AIX Specialty Insurance Company Review (2026)

Discover the comprehensive offerings of AIX Specialty Insurance Company, a key player in the insurance sector, providing tailored coverage options for both individuals and businesses, backed by a strong A.M. Best rating and a commitment to customer satisfaction.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive guide, we’ve explored AIX Specialty Insurance Company, a prominent name in the insurance sector. From individuals to businesses, AIX offers a range of coverage options tailored to diverse needs.

The company’s commitment to customer satisfaction shines through its customizable policies, efficient claim resolution, and robust financial stability reflected in its A.M. Best rating of A. We’ve delved into AIX’s coverage offerings, including property, liability, professional indemnity, cyber liability, and directors and officers insurance.

Additionally, we’ve highlighted the company’s competitive advantages, such as its multi-policy discounts, safe driver incentives, and commitment to rewarding responsible behavior.

Positioned amidst competitors like Zenith Insurance, Guardian Professional Services, CyberSure Insurance, and ExecutiveGuard Corporation, AIX thrives by delivering excellence, ensuring that clients’ assets and interests remain secure in an ever-changing world.

AIX Specialty Insurance Coverage Options

AIX Specialty Insurance Company provides a comprehensive range of coverage options to meet diverse insurance needs. With a focus on protecting individuals, businesses, and professionals, their offerings include:

- Property insurance: Safeguard your valuable assets, including homes, businesses, and rental properties, against risks like damage, theft, and natural disasters.

- Liability insurance: Shield yourself from potential lawsuits and claims with coverage that spans general liability, product liability, and more.

- Professional indemnity insurance: Tailored for professionals, this coverage addresses claims arising from errors, omissions, or negligence in your professional services.

- Cyber liability insurance: In an increasingly digital world, protect yourself against cyber risks and data breaches that could impact your business or personal information.

- Directors and officers (D&O) insurance: Cover the legal expenses and liabilities that directors and officers of a company may face due to their decisions and actions.

These coverage options cater to a wide range of scenarios, ensuring that you have the right protection in place, no matter your situation.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

