AXIS Reinsurance Company Review (2026)

Explore AXIS Reinsurance Company—a global powerhouse redefining industry standards with innovative, tailored insurance solutions across property, life, and specialty insurance, backed by an 'A (Excellent)' A.M. Best rating.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Explore the dynamic realm of AXIS Reinsurance Company in this comprehensive article. From its robust financial stability reflected in an “A (Excellent)” A.M. Best rating to its diverse array of insurance offerings spanning property and casualty, life and health, and specialty insurance, AXIS Reinsurance Company stands as a global leader with a strong commitment to innovation.

With a strategic presence in multiple countries, the company’s tailored solutions leverage cutting-edge technology and data analytics to address evolving client needs. Moreover, their active engagement in sustainability initiatives underscores their role as a responsible corporate citizen.

This in-depth analysis reveals how AXIS Reinsurance Company’s innovation, global reach, and dedication to a sustainable future make it a trailblazer in the insurance landscape, catering to both individual and business clients with an unmatched blend of expertise and integrity.

AXIS Reinsurance Company Insurance Coverage Options

AXIS Reinsurance Company provides a comprehensive range of insurance coverage options to meet the diverse needs of its clients. Whether you’re an individual seeking personal insurance or a business in need of specialized coverage, AXIS Reinsurance Company offers a variety of solutions. Below, we’ve outlined the coverage options provided by the company:

- Property and Casualty Insurance: AXIS Reinsurance Company offers property and casualty insurance to protect individuals and businesses against unexpected property damage, liability claims, and other unforeseen events.

- Life and Health Insurance: For individuals and families, AXIS provides life and health insurance products that offer financial protection and peace of mind in the face of life’s uncertainties.

- Specialty Insurance: AXIS specializes in providing insurance solutions tailored to unique and specialized needs, catering to industries and situations that require specific coverage.

- Reinsurance Services: Beyond traditional insurance, AXIS Reinsurance Company offers reinsurance services to other insurance companies, helping them manage risk and enhance their financial stability.

AXIS Reinsurance Company’s commitment to innovation and global reach ensures that clients have access to a wide range of coverage options designed to meet their unique requirements.

With these diverse coverage options, AXIS Reinsurance Company strives to provide clients with the protection and support they need in an ever-changing world.

For more information about AXIS Reinsurance Company’s coverage options, you can explore their website or contact their representatives to discuss your specific insurance needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

