Empire Indemnity Insurance Company Review (2026)

Empire Indemnity Insurance Company, a beacon of reliability in the insurance landscape, distinguishes itself through a diverse range of coverage options, competitive rates, and a customer-centric approach, offering personalized protection for life's uncertainties.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Empire Indemnity insurance company emerges as a trusted partner in safeguarding against life’s uncertainties. Offering a diverse range of coverage, including auto, home, health, life, and travel insurance, the company ensures peace of mind through competitive pricing and customizable policies.

With a commitment to customer satisfaction, streamlined claims processes, and a range of discounts, Empire Indemnity caters to individual needs. Positioned within a competitive landscape, it distinguishes itself through personalized attention, comprehensive protection, and an unwavering dedication to helping clients navigate the complexities of insurance.

What You Should Know About Empire Indemnity Insurance Company

Company contact information:

- Website: www.empireindemnity.com

- Email: info@empireindemnity.com

Related parent or child companies:

- Empire Financial Group

Financial ratings:

- A.M. Best Rating: A

Customer service ratings:

- Positive customer testimonials highlight exceptional customer service.

Claims information:

- Claims can be filed online through the user-friendly platform.

- A dedicated claims team is available to guide customers through the process.

Company apps:

- Empire Indemnity offers a user-friendly mobile app for managing policies, filing claims, and accessing resources. Available for download on iOS and Android devices.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Empire Indemnity Insurance Company Insurance Coverage Options

Empire Indemnity insurance company offers a comprehensive range of coverage options to protect what matters most. From safeguarding your home to ensuring your health and travels, our diverse insurance offerings provide peace of mind in every facet of life. Here are the following coverage options by Empire Indemnity:

- Auto insurance: Protects vehicles against accidents, theft, and damages.

- Home insurance: Safeguards homes and belongings from risks like fire, theft, and natural disasters.

- Health insurance: Offers comprehensive coverage for medical expenses and treatments.

- Life insurance: Provides financial security to loved ones in the event of the policyholder’s passing.

- Travel insurance: Ensures peace of mind during travels by covering unexpected events.

With Empire Indemnity’s extensive coverage options, you can rest assured that you and your loved ones are well-protected. Explore our range of insurance solutions and choose the coverage that aligns with your unique needs and priorities.

