Continental Indemnity Company: Customer Ratings & Reviews [2026]

Continental Indemnity Company stands as a trusted provider of auto, home, and various insurance products, offering reliable protection and competitive rates to customers across all 50 states.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated April 2024

Continental Indemnity Company is an excellent insurance provider with a wide range of insurance products that cater to the unique needs of its customers. As an A- rated company, Continental Indemnity Company offers affordable insurance rates to its customers and provides discounts to help them save money on their insurance premiums.

With a low complaint level according to industry standards, Continental Indemnity Company offers insurance products in all 50 states. However, the website lacks information on the claims process, and there is no online chat support for customers seeking quick assistance.

Overall, Continental Indemnity Company is an excellent choice for customers looking for a reliable insurance provider.

What You Should Know About Continental Indemnity Company

Company contact information: There is no specific contact information for Continental Indemnity Company. However, customers can likely find contact information on the company’s website or by contacting their local agent.

Related parent or child companies: There is no related parent or child companies for Continental Indemnity Company.

Financial ratings: It states that Continental Indemnity Company has an A- rating from A.M. Best, which is considered excellent.

Customer service ratings: It mentions that the company has a low complaint level according to industry standards.

Claims information: It was mentioned that the website lacks information on the claims process for Continental Indemnity Company.

Company apps: There was no apps offered by Continental Indemnity Company.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Continental Indemnity Company Insurance Coverage Options

Continental Indemnity Company offers a variety of coverage options to protect its customers from unexpected events. These coverage options include:

- Auto insurance: Liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection, roadside assistance, and rental reimbursement.

- Homeowners insurance: Property damage coverage, liability coverage, personal property coverage, additional living expenses coverage, flood insurance, earthquake insurance.

- Renters insurance: Personal property coverage, liability coverage, additional living expenses coverage, identity theft protection.

- Condo insurance: Property damage coverage, liability coverage, personal property coverage, additional living expenses coverage, and loss assessment coverage.

- Motorcycle insurance: Liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection, roadside assistance.

- RV insurance: Liability coverage, collision coverage, comprehensive coverage, personal injury protection, roadside assistance, vacation liability coverage.

- Boat insurance: Liability coverage, collision coverage, comprehensive coverage, personal injury protection, roadside assistance, and wreck removal coverage.

It’s important to note that the availability and specifics of coverage options may vary depending on the customer’s location and other factors. Customers should check with their local agent or visit the company’s website to learn more about the coverage options available to them.

