Compwest Insurance Company Review (2026)

Within the sphere of insurance protection, Compwest Insurance Company stands out as a dependable ally, providing an extensive array of coverage options to safeguard what matters most.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In the realm of insurance protection, Compwest Insurance Company emerges as a reliable partner offering an extensive range of coverage options to safeguard what matters most.

With a commitment to personalized service, Compwest caters to diverse needs, encompassing home, auto, business, health, and life insurance.

Compwest Insurance Company Insurance Coverage Options

Compwest Insurance Company offers a wide array of coverage options to cater to diverse insurance needs. From protecting your home to ensuring your vehicle and business, Compwest’s policies are designed to provide comprehensive and tailored protection. Here are the coverage options you can expect:

Home Insurance:

- Property damage coverage

- Theft and vandalism protection

- Liability coverage for accidents on your property

- Additional living expenses in case of home damage

Auto Insurance:

- Collision coverage for vehicle damage

- Comprehensive coverage for non-collision incidents

- Liability coverage for bodily injury and property damage

- Uninsured/underinsured motorist coverage

- Roadside assistance and rental vehicle coverage

Business Insurance:

- Property insurance for business premises and assets

- Liability coverage for customer injuries and property damage

- Business interruption coverage for income loss due to interruptions

- Workers’ compensation for employee injuries

- Professional liability insurance for service-based businesses

Health Insurance:

- Network access to healthcare providers and facilities

- Coverage for medical treatments, surgeries, and prescriptions

- Preventive care and wellness programs

- Hospitalization and emergency medical services

- Dental and vision coverage options

Life Insurance:

- Term life insurance for temporary coverage

- Whole life insurance for lifelong protection

- Option to add riders for additional benefits

- Death benefit to support beneficiaries in case of the policyholder’s passing

- Cash value accumulation for certain policies

Compwest’s comprehensive coverage options ensure that you can select the policies that align with your individual or business needs, providing you with the peace of mind you deserve.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compwest Insurance Company Insurance Rates Breakdown

