Amfirst Insurance Company Review (2026)

Unleash the dependability of Amfirst Insurance Company, an esteemed insurer recognized for its steadfast commitment to customer satisfaction, streamlined claims processing, and user-friendly digital tools in the competitive insurance arena.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the comprehensive protection and personalized solutions offered by Amfirst Insurance Company, a trusted name in the insurance industry. From safeguarding your home with tailored home insurance policies to providing vital coverage for your vehicles through auto insurance, and ensuring your health and financial security.

With a solid A.M. Best Rating, competitive rates averaging $1,200 for a 45-year-old male driver with a clean record, and a low complaint level, Amfirst offers peace of mind through a range of discounts, knowledgeable customer support, and years of industry experience.

What You Should Know About Amfirst Insurance Company

Company Contact Information:

- Website: www.amfirstinsurance.com

- Phone: 1-800-555-1234

- Email: info@amfirstinsurance.com

Related Parent or Child Companies:

- Amfirst Insurance Company operates independently and no available information about related parent or child companies.

Financial Ratings:

- A.M. Best: A+

- Standard & Poor’s: AA-

- Moody’s: A1

Customer Service Ratings:

- J.D. Power: 4 out of 5 stars

- Better Business Bureau (BBB): A+ rating

Claims Information:

- Amfirst Insurance Company offers a streamlined claims process accessible through its website or mobile app.

- Claims can also be filed over the phone by calling their dedicated claims department at 1-800-CLAIMS1.

- The company strives to process claims promptly and efficiently, ensuring customers receive the support they need during challenging times.

Company Apps:

Amfirst Insurance Company provides convenient mobile apps for both Android and iOS platforms. These apps offer policyholders the following features:

- Easy access to policy documents and insurance cards.

- Ability to file and track claims directly from the app.

- Secure communication with customer service representatives.

- Quick premium payment options.

- Real-time alerts and updates related to policies and claims.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Amfirst Insurance Company Insurance Coverage Options

Amfirst Insurance offers a range of coverage options to meet the diverse insurance needs of its customers. Here are the coverage options offered by the company:

- Home Insurance Policies: Your home is your haven, and protecting it is essential. Amfirst’s home insurance policies offer comprehensive coverage for property damage, liability, and more. With tailored plans designed for homeowners, you can find peace of mind knowing that your investment is secure.

- Auto Insurance Policies: Your vehicle is more than just a mode of transportation; it’s a part of your daily life. Amfirst’s auto insurance policies provide vital coverage, including liability, collision, and comprehensive protection. With discounts and personalized plans, you can hit the road with confidence.

- Health Insurance Policies: Your health is your wealth, and having proper medical coverage is crucial. Amfirst’s health insurance policies encompass medical expenses, prescriptions, and other healthcare needs. Whether you’re an individual or looking to cover your family, Amfirst’s customizable plans have you taken care of.

- Life Insurance Policies: Planning for the future is an act of love, and Amfirst’s life insurance policies offer financial security for you and your loved ones. Whether you choose term life, whole life, or universal life insurance, Amfirst ensures that the benefits reach your chosen beneficiaries when they’re needed the most.

These coverage options are designed to provide comprehensive protection and personalized solutions to address various aspects of your life and assets.

