Employers Compensation Insurance Company Review (2026)

Employers Compensation Insurance Company, a leading insurer, stands out as a trusted partner for businesses seeking comprehensive coverage solutions, with competitive rates, customizable policies, and a commitment to efficient claims processing.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive review, we explore Employers Compensation Insurance Company, a trusted provider of insurance solutions for businesses. The company offers a diverse range of coverage options, including workers’ compensation, liability, property, commercial auto, and cyber insurance, all designed to meet the specific needs of various industries.

Employers Compensation Insurance Company boasts a strong financial standing, exceptional customer service, and a commitment to efficient claims processing. Their competitive rates, customizable policies, and discounts make them an attractive choice for businesses seeking comprehensive coverage.

While the company receives overwhelmingly positive feedback, some minor improvements in online services have been suggested. Overall, Employers Compensation Insurance Company stands out as a reliable partner for businesses looking to protect their assets and manage risk effectively.

Employers Compensation Insurance Company Insurance Coverage Options

Employers Compensation insurance company provides an array of comprehensive coverage options tailored to meet the diverse needs of businesses. From safeguarding against workplace injuries to protecting assets and digital operations, their insurance solutions are designed to provide peace of mind and financial security. Here are the following coverage options available:

- Workers’ compensation insurance: This coverage is designed to protect both employers and employees in the event of work-related injuries or illnesses. It covers medical expenses, lost wages, and rehabilitation costs for employees who sustain injuries while performing their job duties.

- Liability insurance: Liability insurance is crucial for businesses to shield themselves from legal claims and lawsuits. It provides coverage for bodily injury, property damage, and legal defense costs if your business is held responsible for harm to others.

- Property insurance: Property insurance safeguards your business assets against damage or loss caused by a wide range of perils, including fire, theft, vandalism, and natural disasters. It ensures that your physical property, such as buildings and equipment, is protected.

- Commercial auto insurance: Commercial auto insurance is vital for businesses with a fleet of vehicles. It covers accidents, damages, and injuries involving company-owned vehicles, ensuring that your business remains protected while on the road.

- Cyber insurance: In an increasingly digital world, cyber insurance is essential to protect businesses from the growing threats of cyberattacks and data breaches. this coverage helps mitigate financial losses and assists in maintaining your company’s reputation in the event of a cyber incident.

With Employers Compensation insurance company’s extensive range of coverage options, businesses can confidently navigate the complex landscape of risk management. These policies offer a robust safety net, ensuring that your business is well-protected in the face of various challenges and uncertainties.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Employers Compensation Insurance Company Insurance Rates Breakdown

