California Insurance Company Review (2026)

California Insurance Company, standing out in the insurance landscape through diverse coverage options, personalized plans, and a hassle-free claims process, making it a reliable choice for your insurance needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover a world of comprehensive protection with California Insurance Company. In this detailed guide, we’ve unveiled the breadth of our insurance offerings, ranging from home, auto, health, life, and business insurance to renter’s and umbrella policies.

Our commitment to tailored coverage shines through, with personalized options ensuring you only pay for what you need. With transparent pricing and a range of discounts, we make quality coverage affordable.

California Insurance Company Insurance Coverage Options

At California Insurance Company, we pride ourselves on offering a wide array of coverage options to meet the diverse needs of our customers. Our comprehensive range of insurance policies includes:

- Home Insurance: Protect your haven with our customizable home insurance policies, covering your property against unforeseen events such as natural disasters, theft, and liability concerns.

- Auto Insurance: Drive with confidence using our auto insurance plans, which provide coverage for accidents, collisions, liability, and more. Enjoy additional peace of mind with our range of discounts for safe driving.

- Health Insurance: Prioritize your well-being with our health insurance coverage, granting you access to a network of top-tier medical professionals and facilities. Choose from flexible plans that cater to your individual health needs.

- Life Insurance: Plan for the future and secure your loved ones’ financial stability with our versatile life insurance options. Whether you need term, whole, or universal coverage, we have you covered.

- Business Insurance: Safeguard your entrepreneurial ventures with our business insurance solutions. From property protection to liability coverage, our policies are tailored to suit different business types and industries.

- Renter’s Insurance: Even if you’re renting, your belongings and well-being deserve protection. Our renter’s insurance policies cover personal belongings and provide liability coverage in rental properties.

- Umbrella Insurance: Go the extra mile with our umbrella insurance policies, which provide an additional layer of security beyond your primary policies. Enjoy increased liability protection and enhanced peace of mind.

- Personalized Coverage Options: We understand that everyone’s needs are unique. That’s why we offer personalized coverage options that align with your specific requirements, ensuring you’re never paying for coverage you don’t need.

With California Insurance Company, you can find tailored coverage solutions for every aspect of your life, allowing you to face the future with confidence.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

