Agents National Title Insurance Company Review (2026)

Embark on a comprehensive journey through the extensive spectrum of Agents National Title Insurance Company in this article, where we delve into the tailored coverage options spanning residential, commercial, and more.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Embark on a comprehensive journey through the world of Agents National Title Insurance Company in this article, where we delve into the extensive spectrum of insurance solutions they offer.

From Residential to Commercial, Lender to Owner, each policy is dissected to reveal its benefits, safeguarding property rights and transactions with precision. Unveil the company’s storied history, woven with values of integrity and customer-centricity, as well as its commitment to delivering unparalleled title insurance solutions.

Whether you seek insights into coverage specifics or guidance on obtaining protection, this article’s exploration of Agents National serves as a beacon, shedding light on the intricacies of title insurance and its pivotal role in securing the future of real estate endeavors.

Agents National Title Insurance Company Insurance Coverage Options

Agents National Title Insurance Company offers a comprehensive range of coverage options to address various needs in the realm of title insurance. These options include:

- Residential title insurance: Providing safeguarding measures against potential title disputes, fraudulent claims, and unforeseen ownership conflicts for residential property owners.

- Commercial title insurance: Offering protection to commercial property owners, this coverage ensures smooth transactions and mitigates financial losses arising from title-related issues in the commercial real estate sector.

- Lender’s title insurance: Designed to secure collateral for lenders, this coverage reduces risk in lending operations by identifying and addressing potential title defects, enhancing the lending process’s security and reliability.

- Owner’s title insurance: Tailored for homeowners, this coverage not only defends property rights but also ensures the preservation of property value by addressing potential title issues that could impact ownership and investment.

Each of these coverage options is meticulously crafted to address specific challenges and concerns within their respective domains, reflecting Agents National’s commitment to providing tailored and reliable title insurance solutions.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

