Allstate Indemnity Company Review (2026)

Unlock secure and personalized insurance solutions with Allstate Indemnity Company, offering tailored coverage, personalized support, competitive discounts, and a commitment to empowering your informed choices.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the comprehensive protection and peace of mind offered by Allstate Indemnity Company. From auto and homeowners insurance to life and business coverage, Allstate’s diverse array of insurance options is tailored to your unique needs.

With a commitment to personalized support and a range of benefits, including accident forgiveness and claim satisfaction guarantees, Allstate stands as a trusted partner in safeguarding your assets and loved ones.

Their competitive edge shines through discounts for safe driving, home safety features, and more. In a competitive landscape that includes State Farm, Geico, and Progressive, Allstate’s reputation for reliability, customization, and customer-focused service sets it apart as a beacon of security in an uncertain world.

Allstate Indemnity Company Insurance Coverage Options

Allstate Indemnity Company understands that your insurance needs are unique. That’s why they offer a range of coverage options designed to provide the protection you require. Here are the coverage options you can choose from:

- Auto Insurance: Whether you’re a new driver or an experienced one, Allstate’s auto insurance offers coverage for accidents, theft, vandalism, and liability (read our “Allstate Auto Insurance Review” for more information). Additional options include collision coverage, comprehensive coverage, and uninsured/underinsured motorist protection.

- Homeowners Insurance: Protect your biggest investment with homeowners insurance. This coverage safeguards your home and its contents against damage caused by fire, storms, theft, and more. It also includes liability coverage in case someone is injured on your property.

- Life Insurance: Allstate offers various types of life insurance, including term life, whole life, and universal life. These policies provide financial security for your loved ones in the event of your passing, covering expenses such as funeral costs, debts, and ongoing living expenses.

- Renters Insurance: Even if you’re renting, your personal belongings deserve protection. Renters insurance covers your possessions in case of theft, fire, or other covered events. It also includes liability coverage if someone is injured in your rental unit.

- Business Insurance: For entrepreneurs and business owners, Allstate offers business insurance solutions. This coverage protects your business assets, property, and liability. It can include commercial property insurance, general liability insurance, commercial auto insurance, and more.

- Umbrella Insurance: An umbrella policy provides an extra layer of liability protection that goes beyond the limits of your other insurance policies. It can be especially beneficial if you’re facing a lawsuit or a significant liability claim.

With Allstate’s diverse array of coverage options, you can build a customized insurance portfolio that aligns with your needs and provides the peace of mind you deserve.

Read more:

- Allstate Homeowners Insurance Review

- Allstate Insurance Company Review

- Allstate Life Insurance Review

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

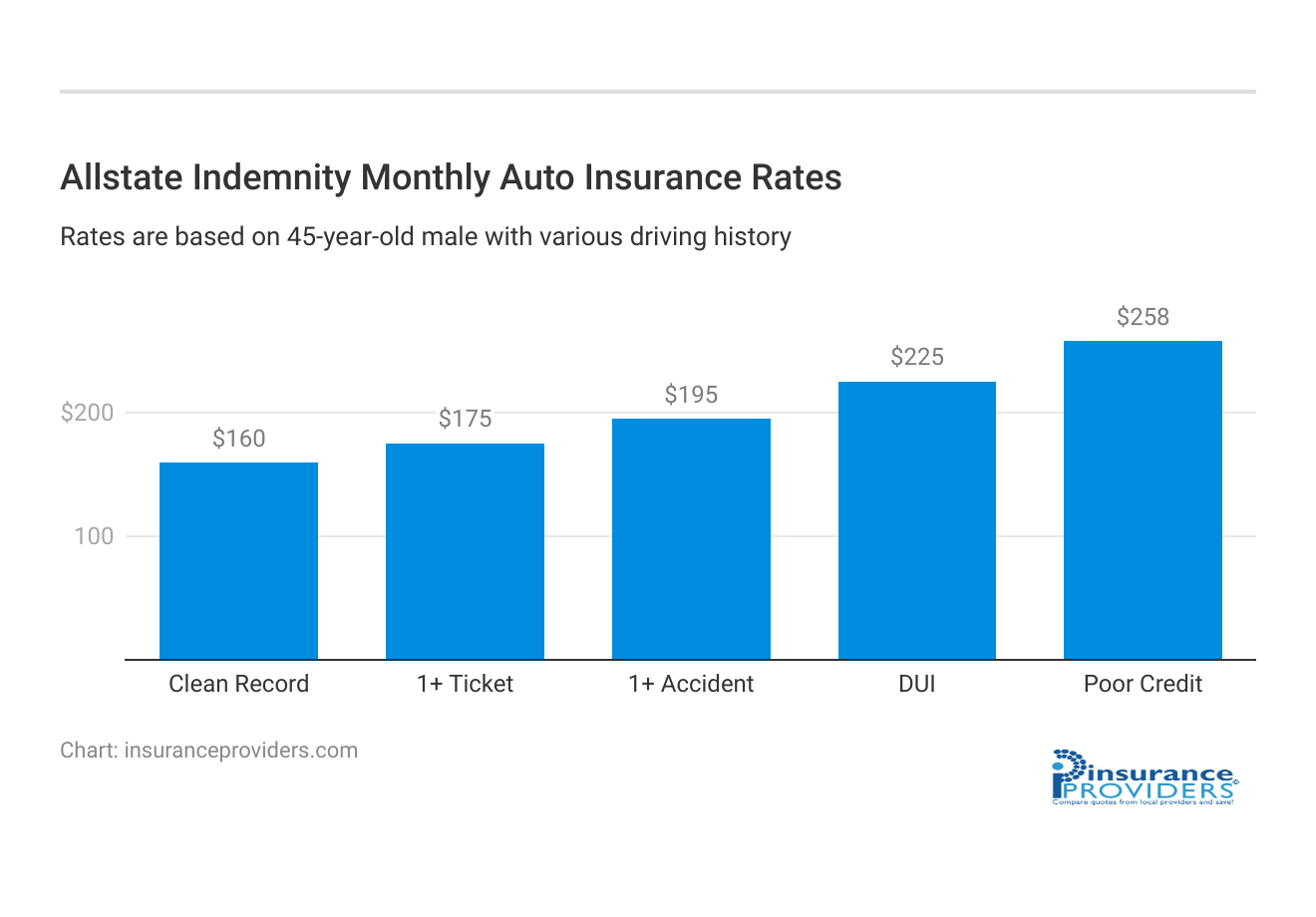

Allstate Indemnity Company Insurance Rates Breakdown

| Driver Profile | Allstate Indemnity | National Average |

|---|---|---|

| Clean Record | $160 | $119 |

| 1+ Ticket | $175 | $147 |

| 1+ Accident | $195 | $173 |

| DUI | $225 | $209 |

| Poor Credit | $258 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Allstate Indemnity Company Discounts Available

| Discount | Allstate Indemnity |

|---|---|

| Anti Theft | 9% |

| Good Student | 14% |

| Low Mileage | 11% |

| Paperless | 6% |

| Safe Driver | 16% |

| Senior Driver | 8% |

Allstate Indemnity Company not only offers comprehensive coverage but also provides various discounts to help you save on your insurance premiums. Here’s a look at some of the discounts and benefits you can enjoy:

- Multi-Policy Discount: Bundle multiple insurance policies, such as auto and homeowners insurance, with Allstate to save on both.

- Safe Driving Discount: Maintain a safe driving record and enjoy lower rates on your auto insurance. This discount rewards you for your responsible behavior on the road.

- Good Student Discount: If you’re a student with good grades, you can benefit from this discount, which reflects your commitment to responsibility and excellence.

- Anti-Theft Discount: Equip your vehicle with anti-theft devices, such as alarms and tracking systems, and receive a discount on your auto insurance.

- Home Safety Features Discount: Enhance the security of your home with features like smoke detectors, burglar alarms, and protective devices to lower your homeowners insurance premiums.

- New Homebuyer Discount: If you’ve recently purchased a new home, you could be eligible for this discount, which recognizes the security associated with new properties.

- Safe Homeowner Discount: Maintain a claim-free history as a homeowner and be rewarded with a discount that acknowledges your commitment to responsible homeownership.

- Auto Features Discount: If your vehicle is equipped with certain safety features like anti-lock brakes or airbags, you could qualify for an additional discount.

- Early Signing Discount: Secure your insurance policy with Allstate in advance and enjoy savings on your premiums.

- Paperless Billing Discount: Option for paperless billing and conveniently manage your insurance documents online while enjoying a discount.

- E-Signature Discount: Streamline the insurance process by signing documents electronically and receive a discount as a result.

- Full Payment Discount: Pay your premium in full upfront and receive a discount for your commitment.

- Responsible Payer Discount: Maintain a consistent payment history and benefit from a discount that recognizes your financial responsibility.

- Utility Vehicle Discount: If you own a utility vehicle, such as an ATV or a snowmobile, you could be eligible for a discount on your insurance coverage.

- Auto Club Discount: If you’re a member of an auto club or other affiliated organization, you could qualify for additional savings.

Read more:

- Auto Club Indemnity Company Review 2023

- Allstate Fire and Casualty Insurance Company Review

- Auto Club Property-Casualty Insurance Company Review

These discounts and benefits reflect Allstate’s commitment to rewarding responsible behavior, providing incentives for safety-conscious choices, and making insurance more affordable for its customers.

As you explore your coverage options with Allstate, be sure to inquire about the discounts that apply to your specific situation.

