AIG Specialty Insurance Company Review (2026)

Embark on a journey through the intricacies of AIG Specialty Insurance Company, a foremost provider of tailored insurance solutions, ranging from property and liability coverage to cutting-edge cyber and professional liability policies, setting the standard for comprehensive protection in an evolving insurance landscape.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the world of AIG Specialty Insurance Company, a trusted name in tailored insurance solutions. From property and liability coverage to cutting-edge cyber and professional liability policies, AIG stands as a beacon of comprehensive protection.

Their commitment to addressing intricate risks sets them apart, empowering both individuals and businesses to navigate uncertainties with confidence. With a diverse range of coverage options and a focus on personalized service, AIG’s industry impact and customer-centric approach shine through.

This article delves into the company’s offerings, pros, and cons, offering a comprehensive look at why AIG Specialty Insurance Company is a go-to choice for those seeking customized protection in an evolving insurance landscape.

American International Group, Inc. (AIG) Insurance Coverage Options

At AIG Specialty Insurance Company, a diverse array of coverage options awaits individuals and businesses alike. Their commitment to tailored protection is evident through the following comprehensive range of insurance types:

- Property insurance: Whether it’s safeguarding commercial real estate, high-value homes, or industrial properties, AIG’s property insurance offers coverage against a wide range of perils and damages.

- Liability insurance: AIG’s liability coverage goes beyond the basics, encompassing general liability, product liability, and more. This ensures that businesses are well-equipped to handle legal challenges that may arise.

- Cyber insurance: In the digital age, cyber threats are a constant concern. AIG’s cyber insurance provides comprehensive coverage against data breaches, cyberattacks, and related financial and reputational losses.

- Professional liability insurance: Tailored for various professions, AIG’s solutions address the nuanced challenges faced by professionals. From medical practitioners to financial advisors, their coverage offers peace of mind in an unpredictable world.

- Marine insurance: Recognizing the significance of global trade, AIG’s marine insurance covers cargo, hull, and liabilities, enabling maritime operators to navigate international waters confidently.

With these coverage options, AIG Specialty Insurance Company ensures that the unique risks and needs of its clients are met with tailored and robust protection.

Read more:

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American International Group, Inc. (AIG) Insurance Rates Breakdown