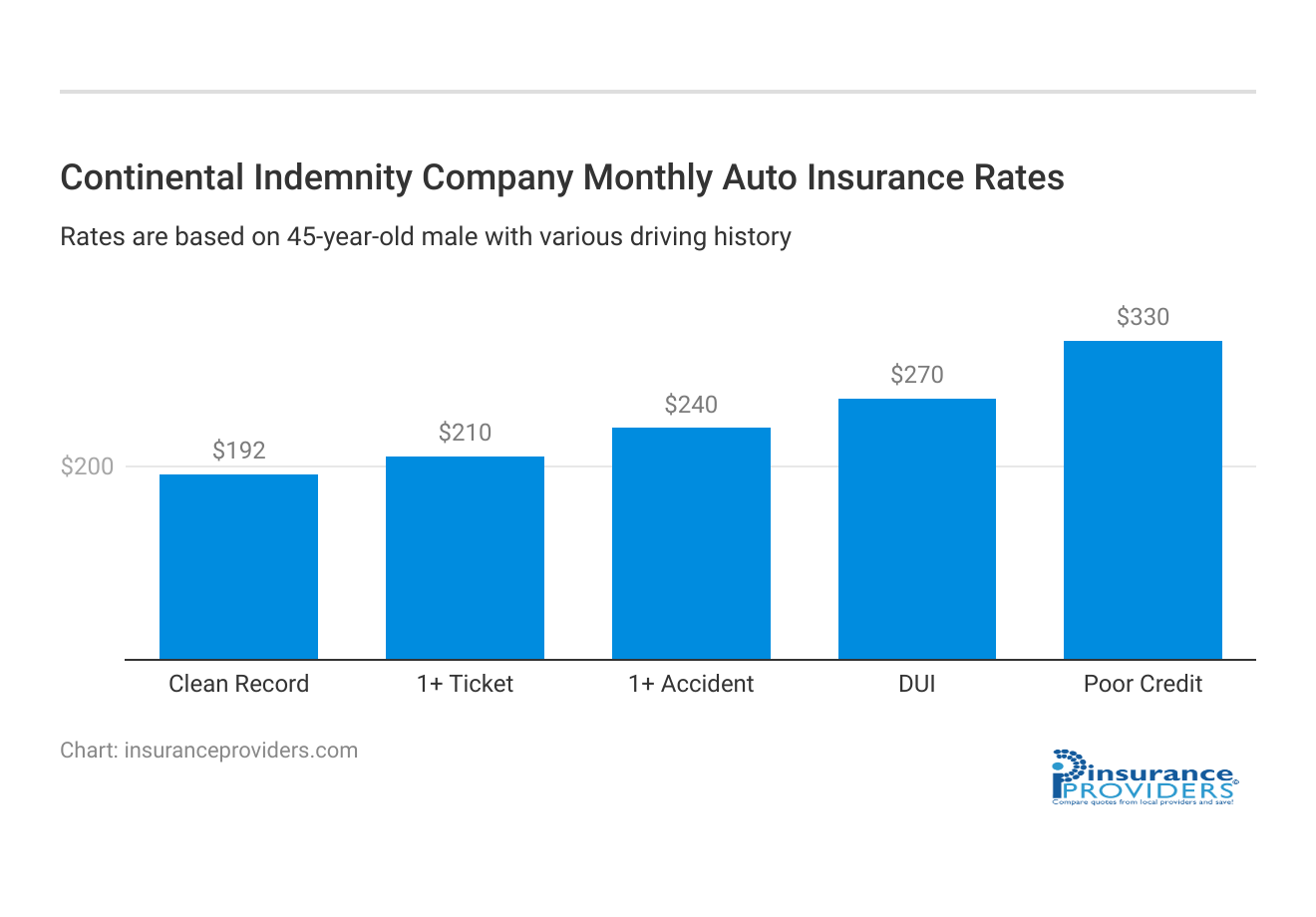

Continental Indemnity Company Insurance Rates Breakdown

| Driver Profile | Continental Indemnity Company | National Average |

|---|---|---|

| Clean Record | $192 | $119 |

| 1+ Ticket | $210 | $147 |

| 1+ Accident | $240 | $173 |

| DUI | $270 | $209 |

| Poor Credit | $330 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Continental Indemnity Company Discounts Available

| Discount | Continental Indemnity Company |

|---|---|

| Anti Theft | 24% |

| Good Student | 25% |

| Low Mileage | 22% |

| Paperless | 10% |

| Safe Driver | 25% |

| Senior Driver | 15% |

Continental Indemnity Company offers several discounts to help customers save money on their insurance premiums. These discounts include:

- Safe driver discount: Customers who maintain a clean driving record for a certain period can qualify for this discount.

- Multi-vehicle discount: Customers who insure more than one vehicle with Continental Indemnity Company can receive a discount on their premiums.

- Multi-policy discount: Customers who bundle multiple insurance policies, such as auto and home insurance, can receive a discount on their premiums.

- Good student discount: Customers with a qualifying high school or college student on their policy can receive a discount on their premiums.

- Military discount: Active military personnel and veterans can qualify for a discount on their premiums.

- Senior citizen discount: Customers who are over a certain age can qualify for a discount on their premiums.

It’s important to note that the availability and amount of these discounts may vary depending on the customer’s location and other factors. Customers should check with their local agent or visit the company’s website to learn more about the discounts available to them.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Continental Indemnity Company Ranks Among Providers

Continental Indemnity Company faces competition from other reputable insurance companies in the market. Below, we’ve compiled a list of some notable competitors to help you make informed decisions about your insurance coverage.

Frequently Asked Questions

Is Continental Indemnity Company a reliable choice for insurance?

Yes, Continental Indemnity Company is a reputable insurance provider offering diverse insurance products, competitive rates, and discounts tailored to meet the unique needs of customers. With an A- rating from A.M. Best and nationwide coverage, it ensures customer satisfaction.

How can I file an insurance claim with Continental Indemnity Company?

To file an insurance claim with Continental Indemnity Company, you can contact their claims department. Provide details about the incident, such as the date, time, and location, and the claims representative will guide you through the process.

How are insurance premiums calculated by Continental Indemnity Company?

Insurance premiums are calculated by Continental Indemnity Company based on factors such as age, gender, driving history, credit score, and the type and amount of coverage needed. The company uses complex algorithms to determine your risk level and sets the premium accordingly.

What discounts are available with Continental Indemnity Company?

Continental Indemnity Company offers various discounts to help customers save on insurance premiums. These discounts may include safe driver discounts, multiple policy discounts, and good student discounts. The availability and amount of discounts can vary, so it’s recommended to check with a local agent or visit the company’s website for specific details.

How can I contact Continental Indemnity Company?

While specific contact information is not mentioned, you can likely find the most accurate and up-to-date contact information for Continental Indemnity Company on their website or by reaching out to their customer service. It’s advisable to visit the website or contact the company directly for the latest contact details.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.