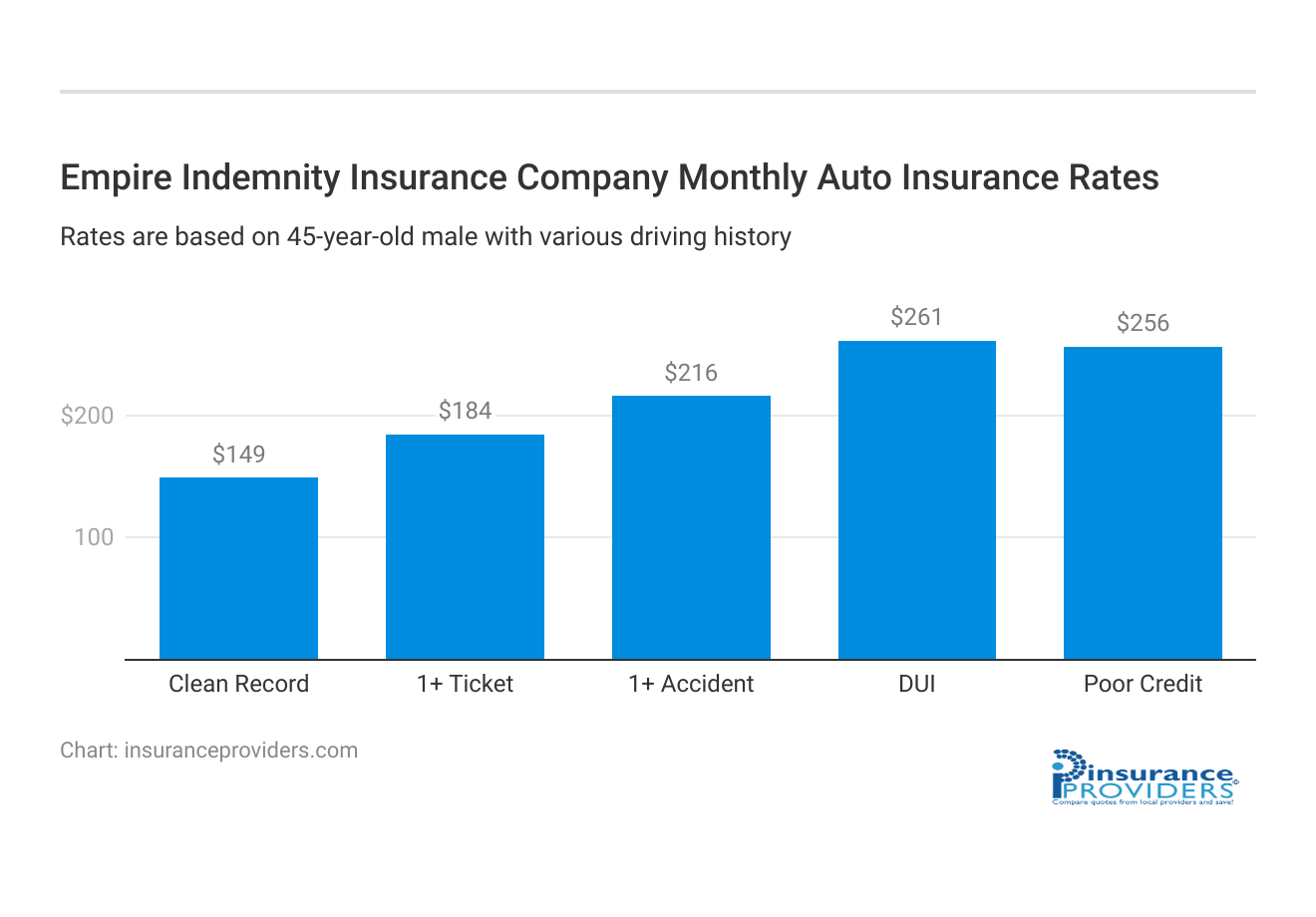

Empire Indemnity Insurance Company Insurance Rates Breakdown

| Driver Profile | Empire Indemnity Insurance Company | National Average |

|---|---|---|

| Clean Record | $149 | $119 |

| 1+ Ticket | $184 | $147 |

| 1+ Accident | $216 | $173 |

| DUI | $261 | $209 |

| Poor Credit | $256 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Empire Indemnity Insurance Company Discounts Available

| Discount | Empire Indemnity Insurance Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 15% |

| Paperless | 8% |

| Safe Driver | 15% |

| Senior Driver | 10% |

At Empire Indemnity insurance company, we understand the importance of providing our customers with not only comprehensive coverage but also opportunities to save on their insurance premiums. These discounts are designed to reward safe driving habits, responsible homeownership, and more:

- Safe driver discount: Reward for maintaining a clean driving record without accidents or violations.

- Multi-policy discount: Savings for customers who bundle multiple insurance policies with Empire Indemnity.

- Home security discount: Discount for homeowners with security systems that reduce the risk of theft and damage.

- Good student discount: Savings for students who maintain good grades, encouraging academic excellence.

- Safe vehicle discount: Discount for vehicles equipped with safety features that reduce the risk of accidents.

- Long-term policyholder discount: Reward for loyal customers who have maintained their policies with Empire Indemnity for an extended period.

Choosing Empire Indemnity not only means securing reliable insurance coverage but also benefiting from a range of discounts that reflect our commitment to your well-being and financial security. Take advantage of these discounts as a testament to our dedication to your satisfaction.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Empire Indemnity Insurance Company Ranks Among Providers

In the dynamic landscape of insurance, Empire Indemnity insurance company stands tall amidst notable competitors. Explore a glimpse of the key players that share the stage with us, each contributing to the industry’s evolution. Some of its main competitors include:

- Globalsure insurance: Known for its wide range of customizable policies and efficient claims processing, Globalsure is a major player in the insurance industry.