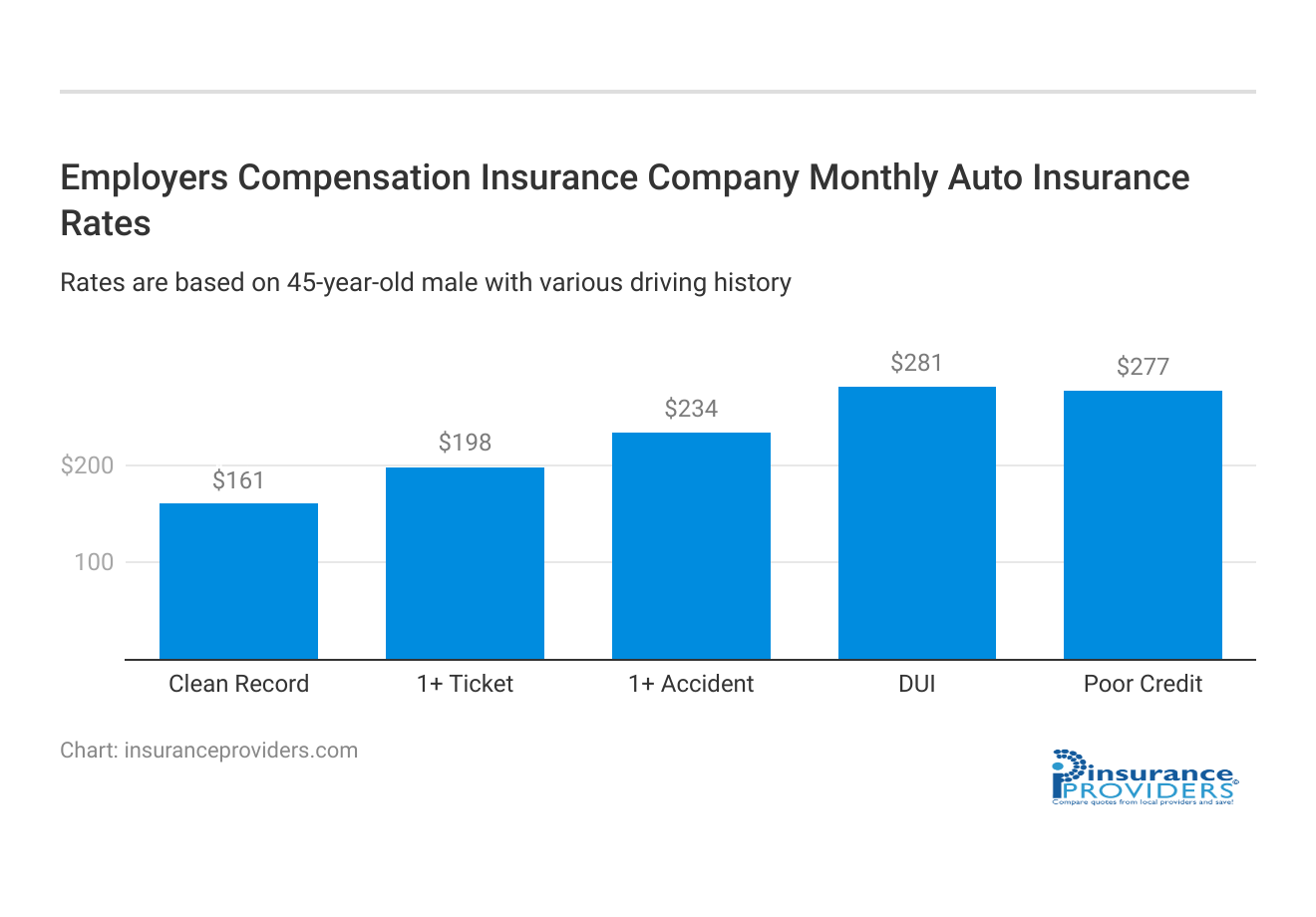

| Driver Profile | Employers Compensation Insurance Company | National Average |

|---|---|---|

| Clean Record | $161 | $119 |

| 1+ Ticket | $198 | $147 |

| 1+ Accident | $234 | $173 |

| DUI | $281 | $209 |

| Poor Credit | $277 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Employers Compensation Insurance Company Discounts Available

| Discount | Employers Compensation Insurance Company |

|---|---|

| Anti Theft | 15% |

| Good Student | 19% |

| Low Mileage | 20% |

| Paperless | 12% |

| Safe Driver | 18% |

| Senior Driver | 12% |

Employers Compensation insurance company understands that businesses appreciate cost-effective insurance solutions. To that end, they offer a range of discounts to help you save on your premiums while maintaining comprehensive coverage. Explore these discounts and opportunities to optimize your insurance protection without compromising your budget:

- Multi-policy discount: Save money by bundling multiple insurance policies together.

- Claims-free discount: Enjoy reduced premiums if your business has a history of minimal or no claims.

- Safety and risk management programs: Participation in safety and risk management programs may qualify you for discounts.

- Experienced and safe drivers: If your business has a fleet of vehicles with experienced and safe drivers, you may be eligible for lower auto insurance rates.

- Pay-in-full discount: Pay your annual premium in full upfront to receive a discount on your policy.

- Membership or association discounts: Being a member of certain professional associations or groups may make you eligible for additional savings.

By taking advantage of Employers Compensation insurance company’s discounts, your business can not only ensure its financial security but also enjoy the peace of mind that comes with a well-protected operation. These discounts exemplify the company’s commitment to providing tailored insurance solutions that meet both your coverage needs and your financial goals.

How Employers Compensation Insurance Company Ranks Among Providers

Employers Compensation insurance company faces competition from several key players in the insurance industry, each with its own strengths and offerings. Here are some of the company’s main competitors:

- The Hartford: Known for its comprehensive business insurance solutions, The Hartford is a major competitor. They offer a wide range of coverage options and have a strong focus on customer service.

- Travelers insurance: Travelers is a well-established insurance company with a strong presence in the commercial insurance sector. They offer customizable policies and have a reputation for financial stability.

