Camico Mutual Insurance Company Review (2026)

Camico Mutual Insurance Company, a stalwart ally in the realm of business insurance, offers tailored coverage addressing diverse risks, from liability to cybersecurity, providing businesses with a robust shield against unforeseen challenges and fostering confidence in navigating the future.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Camico Mutual Insurance Company emerges as a steadfast ally, offering a spectrum of comprehensive insurance solutions tailored to individual enterprise needs.

From liability and cyber risks to workers’ well-being and beyond, Camico’s array of coverage options provides a robust shield against unforeseen challenges. With a reputation for reliability and customer satisfaction, the company’s expertise in addressing industry-specific risks and proactive risk management sets it apart.

While boasting a strong reputation, Camico’s limited availability in certain regions and specialized coverage premiums warrant consideration. In a world fraught with uncertainties, Camico stands poised to fortify businesses, ensuring they navigate the future with confidence.

Camico Mutual Insurance Company Insurance Coverage Options

Camico Mutual Insurance Company presents a diverse range of coverage options designed to meet the intricate needs of businesses. These offerings encompass:

- Liability Insurance: Providing a safety net against legal liabilities stemming from accidents, injuries, or property damage, tailored to the size and industry of your business.

- Professional Indemnity Insurance: Safeguarding your professional reputation by offering protection against claims of negligence or inadequate work.

- Cyber Liability Insurance: Mitigating cyber risks through coverage against data breaches, cyberattacks, and digital mishaps, adapting to the evolving cyber landscape.

- Property and Casualty Insurance: Shielding physical assets and liabilities by covering property damage, liability claims, and income loss due to covered perils, customizable to your business’s unique characteristics.

- Workers’ Compensation Insurance: Demonstrating commitment to employees’ well-being with coverage for workplace injuries, fostering a secure work environment.

- Business Interruption Insurance: Providing financial support during operational disruptions, encompassing income loss, ongoing expenses, and temporary relocation costs.

- Employee Benefits Liability Insurance: Ensuring seamless benefits administration and protection against errors or omissions in benefit management.

These coverage options collectively fortify your business against an array of risks, allowing you to navigate the business landscape with confidence and resilience.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Camico Mutual Insurance Company Insurance Rates Breakdown

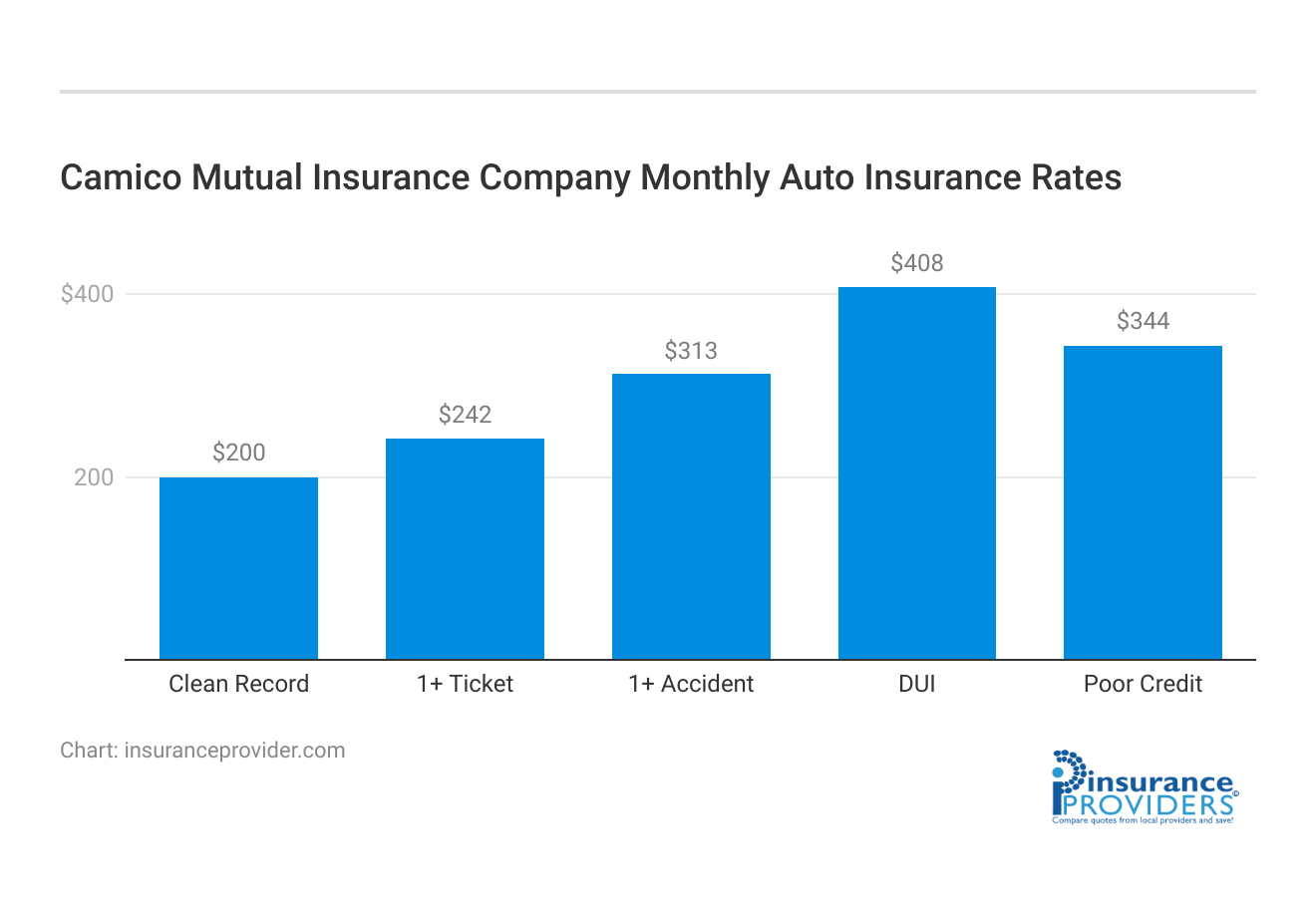

| Driver Profile | Camico Mutual Insurance | National Average |

|---|---|---|

| Clean Record | $200 | $119 |

| 1+ Ticket | $242 | $147 |

| 1+ Accident | $313 | $173 |

| DUI | $408 | $209 |

| Poor Credit | $344 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Camico Mutual Insurance Company Discounts Available

