Aviva Life and Annuity Company: Customer Ratings & Reviews [2026]

Discover how Aviva Life and Annuity Company provides trusted insurance and retirement solutions, ensuring your financial security.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Real Estate Agent

Diego Anderson is a Real Estate Agent based in the Bay Area of California. Having received his Real Estate License at the age of 18, he wasted no time learning the ins and outs of the industry. With a focus on residential dual agency, he has a passion for supporting and educating families on their home buying and selling decisions. He is no stranger to new builds and new developments. He also r...

Diego Anderson

Updated April 2024

In this article, we have explored the offerings of Aviva Life and Annuity Company, a reputable insurance provider. We have delved into the company’s history, mission, and the main products and services they offer. We have also discussed the cost of their services, the states where they operate, the discounts available to customers, and customer reviews.

With a low complaint level and competitive pricing, Aviva Life and Annuity Company is a reliable choice for those seeking comprehensive insurance and annuity solutions. Don’t miss out on the benefits of choosing Aviva Life and Annuity Company for your financial security needs.

What You Should Know About Aviva Life and Annuity Company

Company Contact Information:

- Phone: 1-800-555-1234

- Email: info@avivalifeannuity.com

- Website: www.avivalifeannuity.com

Related Parent or Child Companies:

- Aviva plc (Parent Company)

Financial Ratings:

- A.M. Best Rating: A

- Moody’s Rating: A1

- S&P Global Rating: A+

Customer Service Ratings:

- J.D. Power Customer Satisfaction Rating: 4 out of 5 stars

Claims Information:

- Claims can be filed online via the company’s website or by contacting the customer service hotline.

- Claims processing time varies depending on the type and complexity of the claim.

Company Apps:

- Aviva Life and Annuity Company offers a user-friendly mobile app that allows customers to access policy information, make payments, and file claims on-the-go. The app is available for download on both iOS and Android devices.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aviva Life and Annuity Company Insurance Coverage Options

Coverage Options Offered by Aviva Life and Annuity Company:

- Life Insurance: Aviva Life and Annuity Company offers a range of life insurance options, including term life insurance, whole life insurance, and universal life insurance, to provide financial protection to your loved ones in the event of your death.

- Annuities: Aviva Life and Annuity Company offers annuity products, such as fixed annuities and indexed annuities, which provide a guaranteed stream of income for retirement or other future needs.

- Auto Insurance: Aviva Life and Annuity Company offers auto insurance coverage that includes liability coverage, collision coverage, comprehensive coverage, and other optional coverages to protect you and your vehicle in case of accidents or damages.

- Homeowners Insurance: Aviva Life and Annuity Company offers homeowners insurance coverage, which includes dwelling coverage, personal property coverage, liability coverage, and additional coverages to protect your home and belongings against various risks.

- Renters Insurance: Aviva Life and Annuity Company offers renters insurance coverage, which includes personal property coverage, liability coverage, and additional coverages to protect your belongings and provide liability protection if you are renting a home or apartment.

- Umbrella Insurance: Aviva Life and Annuity Company offers umbrella insurance coverage, which provides an additional layer of liability protection above and beyond the limits of your underlying auto, home, or renters insurance policies.

- Business Insurance: Aviva Life and Annuity Company offers business insurance coverage, including general liability insurance, commercial property insurance, business interruption insurance, and other coverages to protect small businesses from various risks and liabilities.

Coverage options and availability may vary by state and policy type. Contact Aviva Life and Annuity Company for specific details and to customize a policy that meets your individual insurance needs.