How Allstate Indemnity Company Ranks Among Providers

In the bustling insurance industry, Allstate Indemnity Company faces competition from several prominent players. Each of these competitors brings its unique strengths and offerings to the table, contributing to a dynamic and competitive insurance market. Let’s take a closer look at some of its main competitors:

- State Farm: State Farm is one of the largest insurance providers in the United States. Known for its extensive network of agents and diverse insurance offerings, State Farm competes strongly with Allstate. It offers auto, home, life, health, and other insurance products, along with a range of discounts and personalized services.

- Geico: Geico is renowned for its catchy advertising campaigns and competitive pricing. As a direct-to-consumer insurer, Geico focuses on providing affordable auto insurance, backed by its user-friendly online platform.

- Progressive: Progressive has gained recognition for its innovative approach to auto insurance. With features like the Snapshot program, which offers personalized rates based on driving behavior, Progressive appeals to tech-savvy customers looking for tailored coverage.

- Liberty Mutual: Liberty Mutual offers a wide range of insurance products, including auto, home, renters, and life insurance. It stands out with its customizable coverage options and a variety of discounts.

- Nationwide: Nationwide is known for its comprehensive lineup of insurance products and financial services. With a strong emphasis on customer satisfaction and a broad network of agents, Nationwide competes for a share of the insurance market.

- Farmers Insurance: Farmers is recognized for its personalized approach to insurance. It offers a variety of coverage options, discounts, and add-ons to tailor policies to individual needs.

- USAA: USAA primarily serves military members and their families. With a strong commitment to customer service and tailored offerings, USAA competes effectively in the insurance landscape.

- Travelers: Travelers focuses on providing specialized insurance solutions for businesses and individuals. Its commercial insurance offerings and risk management services set it apart in the market.

- Erie Insurance: Erie Insurance prides itself on personalized service and competitive rates. It caters to a range of insurance needs, from auto and home to life and business insurance.

- Aflac: Aflac specializes in supplemental insurance, offering policies that cover specific health-related expenses not typically covered by major medical insurance.

Allstate Indemnity Company distinguishes itself through its comprehensive coverage options, personalized service, and reputation for reliability. In this landscape, understanding the features and benefits offered by Allstate in comparison to its competitors is crucial for consumers looking for the right insurance partner.

Read more: USAA General Indemnity Company: Customer Ratings & Reviews

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate Indemnity Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Allstate Indemnity Company provides multiple convenient channels for filing insurance claims, ensuring flexibility for policyholders. Whether you prefer an online submission, phone call, or mobile app usage, Allstate has you covered. This user-friendly approach makes the claims process accessible and hassle-free.

Average Claim Processing Time

The speed at which insurance claims are processed can significantly impact a policyholder’s experience. Allstate aims to provide efficient claim processing, but it’s essential to review current data or contact the company for specific information on their average claim processing times.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance in handling claims. To gain insight into Allstate Indemnity Company’s claim resolutions and payouts, it’s recommended to read customer reviews and testimonials. These real-world experiences can provide valuable information when evaluating the company’s claim satisfaction.

Allstate Indemnity Company’s Digital and Technological Features

Mobile App Features and Functionality

Allstate’s mobile app offers a range of features and functionalities designed to enhance the customer experience. From policy management to claims tracking and roadside assistance, the app provides policyholders with on-the-go access to essential services and information.

Online Account Management Capabilities

Managing insurance policies and accounts online is a convenience many policyholders appreciate. Allstate offers robust online account management capabilities, allowing customers to view policy details, make payments, and update information with ease.

Digital Tools and Resources

In addition to their mobile app and online account management, Allstate provides various digital tools and resources to assist policyholders. These may include insurance calculators, educational materials, and resources to help customers better understand their coverage and make informed decisions.

Frequently Asked Questions

What types of insurance does Allstate Indemnity Company offer?

Allstate Indemnity Company provides a comprehensive range of insurance options, including coverage for auto, home, life, and business, ensuring a tailored approach to your specific needs.

How does Allstate stand out in the competitive insurance landscape?

Allstate distinguishes itself through personalized support, competitive discounts, and a commitment to empowering customers to make informed decisions, setting it apart as a reliable and customer-focused insurance provider.

What benefits and discounts does Allstate offer to policyholders?

Policyholders with Allstate can enjoy a variety of benefits, including accident forgiveness and claim satisfaction guarantees, along with competitive discounts for safe driving, home safety features, and more, emphasizing a commitment to rewarding responsible behavior.

How user-friendly is the claims process with Allstate Indemnity Company?

Allstate simplifies the claims process by providing multiple convenient channels, including online submission, phone calls, and a mobile app, ensuring a hassle-free experience for policyholders. The company prioritizes efficiency in claim processing to enhance the overall customer experience.

In a competitive market, how does Allstate compare to other insurance providers?

Allstate Indemnity Company distinguishes itself from competitors like State Farm, Geico, and Progressive by offering comprehensive coverage options, personalized service, and a reputation for reliability, making it a trusted partner in safeguarding assets and loved ones in a dynamic insurance landscape.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.