- Shieldguard insurance group: With a reputation for excellent customer service and competitive pricing, Shieldguard offers a variety of coverage options to cater to diverse needs.

- Safenet assurance: Safenet is recognized for its innovative technology-driven approach, making insurance management and claims processing seamless for its policyholders.

- Surecare insurance solutions: Surecare stands out for its comprehensive policies that provide holistic protection, catering

Navigating the world of insurance means considering a range of options, and Empire Indemnity remains a steadfast choice in the midst of formidable competitors. Our commitment to comprehensive coverage and exceptional service sets us apart in this thriving arena.

Empire Indemnity Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Empire Indemnity Insurance Company strives to make the claims process as convenient as possible for its customers. They offer multiple channels for filing claims, including online, over the phone, and through mobile apps.

For tech-savvy customers who prefer a digital approach, Empire Indemnity’s mobile app is a user-friendly option. The app provides a seamless experience for filing claims, allowing customers to upload necessary documents and track the progress of their claims in real time. This digital convenience aligns with the company’s commitment to customer-oriented service.

Average Claim Processing Time

Empire Indemnity Insurance Company is known for its efficient claim processing. On average, they prioritize quick claim resolutions to provide their customers with peace of mind during uncertain times. While specific processing times can vary depending on the complexity of the claim, the company’s dedication to timely resolutions is a key part of its customer-focused approach.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a vital role in shaping Empire Indemnity’s claims process. The company values input from its policyholders and continuously strives to improve its claim resolutions and payouts. By actively seeking customer feedback and implementing necessary changes, Empire Indemnity aims to ensure that their customers are satisfied with the outcomes of their claims.

Empire Indemnity Insurance Company’s Digital and Technological Features

Mobile App Features and Functionality

Empire Indemnity’s mobile app is more than just a platform for filing claims. It offers a range of features and functionalities to enhance the overall insurance experience. Customers can use the app to access their policy information, make payments, request quotes, and even receive real-time updates on their coverage.

This comprehensive mobile app empowers customers to manage their insurance needs conveniently from their smartphones.

Online Account Management Capabilities

In addition to the mobile app, Empire Indemnity provides robust online account management capabilities through its website. Customers can log in to their accounts to review policy details, update personal information, and request policy changes.

This online portal streamlines the communication between customers and the company, making it easy for policyholders to stay informed and in control of their insurance coverage.

Digital Tools and Resources

Empire Indemnity understands that informed customers make better decisions. To support this, they offer a range of digital tools and resources on their website. These resources include educational articles, calculators, and FAQs to help customers understand their insurance options better.

By providing these digital resources, Empire Indemnity empowers its customers to make informed choices when it comes to their insurance coverage.

Frequently Asked Questions

What types of insurance does Empire Indemnity offer?

Empire Indemnity provides a comprehensive range of insurance options, including auto insurance, home insurance, health insurance, life insurance, and travel insurance.

How can I save on my insurance premiums with Empire Indemnity?

Empire Indemnity offers various discounts, such as safe driver, multi-policy, and good student discounts, to help you save on your insurance premiums while promoting responsible behavior.

How do I file a claim with Empire Indemnity?

Filing a claim is simple and can easily be submitted through Empire Indemnity’s user-friendly platform. They offer multiple channels for filing claims, including online, over the phone, and through mobile apps.

What sets Empire Indemnity apart from its competitors?

Empire Indemnity stands out with its personalized approach, competitive pricing, commitment to comprehensive coverage, and exceptional customer service, ensuring that the customer’s insurance experience is tailored to their needs.

Can I customize my insurance policy to fit my specific needs?

Absolutely. Empire Indemnity offers customizable policies, allowing you to tailor coverage to preferred unique requirements, ensuring customers get the protection they need without paying for unnecessary extras.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.