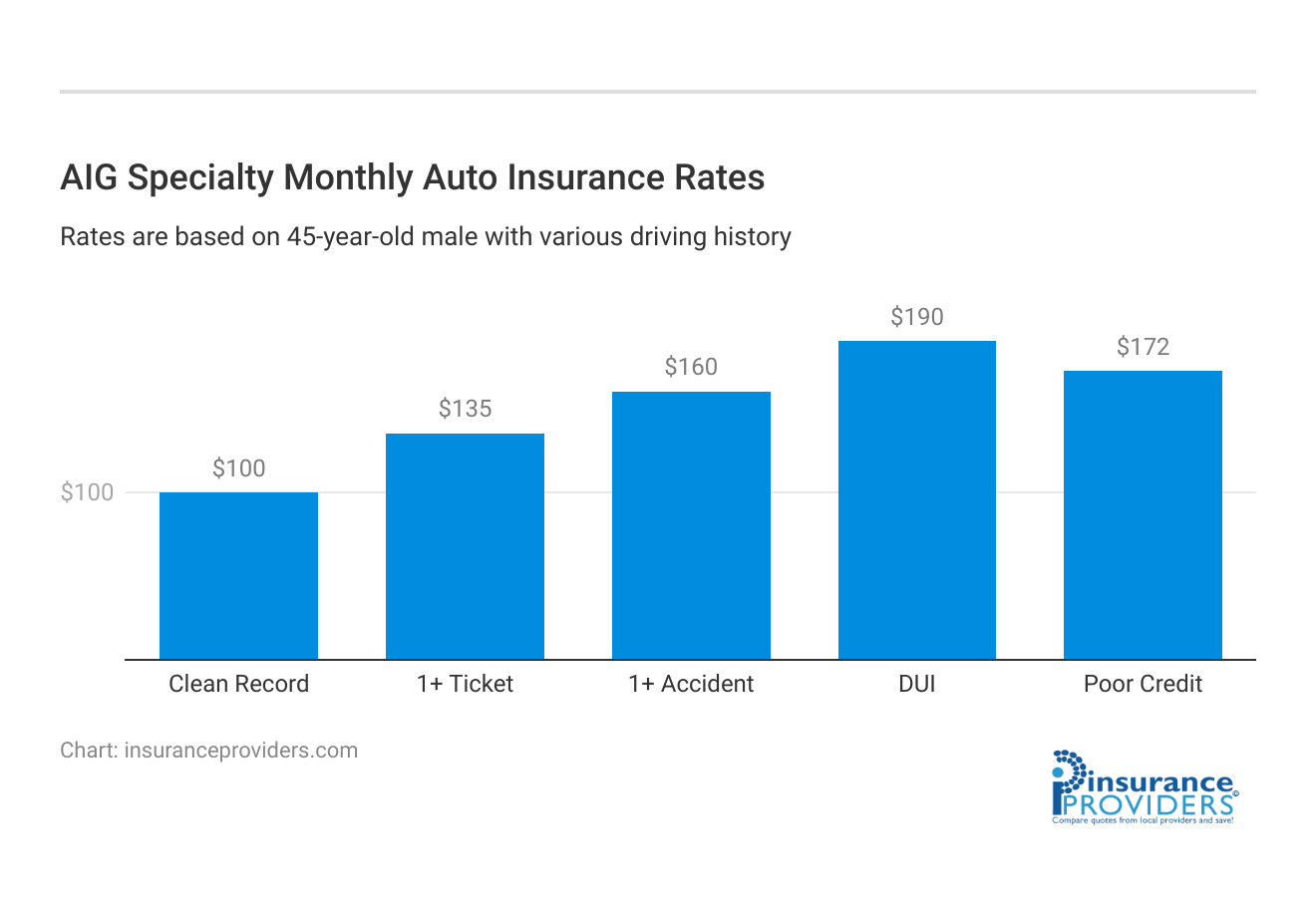

| Driver Profile | AIG Specialty | National Average |

|---|---|---|

| Clean Record | $100 | $119 |

| 1+ Ticket | $135 | $147 |

| 1+ Accident | $160 | $173 |

| DUI | $190 | $209 |

| Poor Credit | $172 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

American International Group, Inc. (AIG) Discounts Available

| Discount | AIG Specialty |

|---|---|

| Anti Theft | 8% |

| Good Student | 12% |

| Low Mileage | 9% |

| Paperless | 5% |

| Safe Driver | 13% |

| Senior Driver | 10% |

AIG Specialty Insurance Company goes the extra mile to provide value to its customers through various discount opportunities. These discounts are designed to make comprehensive coverage more accessible and affordable for individuals and businesses alike. Here are some of the discounts you can take advantage of:

- Multi-policy discount: AIG encourages bundling insurance policies to save on overall premiums. By combining multiple coverage types, customers can enjoy significant cost savings.

- Safe driver discount: Safe driving habits are rewarded with this discount. Drivers who maintain a clean driving record and demonstrate responsible behavior on the road can enjoy reduced insurance rates.

- Claims-free discount: AIG values long-term relationships with its clients. Those who maintain a claims-free history over a certain period may be eligible for a discount as a reward for responsible behavior.

- Security system discount: Homes and businesses equipped with advanced security systems are less risky to insure. AIG offers discounts to customers who have installed security measures to protect their properties.

- Professional group discount: AIG recognizes the importance of certain professional affiliations. Members of specific professional groups or associations may qualify for exclusive discounts tailored to their needs.

These discounts not only help customers save money but also underscore AIG’s commitment to rewarding responsible behavior, loyalty, and proactive risk management.

How American International Group, Inc. (AIG) Ranks Among Providers

AIG Specialty Insurance Company operates in a competitive landscape where several other insurance providers vie for market share. Some of the main competitors of AIG Specialty Insurance Company include:

- Chubb: Chubb is a global insurance powerhouse known for its wide range of specialty insurance products and high-end coverage. With a focus on tailored solutions, Chubb competes directly with AIG Specialty Insurance Company in providing comprehensive coverage for unique risks.

