Ace Property and Casualty Insurance Company: Customer Ratings & Reviews [2026]

Ace Property and Casualty Insurance Company stands out for its diverse coverage options, affordability, and efficient claims process, making it a reliable choice for insurance seekers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated April 2024

Ace Property and Casualty Insurance Company is an excellent choice for individuals looking for a reliable insurance provider. The company offers a diverse range of insurance products, including auto, home, and liability insurance. Ace Property and Casualty Insurance Company has an A- (Excellent) rating from A.M. Best, and its rates are affordable for customers.

The claims process is efficient, and the company provides various discounts to eligible customers. Although the company has limited availability in certain states, it has received mostly positive customer reviews. Overall, Ace Property and Casualty Insurance Company is a trustworthy and dependable insurance provider.

What You Should Know About ACE

Company contact information:

- Phone: 1-800-433-0385

- Website: https://www.acegroup.com/us-en/

Related parent or child companies:

- Ace Limited (parent company)

Financial ratings:

- A- (Excellent) rating from A.M. Best

Customer service ratings:

- No specific customer service ratings were mentioned in the article.

Claims information:

- The article mentions that the claims process is easy and efficient, but there were no specific details about the process or any metrics mentioned.

Company apps:

- No specific information about any company apps was mentioned in the article.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

ACE Insurance Coverage Options

ACE Insurance Rates Breakdown

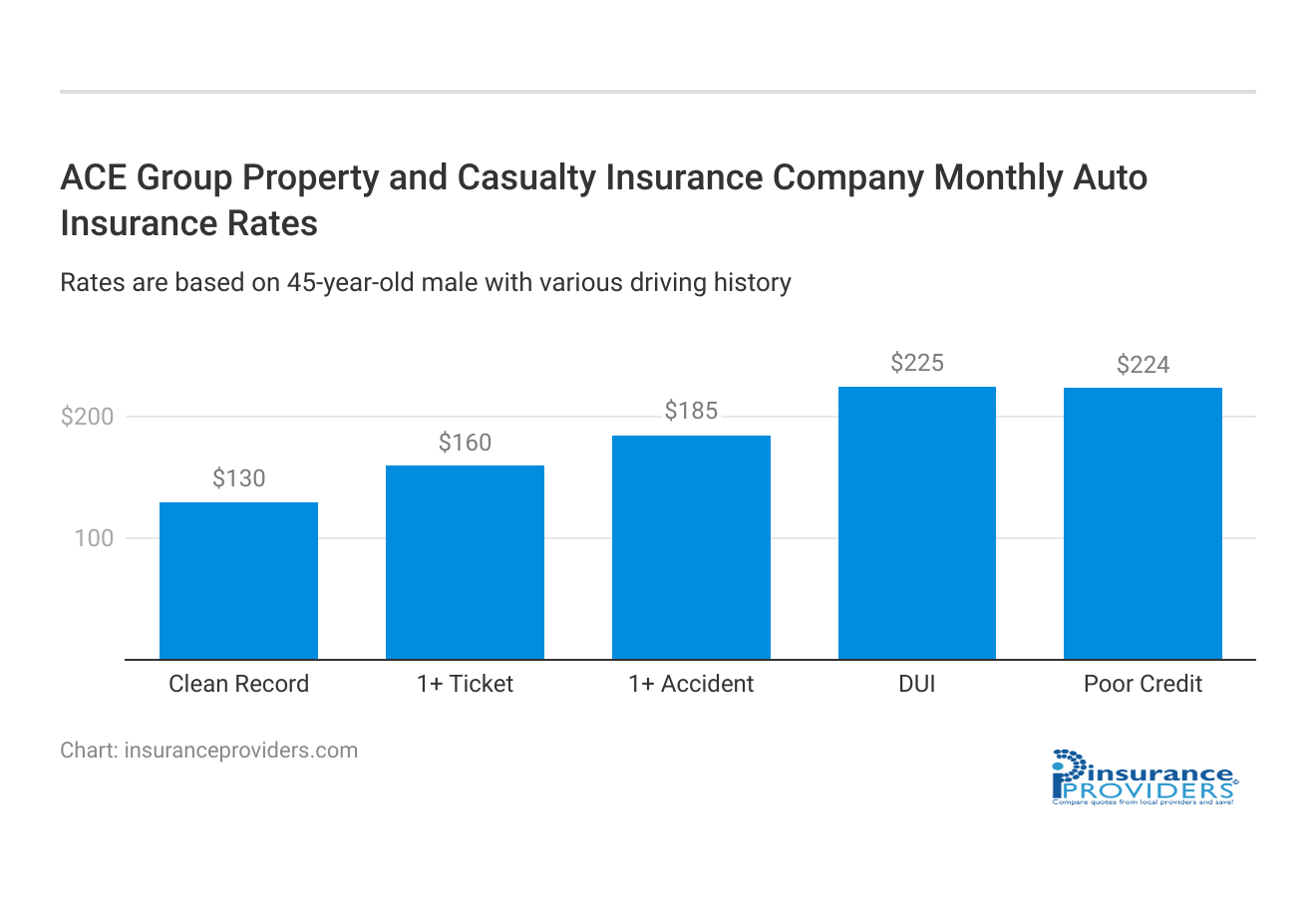

| Driver Profile | ACE Group Property and Casualty Insurance Company | National Average |

|---|---|---|

| Clean Record | $130 | $119 |

| 1+ Ticket | $160 | $147 |

| 1+ Accident | $185 | $173 |

| DUI | $225 | $209 |

| Poor Credit | $224 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

ACE Discounts Available

| Discount | ACE Group Property and Casualty Insurance Company |

|---|---|

| Anti Theft | 20% |

| Good Student | 15% |

| Low Mileage | 18% |

| Paperless | 8% |

| Safe Driver | 25% |

| Senior Driver | 10% |

Ace Property and Casualty Insurance Company offers a variety of discounts to eligible customers. These discounts include:

- Safe driver discount

- Multi-policy discount

- Multi-vehicle discount

- Good student discount

- Homeowners discount

- Low mileage discount

- Anti-theft device discount

- Accident forgiveness discount

- Pay in full discount

