American Public Life Ins Co Review (2025)

American Public Life Insurance Co., a stalwart in the insurance industry, emerges as a trusted shield against life's uncertainties, offering diverse coverage with transparency and financial stability, ensuring peace of mind despite minor interface improvements needed for online interactions.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the comprehensive coverage options provided by American Public Life Insurance Co., a trusted name in the insurance industry. With a diverse array of insurance policies, including life, health, auto, and home coverage, AP Life stands out for its transparent and customer-centric approach.

The company’s commitment to responsive claims support, customizable coverage plans, and strong financial stability ensures peace of mind for policyholders.

While limitations in coverage availability in certain regions and minor interface improvements for online account management are noted, AP Life’s competitive rates and discounts, combined with its commitment to customer satisfaction, make it a compelling choice for those seeking reliable and customizable insurance solutions.

American Public Life Insurance Co. Insurance Coverage Options

These coverage options encompass various aspects of life, health, property, and more. Here is a breakdown of the coverage options offered by the company:

- Life Insurance: American Public Life Insurance Co. offers a variety of life insurance options to provide financial security for you and your loved ones. Term Life Insurance offers coverage for a specific period, while Whole Life Insurance provides lifelong protection with a cash value component.

- Health Insurance: With a strong emphasis on health and well-being, American Public Life Insurance Co. offers comprehensive health insurance coverage.

- Auto Insurance: American Public Life Insurance Co. understands the importance of protecting your vehicle and yourself on the road. Their auto insurance coverage includes liability coverage, which helps cover damages to others in case of an accident.

- Home Insurance: Your home is your haven, and American Public Life Insurance Co. offers home insurance policies to safeguard it. Dwelling coverage protects the structure of your home, while personal property coverage ensures your belongings are covered in case of damage or theft.

Each of these coverage options is tailored to meet specific needs and situations, ensuring that policyholders have access to comprehensive protection in various aspects of their lives.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

