Delaware Life Insurance Company Review (2026)

Delaware Life Insurance Company stands out as a versatile provider, offering a comprehensive range of life insurance options, including term, whole, universal, and variable coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Delaware Life Insurance Company emerges as a multifaceted provider offering a spectrum of coverage options: term, whole, universal, and variable life insurance. Backed by a robust financial reputation, the company tailors policies to diverse needs, ensuring both security and growth potential.

Navigating the application process, client testimonials, and policy advantages, the article provides an illuminating overview of Delaware Life’s offerings.

Its conversational tone, structured headers, and informative FAQs create a comprehensive guide for individuals seeking well-informed insurance decisions, making Delaware Life a compelling choice in the insurance landscape.

Delaware Life Insurance Company Insurance Coverage Options

Delaware Life Insurance Company offers a diverse range of coverage options tailored to meet varying needs and circumstances. Here are the coverage options they provide:

- Term Life Insurance: Provides coverage for a specified period, typically ranging from 10 to 30 years. This option offers a death benefit to beneficiaries if the insured passes away during the term.

- Whole Life Insurance: Offers lifelong coverage with a guaranteed death benefit. Additionally, it accumulates cash value over time, which can be borrowed against or withdrawn for various purposes.

- Universal Life Insurance: Combines life insurance with a savings component. Policyholders have flexibility in adjusting premium payments and death benefits, and the policy’s cash value can grow over time.

- Variable Life Insurance: This option allows policyholders to invest their cash value in various investment options such as stocks, bonds, and mutual funds. The policy’s cash value and death benefit can fluctuate based on the performance of the chosen investments.

Each coverage option offers distinct benefits and features, catering to different financial goals and preferences. Delaware Life Insurance Company ensures a comprehensive range of choices to provide financial security and peace of mind to policyholders and their beneficiaries.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