Customers can qualify for these discounts by meeting certain criteria, such as maintaining a clean driving record, bundling multiple policies, insuring multiple vehicles, having a student with good grades, owning a home, driving less than a certain number of miles per year, installing anti-theft devices in their vehicle, and paying their premium in full.

These discounts can help customers save money on their insurance premiums and make Ace Property and Casualty Insurance Company a more affordable option for them.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How ACE Ranks Among Providers

While the article did not mention any specific competitors of Ace Property and Casualty Insurance Company, there are several other insurance providers in the market that offer similar products and services. Some of the main competitors of Ace Property and Casualty Insurance Company include:

- State Farm

- Allstate

- Progressive

- Geico

- Nationwide

- Farmers Insurance

These companies also offer a variety of insurance products, including auto, home, and liability insurance, and are well-known names in the insurance industry. They also have their own unique strengths and weaknesses, such as pricing, customer service, and claims handling, which may make them more or less attractive to potential customers.

Overall, while Ace Property and Casualty Insurance Company may face competition from these companies, its range of insurance products, affordable rates, and positive customer reviews can help it stand out in the market.

Frequently Asked Questions

How can I obtain a quote from Ace Property and Casualty Insurance Company?

You can easily get a free quote by visiting their official website or contacting their customer service team.

What types of insurance does Ace Property and Casualty Insurance Company offer?

Ace provides various insurance types, including homeowners insurance, auto insurance, renters insurance, umbrella insurance, and flood insurance.

Does Ace Property and Casualty Insurance Company offer discounts to its customers?

Absolutely, Ace offers a range of discounts such as multi-policy discounts, safe driver discounts, and loyalty discounts to eligible customers.

Where can I find customer ratings and reviews for Ace Property and Casualty Insurance Company?

You can discover customer ratings and reviews on platforms like independent review websites, social media, and the Better Business Bureau (BBB) website.

Are customer ratings and reviews the sole factors in choosing an insurance company?

No, while valuable, customer ratings and reviews should complement other considerations like coverage options, pricing, customer service, and the company’s reputation in the industry.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.