Canal Insurance Company Review (2026)

Introducing Canal Insurance Company, a stalwart industry leader specializing in tailored protection for businesses and individuals, with a notable A.M. Best rating and a distinct focus on Commercial Trucking Insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the reliable choice for safeguarding what matters most—Canal Insurance Company. With an A.M. Best rating of A (Excellent), they offer tailored protection through specialized Commercial Trucking Insurance, covering businesses of all sizes. From Commercial Auto Liability to Physical Damage Coverage, Canal ensures security in challenging situations.

Their Motor Truck Cargo Coverage safeguards transported goods, while General Commercial Liability extends protection against liability claims. With a trusted reputation, decades of experience, and a customer-centric approach, Canal Insurance stands as the preferred option for businesses and individuals alike.

Canal Insurance Company Insurance Coverage Options

Canal Insurance Company specializes in providing comprehensive insurance coverage tailored to meet the unique needs of businesses and individuals, with a primary focus on Commercial Trucking Insurance. Below, we outline the coverage options offered by Canal Insurance Company:

- Commercial Auto Liability: Canal Insurance offers liability coverage for commercial vehicles, protecting businesses from financial losses resulting from accidents or injuries caused by their vehicles.

- Physical Damage Coverage: This coverage safeguards commercial vehicles against damage from accidents, collisions, vandalism, or theft, helping businesses repair or replace their assets.

- Motor Truck Cargo Coverage: Canal’s motor truck cargo coverage ensures that goods being transported are protected, providing compensation for cargo damage or loss during transit.

- General Commercial Liability: This coverage extends protection to businesses against liability claims related to bodily injury or property damage that may occur during their operations.

- Commercial Property Insurance: Canal Insurance Company also offers coverage for commercial properties, protecting business assets such as buildings and equipment from perils like fire, theft, or natural disasters.

- Commercial Umbrella Insurance: To provide an extra layer of liability protection, Canal offers commercial umbrella insurance, which extends the coverage limits of underlying policies.

- Commercial Inland Marine Insurance: This coverage is designed to protect movable business property, such as tools and equipment, that may not be adequately covered by standard property insurance.

- Commercial Pollution Liability: Canal Insurance Company provides coverage for businesses facing environmental liability risks, helping them address pollution-related claims and cleanup costs.

- Fleet Size Discounts: Canal offers discounts based on the size of a business’s commercial vehicle fleet, providing cost-effective solutions for larger operations.

- Safety Program Discounts: Businesses can qualify for discounts by implementing safety programs and practices, and encouraging responsible and safe driving behaviors.

- Good Driver Discounts: Safe and responsible drivers can benefit from discounts on their insurance premiums, promoting safe driving practices.

- Multi-Policy Discounts: Canal Insurance Company incentivizes policyholders to bundle multiple insurance policies, such as auto and property insurance, to save on overall costs.

- Flexible Payment Options: Canal Insurance offers various payment options, allowing policyholders to choose a payment plan that suits their financial preferences.

Canal Insurance Company stands out for its specialized insurance offerings, commitment to tailored protection, and a range of discounts aimed at making insurance more affordable for businesses and individuals.

For more information about Canal Insurance Company or to explore these coverage options in detail, it is recommended to contact their experienced agents who can provide personalized guidance and policy customization to meet your specific insurance needs.

Read more: Canal Indemnity Company Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