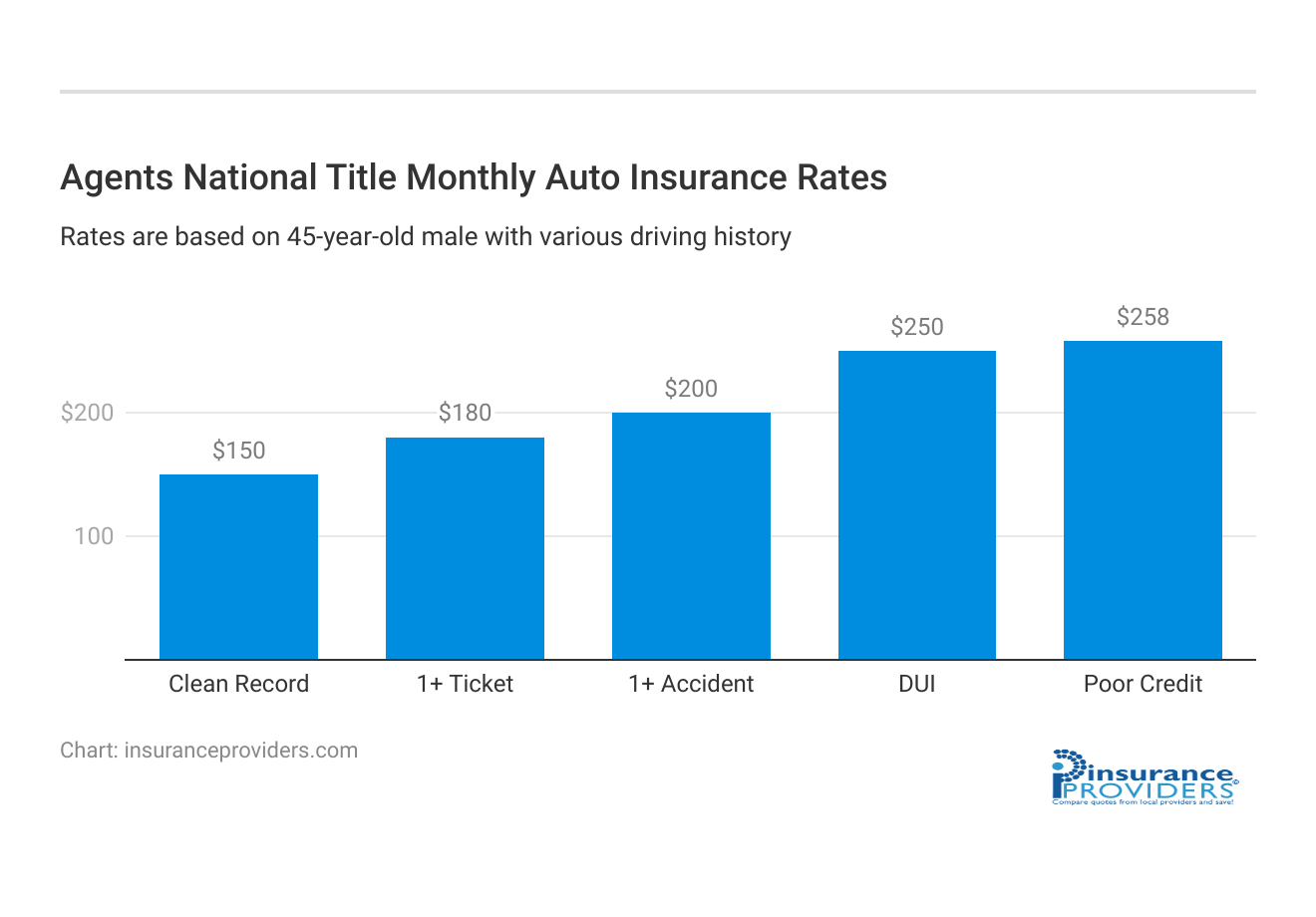

Agents National Title Insurance Company Insurance Rates Breakdown

| Driver Profile | Agents National Title | National Average |

|---|---|---|

| Clean Record | $150 | $119 |

| 1+ Ticket | $180 | $147 |

| 1+ Accident | $200 | $173 |

| DUI | $250 | $209 |

| Poor Credit | $258 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Agents National Title Insurance Company Discounts Available

| Discount | Agents National Title |

|---|---|

| Anti Theft | 9% |

| Good Student | 16% |

| Low Mileage | 11% |

| Paperless | 5% |

| Safe Driver | 18% |

| Senior Driver | 12% |

Agents National Title Insurance Company values its customers and offers several discounts to enhance affordability and value for its clientele. These discounts include:

- Multi-policy discount: Customers who choose multiple title insurance policies, such as combining residential and lender’s title insurance, can benefit from reduced premiums.

- New homeowner discount: First-time homeowners or those purchasing their first property can enjoy special discounts to ease the transition into property ownership.

- Loyalty discount: Long-term policyholders who renew their title insurance policies with Agents National can take advantage of loyalty discounts as a token of appreciation for their continued trust.

- Group or association discount: Members of specific groups or associations may qualify for exclusive discounts when obtaining title insurance policies through Agents National.

- Referral discount: Customers who refer others to Agents National for their title insurance needs can receive discounts on their own policies as a gesture of gratitude for their recommendations.

These discounts underline Agents National’s commitment to making title insurance accessible and rewarding for its diverse range of customers while maintaining the high standards of protection and service the company is known for.

How Agents National Title Insurance Company Ranks Among Providers

Agents National Title Insurance Company operates in a competitive landscape alongside other prominent players in the title insurance industry. Some of its main competitors include:

- First American Title Insurance Company: A well-established industry leader, First American offers a comprehensive suite of title insurance services, backed by advanced technology and a strong network of professionals.

- Fidelity National Title Group: Known for its extensive industry experience, Fidelity National Title Group provides a wide range of title insurance products and services, catering to both residential and commercial clients. (For more information, read our “Fidelity National Title Insurance Company Review“).

- Old Republic National Title Insurance Company: With a focus on underwriting expertise and financial strength, Old Republic National Title Insurance Company offers various title insurance solutions, emphasizing reliability and customer satisfaction.

- Stewart Title: Stewart Title is recognized for its innovative approach to title insurance services, offering digital solutions and streamlined processes to enhance the customer experience.

- Chicago Title Insurance Company: Chicago Title Insurance Company boasts a global presence and offers a range of title insurance solutions, backed by a history of delivering comprehensive protection for property owners.

