them an appealing option for customers seeking tailored coverage.

- National Protection Insurance: With a focus on customer-centric policies, National Protection Insurance offers a range of coverage options to individuals and businesses. They are recognized for their customizable insurance plans and efficient claims processing, positioning them as a notable competitor.

- SecureShield Insurance: A major competitor, SecureShield Insurance, is known for its emphasis on digital convenience and user-friendly interfaces. Their emphasis on technology-driven services might attract customers looking for streamlined online interactions and policy management.

- ReliableCoverage Assurance: This insurance provider stands out for its diverse range of policies and a strong emphasis on personalized customer interactions. Their focus on building long-term relationships and addressing unique customer needs could make them a direct competitor to Accredited Surety and Casualty Company, Inc.

- GuardianGuard Insurers: GuardianGuard Insurers is recognized for its stability and reputation in the industry. They offer a comprehensive suite of insurance products, including specialized coverage options that appeal to specific niches, potentially attracting customers with specialized needs.

The company’s ability to stand out in this competitive environment showcases its strengths and the value it offers to its customers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Accredited Surety and Casualty Company, Inc.: Streamlined Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Accredited Surety and Casualty Company, Inc. prides itself on providing a hassle-free claims process to its policyholders. They offer multiple convenient methods for filing a claim, including online submissions, over-the-phone assistance, and mobile app functionality.

This flexibility ensures that customers can choose the method that suits them best, making the claims process as straightforward as possible.

Average Claim Processing Time

One crucial aspect of insurance satisfaction is the speed at which claims are processed. Accredited Surety and Casualty Company, Inc. is dedicated to efficiently handling claims.

While actual processing times may vary depending on the nature and complexity of the claim, the company strives to provide timely resolutions to ensure that policyholders can recover from unexpected events as quickly as possible.

Customer Feedback on Claim Resolutions and Payouts

The real measure of an insurance company’s reliability lies in how well they handle claims and fulfill their promises. Customer feedback plays a significant role in assessing this aspect.

Accredited Surety and Casualty Company, Inc. values customer input and continuously strives to improve its claim resolution and payout processes based on customer experiences. Positive feedback on these aspects reflects the company’s commitment to its policyholders.

Accredited Surety and Casualty Company, Inc.: Cutting-Edge Digital and Technological Features

Mobile App Features and Functionality

Accredited Surety and Casualty Company, Inc. offers a robust mobile app that provides policyholders with convenient access to their insurance information. The app includes features such as policy management, claims filing, and digital ID cards. It ensures that customers have their insurance information at their fingertips, making it easier to navigate and manage their policies.

Online Account Management Capabilities

For policyholders who prefer managing their insurance accounts online, Accredited Surety and Casualty Company, Inc. offers a user-friendly online portal. This portal allows customers to review policy details, make payments, update information, and access important documents.

The company’s commitment to digital convenience ensures that policyholders have easy access to their insurance accounts whenever they need it.

Digital Tools and Resources

In addition to the mobile app and online account management, Accredited Surety and Casualty Company, Inc. provides a range of digital tools and resources to help policyholders make informed decisions.

These tools may include calculators, educational articles, and resources to understand insurance options better. These digital assets empower policyholders to navigate the complex world of insurance with confidence.

Frequently Asked Questions

How do I determine which type of insurance is best suited for my needs?

Accredited Surety and Casualty Company, Inc. offers personalized consultations to assist in selecting the most suitable insurance based on individual circumstances.

Can I bundle different types of insurance together for comprehensive coverage?

Yes, the company provides bundling options, allowing the combination of various insurance types to ensure comprehensive coverage.

What sets Accredited Surety and Casualty Company, Inc. apart as a reliable insurance choice?

The company’s commitment to excellence, personalized service, and a history of trust and customer satisfaction distinguish it as a reliable choice.

How quickly can I obtain coverage after choosing a policy?

Accredited Surety and Casualty Company, Inc. aims to offer swift coverage; however, the exact timeline may vary based on the chosen type of insurance.

Are my personal details secure during the insurance application process?

Absolutely, the company prioritizes the security and confidentiality of personal information throughout the application process.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.