Compbenefits Insurance Company Review (2026)

Discover the world of insurance excellence with Compbenefits Insurance Company, a leading provider of diverse insurance solutions tailored to meet your unique needs.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the world of insurance excellence with Compbenefits Insurance Company, a leading provider of diverse insurance solutions tailored to meet your unique needs.

Offering a comprehensive range of coverage options including health, dental, vision, life, and disability insurance, Compbenefits stands out for its exceptional customer service, transparent policies, and a commitment to your well-being.

Compbenefits Insurance Company Insurance Coverage Options

Compbenefits Insurance Company is dedicated to providing a diverse range of coverage options to cater to various individual needs.

Whether you’re looking to protect your health, secure your financial future, or ensure your overall well-being, Compbenefits has you covered with its comprehensive insurance offerings. Here are the coverage options they provide:

- Health Insurance: Compbenefits offers extensive health insurance plans that cover a wide range of medical services, including regular check-ups, specialist consultations, hospital stays, and prescription medications.

- Dental Insurance: With dental coverage from Compbenefits, you can maintain your oral health with coverage for routine dental check-ups, cleanings, X-rays, and various dental procedures.

- Vision Insurance: Compbenefits’ vision insurance provides coverage for regular eye exams, prescription eyewear (glasses or contact lenses), and even discounts on corrective eye surgeries, ensuring you maintain clear vision.

- Life Insurance: Protect your loved ones’ financial security with Compbenefits’ life insurance policies. These policies offer a payout to your beneficiaries in the event of your passing, helping them manage expenses during challenging times.

- Disability Insurance: Compbenefits’ disability insurance ensures you have a safety net if you’re unable to work due to a covered disability. It provides financial support to help you meet your expenses during such periods.

Compbenefits Insurance Company’s commitment to offering a diverse array of coverage options underscores its dedication to meeting the unique needs of individuals and families, providing them with the security and peace of mind they deserve.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compbenefits Insurance Company Insurance Rates Breakdown