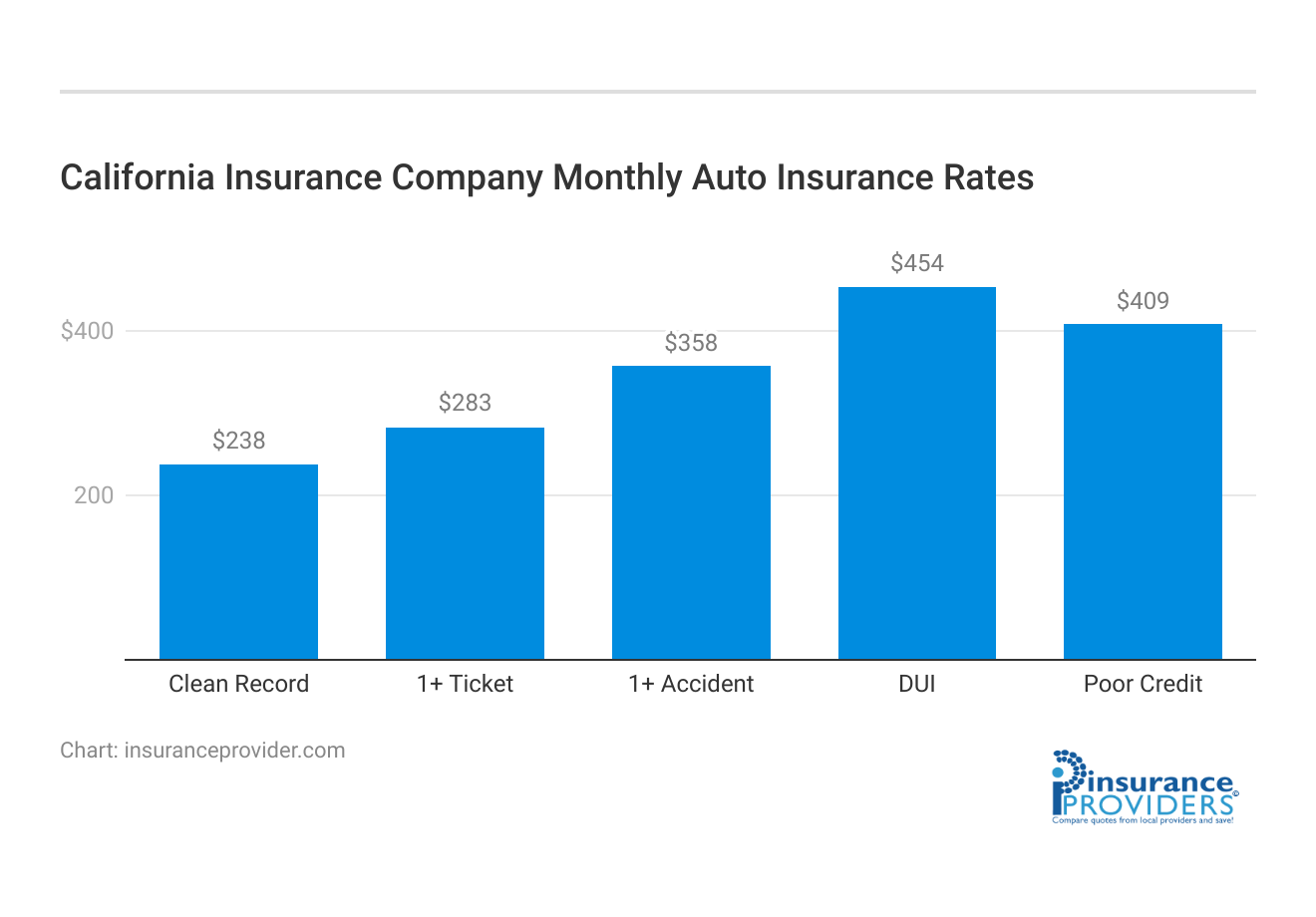

California Insurance Company Insurance Rates Breakdown

| Driver Profile | California Insurance Company | National Average |

|---|---|---|

| Clean Record | $238 | $119 |

| 1+ Ticket | $283 | $147 |

| 1+ Accident | $358 | $173 |

| DUI | $454 | $209 |

| Poor Credit | $409 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

California Insurance Company Discounts Available

| Discounts | California Insurance Company |

|---|---|

| Anti Theft | 14% |

| Good Student | 16% |

| Low Mileage | 11% |

| Paperless | 10% |

| Safe Driver | 15% |

| Senior Driver | 11% |

California Insurance Company is committed to not only providing comprehensive coverage but also ensuring that our customers can access affordable insurance solutions. To that end, we offer a range of discounts that reward responsible behavior and safe practices.

Our discounts include:

- Safe Driving Discount: Rewarding policyholders who maintain a clean driving record and exhibit safe driving habits on the road.

- Multi-Policy Discount: Enjoy savings when you bundle multiple insurance policies with us, such as home and auto insurance.

- Good Student Discount: Students with excellent academic performance can benefit from reduced insurance rates.

- Safe Vehicle Discount: If your vehicle is equipped with safety features such as anti-lock brakes, airbags, and anti-theft devices, you can qualify for this discount.

- Low Mileage Discount: Policyholders who drive fewer miles may be eligible for lower insurance premiums.

- Loyalty Discount: We value our long-term customers. This discount rewards loyalty and continued partnership with California Insurance Company.

- Defensive Driving Course Discount: Completing an approved defensive driving course can lead to reduced insurance rates.

- Payment Discounts: Opting for electronic funds transfer (EFT) or paying your premium in full upfront can make you eligible for additional savings.

These discounts not only make our insurance policies more accessible but also encourage behaviors that promote safety and responsible ownership.

At California Insurance Company, we believe in giving our customers every opportunity to save while enjoying the peace of mind that comes with comprehensive coverage.

How California Insurance Company Ranks Among Providers

California Insurance Company operates in a competitive landscape where several prominent insurance providers vie for customers’ attention.