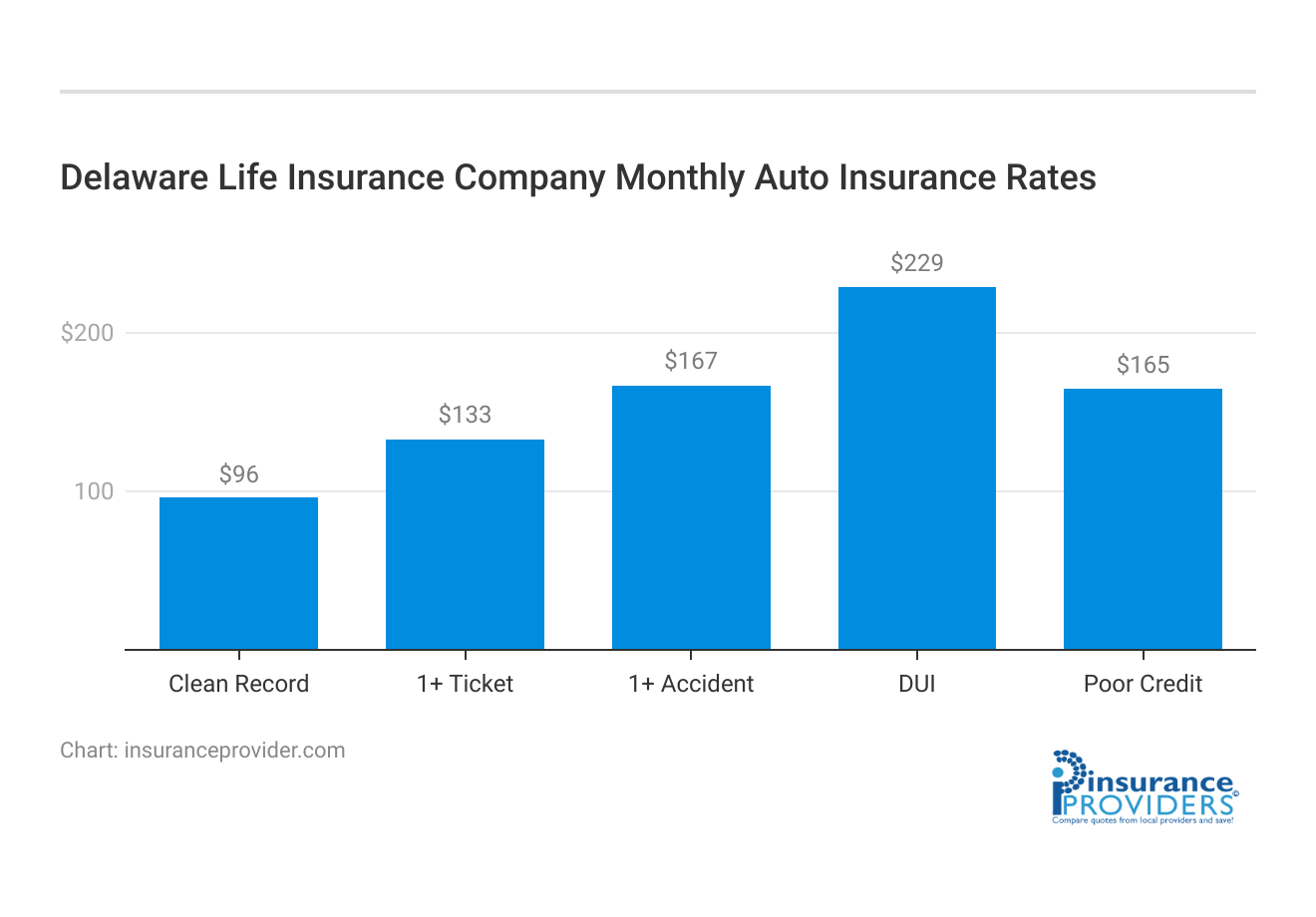

Delaware Life Insurance Company Insurance Rates Breakdown

| Driver Profile | Delaware Life | National Average |

|---|---|---|

| Clean Record | $96 | $119 |

| 1+ Ticket | $133 | $147 |

| 1+ Accident | $167 | $173 |

| DUI | $229 | $209 |

| Poor Credit | $165 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Delaware Life Insurance Company Discounts Available

| Discounts | Delaware Life |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 9% |

| Paperless | 6% |

| Safe Driver | 18% |

| Senior Driver | 10% |

Delaware Life Insurance Company offers a variety of discounts that policyholders can take advantage of to save on their insurance premiums. These discounts are designed to reward responsible behavior, safety precautions, and other factors that contribute to lower risk profiles. Here are the discounts they offer:

- Multi-Policy Discount: Save when you bundle multiple insurance policies, such as auto and home insurance, with Delaware Life Insurance Company.

- Safe Driver Discount: Enjoy reduced premiums if you have a clean driving record with no accidents or traffic violations.

- Good Student Discount: Students with excellent academic performance can qualify for lower rates, promoting responsible behavior both on and off the road.

- Safe Vehicle Discount: If your vehicle is equipped with safety features like anti-lock brakes, airbags, and anti-theft systems, you may be eligible for this discount.

- Multi-Car Discount: Insure more than one vehicle with Delaware Life Insurance Company to benefit from a discount on your premiums.

- Loyalty Discount: Policyholders who stay with the company for an extended period can earn a loyalty discount as a reward for their continued business.

- Pay-in-Full Discount: Opt to pay your annual premium in full upfront to receive a discount on your insurance policy.

- Paperless Billing Discount: Choose to receive your bills and policy documents electronically to qualify for this eco-friendly discount.

- Defensive Driving Course Discount: Completing an approved defensive driving course can lead to lower premiums, as it demonstrates your commitment to safe driving practices.

These discounts can significantly reduce the cost of your insurance coverage while encouraging behaviors that promote safety and responsibility. Be sure to inquire with Delaware Life Insurance Company to determine which discounts you may be eligible for and maximize your savings.

How Delaware Life Insurance Company Ranks Among Providers

Delaware Life Insurance Company operates in a competitive landscape alongside other established life insurance providers. Some of its main competitors might include:

- Prudential Financial: A well-known company offering a range of insurance and financial products, including life insurance policies tailored to different needs and preferences.

- Metlife: With a strong presence in the insurance industry, Metlife offers a variety of life insurance options, investment products, and retirement solutions.

- New York Life: A mutual insurance company that has been operating for over 175 years, providing a wide array of life insurance and financial services.

