Compass Insurance Company Review (2026)

Explore the safeguarding expertise of Compass Insurance Company – a comprehensive shield against life's uncertainties, offering tailored solutions and peace of mind across homes, vehicles, health, and business ventures.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the comprehensive protection and peace of mind offered by Compass Insurance Company. From safeguarding your home against natural disasters and theft to providing coverage for your vehicle’s journey on the road, Compass ensures you’re shielded from life’s uncertainties.

Their commitment extends to your health, with an extensive network of healthcare providers offering comprehensive medical coverage and additional wellness services. Looking ahead, Compass’s life insurance policies secure your family’s financial future, while their tailored business plans protect your ventures against unexpected challenges.

With a focus on tailored solutions and attractive discounts, Compass Insurance Company stands as a reliable ally in navigating life’s twists and turns, providing not just coverage, but also confidence in the face of the unknown.

Compass Insurance Company Insurance Coverage Options

At Compass Insurance Company, safeguarding what matters most to you is their paramount concern. With a deep understanding of life’s uncertainties, they offer a diverse range of coverage options that cater to your unique needs.

From protecting your home and vehicle to ensuring the well-being of your loved ones and securing your business, Compass has tailored solutions that bring you peace of mind.

- Home Insurance: Compass Insurance Company provides comprehensive coverage for your home, including protection against natural disasters, theft, and liability. Their policies extend to both structural elements and personal belongings, offering a holistic shield against unexpected events.

- Auto Insurance: When it comes to your vehicle, Compass offers coverage that includes collision, comprehensive damages, and bodily injury liability. Drive with confidence knowing you’re protected against a range of potential risks on the road.

- Health Insurance: Your well-being is a priority, and Compass Insurance Company recognizes that. They partner with a vast network of healthcare providers to offer comprehensive medical coverage, ensuring you receive the care you need when you need it.

- Life Insurance: Planning for the future is essential, and Compass’s life insurance policies provide a safety net for your loved ones. Their coverage options include financial protection against final expenses, income replacement, and more, ensuring your family’s financial stability.

- Business Insurance: Compass understands the challenges businesses face, which is why they offer tailored plans for both small and large enterprises. From property damage to liability and business interruption, their coverage options are designed to keep your business secure.

In a world where the unexpected is a constant presence, Compass Insurance Company stands by your side, offering a suite of coverage options that extend well beyond the ordinary. No matter the stage of life you’re in or the size of your business, Compass’s commitment to your protection shines through in every policy they offer.

With their expertise and dedication, you can face the future with confidence, knowing that you’ve partnered with a company that truly understands and anticipates your needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compass Insurance Company Insurance Rates Breakdown

