Allstate Northbrook Indemnity Company Review (2026)

Discover the world of protection and peace of mind with Allstate Northbrook Indemnity Company, a leading insurance provider offering a comprehensive range of coverage options, from auto and home to renters and life insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the world of protection and peace of mind with Allstate Northbrook Indemnity Company. This comprehensive article delves into the diverse spectrum of insurance coverage offered by Allstate, encompassing auto, home, renters, and life insurance.

From its A.M. Best rating of A+ to its commitment to customer satisfaction, Allstate shines as a reliable partner in safeguarding what matters most. The company’s competitive rates, efficient claims process, and an array of benefits, including safe driving and multi-policy discounts, set it apart in a crowded insurance landscape.

Whether you’re seeking tailored coverage, stellar customer service, or a range of discounts, Allstate Northbrook Indemnity Company stands ready to provide unwavering protection for your present and future.

allstate Insurance Coverage Options

Allstate Northbrook Indemnity Company offers a diverse range of coverage options to ensure that you’re prepared for various life situations. Their commitment to comprehensive protection goes beyond the basics, providing you with peace of mind and security. Here are the coverage options they offer:

- Auto insurance: Allstate’s auto insurance policies encompass a wide spectrum of coverage, including liability, collision, and comprehensive coverage (read our “Allstate Auto Insurance Review” for more information). They also offer coverage for uninsured/underinsured motorists, medical payments, and personal injury protection.

- Home insurance: Protecting your home and belongings is paramount, and Allstate’s home insurance covers everything from structural damage caused by fire, natural disasters, or accidents to personal property protection (read our “Allstate Homeowners Insurance Review” for more information). Additional coverage options include dwelling protection, personal liability coverage, and coverage for other structures on your property.

- Renters insurance: Even if you’re renting, safeguarding your possessions is crucial. Allstate’s renters insurance provides coverage for personal belongings, liability protection, and additional living expenses if you’re displaced due to a covered event. This coverage ensures that your lifestyle remains uninterrupted.

- Life insurance: Planning for the future is about taking care of your loved ones. Allstate’s life insurance policies offer different options, such as term life, whole life, and universal life insurance, providing financial security to your family in the event of your passing.

- Specialized policies: Allstate goes beyond the ordinary, offering specialized policies like flood insurance to protect against natural disasters, identity theft protection for your personal information, and umbrella insurance to provide an extra layer of liability coverage beyond standard policies.

- Business insurance: For business owners, Allstate offers business insurance coverage to protect against property damage, liability, and other business-related risks. This coverage helps ensure that your business remains resilient in the face of unexpected challenges.

- Motorcycle, boat, and RV insurance: Allstate also provides coverage options for your recreational vehicles, including motorcycles, boats, and RVs. These policies help protect your investments and ensure you’re covered while enjoying your leisure time.

With these comprehensive coverage options, Allstate Northbrook Indemnity Company ensures that you have the right protection for every aspect of your life. Whether you’re a homeowner, renter, driver, or business owner, their versatile policies offer the security and peace of mind you deserve.

Read more:

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

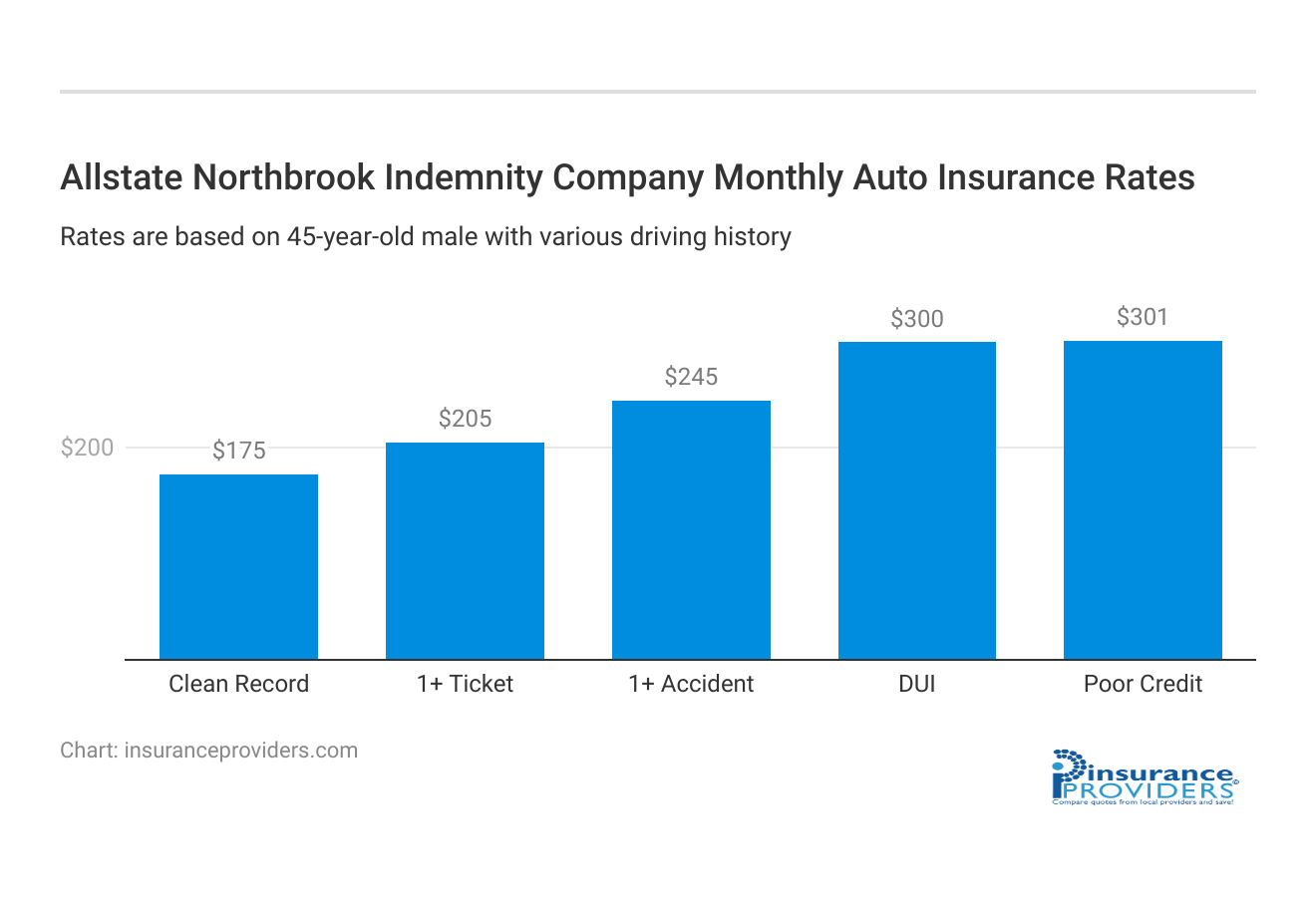

allstate Insurance Rates Breakdown

| Driver Profile | Allstate Northbrook Indemnity Company | National Average |

|---|---|---|

| Clean Record | $175 | $119 |

| 1+ Ticket | $205 | $147 |

| 1+ Accident | $245 | $173 |

| DUI | $300 | $209 |

| Poor Credit | $301 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

allstate Discounts Available

| Discount | Allstate Northbrook Indemnity Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 20% |

| Paperless | 8% |

| Safe Driver | 25% |

| Senior Driver | 10% |

Allstate Northbrook Indemnity Company values responsible behavior and offers a range of benefits and discounts that can help you save on your insurance premiums. These incentives are designed to reward good driving habits, encourage policy bundling, and provide financial relief. Here are the notable discounts they offer:

- Safe driving discount: Allstate rewards safe drivers with discounts for maintaining a clean driving record and practicing safe driving habits.

- Multi-policy discount: If you choose to bundle multiple insurance policies with Allstate, such as auto and home insurance, you can enjoy a discount on both policies.

- Safe driver bonus: Allstate offers a bonus for safe drivers who maintain a record of safe driving without any accidents or violations.

- Good student discount: If you’re a student who maintains good grades, you can qualify for a discount on your auto insurance policy.

- Anti-theft device discount: Installing anti-theft devices in your vehicle can make you eligible for a discount on your auto insurance premium.

- Responsible payment discount: Setting up automatic payments or paying your premium in full can lead to additional savings.

- Early signing discount: By signing up for a new policy with Allstate before your current one expires, you can receive a discount.

- Paperless billing discount: Opting for paperless billing and electronic communication can lead to a discount on your premiums.

- New car discount: Insuring a new car with Allstate may qualify you for a discount due to the vehicle’s advanced safety features.

- Full payment discount: Paying your entire annual premium upfront may result in a discount on your policy.

These discounts reflect Allstate’s commitment to providing affordable coverage options and acknowledging responsible behavior. By taking advantage of these incentives, you not only save money but also demonstrate your commitment to safe driving and responsible insurance practices.

How allstate Ranks Among Providers

Allstate Northbrook Indemnity Company operates in a competitive landscape where several notable insurance companies vie for customers’ attention. While Allstate stands out for its comprehensive coverage options and reliable customer service, it’s essential to consider its main competitors in the industry:

- State Farm: State Farm is one of the largest and most well-known insurance providers in the United States. Like Allstate, State Farm offers a wide range of insurance options, including auto, home, renters, and life insurance. State Farm is known for its extensive network of agents and strong customer service.

- Geico: Geico is renowned for its catchy advertising campaigns and competitive rates. The company excels in providing online services and streamlined quote processes, making it a popular choice for tech-savvy customers seeking quick insurance solutions.