While we stand out for our comprehensive coverage options, personalized plans, and exceptional customer support, it’s important to acknowledge our main competitors:

- Global Insurance Group: Known for its extensive range of insurance offerings, Global Insurance Group is a formidable competitor. They emphasize a strong online presence, user-friendly interfaces, and a reputation for prompt claims processing.

- Stateguard Assurance: Stateguard Assurance is recognized for its competitive pricing and streamlined claims process. They have a wide network of agents who offer personalized assistance to customers, making insurance decisions easier.

- Secureshield Insurance: Secureshield Insurance focuses on innovative policy customization, allowing customers to tailor their coverage to unique needs. Their technologically advanced tools for policy management and claims handling give them an edge in customer convenience.

- Nexaprotect Solutions: Nexaprotect Solutions is a strong contender with a reputation for offering comprehensive coverage, particularly in specialized areas like cyber insurance and identity theft protection. Their commitment to adapting to emerging risks sets them apart.

- Trucover Insurance: Trucover Insurance emphasizes simplicity and affordability. Their straightforward policies and transparent pricing structure resonate with customers looking for accessible coverage without compromising on quality.

In this competitive landscape, California Insurance Company continues to differentiate itself through its commitment to personalized coverage, transparent pricing, and outstanding customer support.

While these competitors offer unique strengths, our dedication to meeting individual needs and providing reliable protection remains our primary focus.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How California Insurance Company Manages Claims

Ease of Filing a Claim

California Insurance Company offers multiple convenient methods for filing insurance claims, ensuring flexibility for policyholders. You can initiate a claim online through their user-friendly website, over the phone with their dedicated customer support, or even via their mobile app. This accessibility allows for quick and hassle-free claim submissions.

Average Claim Processing Time

One of the crucial aspects of an insurance company is the speed at which they process claims. California Insurance Company is known for its efficient claims processing. They prioritize swift resolution, ensuring that policyholders receive the support they need promptly during challenging times.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurer’s performance. Many California Insurance Company policyholders have expressed satisfaction with the way their claims were resolved. Positive feedback often highlights the ease of the claims process and the fair and timely payouts provided by the company.

Digital Tools and Tech Features at California Insurance Company

Mobile App Features and Functionality

California Insurance Company’s mobile app is a powerful tool for policyholders. It offers features such as policy management, digital ID cards, claims tracking, and even roadside assistance. This comprehensive app simplifies insurance-related tasks and enhances the overall customer experience.

Online Account Management Capabilities

Managing your insurance policies online has never been easier. With California Insurance Company’s online account management capabilities, policyholders can access policy details, make payments, update personal information, and even file claims from the comfort of their homes. The user-friendly online portal ensures convenience and accessibility.

Digital Tools and Resources

California Insurance Company provides a range of digital tools and resources to assist policyholders in understanding their coverage better. These include educational articles, calculators, and informative guides on insurance-related topics. These resources empower customers to make informed decisions about their insurance needs.

Frequently Asked Questions

What types of insurance does California Insurance Company offer?

California Insurance Company provides a comprehensive range of insurance options, including home insurance, auto insurance, health insurance, life insurance, business insurance, renter’s insurance, and umbrella insurance.

What discounts does California Insurance Company provide?

California Insurance Company offers a variety of discounts, including safe driving, multi-policy, good student, safe vehicle, low mileage, loyalty, defensive driving course, and payment discounts. These discounts help you save while promoting responsible behavior.

How efficient is California Insurance Company’s claims process?

The claims process at California Insurance Company is designed for efficiency and support. The company ensures timely assistance, with a dedicated team guiding policyholders through the process and helping them navigate any challenges.

What sets California Insurance Company apart from its competitors?

California Insurance Company stands out through its commitment to personalized coverage, transparent pricing, exceptional customer support, and a comprehensive range of insurance offerings. The focus on meeting individual needs and providing reliable protection distinguishes the company in the industry.

Can I bundle multiple insurance policies with California Insurance Company?

Yes, California Insurance Company offers a multi-policy discount, allowing customers to bundle multiple insurance policies, such as home and auto insurance, to save on premiums and simplify coverage management.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.