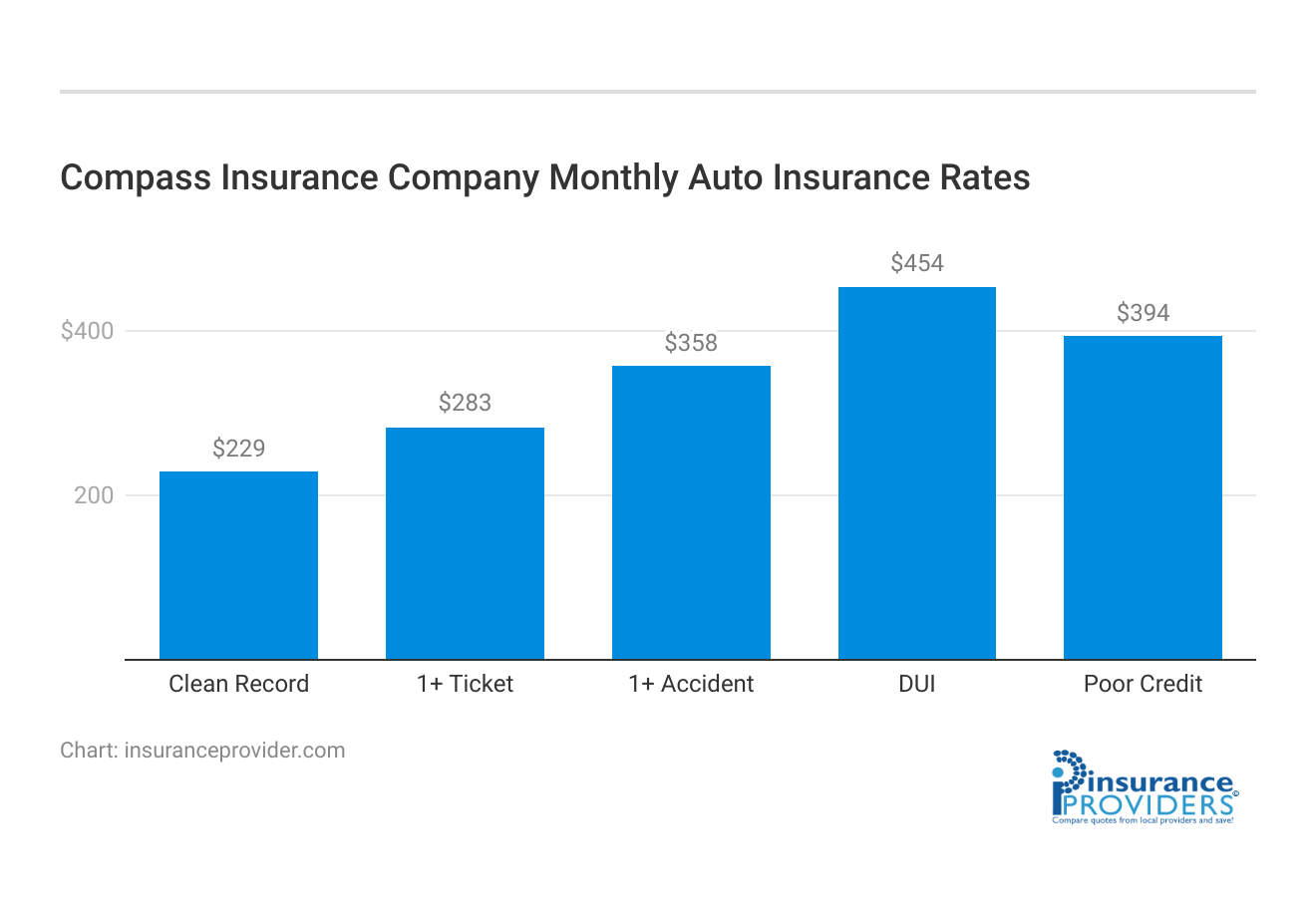

| Driver Profile | Compass Insurance Company | National Average |

|---|---|---|

| Clean Record | $229 | $119 |

| 1+ Ticket | $283 | $147 |

| 1+ Accident | $358 | $173 |

| DUI | $454 | $209 |

| Poor Credit | $394 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Compass Insurance Company Discounts Available

| Discounts | Compass Insurance |

|---|---|

| Anti Theft | 13% |

| Good Student | 15% |

| Low Mileage | 11% |

| Paperless | 10% |

| Safe Driver | 14% |

| Senior Driver | 10% |

At Compass Insurance Company, your security and satisfaction are of utmost importance. That’s why they offer a range of attractive discounts that not only protect you but also help you save. Here are some of the discounts you can take advantage of:

- Safe Driver Discount: Rewarding those with a clean driving record, this discount recognizes your commitment to safe driving practices, lowering your premium as a result.

- Multi-Policy Discount: Bundle your insurance policies with Compass, and enjoy substantial savings. Combining your home and auto insurance or other coverage options can lead to more affordable rates.

- Good Student Discount: If you have a young driver in the family who maintains good grades, you can benefit from this discount, which acknowledges their responsible behavior both on and off the road.

- Anti-Theft Device Discount: Equipping your vehicle with anti-theft devices not only enhances your security but also qualifies you for a discount on your auto insurance premium.

- Pay-in-Full Discount: Choosing to pay your premium in full upfront demonstrates your commitment, and Compass rewards this with a discount that helps you save over the long term.

- Safe Vehicle Discount: If your vehicle is equipped with advanced safety features, such as airbags, anti-lock brakes, and electronic stability control, you’re eligible for this discount.

- Loyalty Discount: Loyalty matters at Compass. The longer you stay with them, the more you save. This discount grows over time as a token of appreciation for your continued trust.

- Good Health Discount: Demonstrating a commitment to your well-being, Compass offers a discount to policyholders who maintain a healthy lifestyle and participate in wellness programs.

At Compass Insurance Company, these discounts are just one way they prioritize your financial well-being while ensuring you receive the highest level of protection.

How Compass Insurance Company Ranks Among Providers

Competition in the insurance industry is fierce, with numerous companies vying to provide the best coverage and services. Compass Insurance Company faces competition from several key players in the market. Here are some of its main competitors:

- Shield Insurance Group: Known for its customer-centric approach and comprehensive coverage options, Shield Insurance Group has built a strong reputation in the industry. They offer a wide range of insurance products, from home and auto to life and health insurance, catering to diverse customer needs.