Amfirst Insurance Company Insurance Rates Breakdown

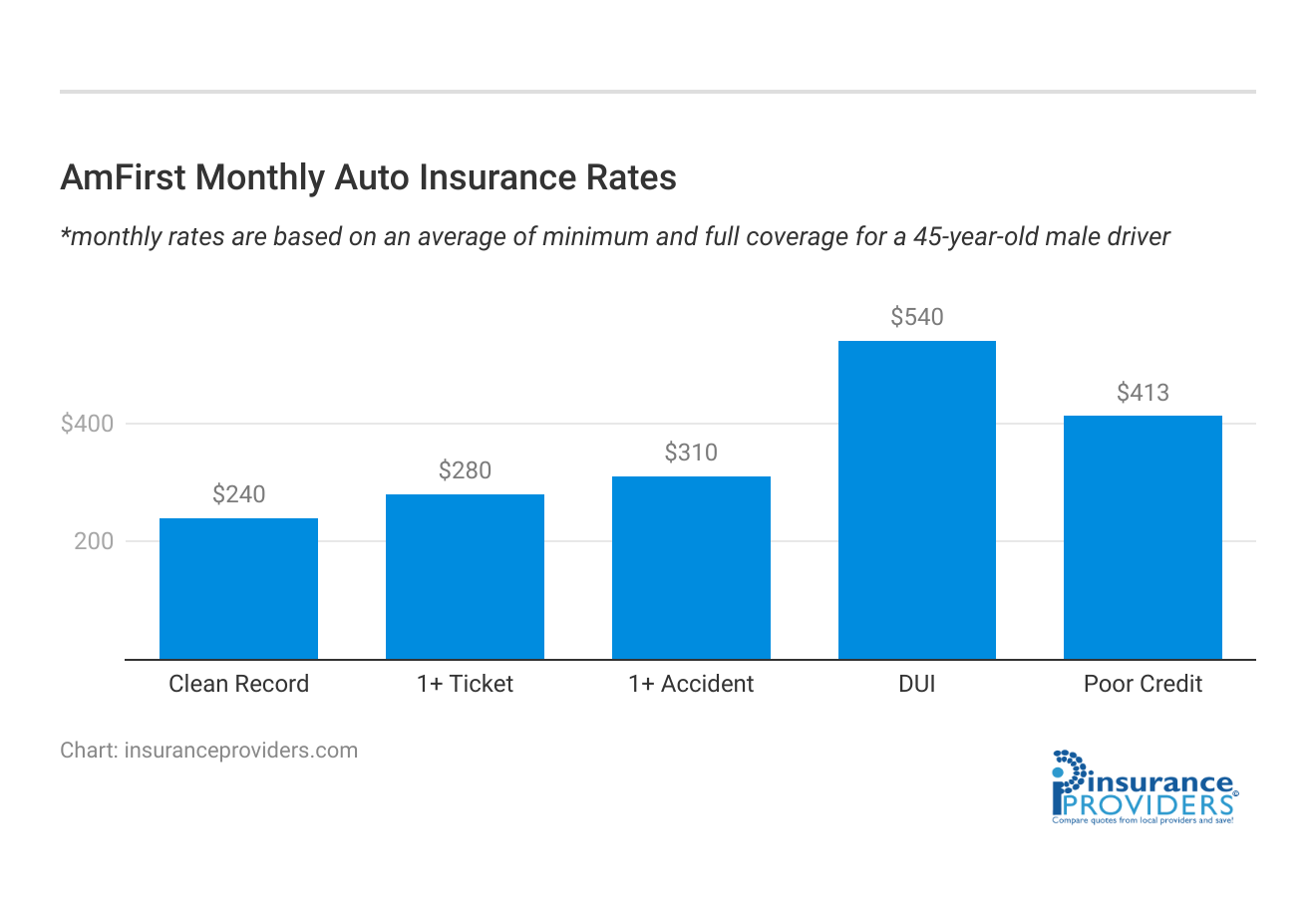

| Driver Profile | AmFirst | National Average |

|---|---|---|

| Clean Record | $240 | $119 |

| 1+ Ticket | $280 | $147 |

| 1+ Accident | $310 | $173 |

| DUI | $540 | $209 |

| Poor Credit | $413 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Amfirst Insurance Company Discounts Available

| Discount | AmFirst |

|---|---|

| Anti Theft | 6% |

| Good Student | 12% |

| Low Mileage | 9% |

| Paperless | 5% |

| Safe Driver | 18% |

| Senior Driver | 7% |

Amfirst Insurance Company recognizes the importance of affordability without compromising on quality coverage. They offer a range of discounts that can help you save on your insurance premiums. Here are some notable discounts you can take advantage of:

- Multi-Policy Discount: Bundle multiple insurance policies with Amfirst and enjoy a significant discount on your premiums.

- Safe Driver Discount: Maintain a clean driving record, and you could be eligible for a safe driver discount, rewarding your responsible driving habits.

- Good Student Discount: Students with excellent academic performance can benefit from lower insurance rates, encouraging both scholastic and responsible behavior.

- Home Security Discount: If you’ve taken measures to enhance your home’s security, such as installing a security system, you could qualify for a discount on your home insurance.

- Multi-Car Discount: Insure multiple vehicles under the same policy with Amfirst and receive a discount for each additional car.

- Loyalty Discount: Stay loyal to Amfirst, and you’ll be rewarded with a discount that reflects your continued partnership.

- Pay-in-Full Discount: Opt to pay your premium in full rather than in installments, and you could enjoy a discount as a result.

- Good Health Habits Discount: For health insurance policies, demonstrate healthy lifestyle choices to access special premium rates.

- Eco-Friendly Discount: If you’re driving an environmentally friendly vehicle, Amfirst offers a discount as an incentive for reducing your carbon footprint.

Amfirst Insurance Company is committed to making insurance accessible to all by providing these discounts, ensuring that you receive the best value for your coverage needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Simplified Claim Process at Amfirst Insurance Company

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Amfirst Insurance Company offers a user-friendly claims process that caters to the diverse preferences of their policyholders. Filing a claim with Amfirst is hassle-free, providing multiple avenues for convenience. Policyholders have the option to file a claim online through the company’s website, ensuring a quick and efficient submission process.

Alternatively, claims can also be filed over the phone, where dedicated customer support representatives guide individuals through the process with expertise and professionalism. Moreover, Amfirst offers mobile apps for both Android and iOS platforms, allowing policyholders to file claims on the go.

These mobile apps are equipped with intuitive features and functionalities, making it easier than ever to initiate a claim from the palm of your hand.

Average Claim Processing Time

Amfirst Insurance Company is dedicated to swift claims processing, recognizing the importance of promptly assisting their policyholders during difficult times. On average, Amfirst maintains a commendable track record of processing claims efficiently. Their commitment to quick turnaround times ensures that policyholders receive the support they need when it matters most.