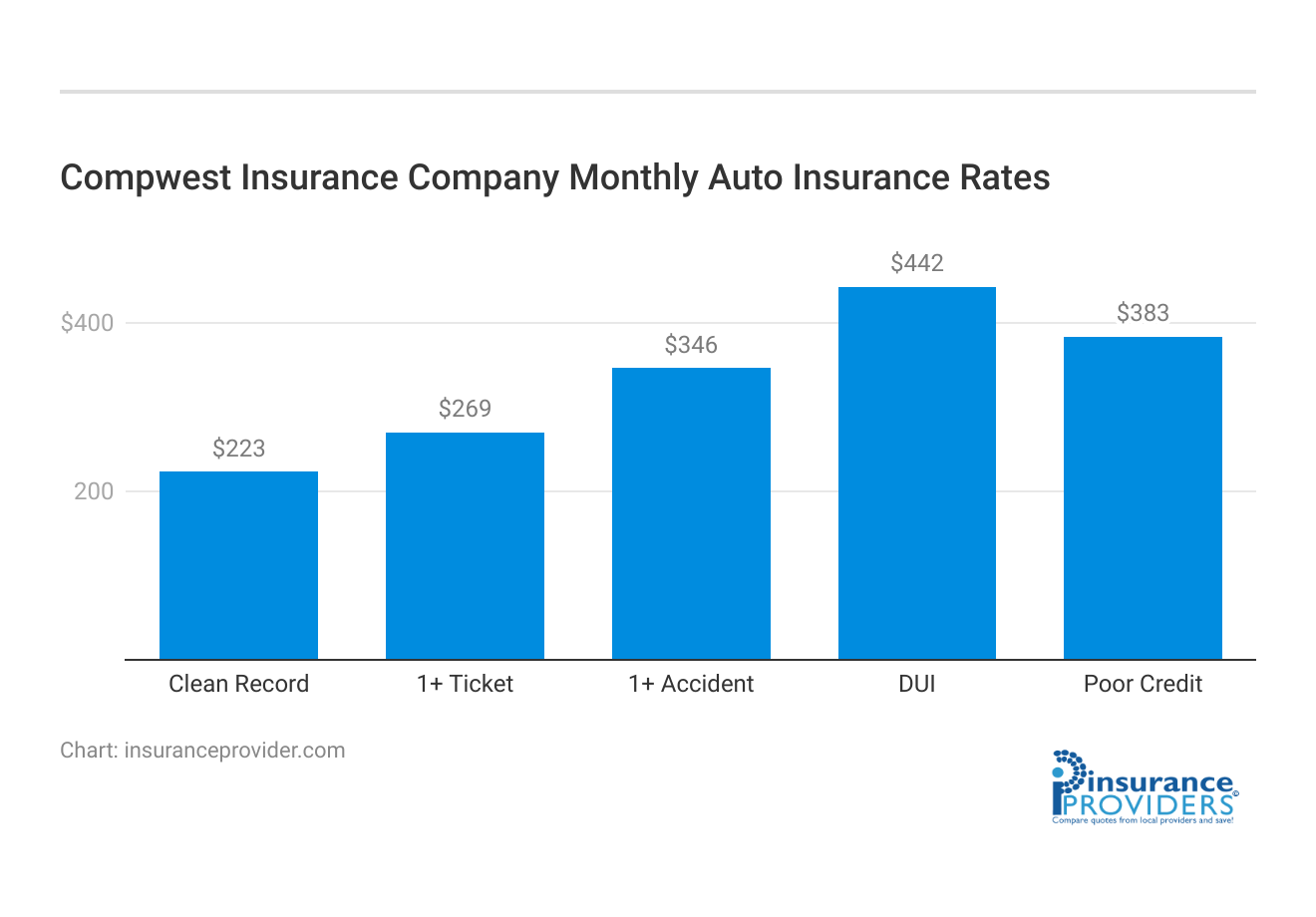

| Driver Profile | Compwest Insurance | National Average |

|---|---|---|

| Clean Record | $223 | $119 |

| 1+ Ticket | $269 | $147 |

| 1+ Accident | $346 | $173 |

| DUI | $442 | $209 |

| Poor Credit | $383 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Compwest Insurance Company Discounts Available

| Discounts | Compwest Insurance |

|---|---|

| Anti Theft | 13% |

| Good Student | 15% |

| Low Mileage | 11% |

| Paperless | 10% |

| Safe Driver | 14% |

| Senior Driver | 10% |

Compwest Insurance Company is committed to helping you save on your insurance premiums while still providing top-notch coverage. They offer a range of discounts that can significantly reduce your insurance costs. Here are some of the discounts you can take advantage of:

- Multi-Policy Discount: Save when you bundle multiple insurance policies with Compwest. Combining your home, auto, and other policies can lead to substantial savings.

- Safe Driver Discount: Rewarding responsible driving, this discount is offered to drivers with a clean driving record, free from accidents and violations.

- Good Student Discount: Students who maintain good grades can enjoy lower insurance rates, promoting both academic excellence and responsible behavior on the road.

- Home Security Discount: Installing security systems in your home can lead to reduced home insurance premiums, as it lowers the risk of theft and vandalism.

- Safe Vehicle Discount: If your vehicle comes equipped with safety features such as anti-lock brakes, airbags, and anti-theft systems, you may be eligible for this discount.

- Multi-Vehicle Discount: Insuring multiple vehicles with Compwest can lead to a discount, making it more affordable to protect all your vehicles.

- Loyalty Discount: Long-term policyholders are recognized with loyalty discounts, rewarding their commitment to Compwest.

- Paid-in-Full Discount: Paying your premium in full upfront can lead to additional savings compared to monthly payments.

- Good Health Discount: For health insurance policies, maintaining a healthy lifestyle and participating in wellness programs can result in discounted rates.

- Safe Business Discount: Businesses that prioritize safety protocols and risk management may qualify for this discount on their business insurance premiums.

These discounts make it easier for you to secure the coverage you need while keeping your insurance costs manageable. Compwest’s commitment to affordability and quality coverage is evident through its diverse discount offerings.

How Compwest Insurance Company Ranks Among Providers

In the competitive landscape of the insurance industry, Compwest Insurance Company faces several formidable competitors that offer similar insurance products and services. These companies provide customers with alternative options for their insurance needs. Here are some of Compwest’s main competitors:

- Secureguard Insurance Group: Secureguard is known for its comprehensive range of insurance policies, including home, auto, business, health, and life insurance. They emphasize personalized coverage and a user-friendly online experience, making them a popular choice among tech-savvy customers.

- Guardian Assurance Services: Guardian Assurance is a strong contender in the insurance market, offering a wide array of policies tailored for individuals and businesses. They are recognized for their exceptional customer service and focus on financial stability, attracting customers who prioritize reliability.

