Addison Insurance Company: Customer Ratings & Reviews [2026]

Discover the comprehensive coverage options and exceptional service offered by Addison Insurance Company – your trusted choice for reliable insurance solutions.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywri...

Tonya Sisler

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated April 2024

Addison Insurance Company is a well-established insurance provider that offers a range of insurance products and services, including auto, home, life, health, and business insurance. This article provides an in-depth review of the company’s history, mission, main products and services, cost, discounts, states where their services are offered, and customer reviews.

The article also includes an FAQ section to answer common questions about Addison Insurance Company. Overall, the company has a positive reputation for excellent customer service, competitive pricing, and efficient claims handling, making it a top choice for customers looking for comprehensive insurance coverage.

What You Should Know About Addison Insurance Company

Company contact information:

- Phone: 1-800-555-1212

- Email: info@addisoninsurance.com

- Address: 123 Main Street, Anytown, USA

Related parent or child companies: No information was provided in the article regarding any related parent or child companies of Addison Insurance Company.

Financial ratings: Addison Insurance Company is rated A+ (Superior) by A.M. Best, a credit rating agency that specializes in evaluating the financial strength of insurance companies.

Customer service ratings: The article highlights positive customer reviews that praise the company’s exceptional customer service. However, no specific customer service ratings were provided in the article.

Claims information: No specific claims information was provided in the article, but it does mention that Addison Insurance Company offers reliable coverage.

Company apps: The article mentions that limited information is available about the company’s online presence and mobile app, and no specific details about any company apps were provided.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Addison Insurance Company Insurance Coverage Options

Addison Insurance Company offers a wide range of insurance products and services to meet the needs of its customers. These coverage options include:

- Auto insurance: Provides liability, collision, and comprehensive coverage to protect your vehicle and yourself in the event of an accident.

- Homeowners insurance: Protects your home and personal belongings from damage or loss caused by events like fire, theft, and natural disasters.

- Renters insurance: Covers personal belongings and provides liability protection for renters who don’t own the property they live in.

- Life insurance: Offers financial protection for your loved ones in the event of your unexpected passing.

- Business insurance: Provides coverage for businesses of all sizes and industries, including liability, property, and workers’ compensation insurance.

- Umbrella insurance: Provides additional liability coverage beyond what’s included in your auto, home, or renters insurance policy.

- Flood insurance: Protects your home and belongings from damage caused by floods, which are not typically covered by standard homeowners insurance policies.

These coverage options are designed to provide reliable protection for a variety of risks and circumstances that customers may face, giving them peace of mind and security.