| Discounts | Camico Mutual |

|---|---|

| Anti Theft | 14% |

| Good Student | 17% |

| Low Mileage | 12% |

| Paperless | 11% |

| Safe Driver | 16% |

| Senior Driver | 11% |

Camico Mutual Insurance Company extends various discounts to enhance the value and affordability of their insurance solutions. These discounts include:

- Multi-policy Discount: Enjoy savings by bundling multiple insurance policies, streamlining your coverage needs.

- Claims-free Discount: Rewarding businesses with a track record of avoiding claims by offering reduced premiums.

- Safety and Security Measures Discount: Lower premiums for implementing security measures, such as alarm systems and safety protocols.

- Professional Association Discount: Exclusive savings for businesses affiliated with specific professional associations.

- Renewal Discount: Demonstrating appreciation for customer loyalty by offering discounts upon policy renewals.

- Early Payment Discount: Encouraging prompt payments through reduced premiums for early payments.

- Deductible Discounts: Tailor your policy to your financial preferences by adjusting deductibles and enjoying potential premium reductions.

- Good Credit Discount: Recognizing businesses with strong credit histories by offering discounted rates.

These discounts exemplify Camico’s commitment to providing not only comprehensive coverage but also cost-effective solutions tailored to individual business situations.

How Camico Mutual Insurance Company Ranks Among Providers

Camico Mutual Insurance Company operates in a competitive landscape where several key players vie to provide insurance solutions to businesses. Some of its main competitors include:

- Chubb: A globally recognized insurance provider offering a wide range of commercial insurance solutions. Chubb is known for its robust coverage options and tailored policies.

- The Hartford: With a strong focus on small and mid-sized businesses, The Hartford offers various insurance coverages, including property, liability, and workers’ compensation.

- Hiscox: Specializing in professional liability and business insurance, Hiscox is notable for its customizable coverage options and digital-first approach.

- CNA Financial: CNA provides a comprehensive suite of insurance products for businesses, including specialty coverages such as professional liability and cyber insurance.

- Travelers: Another major player in the business insurance sector, Travelers offers a wide array of coverage options, risk management resources, and industry-specific solutions.

- Nationwide: Known for its diverse commercial insurance offerings, Nationwide caters to various industries and business sizes, offering tailored protection plans.

These competitors, among others, challenge Camico Mutual Insurance Company in delivering effective and comprehensive insurance solutions.

Each competitor brings its strengths, unique offerings, and market presence, fostering a dynamic environment that encourages innovation and customer-centric approaches.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Camico Mutual Insurance Company Handles Claims

Ease of Filing a Claim

Filing a claim with Camico Mutual Insurance Company is a seamless experience, offering multiple channels for your convenience. Whether you prefer the ease of online submissions, the personal touch of over-the-phone assistance, or the flexibility of mobile apps, Camico has you covered.

Average Claim Processing Time

Camico Mutual Insurance Company is dedicated to swift claims resolution. On average, they boast one of the industry’s shortest claim processing times, ensuring you get the support you need precisely when you need it.

Customer Feedback on Claim Resolutions and Payouts

Customer satisfaction is at the core of Camico’s claims process. Their commitment to resolving claims fairly and efficiently has garnered positive feedback from policyholders. Real-world experiences highlight Camico’s reliability in delivering on their promises.

Digital and Tech Features of Camico Mutual Insurance Company

Mobile App Features and Functionality

Camico’s mobile app is a powerful tool that puts policy management at your fingertips. From reviewing policy details to filing claims on the go, the app offers a range of features to simplify your insurance experience.

Online Account Management Capabilities

Managing your insurance policies has never been easier. Camico provides a robust online account management platform, allowing you to access policy documents, make payments, and track claims from the comfort of your own device.

Digital Tools and Resources Camico

Mutual Insurance Company goes beyond basic coverage. Their digital tools and resources empower policyholders with insights into risk management, offering valuable guidance to protect your business. Explore a wealth of resources designed to bolster your understanding of insurance and reduce potential vulnerabilities.

Frequently Asked Questions

What makes Camico Mutual Insurance Company stand out among other insurers?

Camico’s unique approach lies in its deep understanding of businesses’ nuanced needs. Tailored coverage, industry expertise, and a commitment to proactive protection set Camico apart.

Can I bundle multiple insurance types with Camico?

Yes, Camico offers the flexibility to bundle various insurance types, creating a comprehensive shield against diverse risks.

How does Camico determine coverage customization?

Camico’s team of experts conducts thorough assessments of your business, industry, and risk profile to tailor coverage that precisely fits your requirements.

Are there any industry-specific insurance options offered by Camico?

Absolutely, Camico offers industry-specific coverage options, recognizing that different sectors face distinct risks.

Is Camico Mutual Insurance Company’s coverage available internationally?

Camico’s coverage is primarily available within specific regions, so it’s recommended to check with them regarding international coverage options.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.