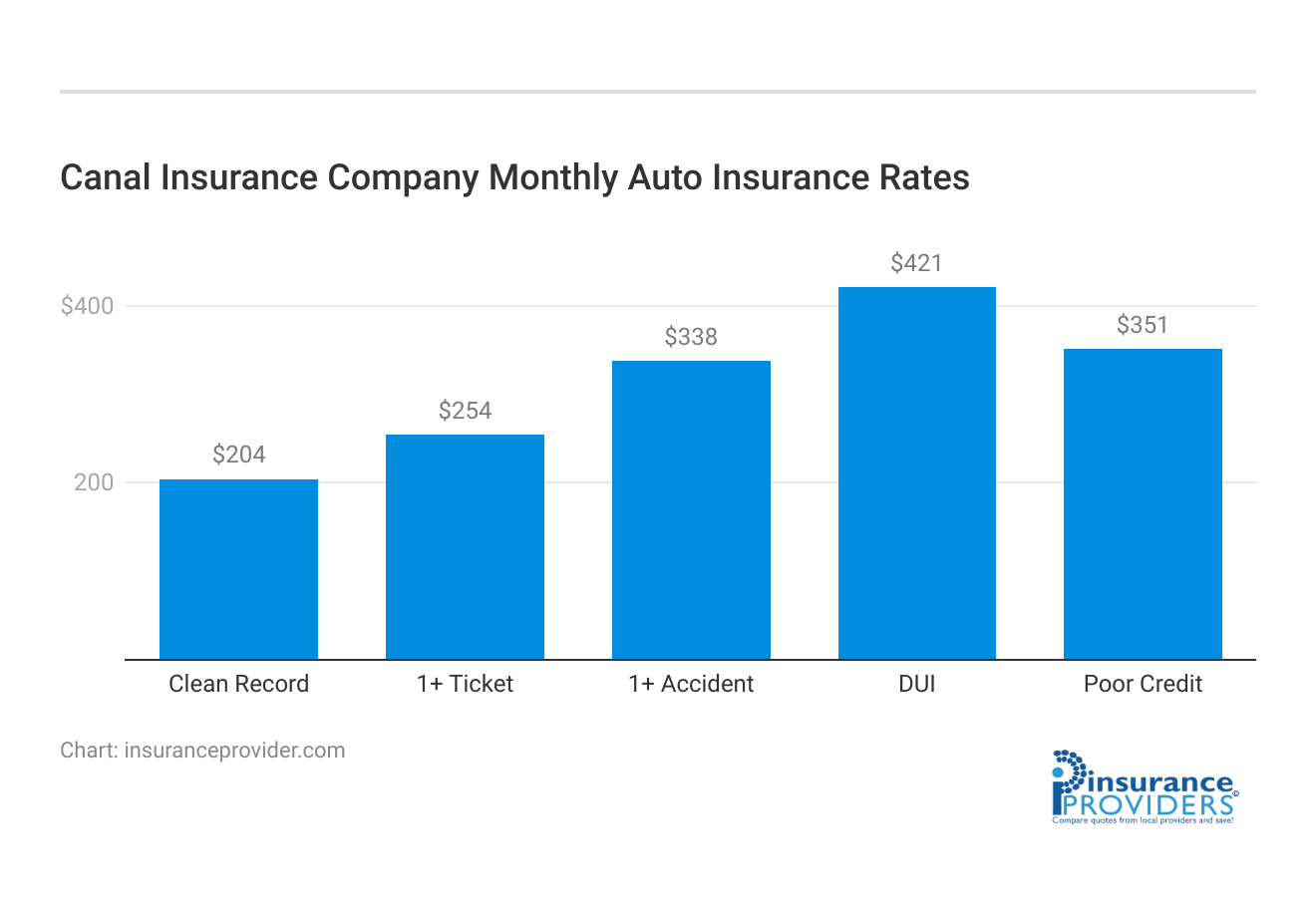

Canal Insurance Company Insurance Rates Breakdown

| Driver Profile | Canal Insurance | National Average |

|---|---|---|

| Clean Record | $204 | $119 |

| 1+ Ticket | $254 | $147 |

| 1+ Accident | $338 | $173 |

| DUI | $421 | $209 |

| Poor Credit | $351 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Canal Insurance Company Discounts Available

| Discounts | Canal Insurance Company |

|---|---|

| Anti Theft | 14% |

| Good Student | 17% |

| Low Mileage | 12% |

| Paperless | 11% |

| Safe Driver | 16% |

| Senior Driver | 11% |

Canal Insurance Company is dedicated to offering not only comprehensive coverage but also cost-effective solutions through a range of enticing discounts:

- Fleet Size Discount: Businesses with larger fleets can enjoy reduced premiums, recognizing their commitment to safe and responsible operations.

- Safety Program Discount: Implementing rigorous safety programs and adhering to best practices can lead to substantial premium discounts, incentivizing safety-conscious behavior.

- Good Driver Discount: Rewarding individual drivers with a clean record, this discount acknowledges responsible driving habits and offers lower premiums as a result.

- Multi-policy Discount: Bundling multiple policies with Canal Insurance leads to cost savings, making it an attractive option for those seeking comprehensive coverage across various aspects of their business.

- Payment Options Discount: Opting for certain payment methods can unlock additional savings, making insurance more accessible and affordable for policyholders.

