American Benefit Life Insurance Company: Customer Ratings & Reviews [2026]

Explore the comprehensive coverage options offered by American Benefit Life Insurance Company as we delve into its product range, customer ratings, and insightful reviews to guide you in making informed and confident decisions for securing your future.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated April 2024

American Benefit Life Insurance Company is a subsidiary of Liberty Bankers Life Insurance Company, a Texas-based insurance company that provides a range of life insurance and annuity products to customers in 49 states in the US.

The company was established in 1963 and has grown to become a leading provider of life insurance products to individuals and families. American Benefit Life Insurance Company offers a range of life insurance products, including term life insurance, whole life insurance, and final expense insurance.

The company’s products are designed to meet the diverse needs of its customers and offer flexible coverage options, competitive pricing, and exceptional customer service.

American Benefit Life Insurance Company Insurance Coverage Options

American Benefit Life Insurance Company offers a variety of coverage options to meet the diverse needs of its customers. These coverage options include:

- Term life insurance: This is the most affordable type of life insurance offered by American Benefit Life Insurance Company, and it provides coverage for a specific period of time, typically 10-30 years.

- Whole life insurance: This type of life insurance offers permanent coverage and builds cash value over time. It’s more expensive than term life insurance but offers lifelong protection.

- Universal life insurance: This type of life insurance offers flexible premiums and death benefits, as well as a cash value component that grows over time.

- Final expense insurance: This type of insurance provides coverage for funeral expenses and other end-of-life costs.

- Accidental death insurance: This type of insurance provides coverage in the event of accidental death, such as a car accident or workplace accident.

Each of these coverage options is designed to meet different needs and budgets, so it’s important to consider your financial situation and the needs of your loved ones when choosing a policy. American Benefit Life Insurance Company offers customizable coverage options to ensure that each policyholder gets the right coverage for their unique situation.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Benefit Life Insurance Company Insurance Rates Breakdown