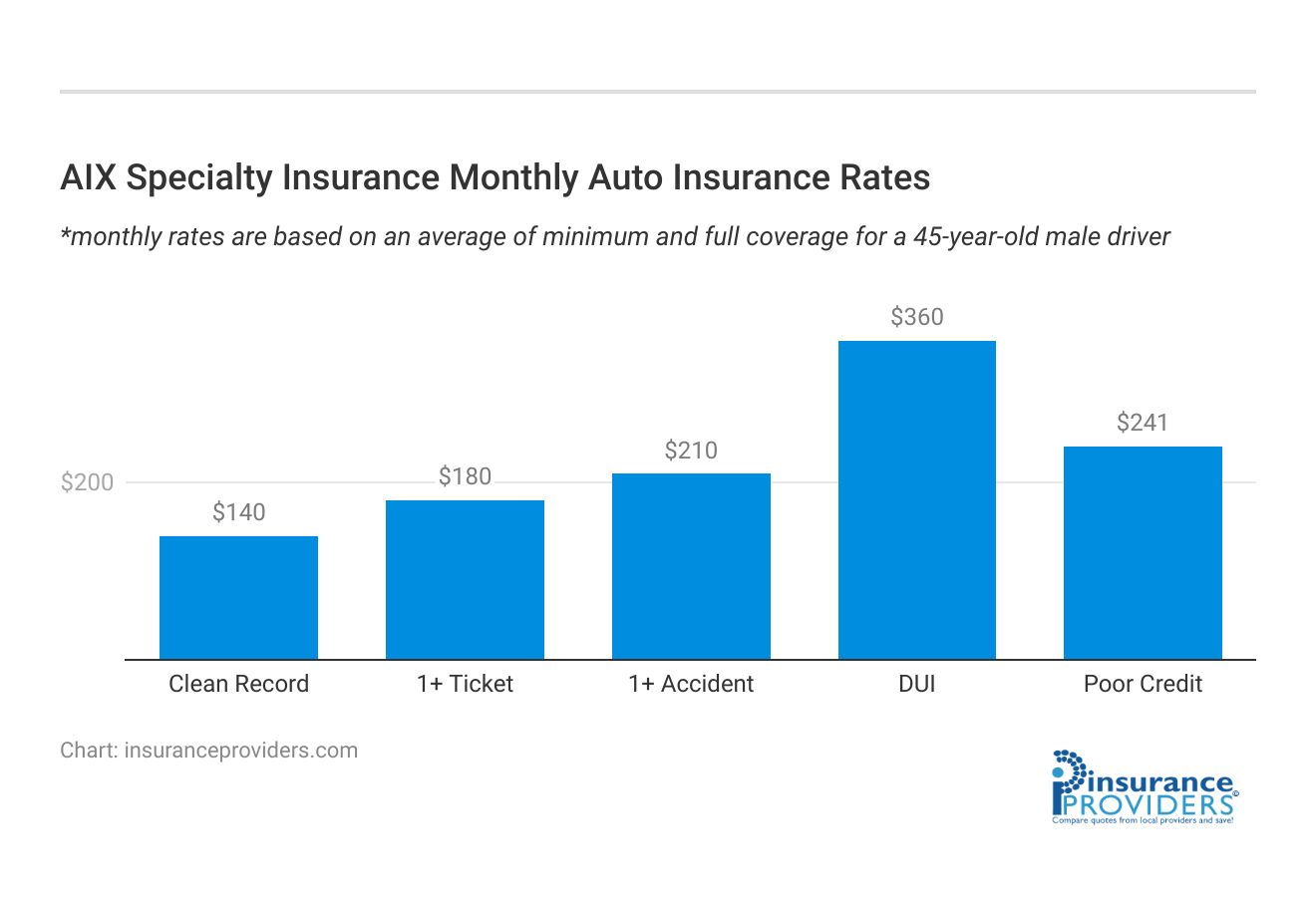

AIX Specialty Insurance Rates Breakdown

| Driver Profile | AIX Specialty | National Average |

|---|---|---|

| Clean Record | $140 | $119 |

| 1+ Ticket | $180 | $147 |

| 1+ Accident | $210 | $173 |

| DUI | $360 | $209 |

| Poor Credit | $241 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

AIX Specialty Insurance Discounts Available

| Discount | AIX Specialty |

|---|---|

| Anti Theft | 7% |

| Good Student | 12% |

| Low Mileage | 10% |

| Paperless | 5% |

| Safe Driver | 18% |

| Senior Driver | 8% |

AIX Specialty Insurance Company understands the importance of affordability without compromising on coverage. To make insurance even more accessible, they offer a variety of discounts that policyholders can take advantage of:

- Multi-policy discount: Save by bundling multiple insurance policies with AIX, such as combining auto and home insurance.

- Safe driver discount: Rewarding good driving behavior, this discount is available to policyholders with a clean driving record and no recent accidents.

- Claim-free discount: If you’ve maintained a claim-free history, you can enjoy reduced premiums as a sign of your responsible risk management.

- Professional association discount: Members of certain professional associations may qualify for exclusive discounts on their insurance policies.

- Safety features discount: Vehicles equipped with advanced safety features may lead to lower premiums due to their enhanced safety measures.

- Good student discount: Students with exceptional academic performance can benefit from lower rates, promoting both education and responsible driving.

These discounts reflect AIX Specialty Insurance Company’s commitment to making insurance affordable while acknowledging and rewarding responsible behavior. Make sure to inquire about these discounts to maximize your savings while securing the coverage you need.