- Progressive: Progressive is recognized for its innovative approach to insurance, offering features like usage-based insurance and SnapShot®. The company appeals to customers looking for personalized coverage and the ability to tailor their policies based on their driving habits.

- Liberty Mutual: Liberty Mutual offers a wide range of insurance options, including auto, home, renters, and life insurance. The company focuses on providing customizable coverage and offers unique add-ons to enhance policies, appealing to those seeking tailored protection.

- USAA (for military members and their families): USAA caters exclusively to military members, veterans, and their families, providing specialized insurance coverage and financial services. The company’s commitment to its unique customer base makes it a strong competitor in the industry. (For more information, read our “Top Auto Insurance Providers for Veteran“).

These competitors, among others, challenge Allstate Northbrook Indemnity Company by offering diverse coverage options, competitive rates, and distinctive features.

Allstate’s strengths lie in its comprehensive range of coverage, efficient claims process, and dedication to customer satisfaction. As consumers weigh their options, understanding the competitive landscape helps them make informed decisions about their insurance needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate Northbrook Indemnity Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Allstate Northbrook Indemnity Company offers multiple convenient options for filing insurance claims. Policyholders can choose to file a claim online through the company’s user-friendly web portal, providing a hassle-free and efficient way to initiate the claims process.

Additionally, they can opt to file a claim over the phone, speaking directly with a claims representative who can guide them through the process step by step. For those who prefer mobile solutions, Allstate offers a mobile app that allows policyholders to submit claims and access other insurance-related features on their smartphones.

This flexibility in filing options caters to the diverse preferences of their customers, making it easier to navigate the claims process.

Average Claim Processing Time

While the specific claim processing time may vary depending on the nature and complexity of the claim, Allstate Northbrook Indemnity Company is known for its efficiency in handling claims. They prioritize swift resolutions to ensure that policyholders receive the support they need promptly.

To get an accurate estimate of the average claim processing time for a specific claim, policyholders can reach out to the claims department or check their online account for updates.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance in handling claims. Allstate Northbrook Indemnity Company has garnered a reputation for its commitment to customer satisfaction in this regard.

While individual experiences may vary, many policyholders have expressed satisfaction with the company’s claim resolutions and payouts. Positive reviews highlight Allstate’s dedication to providing fair and timely compensation to policyholders when they need it most.

To gauge customer feedback more comprehensively, potential policyholders can explore online reviews and testimonials from Allstate’s existing customers.

Allstate Northbrook Indemnity Company Digital and Technological Features

Mobile App Features and Functionality

Allstate Northbrook Indemnity Company offers a feature-rich mobile app that empowers policyholders with convenient access to their insurance information. The app provides functionality for policy management, allowing users to view and update their coverage, pay premiums, and access policy documents on the go.

Moreover, the app includes features for filing claims, which streamlines the claims process by enabling users to submit necessary information and photos directly from their smartphones. Additionally, the mobile app offers tools for roadside assistance, making it a comprehensive solution for policyholders’ insurance needs.

Online Account Management Capabilities

Policyholders with Allstate can take advantage of robust online account management capabilities. Through the company’s website, users can log in to their accounts and access a wide range of features. These include viewing policy details, making payments, tracking claims, and updating personal information.

The online account management platform is designed for ease of use, ensuring that policyholders have the flexibility to manage their insurance policies and information online whenever it’s convenient for them.

Digital Tools and Resources

In addition to the mobile app and online account management, Allstate Northbrook Indemnity Company provides policyholders with a variety of digital tools and resources to enhance their insurance experience. These resources may include educational content, such as articles and videos, to help customers better understand insurance-related topics.

Furthermore, Allstate may offer calculators and tools to assist users in estimating coverage needs and premiums. These digital resources contribute to Allstate’s commitment to empowering policyholders with the information they need to make informed decisions about their insurance coverage.

Frequently Asked Questions

Is Allstate Northbrook Indemnity Company only known for auto insurance?

No, Allstate offers a diverse range of insurance policies, including auto, home, renters, and life insurance, among others. Their coverage options cater to various aspects of your life.

Can I customize my coverage with Allstate’s policies?

Absolutely. Allstate understands that each individual’s needs are unique. They allow you to tailor your coverage to your specific requirements, ensuring you’re not paying for anything you don’t need.

What benefits do safe drivers get from Allstate?

Allstate rewards safe drivers with discounts and benefits. By maintaining a clean driving record and practicing safe driving habits, you can enjoy reduced premiums and other incentives.

How can I save on my insurance premiums with Allstate?

Allstate provides a variety of discounts to help you save on your premiums. These include safe driving discounts, multi-policy discounts for bundling different insurance types, good student discounts, and more. Exploring their range of incentives can lead to significant savings.

What sets Allstate apart from other insurance companies?

Allstate’s dedication to customer satisfaction, diverse coverage options, and efficient claims process make it a standout choice in the insurance landscape. Their competitive rates, extensive discounts, and commitment to personalized service contribute to their reputation.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.