American Safety Insurance Company Review (2026)

Explore American Safety Insurance Company's commitment to tailored solutions, customer-centric practices, and excellence in policies and claims processing, highlighting its role as a beacon of assurance in the evolving insurance landscape.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the comprehensive world of American Safety Insurance Company in this in-depth guide. As a stalwart in the insurance landscape, American Safety offers an array of policies designed to safeguard what matters most. From auto and home insurance to health and life coverage, their diverse options cater to various needs.

This article explores the company’s commitment to excellence, prompt claims processing, and customizable policies that align with individual requirements. With a focus on customer well-being and a reputation for reliability, American Safety shines as a beacon of assurance in an uncertain world.

Whether you’re seeking financial security, peace of mind, or a partner that prioritizes your protection, this guide provides insights into the multifaceted world of American Safety Insurance Company.

What You Should Know About American Safety Insurance Company

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Safety Insurance Company Insurance Coverage Options

American Safety Insurance Company offers a diverse spectrum of coverage options to cater to a wide range of needs. These coverage options include:

- Auto Insurance: American Safety’s auto insurance provides protection for drivers, encompassing liability coverage, comprehensive coverage, collision coverage, and more. Whether you’re looking to meet legal requirements or ensure financial security in case of accidents, their auto insurance policies offer comprehensive solutions.

- Home Insurance: Protecting your home is paramount, and American Safety’s home insurance policies are designed to safeguard your property from unforeseen events like natural disasters, theft, and more. With coverage for both the structure and contents of your home, their policies offer peace of mind.

- Health Insurance: Prioritizing your health is easier with American Safety’s health insurance offerings. These policies provide access to quality medical care, helping to cover medical expenses and reducing the financial burden of unexpected healthcare costs.

- Life Insurance: Planning for the future is a responsible step, and American Safety’s life insurance policies ensure that your loved ones are financially secure in the event of your passing. With various types of life insurance, including term life and whole life, you can choose the coverage that aligns with your long-term goals.

Each of these coverage options is designed to provide tailored solutions, ensuring that you have the necessary protection and support when you need it most.

