Aetna Health Inc. (A Pennsylvania Corporation) Review (2026)

Discover Aetna Health Inc., a Pennsylvania corporation dedicated to comprehensive insurance solutions, offering diverse coverage options, discounts, and a seamless claims process in a competitive landscape.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the comprehensive range of insurance solutions offered by Aetna Health Inc., a Pennsylvania corporation dedicated to safeguarding your well-being. From health and life insurance to dental, vision, and disability coverage, Aetna ensures holistic protection for individuals and families.

With a commitment to customization, financial stability, and an extensive network of healthcare providers, Aetna stands as a reliable partner in securing your future.

Explore their array of coverage options and discounts, designed to cater to diverse needs, while competing in a landscape where competitors like UnitedHealth Group, Anthem, and Cigna vie for market dominance. Embrace peace of mind with Aetna Health Inc.’s comprehensive coverage and value-driven approach.

Aetna Health Inc. Insurance Coverage Options

Aetna Health Inc. provides a diverse array of coverage options to cater to the various needs of individuals and families. Their insurance policies extend across different domains, ensuring holistic protection. Here is a breakdown of the coverage options offered by the company:

- Health Insurance: Aetna offers comprehensive health insurance plans that encompass a wide range of medical services, including doctor visits, hospital stays, prescription medications, preventive care, and specialist consultations.

- Life Insurance: The company provides life insurance coverage that ensures financial security for your loved ones in the event of your passing. These policies can be tailored to meet specific needs and offer various coverage amounts.

- Dental Insurance: Aetna’s dental insurance plans cover routine dental check-ups, preventive services, as well as restorative treatments like fillings, crowns, and orthodontics, depending on the plan.

- Vision Insurance: With vision insurance, Aetna covers regular eye exams, prescription eyeglasses, contact lenses, and even discounts on laser eye surgery in some cases.

- Disability Insurance: Aetna’s disability insurance offers income protection if you’re unable to work due to a disability. This coverage helps you maintain financial stability during challenging times.

- Supplemental Insurance: Aetna also provides supplemental insurance policies that can help fill gaps in your primary coverage. These can include critical illness coverage, accident insurance, and hospital indemnity plans.

Aetna Health Inc.’s coverage options are designed to provide a comprehensive safety net, ensuring that you and your family are protected in various aspects of life.

Read more:

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

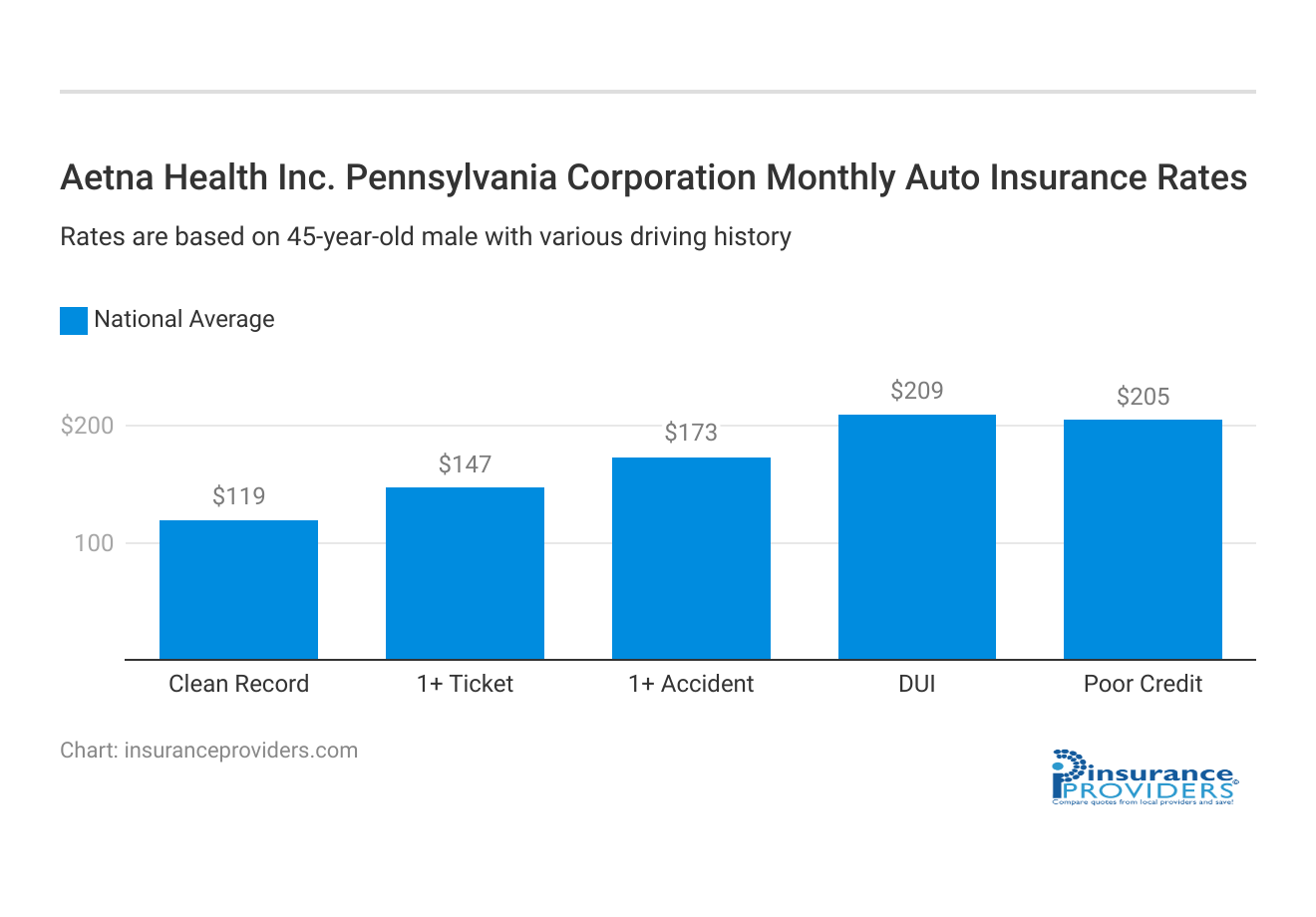

Aetna Health Inc. Insurance Rates Breakdown

| Driver Profile | Aetna Health and Life | National Average |

|---|---|---|

| Clean Record | $150 | $119 |

| 1+ Ticket | $180 | $147 |

| 1+ Accident | $200 | $173 |

| DUI | $250 | $209 |

| Poor Credit | $258 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Aetna Health Inc. Discounts Available

| Discount | Aetna Health Inc. Pennsylvania |

|---|---|

| Anti Theft | 8% |

| Good Student | 15% |

| Low Mileage | 10% |

| Paperless | 6% |

| Safe Driver | 15% |

| Senior Driver | 10% |

Aetna Health Inc. understands the importance of affordability while seeking comprehensive insurance coverage. To make their policies even more accessible, they offer various discounts to policyholders.

These discounts can help individuals and families save on their insurance premiums and enhance their overall financial security. Here are some of the notable discounts offered by the company:

- Multi-Policy Discount: Aetna offers discounts to customers who bundle multiple insurance policies together. This could include combining health insurance with life insurance or other coverage options.

- Safe Driver Discount: For auto insurance policies, Aetna provides discounts to policyholders with a clean driving record and a history of safe driving habits.

- Good Health Discount: Policyholders who demonstrate healthy behaviors, such as regular exercise, non-smoking, and maintaining a healthy weight, may qualify for a good health discount on their health insurance premiums.

- Family Discount: Aetna recognizes the importance of insuring the whole family. Families that have multiple members covered under the same policy may be eligible for a family discount.

- Group Coverage Discount: Aetna often partners with employers or organizations to offer group coverage to their members. This group coverage arrangement can lead to discounted rates for participants.

- Safe Home Discount: Homeowners who take proactive measures to secure their homes may qualify for a discount on their homeowners insurance premiums.

- Pay-in-Full Discount: Customers who choose to pay their annual insurance premium in full upfront can often receive a discount on their overall premium cost.

- Auto-Pay and Paperless Billing Discount: Enrolling in auto-pay and opting for paperless billing methods can result in additional savings on insurance premiums.

Aetna Health Inc.’s discounts are designed to make quality insurance coverage more accessible and affordable for a wide range of individuals and families. These discounts, combined with their comprehensive coverage options, highlight the company’s commitment to providing value and security to their policyholders.

How Aetna Health Inc. Ranks Among Providers

Aetna Health Inc. operates in a competitive landscape within the insurance industry, where several notable competitors vie for market share and customer trust. Understanding the company’s main competitors can provide valuable insights into the industry dynamics. Here are some of Aetna Health Inc.’s primary competitors:

- UnitedHealth Group: One of the largest healthcare and insurance providers globally, UnitedHealth Group offers a wide range of health insurance plans, as well as ancillary services such as pharmacy benefit management and healthcare technology solutions.

- Anthem, Inc.: As a leading health benefits company, Anthem offers health insurance plans that cover a diverse spectrum of individuals and families. They focus on innovative healthcare solutions and often have a significant presence in various states.

- Cigna Corporation: Cigna is known for its comprehensive health, dental, and vision insurance offerings. They emphasize personalized healthcare solutions and often collaborate with healthcare professionals to enhance the customer experience.

- Humana Inc.: Humana specializes in health and wellness services, offering health insurance plans along with wellness programs and support services. They focus on promoting preventive care and overall well-being.