By providing these discounts, Canal Insurance Company not only demonstrates their commitment to their clients’ financial well-being but also encourages safety, responsible practices, and long-term partnerships.

How Canal Insurance Company Ranks Among Providers

Canal Insurance Company navigates a competitive landscape with several notable contenders.

While each competitor brings its strengths to the table, Canal Insurance distinguishes itself through its specialized offerings and customer-centric approach:

- Progressive Commercial: A major player known for its comprehensive range of commercial insurance options, Progressive Commercial boasts an easy-to-use online platform and a strong focus on customization.

- Travelers Business Insurance: Travelers is recognized for its extensive network and diverse coverage options, catering to both small businesses and larger enterprises with a variety of industry-specific packages.

- Nationwide Commercial: Nationwide stands out for its robust insurance products and a range of coverage options, including commercial auto insurance and general liability coverage.

- State Farm Business Insurance: State Farm’s longstanding reputation and extensive agent network provide a personal touch to their commercial insurance services, appealing to businesses seeking a more traditional approach.

- Liberty Mutual Business Insurance: Liberty Mutual offers comprehensive business insurance solutions and emphasizes risk management, making it an attractive choice for businesses focused on proactive risk mitigation.

Despite the competition, Canal Insurance Company’s niche focus on Commercial Trucking Insurance and their commitment to tailor-made solutions positions them as a strong choice for businesses seeking specialized coverage and dedicated customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canal Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Canal Insurance Company understands the importance of a smooth and hassle-free claims process for its customers. They offer multiple convenient methods for filing claims, including online submissions, over-the-phone assistance, and mobile app accessibility.

This flexibility ensures that policyholders can choose the option that suits them best, making it easy to report and initiate the claims process.

Average Claim Processing Time

One of the critical factors in evaluating an insurance company is the speed at which they process claims. Canal Insurance Company strives to expedite claim processing to minimize disruptions for their policyholders. While specific processing times may vary depending on the nature of the claim, they aim to handle claims efficiently to provide timely support to their customers.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is invaluable in assessing an insurance company’s performance in handling claims. Canal Insurance Company has garnered positive reviews for its fair and prompt claim resolutions and payouts. Their commitment to customer satisfaction is reflected in the testimonials and feedback from policyholders who have experienced smooth claim settlements.

Digital and Technological Features of Canal Insurance Company

Mobile App Features and Functionality

Canal Insurance Company offers a user-friendly mobile app that provides policyholders with convenient access to their insurance information. The app features a range of functionalities, including policy management, claims tracking, and digital ID cards. This mobile app empowers customers to manage their insurance needs on the go, enhancing their overall experience.

Online Account Management Capabilities

Policyholders can take advantage of Canal Insurance Company’s robust online account management capabilities. Through their secure online portal, customers can view and update policy details, make payments, and track claims. This digital convenience simplifies the insurance experience and ensures that customers have easy access to essential information and services.

Digital Tools and Resources

In addition to their mobile app and online account management, Canal Insurance Company offers a variety of digital tools and resources to assist policyholders. These resources may include educational materials, risk assessment tools, and access to helpful insurance information.

By providing these digital resources, Canal Insurance Company empowers their customers to make informed decisions about their insurance coverage. With a commitment to both a seamless claims process and advanced digital features, Canal Insurance Company strives to deliver a comprehensive and customer-focused insurance experience for businesses and individuals alike.

Frequently Asked Questions

What types of insurance does Canal Insurance Company offer?

Canal Insurance Company specializes in Commercial Trucking Insurance, providing coverage such as auto liability, physical damage, motor truck cargo, and general liability.

How does Canal Insurance stand out from competitors?

Canal’s expertise in trucking insurance, coupled with a commitment to tailored protection and exceptional customer service, sets them apart in a competitive landscape.

Can individuals get coverage from Canal Insurance?

Canal primarily serves businesses, they also offer commercial auto liability coverage, extending benefits to individual drivers with commercial vehicles.

What discounts does Canal Insurance provide?

Canal Insurance Company offers various discounts, including fleet size, safety program, good driver, multi-policy, and payment options discounts, enhancing affordability for policyholders.

How can I get a policy from Canal Insurance?

Obtaining a policy is straightforward. Canal’s expert agents work with you to understand your needs and customize a policy that suits your specific requirements.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.