Anthem Insurance Companies, Inc. Review (2026)

Unveil Anthem Insurance Companies, Inc., a trusted partner offering comprehensive coverage options from health and life to auto and home insurance.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we explore the offerings of Anthem Insurance Companies, Inc., a trusted name in the insurance industry. With an array of insurance options spanning health, life, auto, home, and dental coverage, Anthem stands out for its commitment to tailored solutions and prompt claims processing.

Boasting a diverse portfolio, the company’s health insurance prioritizes well-being with a broad network of healthcare providers, while their life insurance policies ensure financial security for loved ones. For auto and home protection, Anthem’s coverage encompasses liability, collision, and even safeguarding against natural disasters.

The company’s benefits include flexible premiums, quick claims processing, and access to extensive provider networks. With a user-friendly application process and positive customer testimonials, Anthem emerges as a reliable partner offering peace of mind across a variety of insurance needs.

What You Should Know About Anthem Insurance Companies, Inc.

Rates: The rates breakdown provides transparency, offering insights into the cost considerations for policyholders, enabling informed decision-making based on individual budgetary preferences.

Discounts: This section aims to highlight potential cost-saving opportunities for policyholders, emphasizing Anthem’s commitment to rewarding responsible behavior and fostering loyalty.

Complaints/Customer Satisfaction: By assessing customer satisfaction and addressing any reported complaints, this category provides valuable insights into the overall customer experience and the company’s commitment to resolving issues promptly.

Claims Handling: The claims handling category aims to evaluate Anthem’s efficiency in processing claims, providing policyholders with timely support during challenging times, and ensuring satisfactory claim resolutions.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Anthem Insurance Companies, Inc. Insurance Coverage Options

Anthem Insurance Companies, Inc. offers a comprehensive range of coverage options to cater to various needs. Here are the coverage options provided by the company:

- Health Insurance: Anthem’s health insurance plans encompass a wide network of healthcare providers, ensuring you receive the medical attention you need. From preventive care to specialized treatments, Anthem’s coverage prioritizes your well-being.

- Life Insurance: Anthem’s life insurance policies provide financial security to your loved ones in times of need. With flexible options such as term life and whole life insurance, you can tailor a plan that suits your family’s future requirements.

- Auto Insurance: Anthem’s auto insurance offers protection for your vehicle and covers liability, collision, and comprehensive damages. Drive with confidence knowing you’re safeguarded against unexpected accidents.

- Home Insurance: Anthem’s home insurance safeguards your property from potential risks such as theft, fire, and natural disasters. With customizable coverage options, you can ensure that your most valuable asset is well-protected.

- Dental Insurance: Anthem also offers dental insurance to help you maintain your oral health. Dental coverage includes routine check-ups, preventive care, and even major dental procedures, ensuring you have access to quality dental services.

These coverage options are designed to provide individuals and families with the peace of mind that comes from knowing they are protected against a wide range of potential risks and uncertainties.