- Blue Cross Blue Shield Association: A network of independent health insurance companies, BCBSA offers plans across different regions of the United States. They have a strong reputation for providing coverage options to diverse populations.

- Kaiser Permanente: Renowned for its integrated healthcare delivery system, Kaiser Permanente provides both health insurance and healthcare services. They emphasize a coordinated approach to medical care.

- AARP (UnitedHealthcare): AARP offers health insurance plans through a partnership with UnitedHealthcare, catering to the needs of older adults. Their focus is on providing specialized coverage for seniors.

- Molina Healthcare, Inc.: Molina Healthcare specializes in government-sponsored health plans, offering coverage options for Medicaid and Medicare beneficiaries. They often target underserved populations.

- Centene Corporation: Centene focuses on providing health insurance plans under Medicaid and Medicare, along with other government-sponsored programs. They prioritize serving vulnerable and low-income communities.

- Wellcare (Centene): Wellcare, now a part of Centene, offers health insurance plans and Medicare Advantage plans, with a particular focus on individuals eligible for government assistance programs.

These competitors, along with others in the market, contribute to a dynamic and evolving landscape within the insurance industry. Each company brings its unique strengths and strategies to provide diverse insurance solutions to consumers across the nation.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aetna Health Inc. Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Aetna understands the importance of convenience when it comes to filing insurance claims. They offer a variety of channels to accommodate your preferences, making the process as seamless as possible.

You can choose to submit your claims online through their user-friendly portal, speak with their dedicated customer service team over the phone, or even utilize their mobile app for hassle-free claim submission. This flexibility empowers you to select the method that suits you best, ensuring that initiating a claim is a straightforward and efficient experience.

Average Claim Processing Time

One of the key metrics to consider when evaluating an insurance provider is the speed at which claims are processed. Aetna is committed to efficiency and strives to provide timely claim processing. While exact processing times may vary depending on the nature of the claim, you can rest assured that Aetna places a high priority on handling claims promptly.

This commitment ensures that policyholders receive the benefits they deserve in a timely manner, contributing to a positive overall customer experience.

Customer Feedback on Claim Resolutions and Payouts

Ultimately, the measure of an insurance company’s dedication to its customers lies in the satisfaction of those who have filed claims. Aetna places significant value on customer feedback and continuously works to enhance its claims resolution and payout processes.

By actively listening to and learning from customer reviews and experiences, Aetna ensures that they provide fair and reliable claim resolutions. This ongoing commitment to improvement helps build trust and confidence among policyholders, reinforcing Aetna’s reputation as a customer-focused insurance provider.

Explore the Digital and Technological Features of Aetna Health Inc.

Mobile App Features and Functionality

Aetna’s mobile app is a powerful tool designed to streamline insurance management and put essential features at your fingertips. Whether you’re on an Android or iOS device, the Aetna mobile app offers a range of convenient features and functionalities.

These include the ability to submit claims directly from your mobile device, access policy information, and use a provider directory to find healthcare professionals in your network. Additionally, the app provides real-time updates on the status of your claims and facilitates easy communication with Aetna’s customer service.

With this app, Aetna prioritizes accessibility and user-friendly interactions, ensuring that you can manage your insurance needs efficiently while on the go.

Online Account Management Capabilities

Managing your insurance policies has never been more straightforward, thanks to Aetna’s online account management capabilities. Through their website, policyholders gain easy access to their accounts, where they can view policy details, make payments, and update personal information.

This user-friendly online interface simplifies the administrative aspects of insurance, providing you with greater control over your coverage and enhancing your overall experience as an Aetna policyholder.

Digital Tools and Resources

Aetna goes the extra mile by offering a suite of digital tools and resources designed to empower policyholders with knowledge and insights. These resources assist you in making informed decisions about your health and insurance coverage.

From online calculators that help you choose the right insurance plan to a wealth of educational materials on health and wellness, Aetna’s digital resources are a valuable asset. They equip you with the information you need to make the most of your insurance coverage, promoting your overall well-being.

Frequently Asked Questions

How can I choose the right health insurance plan from Aetna?

Aetna offers a variety of health insurance plans catering to different needs. Consider your medical history, budget, and coverage preferences to find the ideal plan.

Is dental insurance only for routine check-ups?

While dental insurance covers routine check-ups, it also provides coverage for procedures like fillings, crowns, and even orthodontic treatments, depending on the plan.

What is the significance of vision insurance if I have perfect eyesight?

Vision insurance goes beyond correcting vision issues. It covers regular eye exams, which can detect underlying health conditions like diabetes and hypertension.

How does disability insurance work?

Disability insurance provides financial assistance if you’re unable to work due to a disability. It ensures you have a steady income during challenging times.

Can I modify my life insurance coverage over time?

Yes, Aetna’s life insurance policies often allow you to adjust your coverage as your life circumstances change. Consult with Aetna’s representatives for more information.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.