How AIX Specialty Insurance Ranks Among Providers

AIX Specialty Insurance Company operates in a competitive landscape alongside several prominent players within the insurance industry. Some of its notable competitors include:

- Zenith Insurance: Known for its comprehensive coverage options and flexible policies, Zenith Insurance is a strong contender, especially in the property and liability insurance sectors.

- Guardian Professional Services: Focusing on professional indemnity insurance, Guardian Professional Services is a key competitor, offering specialized coverage tailored to the needs of professionals.

- Cybersure Insurance: When it comes to cyber liability insurance, CyberSure Insurance stands out with its robust cybersecurity coverage and risk management solutions.

- Executiveguard Corporation: A significant competitor in the directors and officers (D&O) insurance realm, ExecutiveGuard Corporation offers extensive protection for the legal liabilities of company directors and officers.

These competitors bring their unique strengths and offerings to the table, catering to specific insurance needs. AIX Specialty Insurance Company thrives in this competitive environment by delivering tailored solutions, excellent customer service, and a diverse range of coverage options.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AIX Specialty Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, mobile Apps)

AIX Specialty Insurance Company understands the importance of a hassle-free claims process. They offer multiple convenient avenues for filing a claim, ensuring that policyholders can choose the method that suits them best.

Whether you prefer the ease of online submissions, the personal touch of speaking to a representative over the phone, or the convenience of using their mobile app, AIX has you covered.

Average Claim Processing Time

Time is of the essence when it comes to insurance claims. AIX Specialty Insurance Company is committed to swift claim processing, aiming to provide policyholders with a timely resolution to their claims. The average claim processing time with AIX is competitive, and their efficiency in handling claims contributes to their reputation for reliability.

Customer Feedback on Claim Resolutions and Payouts

The true measure of an insurance company’s performance lies in the satisfaction of its policyholders. AIX Specialty Insurance Company values customer feedback and strives to ensure fair and satisfactory claim resolutions and payouts. The experiences of policyholders can shed light on the company’s commitment to its customers and the quality of service they provide.

Digital and Technological Features of AIX Specialty Insurance Company

Mobile App Features and Functionality

AIX Specialty Insurance Company offers a user-friendly mobile app designed to enhance the overall insurance experience. The app provides a range of features and functionality, allowing policyholders to manage their policies, file claims, access important documents, and stay informed about their coverage, all from the convenience of their mobile devices.

Online Account Management Capabilities

For policyholders who prefer managing their insurance accounts online, AIX offers robust online account management capabilities. This includes the ability to review policy details, make payments, update personal information, and track claims progress, all through a secure and user-friendly online portal.

Digital Tools and Resources

In today’s digital age, having access to valuable resources and tools is essential for making informed insurance decisions. AIX Specialty Insurance Company provides policyholders with a range of digital tools and resources, including educational materials, calculators, and risk assessment tools, to empower them to make the right coverage choices and stay informed about their insurance needs.

Frequently Asked Questions

Is AIX Specialty Insurance Company suitable for both individuals and businesses?

Absolutely! AIX caters to both individuals and businesses, offering a wide array of insurance solutions tailored to their unique needs.

How can I benefit from AIX’s multi-policy discount?

AIX Specialty Insurance Company offers a multi-policy discount when you bundle multiple insurance policies together. This could include combining auto and home insurance, leading to substantial savings on your premiums.

What is the significance of AIX’s A.M. Best rating?

AIX’s A.M. Best rating of A reflects its strong financial stability and ability to meet policyholders’ claims and obligations, reassuring you of its reliability and trustworthiness.

Can you elaborate on the claim filing process with AIX?

Filing a claim with AIX Specialty Insurance is straightforward. Contact their claims department, and they’ll guide you through the necessary steps, ensuring a smooth and efficient process.

What sets AIX apart from its competitors in terms of coverage options?

AIX Specialty Insurance Company offers a diverse range of coverage options, including property, liability, professional indemnity, cyber liability, and directors and officers insurance. This comprehensive selection ensures that all your insurance needs are met under one roof.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.