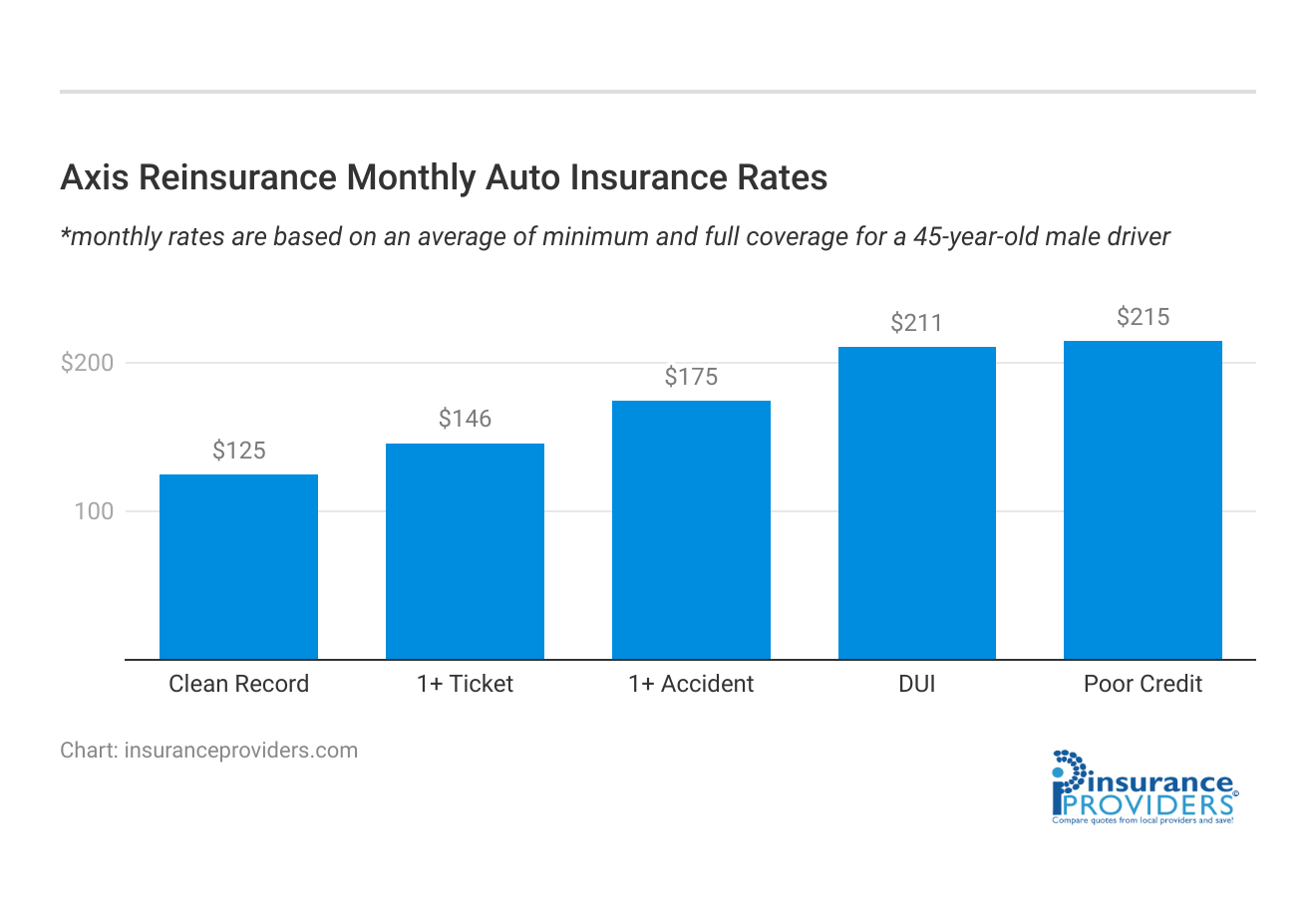

AXIS Reinsurance Company Insurance Rates Breakdown

| Driver Profile | Axis Reinsurance | National Average |

|---|---|---|

| Clean Record | $125 | $119 |

| 1+ Ticket | $146 | $147 |

| 1+ Accident | $175 | $173 |

| DUI | $211 | $209 |

| Poor Credit | $215 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

AXIS Reinsurance Company Discounts Available

| Discount | AXIS Reinsurance |

|---|---|

| Anti Theft | 6% |

| Good Student | 12% |

| Low Mileage | 9% |

| Paperless | 5% |

| Safe Driver | 18% |

| Senior Driver | 7% |

AXIS Reinsurance Company understands the importance of helping clients save on their insurance premiums while still receiving top-notch coverage. To make insurance more affordable, they offer a range of discounts. Here are the discounts you may be eligible for when choosing AXIS Reinsurance Company:

- Multi-Policy Discount: By bundling multiple insurance policies with AXIS, such as auto and home insurance, you can often qualify for a multi-policy discount, reducing the overall cost of your coverage.

- Good Driver Discount: Safe and responsible drivers may be rewarded with a good driver discount, which reflects a lower risk profile and can result in reduced premiums.

- Safe Home Discount: For homeowners, maintaining a safe and secure home can lead to a safe home discount, encouraging responsible homeownership practices.

- Good Health Discount: In the realm of life and health insurance, individuals who maintain good health habits and regular check-ups may be eligible for a good health discount, potentially reducing the cost of health insurance coverage.

- Group or Employee Discounts: Some coverage options offered by AXIS Reinsurance Company may be available at a discounted rate for groups or employees of specific organizations, such as employer-sponsored health insurance plans.

- Claims-Free Discount: AXIS values policyholders who have a history of making minimal or no claims. As a reward, they may offer a claims-free discount, lowering premiums for those with a clean claims record.

The availability of these discounts may vary depending on your location and the specific insurance products you’re interested in. To find out which discounts you qualify for and to get more details about potential savings, reach out to AXIS Reinsurance Company or their authorized agents for personalized assistance.

Taking advantage of these discounts can help you maximize the value of your insurance coverage while minimizing costs.

How AXIS Reinsurance Company Ranks Among Providers

AXIS Reinsurance Company operates in a competitive landscape within the insurance and reinsurance industry. Several prominent players vie for market share and offer similar services. Here are some of AXIS Reinsurance Company’s main competitors:

- Swiss Re: Swiss Re is a global reinsurance company with a strong presence in the industry. They offer a wide range of reinsurance and insurance products, including property and casualty, life and health, and specialty insurance.

- Munich Re: Munich Re is another major global reinsurer and a direct competitor of AXIS Reinsurance Company. They provide reinsurance solutions to clients worldwide, covering various lines of business.

- Lloyd’s of London: Lloyd’s of London is a renowned insurance and reinsurance marketplace that operates globally. It is known for its unique market structure, where various underwriters provide coverage for diverse risks.