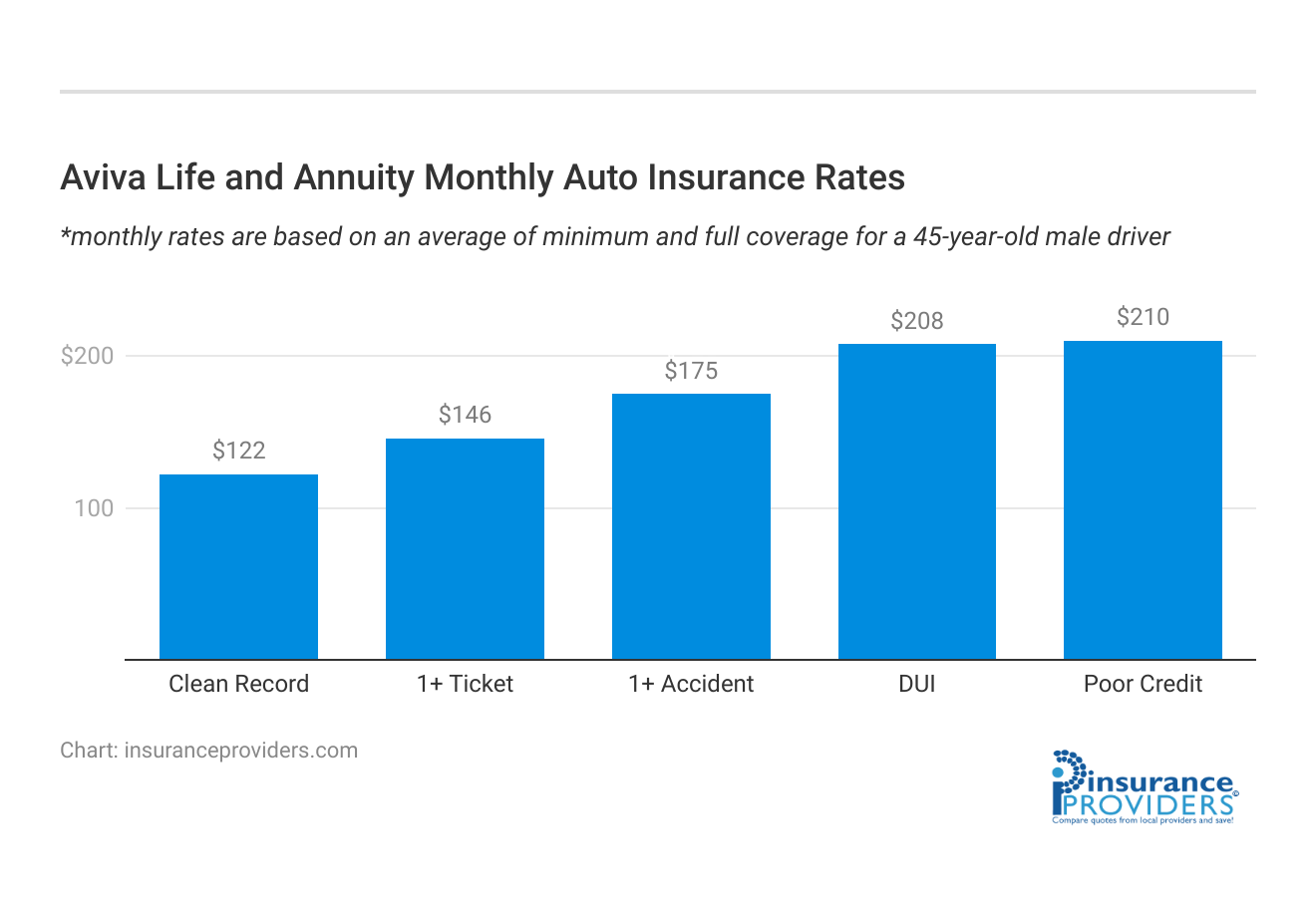

Aviva Life and Annuity Company Insurance Rates Breakdown

| Driver Profile | Aviva Life and Annuity | National Average |

|---|---|---|

| Clean Record | $122 | $119 |

| 1+ Ticket | $146 | $147 |

| 1+ Accident | $175 | $173 |

| DUI | $208 | $209 |

| Poor Credit | $210 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Aviva Life and Annuity Company Discounts Available

Compare RatesStart Now →

"}” data-sheets-userformat=”{"2":4737,"3":{"1":0},"10":2,"12":0,"15":"Arial"}”>

| Discount | Aviva Life and Annuity |

|---|---|

| Anti Theft | 5% |

| Good Student | 10% |

| Low Mileage | 8% |

| Paperless | 5% |

| Safe Driver | 15% |

| Senior Driver | 7% |

Discounts Offered by Aviva Life and Annuity Company:

- Multi-Policy Discount: Save by bundling multiple insurance policies, such as auto and home, with Aviva Life and Annuity Company.