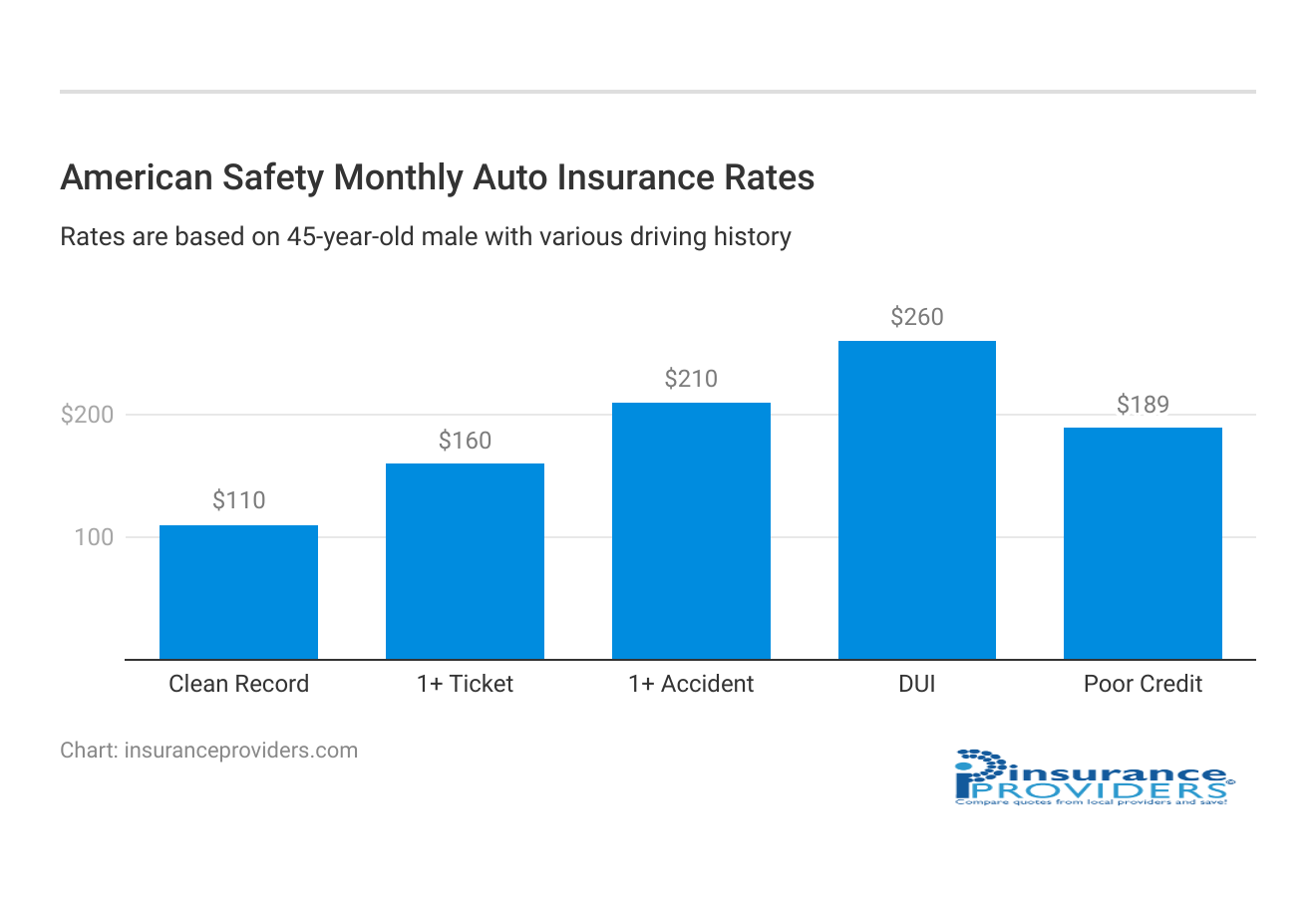

American Safety Insurance Company Insurance Rates Breakdown

| Driver Profile | American Safety | National Average |

|---|---|---|

| Clean Record | $110 | $119 |

| 1+ Ticket | $160 | $147 |

| 1+ Accident | $210 | $173 |

| DUI | $260 | $209 |

| Poor Credit | $189 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Understanding the landscape of insurance costs is crucial for informed decision-making. American Safety Insurance Company, with its commitment to providing comprehensive coverage, is a valuable resource for those seeking financial protection. Grasping the factors that influence insurance costs is essential to tailor coverage to individual needs.

Factors Influencing Insurance Costs:

- Coverage Type: The type of insurance coverage chosen, whether it’s auto, home, health, or life, directly impacts the overall cost.

- Policy Limits: Higher coverage limits typically result in increased premiums but offer more extensive protection in return.

- Deductibles: Opting for a higher deductible can lower premiums, but it also means paying more out-of-pocket in the event of a claim.

- Personal Factors: Individual characteristics such as age, gender, and health status can influence insurance costs.

- Driving Record: For auto insurance, a clean driving record often leads to lower premiums, while accidents or violations may increase costs.

- Location: The geographical area, including factors like crime rates and weather patterns, can affect home and auto insurance rates.

- Credit Score: In many cases, a higher credit score can result in lower insurance premiums.

- Policy Add-Ons: Additional coverage options, such as riders or endorsements, contribute to the overall cost.

- Discounts: Taking advantage of available discounts, such as bundling policies or maintaining a good driving record, can reduce premiums.

- Vehicle or Property Type: The make and model of a vehicle or the type of property being insured play a role in determining costs.

Grasping these factors ensures a comprehensive understanding of the elements influencing insurance expenses. American Safety Insurance Company, with its dedication to transparent and customizable policies, empowers individuals to make well-informed choices, aligning coverage with both needs and budgetary considerations.

American Safety Insurance Company Discounts Available

| Discount | American Safety |

|---|---|

| Anti Theft | 8% |

| Good Student | 25% |

| Low Mileage | 15% |

| Paperless | 14% |

| Safe Driver | 30% |

| Senior Driver | 20% |

These discounts are designed to make comprehensive coverage more affordable without compromising on the quality of protection. Here are some of the notable discounts you can take advantage of:

- Multi-Policy Discount: American Safety rewards customers who bundle multiple insurance policies, such as auto and home insurance, with significant discounts on their premiums.

- Safe Driver Discount: If you have a clean driving record and have demonstrated safe driving habits over time, you can qualify for a safe driver discount, reflecting your responsible behavior on the road.

- Good Student Discount: Students who excel academically can benefit from this discount, which acknowledges their dedication to their studies and responsible behavior.

- Safety Features Discount: If your vehicle is equipped with safety features such as anti-lock brakes, airbags, and anti-theft devices, you may be eligible for this discount, as these features contribute to safer driving and reduced risks.

- Home Security Discount: Homeowners who have implemented security measures in their homes, such as alarm systems and smoke detectors, can enjoy reduced home insurance premiums.