- Nationwide Coverage Corporation: Nationwide Coverage Corporation is renowned for its extensive network and broad range of insurance offerings. They stand out for their flexibility in policy customization and their ability to serve diverse customer demographics, from individuals to large corporations.

- Reliance Shield Insurance: Reliance Shield is a notable competitor that emphasizes comprehensive coverage at competitive rates. They are particularly known for their innovative online tools that simplify the insurance process and allow customers to manage policies with ease.

- Safetynet Insurance Solutions: Safetynet specializes in offering insurance solutions that emphasize risk management and tailored coverage options. They cater to individuals and businesses seeking proactive approaches to insurance protection and value-added services.

- Trustedlife Assurance Group: Trustedlife Assurance Group is a strong contender in the life insurance sector, focusing on both term and whole life coverage options. Their emphasis on transparency and simplified policies attracts customers looking for straightforward protection.

- Protekta Insurance Services: Protekta Insurance Services is known for its competitive rates and personalized customer service. They offer a range of insurance products, including home, auto, and business coverage, catering to a diverse clientele.

- Totalcare Coverage Solutions: Totalcare stands out for its comprehensive approach to insurance, providing a holistic range of coverage options for individuals and businesses. They are recognized for their prompt claims processing and attentive customer support.

While Compwest Insurance Company has its unique strengths and offerings, these competitors showcase the diversity of choices available to customers seeking insurance coverage.

Each competitor brings its approach to meeting the needs of policyholders, creating a dynamic and competitive marketplace.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compwest Insurance Company Claims Process

Ease of Filing a Claim

When it comes to filing a claim with Compwest Insurance Company, policyholders enjoy a seamless and user-friendly process. Whether you prefer to file a claim online, over the phone, or through their mobile app, Compwest offers multiple convenient options to cater to your preferences.

This accessibility ensures that reporting incidents and initiating claims is a straightforward experience.

Average Claim Processing Time

Efficiency in claims processing is a critical factor in evaluating an insurance provider. Compwest Insurance Company is dedicated to expediting claim resolutions.

While the actual processing time may vary depending on the nature of the claim, policyholders can generally expect a reasonable and timely turnaround. This commitment to swift resolutions enhances the overall customer experience.

Customer Feedback on Claim Resolutions and Payouts

Customer satisfaction is paramount to Compwest Insurance Company. They actively seek and value customer feedback on claim resolutions and payouts. By examining customer reviews and experiences, you can gain insights into the company’s dedication to providing fair and satisfactory outcomes for its policyholders.

Compwest Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Compwest Insurance Company’s mobile app is a powerful tool that enhances the insurance management experience.

The app offers a wide range of features and functionalities, allowing policyholders to effortlessly access policy information, file claims, make payments, and receive real-time updates on their coverage. This mobile convenience ensures that Compwest policyholders have their insurance needs at their fingertips, 24/7.

Online Account Management Capabilities

Managing insurance policies has never been more convenient, thanks to Compwest’s robust online account management capabilities.

Through the company’s website, policyholders can log in to their accounts to view policy details, update personal information, track claims, and make necessary policy adjustments. This digital platform empowers policyholders to take control of their insurance portfolios with ease.

Digital Tools and Resources

Compwest Insurance Company recognizes the value of providing useful resources to its policyholders. Their website and online portal offer a variety of digital tools and resources designed to facilitate informed decision-making regarding insurance coverage.

Whether you need to calculate insurance rates, access educational materials, or explore different coverage options, Compwest’s digital offerings are tailored to enhance the insurance experience.

Frequently Asked Questions

What types of insurance does Compwest Insurance Company offer?

Compwest Insurance Company provides a diverse range of coverage options, including home insurance, auto insurance, business insurance, health insurance, and life insurance.

Can I bundle different insurance policies with Compwest Insurance Company?

Yes, Compwest Insurance Company offers bundling options, allowing you to combine multiple insurance policies for potential cost savings.

How can I get a quote for insurance coverage from Compwest Insurance Company?

To obtain a quote from Compwest Insurance Company, you can visit their website or contact their customer service to receive a personalized insurance quote based on your needs.

What is the claims process like with Compwest Insurance Company?

Compwest Insurance Company’s claims process involves reporting the incident to their claims department or using their online claims filing system. A claims adjuster will assess the damages, guide you through the process, and work towards a prompt resolution.

Is Compwest Insurance Company suitable for both individuals and businesses?

Yes, Compwest Insurance Company caters to both individuals and businesses, offering a range of insurance options to meet the unique needs of different clientele.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.