Armed Forces Insurance Exchange Review (2026)

In a landscape where uncertainties cast shadows on even the most carefully crafted plans, Armed Forces Insurance Exchange stands as a beacon of security for military personnel and their families.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In a world where uncertainties cast shadows on even the most carefully crafted plans, Armed Forces Insurance Exchange emerges as a beacon of security for military personnel and their families. With a profound commitment to safeguarding what matters most, this dedicated insurer offers a comprehensive array of tailored insurance policies.

From auto and home insurance to life and health coverage, Armed Forces Insurance Exchange stands resolute in providing solutions that understand the unique demands of military life. Its seamless online application process and efficient claims handling epitomize its customer-oriented approach.

By blending compassion with professionalism, this insurer empowers its clients to focus on their duties, fortified by the assurance that their futures are secured.

As a trusted ally, Armed Forces Insurance Exchange not only acknowledges the challenges that service members face but also rises to meet them with a steadfast resolve, ensuring that those who protect us find unwavering protection in return.

Armed Forces Insurance Coverage Options

Armed Forces Insurance Exchange stands as a comprehensive resource for military personnel and their families, offering a diverse range of coverage options tailored to their unique needs. These coverage options include:

- Auto Insurance: Providing protection for vehicles against accidents, theft, and damage, with options for comprehensive, collision, and liability coverage.

- Home Insurance: Safeguarding homes and personal belongings from unforeseen events like natural disasters, fires, and theft, encompassing dwelling, personal property, and liability coverage.

- Renters Insurance: Extending coverage to those renting properties, protecting personal belongings and offering liability coverage against accidents on rented premises.

- Life Insurance: Ensuring financial security for loved ones in the face of life’s uncertainties, including term life and whole life insurance options.

- Health Insurance: Prioritizing the health and well-being of military families, providing medical coverage that supports them in accessing quality healthcare services.

These coverage options not only cater to the distinct circumstances of military life but also embody Armed Forces Insurance Exchange’s dedication to offering holistic protection. With a deep understanding of the challenges faced by service members, these coverage choices serve as a testament to the company’s commitment to providing comprehensive and tailored solutions.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