- Northwestern Mutual: Known for its whole life insurance policies and financial planning services, Northwestern Mutual is a prominent player in the industry.

- State Farm: A popular insurance company that offers life insurance along with auto, home, and other types of coverage.

- Massmutual: With a focus on offering whole life insurance and other financial services, Massmutual is a significant competitor in the market. (For more information, read our “Massachusetts Mutual Life Insurance Company Review“).

- Lincoln Financial Group: Providing various insurance and retirement solutions, Lincoln Financial Group competes with comprehensive life insurance offerings.

- AIG (American International Group): A global insurance company that offers a range of insurance products, including life insurance, to individuals and businesses.

- Guardian Life: Known for its whole life insurance policies and employee benefits solutions, Guardian Life is a competitor in the industry.

- Transamerica: Offering various life insurance options, retirement solutions, and investment products, Transamerica is another player in the market.

These companies, among others, compete in the life insurance industry by offering a mix of coverage options, policy features, and customer service. Delaware Life Insurance Company would need to differentiate itself through its offerings, customer experience, and unique selling points to stand out in this competitive landscape.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Delaware Life Insurance Company Manages Claims

Ease of Filing a Claim

When it comes to filing a claim with Delaware Life Insurance Company, policyholders have the convenience of choosing their preferred method. Whether it’s through their user-friendly online portal, a simple phone call, or utilizing the mobile app, Delaware Life ensures that the claims process is accessible and adaptable to individual preferences.

Average Claim Processing Time

Delaware Life Insurance Company places a strong emphasis on expediting the claims process. While the specific processing time can vary depending on the nature of the claim, Delaware Life is committed to swift and efficient claim resolution. Policyholders can trust in a timely response to their claims, providing the financial support they need when it matters most.

Customer Feedback on Claim Resolutions and Payouts

Customer satisfaction is a top priority for Delaware Life Insurance Company. To gauge their performance in handling claims, the company values and actively seeks customer feedback.

The section will delve into the experiences and opinions of policyholders regarding the efficiency and fairness of claim resolutions and payouts, offering valuable insights into Delaware Life’s commitment to its customers.

Digital Tools and Tech Features at Delaware Life Insurance Company

Mobile App Features and Functionality

Delaware Life Insurance Company recognizes the significance of modern technology in enhancing the overall customer experience. With their mobile app, policyholders have access to a range of features and functionalities that simplify insurance management.

This section will explore the app’s capabilities, from policy management to claims tracking, ensuring that Delaware Life policyholders have a powerful and user-friendly tool at their disposal.

Online Account Management Capabilities

Managing insurance policies should be seamless and convenient. Delaware Life Insurance Company offers robust online account management capabilities that empower policyholders to take control of their coverage.

From accessing policy details to reviewing payment history, this section will delve into the user-friendly features that make online account management with Delaware Life a smooth and efficient process.

Digital Tools and Resources

In addition to their mobile app and online account management, Delaware Life provides a suite of digital tools and resources designed to assist policyholders in making informed decisions about their insurance coverage.

These resources may include educational materials, calculators, and other valuable assets. This section will explore the digital tools and resources available, highlighting how they can benefit policyholders on their insurance journey.

Frequently Asked Questions

What types of life insurance does Delaware Life Insurance Company offer?

Delaware Life offers a range of life insurance options, including term life, whole life, universal life, and variable life insurance, each tailored to different needs and circumstances.

How financially stable is Delaware Life Insurance Company?

Delaware Life Insurance Company has a strong financial reputation, ensuring policyholders of its stability and ability to meet claims and financial commitments.

What if I miss a premium payment? Will my coverage be affected?

The impact of missed premium payments can vary depending on the policy. Many policies offer a grace period or options to maintain coverage even after a missed payment. For specific information, consult Delaware Life’s customer service.

Are there any discounts available to help reduce premiums?

Yes, Delaware Life offers various discounts, such as multi-policy, safe driver, and good student discounts. These can significantly lower your insurance premiums and make coverage more affordable.

Is Delaware Life Insurance Company only for residents of Delaware?

No, Delaware Life’s coverage is available to residents of various states, extending its reach beyond Delaware’s borders.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.