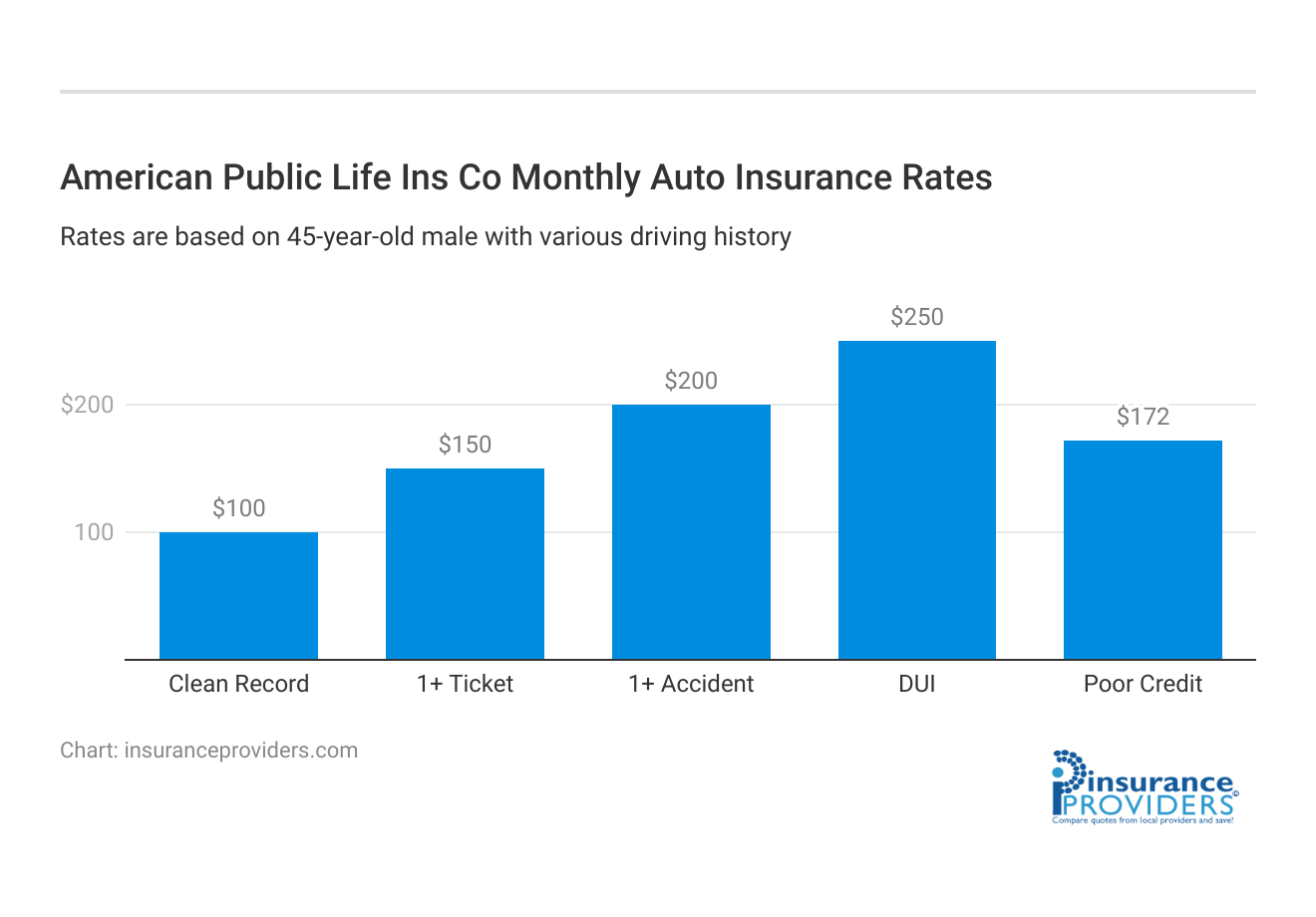

American Public Life Insurance Co. Insurance Rates Breakdown

| Driver Profile | American Public Life Ins Co | National Average |

|---|---|---|

| Clean Record | $100 | $119 |

| 1+ Ticket | $150 | $147 |

| 1+ Accident | $200 | $173 |

| DUI | $250 | $209 |

| Poor Credit | $172 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

American Public Life Insurance Co. Discounts Available

| Discount | American Public |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 15% |

| Paperless | 10% |

| Safe Driver | 20% |

| Senior Driver | 10% |

These discounts are designed to reward responsible behavior, specific affiliations, and other factors that contribute to a policyholder’s risk profile. Here are some of the discounts that the company provides:

- Safe Driver Discount: Policyholders who maintain a clean driving record and avoid accidents can qualify for a safe driver discount, reflecting their responsible behavior on the road.

- Multi-Policy Discount: Customers who choose to bundle multiple insurance policies, such as auto and home insurance, with American Public Life Insurance Co. can benefit from a multi-policy discount, reducing their overall insurance costs.

- Good Student Discount: Students who excel academically can earn a good student discount, acknowledging their dedication to their studies and responsible behavior.

- Multi-Vehicle Discount: Families or individuals with multiple vehicles can enjoy a discount when insuring more than one vehicle with the company.

- Affinity Group Discount: Members of certain professional organizations, alumni associations, or other affiliated groups may qualify for affinity group discounts, rewarding their association with recognized organizations.

- Safety Features Discount: Vehicles equipped with advanced safety features such as anti-lock brakes, airbags, and anti-theft devices may be eligible for a safety features discount.

- Pay-in-Full Discount: Customers who choose to pay their annual premium in full upfront can benefit from a pay-in-full discount, offering savings compared to paying in installments.

- Renewal Discount: Policyholders who renew their insurance policies with American Public Life Insurance Co. without any lapses may be eligible for a renewal discount, incentivizing loyalty.

These discounts provide opportunities for policyholders to reduce their insurance costs while maintaining the same level of coverage.

How American Public Life Insurance Co. Ranks Among Providers

American Public Life Insurance Co. operates in a highly competitive insurance industry, where numerous companies vying for customers’ attention. To help you understand where American Public Life Insurance Co. stands among its peers, let’s take a closer look at some of its main competitors.

- State Farm Insurance: State Farm is one of the largest insurance providers in the United States, offering a wide range of insurance products, including life, auto, home, and health insurance. The company is known for its extensive network of agents and a strong presence in the market.

- Allstate Insurance: Allstate is another major player in the insurance industry, providing a comprehensive suite of insurance products. They are recognized for their innovative insurance tools and technologies, aimed at simplifying the customer experience.