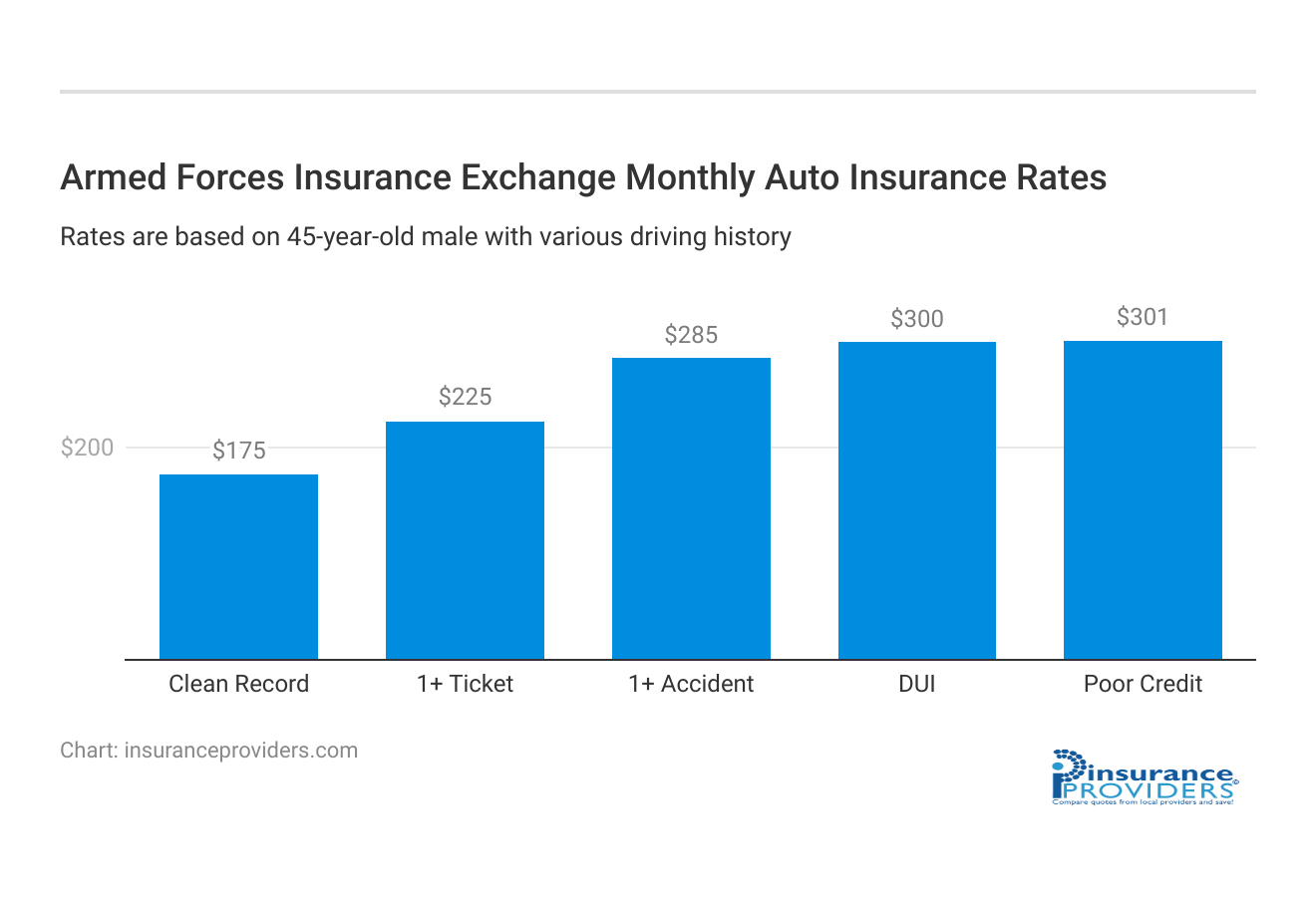

Armed Forces Insurance Rates Breakdown

| Driver Profile | Armed Forces Insurance Exchange | National Average |

|---|---|---|

| Clean Record | $175 | $119 |

| 1+ Ticket | $225 | $147 |

| 1+ Accident | $285 | $173 |

| DUI | $300 | $209 |

| Poor Credit | $301 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Armed Forces Insurance Discounts Available

| Discount | Armed Forces Insurance Exchange |

|---|---|

| Anti Theft | 10% |

| Good Student | 20% |

| Low Mileage | 15% |

| Paperless | 10% |

| Safe Driver | 15% |

| Senior Driver | 12% |

Armed Forces Insurance Exchange extends its commitment to its military community through a range of valuable discounts that help members make the most of their coverage. These discounts include:

- Multi-Policy Discount: Combine multiple insurance policies, such as auto and home insurance, to enjoy significant savings on your premiums.

- Safe Driver Discount: Rewarding safe driving habits, this discount is designed to lower rates for individuals with clean driving records.

- Good Student Discount: Acknowledging the dedication of military families, this discount offers reduced rates for students who maintain good academic standing.

- Military Installation Discount: Recognizing the unique circumstances of military life, this discount provides savings to those living on military bases or installations.

- Deployment Discount: During periods of deployment, eligible policyholders can benefit from reduced rates, reflecting the company’s understanding of the challenges faced by military personnel.

- Pay-in-Full Discount: Opting to pay your annual premium upfront can lead to substantial savings on your insurance costs.

- Safety Features Discount: If your vehicle is equipped with advanced safety features, such as anti-lock brakes and airbags, you could qualify for this discount.

- Good Credit Discount: Demonstrating the company’s holistic approach, this discount offers lower rates to policyholders with good credit scores.

- Paperless Discount: Embracing technology, Armed Forces Insurance Exchange encourages paperless transactions by offering discounts for opting for electronic billing and communication.

These discounts exemplify Armed Forces Insurance Exchange’s dedication to supporting its military clientele with tailored solutions that ease financial burdens while ensuring robust coverage.

How Armed Forces Insurance Ranks Among Providers

Armed Forces Insurance Exchange operates in a niche sector that addresses the insurance needs of military personnel and their families. While its focus on serving this specific demographic is unique, there are several other insurance companies that compete to provide coverage to military members. Some of the main competitors in this field include:

- USAA (United Services Automobile Association): One of the most well-known competitors, USAA offers a wide range of insurance and financial services exclusively to military members and their families. They provide various insurance options, including auto, home, renters, and life insurance, along with banking and investment services.

- Navy Federal Credit Union: Although primarily a credit union, Navy Federal offers insurance products as well. They cater to the needs of Navy personnel and their families, offering services similar to those of traditional insurers.

