American Industries Life Insurance Company: Customer Ratings & Reviews [2026]

Secure your family's financial future with American Industries Life Insurance Company, a trusted provider offering a range of coverage options tailored to diverse needs, accompanied by competitive rates and a commitment to helping you make informed coverage choices.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated April 2024

American Industries Life Insurance Company, a reputable provider of life insurance products. Begins with an overview of the types of insurance offered by the company, including term life insurance and permanent life insurance. It then delves into the company’s history and mission, along with information on the states where their services are offered. The article also covers the cost of the company’s products, discounts available to customers, and a summary of customer reviews. Finally, an FAQ section answers common questions about American Industries Life Insurance Company. Overall, this article is an informative and authoritative resource for anyone considering life insurance from this provider.

What You Should Know About American Industries Life Insurance Company

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Industries Life Insurance Company Insurance Coverage Options

American Industries Life Insurance Company offers a range of coverage options to fit the diverse needs of their customers. These include:

- Term life insurance: This type of policy provides coverage for a set period of time, such as 10, 20, or 30 years. Term life insurance is typically less expensive than permanent life insurance and can be a good option for those who need coverage for a specific period of time.

- Whole life insurance: This type of policy provides coverage for the entirety of the policyholder’s life, as long as premiums are paid. Whole life insurance typically has higher premiums than term life insurance but can build cash value over time.

- Universal life insurance: This type of policy provides flexible premiums and death benefits, allowing policyholders to adjust their coverage as needed. Universal life insurance can also build cash value over time.

- Variable life insurance: This type of policy allows policyholders to invest a portion of their premiums in various investment accounts, such as stocks or mutual funds. The cash value of the policy can grow or shrink depending on the performance of the investments.

- Final expense insurance: This type of policy provides coverage for end-of-life expenses, such as funeral costs and medical bills. Final expense insurance is typically less expensive than other types of life insurance and can be a good option for those who want to ensure their loved ones are not burdened with these costs.

Note that not all coverage options may be available in all states or for all policy types. To find out which options are available to you, contact American Industries Life Insurance Company directly.

Read more:

American Industries Life Insurance Company Insurance Rates Breakdown

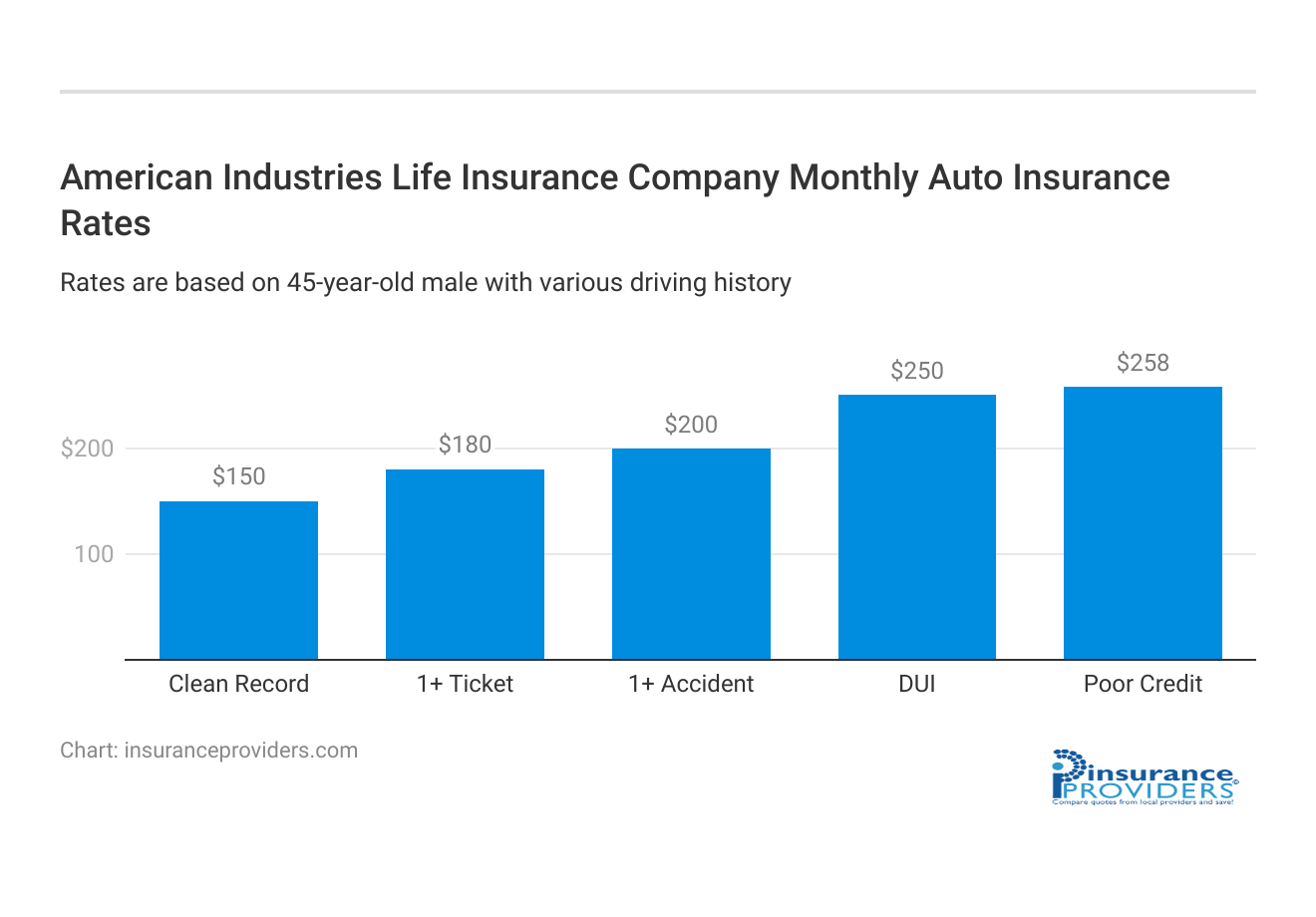

| Driver Profile | American Industries Life Insurance Company | National Average |

|---|---|---|

| Clean Record | $150 | $119 |

| 1+ Ticket | $180 | $147 |

| 1+ Accident | $200 | $173 |

| DUI | $250 | $209 |

| Poor Credit | $258 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

American Industries Life Insurance Company offers competitive rates for healthy individuals. The average monthly rate is calculated based on several factors, including age, gender, health condition, and the type of life insurance coverage selected.

American Industries Life Insurance Company Discounts Available

| Discount | American Industries Life Insurance Company |

|---|---|

| Anti Theft | 25% |

| Good Student | 20% |

| Low Mileage | 25% |

| Paperless | 9% |

| Safe Driver | 25% |

| Senior Driver | 10% |

American Industries Life Insurance Company offers several discounts to its customers, including:

- Multi-policy discount: Customers who have more than one policy with American Industries Life Insurance Company may be eligible for a discount on their premiums.

- Non-smoker discount: Customers who do not use tobacco products may qualify for a discount on their life insurance premiums.

- Healthy lifestyle discount: Customers who meet certain health criteria, such as having a healthy body mass index (BMI) or low cholesterol levels, may be eligible for a discount on their premiums.

- Safe occupation discount: Customers who work in low-risk occupations, such as teachers or office workers, may qualify for a discount on their life insurance premiums.

- Age-based discount: Customers who purchase a policy at a young age may qualify for a lower premium than those who wait until later in life.

Read more: Teachers Insurance Company: Customer Ratings & Reviews

Note that not all discounts may be available in all states or for all policy types. To find out which discounts you may be eligible for, contact American Industries Life Insurance Company directly.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How American Industries Life Insurance Company Ranks Among Providers

American Industries Life Insurance Company operates in a highly competitive industry, with several major players vying for market share. Some of the company’s main competitors include:

- Prudential Financial: One of the largest life insurance companies in the United States, Prudential offers a wide range of insurance and investment products.

- MetLife: Another large life insurance company, MetLife provides a variety of insurance and financial services to individuals and businesses.

- New York Life: This company is the largest mutual life insurance company in the United States, offering a range of insurance and investment products to its customers.

- State Farm: While best known for its auto and home insurance offerings, State Farm also provides life insurance coverage to its policyholders.

- Northwestern Mutual: One of the oldest and most respected life insurance companies in the United States, Northwestern Mutual offers a variety of insurance and financial products to its customers.

These companies and others like them compete with American Industries Life Insurance Company in terms of pricing, coverage options, customer service, and financial strength. To choose the best life insurance provider for your needs, it’s important to compare offerings from multiple companies and consider factors such as reputation, financial stability, and customer reviews.

Frequently Asked Questions

What types of life insurance does American Industries Life Insurance Company offer?

The company offers term life insurance, whole life insurance, universal life insurance, variable life insurance, and final expense insurance.

How can I get a quote for life insurance from American Industries Life Insurance Company?

You can request a quote directly from the company’s website or by contacting their customer service department.

Does American Industries Life Insurance Company offer any discounts on life insurance premiums?

Yes, the company offers several discounts, including a multi-policy discount, a safe driving discount, and a healthy lifestyle discount.

Can I change my beneficiaries on my life insurance policy with American Industries Life Insurance Company?

Yes, you can typically change your beneficiaries on your life insurance policy with American Industries Life Insurance Company. Contact them directly to learn more about the process.

Can I purchase life insurance from American Industries Life Insurance Company if I have existing health conditions?

American Industries Life Insurance Company may consider offering coverage to individuals with existing health conditions, depending on the specific condition and underwriting guidelines. Contact them directly to discuss your situation.

Does American Industries Life Insurance Company offer group life insurance plans for businesses?

American Industries Life Insurance Company may offer group life insurance plans for businesses. Contact them to learn more about their offerings for employers and employees.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.