Read more: Anthem Life Insurance Company Review

Anthem Insurance Companies, Inc. Insurance Rates Breakdown

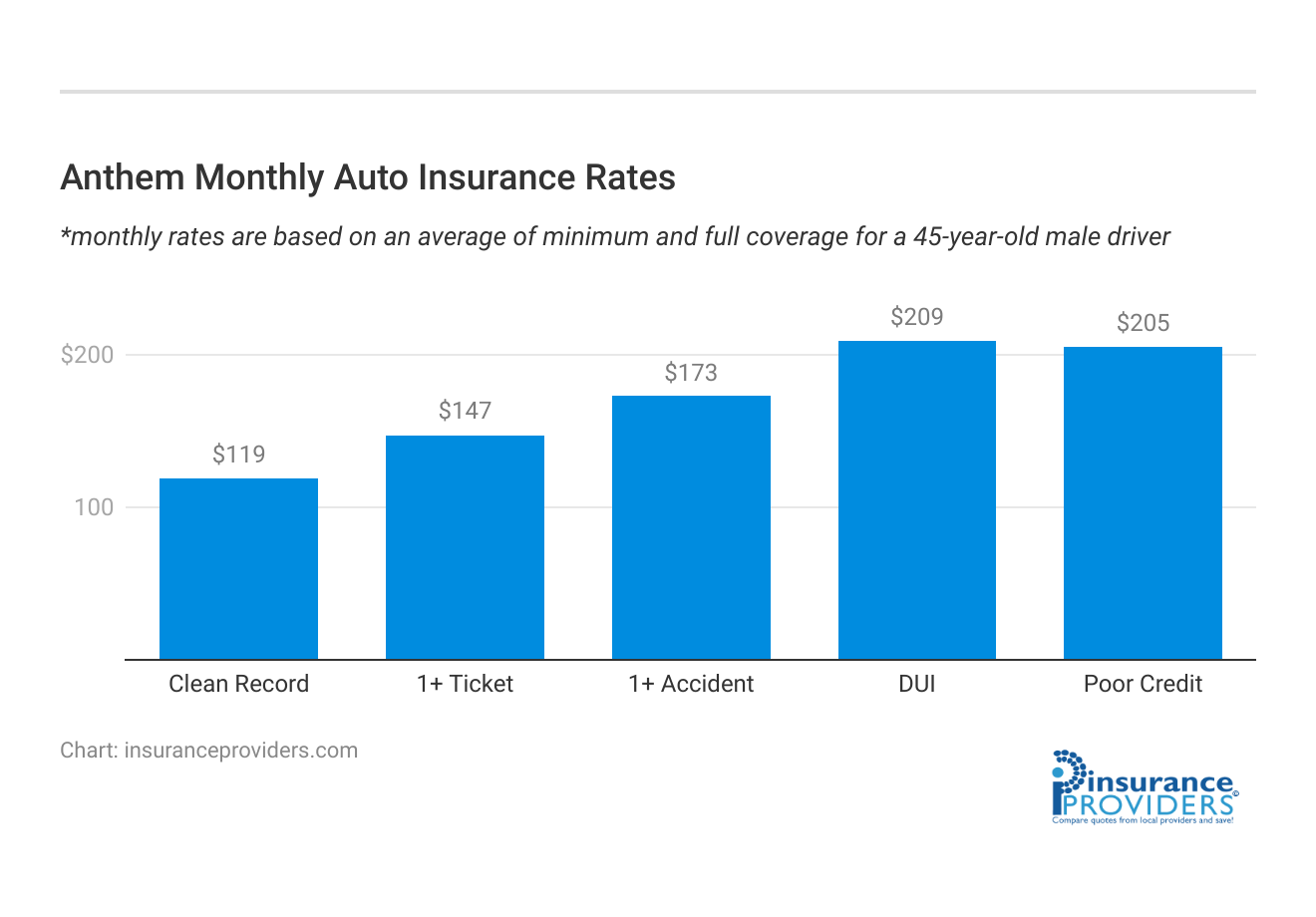

| Driver Profile | Anthem | National Average |

|---|---|---|

| Clean Record | $230 | $119 |

| 1+ Ticket | $280 | $147 |

| 1+ Accident | $320 | $173 |

| DUI | $370 | $209 |

| Poor Credit | $396 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Anthem Insurance Companies, Inc. Discounts Available

| Discount | Anthem Insurance Companies, Inc. |

|---|---|

| Anti Theft | 5% |

| Good Student | 8% |

| Low Mileage | 7% |

| Paperless | 6% |

| Safe Driver | 9% |

| Senior Driver | 10% |

Anthem Insurance Companies, Inc. offers a variety of discounts to help policyholders save on their insurance premiums. Here are some of the discounts that the company provides:

- Multi-Policy Discount: Anthem offers discounts when you bundle multiple insurance policies, such as combining your auto and home insurance, providing you with cost savings across your coverage needs.

- Good Driver Discount: If you have a clean driving record without any recent accidents or traffic violations, you may qualify for a good driver discount, reducing your auto insurance premiums.

- Safe Driver Discount: Anthem rewards safe driving habits by offering discounts to drivers who maintain a history of safe driving and avoid accidents over an extended period.

- Good Student Discount: Students who excel academically often qualify for reduced auto insurance rates, encouraging and recognizing responsible behavior both in school and on the road.

- Multi-Vehicle Discount: If you insure more than one vehicle under an Anthem policy, you can receive a multi-vehicle discount, helping you save on insurance costs for all your cars.

- Home Security Discount: Homeowners who implement security measures such as alarm systems, smoke detectors, and security cameras may be eligible for discounts on their home insurance premiums.

- Safe Home Discount: Homes with protective features like fire-resistant roofing, sturdy construction, and modern electrical systems may qualify for reduced home insurance rates.

- Pay-in-Full Discount: Anthem offers discounts to policyholders who choose to pay their entire annual premium upfront instead of making monthly payments.

- Automatic Payment Discount: Enrolling in automatic payment methods can lead to discounts on your insurance premiums, ensuring timely payments and reducing administrative costs.

- Good Health Discount: Some health insurance policies offer discounts or rewards for maintaining a healthy lifestyle, participating in wellness programs, or undergoing regular health check-ups.

These discounts provide an incentive for responsible behavior, loyalty, and proactive risk management, ultimately helping policyholders achieve cost savings while maintaining comprehensive coverage.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Anthem Insurance Companies, Inc. Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Anthem Insurance Companies, Inc. understands the importance of a streamlined claims process for its policyholders. Whether you prefer the convenience of filing claims online, over the phone, or through their mobile app, Anthem offers multiple avenues to make the process hassle-free. This flexibility ensures that you can report a claim in a way that suits your preferences and schedule.

Average Claim Processing Time

When it comes to processing claims promptly, Anthem Insurance Companies, Inc. excels in delivering quick results. While the exact processing time may vary depending on the nature of the claim and the information provided, Anthem’s commitment to swift claims resolution is a significant advantage for its policyholders.