- Guardian Assurance Services: Guardian Assurance Services is a notable competitor, particularly in the life insurance sector. They focus on innovative policy customization and financial planning, aiming to secure the future of their customers and their families.

- Safedrive Insurance: As a direct competitor in the auto insurance domain, Safedrive Insurance is renowned for its emphasis on safe driving practices. They provide telematics-based policies that reward responsible drivers with lower premiums, making them an appealing choice for those looking to save on auto insurance.

- Wellcare Insurance Solutions: Wellcare specializes in health insurance coverage, offering a comprehensive range of plans that cater to various medical needs. With a vast network of healthcare providers, Wellcare competes by providing extensive coverage options and additional wellness services.

- Businessguard Insurance: In the realm of business insurance, Businessguard stands out as a formidable rival to Compass. They offer tailored coverage solutions for businesses of all sizes, focusing on risk management and comprehensive protection against potential business disruptions.

- Nationalhome Insurance: Competing in the home insurance sector, Nationalhome Insurance boasts a wide variety of policy options, customizable coverage, and a user-friendly online platform. They are known for their quick claims processing and dedicated customer service.

Each of these competitors brings its own strengths and unique offerings to the table, contributing to a dynamic landscape where Compass Insurance Company strives to differentiate itself through its comprehensive coverage options, attractive discounts, and commitment to customer satisfaction.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compass Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Compass Insurance Company offers a user-friendly claims process designed to provide convenience to its policyholders. Customers have the option to file claims through multiple channels, including online, over the phone, and through their mobile app.

This flexibility ensures that policyholders can choose the method that best suits their preferences and needs. Whether you prefer the convenience of filing a claim online, the personal touch of speaking with a representative over the phone, or the ease of using a mobile app, Compass Insurance Company has you covered.

Average Claim Processing Time

One of the key factors that policyholders consider when evaluating an insurance company is the speed at which claims are processed. Compass Insurance Company is committed to efficiently handling claims to minimize the disruption and stress that can accompany unexpected events.

While specific processing times may vary depending on the nature and complexity of the claim, Compass strives to process claims in a timely manner, keeping customers informed throughout the process.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is invaluable in assessing an insurance company’s performance in claim resolutions and payouts. Compass Insurance Company prioritizes customer satisfaction and continuously seeks feedback to improve its services.

Policyholders’ experiences with claim resolutions and payouts are a crucial aspect of this process. By listening to customer feedback, Compass aims to enhance its claims-handling procedures to ensure fair and satisfactory outcomes for its valued customers.

Compass Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Compass Insurance Company understands the importance of digital accessibility and convenience. Their mobile app offers a range of features and functionalities to enhance the overall customer experience.

Through the app, policyholders can access their insurance information, view policy documents, make premium payments, and even file claims. The intuitive design of the app makes it easy for users to navigate and manage their insurance needs on the go.

Online Account Management Capabilities

In addition to the mobile app, Compass Insurance Company provides robust online account management capabilities through its website. Policyholders can log in to their accounts to review and update their policies, track claims, and access important documents.

This online portal empowers customers with the tools they need to manage their insurance policies efficiently and conveniently from the comfort of their homes.

Digital Tools and Resources

Compass Insurance Company recognizes that informed policyholders make better decisions. To support this, they offer a variety of digital tools and resources on their website.

These resources include informative articles, FAQs, and calculators to help customers better understand their insurance needs and make well-informed choices. By providing these digital resources, Compass aims to empower its customers to navigate the complexities of insurance with confidence.

Frequently Asked Questions

What types of insurance does Compass Insurance Company offer?

Compass Insurance Company offers a wide array of insurance options, including home, auto, health, life, and business insurance. Their coverage spans from protecting your home and vehicle to ensuring your health and planning for the future.

What are the benefits of bundling multiple insurance policies with Compass?

Bundling policies with Compass Insurance Company can lead to significant savings. By combining your home, auto, or other coverage options, you can enjoy a multi-policy discount, making your insurance more affordable and convenient.

How does Compass Insurance Company reward safe drivers?

Compass provides a Safe Driver Discount for those with a clean driving record. This discount acknowledges your commitment to safe driving practices and results in a lower insurance premium.

What is the Loyalty Discount offered by Compass Insurance Company?

The Loyalty Discount rewards long-term policyholders for their continued trust. As you remain with Compass, this discount grows over time as an expression of appreciation.

Does Compass Insurance Company offer personalized consultations for insurance needs?

Yes, Compass offers personalized consultations to assess your specific requirements and recommend the ideal coverage options tailored to your needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.