- Hannover Re: Hannover Re is a leading reinsurance company with a strong focus on property and casualty, life and health, and financial reinsurance. They compete in the same markets as AXIS Reinsurance Company.

- SCOR: SCOR is a global reinsurance company that offers a broad spectrum of reinsurance solutions. They have a significant presence in both traditional and specialty reinsurance lines.

- Berkshire Hathaway Reinsurance Group: This subsidiary of Berkshire Hathaway is a significant player in the reinsurance industry. They offer a wide array of reinsurance products and services.

- Everest Re Group: Everest Re Group is a global provider of reinsurance and insurance solutions, covering various lines of business. They compete with AXIS Reinsurance Company in offering property and casualty, life, and specialty reinsurance.

- AIG (American International Group): AIG is a multinational insurance company that provides both insurance and reinsurance services. They have a global reach and offer a diverse range of coverage options.

These competitors, like AXIS Reinsurance Company, have robust financial stability and diverse portfolios of insurance and reinsurance offerings. The competitive landscape in the insurance industry encourages innovation and the development of tailored solutions to meet the evolving needs of clients.

Clients and businesses have the opportunity to choose from a wide range of providers, each with its own strengths and areas of expertise, allowing them to select the best fit for their specific insurance requirements.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Axis Reinsurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Axis Reinsurance Company prioritizes customer convenience when it comes to filing claims. They offer multiple avenues for submitting claims, ensuring that policyholders can choose the method that suits them best.

Whether it’s through their user-friendly online portal, over the phone with their helpful customer service representatives, or using their mobile app, the process is designed to be seamless. Policyholders can file claims from the comfort of their homes or while on the go, thanks to the accessibility provided by Axis Reinsurance Company.

Average Claim Processing Time

When it comes to claim processing, Axis Reinsurance Company is committed to efficiency. On average, they strive to process claims in a timely manner to provide relief to policyholders when they need it most.

While specific processing times may vary depending on the complexity of the claim, Axis Reinsurance Company’s dedication to expeditious processing sets them apart in the industry. Policyholders can expect a swift response and resolution to their claims, reducing the stress associated with insurance claims.

Customer Feedback on Claim Resolutions and Payouts

Axis Reinsurance Company values customer feedback and continuously seeks to improve its claim resolution and payout processes. They have garnered positive reviews from policyholders who appreciate the fairness and transparency in their claim settlements.

Axis Reinsurance Company’s commitment to delivering on their promises is evident in the satisfaction of their customers. They go the extra mile to ensure that policyholders are well-informed throughout the claim process, fostering trust and confidence in their services.

Explore Axis Reinsurance Company’s Digital and Technological Features

Mobile App Features and Functionality

Axis Reinsurance Company’s mobile app is a testament to its commitment to innovation and customer-centric solutions. The app offers a range of features and functionalities designed to enhance the insurance experience.

Policyholders can easily access their policies, file claims, make payments, and even receive real-time updates on their claims through the app. It’s a convenient tool that puts control and information at the fingertips of policyholders, making insurance management effortless.

Online Account Management Capabilities

With Axis Reinsurance Company’s online account management capabilities, policyholders have the flexibility to manage their insurance policies with ease. The online portal provides a secure and user-friendly interface for policyholders to review policy details, update information, and track their claims.

It’s a valuable resource that empowers policyholders to take charge of their insurance needs conveniently from anywhere with an internet connection.

Digital Tools and Resources

Axis Reinsurance Company understands the importance of providing policyholders with valuable digital tools and resources. They offer a wealth of information, including educational resources, FAQs, and interactive tools to help policyholders make informed decisions about their insurance coverage.

These digital resources empower policyholders to navigate the complex world of insurance with confidence and clarity, aligning with Axis Reinsurance Company’s commitment to customer education and support.

Frequently Asked Questions

What types of insurance does AXIS Reinsurance Company offer?

AXIS Reinsurance Company offers property and casualty, life and health insurance, specialty insurance, and reinsurance services.

Is AXIS Reinsurance Company financially stable?

Yes, AXIS Reinsurance Company has a strong financial foundation and consistently receives high ratings from rating agencies.

Where does AXIS Reinsurance Company operate?

AXIS Reinsurance Company has a global presence with offices around the world, ensuring comprehensive coverage and support.

How does AXIS Reinsurance Company contribute to sustainability?

AXIS Reinsurance Company actively participates in various sustainability initiatives to promote a more sustainable future.

What sets AXIS Reinsurance Company apart from other insurers?

AXIS Reinsurance Company’s innovative approach to reinsurance and its commitment to customer-centric solutions make it stand out in the industry.