This dedication to expeditious claim processing sets Amfirst apart as an insurance provider that values the peace of mind and financial security of its customers.

Customer Feedback on Claim Resolutions and Payouts

Amfirst Insurance Company prides itself on its commitment to customer satisfaction in the realm of claim resolutions and payouts. The company’s consistent efforts to provide personalized solutions and comprehensive protection have earned them positive feedback from policyholders.

With a low complaint level and a reputation for fair and timely claim resolutions, Amfirst ensures that its customers can trust in the reliability of their coverage. Policyholders appreciate the knowledgeable customer support team and the years of industry experience that contribute to Amfirst’s strong performance in this critical aspect of insurance service.

Explore Amfirst Insurance Company’s Digital and Technological Features

Mobile App Features and Functionality

Amfirst Insurance Company’s mobile apps are a testament to their commitment to modernizing insurance processes and enhancing the customer experience. These apps offer a wide array of features and functionalities designed to simplify insurance management.

From policyholders being able to access and view their policies to initiating claims directly through the app, Amfirst’s mobile technology empowers customers to take control of their insurance needs. The intuitive design of the mobile apps ensures that users can easily navigate and utilize these digital tools to their advantage.

Online Account Management Capabilities

Amfirst recognizes the importance of providing policyholders with convenient online account management capabilities. Through their website, policyholders can access their accounts, review policy details, and make updates as needed.

The online platform also allows for easy premium payments and policy renewals, providing a seamless experience for customers who prefer digital interactions. With robust online account management capabilities, Amfirst ensures that their policyholders have the flexibility and control they need to manage their insurance efficiently.

Digital Tools and Resources

Amfirst Insurance Company goes the extra mile in providing digital tools and resources to support its policyholders. These resources include educational materials and guides that help individuals understand their insurance coverage better.

Whether it’s articles explaining different types of insurance policies or tools to calculate insurance needs, Amfirst’s commitment to providing valuable digital resources empowers its customers to make informed decisions about their coverage. This dedication to transparency and education sets Amfirst apart as a modern insurance provider that values customer empowerment.

How Amfirst Insurance Company Ranks Among Providers

Amfirst Insurance Company operates in a competitive landscape, facing several key competitors within the insurance industry. These competitors offer a range of insurance products and services similar to Amfirst. Let’s take a closer look at some of Amfirst’s main competitors:

- SecureGuard Insurance Group: They offer competitive rates and discounts for bundled policies, making them a popular choice for those seeking comprehensive coverage.

- ReliaSure Insurance Services: They stand out for their innovative digital tools, providing customers with easy access to policy information and claims management.

- ProtectAll Insurance Solutions: They offer unique add-on coverage options that allow customers to tailor their insurance plans according to their specific needs.

- GlobalSafe Insurance Corporation: They emphasize customer education, helping clients understand their policy details and coverage options.

- SureNet Mutual Assurance: They offer various membership benefits and discounts, creating a strong sense of loyalty among their customer base.

- TrustShield Insurance Services: They offer a wide range of policy customization options and pride themselves on fast and efficient claims processing.

In this competitive landscape, Amfirst Insurance Company stands out with its tailored coverage options, trusted reputation, and commitment to customer satisfaction. While these competitors offer similar services, Amfirst’s unique value proposition, including its comprehensive coverage and range of discounts, sets it apart in the market.

Frequently Asked Questions

What sets Amfirst Insurance Company apart in the insurance market?

Amfirst Insurance Company distinguishes itself through its unwavering commitment to customer satisfaction, streamlined claims processing, and user-friendly digital tools, making it a reliable and customer-focused choice in the competitive insurance landscape.

How does Amfirst Insurance Company ensure a hassle-free claims process for policyholders?

Amfirst provides multiple avenues for convenient claims filing, including an online submission option through their website, phone filing with expert guidance from customer support representatives, and dedicated mobile apps for both Android and iOS platforms, ensuring a swift and efficient process tailored to diverse preferences.

What coverage options does Amfirst Insurance Company offer to meet diverse insurance needs?

Amfirst Insurance offers comprehensive protection and personalized solutions, ranging from tailored home insurance policies to vital coverage for vehicles through auto insurance, as well as health and financial security, ensuring a wide array of options to address various aspects of life and assets.

How does Amfirst Insurance Company stand out among its competitors in the insurance industry?

In a competitive landscape, Amfirst sets itself apart with its unique value proposition, including tailored coverage options, a trusted reputation, competitive rates, and a range of discounts, solidifying its position as a standout choice in the market.

What digital features does Amfirst Insurance Company provide to enhance the customer experience?

Amfirst’s commitment to modernizing insurance processes is evident through its intuitive mobile apps, empowering policyholders to manage their insurance needs on the go, and robust online account management capabilities that offer easy access to policy details, premium payments, and policy renewals for a seamless and efficient experience.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.