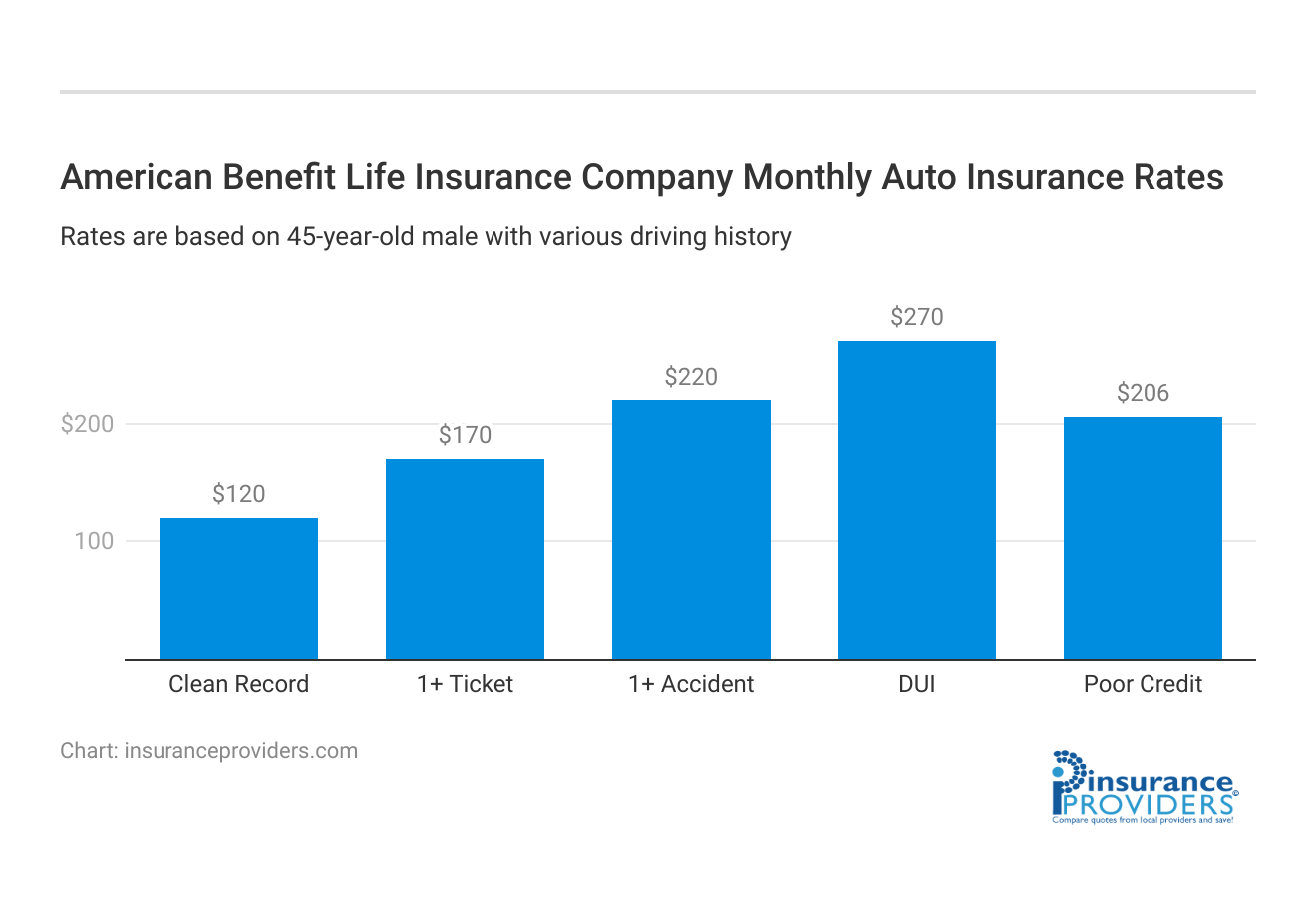

| Driver Profile | American Benefit Life | National Average |

|---|---|---|

| Clean Record | $120 | $119 |

| 1+ Ticket | $170 | $147 |

| 1+ Accident | $220 | $173 |

| DUI | $270 | $209 |

| Poor Credit | $206 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

American Benefit Life Insurance Company Discounts Available

| Discount | American Benefit |

|---|---|

| Anti Theft | 13% |

| Good Student | 9% |

| Low Mileage | 17% |

| Paperless | 4% |

| Safe Driver | 20% |

| Senior Driver | 3% |

American Benefit Life Insurance Company offers various discounts to its customers to help them save money on their life insurance premiums. These discounts include:

- Multi-policy discount: If you have more than one policy with American Benefit Life Insurance Company, you may qualify for a discount on your premiums.

- Non-smoker discount: If you are a non-smoker, you may be eligible for a discount on your life insurance premiums.

- Healthy lifestyle discount: If you live a healthy lifestyle, such as maintaining a healthy weight, exercising regularly, and eating a balanced diet, you may be eligible for a discount on your premiums.

- Safe driving discount: If you have a good driving record, you may be eligible for a discount on your life insurance premiums.

These discounts can help policyholders save money on their life insurance premiums, making it more affordable to protect their loved ones in the event of an unexpected tragedy. It’s important to note that the availability and amount of discounts may vary by state and policy type, so it’s best to check with the company directly or with an insurance agent to see which discounts you may be eligible for.

How American Benefit Life Insurance Company Ranks Among Providers

American Benefit Life Insurance Company stands as a notable provider in the life insurance market, offering diverse coverage options and competitive rates. However, prospective policyholders often benefit from exploring alternatives to ensure they find the best fit for their unique needs. Here are some key competitors that individuals may consider when navigating the life insurance landscape:

- Liberty Bankers Life Insurance Company: As the parent company of American Benefit Life Insurance, Liberty Bankers offers a range of life insurance and annuity products, providing an alternative for those seeking a similar corporate background.

- Prudential Financial: A well-established player in the insurance industry, Prudential offers a comprehensive suite of life insurance products, including term life, whole life, and universal life policies.

- Metlife: Known for its financial stability and global presence, Metlife provides a diverse range of life insurance solutions, along with other financial services, appealing to those looking for a one-stop shop.

- New York Life Insurance Company: With a reputation for financial strength and a focus on policyholder dividends, New York Life is a mutual company offering a variety of life insurance options and investment products.

- Northwestern Mutual: Renowned for its financial planning services, Northwestern Mutual provides life insurance products and emphasizes a holistic approach to financial security.

While American Benefit Life Insurance Company presents compelling options, exploring the offerings from these competitors ensures that individuals can make well-informed decisions tailored to their specific requirements.

Read more:

- Liberty Bankers life insurance: Customer Ratings & Reviews

- New York Life Insurance and Annuity Corporation Review

Frequently Asked Questions

How long has American Benefit Life Insurance Company been in operation?

American Benefit Life Insurance Company was established in 1963 and has since grown to become a leading provider of life insurance products, offering reliable coverage to individuals and families for nearly six decades.

What types of life insurance does American Benefit Life Insurance Company offer?

American Benefit Life Insurance Company provides a range of life insurance products, including term life insurance, whole life insurance, and final expense insurance, catering to diverse needs with flexible coverage options, competitive pricing, and exceptional customer service.

Can I customize my life insurance coverage with American Benefit Life Insurance Company?

Yes, American Benefit Life Insurance Company offers customizable coverage options, allowing policyholders to tailor their insurance plans to specific needs and preferences, ensuring a personalized approach to protection.

What discounts are available to policyholders with American Benefit Life Insurance Company?

American Benefit Life Insurance Company offers various discounts to help policyholders save on premiums. These discounts may include multi-policy discounts, good health discounts, and other savings opportunities. Availability and amounts may vary by state and policy type.

How does American Benefit Life Insurance Company compare to other life insurance providers?

American Benefit Life Insurance Company competes with other well-known providers, such as Liberty Bankers Life Insurance Company and others. It’s advisable to compare policies, rates, and reputations across multiple companies to make an informed decision on your life insurance provider.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.