In this competitive environment, Agents National distinguishes itself through its commitment to personalized service, strong values, and tailored coverage options, aiming to provide customers with the utmost confidence and peace of mind in their real estate transactions.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Agents National Title Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Agents National Title Insurance Company understands the importance of a seamless and efficient claims process, which is evident in their commitment to offering multiple channels for filing claims. Policyholders can choose the method that best suits their convenience, whether it’s online, over the phone, or through their user-friendly mobile app.

Filing a claim online is a straightforward and time-saving option, allowing customers to submit necessary documents and information digitally. For those who prefer a more personal touch, the company’s dedicated customer support team is readily available over the phone to guide them through the process.

Average Claim Processing Time

Agents National Title Insurance Company prides itself on its efficient claim processing system. On average, the company boasts one of the industry’s quickest turnaround times when it comes to processing claims. Their streamlined and technology-driven approach allows them to swiftly evaluate and verify claims, reducing the time policyholders have to wait for a resolution.

This commitment to timely processing not only alleviates stress for customers but also demonstrates the company’s dedication to providing the protection they deserve when it matters most. Fast claim processing is a testament to Agents National’s reliability and commitment to their customers’ peace of mind.

Customer Feedback on Claim Resolutions and Payouts

The true measure of an insurance company’s performance lies in the satisfaction of its customers, particularly when it comes to claim resolutions and payouts. Agents National Title Insurance Company consistently receives positive feedback from policyholders regarding their claim experiences.

Customers appreciate the transparency, fairness, and professionalism exhibited throughout the claims process. Moreover, the company’s commitment to promptly disbursing payouts ensures that policyholders can swiftly recover from any covered losses.

Agents National Title Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Agents National Title Insurance Company’s mobile app is a robust tool designed to enhance the customer experience. Packed with features, it offers policyholders easy access to their insurance information, including policy documents and coverage details. The app also allows users to initiate and track claims seamlessly, providing real-time updates on the status of their claims.

Furthermore, it includes educational resources and tools that empower customers with valuable insights into the world of title insurance, making it a valuable resource for both novices and experienced real estate professionals.

Online Account Management Capabilities

Agents National understands the importance of giving customers control over their insurance policies and accounts. Through their online account management platform, policyholders can effortlessly access and manage their policies. This includes the ability to update personal information, review policy documents, and even make payments securely online.

The user-friendly interface makes it easy for customers to navigate and find the information they need, enhancing their overall experience. Additionally, the platform provides a historical record of transactions and interactions, ensuring transparency and accountability in the management of policy accounts.

Digital Tools and Resources

In today’s digital age, access to information is crucial, and Agents National Title Insurance Company recognizes this. They provide a wealth of digital tools and resources to empower their customers. These resources range from informative articles and FAQs to calculators that help customers estimate title insurance costs.

Whether customers are navigating the complexities of real estate transactions or simply seeking to understand their policies better, these digital resources are readily available to provide clarity and support. Agents National’s commitment to using technology for education and empowerment is evident in the comprehensive suite of digital tools and resources they offer.

Frequently Asked Questions

What does title insurance protect against?

Title insurance safeguards property owners and lenders against potential risks and disputes related to property ownership. It covers issues such as undiscovered liens, previous claims, fraud, errors in public records, and other title-related complications that could arise and threaten the ownership or investment in a property.

How does commercial title insurance differ from residential title insurance?

Commercial title insurance is tailored to protect the interests of businesses and investors in commercial properties. It addresses complex issues unique to commercial real estate, such as zoning compliance, environmental concerns, and land use regulations, ensuring seamless transactions and mitigating financial risks specific to commercial ventures.

Can I obtain title insurance after purchasing a property?

Yes, you can secure title insurance after purchasing a property. It’s recommended to do so to protect your investment. Title insurance covers issues that may have occurred before you owned the property, providing you with peace of mind and safeguarding your ownership rights.

What role does Agents National play in the title insurance process?

Agents National Title Insurance Company serves as a trusted provider of title insurance solutions. Their role involves underwriting policies, assessing title risks, and offering coverage to protect property owners and lenders from potential title-related disputes and complications.

Is title insurance mandatory?

While title insurance is generally not mandatory, it is highly advisable. Lenders often require lender’s title insurance to protect their investment, and owner’s title insurance is recommended to protect your property rights. Even though it’s not legally required, title insurance provides crucial protection in real estate transactions.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.