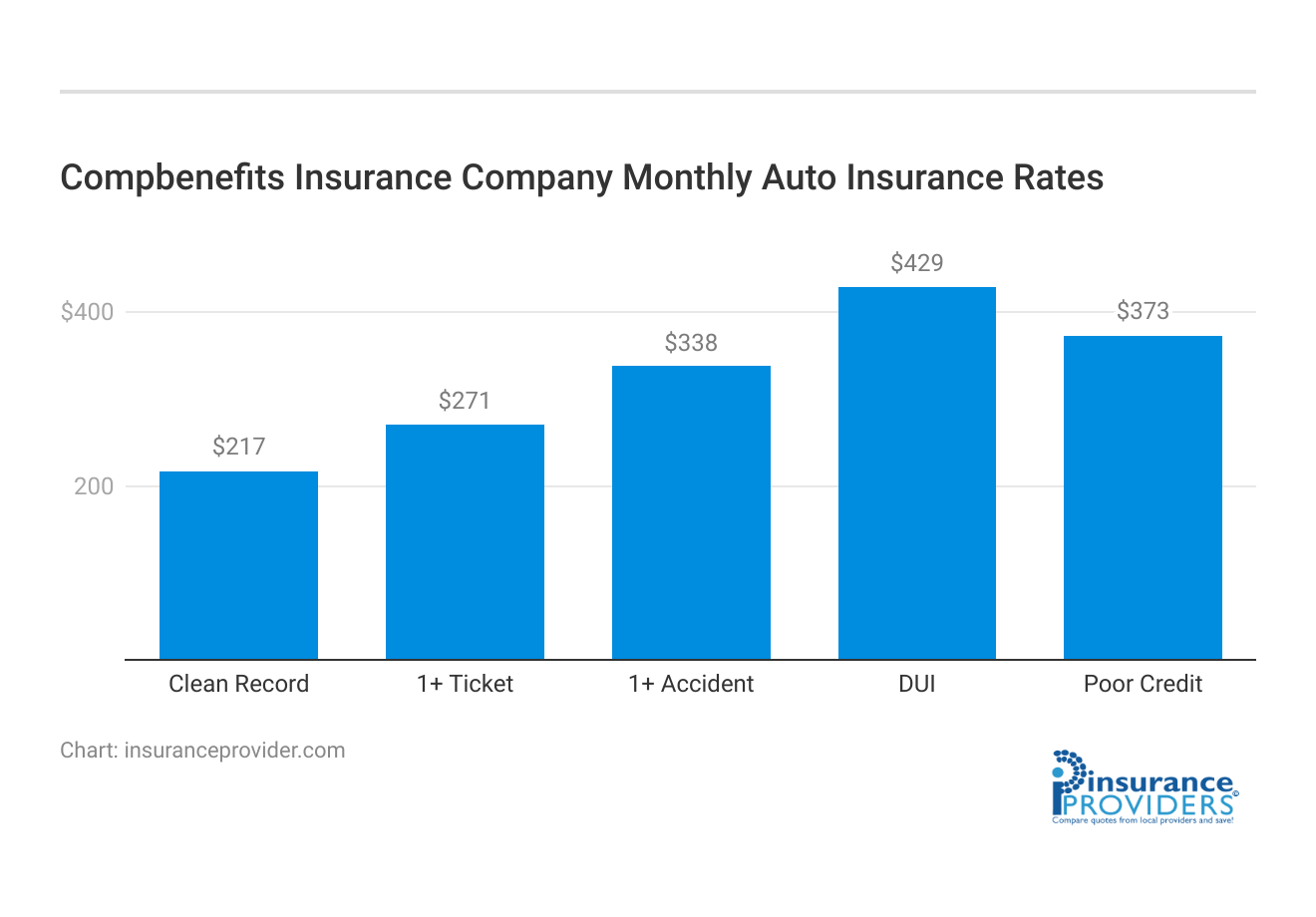

| Driver Profile | Compbenefits Insurance | National Average |

|---|---|---|

| Clean Record | $217 | $119 |

| 1+ Ticket | $271 | $147 |

| 1+ Accident | $338 | $173 |

| DUI | $429 | $209 |

| Poor Credit | $373 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Compbenefits Insurance Company Discounts Available

| Discounts | Compbenefits Insurance |

|---|---|

| Anti Theft | 12% |

| Good Student | 14% |

| Low Mileage | 10% |

| Paperless | 9% |

| Safe Driver | 13% |

| Senior Driver | 9% |

Compbenefits Insurance Company goes the extra mile to make insurance coverage more affordable and accessible for its customers.

To ensure that individuals and families can protect themselves without breaking the bank, Compbenefits offers a range of discounts that can lead to significant savings. Here are the discounts you can take advantage of:

- Bundle Discount: Combining multiple insurance policies with Compbenefits, such as health and dental insurance, can lead to substantial savings through a bundled policy discount.

- Family Plan Discount: Families can enjoy reduced rates by enrolling multiple family members under the same insurance plan, making it an economical choice for those with dependents.

- Safe Driving Discount: For auto insurance, safe drivers with a clean driving record can qualify for a safe driving discount, rewarding responsible driving habits.

- Healthy Lifestyle Discount: Compbenefits promotes healthy living by offering discounts to policyholders who actively engage in wellness activities, such as gym memberships, annual health check-ups, and participation in health programs.

- Multi-Year Policy Discount: Opting for a multi-year insurance policy with Compbenefits can lead to lower premium rates, providing both stability and cost savings.

- Good Student Discount: Students who excel academically can benefit from reduced rates on their insurance policies, encouraging academic achievement and responsible behavior.

These discounts are a testament to Compbenefits’ commitment to ensuring that its customers receive the best possible value for their insurance coverage.

By offering a variety of ways to save, Compbenefits helps individuals and families achieve the protection they need while keeping their budgets in mind.

How Compbenefits Insurance Company Ranks Among Providers

In the competitive landscape of the insurance industry, Compbenefits Insurance Company faces various rivals that also offer a range of coverage options and services.

Understanding the company’s main competitors provides valuable insights into the industry dynamics. Here are some of Compbenefits’ primary competitors:

- Wellguard Insurance Group: Wellguard is a well-established player in the insurance industry known for its comprehensive health, dental, and vision insurance offerings. The company emphasizes personalized coverage and innovative wellness programs, attracting a diverse customer base.

- Dentasure Insurance Services: Specializing in dental insurance, Dentasure is a formidable competitor to Compbenefits. With a focus on dental care and a wide network of dental providers, Dentasure appeals to individuals seeking robust dental coverage.

- Visicare Assurance: Visicare Assurance is a strong contender in the vision insurance sector. Offering coverage for eye exams, eyewear, and corrective surgeries, Visicare appeals to those who prioritize their visual health.

- Lifeshield Financial Services: Lifeshield is a key rival in the life insurance segment. The company’s comprehensive life insurance policies, along with investment-linked plans, provide customers with financial security and wealth-building opportunities.

- Disabilityguard Insure: For disability insurance, Disabilityguard Insure competes directly with Compbenefits. Known for its flexible coverage options and prompt claims processing, the company appeals to individuals seeking income protection during disability.