- Geico: Geico specializes in auto insurance and is well-known for its memorable advertising campaigns. The company is lauded for its competitive auto insurance rates and user-friendly online services.

- Progressive Insurance: Progressive has carved out a niche for itself by offering innovative auto insurance solutions, including usage-based insurance. They are often praised for their forward-thinking approach to insurance.

- Prudential Financial: Prudential is a prominent life insurance provider with a global presence. They offer a wide array of life insurance and investment products, catering to individuals’ long-term financial planning needs.

American Public Life Insurance Co. faces stiff competition from these major insurance providers, each with its own strengths and unique offerings. When choosing an insurance provider, consumers must compare the services, rates, and customer satisfaction levels offered by these companies to find the best fit for their insurance needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Public Life Ins Co Claims Process

Ease of Filing a Claim

American Public Life Insurance Company (APLIC) offers a user-friendly claims filing process that caters to the convenience of its policyholders. Policyholders have multiple options when it comes to filing a claim.

They can file a claim online through the company’s official website, over the phone with the assistance of a dedicated claims representative, or even via mobile apps designed specifically for this purpose. This flexibility ensures that policyholders can choose the method that suits them best, whether they prefer the convenience of digital platforms or prefer to speak with a live representative.

Average Claim Processing Time

One of the key factors that policyholders consider when choosing an insurance provider is the speed and efficiency of the claims processing. APLIC takes pride in its efficient claims processing system.

While the exact processing time may vary depending on the complexity of the claim, APLIC strives to process claims promptly and keep its policyholders informed throughout the process. On average, policyholders can expect a reasonably quick turnaround time, which is crucial during times of need.

Customer Feedback on Claim Resolutions and Payouts

The ultimate test of an insurance company’s claims process lies in the satisfaction of its policyholders. APLIC has garnered positive feedback from many of its policyholders regarding the fairness and timeliness of claim resolutions and payouts.

Customer reviews and testimonials often highlight the company’s commitment to addressing claims fairly and promptly. This reputation for reliable claim resolutions contributes to the overall trust and satisfaction levels among APLIC’s policyholders.

American Public Life Ins Co Digital and Technological Features

Mobile App Features and Functionality

APLIC understands the importance of digital accessibility in today’s fast-paced world. The company offers a feature-rich mobile app that allows policyholders to manage their insurance policies on the go.

The app provides functionalities such as policy access, premium payments, claims filing, and even policy document storage. With a user-friendly interface and robust features, the APLIC mobile app empowers policyholders to have their insurance information at their fingertips.

Online Account Management Capabilities

For those who prefer managing their insurance policies through a web browser, APLIC offers comprehensive online account management capabilities.

Policyholders can log in to their accounts on the company’s website to access policy details, make premium payments, update personal information, and more. This online platform enhances the overall customer experience by providing a convenient and secure way to interact with APLIC’s services.

Digital Tools and Resources

In addition to its mobile app and online account management, APLIC provides various digital tools and resources to assist policyholders in understanding their insurance coverage better.

These resources may include educational articles, calculators for estimating coverage needs, and FAQs to address common queries. APLIC’s commitment to leveraging technology to support and educate its policyholders reflects its dedication to providing a modern and customer-centric insurance experience.

Frequently Asked Questions

How do I determine the right life insurance coverage for my family’s needs?

Understanding your family’s financial goals and considering factors like outstanding debts, future expenses, and long-term aspirations can help you choose the appropriate life insurance coverage.

Can I customize my health insurance plan to include specific coverage?

Absolutely! AP Life offers customizable health insurance plans that allow you to tailor coverage according to your medical needs and preferences.

What factors affect the cost of auto insurance premiums?

The cost of auto insurance premiums can be influenced by factors such as your driving history, the type of vehicle, your location, and the coverage options you choose.

How does home insurance protect against natural disasters?

Home insurance from AP Life can provide coverage against damages caused by natural disasters, such as earthquakes, hurricanes, and wildfires, depending on the policy terms.

How quickly can I expect my insurance claim to be processed?

AP Life is committed to a prompt claims process. The timeline for claim processing can vary depending on the complexity of the claim, but they strive to ensure a swift resolution to your satisfaction.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.