- Travelers: Travelers is a well-established insurance company that offers a diverse portfolio of insurance options, including property, liability, and specialty coverage. Known for its strong customer service and personalized policies, Travelers competes with AIG in catering to a broad range of insurance needs.

- Hiscox: Hiscox specializes in providing coverage for small businesses and professionals. Their offerings include professional liability, cyber, and business insurance. Hiscox’s focus on niche markets and specialized coverage makes it a competitor to AIG’s targeted approach.

- Zurich Insurance Group: Zurich is a global insurance company that provides a wide range of insurance products to businesses and individuals. With a strong international presence, Zurich competes with AIG in offering comprehensive coverage solutions for complex risks.

- Allianz: Allianz is another global insurance giant that competes with AIG in providing a variety of insurance products and services. Their extensive network and diverse coverage options make them a significant player in the insurance industry.

These competitors, along with others, contribute to a dynamic and evolving landscape in which AIG Specialty Insurance Company continues to distinguish itself through its tailored coverage, customer-centric approach, and commitment to addressing specialized risks.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AIG Specialty Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

AIG Specialty Insurance Company understands the importance of a seamless claims process. They offer multiple convenient channels for filing claims, ensuring that customers can choose the method that suits them best.

Policyholders have the option to file claims online through the company’s user-friendly website, over the phone by speaking with a dedicated claims representative, or even through their mobile app for added convenience. The flexibility in filing options reflects AIG’s commitment to making the claims experience as hassle-free as possible for their valued clients.

Average Claim Processing Time

When it comes to processing claims, AIG Specialty Insurance Company places a strong emphasis on efficiency. While actual processing times can vary depending on the complexity of the claim, AIG strives to resolve claims promptly and transparently.

On average, customers can expect their claims to be processed in a timely manner, with the company’s experienced claims professionals working diligently to ensure a swift resolution. This commitment to quick claims processing is a testament to AIG’s dedication to providing exceptional service to policyholders.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a pivotal role in evaluating an insurance company’s performance, especially when it comes to claim resolutions and payouts. AIG Specialty Insurance Company values feedback from its policyholders and continuously seeks to improve its claims handling process based on their experiences.

While individual experiences can vary, customer feedback generally highlights AIG’s commitment to fair and efficient claim resolutions. The company aims to provide policyholders with the support and financial assistance they need during challenging times, reinforcing their reputation as a customer-centric insurance provider.

Digital and Technological Features of AIG Specialty Insurance Company

Mobile App Features and Functionality

AIG Specialty Insurance Company offers a comprehensive mobile app designed to enhance the overall insurance experience for their customers. The app provides policyholders with convenient access to their insurance information, allowing them to view policy details, make payments, and file claims right from their smartphones or tablets.

Additionally, the app offers features such as digital ID cards and the ability to contact customer support quickly. AIG’s mobile app empowers policyholders with the tools they need to manage their insurance on the go.

Online Account Management Capabilities

Managing insurance policies and accounts online has become a necessity in today’s digital age, and AIG Specialty Insurance Company understands this. Their online account management platform is user-friendly and robust, giving policyholders the ability to make changes to their policies, review billing statements, and access important documents easily.

The platform is designed to provide policyholders with full control over their insurance accounts, making it a convenient and time-saving resource.

Digital Tools and Resources

AIG’s commitment to digital innovation extends beyond their mobile app and online account management platform. The company provides a range of digital tools and resources to help policyholders make informed decisions about their coverage.

These resources may include educational materials, risk assessment tools, and online calculators that help customers better understand their insurance needs. AIG’s investment in digital tools underscores their dedication to providing policyholders with the information and resources necessary to navigate the complexities of insurance effectively.

Frequently Asked Questions

Is AIG Specialty Insurance only for businesses?

No, AIG’s offerings extend to both individuals and businesses, providing coverage that suits various needs.

What sets AIG Specialty Insurance apart from other providers?

AIG’s specialization in niche areas allows them to offer customized coverage that addresses unique risks.

How do I know which insurance type is right for me?

AIG’s expert advisors work closely with clients to assess their needs and recommend the most suitable insurance type.

Can I bundle multiple insurance types with AIG?

Absolutely, bundling different insurance types with AIG can lead to comprehensive coverage and potential cost savings.

What’s the claims process like with AIG Specialty Insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.