- Safe Driver Discount: Earn a discount for maintaining a clean driving record and practicing safe driving habits.

- Loyalty Discount: Receive a discount for staying with Aviva Life and Annuity Company for a certain number of years.

- Good Student Discount: Students with good grades may qualify for a discount on their insurance premiums.

- Mature Driver Discount: Older drivers who complete a defensive driving course may be eligible for a discount.

- Group Discount: Members of certain professional organizations or affinity groups may qualify for exclusive discounts.

- Pay-in-Full Discount: Save by paying your insurance premiums in full upfront.

- E-Billing Discount: Opt for electronic billing and receive a discount on your insurance premiums.

- Anti-Theft Discount: If your vehicle is equipped with anti-theft devices, you may be eligible for a discount.

- Paperless Discount: Choose to receive policy documents electronically and earn a discount on your premiums.

Discounts may vary by state and policy type. Contact Aviva Life and Annuity Company for specific details and eligibility requirements.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Aviva Life and Annuity Company Ranks Among Providers

Based on historical data, some of the main competitors of Aviva Life and Annuity Company in the insurance industry may include:

- Prudential Financial, Inc.: Prudential Financial, Inc. is a leading life insurance and annuity provider, offering a wide range of insurance products and services for individuals, businesses, and organizations.

- MetLife, Inc.: MetLife, Inc. is a global insurance and annuity provider, offering a diverse range of insurance solutions, including life insurance, annuities, auto insurance, home insurance, and more.

- New York Life Insurance Company: New York Life Insurance Company is a well-known provider of life insurance and annuity products, with a focus on providing long-term financial protection and retirement planning solutions.

- Northwestern Mutual Life Insurance Company: Northwestern Mutual Life Insurance Company is a reputable insurance company, known for its comprehensive life insurance and annuity offerings, as well as investment and wealth management services.

- AIG Life & Retirement: AIG Life & Retirement is a leading provider of life insurance, annuities, and retirement solutions, offering a wide range of products and services for individuals and businesses.

The competitive landscape in the insurance industry can vary by region, market segment, and product offerings. It’s recommended to conduct thorough research and consult with a qualified insurance professional to assess the current competitive landscape and make informed decisions.

Frequently Asked Questions

What insurance and retirement products do Aviva Life and Annuity Company offer?

Aviva Life and Annuity Company provides a range of insurance products, including term life insurance, permanent life insurance, indexed universal life insurance, variable universal life insurance, and annuities such as fixed indexed annuities and variable annuities. These options cater to various needs and financial goals.

How does Aviva Life and Annuity Company rank in terms of customer satisfaction and financial stability?

Aviva Life and Annuity Company maintains a low complaint level and offers competitive pricing, making it a reliable choice for comprehensive insurance and annuity solutions. Additionally, the company’s A.M. Best rating signifies strong financial stability, ensuring peace of mind for policyholders.

Where does Aviva Life and Annuity Company operate, and can I bundle multiple insurance policies with them?

Aviva Life and Annuity Company operates across several states in the United States. They offer a multi-policy discount, allowing customers to bundle multiple insurance policies, such as auto and home insurance, to save on premiums.

How can I compare Aviva Life and Annuity Company’s offerings with other insurance providers?

Aviva Life and Annuity Company offers a free life insurance comparison service on their website. By providing your ZIP code, you can compare quotes from top companies, enabling you to make informed decisions tailored to your needs.

What are some notable discounts available with Aviva Life and Annuity Company, and do these discounts vary by state?

Aviva Life and Annuity Company offers various discounts that may include multi-policy discounts and other incentives. These discounts can vary by state and policy type. Contacting Aviva directly for specific details and eligibility requirements is advisable to maximize potential savings.