- Insurancemasters: Insurancemasters offers a diverse range of insurance options, including health, dental, vision, life, and disability coverage. Their strong online platform and user-friendly experience make them a popular choice among tech-savvy customers.

- Caringfamilies Assurance: Caringfamilies Assurance focuses on providing family-oriented coverage, making them a direct competitor to Compbenefits. Their family plans and child-specific coverage options resonate with parents and caregivers.

These competitors challenge Compbenefits by offering similar insurance solutions with varying degrees of specialization and unique features.

As the insurance landscape evolves, Compbenefits remains committed to distinguishing itself through its exceptional customer service, customizable coverage options, and the array of discounts it provides to its valued customers.

Read More: Lifeshield National Insurance Co. Review

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Claims Process With Compbenefits Insurance

Filing a Claim Made Easy

When it comes to filing a claim with Compbenefits Insurance, the process is designed to be as straightforward and hassle-free as possible. Whether you prefer the convenience of handling it online, the personalized touch of speaking to a representative over the phone, or the on-the-go accessibility of mobile apps, Compbenefits Insurance has you covered.

They understand that every customer is unique, and they’ve tailored their claims filing options to suit your individual preferences. In this section, we’ll delve into the various methods available for filing a claim, helping you choose the one that best aligns with your needs.

Quick Claim Processing Times

Time is of the essence when it comes to insurance claims. Compbenefits Insurance understands this, and they strive to ensure that their claim processing times are among the swiftest in the industry. After all, the speed at which your claim is processed can significantly impact how quickly you receive the benefits you’re entitled to.

We’ll provide you with insights into the average claim processing times at Compbenefits Insurance, giving you a clear picture of what to expect when you need to file a claim.

Customer Satisfaction With Claim Resolutions

While the ease of filing a claim and quick processing times are crucial factors, the ultimate test of an insurance company’s performance lies in its customers’ satisfaction with claim resolutions. At Compbenefits Insurance, they take pride in their commitment to customer satisfaction.

In this section, we’ll explore the valuable feedback from policyholders regarding their experiences with claim resolutions and payouts. Real-life customer stories can provide invaluable insights into the company’s track record in this critical area, helping you make an informed decision about your insurance provider.

Digital and Technological Features of Compbenefits Insurance

Mobile App: Features and Functionality

In today’s digitally connected world, insurance companies are expected to offer robust mobile app experiences that put policyholders in control. Compbenefits Insurance is no exception. Their mobile app is a powerful tool designed to simplify policy management, claims tracking, and accessing essential information.

From checking your coverage details on the go to initiating a claim with just a few taps, we’ll walk you through the features and functionality of the Compbenefits Insurance mobile app. By understanding what it has to offer, you’ll be better equipped to navigate your insurance needs with ease.

Online Account Management

Online account management has become a cornerstone of convenience for modern insurance customers. Compbenefits Insurance recognizes this and has invested in providing a seamless online account management experience. In this section, we’ll guide you through the online tools and capabilities that Compbenefits Insurance offers to its policyholders.

These features empower you to access your policy details, update your information, and make informed decisions about your coverage—all from the comfort of your own home.

Digital Tools and Resources at Your Fingertips

In addition to the mobile app and online account management, Compbenefits Insurance offers a range of digital tools and resources designed to assist policyholders in making informed insurance decisions. These resources are designed to demystify the insurance landscape, providing you with the knowledge you need to choose the right coverage for your unique circumstances.

From educational materials to interactive calculators, we’ll delve into the digital tools and resources that Compbenefits Insurance places at your fingertips, empowering you to take control of your insurance journey.

Frequently Asked Questions

What types of insurance does Compbenefits Insurance Company offer?

Compbenefits Insurance Company provides a range of insurance options, including health insurance, dental insurance, vision insurance, life insurance, and disability insurance.

How does Compbenefits Insurance Company differentiate itself from its competitors?

Compbenefits stands out by offering comprehensive coverage, exceptional customer service, transparent policies, and a variety of discounts to ensure customers receive the best value.

Can I customize my insurance coverage with Compbenefits Insurance Company?

Yes, Compbenefits Insurance Company offers customizable insurance options that allow you to tailor your coverage to your specific needs and preferences.

What discounts are available with Compbenefits Insurance Company?

Compbenefits Insurance Company provides various discounts, including bundle discounts for combining multiple insurance policies, safe driving rewards, healthy lifestyle discounts, and more.

How can I apply for insurance with Compbenefits Insurance Company?

Applying for insurance with Compbenefits Insurance Company is easy. Visit their user-friendly website, explore the available insurance options, and follow the simple online application process.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.