- Loyalty Discount: American Safety values long-term relationships with its customers. Policyholders who have been with the company for an extended period may qualify for a loyalty discount as a token of appreciation.

- Pay-in-Full Discount: Opting to pay your annual premium in full, rather than through installments, can lead to additional savings on your insurance costs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How American Safety Insurance Company Ranks Among Providers

American Safety Insurance Company operates in a competitive landscape within the insurance industry, where several notable players vie for the attention of insurance seekers. Some of the company’s main competitors include:

- State Farm: As one of the largest and most well-known insurance providers in the United States, State Farm offers a wide range of insurance options, including auto, home, health, and life insurance. With a strong emphasis on customer service and a vast network of agents, State Farm poses significant competition to American Safety.

- Geico: Known for its catchy advertising and competitive pricing, Geico is a major player in the auto insurance sector. The company is celebrated for its user-friendly online platform and the ability to offer quick quotes, which can be attractive to customers seeking convenience.

- Allstate: Another prominent insurance provider, Allstate offers comprehensive coverage options, including auto, home, life, and more. Known for its “You’re in Good Hands” slogan, Allstate emphasizes its commitment to customer protection and satisfaction.

- Progressive: Progressive has made a name for itself by offering innovative insurance solutions, including its well-known usage-based insurance program. The company’s user-friendly digital experience and focus on providing customizable coverage options make it a formidable competitor.

- Nationwide: Nationwide boasts a wide array of insurance offerings, including auto, home, and life insurance. The company’s emphasis on personalized service and its strong financial stability contribute to its competitive standing.

These competitors, along with others in the industry, are constantly evolving and adapting to meet the changing needs of insurance consumers.

American Safety Insurance Company Claims Process

Ease of Filing a Claim

American Safety Insurance Company offers multiple convenient ways for policyholders to file insurance claims. You can file a claim online through their user-friendly website, over the phone by contacting their dedicated claims department, or even through their mobile app. This variety of options ensures that policyholders can choose the method that best suits their preferences and needs.

Average Claim Processing Time

One of the key factors that customers often consider when evaluating an insurance company is the speed at which claims are processed. American Safety Insurance Company is committed to providing efficient claim processing services.

While specific processing times can vary depending on the complexity of the claim and other factors, many policyholders report that their claims are handled promptly. However, it’s essential to note that individual experiences may vary, and some claims may take longer to process than others.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance in handling claims. American Safety Insurance Company has received mixed feedback regarding claim resolutions and payouts.

While some policyholders have expressed satisfaction with the fairness and efficiency of the claim settlements, others have reported challenges in obtaining the desired outcomes. It’s essential for potential policyholders to research and consider customer reviews and ratings to make an informed decision about their insurance provider.

American Safety Insurance Company Digital and Technological Features

Mobile App Features and Functionality

American Safety Insurance Company offers a feature-rich mobile app that enhances the convenience of managing your insurance policies.

The app allows policyholders to access their policy information, file claims, and even make payments directly from their mobile devices. Additionally, it provides features like policy document storage, digital ID cards, and notifications, making it a valuable tool for policyholders on the go.

Online Account Management Capabilities

Policyholders can efficiently manage their insurance policies through American Safety Insurance Company’s online account management platform.

This platform enables users to review policy details, update personal information, make premium payments, and track the status of their claims. The user-friendly interface ensures that policyholders can easily navigate and perform essential tasks within their accounts.

Digital Tools and Resources

To further assist policyholders in managing their insurance needs, American Safety Insurance Company offers a range of digital tools and resources.

These include online calculators to estimate coverage needs, informative articles and FAQs to address common insurance queries, and resources for risk management and loss prevention. These digital resources aim to empower policyholders with the knowledge and tools to make informed decisions about their insurance coverage and risk mitigation strategies.

Frequently Asked Questions

What sets American Safety’s insurance apart from competitors?

American Safety distinguishes itself through its personalized service, comprehensive coverage, and hassle-free claims process.

Can I customize my insurance policy to suit my specific needs?

Absolutely. American Safety offers customizable policies that can be tailored to match your unique requirements.

How do I file a claim in case of an unforeseen event?

Filing a claim is straightforward. Contact American Safety’s claims team, and they will guide you through the process step by step.

Are there any discounts available for multiple insurance policies?

Yes, American Safety provides discounts for bundling multiple insurance policies, allowing you to save while securing comprehensive coverage.

What’s the best way to reach customer support for inquiries?

You can easily reach American Safety’s customer support through their website or by calling their toll-free helpline. Their dedicated team is ready to assist you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.