Timely assistance can be crucial during challenging times, and Anthem ensures that you receive the support you need.

Customer Feedback on Claim Resolutions and Payouts

Anthem values customer feedback and continually strives to improve its claims resolution and payout processes. Policyholders’ experiences play a vital role in shaping Anthem’s approach to handling claims.

Positive customer testimonials highlight Anthem’s reliability as a partner that offers peace of mind across a variety of insurance needs. The company’s dedication to providing satisfactory claim resolutions and payouts is reflected in the feedback from its satisfied customers.

Anthem Insurance Companies, Inc. Digital and Technological Features

Mobile App Features and Functionality

Anthem Insurance Companies, Inc. recognizes the importance of technology in enhancing the insurance experience. Their mobile app is a powerful tool that provides policyholders with convenient access to their insurance information.

The app offers a range of features and functionalities, including policy management, claims filing, and digital ID cards. It empowers policyholders to have their insurance information at their fingertips, making it easier to manage their coverage on the go.

Online Account Management Capabilities

Anthem’s commitment to digital convenience extends to its online account management capabilities. Policyholders can access their accounts through a user-friendly online portal, allowing them to review policy details, track claims, and make payments with ease.

The online platform simplifies the insurance experience, giving customers the ability to manage their policies and access essential information from the comfort of their homes.

Digital Tools and Resources

In addition to the mobile app and online account management, Anthem Insurance Companies, Inc. provides policyholders with a suite of digital tools and resources. These resources are designed to empower customers to make informed decisions about their insurance coverage.

From educational materials to insurance calculators, Anthem offers valuable digital assets that help policyholders understand their options and choose the right coverage for their needs.

How Anthem Insurance Companies, Inc. Ranks Among Providers

Anthem Insurance Companies, Inc. operates in a competitive insurance landscape where several prominent players vie for market share. Here are some of the company’s main competitors:

- United Health Group: United Health Group is one of the largest health insurance providers in the United States, offering a wide range of health insurance plans and healthcare services. The company’s extensive network and diverse offerings make it a strong contender in the health insurance sector.

- Aetna (CVS Health Company): Aetna is another major player in the health insurance industry, known for its innovative health and wellness solutions. The company’s merger with CVS Health has allowed it to provide integrated healthcare services and comprehensive insurance plans.

- State Farm: State Farm is a well-known insurance provider offering auto, home, and life insurance, among other coverage options. With its extensive network of agents and a variety of policy choices, State Farm competes with Anthem’s auto and home insurance offerings.

- Metlife: Metlife is a leading life insurance provider, offering a range of life insurance policies tailored to different needs. The company’s reputation and diverse product offerings make it a competitor to Anthem’s life insurance options.

- Progressive: Progressive is a significant player in the auto insurance industry, known for its innovative approach to auto coverage and competitive pricing. Its online platform and unique features set it apart as a competitor to Anthem’s auto insurance.

- Allstate: Allstate is a widely recognized insurance company offering a range of coverage options, including auto, home, and life insurance. With its strong brand presence and comprehensive offerings, Allstate competes with Anthem across multiple insurance sectors.

- Geico: Geico is known for its direct-to-consumer model and humorous advertising campaigns. It is a major player in the auto insurance industry, offering competitive rates and a user-friendly online experience, which positions it as a competitor to Anthem’s auto insurance.

These competitors contribute to a dynamic and evolving insurance landscape, where companies strive to differentiate themselves through product innovation, customer service, pricing strategies, and effective marketing. Anthem’s ability to adapt to market trends and provide unique value to its customers is crucial for maintaining its competitive edge.

Frequently Asked Questions

What types of insurance does Anthem Insurance Companies, Inc. offer?

Anthem Insurance Companies, Inc. provides a diverse range of coverage options, including health, life, auto, home, and dental insurance.

How does Anthem Insurance Companies, Inc. differentiate itself in the competitive insurance landscape?

Anthem stands out through its commitment to tailored solutions, prompt claims processing, and a broad network of healthcare providers, offering a reliable choice for comprehensive protection.

What benefits does Anthem Insurance Companies, Inc. offer to policyholders?

Anthem’s benefits include flexible premiums, quick claims processing, and access to extensive provider networks, ensuring a user-friendly experience and peace of mind across various insurance needs.

Can you provide information on Anthem Insurance Companies, Inc.’s claims process?

Anthem excels in providing a streamlined claims process with multiple filing options, including online, over the phone, and through a mobile app, ensuring policyholders can report claims in a way that suits their preferences.

What digital features does Anthem Insurance Companies, Inc. offer to enhance the insurance experience?

Anthem prioritizes digital convenience with a powerful mobile app for policy management, claims filing, and digital ID cards, along with an online portal for easy account access and a suite of digital tools and resources to empower informed decision-making.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.