- Liberty Mutual: Liberty Mutual provides various insurance products tailored for businesses, including workers’ compensation and liability coverage. They are known for their competitive rates and extensive network of agents.

- Chubb: Chubb specializes in offering insurance solutions for mid-sized and large businesses. They are recognized for their risk management expertise and high-quality coverage options.

- CNA Financial: CNA is a reputable provider of business insurance, offering a wide range of policies and risk management services. They have a long history of serving businesses across different industries.

- State Farm: While primarily known for personal insurance, State Farm also offers commercial insurance products. Their large customer base and financial strength make them a notable competitor.

- Zurich insurance group: Zurich is a global insurance company with a strong presence in the commercial insurance sector. They offer tailored solutions for businesses of all sizes.

These competitors challenge Employers Compensation insurance company by offering a variety of coverage options, competitive pricing, and strong customer service. Businesses often evaluate and compare these options to find the best fit for their insurance needs.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Employers Compensation Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Employers Compensation Insurance Company offers a user-friendly claims process with multiple convenient options. Policyholders can file claims online through their website, making it a hassle-free and efficient method. For those who prefer human interaction, phone claims are also available, ensuring that customers have the flexibility to choose the method that suits them best.

Additionally, Employers Compensation Insurance Company provides a mobile app that streamlines the claims filing process. With this app, customers can easily submit and track their claims from the palm of their hand, enhancing accessibility and convenience.

Average Claim Processing Time

One of the key factors that sets Employers Compensation Insurance Company apart is its commitment to swift claim processing. On average, the company processes claims efficiently, ensuring that customers receive prompt assistance during challenging times.

This quick turnaround time minimizes disruptions to businesses and helps policyholders get back on track sooner, showcasing the insurer’s dedication to excellent service.

Customer Feedback on Claim Resolutions and Payouts

Employers Compensation Insurance Company consistently receives positive feedback from customers regarding claim resolutions and payouts. Their commitment to fairness and transparency in handling claims is evident in the high satisfaction rates among policyholders.

The company strives to ensure that claimants receive the support they need and that settlements are fair and prompt, strengthening its reputation as a reliable insurance provider.

Employers Compensation Insurance Company’s Digital and Technological Features

Mobile App Features and Functionality

Employers Compensation Insurance Company’s mobile app offers a range of features and functionalities that enhance the overall insurance experience. Customers can use the app to not only file and track claims but also access policy documents, review coverage details, and even receive important notifications in real time.

The app’s user-friendly interface ensures that policyholders can easily manage their insurance needs on the go, making it a valuable tool for businesses.

Online Account Management Capabilities

The insurer’s online account management capabilities provide policyholders with a seamless and convenient way to oversee their insurance policies. Through the online portal, customers can make payments, update their policy information, and view billing statements with ease. This digital convenience simplifies policy management, empowering businesses to stay organized and informed.

Digital Tools and Resources

Employers Compensation Insurance Company goes beyond the basics by offering a variety of digital tools and resources to support their policyholders. These resources include educational materials, risk management tools, and safety resources to help businesses mitigate potential risks and losses.

The company’s commitment to providing valuable digital assets demonstrates its dedication to helping businesses thrive while safeguarding their assets.

Frequently Asked Questions

How can I request a quote from Employers Compensation Insurance Company?

You can request a quote by visiting their official website or by contacting their customer service team directly. They will assist you in getting the information you need to make an informed decision about your insurance coverage.

What types of businesses does an Employers Compensation Insurance Company cater to?

Employers Compensation Insurance Company provides insurance solutions for businesses of all sizes and across various industries. Whether you run a small local business or a large corporation, they have coverage options to meet your specific needs.

Do they offer discounts for bundled insurance policies?

Yes, Employers Compensation Insurance Company often offers discounts when you bundle multiple insurance policies together. Bundling can be an excellent way to save on your overall insurance costs while maintaining comprehensive coverage.

How are claims processed with Employers Compensation Insurance Company?

Claims can be filed online or by contacting their claims department directly. The company strives to process claims efficiently and ensure that you receive the support you need during the claims process.

Are there any additional services offered besides insurance coverage?

In addition to insurance coverage, Employers Compensation Insurance Company may offer risk management and safety services to help businesses minimize potential risks and losses. These services can be valuable for businesses looking to enhance their safety protocols and reduce incidents.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.