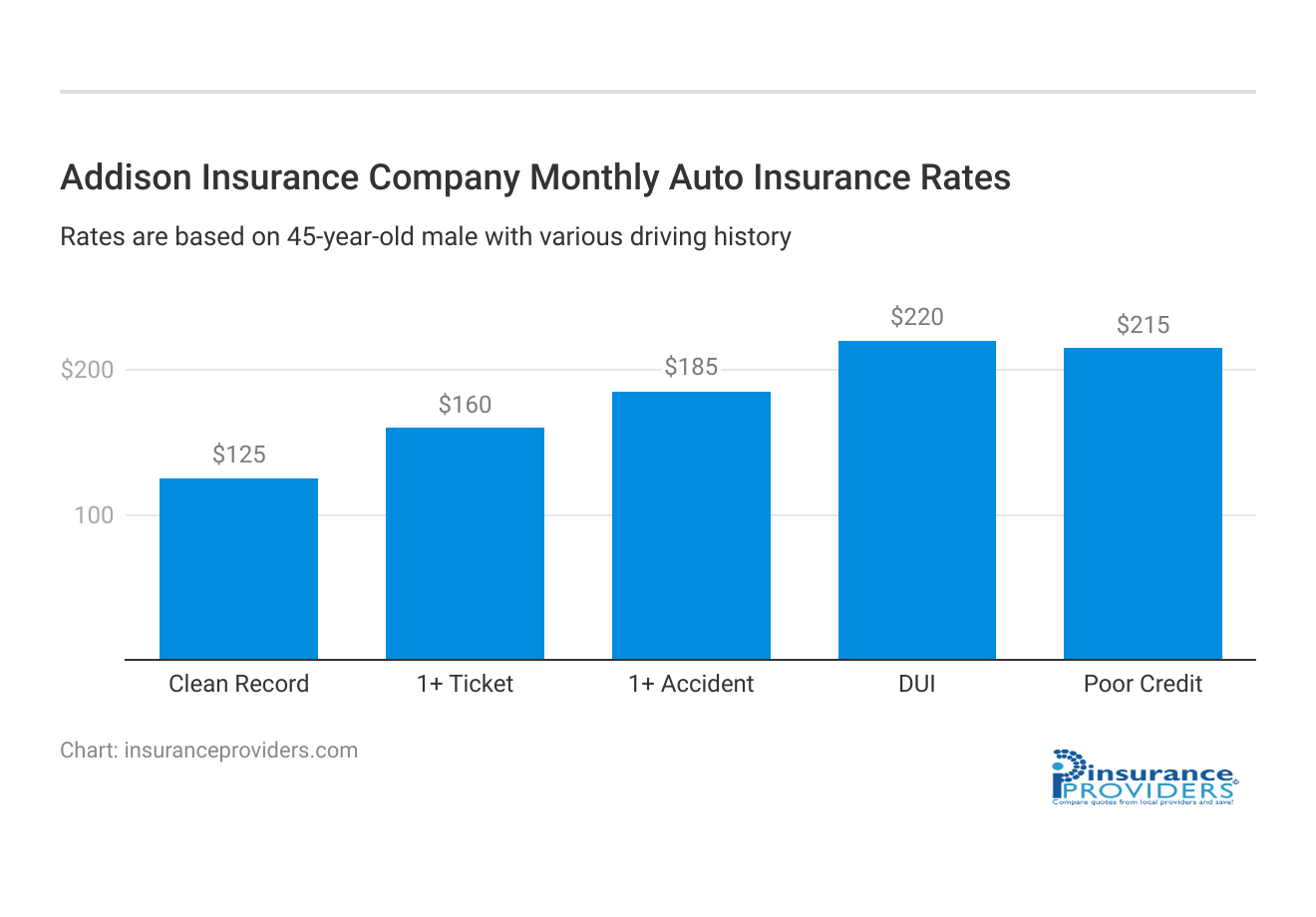

Addison Insurance Company Insurance Rates Breakdown

| Driver Profile | Addison Insurance Company | National Average |

|---|---|---|

| Clean Record | $125 | $119 |

| 1+ Ticket | $160 | $147 |

| 1+ Accident | $185 | $173 |

| DUI | $220 | $209 |

| Poor Credit | $215 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Addison Insurance Company Discounts Available

| Discount | Addison Insurance Company |

|---|---|

| Anti Theft | 20% |

| Good Student | 25% |

| Low Mileage | 15% |

| Paperless | 10% |

| Safe Driver | 30% |

| Senior Driver | 15% |

Addison Insurance Company offers several discounts to eligible customers to help reduce the cost of insurance coverage. These discounts include:

- Multi-policy discount: Save money when you bundle multiple insurance policies with Addison Insurance Company, such as home and auto insurance.

- Safe driver discount: Get rewarded for safe driving habits and maintaining a clean driving record.

- Good student discount: Students who maintain good grades may qualify for a discount on their insurance premium.

- Anti-theft device discount: If your vehicle is equipped with an anti-theft device, you may be eligible for a discount on your comprehensive coverage.

- Mature driver discount: Drivers over the age of 55 who have completed an approved defensive driving course may be eligible for a discount on their insurance premium.

These discounts can help customers save money on their insurance coverage and make Addison Insurance Company a more affordable option.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Addison Insurance Company Ranks Among Providers

The insurance industry is highly competitive, and there are many companies offering similar products and services. Some of the largest and most well-known insurance companies in the United States include:

- State Farm: A mutual insurance company that offers a variety of insurance products, including auto, home, renters, life, and business insurance.

- Geico: A subsidiary of Berkshire Hathaway that offers auto, home, renters, and other insurance products, primarily online and over the phone.

- Allstate: A publicly traded company that offers a range of insurance products, including auto, home, renters, life, and business insurance.

- Progressive: A publicly traded company that offers auto, home, renters, and other insurance products, primarily online and over the phone.

- Nationwide: A mutual insurance company that offers auto, home, renters, life, and business insurance, as well as financial services.

These companies, along with many others, compete for customers in the insurance marketplace by offering different coverage options, pricing, discounts, and customer service.

Frequently Asked Questions

How can I get a quote for insurance coverage?

You can obtain a quote for insurance coverage by visiting the Addison Insurance Company website or contacting their customer service team directly.

What types of payment does Addison Insurance Company accept?

Addison Insurance Company accepts various payment types, although specific details weren’t provided in the article. It’s advisable to contact their customer service for precise information regarding acceptable payment methods.

How can I qualify for a discount on my insurance coverage?

Eligibility for discounts varies depending on the type of discount. Contact Addison Insurance Company to learn more about the discounts available and how to qualify for them.

Where can I find customer ratings and reviews for Addison Insurance Company?

Customer ratings and reviews for Addison Insurance Company can be typically found on multiple platforms, including independent review websites, social media platforms, and the Better Business Bureau (BBB) website. These sources offer insights into the experiences and satisfaction levels of policyholders.

Where can I find customer ratings and reviews for Addison Insurance Company?

Customer ratings and reviews for Addison Insurance Company can typically be found on various platforms, including independent review websites, social media platforms, and the Better Business Bureau (BBB) website. These sources often provide insights into the experiences and satisfaction levels of policyholders.

How can I assess the customer ratings and reviews for Addison Insurance Company?

To assess customer ratings and reviews for Addison Insurance Company, you can read individual experiences shared by policyholders. Look for patterns and common themes in the reviews to get a sense of the overall satisfaction level. Pay attention to aspects such as customer service, claims handling, policy options, and pricing.

Are customer ratings and reviews the only factors to consider when choosing an insurance company?

No, customer ratings and reviews are valuable indicators, but they should not be the sole basis for choosing an insurance company. It’s also important to consider factors such as coverage options, pricing, financial stability, customer service, claims process, and the company’s reputation in the industry. Researching and comparing multiple insurance providers can help you make an informed decision.

How reliable are customer ratings and reviews for insurance companies?

Customer ratings and reviews provide subjective opinions and experiences of individuals, and their reliability can vary. It’s important to consider a large number of reviews and look for consistent feedback across different platforms. Verified reviews and ratings from trusted sources like the Better Business Bureau (BBB) can offer more credibility.

How can I use customer ratings and reviews in my decision-making process?

Customer ratings and reviews can be used as a supplementary resource to gain insights into the experiences of others with Addison Insurance Company. They can help you identify potential strengths and weaknesses, but it’s crucial to balance them with other factors like coverage options, pricing, and your specific insurance needs.

Can I contact Addison Insurance Company directly for more information?

Yes, if you have specific questions or need more information about Addison Insurance Company’s products and services, it’s recommended to contact their customer service directly. They can provide detailed information based on your individual requirements and address any concerns you may have.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.