- Geico: While not exclusively military-focused, Geico offers military discounts and has a history of providing insurance to government employees, including military personnel. They offer auto and motorcycle insurance, among other types.

- Progressive: Progressive also offers insurance options for military personnel, often extending special discounts to those who have served in the armed forces. They provide coverage for vehicles, homes, and more.

- Military Benefit Association: This organization specializes in providing insurance and financial services to military personnel and veterans. They offer a variety of life insurance options and financial planning services.

These competitors each have their own strengths and unique offerings within the realm of military-focused insurance. While Armed Forces Insurance Exchange boasts its tailored coverage options and deep understanding of military life, its competitors also strive to provide quality insurance solutions to those who have served or are serving in the military.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Armed Forces Insurance Exchange Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Armed Forces Insurance Exchange recognizes the importance of a streamlined claims process for military personnel and their families. They offer multiple convenient methods for filing claims, ensuring that their policyholders can access support efficiently.

Whether policyholders prefer to file claims online, over the phone, or through mobile apps, Armed Forces Insurance Exchange strives to make the process as user-friendly as possible.

Average Claim Processing Time

Timely claim processing is crucial, especially for those in the military who may have unique circumstances and tight schedules. Armed Forces Insurance Exchange prioritizes quick claim processing to provide prompt assistance to their policyholders.

While specific processing times may vary depending on the nature of the claim, the company is committed to minimizing delays and ensuring policyholders receive the support they need when they need it.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurer’s performance. Armed Forces Insurance Exchange takes customer satisfaction seriously and continuously collects feedback on their claim resolutions and payouts.

By listening to their policyholders, they aim to improve their services and ensure that claim resolutions are fair, efficient, and meet the expectations of those who rely on their coverage.

Digital and Technological Features of Armed Forces Insurance Exchange

Mobile App Features and Functionality

Armed Forces Insurance Exchange understands the importance of technology in today’s world. They offer a comprehensive mobile app that provides policyholders with convenient features and functionality.

Through the app, policyholders can manage their accounts, access important policy information, file claims, and even receive updates on the status of their claims. The app is designed to empower policyholders with the tools they need to navigate their insurance coverage seamlessly.

Online Account Management Capabilities

In addition to their mobile app, Armed Forces Insurance Exchange provides robust online account management capabilities through their website. Policyholders can log in to their accounts, review policy details, make payments, and update their information at their convenience.

This online portal offers a user-friendly interface, ensuring that policyholders can easily access and manage their insurance accounts online.

Digital Tools and Resources

Armed Forces Insurance Exchange goes beyond basic coverage by offering a range of digital tools and resources to support their policyholders. These resources may include educational materials, insurance calculators, and informative articles.

By providing access to these digital tools, Armed Forces Insurance Exchange empowers their policyholders with the knowledge and resources to make informed decisions about their insurance coverage.

Armed Forces Insurance Exchange’s commitment to technology and digital features reflects their dedication to providing military personnel and their families with a modern and efficient insurance experience.

Frequently Asked Questions

What makes the Armed Forces Insurance Exchange’s policies unique?

Armed Forces Insurance Exchange stands out by tailoring its insurance policies to the specific needs of military personnel and their families. These policies accommodate the challenges of military life, such as deployments and relocations, providing comprehensive coverage that addresses the unique circumstances of service members.

Can I apply for insurance online?

Yes, the Armed Forces Insurance Exchange offers a user-friendly online application process. Visit their website, navigate through the easy-to-use forms, and get a personalized quote based on your requirements. Their online platform is designed to streamline the application process for your convenience.

How do I file a claim with the Armed Forces Insurance Exchange?

Filing a claim with the Armed Forces Insurance Exchange is straightforward. You can initiate the claims process through their dedicated claims portal on their website. Alternatively, you can contact their responsive claims team directly. They prioritize efficiency and aim to process claims promptly, ensuring you receive the support you need.

Are there health insurance options for military families?

Yes, Armed Forces Insurance Exchange offers health insurance options tailored to military families. These health insurance plans are designed to prioritize the well-being of military personnel and their loved ones, ensuring access to quality healthcare services when needed.

What do clients appreciate most about the Armed Forces Insurance Exchange?

Clients value the Armed Forces Insurance Exchange’s exceptional service, understanding of military life, and efficient claims processing. The company’s commitment to its military community, personalized approach, and responsiveness resonate with policyholders, making them feel supported and cared for.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.